Bank Loans Definition Business

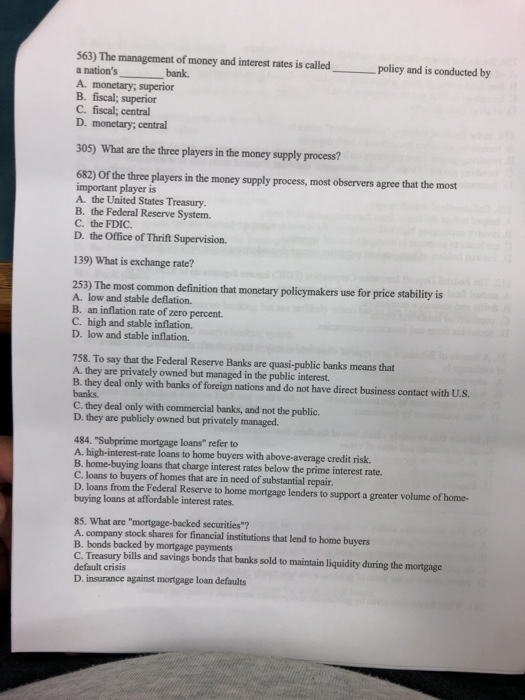

The bank sets the fixed period over which the loan is provided eg.

