Emergency Loans For Employees

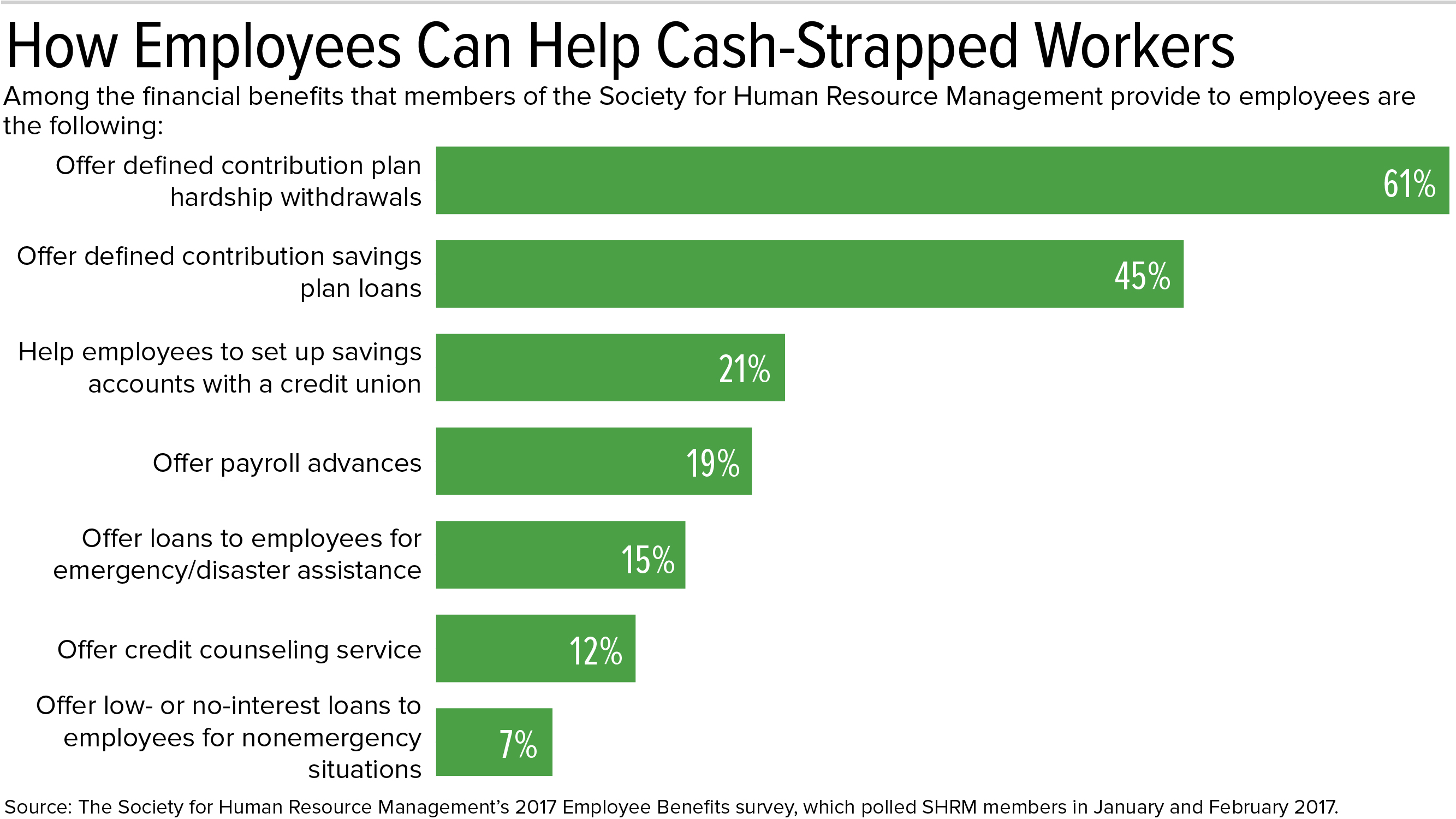

An employee should ask the companys human resources department if there are any policies for emergency loans.

