Guarantor Loan Home

They estimate their lenders mortgage insurance lmi premium using genworths calculator and.

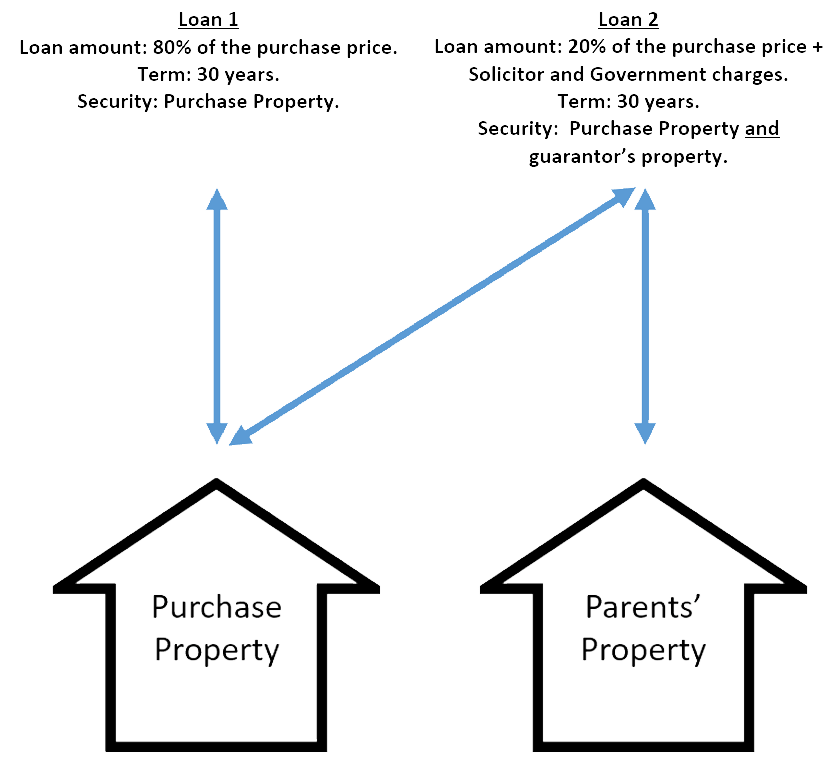

Guarantor loan home. And thats the catch. However they will have to accept the obligations associated with entering into a guarantee. For example if your guarantor had a home loan with 100000 owing and they needed to give a limited guarantee of 100000 then the total debt secured on their property would be 200000. Lets say that you want to buy a place costing 500000.

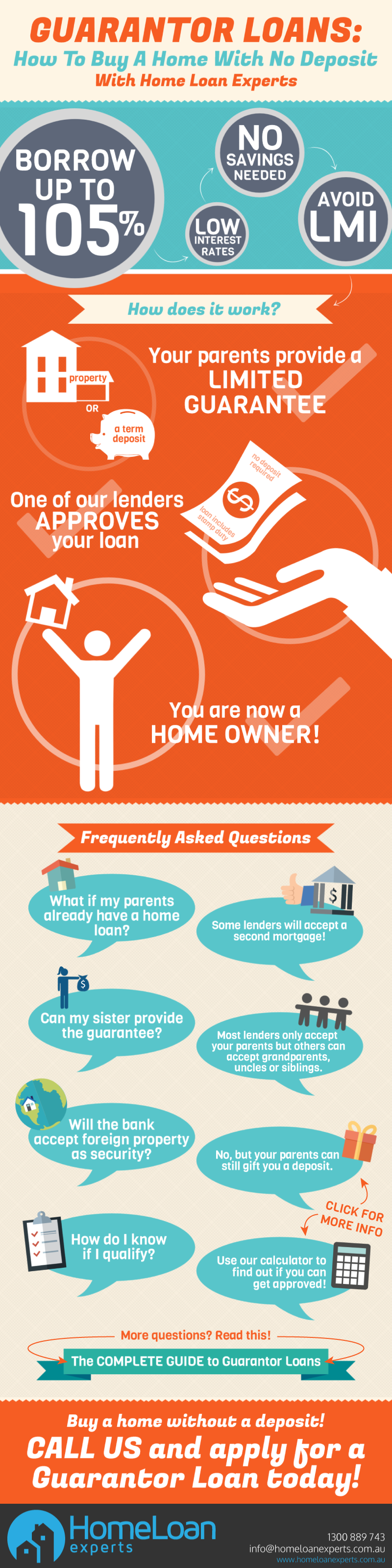

A guarantor home loan can also be a way to avoid the cost of lenders mortgage insurance lmi. John and rachel purchase a 600000 apartment with a 5 deposit 30000. The guarantor uses equity from their home to guarantee part of their family members loan. Its a saving that can be worth thousands of dollars.