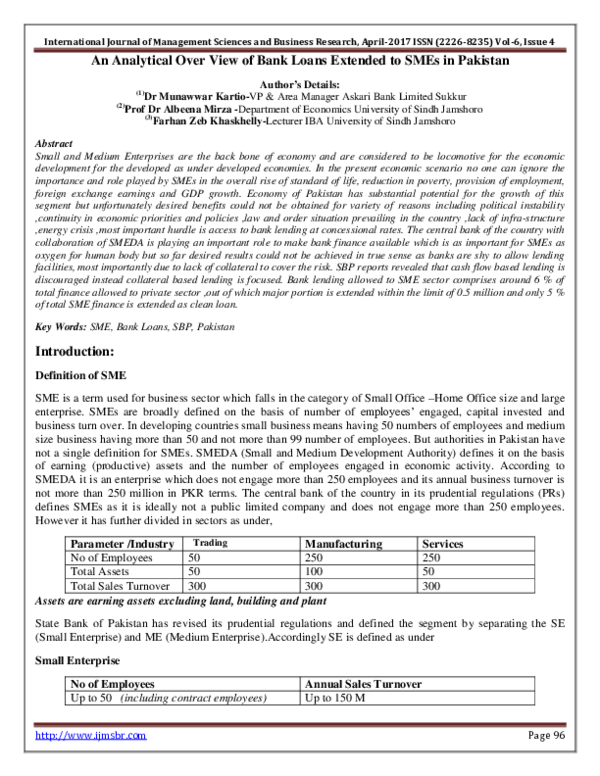

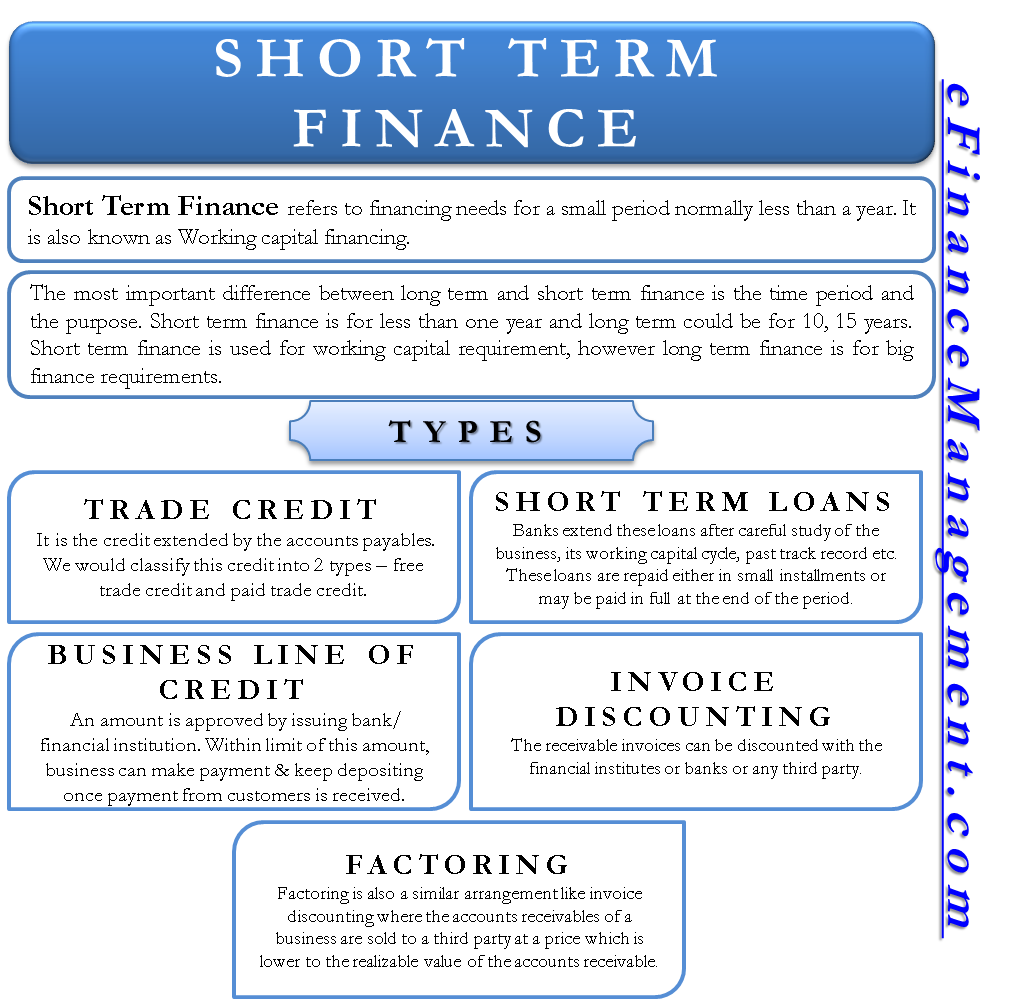

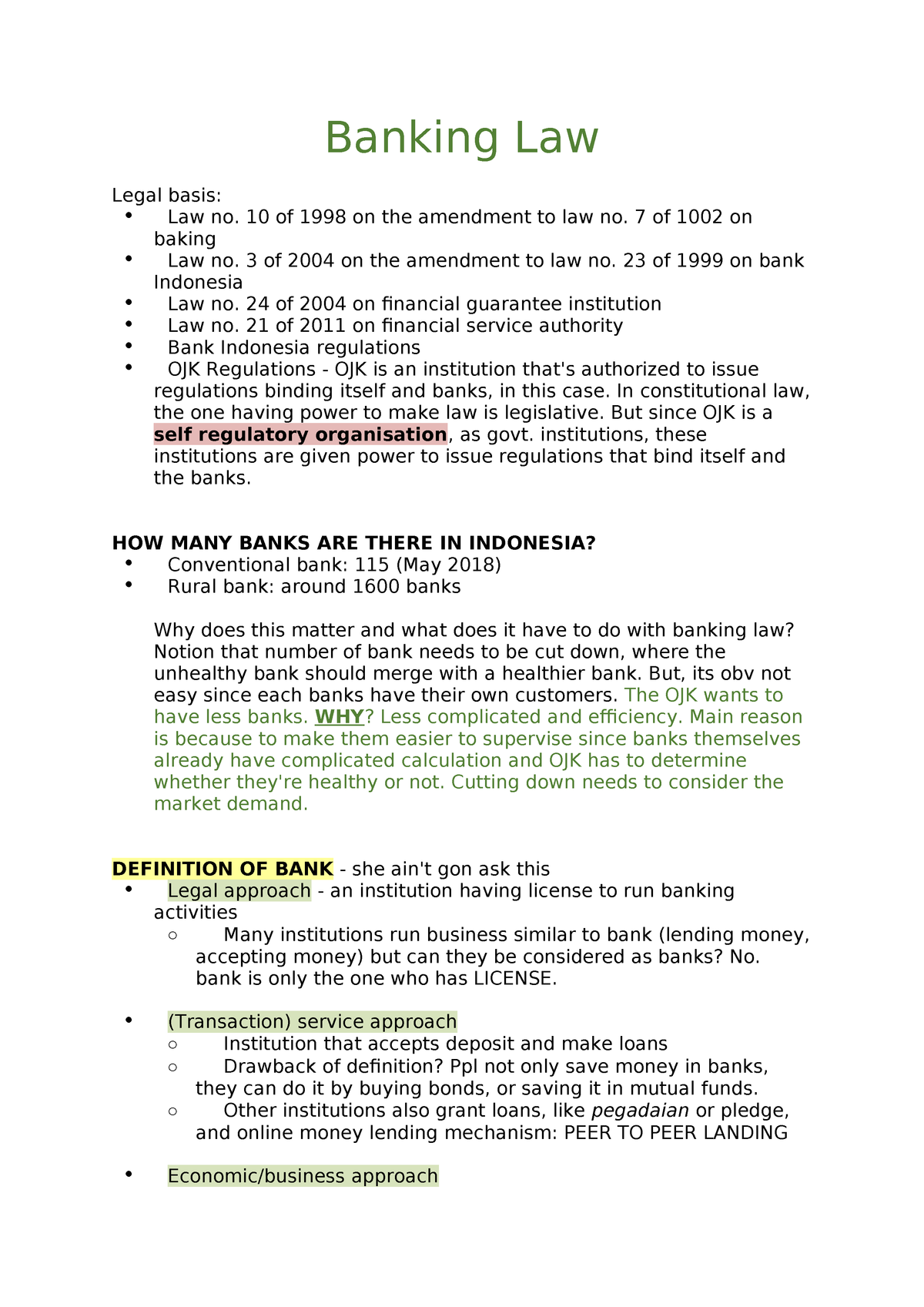

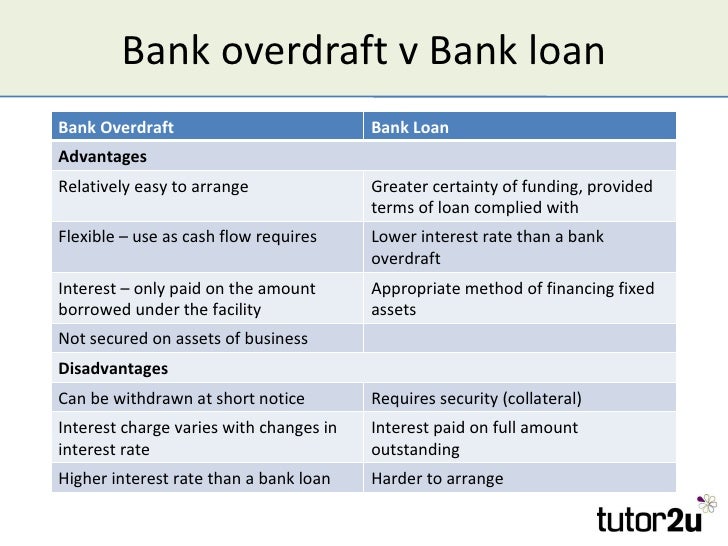

Bank loans definition business. With an overdraft the amount of borrowing may vary on a daily basis. A bank loan is a fixed amount for a fixed term with regular fixed repayments. 3 5 or 10 years the rate of interest and the timing and amount of repayments. A business loan is a loan specifically intended for business purposes.

