Bank Loan Balance Sheet Ratios

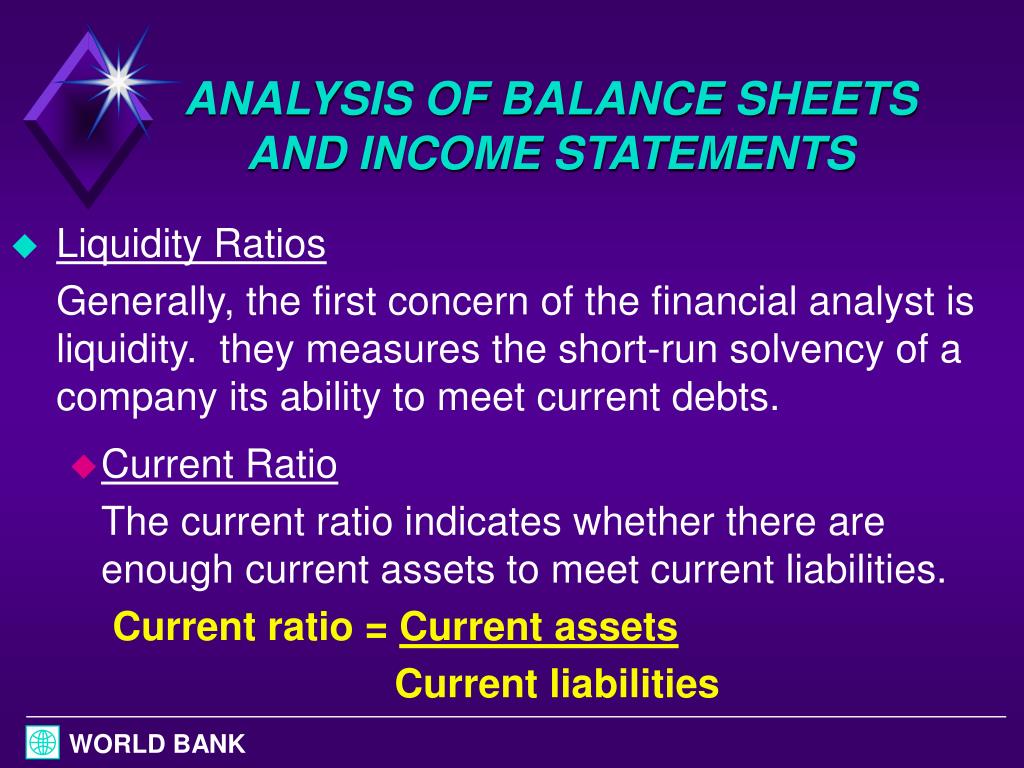

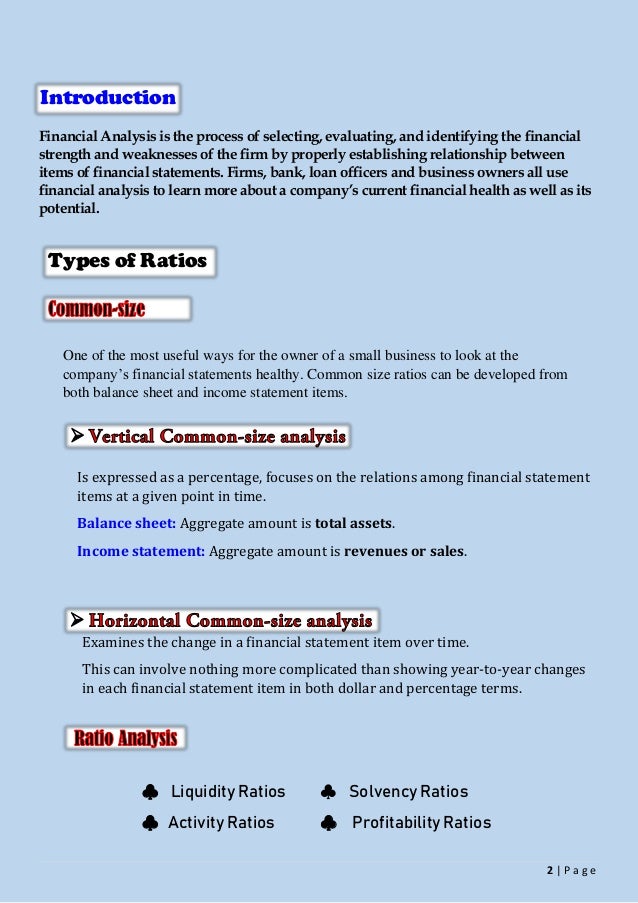

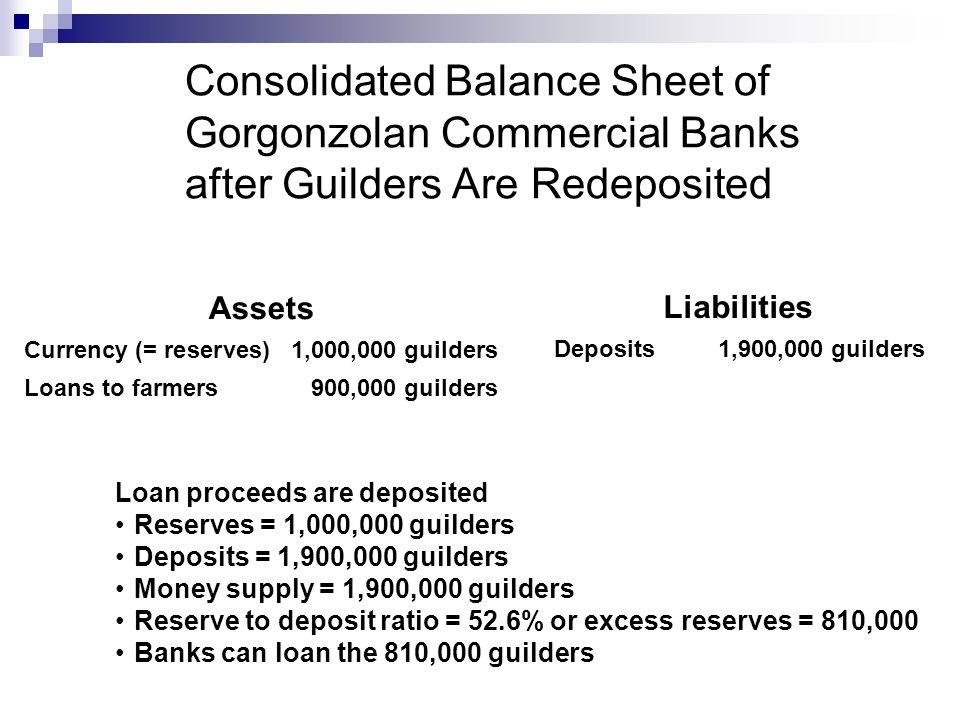

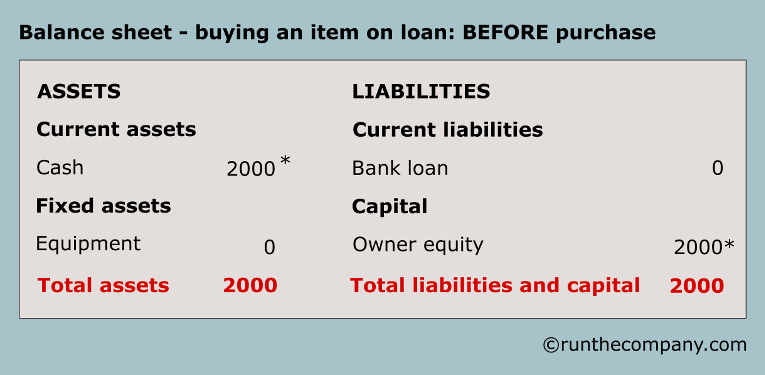

