Bridging Loans Best Rates

A residential bridge loan can either take first position as the primary mortgage on your current home or second position.

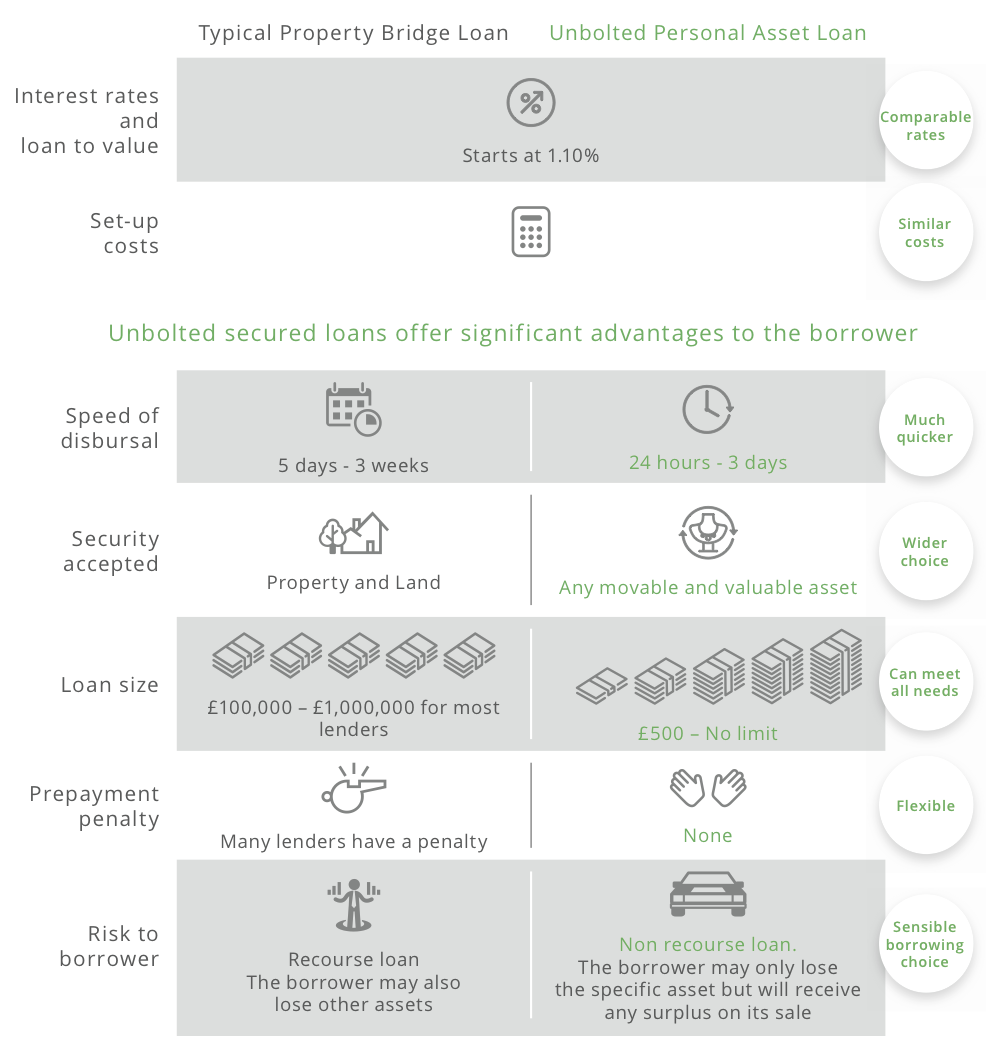

Bridging loans best rates. Bridging loan rates can be influenced by the bank of england base rate and depending on the circumstance can vary between 043 and 15 per month. The key to finding the best bridging loans with the best rates around is having access to the whole of the market and meeting the eligibility criteria at as many lenders as possible. Bridge loan rates vary by lender but are typically higher than traditional mortgage rates. Bridge loans are short term up to one year have relatively high interest rates and are usually backed by some form of collateral such as real estate or inventory.

A development loans is also a short term loan for property developments including refurbishment and construction and is based on the gross development value which youll pay back in stages. On this page youll find a number of lenders that offer bridging finance home loans where you can compare the interest rates offered. For example a rate of 048 a month translates to 576 apr. Read on to find out which factors bridging lenders take into account when assessing eligibility or make an enquiry to talk to a bridging expert over the phone.

After you compare bridging loans and find the best bridging loan rates you can do your application online. Once your applications approved the money could be in your account within two weeks. They also may include several fees including an origination fee and the cost of an appraisal. When taking out a bridging loan you could face much higher interest rates than with a traditional mortgage.

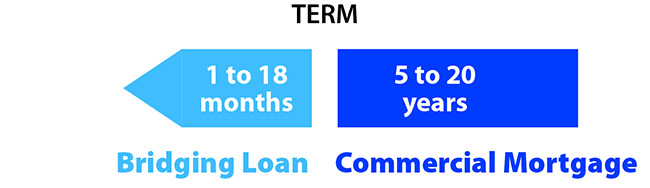

As the loans are short term rates are sometimes expressed as the rate per month. Most lenders will offer bridging loans for no longer than. These types of loans are also. Find bridging home loans at ratecity and compare over 5914 home loans.

Bridging loan interest rates and fees. A bridging loan typically runs from 0 12 months though certain circumstances can be extended longer. Bridge loans have high interest rates require 20 equity and work best in fast moving markets. View all product details interest rates and fees to find the home loan that suits your needs at ratecity.

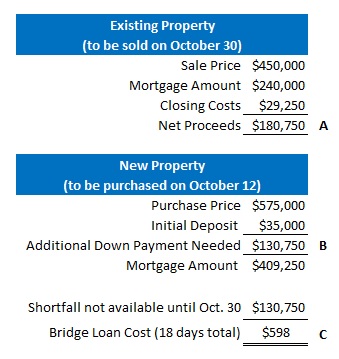

A bridge loan may let you buy a new house before selling your old one. How a bridge loan works.

/what-are-bridge-loans-1798410-final-updated-d9611d2b5ab44068b6fe5222b4e51151.png)