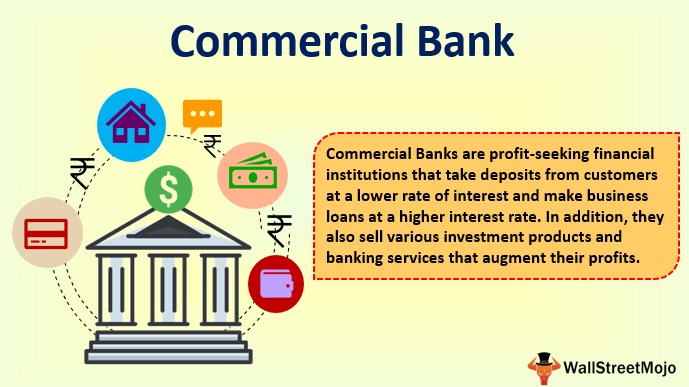

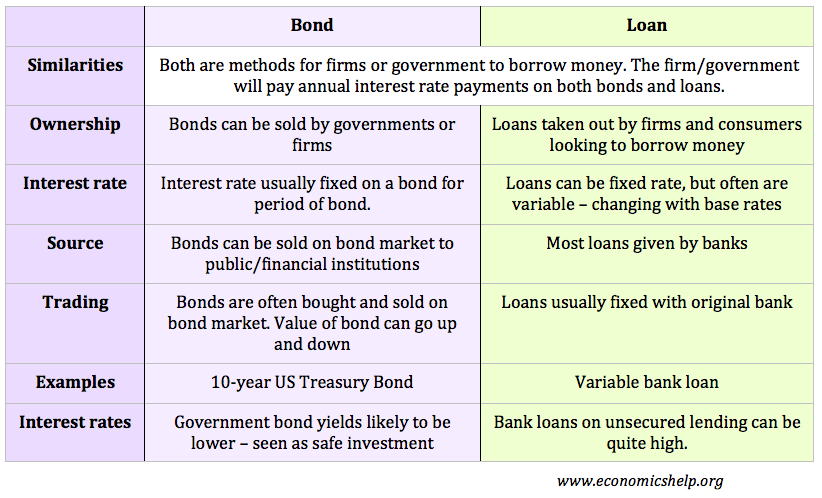

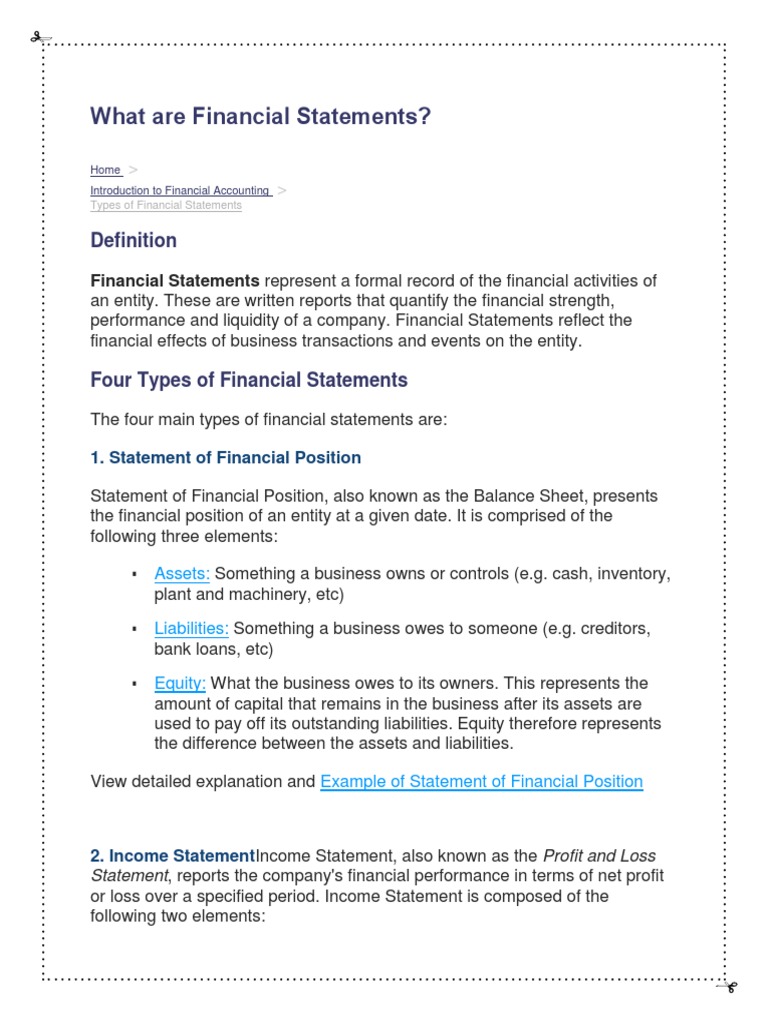

The lenderusually a corporation financial institution or governmentadvances a sum of money to the. The interest on a loan tends to be lower than an overdraft. The lendera bank loan is a form of credit which is extended for a specified period of time usually on fixed interest terms related to the base rate of interest with the principal being repaid either on a regular instalment basis or in full. A mortgage loan is a very common type of loan used by many individuals to purchase residential property.

The lender usually a financial institution is given security a lien on the title to the property until the mortgage is paid off in full. To be repaid with interest on or before a fixed date business loan commercial loan a bank loan granted for the. Bank loan a loan made by a bank. Bank loans can be capitalprincipal repayment or interest only and can be structured to meet the businesss needs.

