Gold Loans Means

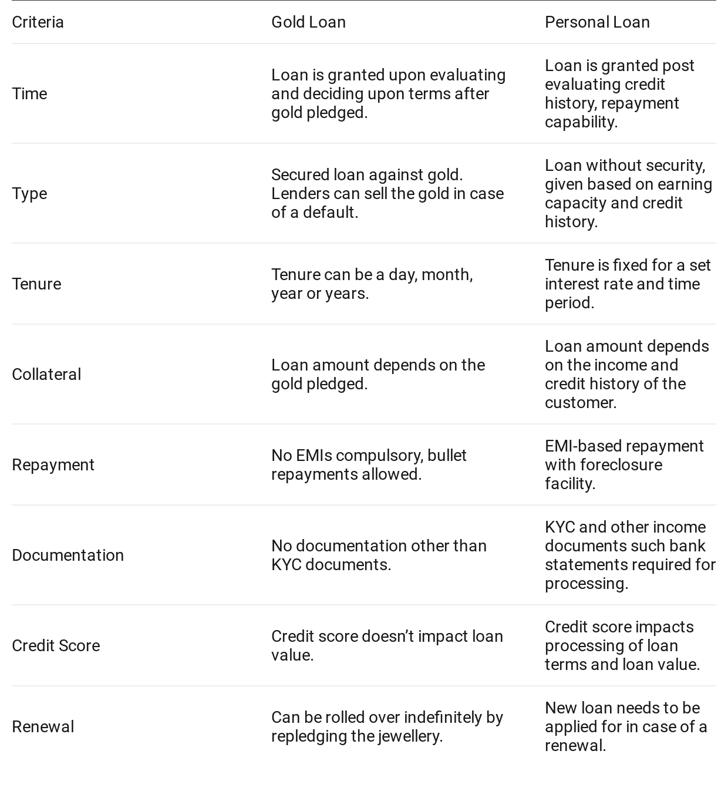

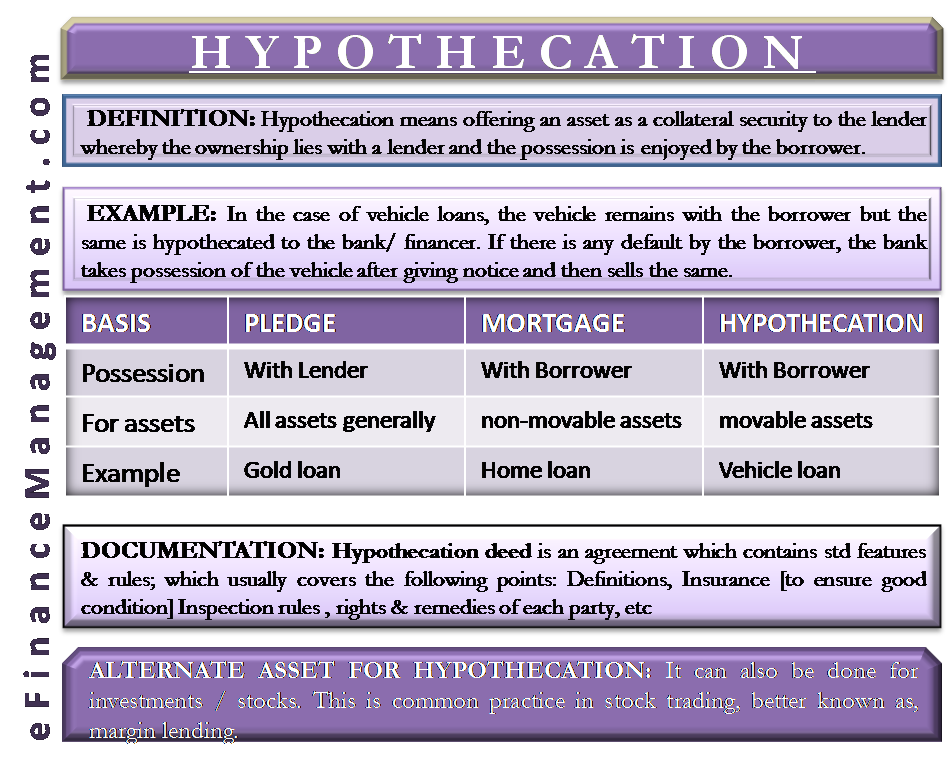

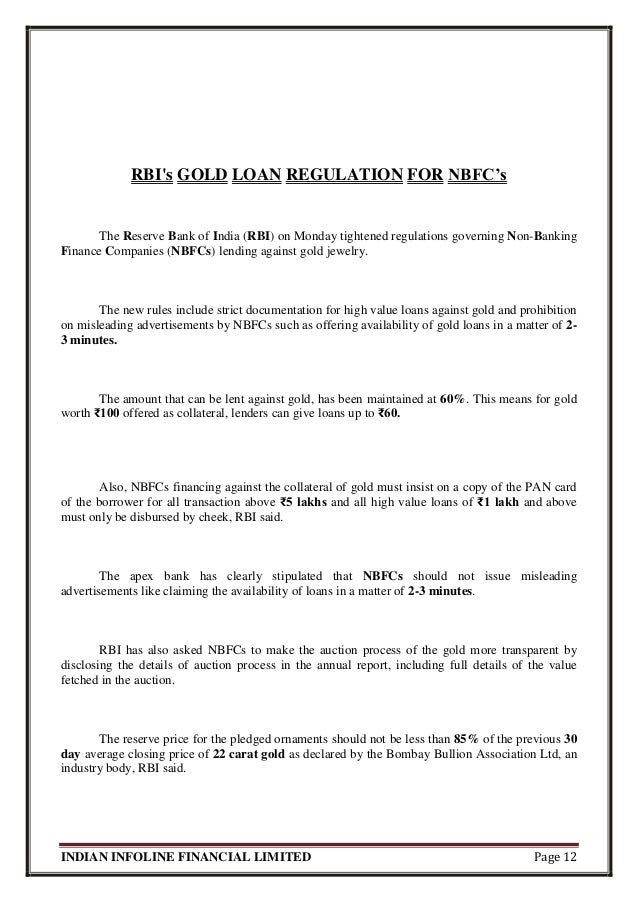

