Consolidation Loans Uk Moneysupermarket

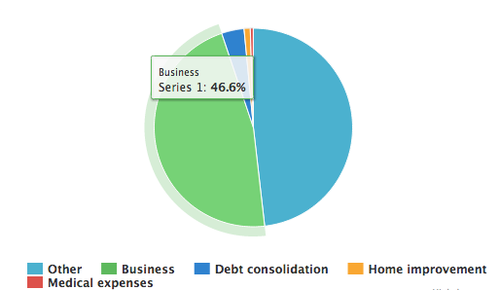

Of the 126 unsecured personal loans analysed on defaqto in december 2014 83 allowed the loan to be used to consolidate debt.

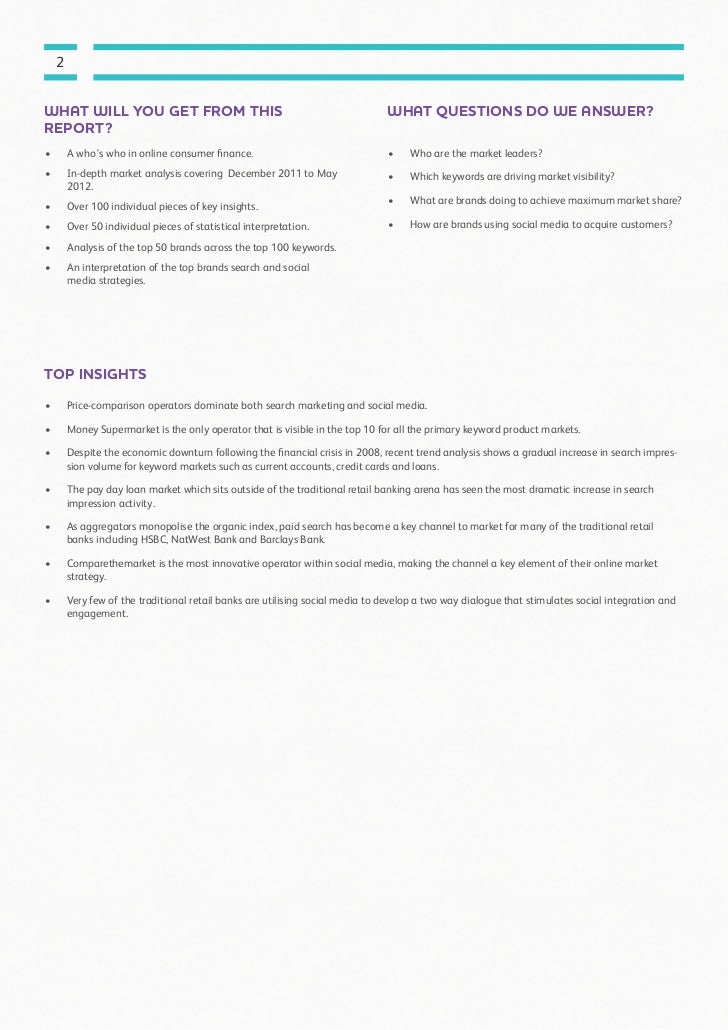

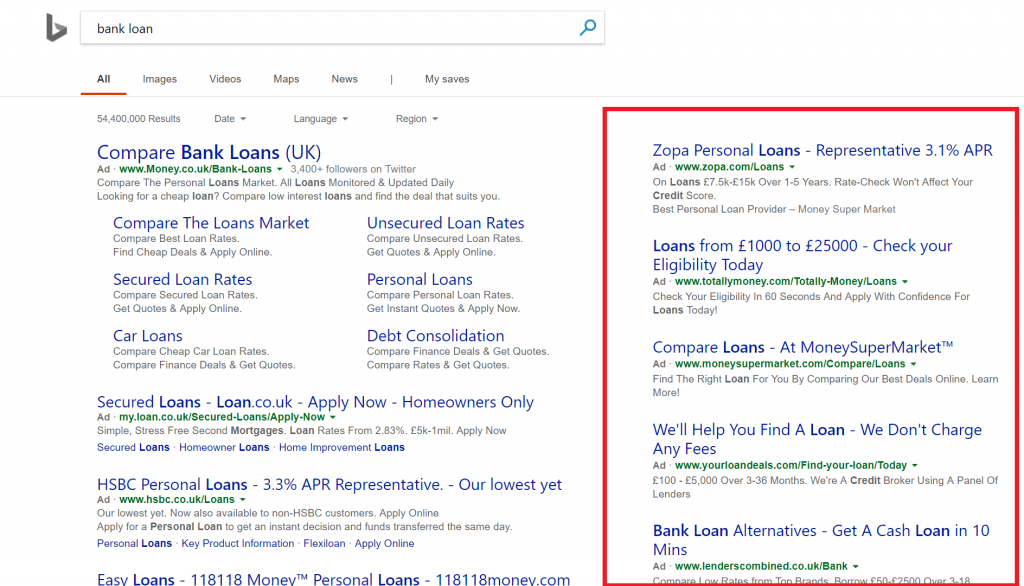

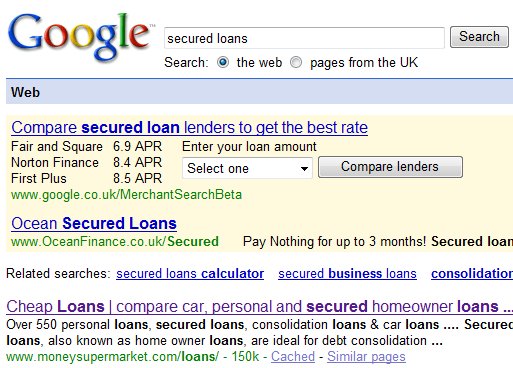

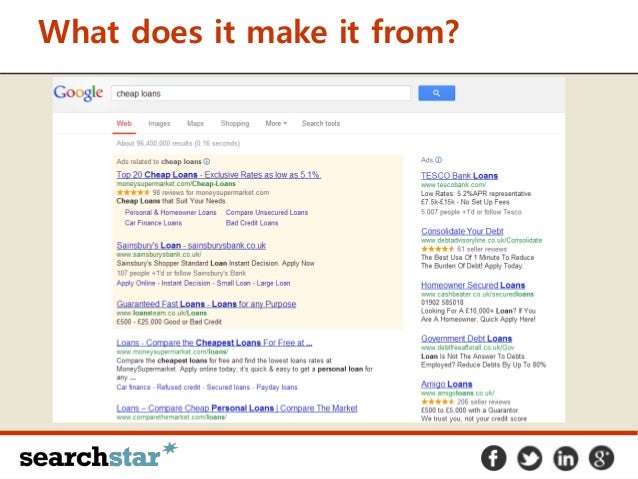

Consolidation loans uk moneysupermarket. The interest rate is fixed so you wont have to worry about it changing over the course of your loan. Moneysupermarket is a credit broker this means well show you products offered by lenders. Dont rule out unsecured loans if the amount you owe is less than about 25000 unsecured personal loan products may be a better option and many allow debt consolidation. A debt consolidation loan lets you combine all your existing loans meaning you could potentially save a lot of money in lost interest.