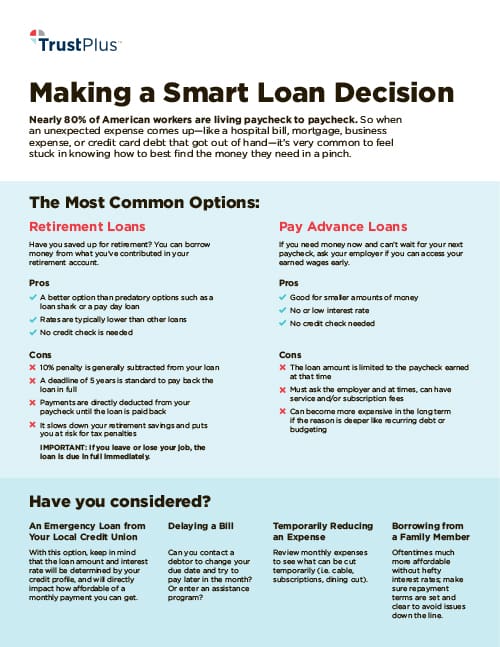

Emergency loans for employees. Canada emergency business account ceba interest free loans. Employees on voluntary leave without pay voluntary reduction of hours or campus wide intermittent furlough are not eligible for an emergency loan. Loan amounts between 1 1000 must be repaid within one year. However a personal loan can help you meet your financial needs when you or your loved one needs emergency medical treatment.

