Haraka Loans Kenya

Haraka loan app review first the interest rates are too high.

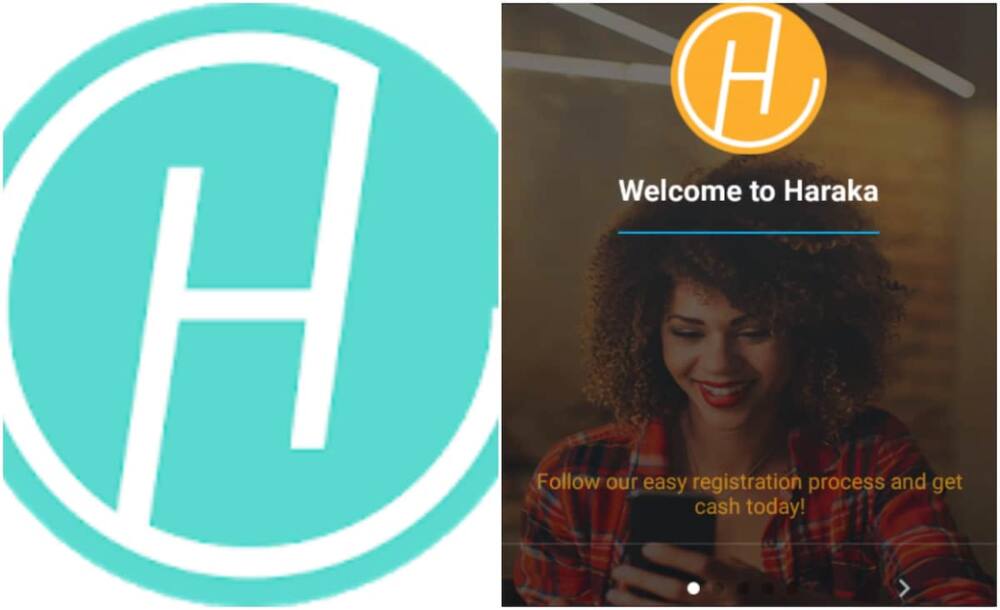

Haraka loans kenya. Haraka loan app has definitely touched the hearts of millions in the countries it operates in. Please assist with their phone no. Haraka savings and credit co operative society was registered in 1976. Besides kenya and south africa haraka loan application also lends to people in uganda swaziland zimbabwe and tanzania.

5000 which isnt much compared to its biggest competitors like tala branch and the rest. Jambo i am trying to get a loan from haraka loans but there is a pop that keeps you for password change required that i cant go beyond. Its objective is to promote the welfare and economic interest of its members in accordance with the co operative principles. However unlike other loan apps in kenya with a higher loan limit of 10000 50000 the haraka loan application is a low range application that lends between 500 to 5000.

Yet the app has already indicated a due date for a loan i never received. Over 1000 ksh interest on a loan of just kes 3750. It was formed to act as a means of facilitating savings and to provide affordable credit. Haraka loan app services are not only available to kenya and south africa but also in other countries including uganda zimbabwe swaziland and tanzania.

Haraka loans are accessible through an android application readily downloadable through google play. While this loan limit might seem. The primary goal behind haraka app loans is to provide affordable turnaround capital for multiple people from around the world. Most successful applicants receive loans ranging between kshs.

This loan app is designed to help africans to get access to instant mobile loans to solve minor emergencies. All you need to enjoy haraka services is an android phone and an active facebook account. Other similar apps and even banks have better rates. Haraka loan app is a small division of getbucks all providing quick loans to kenyans and africans at largewhile getbucks provide financing to employed individuals and stable business entities haraka gives loans to anyone especially unbanked individuals in informal businesses.

For example joseph wrote. Second and worst of all the loan was approved but it never made it to my mpesa wallet. Haraka loan app is owned by getbucks pty limited a south african money lender. This is what some of the loan app users have been asking mei received emails in my inbox asking for the same haraka loan contacts in kenya.

People from uganda tanzania zimbabwe and swaziland also enjoy the benefits of the app as it is actively available in their countrydespite being in numerous countries the app only offers small loans of between ksh.