Debenture Loan In Balance Sheet

100 debenture is issued at rs.

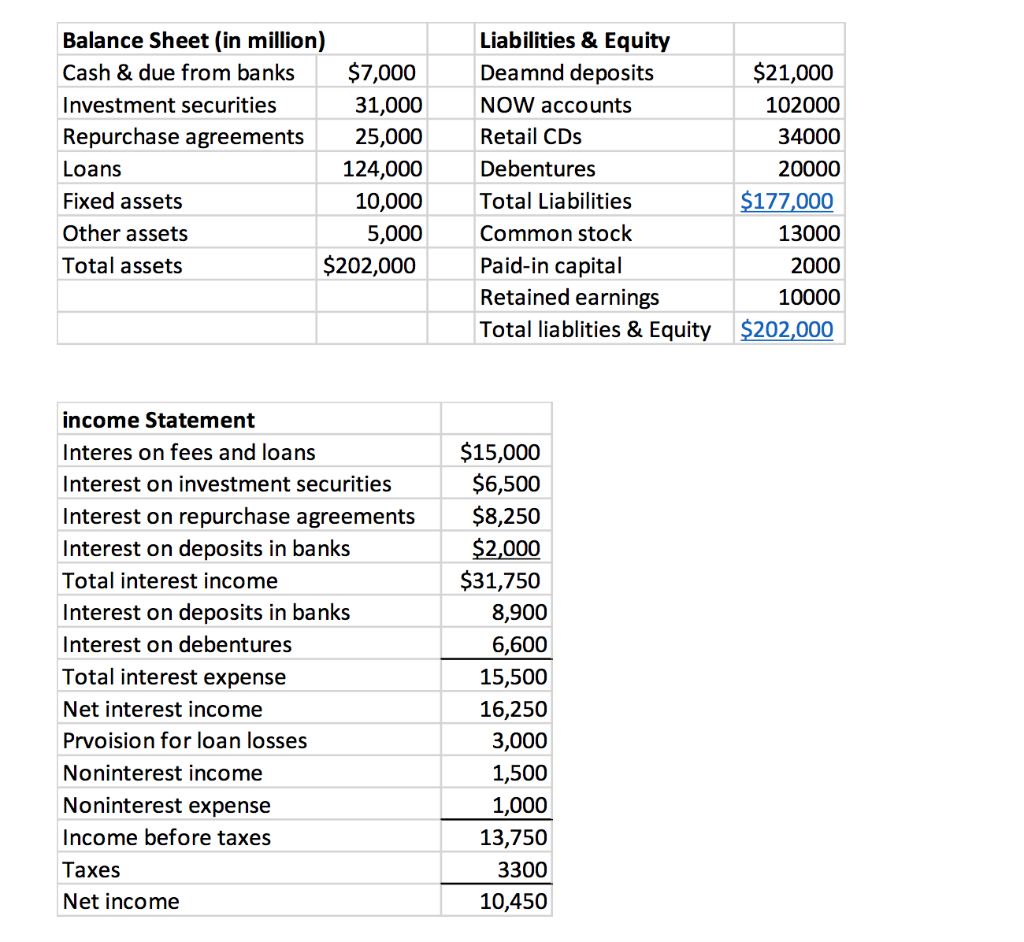

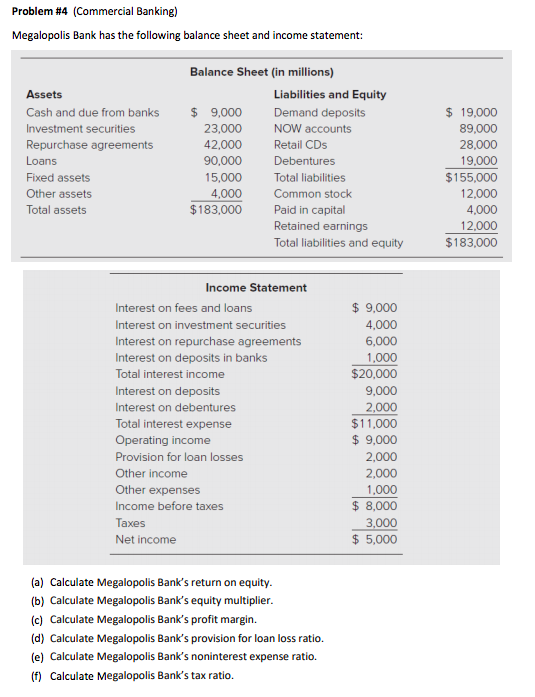

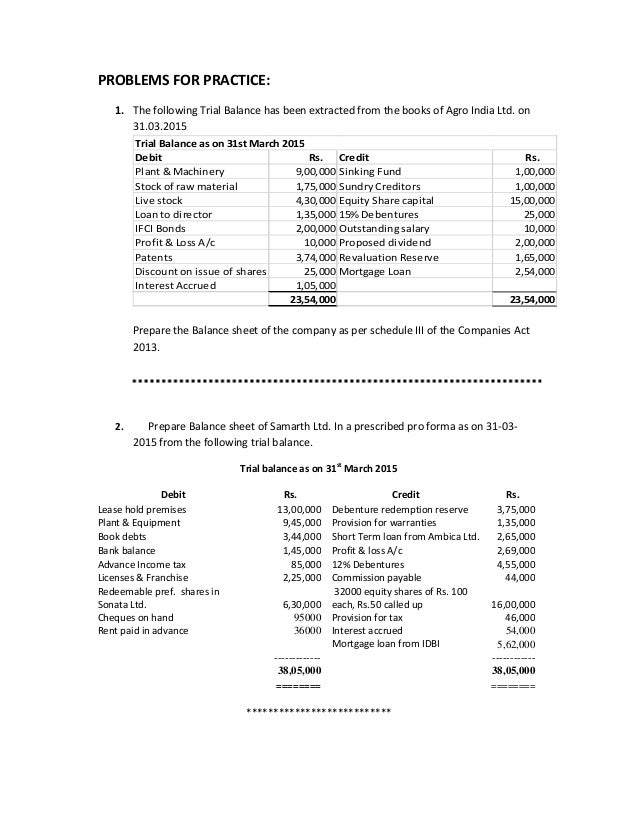

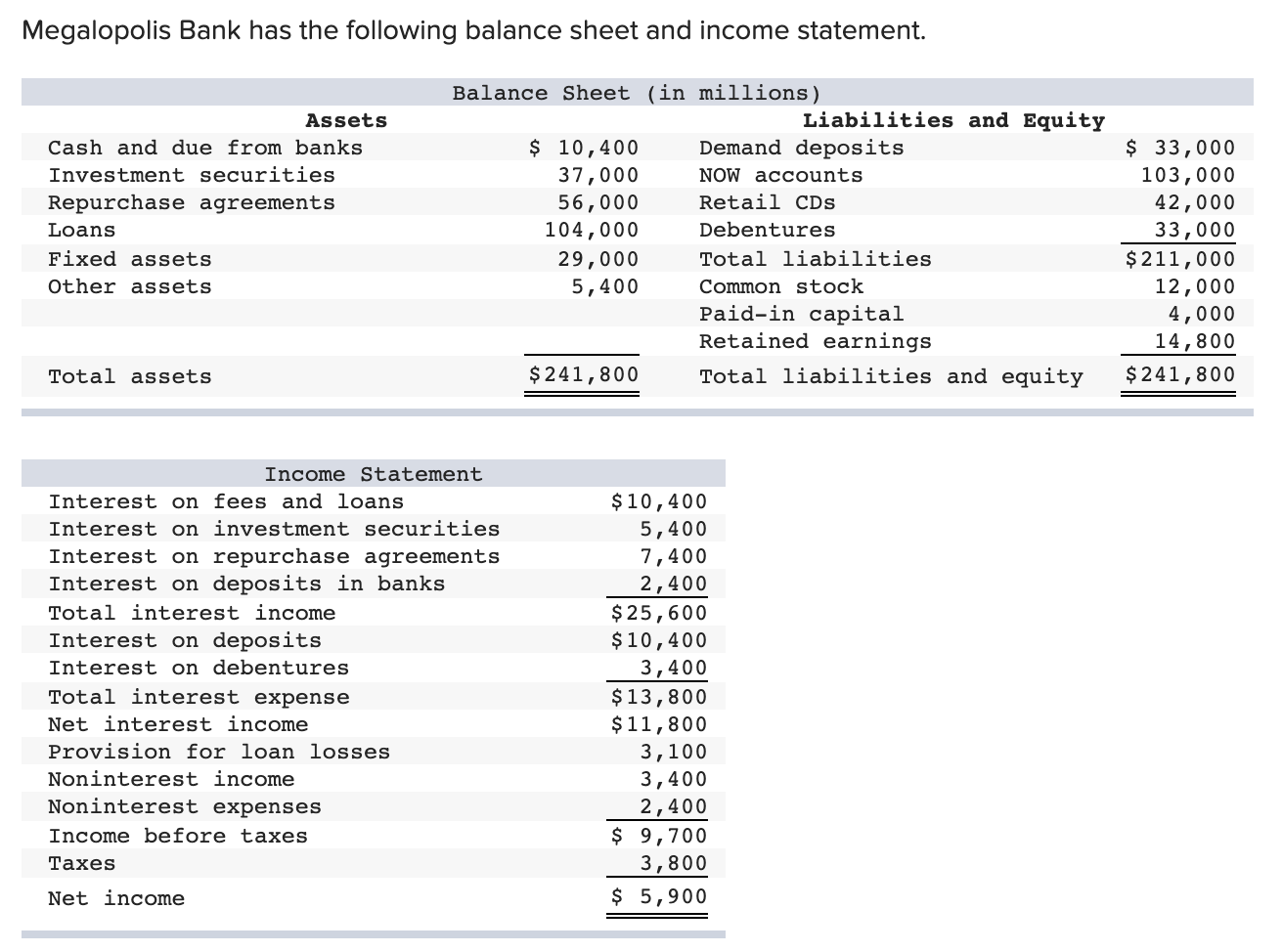

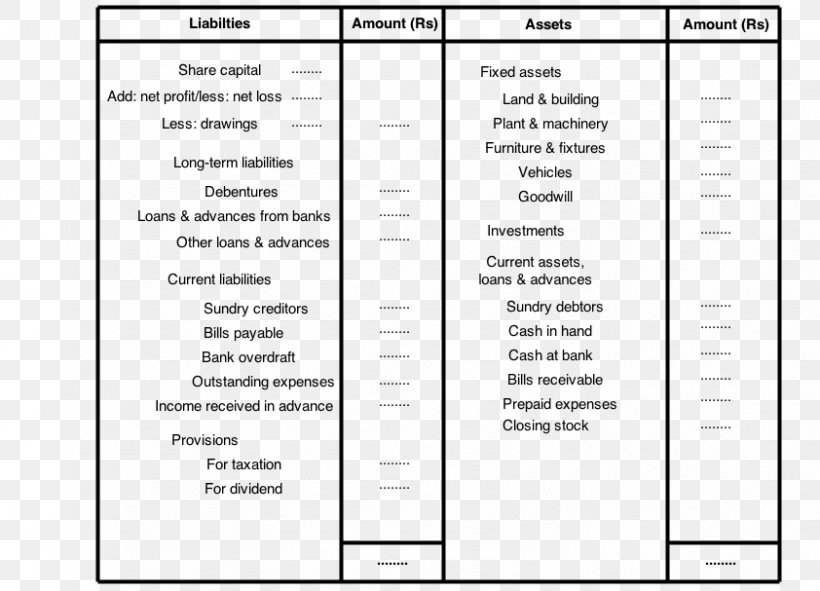

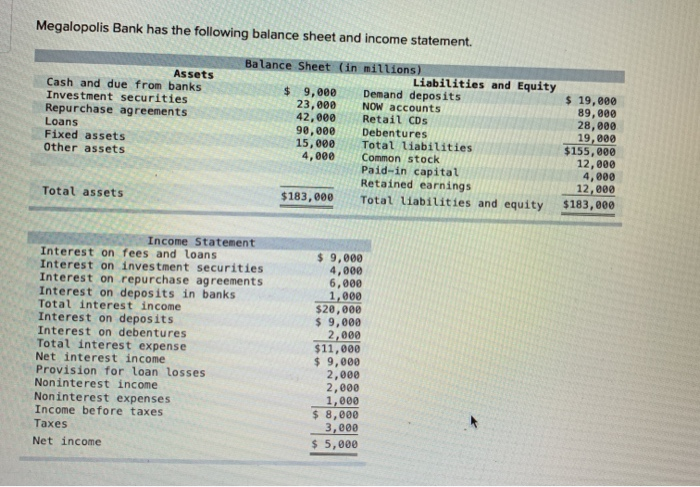

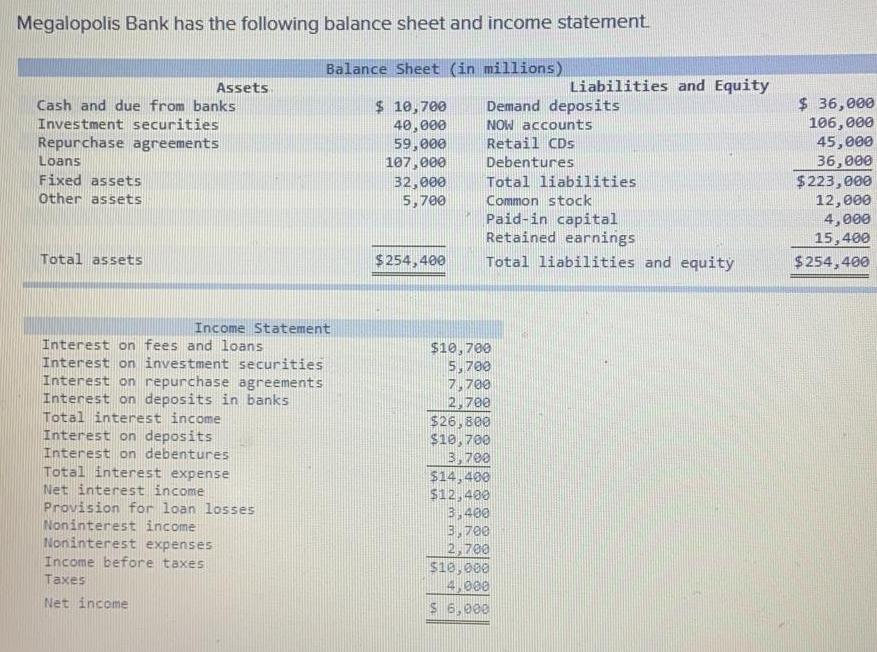