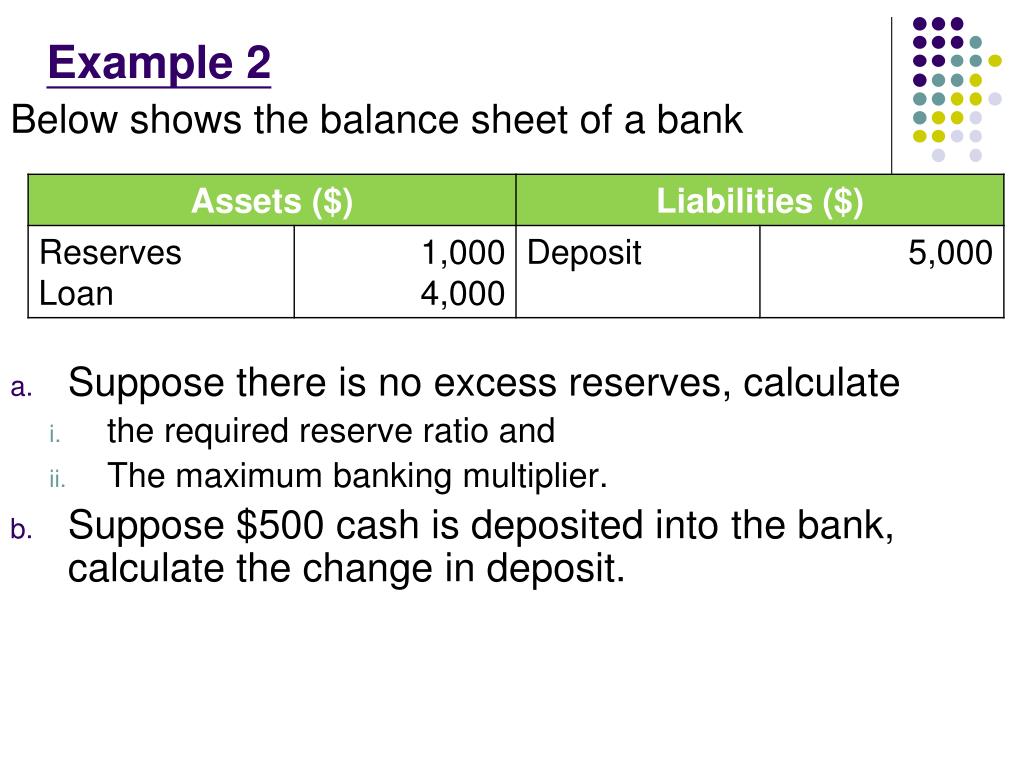

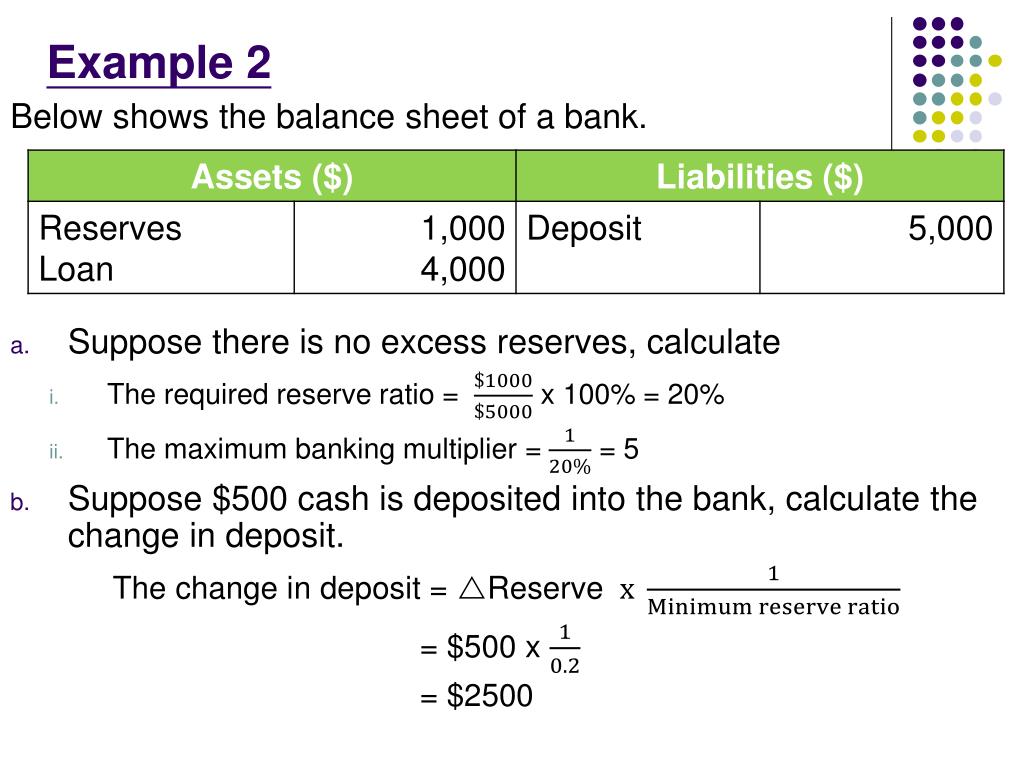

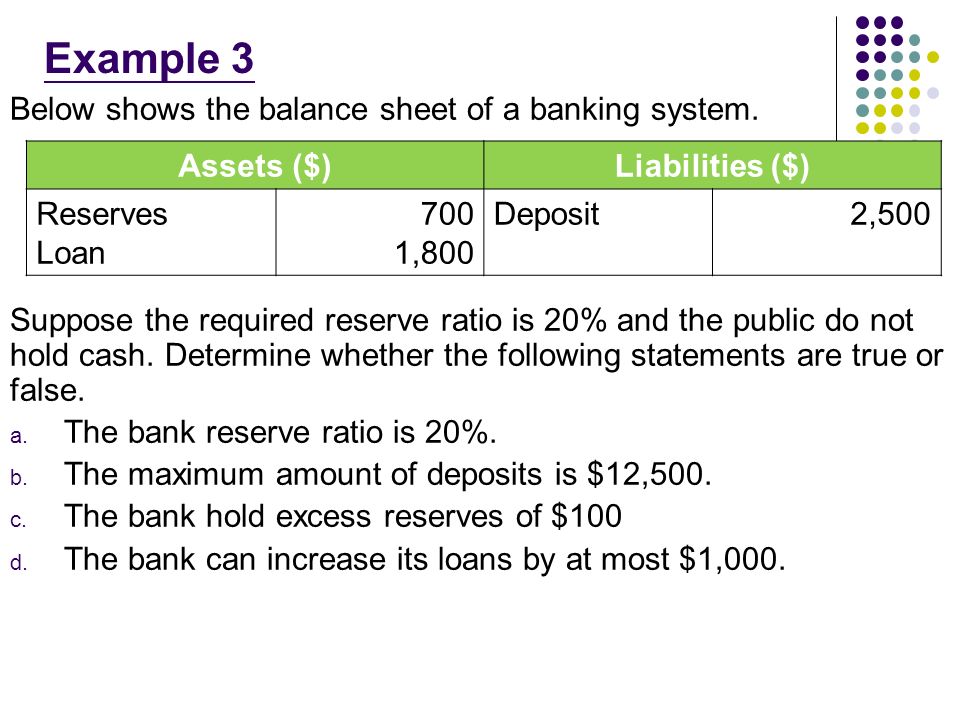

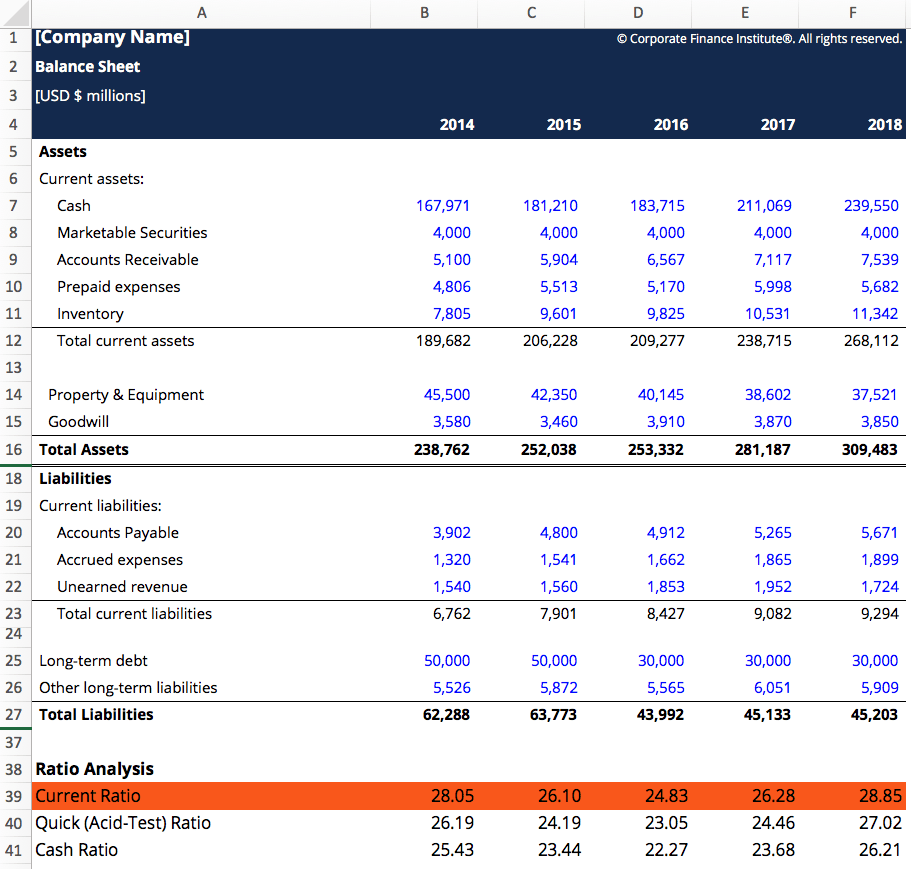

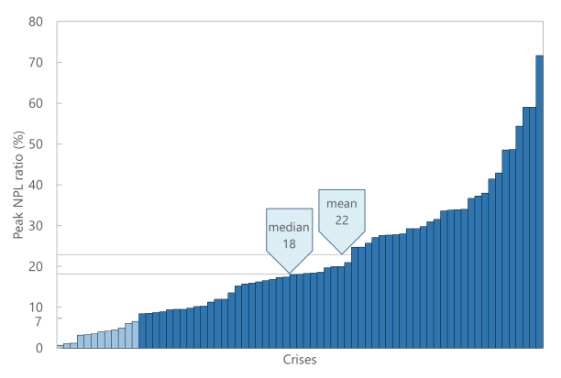

