Credit Cards Loans Written Off

Check your credit report to ensure that the accounts pertain to you.

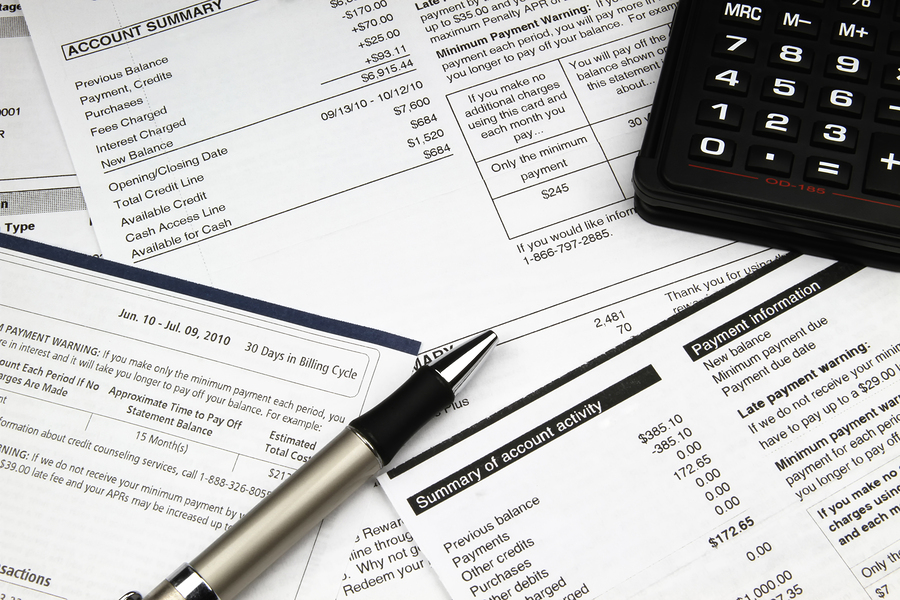

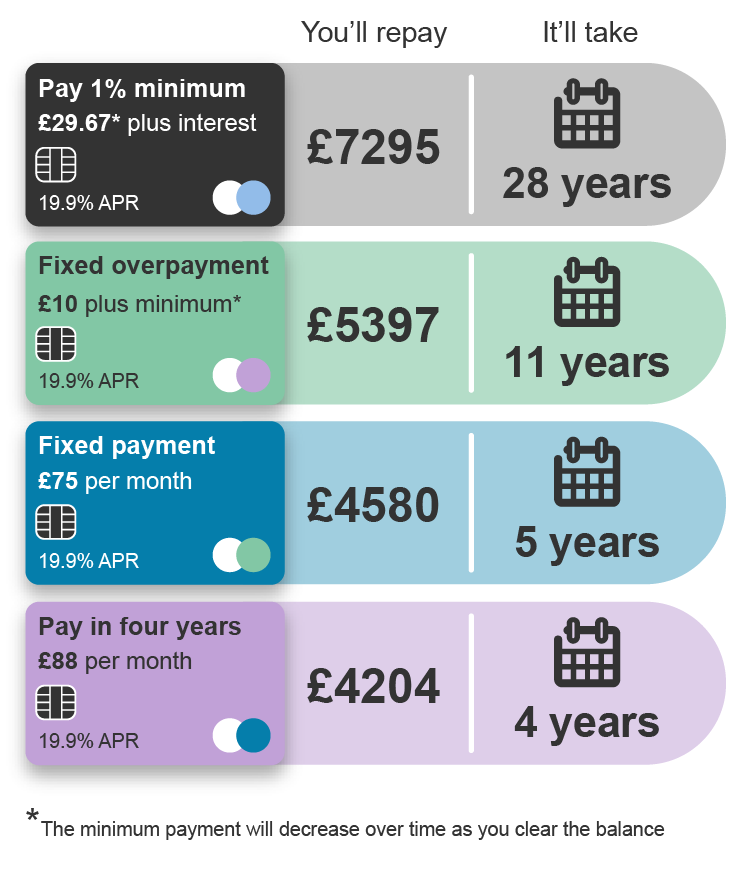

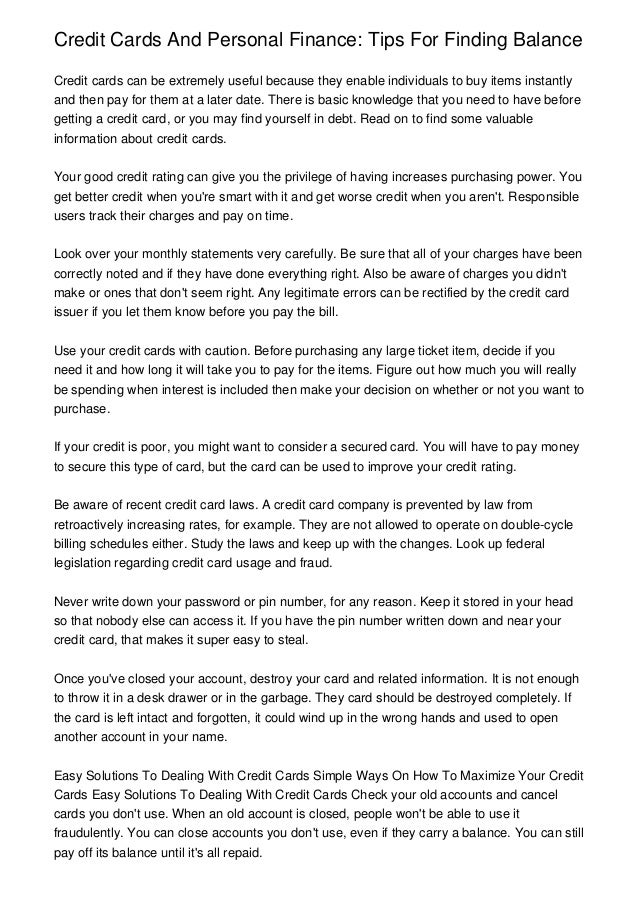

Credit cards loans written off. Credit card consolidation with a personal loan is often the best strategy to pay off credit card debt faster. According to msn banks are open to debt settlement offers just before your account is written off. Few things are more damaging to a persons credit profile than a write off. You can avoid the threat of a lawsuit by resolving your credit card account before or after the writeoff.

In our opinion going with a personal loan with lower interest to pay off credit cards is a good idea if you are facing difficulty to afford credit card payments. From an accounting standpoint that means they remove that anticipated income from their accounts receivables ledger and document the loss as charged off to bad debt or written off to bad debt at that point. A personal loan is an unsecured fixed rate loan from 1000 to 100000 that is. The payday lender has been told to write off loans after not providing customers with important information.

By that time the bank has become convinced that you cannot or will not make the payments. So your debt was just written off of one credtitors books. The main consequence for you is that theres a good chance that the company reported the write off to the credit rating agencies which would hurt your score. You still owe the money.