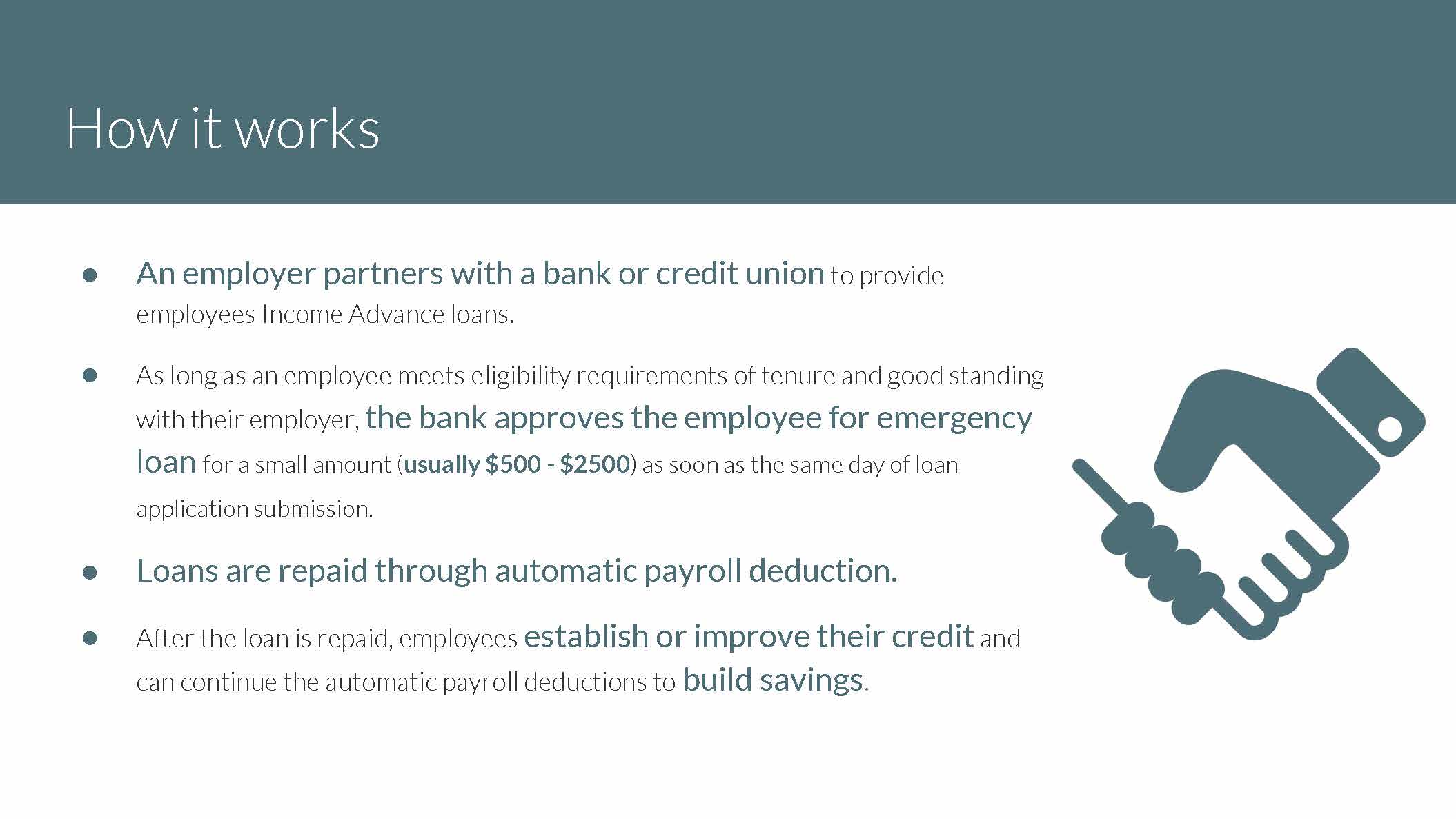

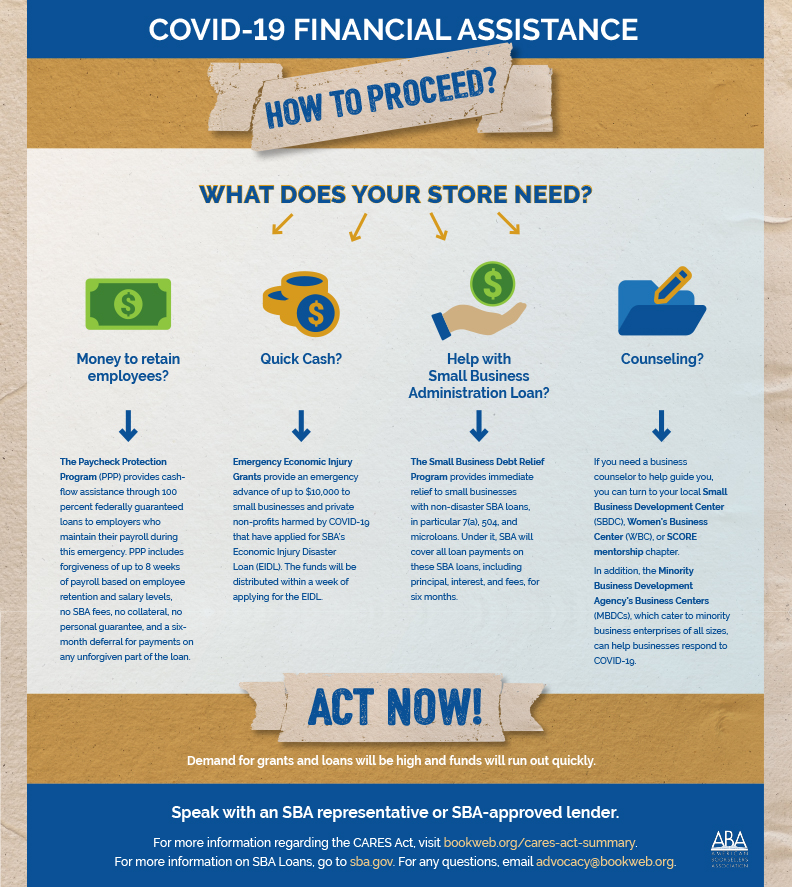

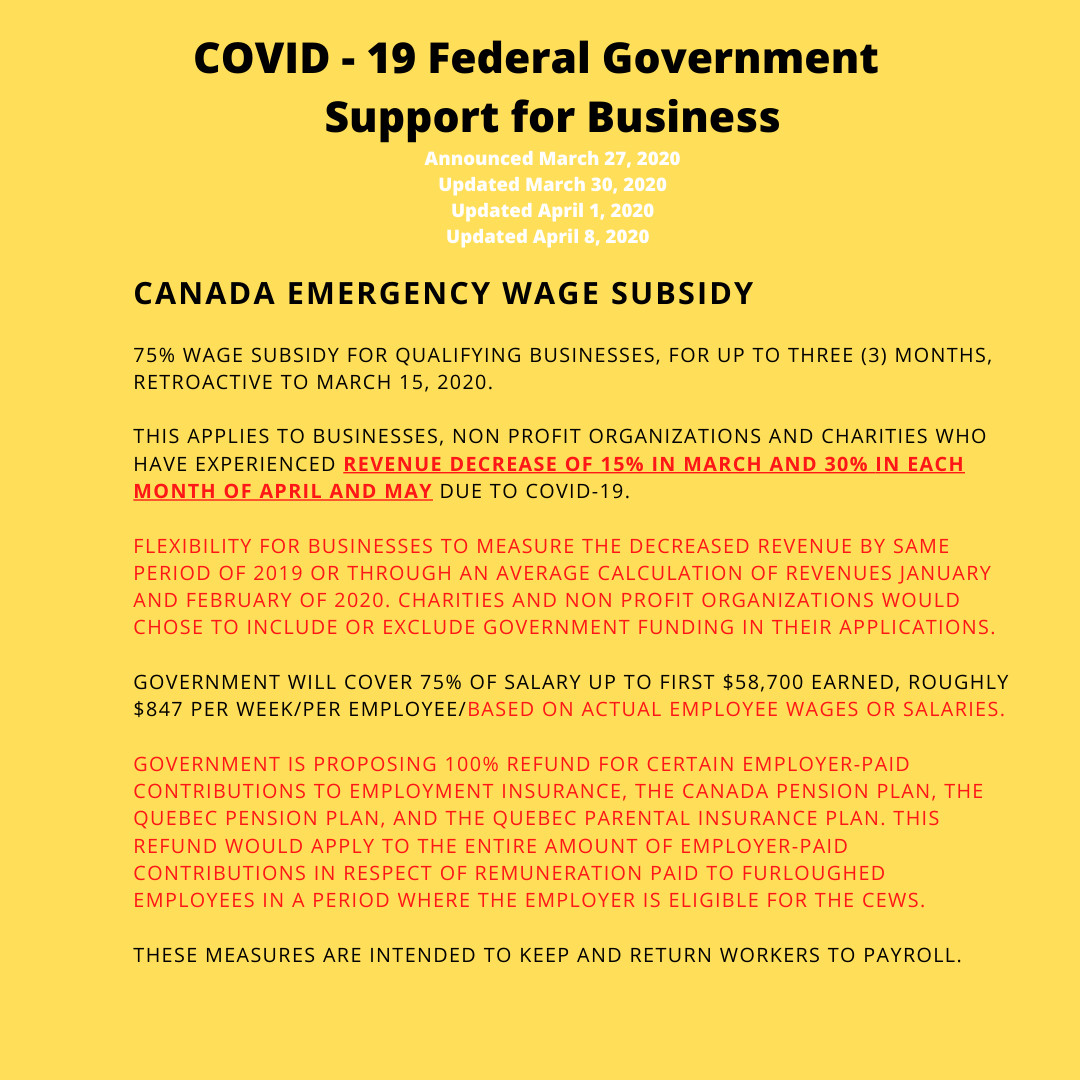

Employers who offer empathy toward employees in need of financial assistance can boost employee loyalty and overall workplace engagement. By niv elis 062620 0435 pm edt. Compared to interest for loans mainly personal loans provided by other financial. The canada emergency business account ceba provides interest free loans of up to 40000 to small businesses and not for profits to help cover their operating costs during a period where their revenues have been temporarily reduced.

The university provides an emergency loan of not more than 250 to eligible employees for financial assistance during an emergency. Performance issues or past disciplinary actions do not disqualify employees from receiving an emergency loan. Probationary periods do not disqualify employees from receiving emergency loans. Repayment periods vary from one to three years depending on the size of the loan as follows.

A personal loan for government employees can help you generate the funds you need to pay for your childs educational tour without distorting your household budget plan. Temporary or student employees. Loan amounts between 2001 4000 must be repaid within three years. Loan amounts between 1001 2000 must be repaid within two years.

A 2016 financial education survey conducted by the international foundation of employee benefit plans suggested that financial stress increases absenteeism tardiness and. An emergency loan may be granted to an employee for a reason that has placed the employee in an immediate financial hardship as defined above. And the emi starts after 6 months. Any required forms need to be filled out and enclosed with the letter.