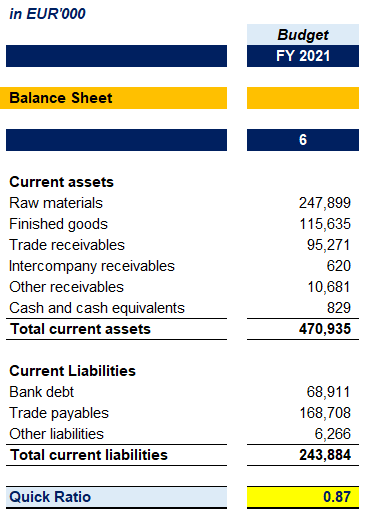

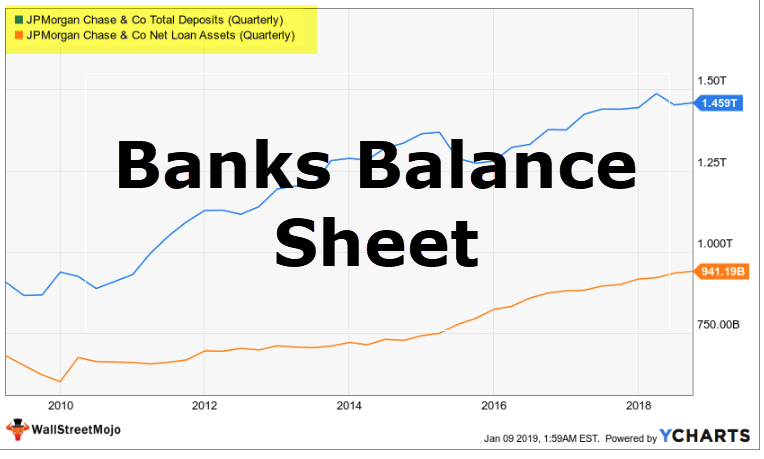

The loan to deposit ratio ltd is a commonly used statistic for assessing a banks liquidity by dividing the banks total loans by its total deposits.