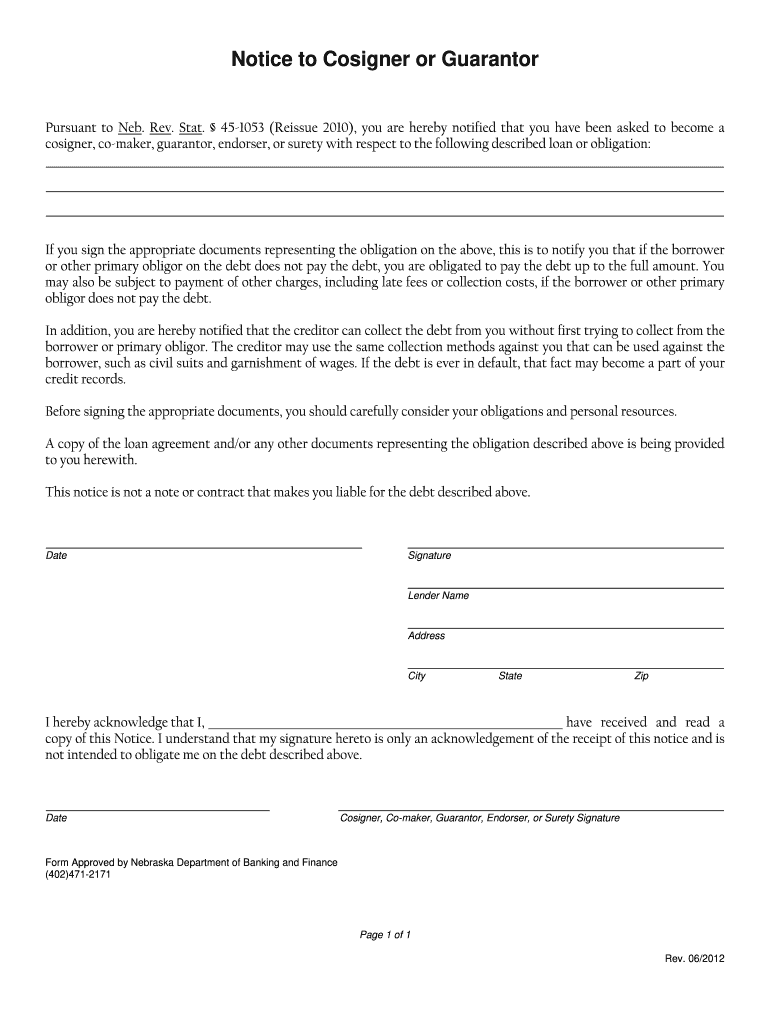

Once the borrower has repaid 20 of the loan the guarantors property is safe even if the borrower fails to repay the remaining 80. Thats equal to 10 of the propertys value. Acting as guarantor for a borrower means you agree to repay the home loan if the borrower cant meet the repayment terms and conditions of their loan contract. The guarantee is limited and allows the guarantor to choose the amount to commit as security for their family members loan.

The guarantor is not required to give any cash to the borrower for their deposit. Their home must be worth 267000 or more for the guarantor loan to be approved. Removing a guarantor from mortgage with a 90 lvr home loan. When someone agrees to act as a mortgage guarantor for you they commit to covering the repayments if you fail to keep up.

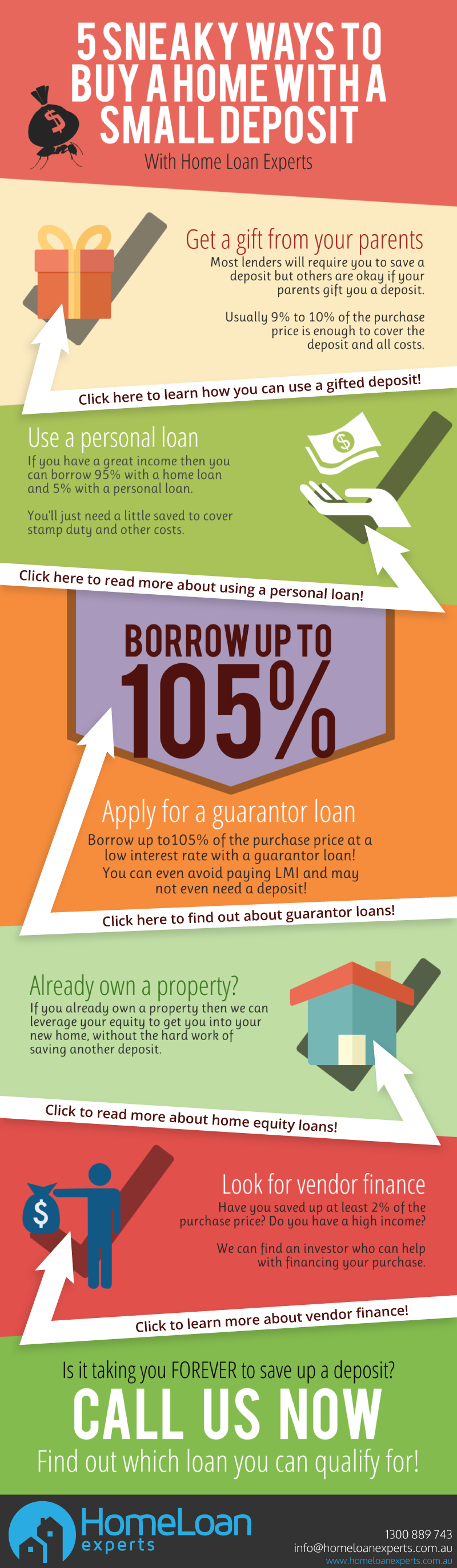

To minimise risks a guarantor can guarantee only a portion of a loan say 20. The person providing the security is known as the guarantor. You still need to borrow money from a lender and repay it but your guarantor provides security for the loan that you would normally have provided in the form of a deposit. A guarantor mortgage is a way of securing a mortgage when you lack the required deposit or have financial circumstances that may discourage lenders.

You have saved a deposit of 50000. The initial steps and process in removing a guarantor with a 90 lvr home loan are similar to above where you will need to meet the banks credit criteria have kept your loan repayments up to date and need a new valuation on your home. A guarantor home loan allows a close relative typically a parent to use the equity in their home as security for part or all of your mortgage. Heres how a guarantor home loan works.

If you are unable to repay the mortgage your guarantor may have to. Under a family security guarantee a family member with sufficient equity in their home can use it as a security guarantee for your loan.