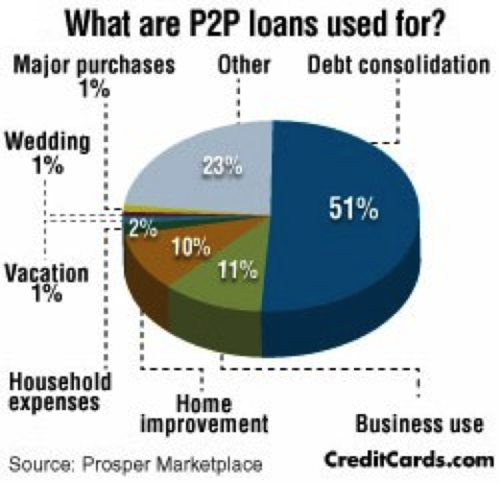

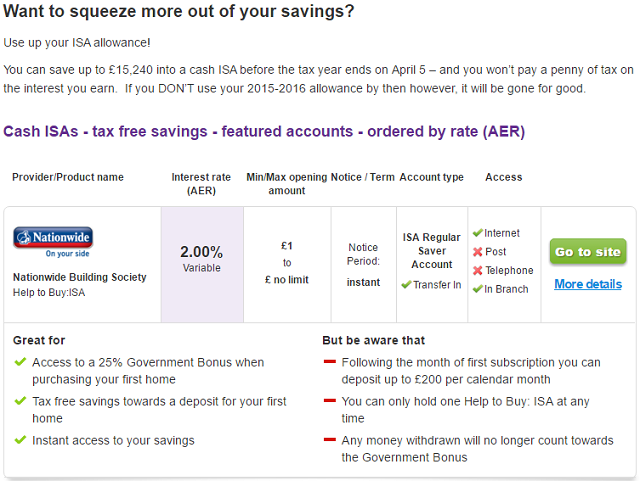

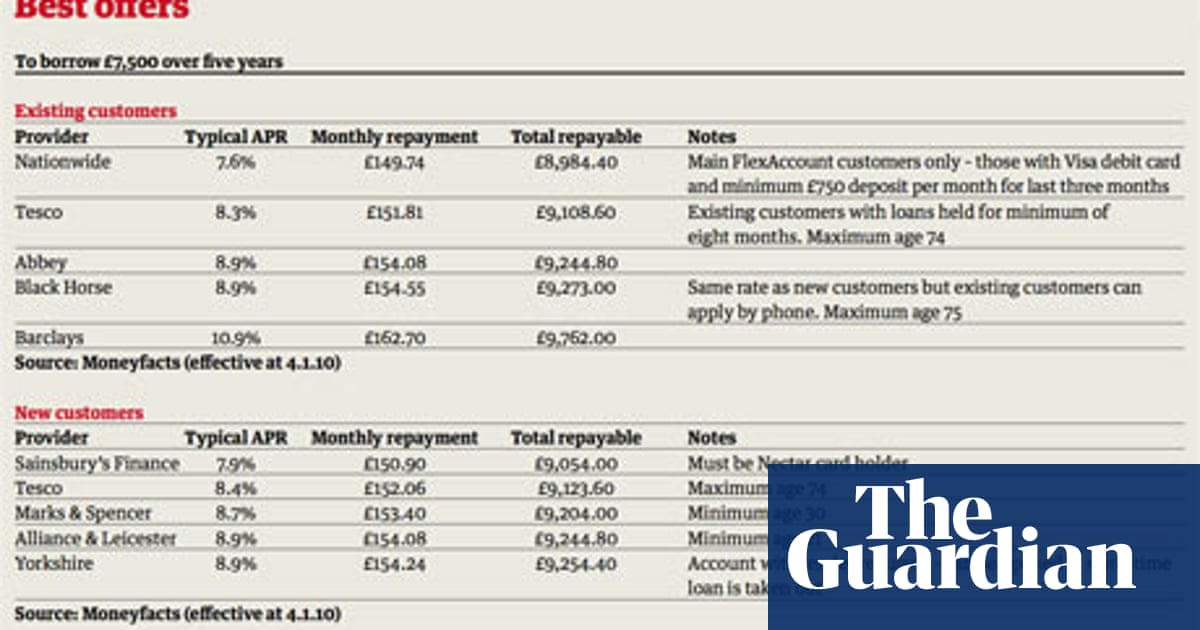

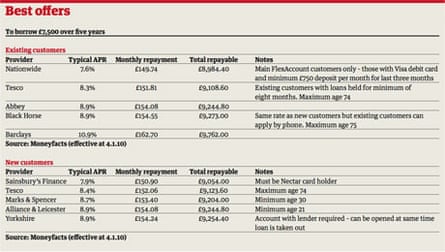

This type of loan could be an especially good option if you can find one with a lower interest rate as it could reduce the total interest youre paying on any outstanding debts. Sometimes you just need a break and a small loan to pay for a nicer holiday than you might otherwise be able to afford can represent a treat. Fixed interest rates on loans of 7500 15000 over 25 years. Debt consolidation loans typically have a higher apr than regular personal loans.

If you have run up other high interest debts a personal loan can help manage the load. You work out how much you owe on all your loans in total and apply for that exact amount at a more favourable rate of interest. You can choose to add any fees associated to secured loans to the total amount you borrow however this will affect the total amount of interest you pay over the term of the loan. If you want the best for your special day loans are one way to.

A secured loan is when you borrow a certain amount and use assets you own as collateral. It works like this. A debt consolidation loan lets you turn multiple debt payments credit cards store cards overdrafts or loans into one convenient payment. This is most commonly your.

Lender fees may apply. Some personal loans charge variable interest rates. According to the price comparison site the rate of interest on personal loans has increased to almost double the base rate since september this year. You can apply for a top up loan if you need extra cash which if granted can be added on to your existing loan or can be created as a second loan.

For secured loans a broker fee of up to 7 of the loan amount may be payable. A personal loan wont require you to put any assets up as collateral but if youve got bad credit youll have limited options when it comes to lenders and interest rates tend to be higher. So borrowing using debt consolidation is more expensive. You must be 18 or over and a uk resident.