Equity Loans Kenya

It is licensed as a commercial bank by the central bank of kenya and the national banking regulator.

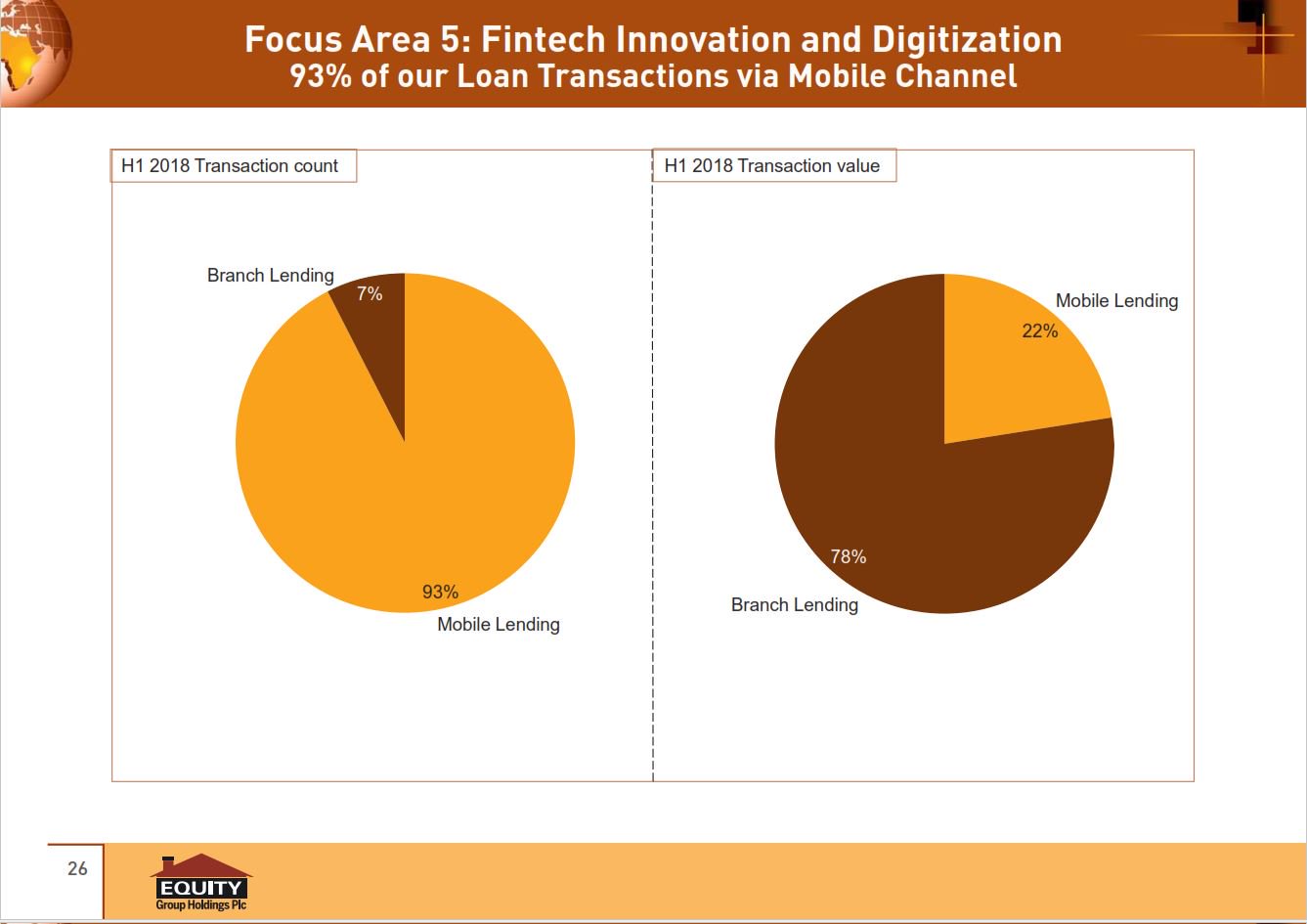

Equity loans kenya. Equity bank has been facilitating its customers to enhance use of its non branch channels to facilitate transactions and access to key products and services such as equity loans. It has grown aggressively and is now the largest bank in the region in terms of customer base kenya loans. Its headquarters are in nairobi kenya. It offers personal loans such as.