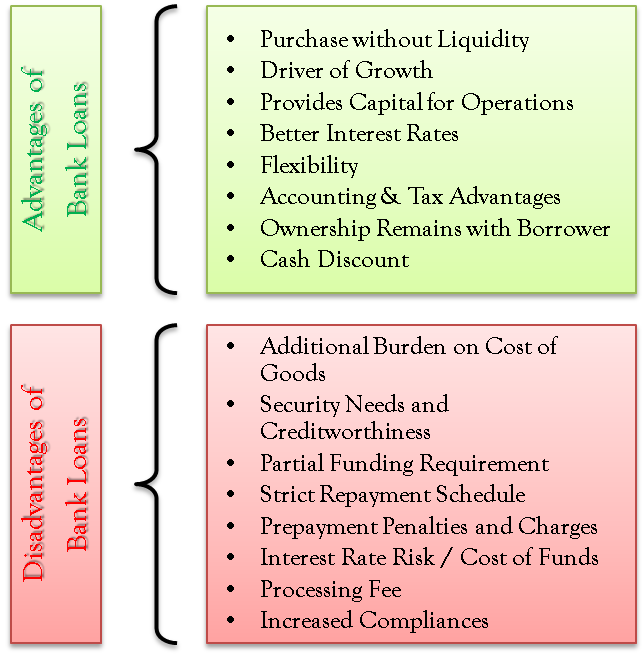

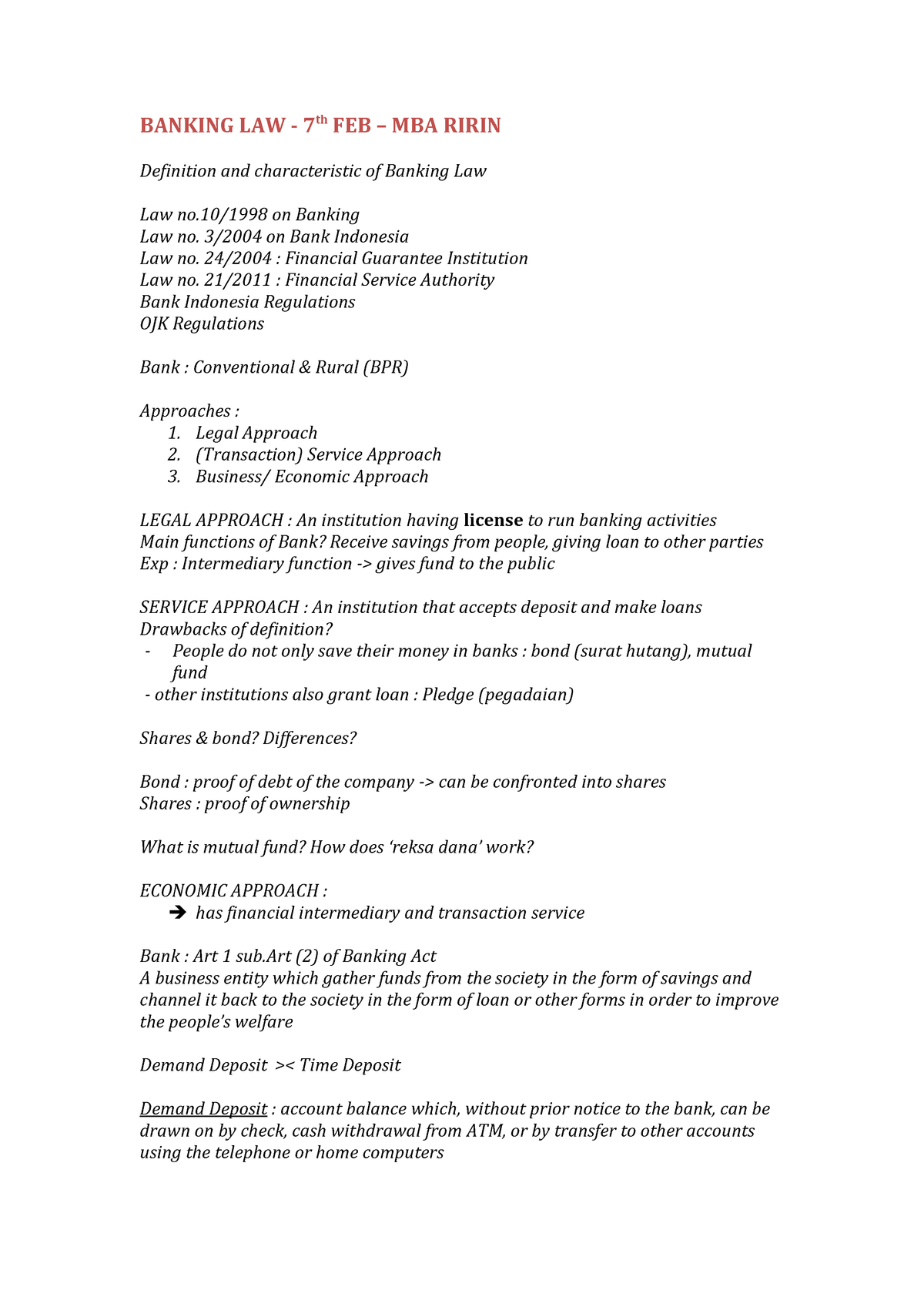

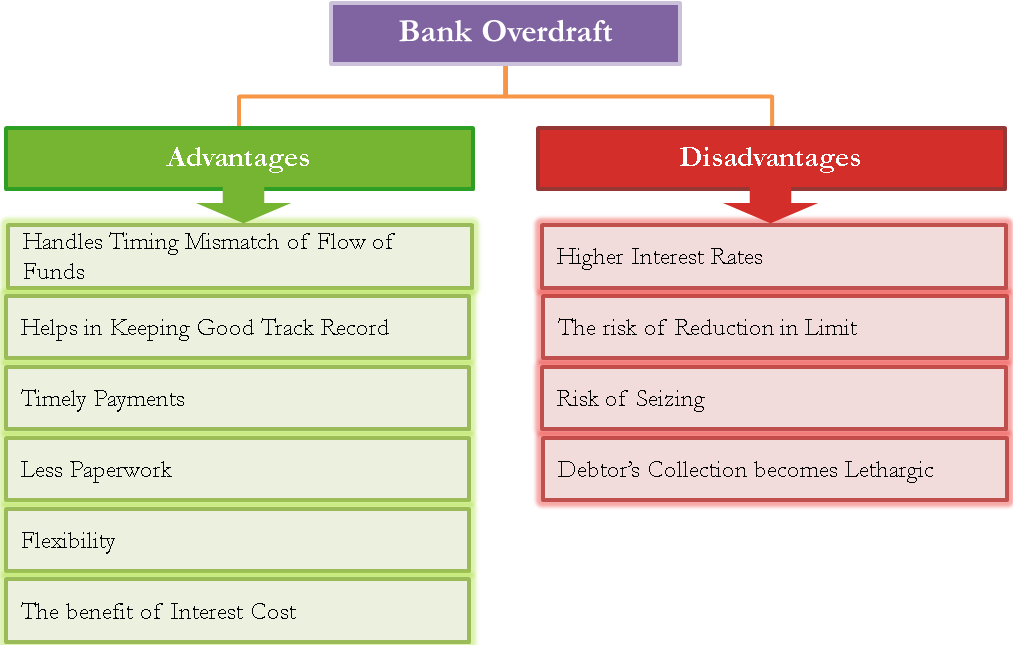

A bank loan is the most common form of loan capital for a business. A loan that a business owners gets from a bank. Although many business owners who need financing will automatically think to turn to a bank for that funding. A bank overdraft is a limit on borrowing on a bank current account.

A bank loan provides medium or long term finance. A secured loan is a loan in which the borrower pledges some asset eg a car or house as collateral. A senior bank loan is a debt financing