Blacklisted Loans Online Approval South Africa

It takes only 15 minutes to proceed with a request.

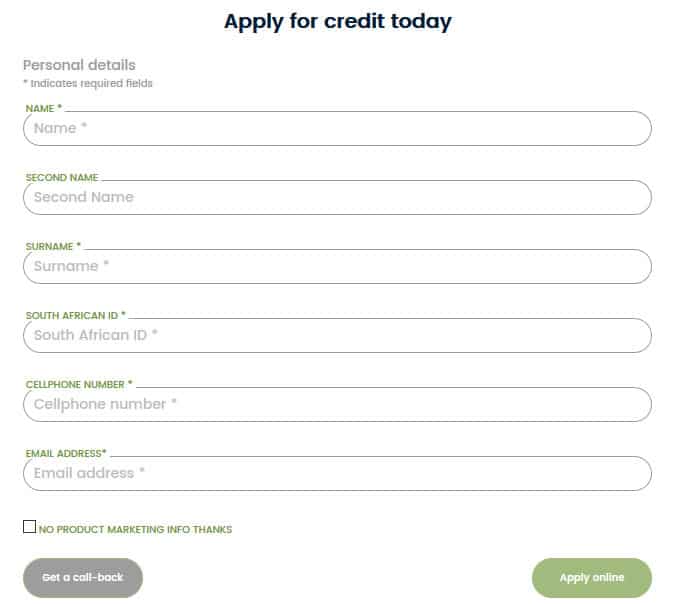

Blacklisted loans online approval south africa. Blacklisted personal loans are very useful for someone who has a loans with bad credit record but is in a situation where they need a loan. Applying for a personal cash loan for any reason is very quick and easy it is just a matter of completing a simple online loan application here. Ayoba loans is a fast flexible solution designed to give you access to the money. A complete list of blacklisted and bad credit loans in south africa.

Benefits of loans for blacklisted in south africa such credits along with debt review loans are very popular within unemployed applicants. A blacklisted person is an individual who has defaulted on a loan from a particular lender and as a result that lender blacklisted their credit score. Repayment periods from 3 60 months. High probability of approval.

Late or missed loan payments may be subject to increased fees and interest rates charged by the lender. Ayoba loans have affordable loans to all south africans whether you are blacklisted or not blacklisted on itc. Unsecured bad credit loans and blacklisted loans up to r 250 00000. Lenders may use collection services for non payment of loans.

As a loanfinder in south africa we will search high and low for the perfect finance solution. Loan repayment periods vary by lender also. Interest rates based on credit profile from 14 32. To apply for a loan you must be a south african citizen or a permanent resident and 18 years or older with a valid identity document earn a minimum of r1500 per month have proof of your current residential address and your own a bank account into which your salary is deposited.

With iloans getting a blacklisted personal loan from a registered credit provider has never been easier. Blacklisted clients can apply. Personal loans south africa no credit checks get personal loans up to r150000 at low rates. Not all lending partners offer up to r200000 loans and not all applicants will be approved for their requested loan amounts.