Fasb Loans Held For Sale

Loans not held for saleloans that management has the intent and ability to hold for the foreseeable.

Fasb loans held for sale. This includes guidance on the accounting for interest income impairment purchased financial assets with credit deterioration refinancing and forclosures. Mortgage loans and mortgage backed securities held for sale are reported at the lower of cost or market value. In a press release dated march 27 2001 the federal financial institutions regulatory agencies announced the issuance of guidance on accounting and reporting for certain loans that are sold directly from the loan portfolio or transferred to a held for sale account. 13 60 and 65 and a rescission of fasb statement no.

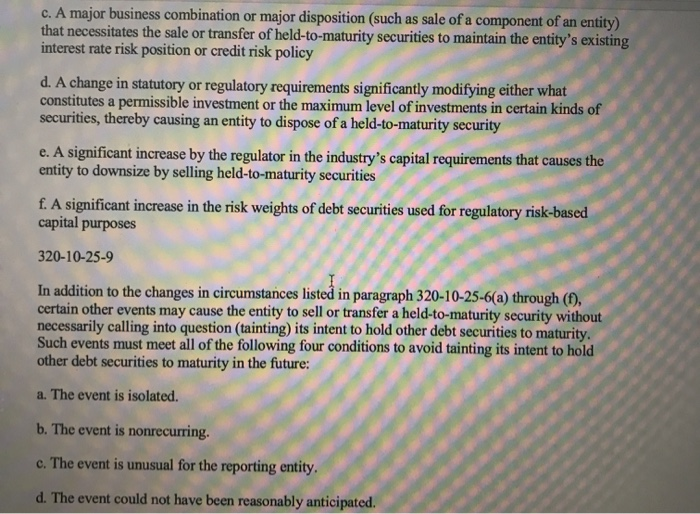

Rebooked loan must be reported as a loan asset in schedule rc c part i either as a loan held for sale or a loan held for investment based on facts and circumstances in accordance with generally accepted accounting principles. This accounting and reporting treatment applies for example to us. Notwithstanding the above characteristics loan commitments that relate to the origination of mortgage loans that will be held for sale as discussed in paragraph 21 of fasb statement no. The federal deposit insurance corporation fdic and the other federal financial institution regulatory agencies have jointly issued the attached interagency guidance on certain loans held for salethe guidance addresses the appropriate accounting and reporting treatment for certain loans that are sold directly from the loan portfolio or transferred to a held for sale account.

A component of an entity that is classified as held for sale or that has been disposed of is presented as a discontinued operation if the operations and cash flows of the component will be or have been eliminated from the ongoing operations of the entity and the entity will not have any. This statement supersedes fasb statement no. 65 accounting for mortgage banking activities as amended shall be accounted for as derivative instruments by the issuer of the loan commitment that is. To all state member banks and bank holding companies in the second federal reserve district.

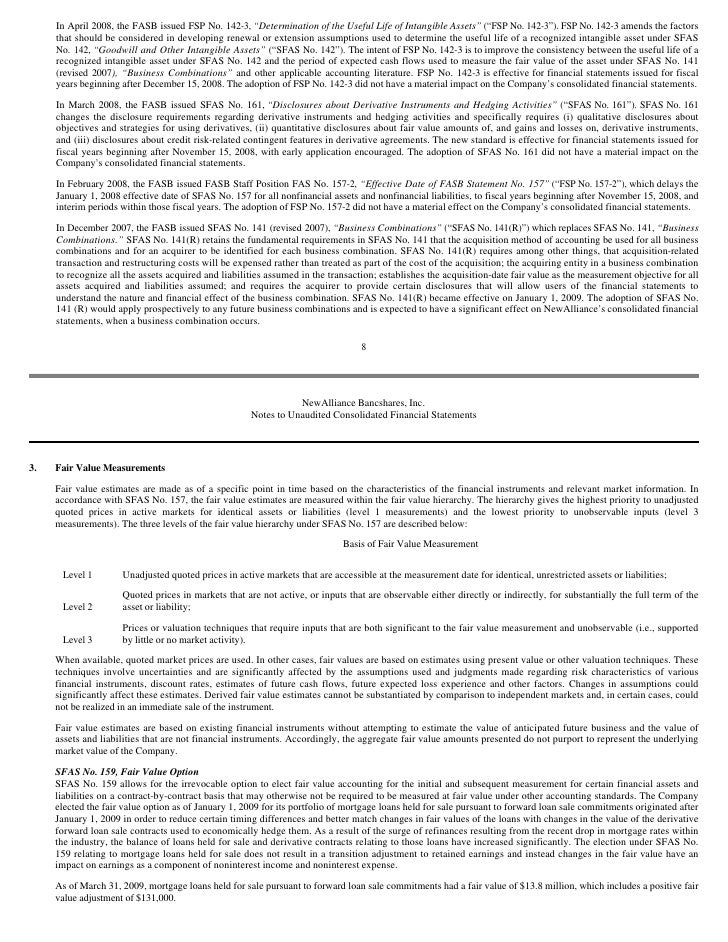

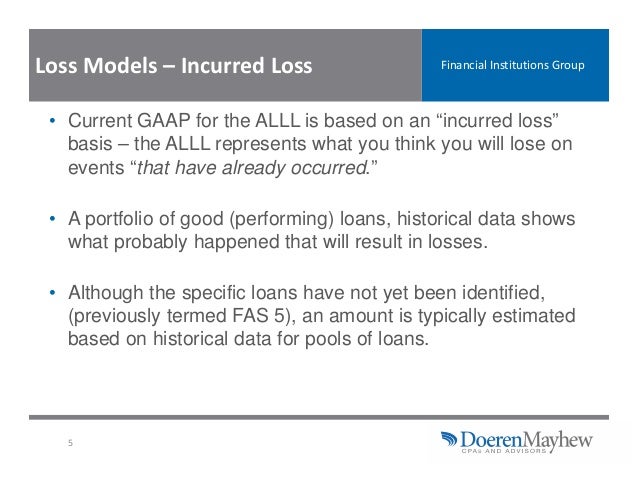

Instead they should be written off as part of the gain or loss on the sale of the loan. Deferred loan origination fees and costs should be netted and presented as a component of loans. If the loans are classified as held for sale the net fees and costs should not be amortized. The loans and investments guide provides guidance on the accounting for loans and investments after the adoption of the fasbs recognition and measurement standard and the new credit losses standard.