Equity bank has also partnered with car corporations in the nation and a car loan seeker can look at the equity bank kenya car loans options and make the right decisions. It offers personal loans such as. This status can be attributed to the efficiency and availability of equity bank business loans. So feel free to look at experts tips and make the right decision.

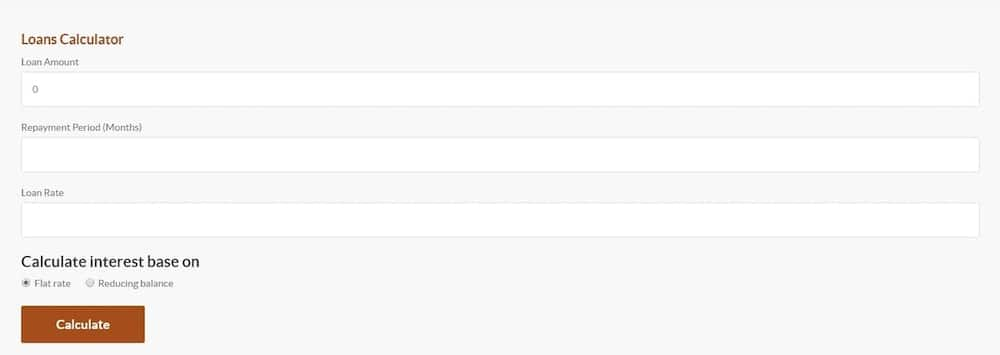

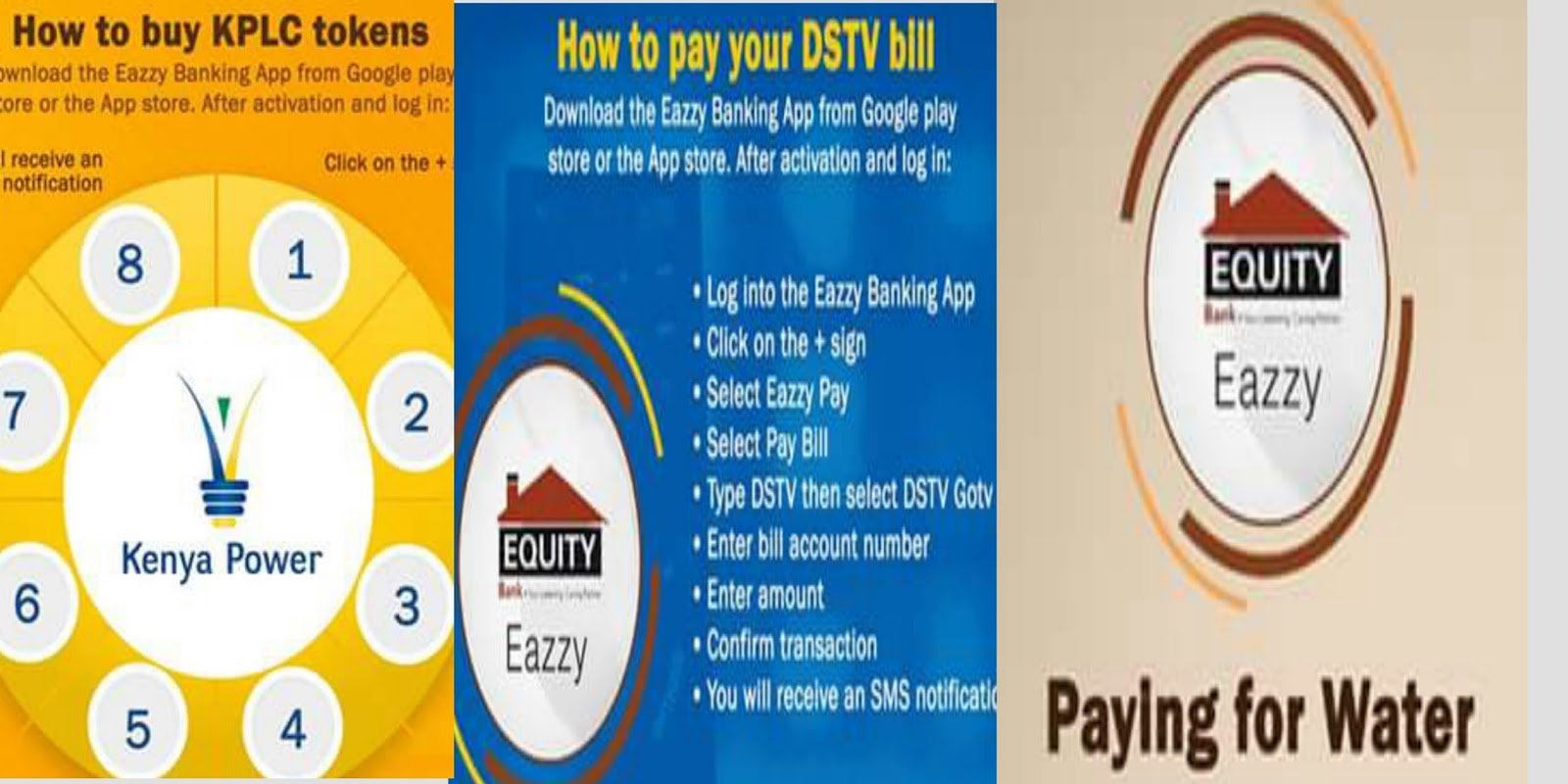

In light of the covid 19 pandemic the government and central bank of kenya advocated for a resort to cashless transactions to contain the spread of the pandemic. Eazzy loan due date na whilst every effort has been made in building these calculators we are not to be held liable for any special incidental indirect or consequential damages or monetary losses of any kind arising out of or in connection with the use of the tools and information derived from the web site. As such the demand for equity bank kenya loans has soared over the years. This type of loan by equity bank kenya can be up to kes 300000 paid for 12 months.

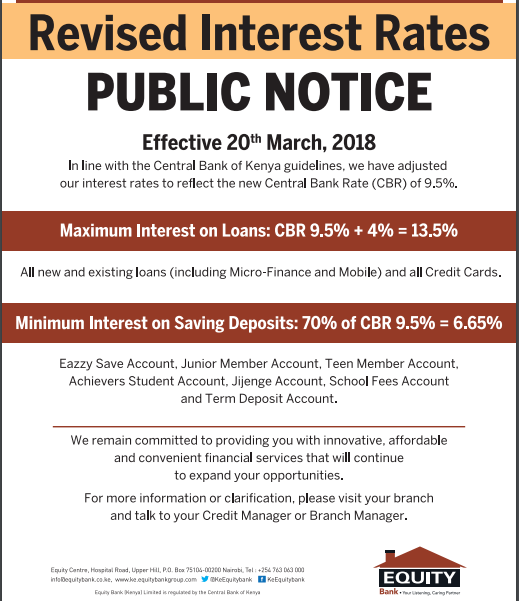

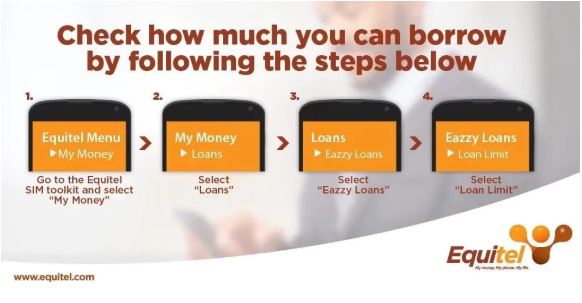

Equity bank commenced business on registration in 1984. Its headquarters are in nairobi kenya. Eazzy loan this type of loan by equity bank is the most accessible loan to borrow. Equity banks terms and conditions might vary with time as well as the rates.

In most cases the customers ability to repay the loan from their income determines whether they qualify for the loan or not. Equity bank business loans are now available to sort you out. This loan is insured against disability or death and therefore sets itself apart from what other banks offer. Equity bank kenya loans gives out unsecured loans by analysing the customers credit scores.

Moreover it is also unsecured. Among the many banks or lending institutions in kenya equity bank kenya stands out above its competitors. The difference between these two is that for the financing you can borrow any amount between 100 and 200000 kenya shillings while for the eazzy plus loan you can borrow upto 3000000 kenya shilings. This is because apart from the equity bank loan there is also the option of the eazzy plus loan.

This loan is meant for those customers who need financial aid but do not have the necessary assets to give as security. Equiloan a loan facility that enables equity bank clients can develop themselves by acquiring assets and also sorting out their own.