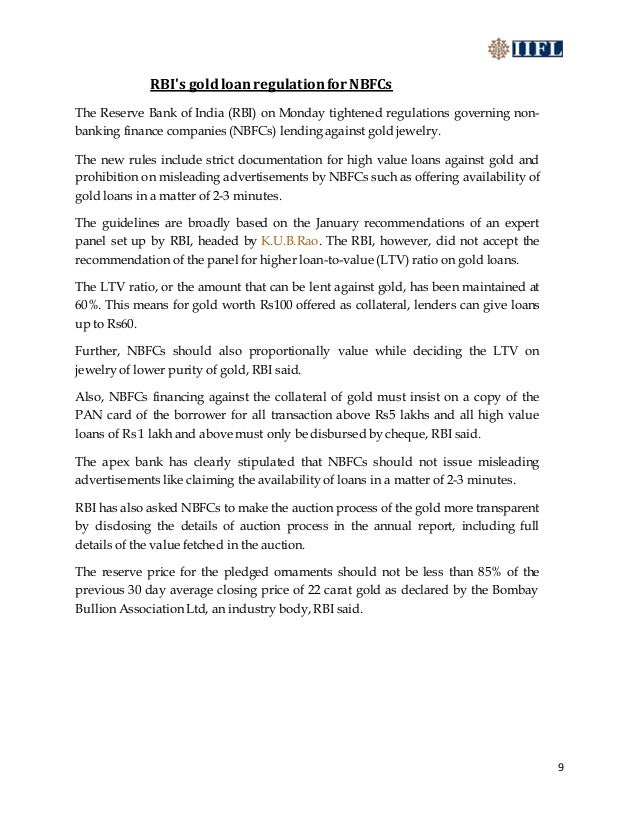

Gold loan or loan against gold is a secured loan in which a customer pledges hisher gold ornaments as collateral with a gold loan company.