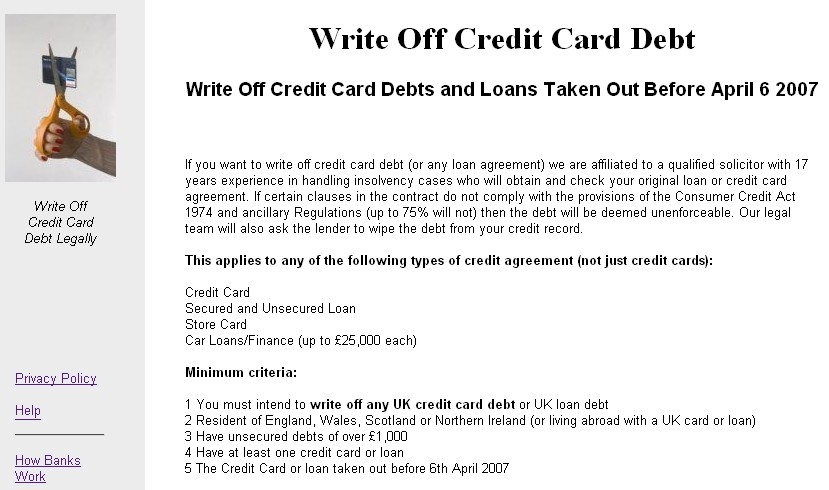

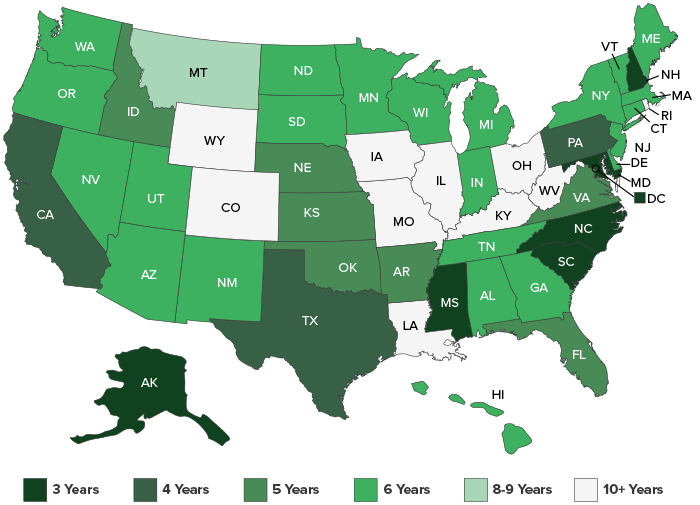

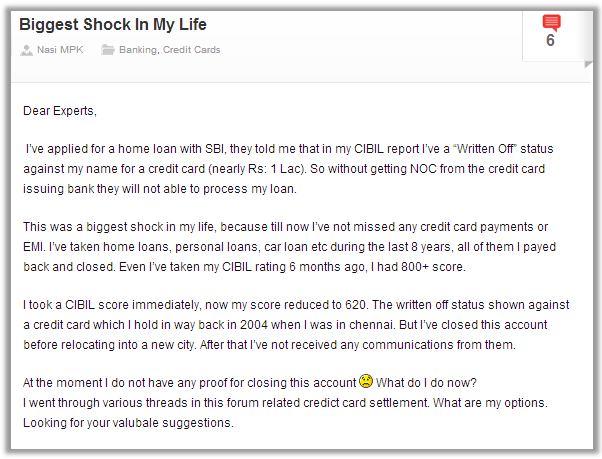

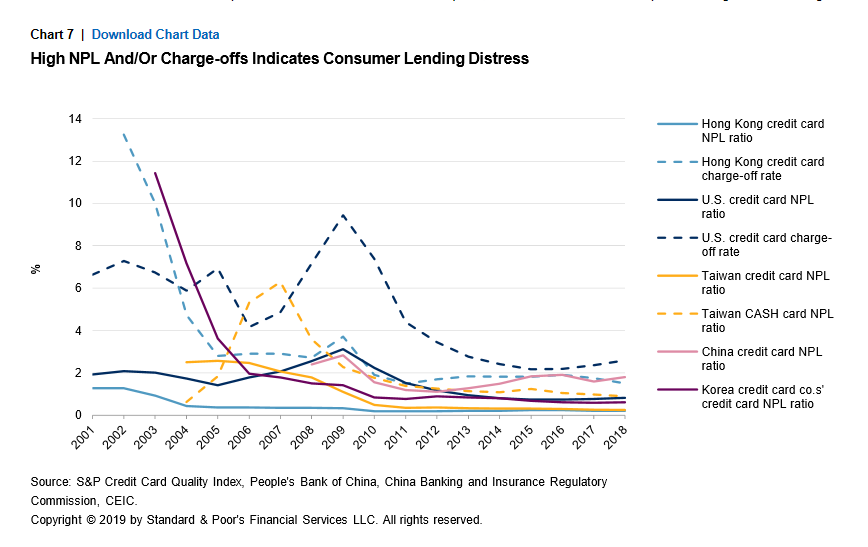

A charged off or written off debt is a debt that has become seriously delinquent and the lender has given up on being paid. The credit card charge off rate was higher when compared to the 093 charge off rate. By posting a write off the lender is then able to list the default as a loss for tax purposes. When you are not able to make payments against the outstanding loancredit card amount for more than 180 days the lender is required to write off the amount in question.

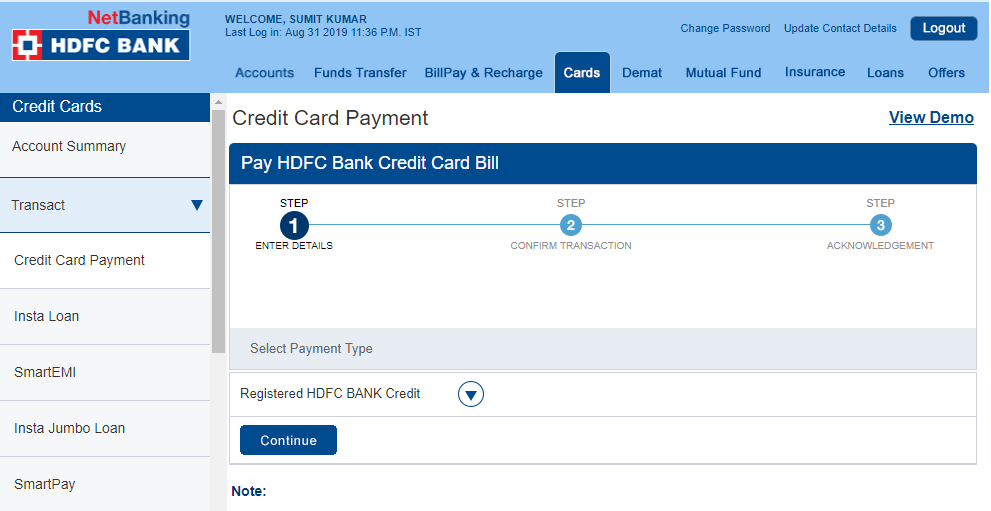

The lender then proceeds to report this on your cibil report as written offthis is a detrimental status for the approval of your loan or credit card applications as the lender may not want to provide a loan. Rarely is debt forgiven or forgotten. It hasnt gone off and died however. The competition and markets authority cma took action after it was discovered that shelby finance did not provide summary of borrowing statements to more than 15000 customers between august 2018 and july 2019 despite being required.

As of the first quarter of 2020 credit card loans from all commercial banks had a charge off rate of 376.

/HowtoNegotiateaCreditCardDebtSettlement-56ca6b385f9b5879cc4d2891.jpg)

:max_bytes(150000):strip_icc()/credit-report-157681670-5b740d0246e0fb00502fd857.jpg)

/how-to-remove-a-charge-off-from-your-credit-report-960360_FINAL-d54108d9603a45aa853c03dbbae765bb.png)

/sample-credit-letters-for-creditors-and-debt-collectors-961135-v12-c4d4a42404f141bda00a74b4963bd940.png)

/GettyImages-166836045-5693e7cb3df78cafda85b1c8.jpg)

/state-by-state-list-of-statute-of-limitations-on-debt-960881-Final-a906cc8bbdb640ee8acdb02c7e81377b.png)