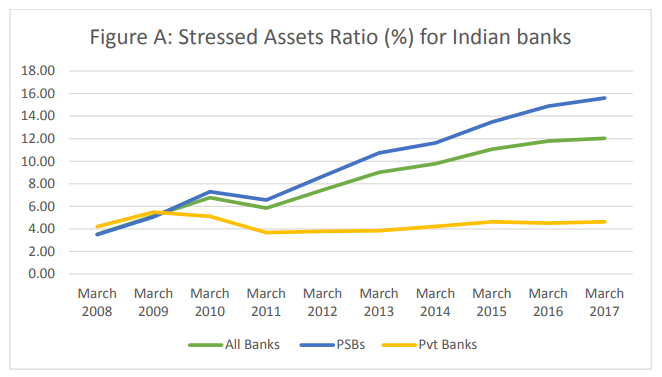

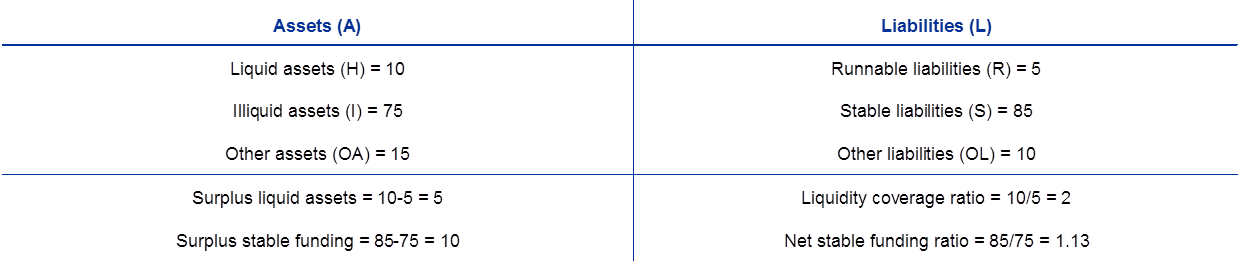

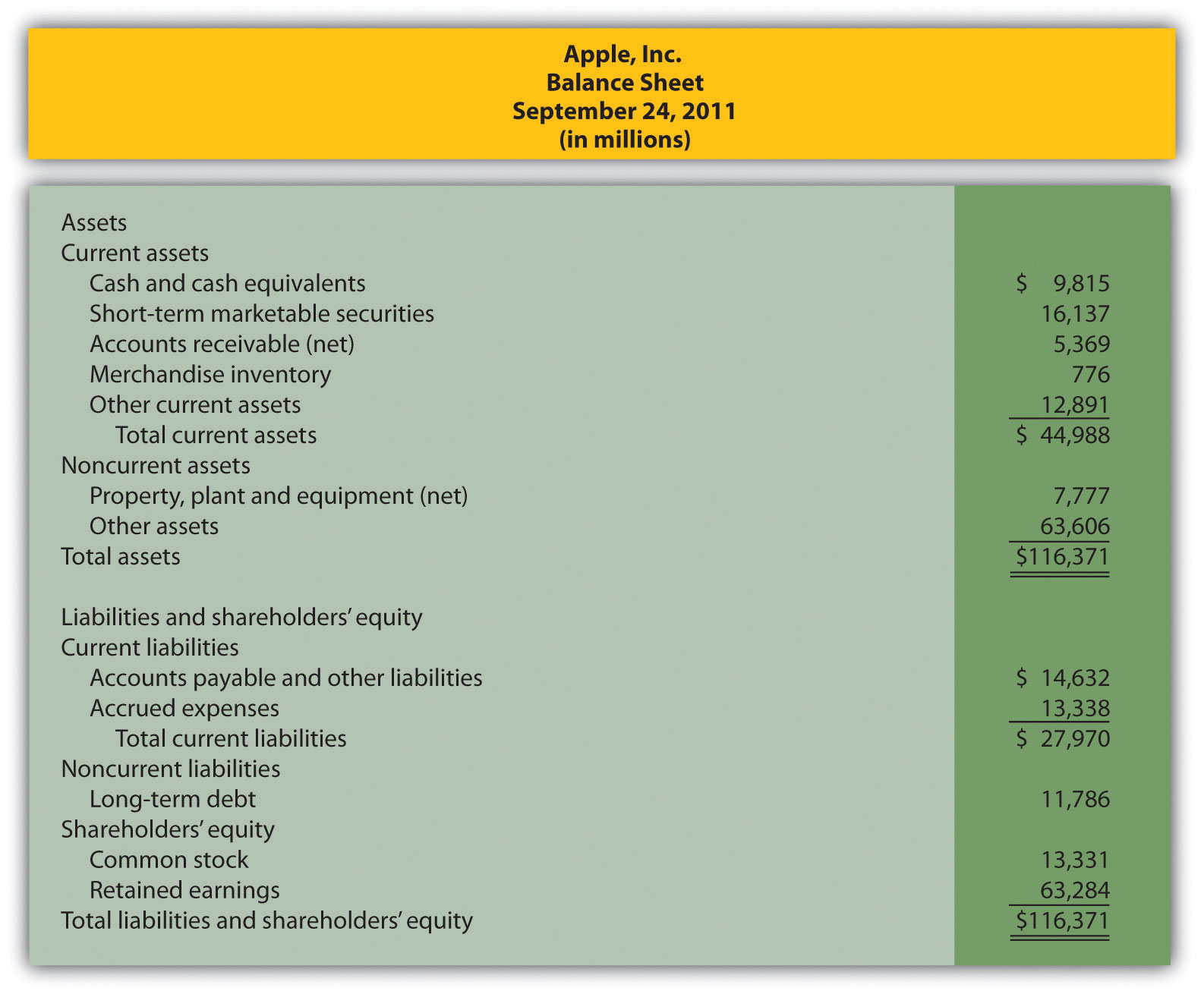

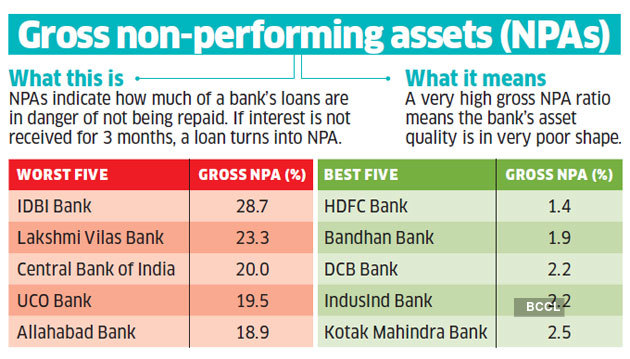

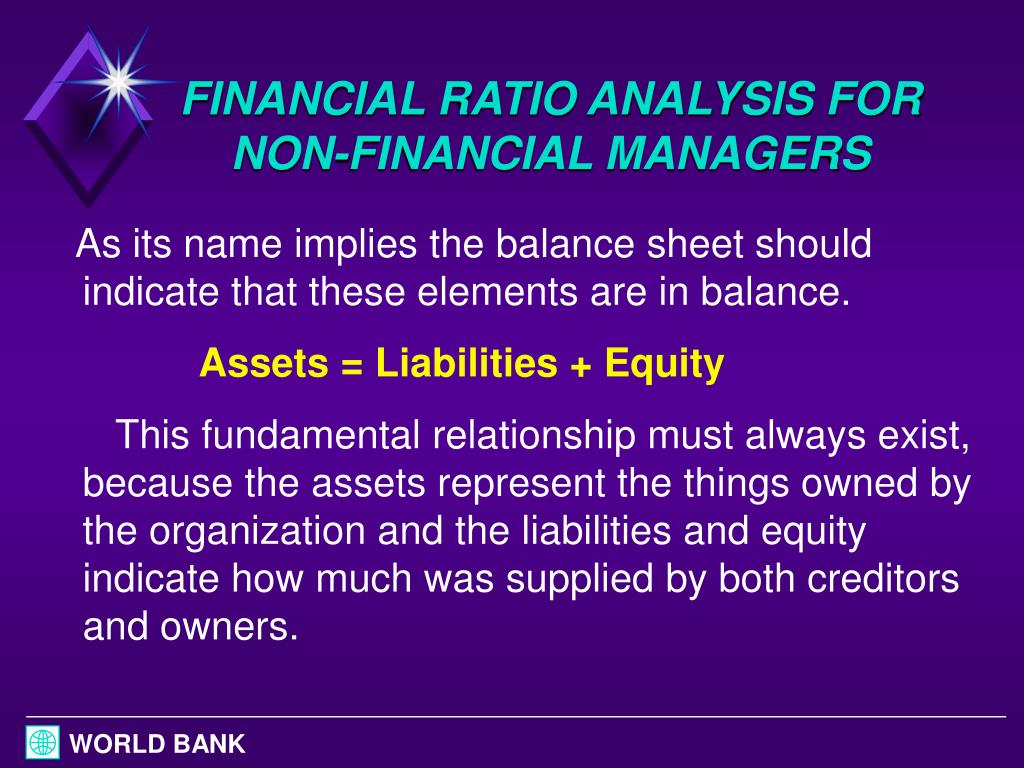

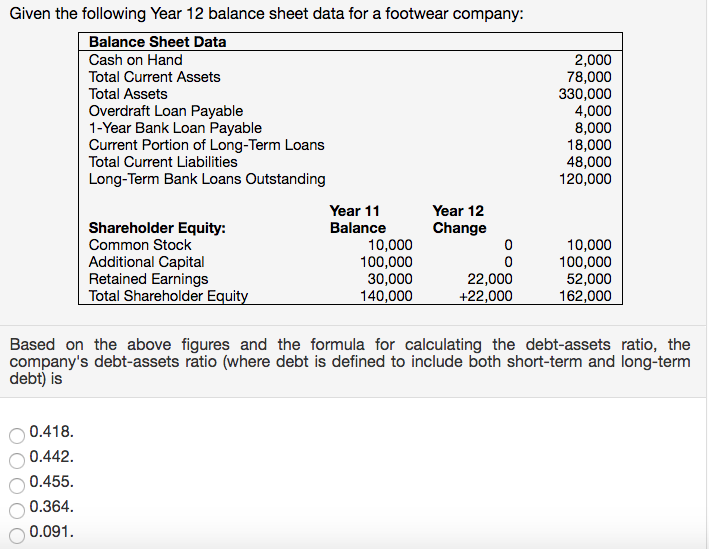

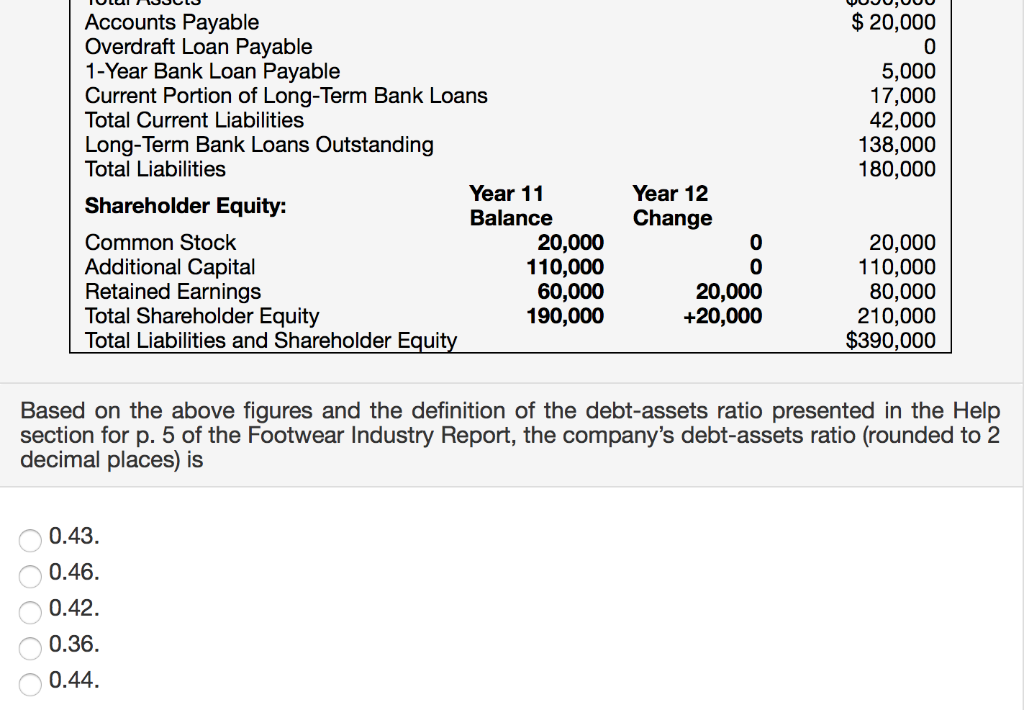

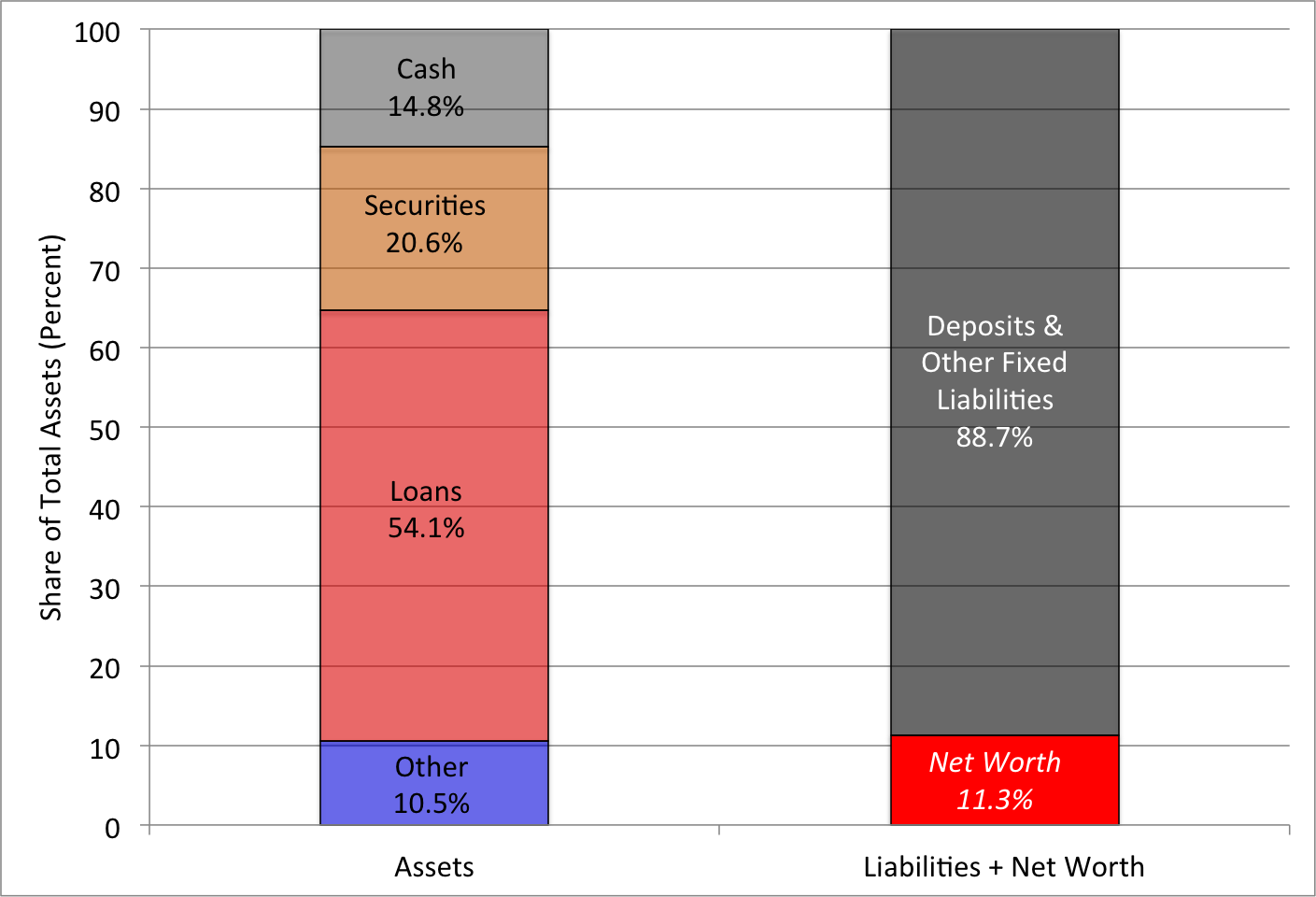

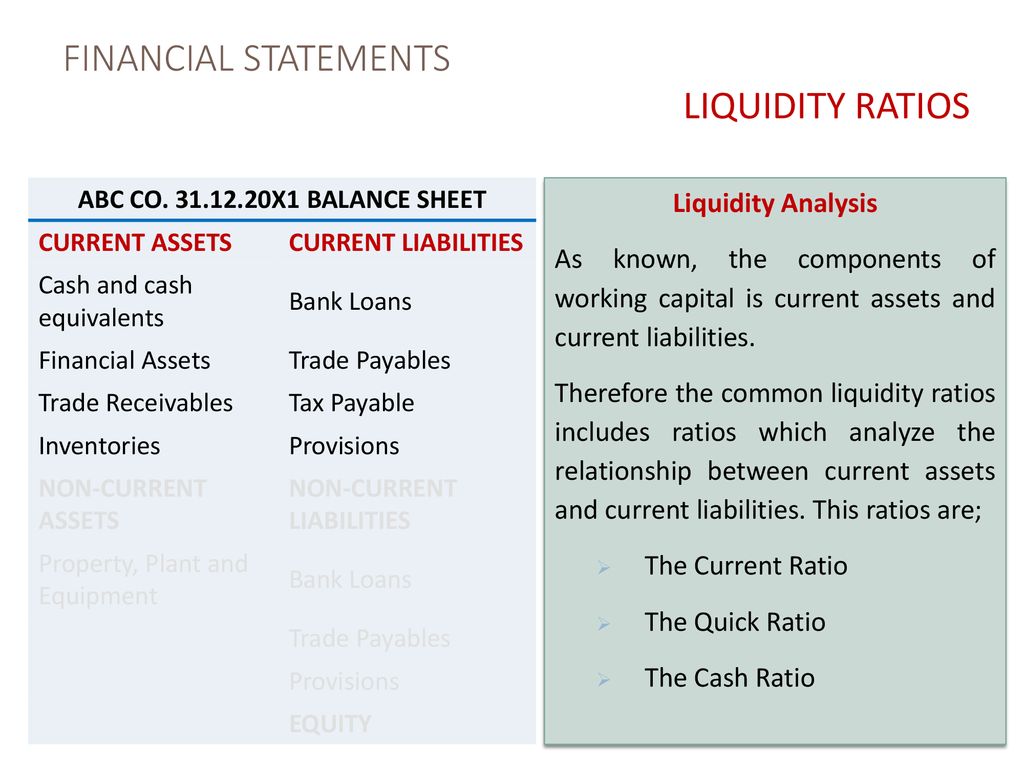