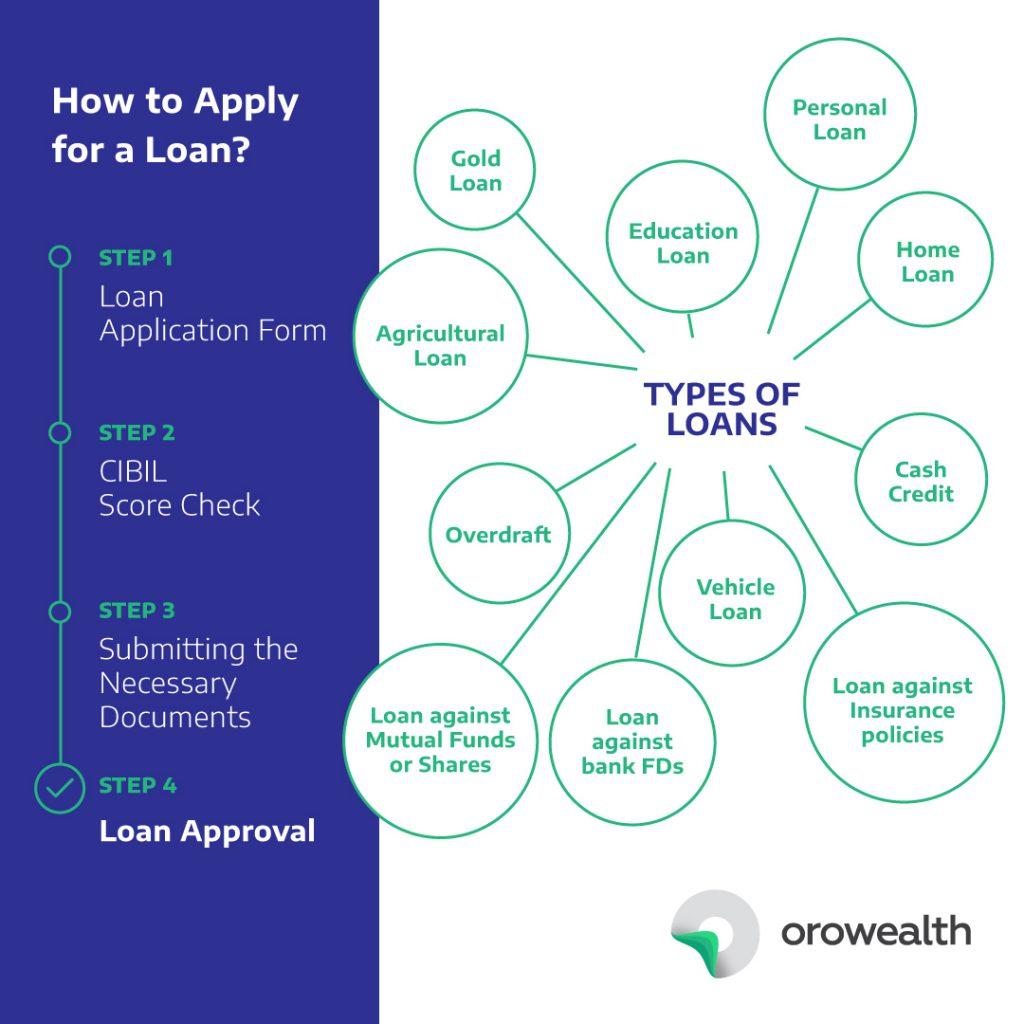

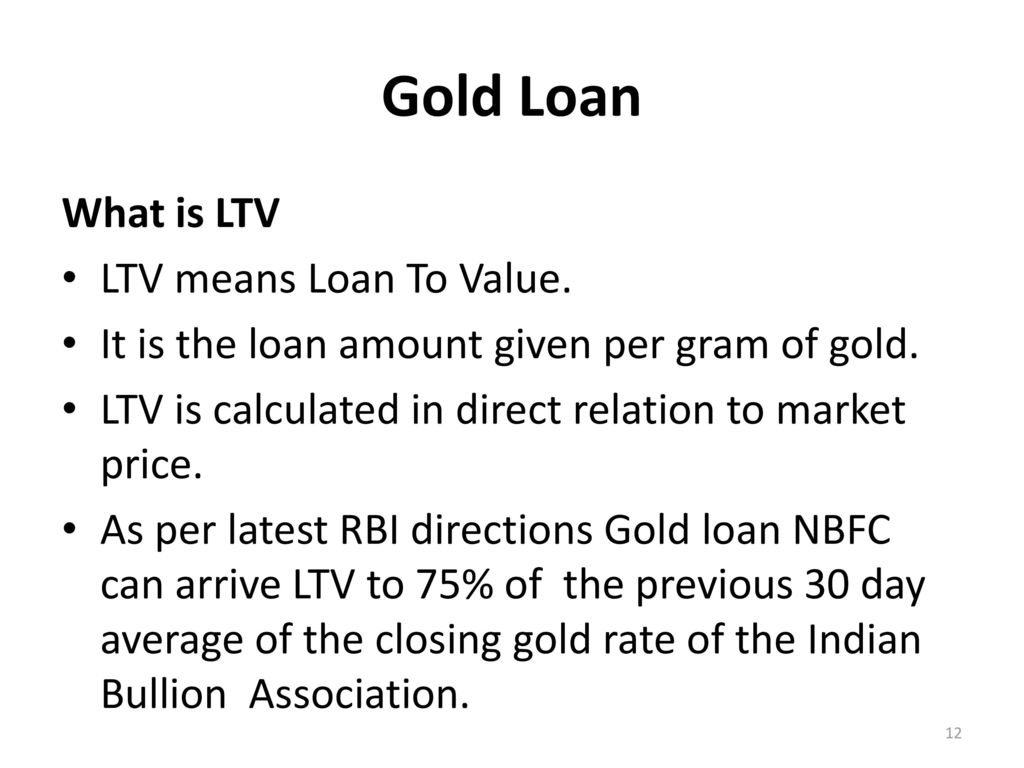

Gold loans means. Personal loan is sanctioned on the basis of source of income and repayment capacity of an applicant. To get a gold loan you can walk into any icici bank branch offering gold loan with your jewellery and avail of a gold loan for any value from rs 10000 to rs 1 crore quickly. It is exclusively created for those who are engaged in agriculture activities. Gold loan is a secured loan.

Unlike any other unsecured loan gold loan doesnt require many papers only few documents such as id proof and address proof is enough to avail for such loan. Exclusively created for sbi housing loan customers. Gold loan is sanctioned by accepting the gold ornaments of the customer as pledge. With our simple and easy documentation process the loan can be availed of across the counter quickly.

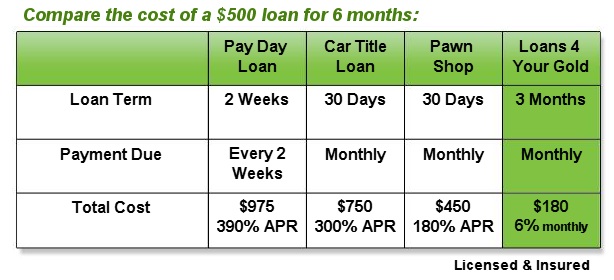

A mortgage loan is a very common type of loan used by many individuals to purchase residential property. Sbi offers three types of gold loan plans and they are discussed in brief below. Therefore its interest rate is low in comparison to unsecured loans such as a personal loan. It is a very quick and easy way of fulfilling ones financial needs as compared to the other loans.