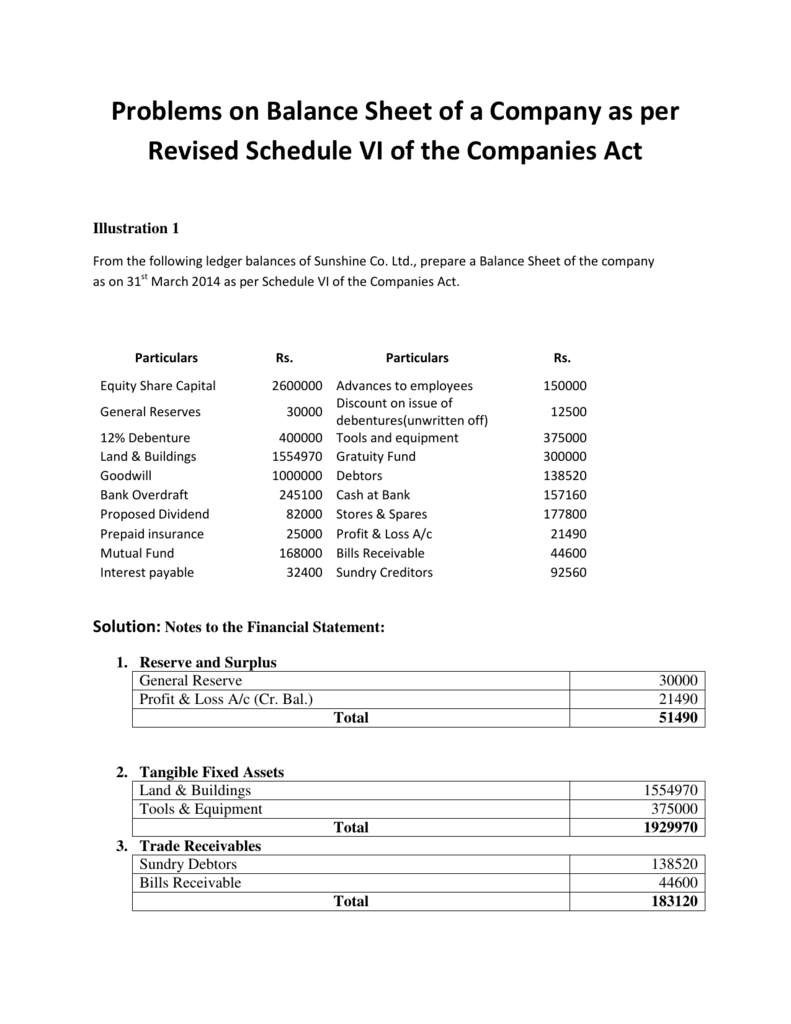

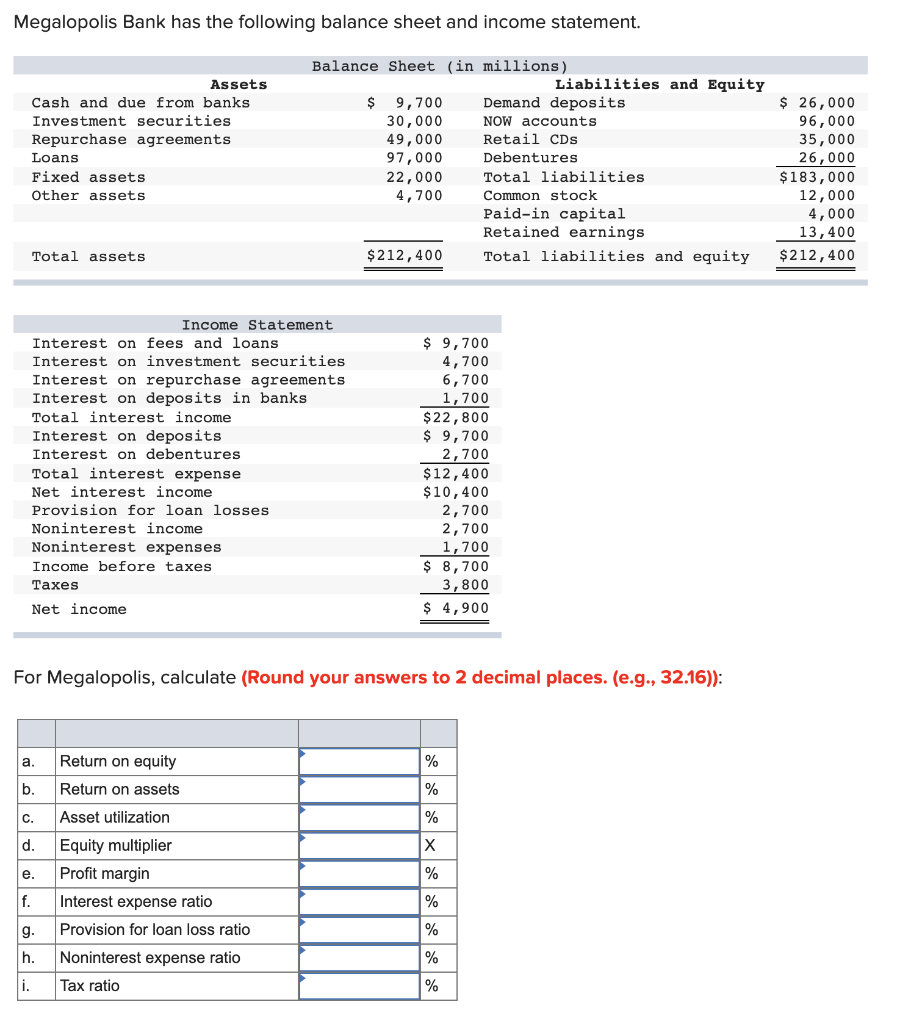

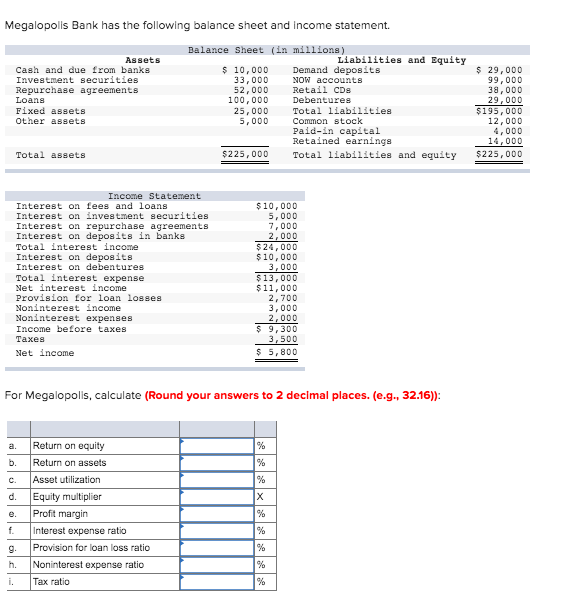

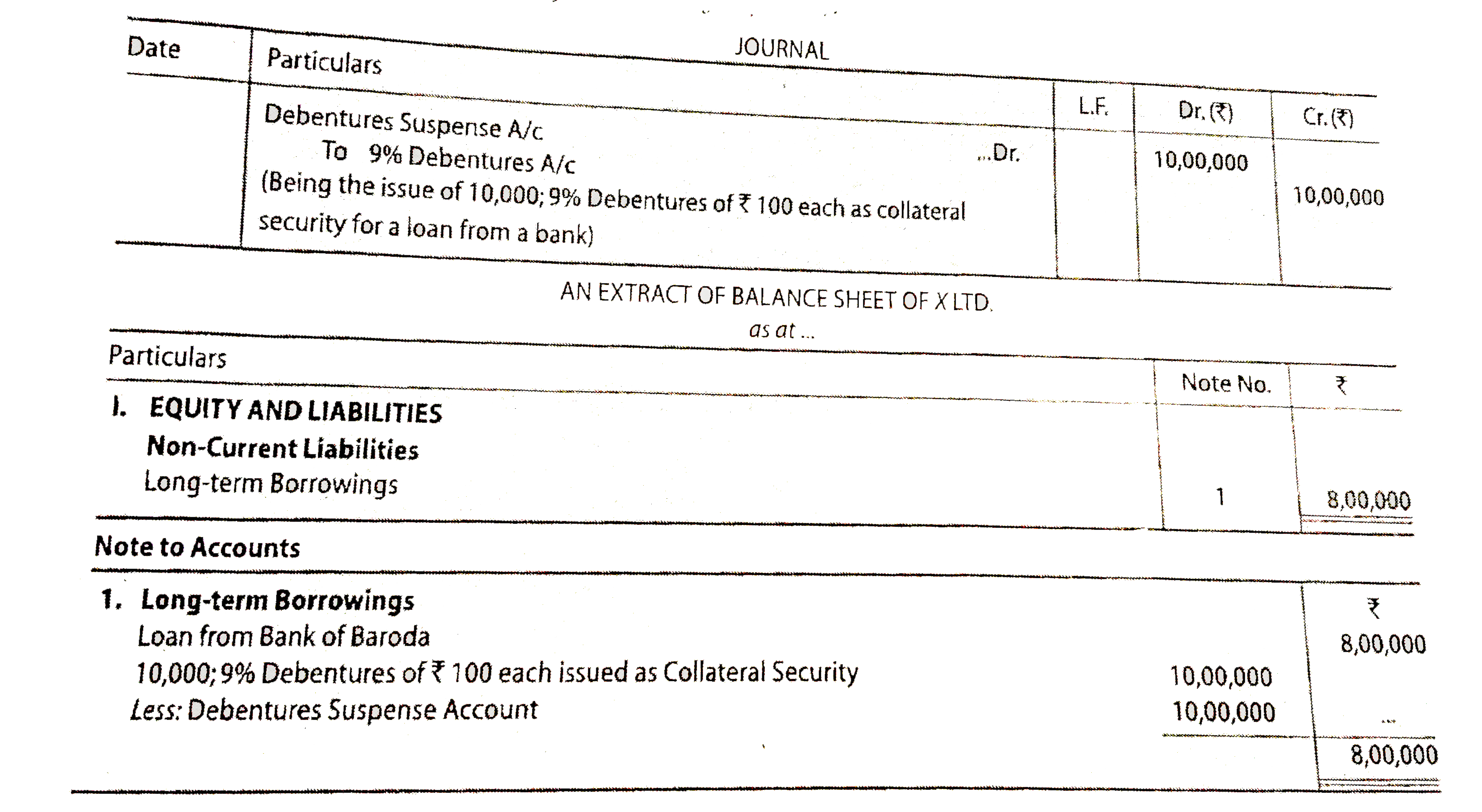

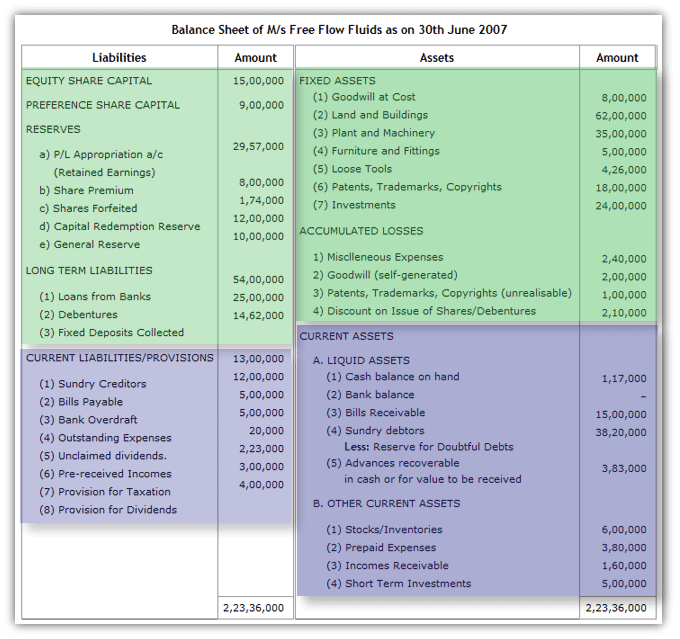

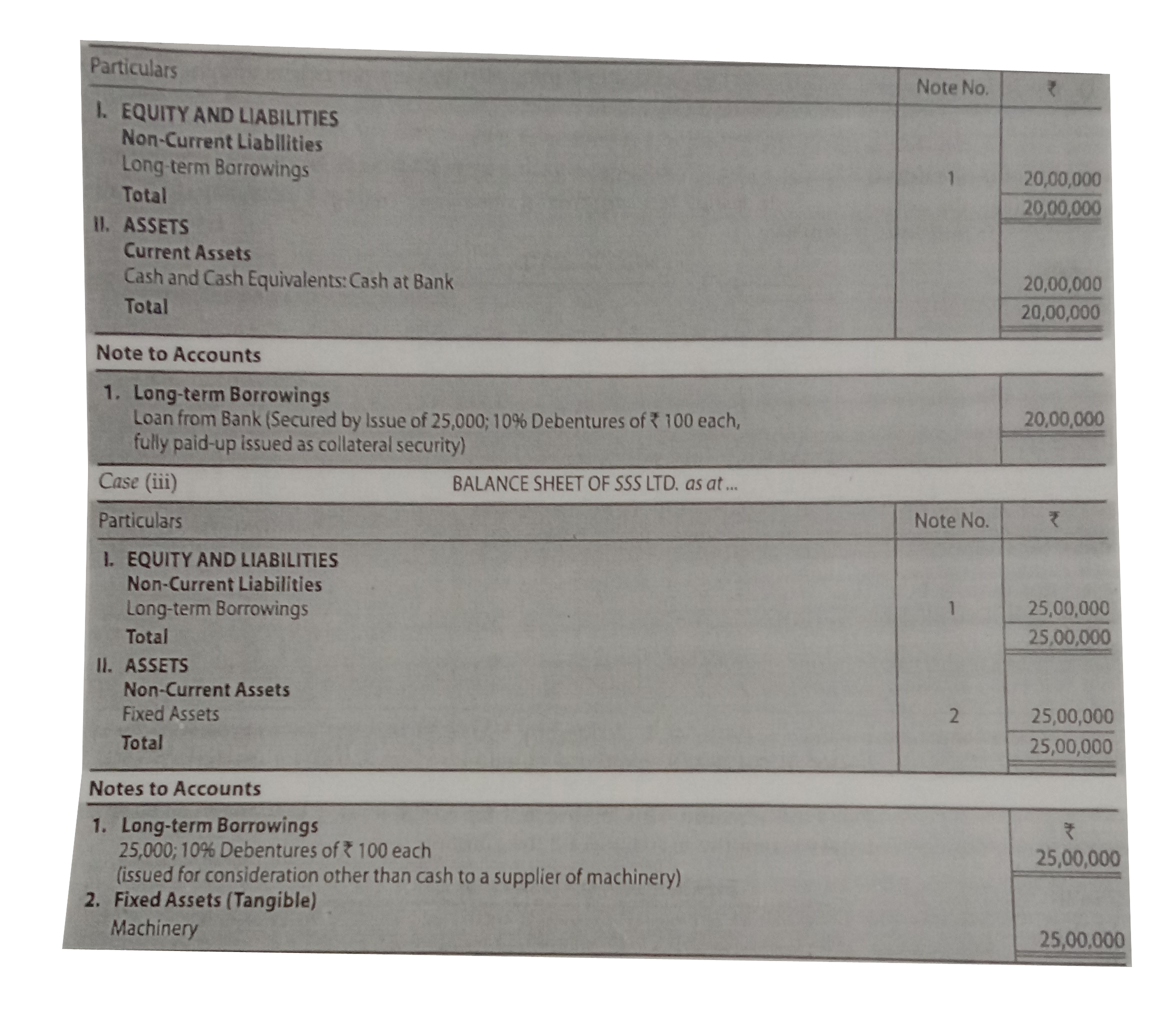

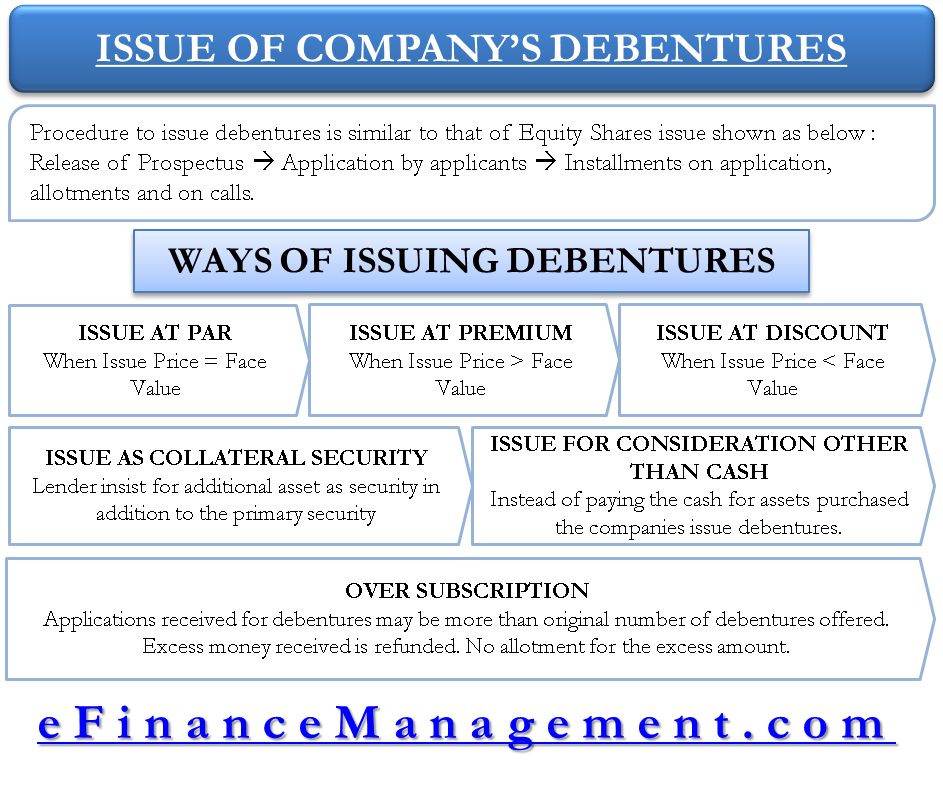

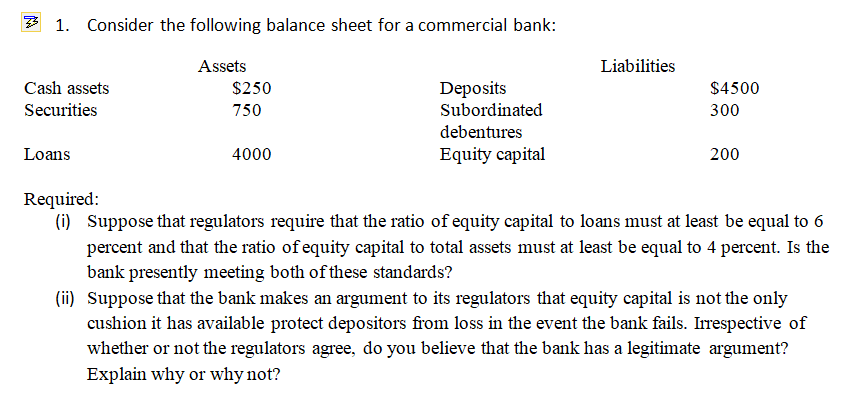

