Home Loan Vs Mortgage

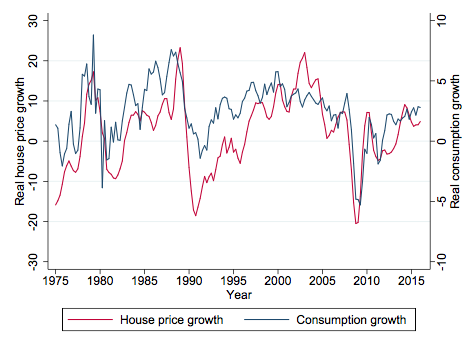

In the event of an unresolvable repayment default against the home loan a mortgage allows the bank to reserve the right to sell the property and use the money to recover the remaining debt.

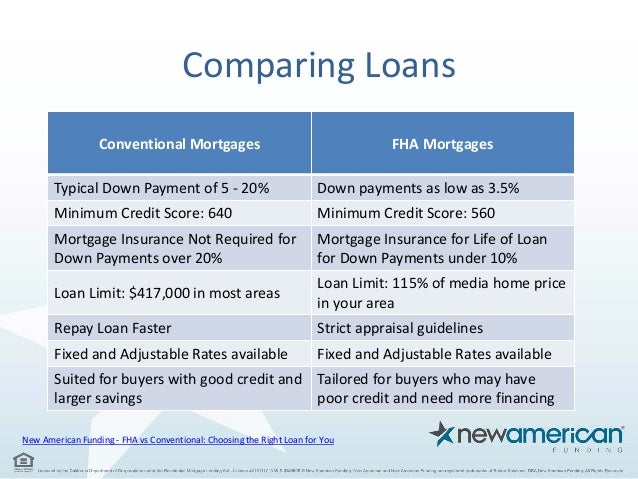

Home loan vs mortgage. A personal loan is unsecured whereas a mortgage uses your house as collateral if you default on a mortgage you could lose your home. Mortgages and home equity loans are both loans in which you pledge your home as collateral. The money lent and received in this transaction is known as a loan. For a home loan an applicant borrows money from a bank or a non banking financial company on interest rate for upgrading constructing or buying a property in a residential real estate.

