Best Rates Jumbo Loans

150 apy 100000 minimum deposit for apy golden 1 credit union.

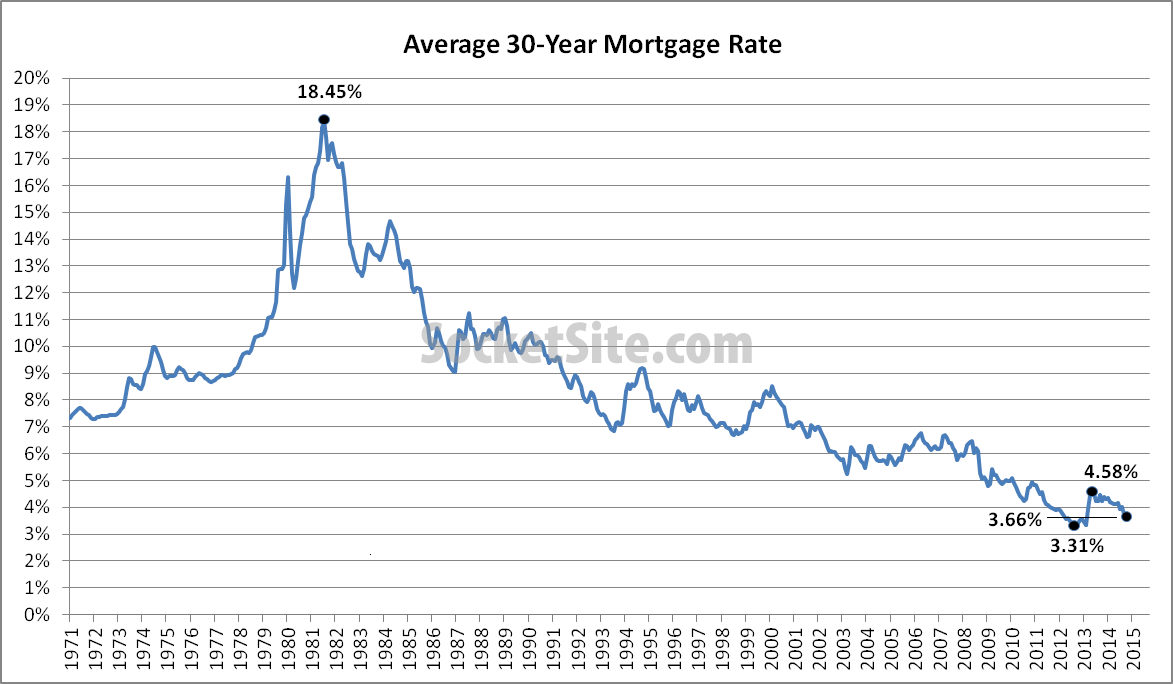

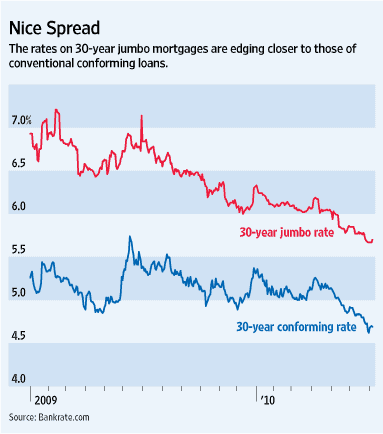

Best rates jumbo loans. Primelending is a dallas based mortgage lender with several mortgage loan options including conventional loans jumbo loans government backed loans and refinance loans. Compare jumbo mortgage rates. But since the end of november 2018 this trend has seemed to shift with jumbo mortgages offering lower rates than conforming. In the past jumbo mortgage rates used to be higher than conforming loans due to jumbo loans not being secured by freddie mac and fannie mae and they ranged around 025 to 050 higher.

The lender is a subsidiary of plainscapital bank. Best for good to fair credit fast funding no fees. Click a lender to jump down to its review. Georgia is one of the fastest growing states in the us with the population predicted to jump 177 by 2030luckily georgia has 42 million housing units to accommodate all those residents and a homeownership rate of 63 according to the us.

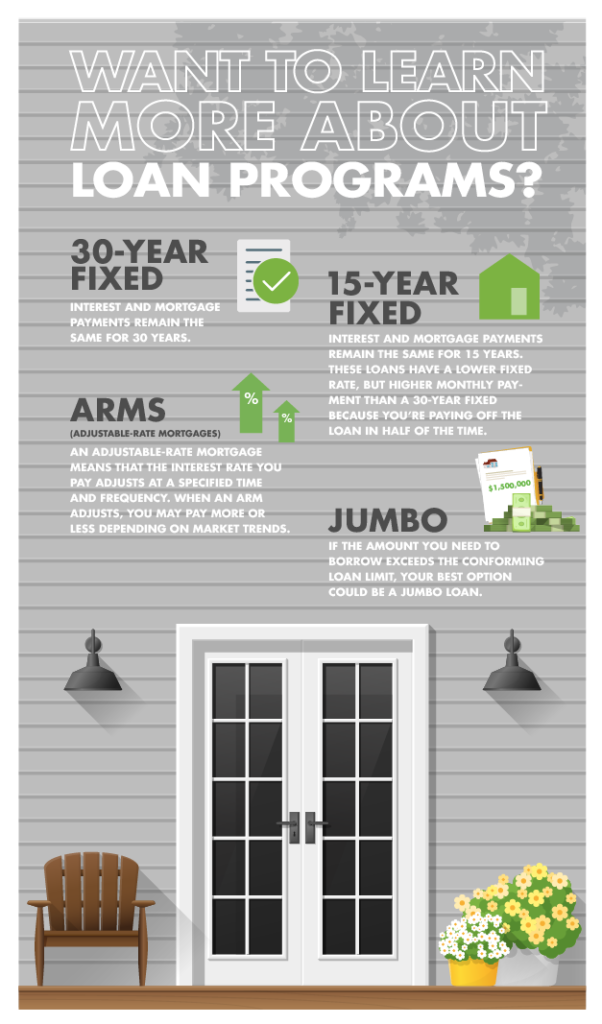

A jumbo loan will typically have a higher interest rate stricter underwriting rules and require a larger down payment than a standard mortgage. Best for fair to bad credit loans under 5k checking rates. Find the best jumbo money market rates from credit unions and banks by comparing apy and minimum deposit required for yields. Government mortgages there are some mortgage loan options issued by the government.

Census bureaus 2017 american community survey. Our list of best jumbo cd rates mostly focuses on cds with minimums from 50000 to 100000 and that are available at banks and credit unions with easy nationwide membership requirements. 140 apy 100000 minimum deposit for apy. Bankrates best 5 year jumbo cd rates for july 2020.

Arm loans are best for buyers who are either a only planning to stay in their homes for a short period of time or b dont mind taking a risk on fluctuating interest rates. Conventional fha va usda arm refinancing. Jumbo mortgage rates today. Loans and credit cards.

Jumbo mortgages are available for primary residences second or vacation homes and investment properties and are also available in a variety of terms including fixed rate and adjustable rate loans. A jumbo mortgage is a big home loan that requires lenders to assume more risk so it sometimes comes with stricter lending standards. Best for fair to bad credit loans under 5k checking rates.

/what-you-need-to-know-about-jumbo-loans-4155160_final2-e8b7d0e5ae39414e9a306c0eadcca732.jpg)

:max_bytes(150000):strip_icc()/GettyImages-1144776052-251ed1c7c9b149d0b0b2043b312dbff3.jpg)