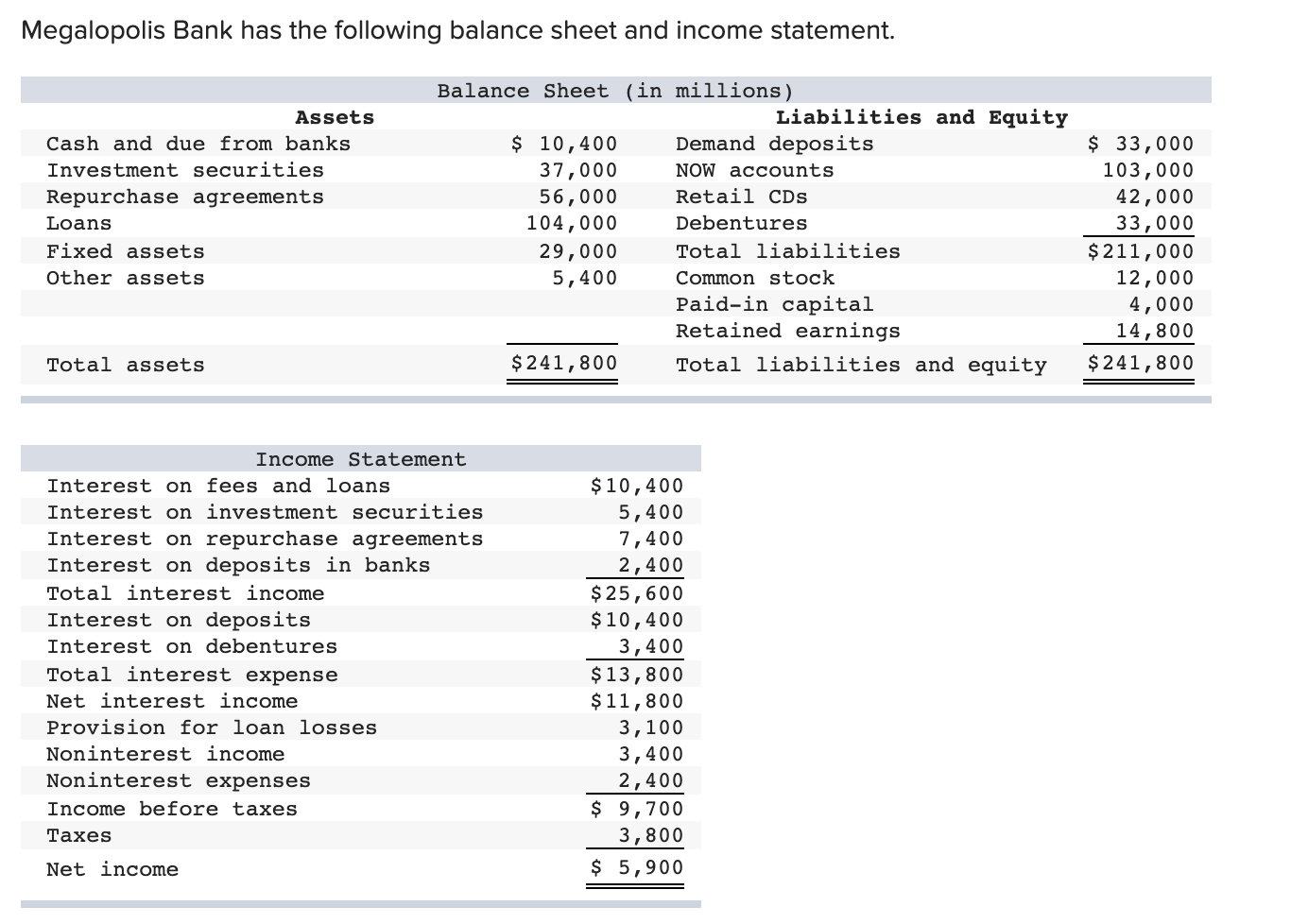

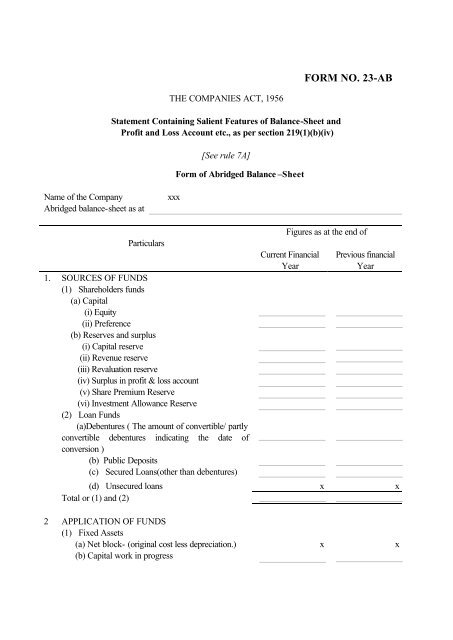

Debenture loan in balance sheet. However on the liability side of the balance sheet below the item of a loan a note to the effect that it has been secured by an issue of debentures as a collateral security is appended. If the company has issued the debentu. Had