Debt Consolidation Loans For Veterans

Military veterans who are struggling with debt may be looking for a debt consolidation loan backed by the veterans administration.

Debt consolidation loans for veterans. Military debt consolidation loans mdcl if you went through the va to get a mortgage with a va home loan you are eligible to use a military debt consolidation loan mdcl. There are two types of debt consolidation loans. There are some distinct advantages to being a service member or vet when you are considering a consolidation loan to take care of debt but there are also some aspects to research and think through before deciding. While you will still owe the debt and will need to make monthly payments on it there are some real advantages to doing this.

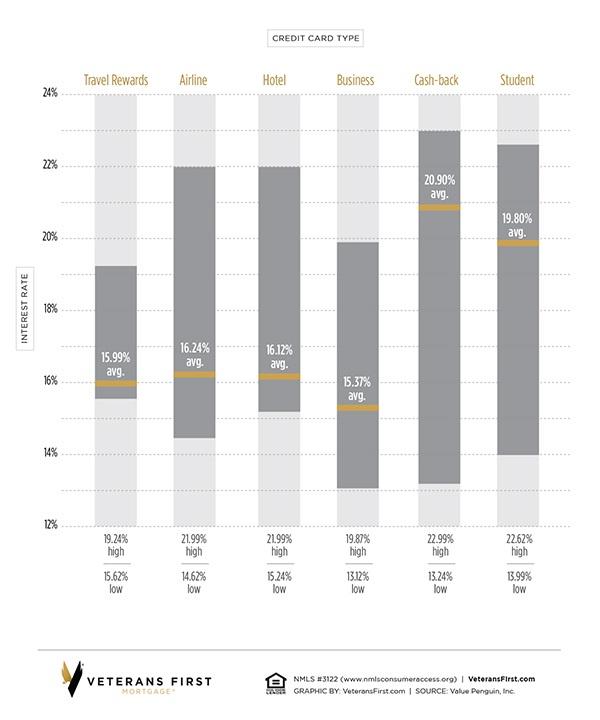

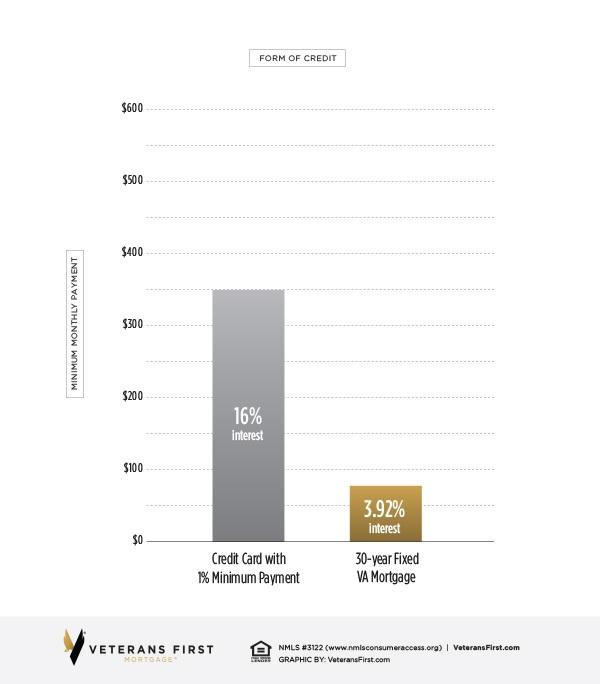

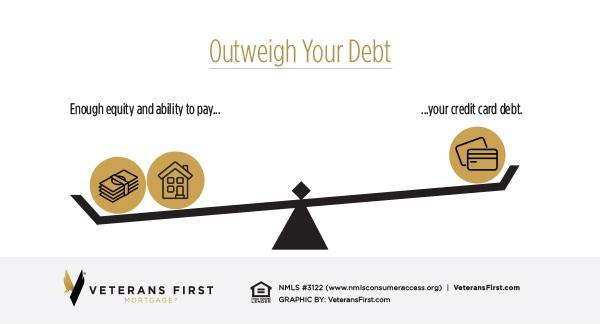

This personal loan combines all your debt into one easy to pay monthly payment often with a lower interest rate. Consolidating your high interest rate debts and loans into one simple loan payment with a lower interest rate may save you money. This loan acts as an intermediary borrower against the equity built up in your home so its like a home equity loan specifically meant for veterans. Qualifying standards for a mdcl loan are easier than for conventional consolidation loans.

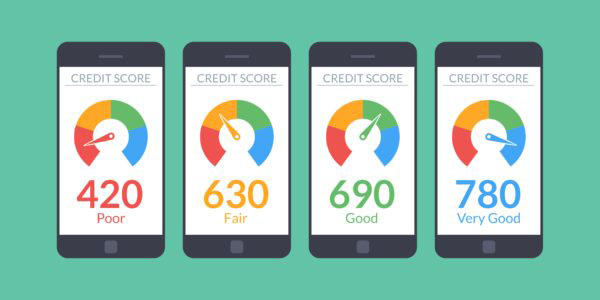

The transition to civilian life from the military can bring some financial challenges during the first few years as you try to establish a more stable outlook. An unsecured debt consolidation loan requires no collateral so the loan is extended to you in good faith based on your credit score and financial situation. Why use a va military debt consolidation. However it is good news for the veterans that they can consider a debt consolidation loan backed by the veterans administration to become debt free.

They are facing dire financial circumstances while paying off their debts. Armed forces active or retired and military family. Debt consolidation is the process of taking all of your debt or some of it if you dont want to include all of it and it combining it into one loan. Most of the military veterans are struggling with debt obligations in our country.

There are significant benefits to obtaining a military debt consolidation loan but its important to understand how they work to determine if this type of loan is right for you. Military debt consolidation loans for veterans. Anyone in the us. Apply for a debt consolidation loan at va financial and you could receive up to 40000 to repay high interest credit card debt or overdue long term loans.

This could be a very trying time but veterans have no need to fret because there are specialized tools designed to help them as they.

/images/2019/11/25/military-veteran-mother-child.jpg)

/navy-federal-inv-daccae32bfff43fdb1199a75c84e848d.png)