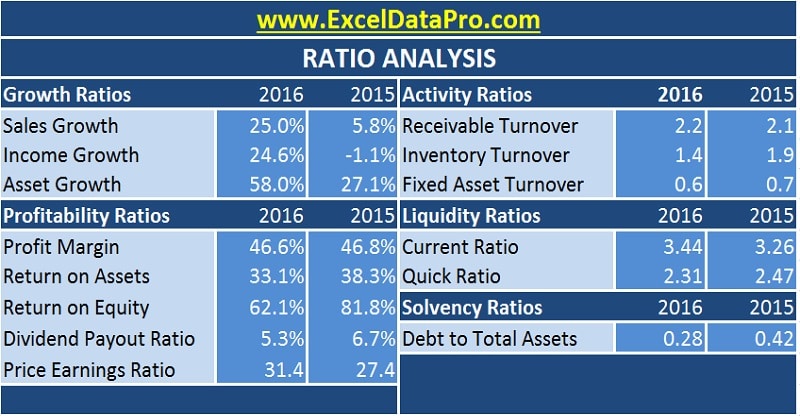

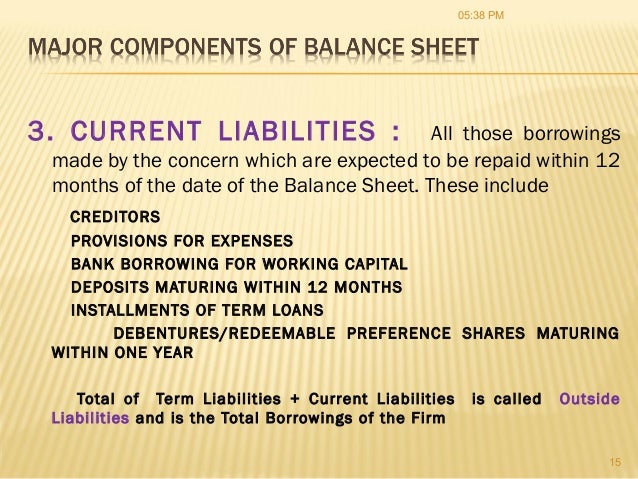

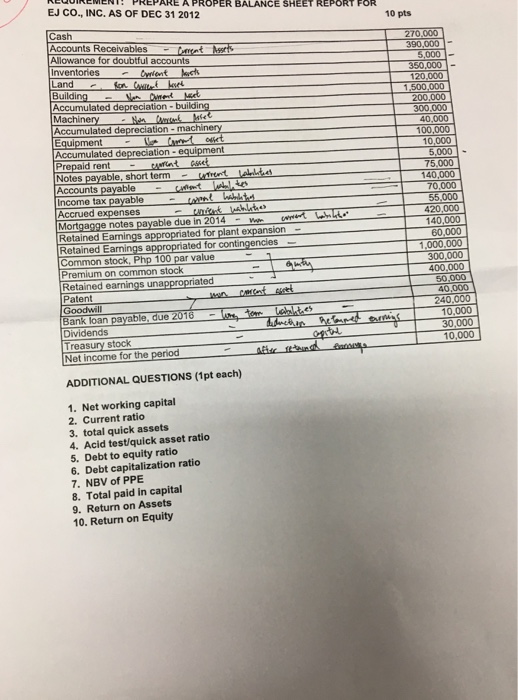

Bank loan balance sheet ratios. The basic idea is that your lender doesnt want you to simply borrow in order to grow the business. While the article related to the key profit and loss statement ratios was more to do with the performance of a bank the following ratios are more to do with the financial stability of a bank. The key highlight is that bank assets include securities purchased loans financial instruments etc. The bank balance sheet ratio calculator is a tool that you can use to determine a banks financial strength and stability using items found on a balance sheet.