rs1200000 11 debentures outstanding on 1st april 2012. The debenture is said to be issued at a discount when the issue price is below its nominal value.

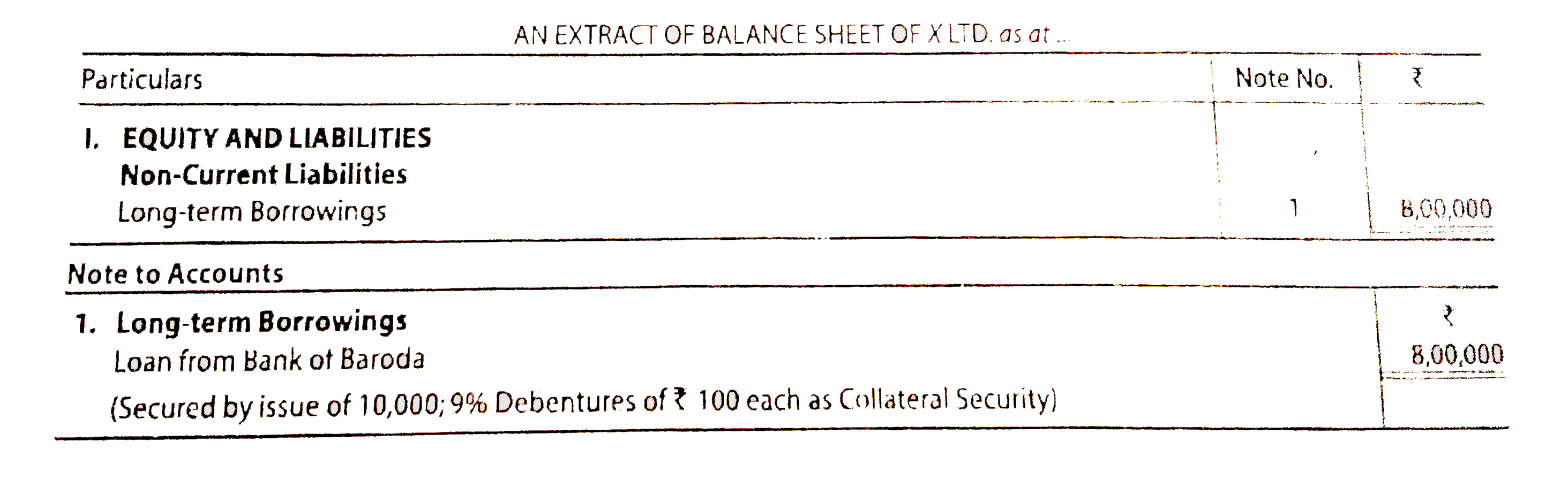

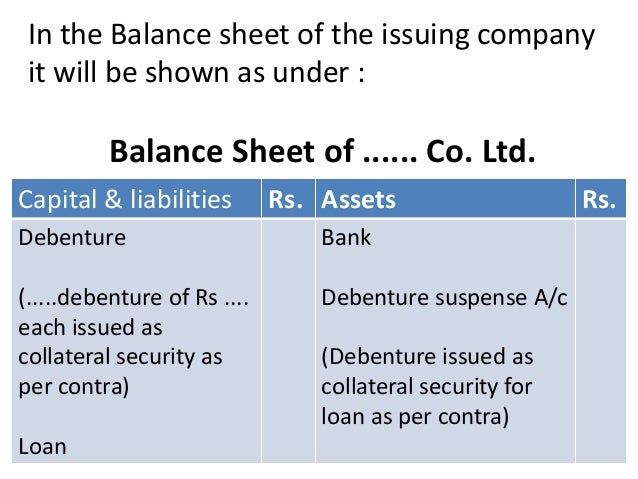

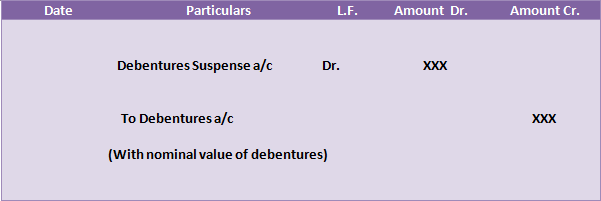

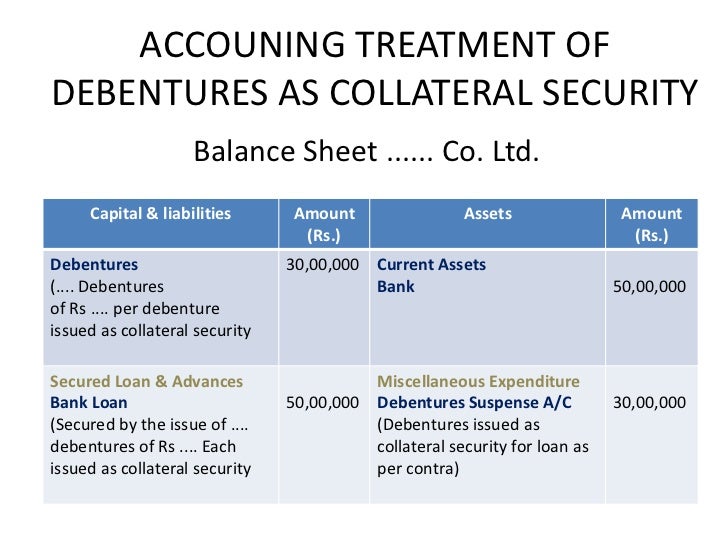

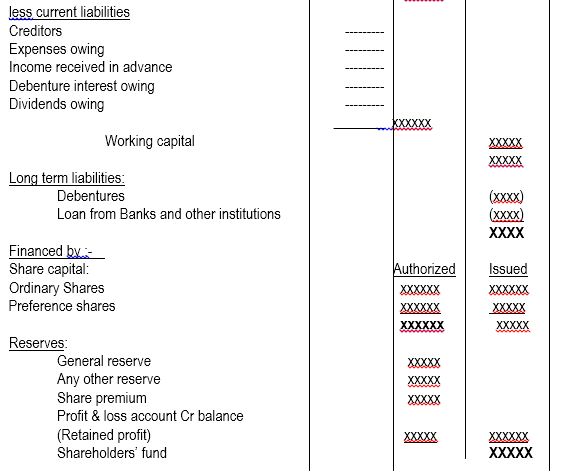

However a note is made in the balance sheet. Selling bonds is a form of financing used by governments and some large companies. A note is appended below the loan on the liabilities side of the balance sheet to the fact that they have been secured by the issue of debentures. A no entry need be made in the books of accounts.