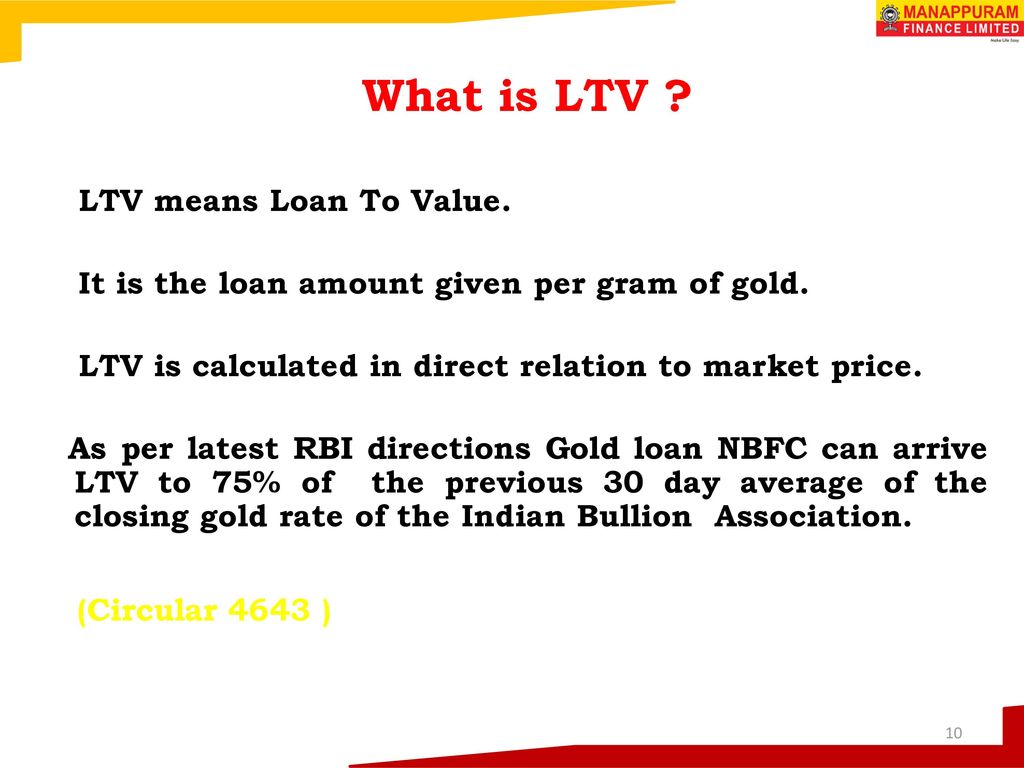

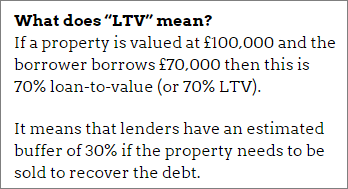

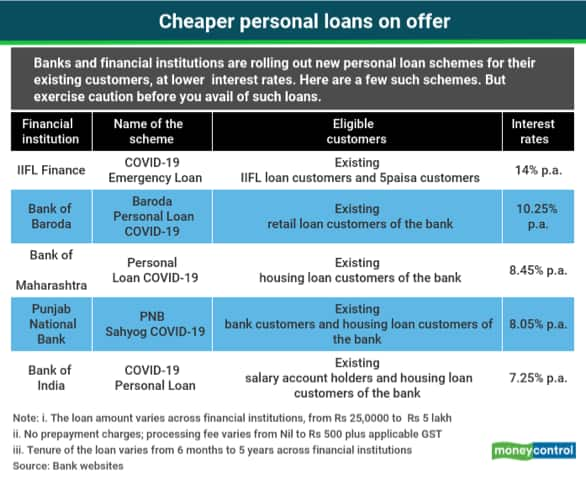

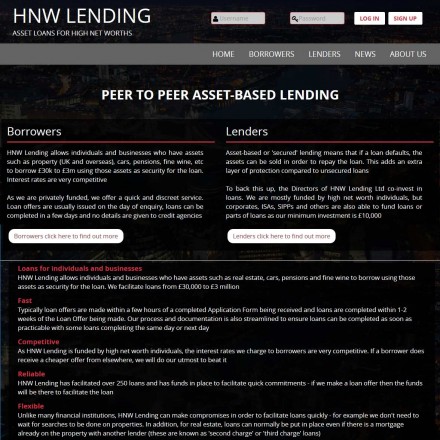

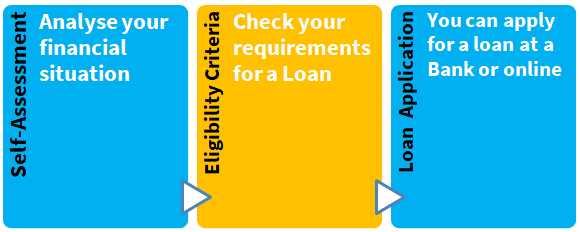

It is true that gold loans like personal loans or credit card borrowings are often used for short term household requirements. The interest rates levied on gold loan varies from one lender to another and depends on various factors such as gold loan tenure loan amount etc. A loan is a form of debt incurred by an individual or other entity. A secured loan is a loan in which the borrower pledges some asset eg a car or house as collateral.

Thus even unemployed and non working people can go for gold loan. Overdraft account with transaction facility and monthly interest is to be served. On or before the term of the loan on closure of account. The lenderusually a corporation financial institution or governmentadvances a sum of money to the.

The company in turn gives a loan amount as per the market value of gold to the customer. Gold loan doesnt demand any certificate to show your salary or income and even no credit card history is required. The lender usually a financial institution is given security a lien on the title to the property until the mortgage is paid off in full. Anyone single or jointly having a steady source of income can avail this plan by pledging their gold.

At the end of the loan period the bank buys back the gold and returns it to the central bank.

.jpg)