Guarantor Loans Non Homeowner

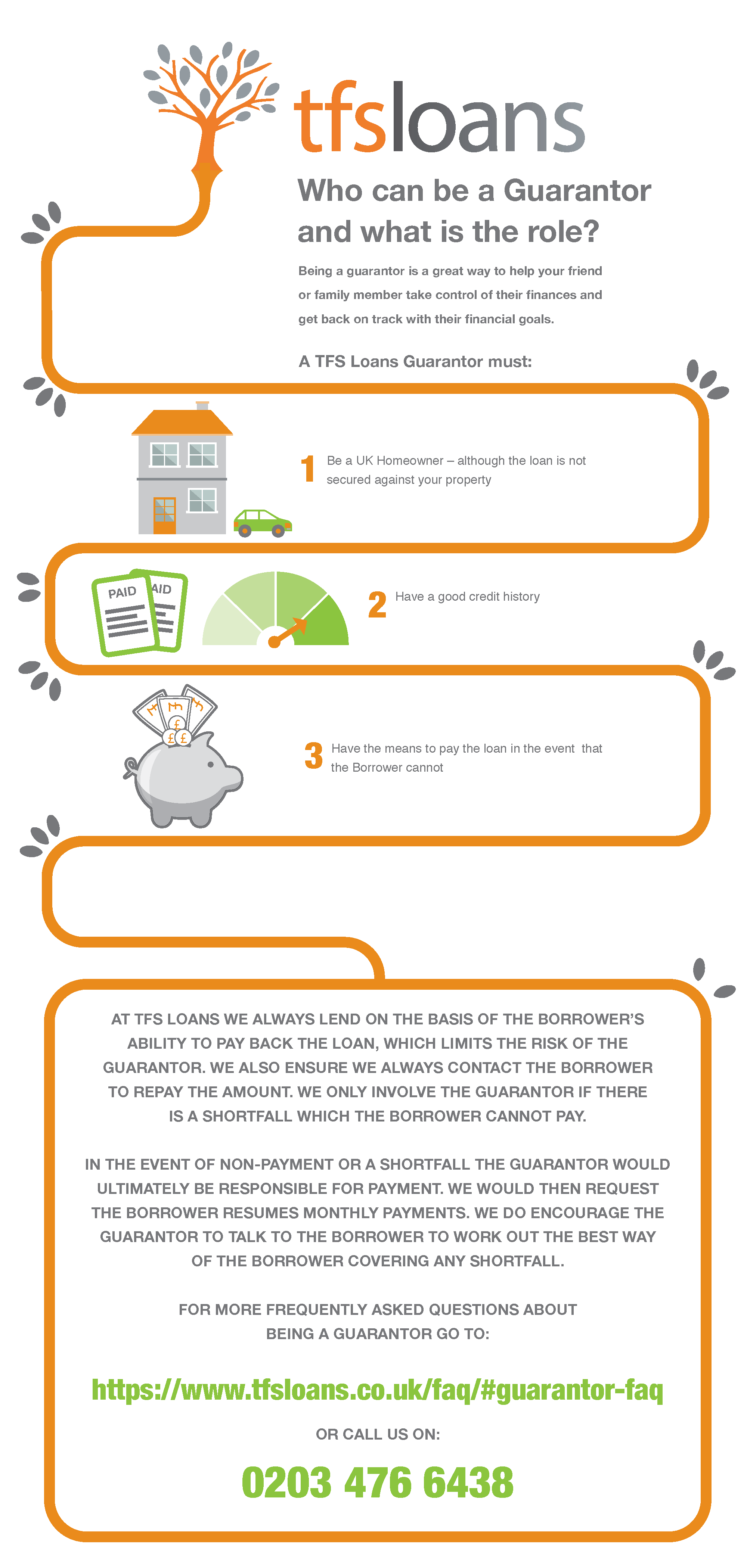

A homeowner guarantor loan is not a secured loan so its not tied to your home as collateral.

Guarantor loans non homeowner. If the borrower defaults the guarantor will need to continue paying off the loan. Sometimes your guarantor needs to be a uk homeowner too but there are non homeowner loans available. Non homeowner loans typically last no more than 5 years. With a non homeowner guarantor or tenant guarantor product you will be able to apply for a guarantor loan of up to 6000 and neither you nor your guarantor needs to own their own home.

Some may offer significantly higher or have different lending criteria allowing you to borrow greater amounts. With the backing of a guarantor you could be able to borrow up to 10000. In contrast guarantor loans from amigo are. Tenant guarantor loans can be both affordable and flexible not only can you take advantage of rates from 399 depending on the amount you borrow.

Non homeowner guarantor loans 500 to 7500. Lets look at the highs lows and need to knows of non homeowner. A non homeowner guarantor loan is simply a loan that you can take out even if you or your guarantor do not own a property. As with most unsecured loans most lenders could request a county court judgement ccj or a charging order on the homeowners property if both the borrower.

These loans are called secured loans because they are secured against a property. These kinds of loans might be secured against the property of the guarantor so if you default on your repayments you risk the guarantors property being repossessed. Some types of loans from high street lenders require a property to be used as collateral. But these differences are relatively small at the typical loan amount 3000 to 4000 and loan term 36 months.

Unlike homeowner loans a guarantor loan is not secured against a property and therefore you may be able to borrow money without being a homeowner and even if you have a poor credit file. But is a guarantor loan the answer to your bleak borrowing outlook or would your time be better spent by heading down another route. And your guarantor doesnt need to own their home either although if they do you may be able to borrow up to 15000. Non homeowner guarantor loans typically let you borrow as little as 1000 to as much as 5000 or so but this varies between providers.

Non homeowners can get a guarantor loan there are some differences between guarantor loans for non homeowners and property owners. Guarantor loans for non homeowners could warrant further exploration.