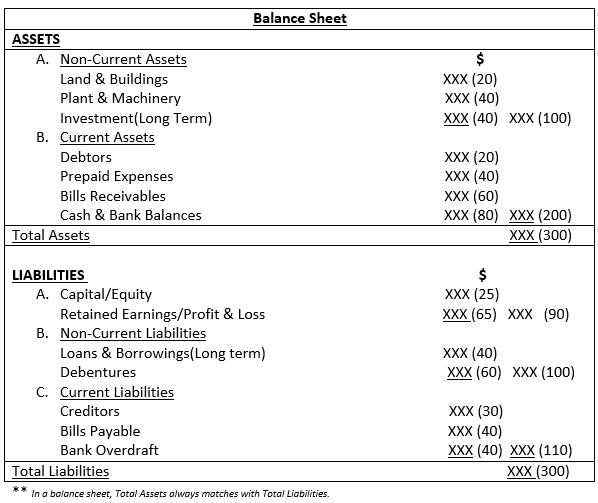

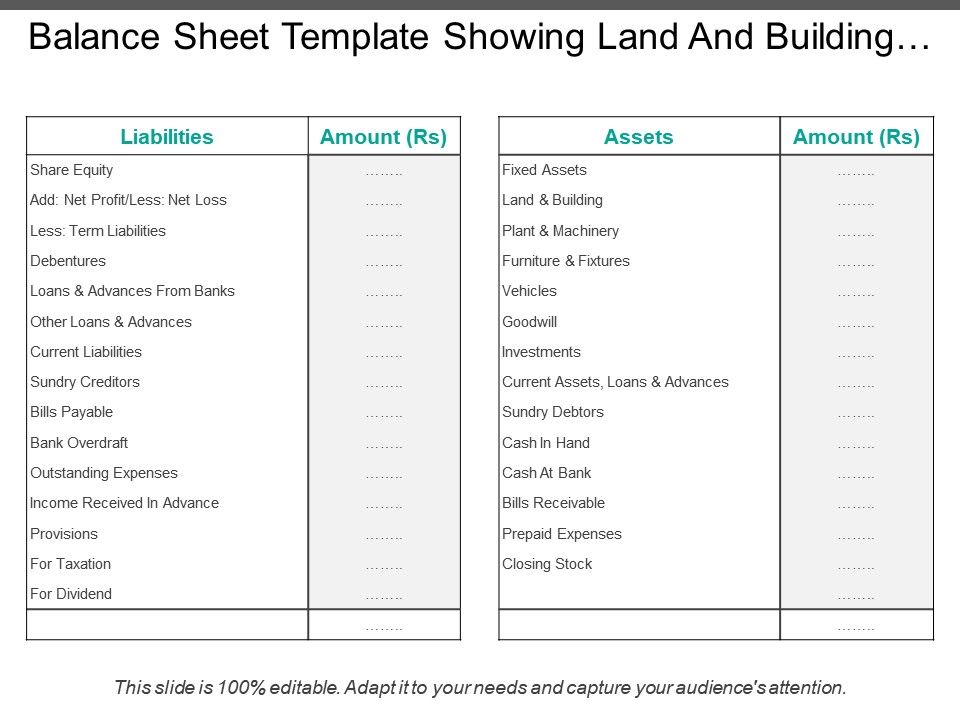

In such a scenario the liabilities and the assets sides of the balance sheet do not match. In the same way when the company issue debenture at discount the amount is debited to the discount on issue of debentures account. On the payment of the concerned loan such debenture reverts back to the company. During the year it took a loan of rs4 lakh from canara bank for which company deposited debentures of rs.

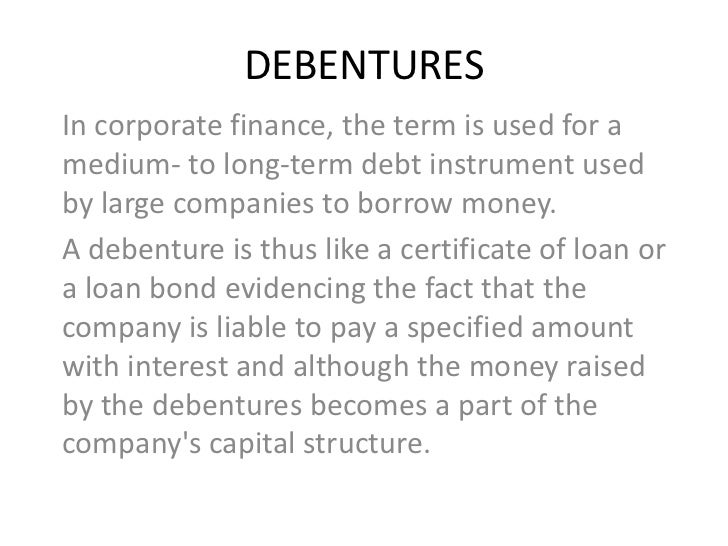

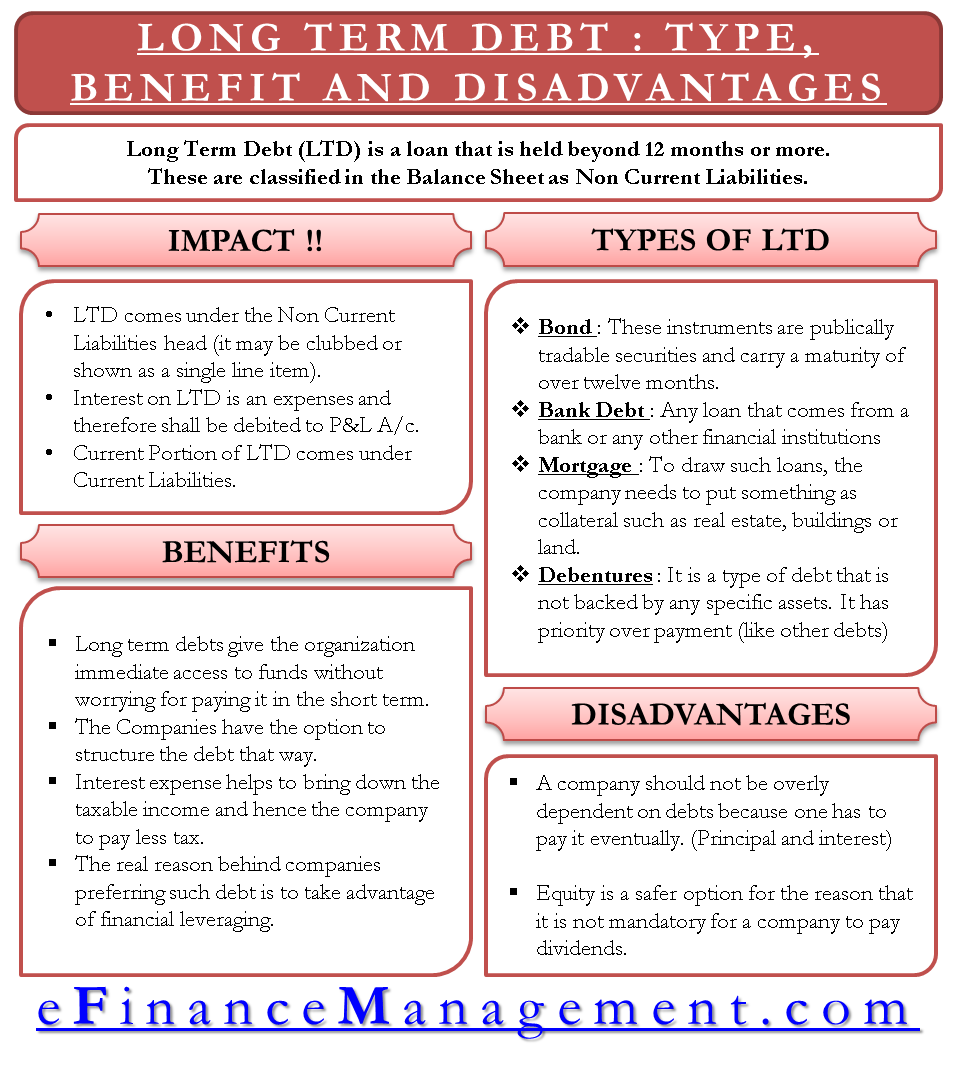

There are two ways to deal such issue of debenture in the books of accounts. Let us take an example a rs. In other words a debenture is a bond without a lien on specific assets owned by the issuing corporation. Show the alternative treatment in the books for debenture collateral.

Further the company transfers the amount of debenture premium account to the capital reserve account. A debenture is an unsecured bond. 90 then rs10 is the discount amount. Debentures for rs120000 as collateral security.