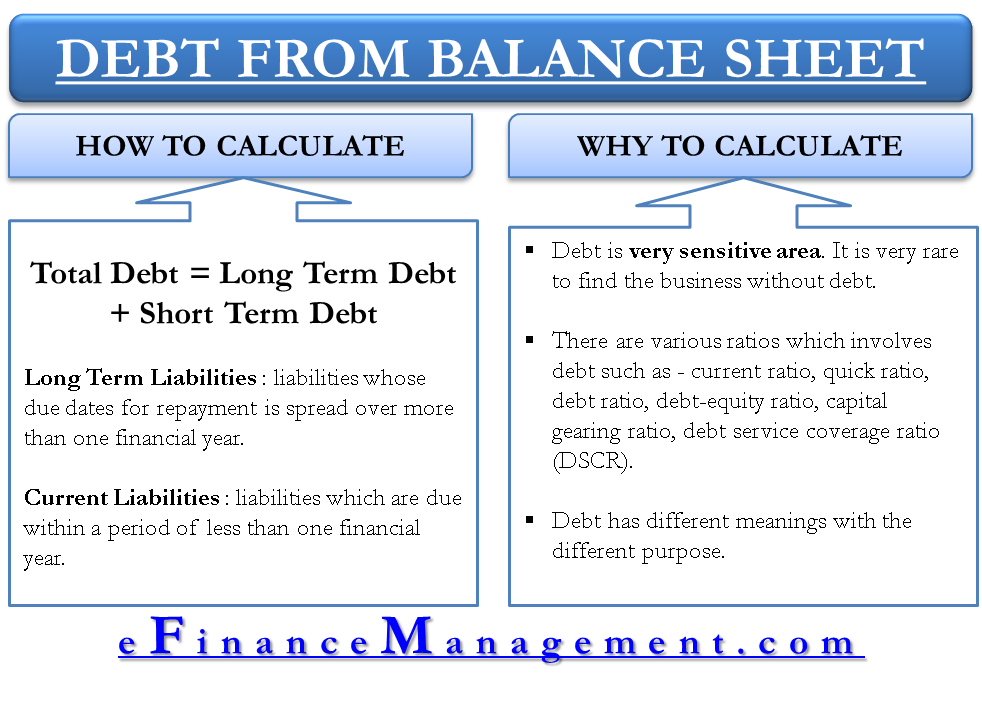

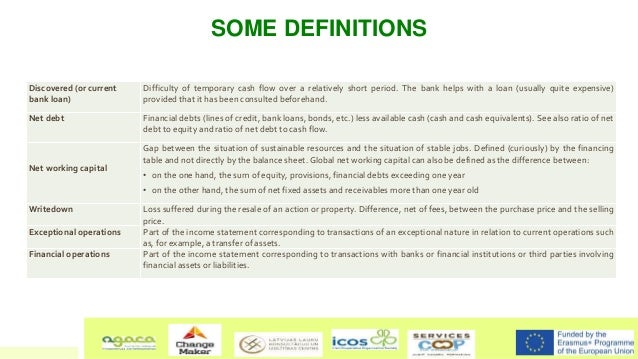

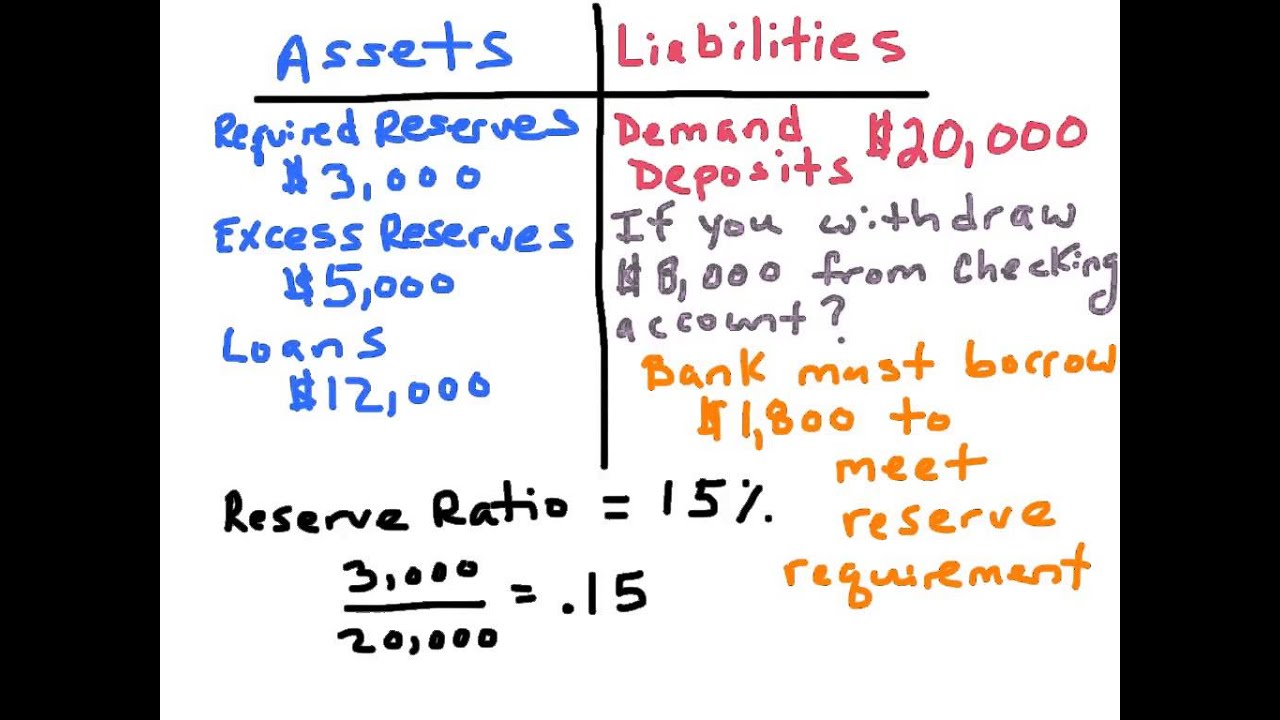

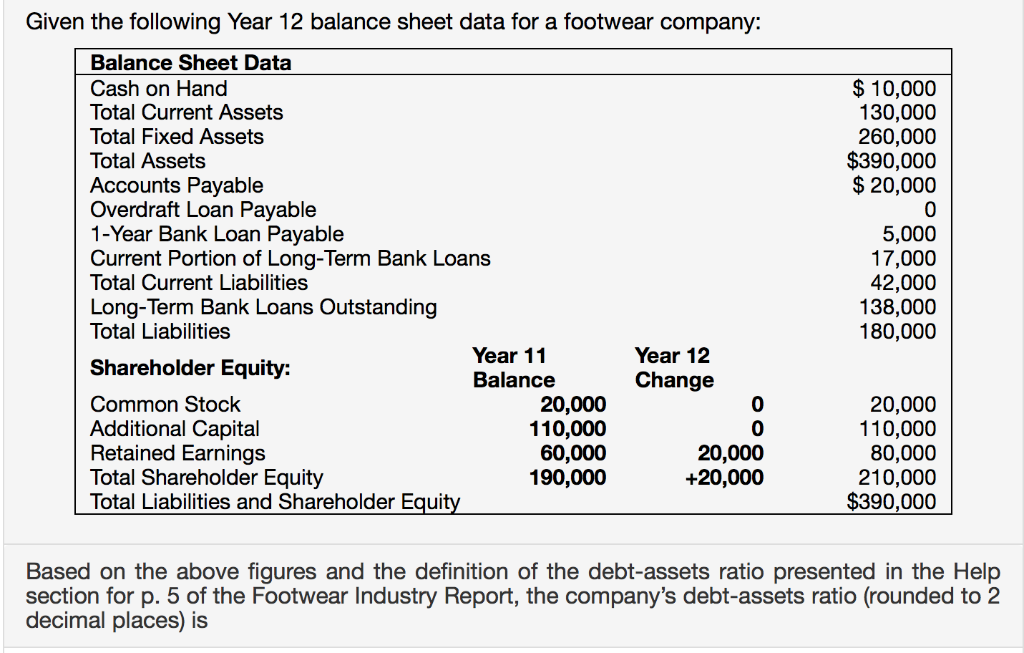

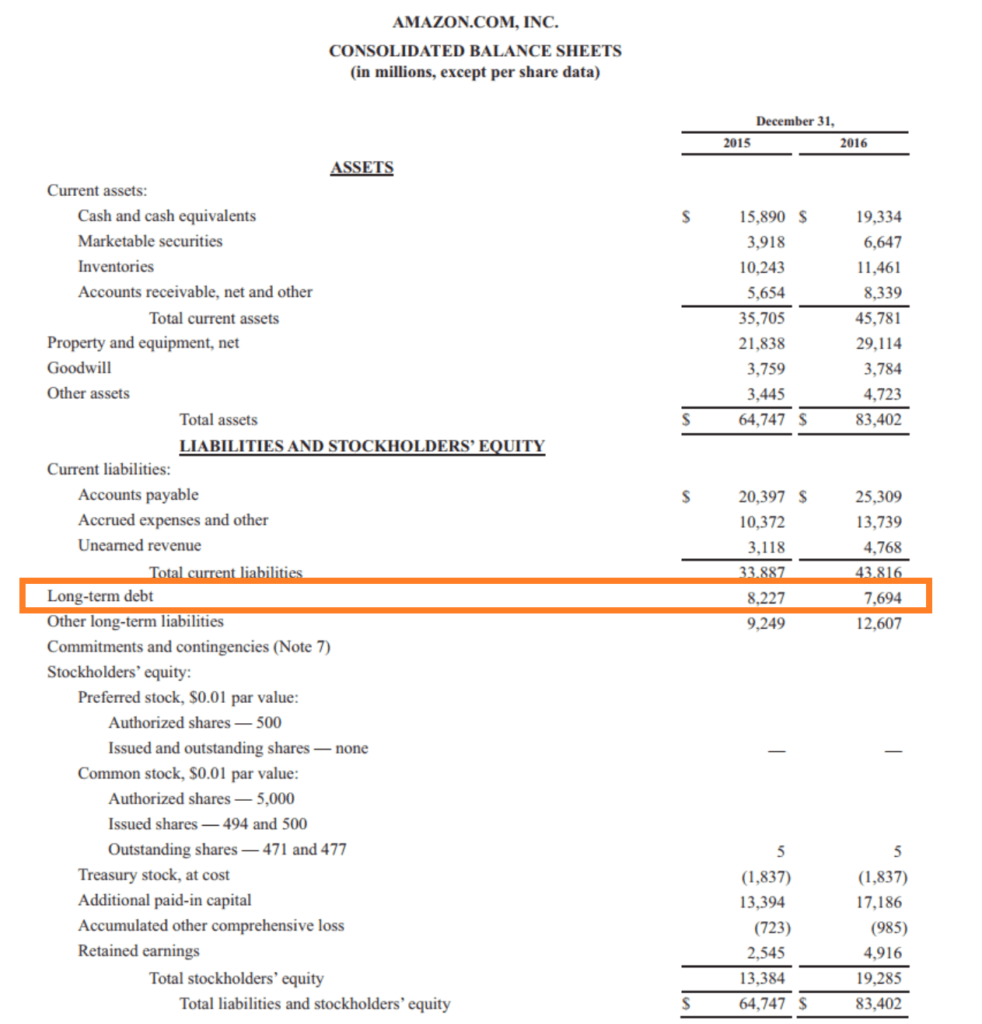

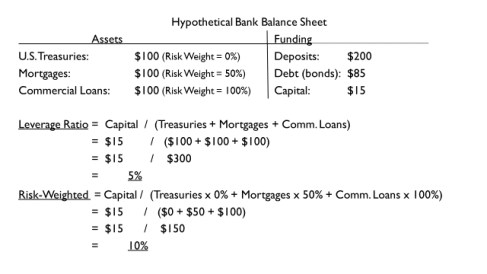

Goldman sachs sec filings we note that the banks balance sheet assets are different from what we usually see in other sectors like manufacturing etc. Some suggest that a leverage ratio over 4 to 1 would significantly reduce your chances of securing a traditional bank loan. Bank balance sheet ratio calculator. Loan loss reserves are typically accounted for on a banks balance sheet which can increase by the amount of the loan loss provision or decrease by the amount of net charge offs each quarter.

A bank balance sheet is a key way to draw conclusions regarding a banks business and the resources used to be able to finance lending. Leverage ratio your leverage ratio is calculated by dividing your total business liabilities by total business equity. Leverage ratio total debt divided by ebitda or noi. Loan to deposit ratio ltd.

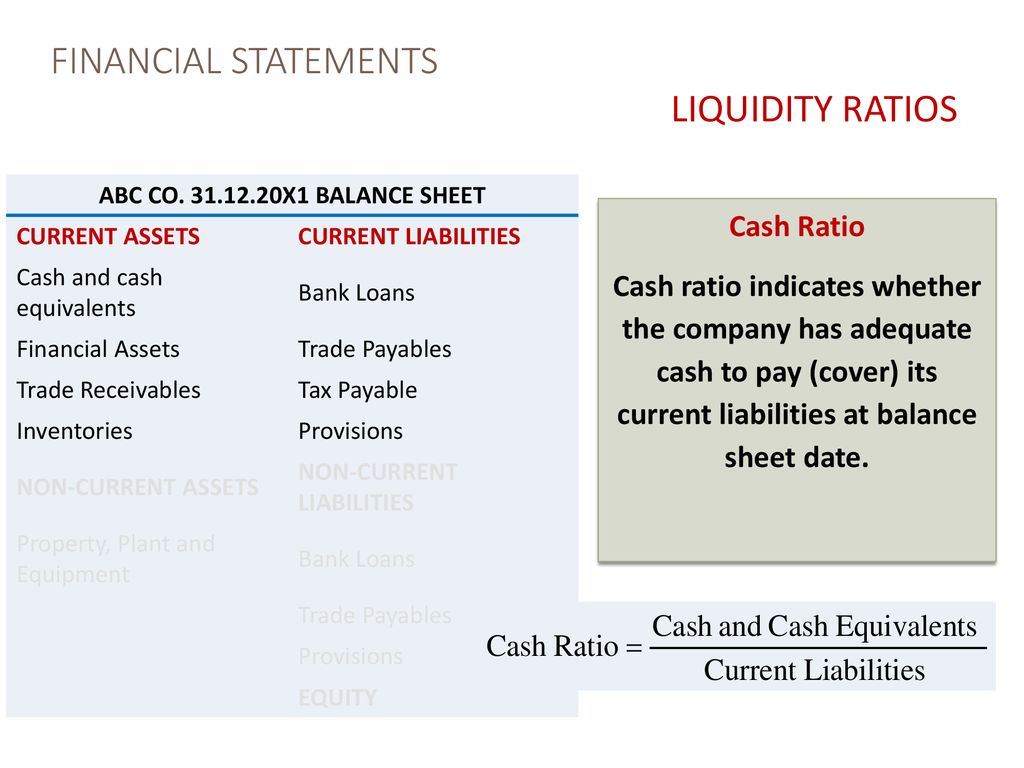

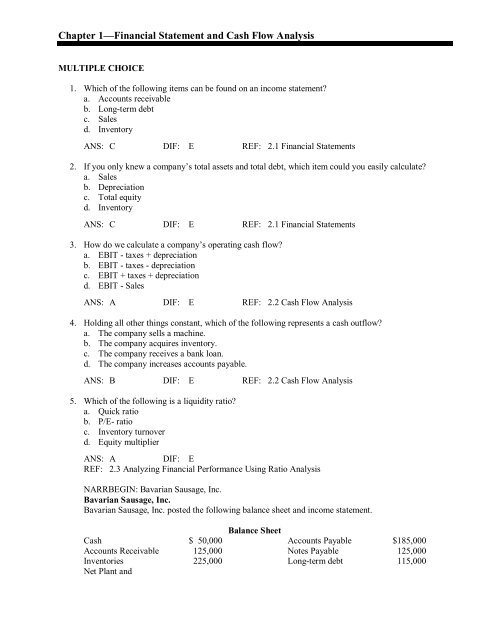