obligation issued by a bank or similar financial institution to a company or individual that holds legal claim to the borrowers assets. Bank loan synonyms bank loan pronunciation bank loan translation english dictionary definition of bank loan.

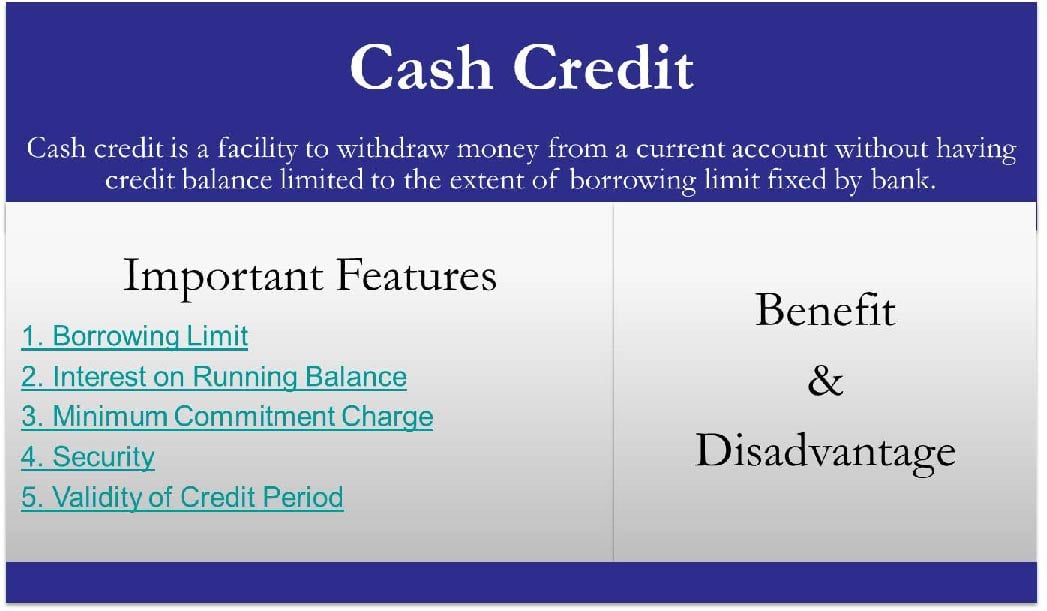

For businesses seeking to purchase business premises commercial mortgages are widely available and will in general offer flexible terms. As with all loans it involves the creation of a debt which will be repaid with added interestthere are a number of different types of business loans including bank loans mezzanine financing asset based financing invoice financing microloans business cash advances and cash flow loans. Bank loan or bank advance the advance of a specified sum of money to an individual or business the borrower by a commercial bank savings bank.

/loan-principal-questions-and-answers-52ba5408c43b44fc940ac8b4c1446f24.png)

:max_bytes(150000):strip_icc()/GettyImages-157335826-09d06968627d4b0f8b4a4ab734200c6c.jpg)

/what-are-interest-rates-and-how-do-they-work-3305855-FINAL2-2f4b8e003d8d475fa79182d2a5cd4aa4.png)

/close-up-young-woman-with-calculator-counting-making-notes-624490712-5ae94f5a0e23d9003918019c.jpg)