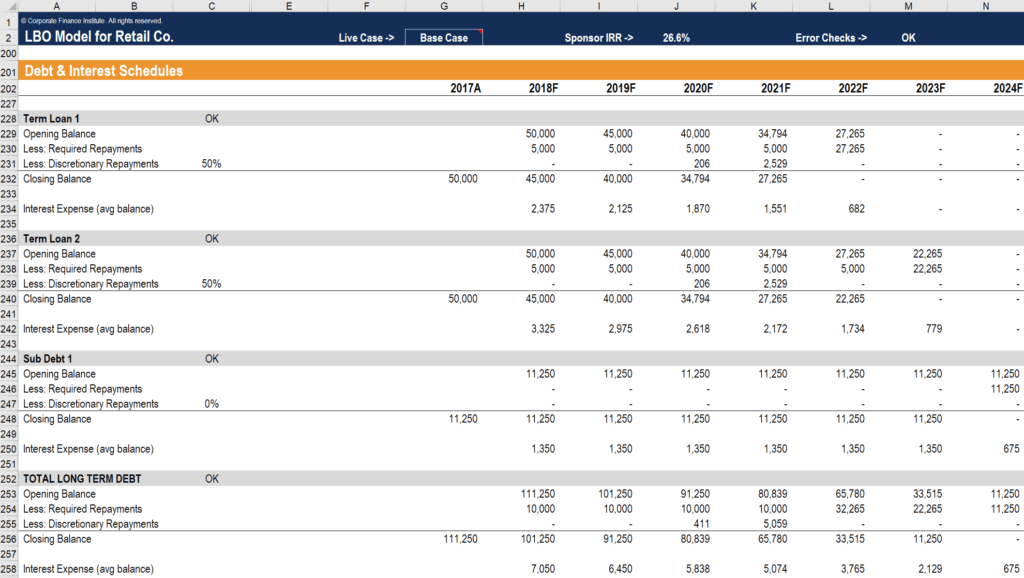

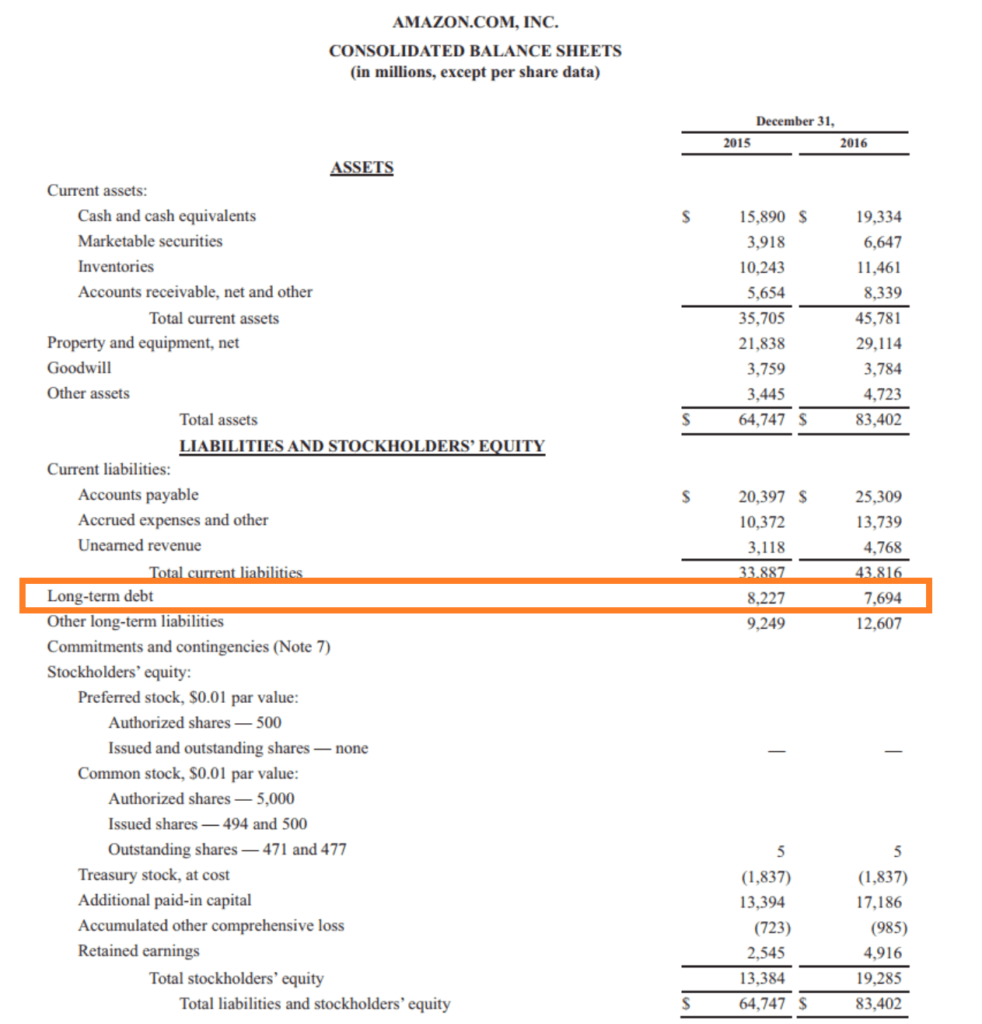

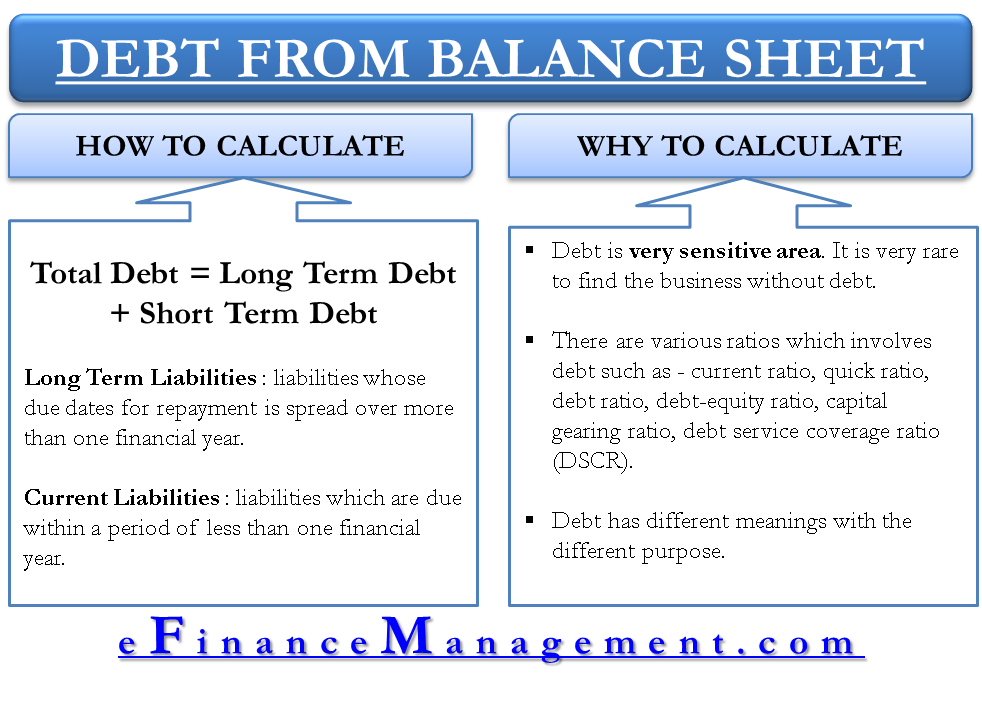

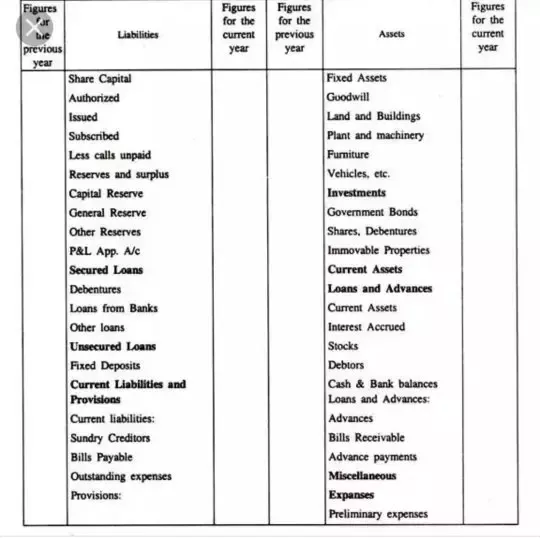

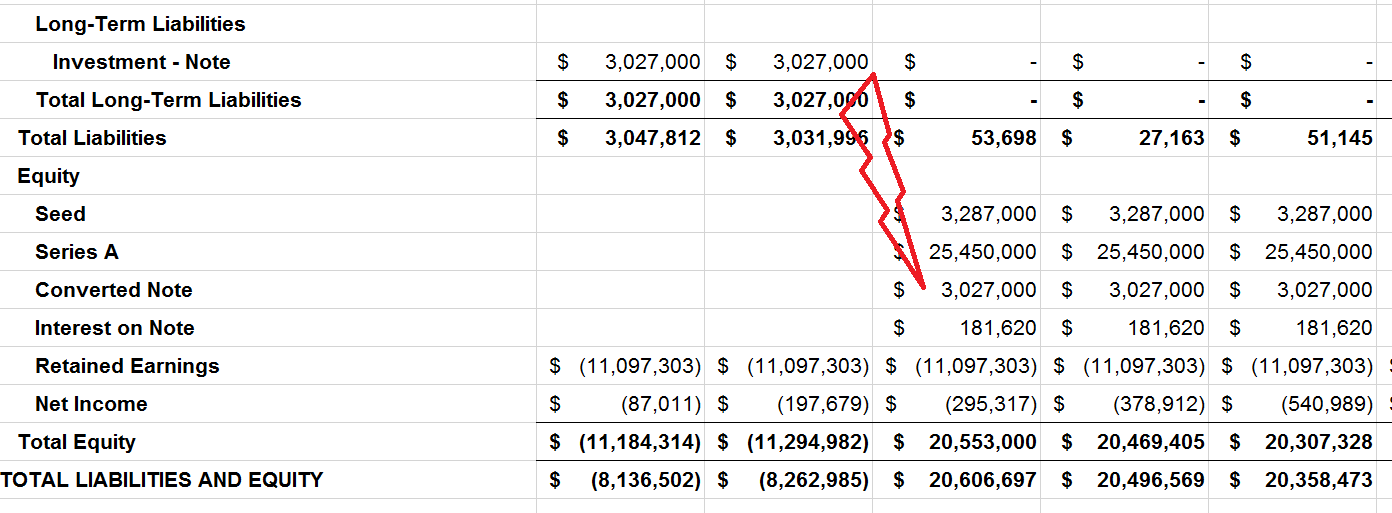

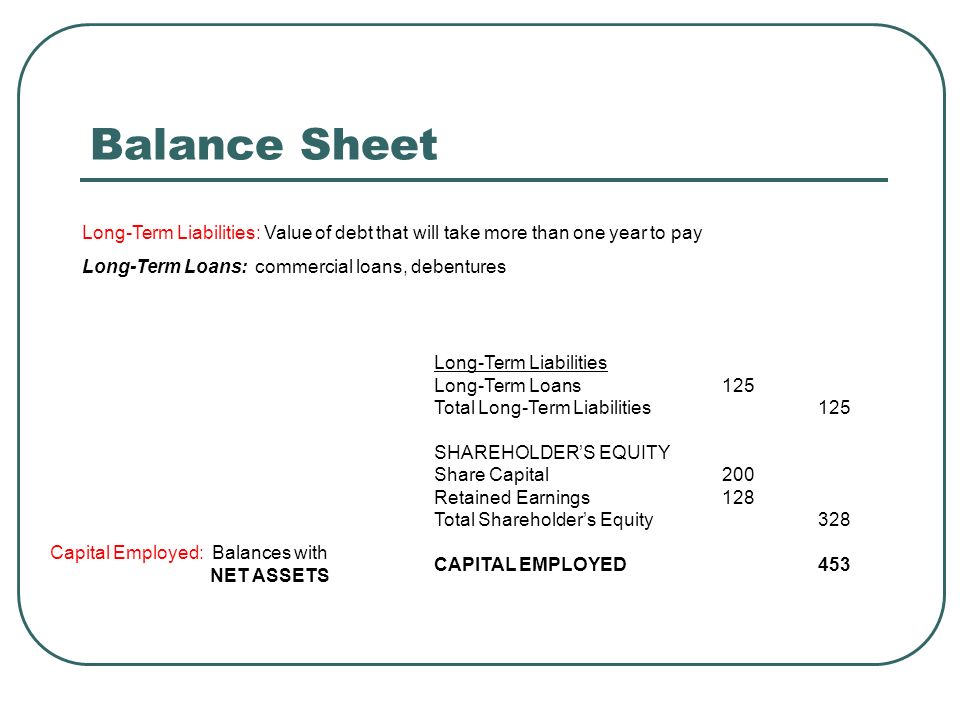

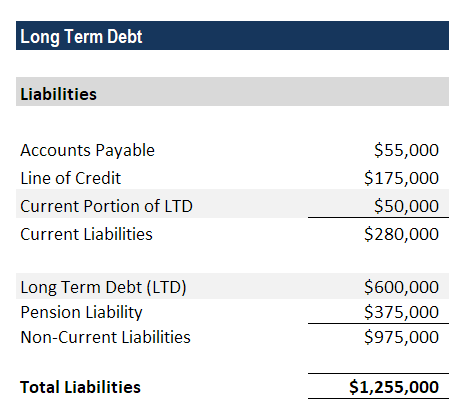

Subordinated debt is also known as a junior security or subordinated. The balance sheet is one of the commonly used financial statements and a debenture bond is one item that may show on a businesss balance sheet. Subordinated debt is a loan or security that ranks below other loans or securities with regard to claims on assets or earnings. 100 each for a loan of rs.

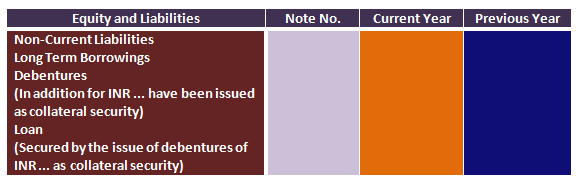

