Blacklisted Home Loans Standard Bank

Make your next big move the right move with the help of our calculators step by step guides and guaranteed personalised interest rate.

Blacklisted home loans standard bank. Most non banking financial institutions were forced to assist clients who is blacklisted due to the new national credit act that was put in place. Blacklisted loans on offer or trying to apply for car finance and personal loans through absa nedbank fnb or standard bank is a somewhat painful and usually disappointing task. Dont let being listed on the credit bureau prevent you from getting a personal loan. For individual with a negative credit record and black listed they will find it harder to get for credit.

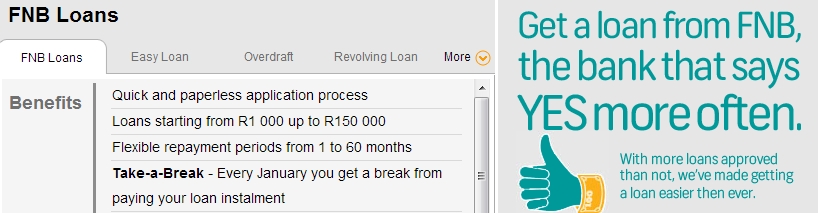

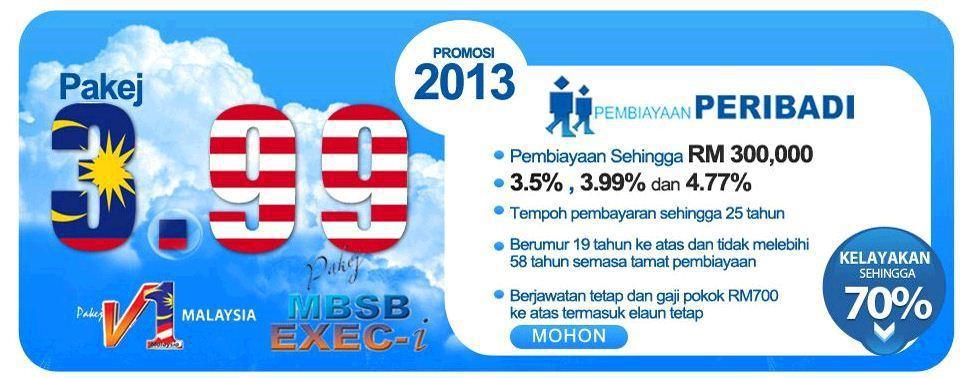

Our loan repayment terms range from a minimum of 12 months to a maximum of 72 months. You can apply for a minimum loan amount of r3 000 to a maximum loan amount of r300 000. Especially credit from the big four institution in the country namely absa nedbank fnb or standard bank. Wizard blacklisted home loan.

Standard bank vehicle and asset finance is one of the leading vehicle and capital equipment financiers in south africa. These banks have very. Our service fees are r69 per month for all loans and our once off initiation fees range from r41975 up to r120750 vat inclusive. Although there is no standard bank personal loans for blacklisted individuals you can take out a loan of up to r300000 if you qualify.

Loan repayment terms are often extended with lower interest rates to assist you in paying off all of your debts over time. This will put all loans into one large loan including credit card private loans and home loans. Whether youre a first time buyer building a house or looking to switch your bond for a better deal it only takes 15 minutes to apply online with sas number 1 home loan provider. If you are looking for a loan a standard bank personal loan may just be the perfect solution.

If you have a bad credit record these major south african banks have very strict rules when it comes to lending money. Wizard financial services assists home buyers in the process of applying for a home loan to all the major banks in south africa in order to get you the right home loan at the best possible interest rate. Standard bank is the second largest mortgage lender in south africa and enjoys a market share of about 30if you consider that the downward slide of the property industry started gaining momentum las blacklisted loans loan comparison.