The ratio is powerful because it combines a market driven value of debt from the balance sheet and a simple cash flow proxy. This is the gold standard of loan underwriting. This ratio explains the borrowers ability to repay debt over a number of years from cash flow generated. The bank balance sheet ratio calculator is a tool that you can use to determine a banks financial stability and liquidity using items found on a balance sheetusing the inputs the calculator will produce ratios that are important for the analysis of a banks balance sheet.

This template calculates the loan to deposit ratio ldr common equity tier 1 cet1 ratio and the leverage ratio. In this article we shall discuss some of the key ratios related to a banks balance sheet statement. The volume of business of a bank is included in its balance sheet for both assets lending and liabilities customer deposits or other financial instruments.

:max_bytes(150000):strip_icc()/Income-Statement-and-Balance-Sheet-for-Tutorial_01-56a0a3333df78cafdaa37e74.png)

/current-ratio-analysis-56a0a31d5f9b58eba4b25303.gif)

/how-to-calculate-working-capital-on-the-balance-sheet-357300-color-2-d3646c47309b4f7f9a124a7b1490e7de.jpg)

/Balance-Sheet-for-Tutorial-copy-image_01-56a0a3303df78cafdaa37e61.png)

/balancesheet.asp-V1-5c897eae46e0fb0001336607.jpg)