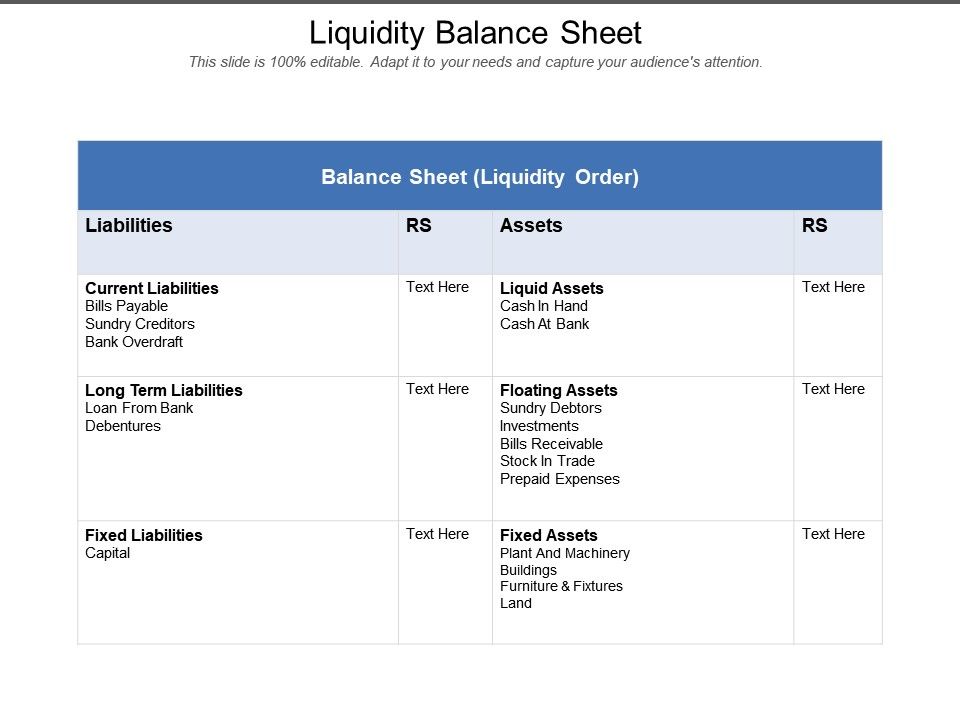

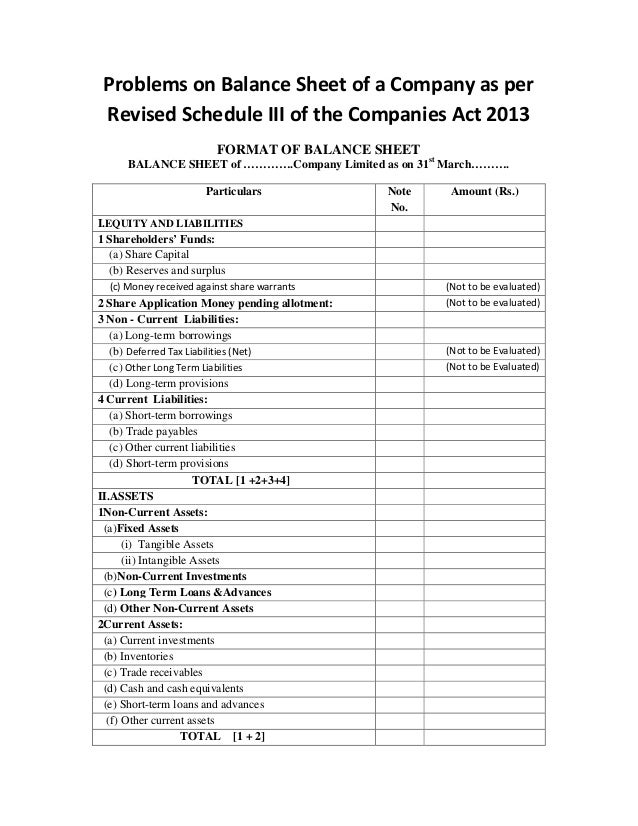

Issue of debenture at discount. If the company has issued the debentures and they are to be redeemed after one year then they are shown under non current liabilities in the balance sheet. This will be shown in the balance sheet as follows. How debentures are shown depends upon a few factors.

When your company sells bonds other businesses or individuals can purchase those bonds from you for a face. Pass journal entries and show how these transactions will appear in balance sheet of the company. X company has issued 9 10000 debentures of rs. 10 00000 taken from a bank.

.png)

/MacysbalanceSheetNov32018-146bc581861a44528f5802bbde519227.jpg)