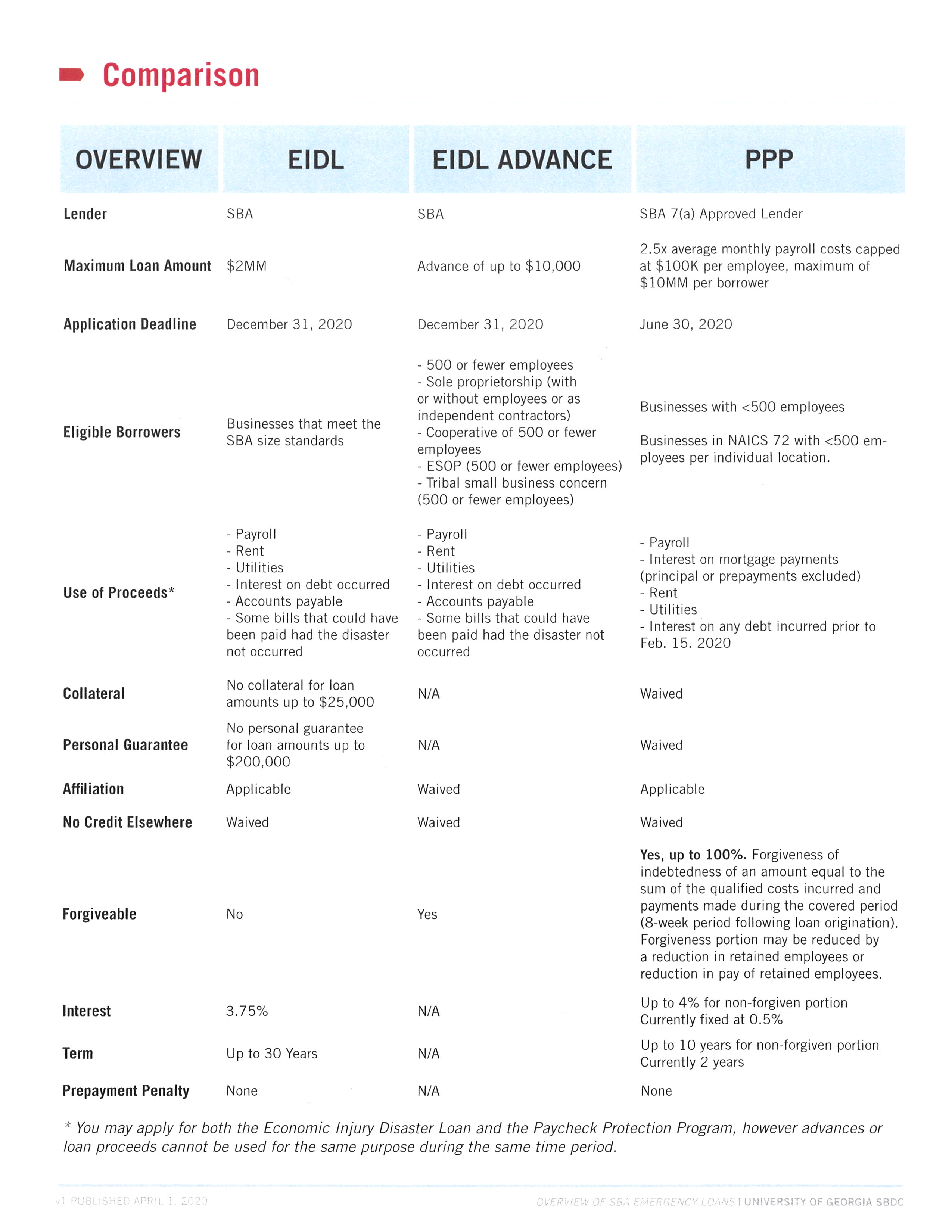

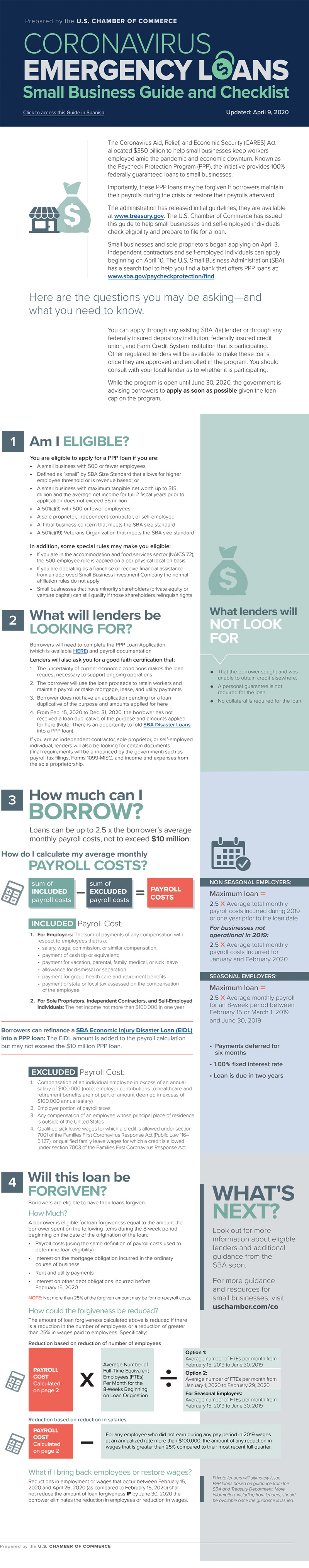

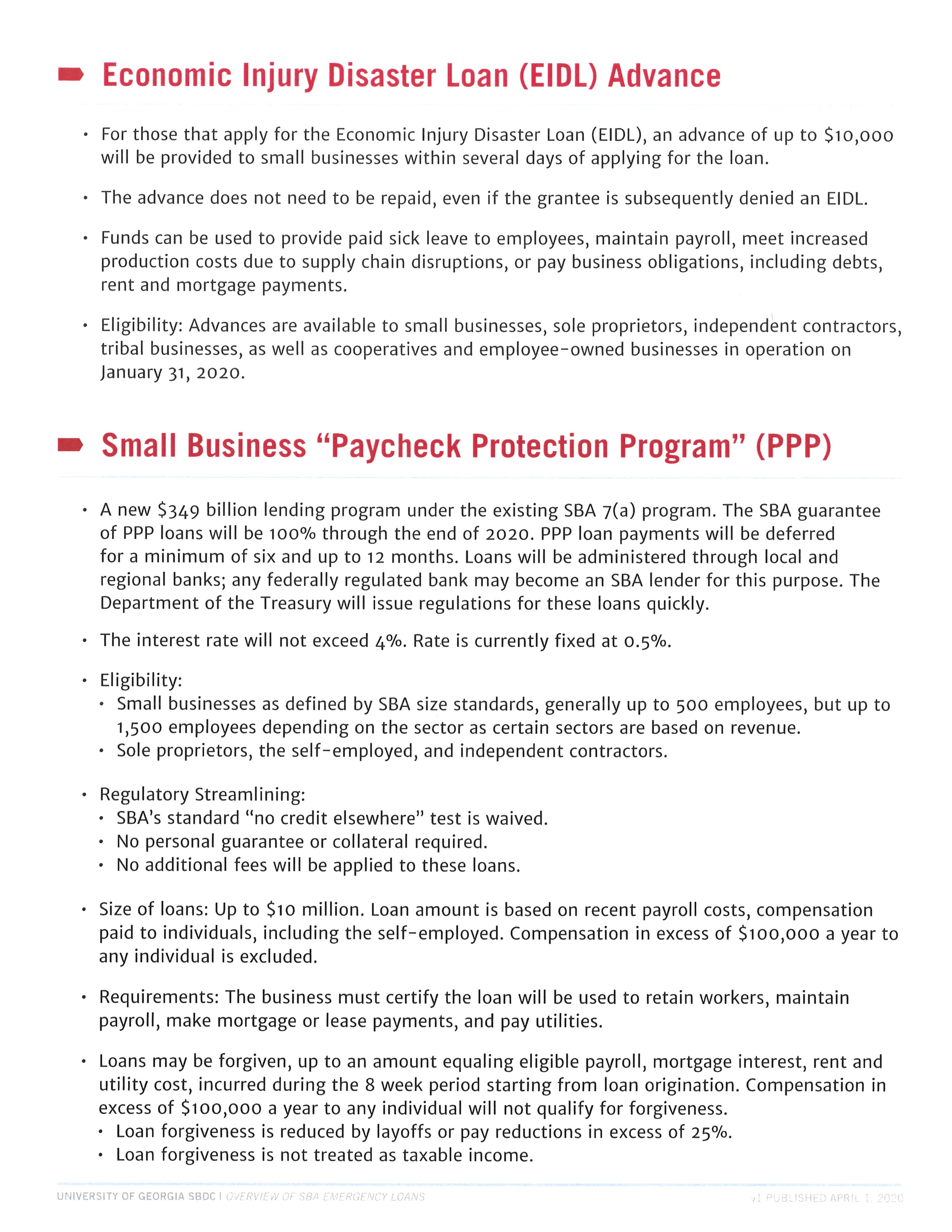

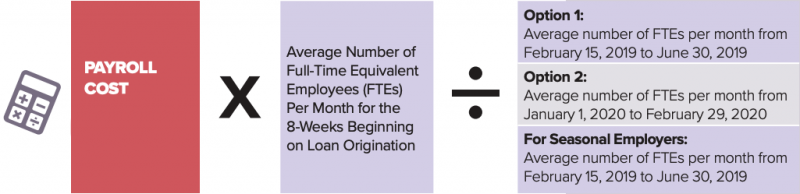

Chamber of commerce has issued this guide and cheat sheet to help small businesses and self employed individuals prepare to file for a loan from the cares acts paycheck protection program. Sba scrapped ethics review for agency employees lawmakers in emergency loan program. Sbi will charge 105 interest for availing this sbi emergency loan.

/credit-union-loans-315401-Final-5c47510a46e0fb000116d502.png)