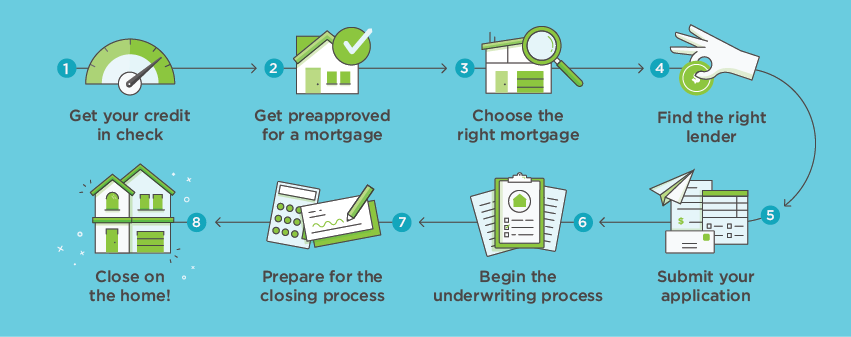

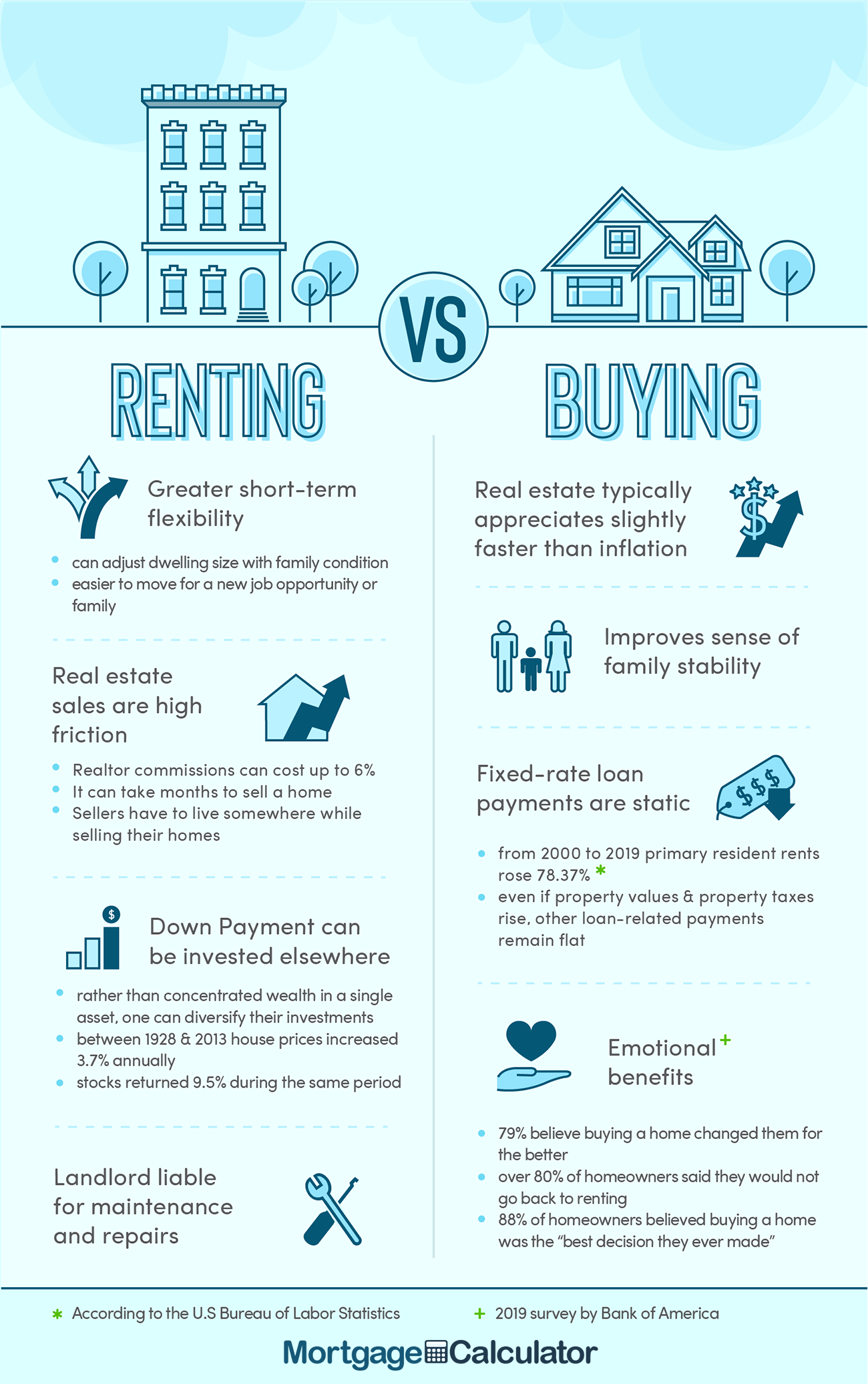

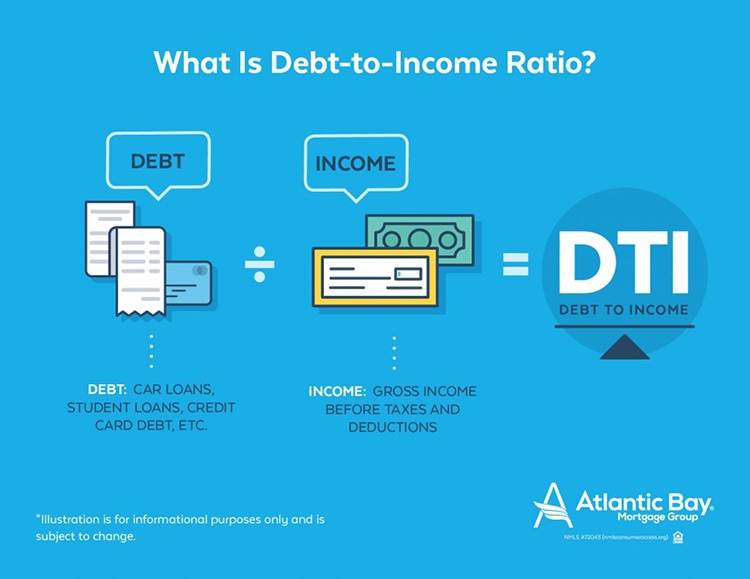

Once your home loan is repaid the mortgage is gone. A personal loan is also for a much smaller amount which makes it difficult to buy a house with one. If the borrower defaults. First knowing your dti ratio can help you gauge how much home is truly affordable based on your current income and existing debt payments.

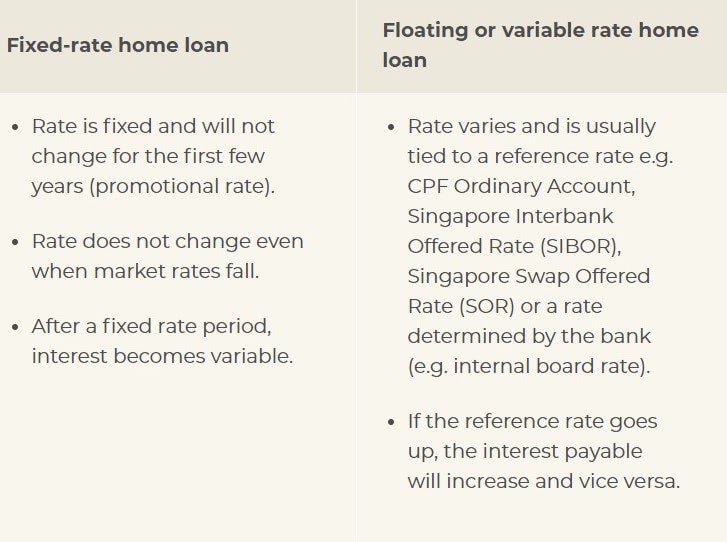

Home equity loan vs. While the lender provides the loan they consider the home or the property as the collateral for the loan amount. One key difference between a home equity loan and a traditional mortgage is that you take out a home. There are two major differences between personal loans and mortgages.

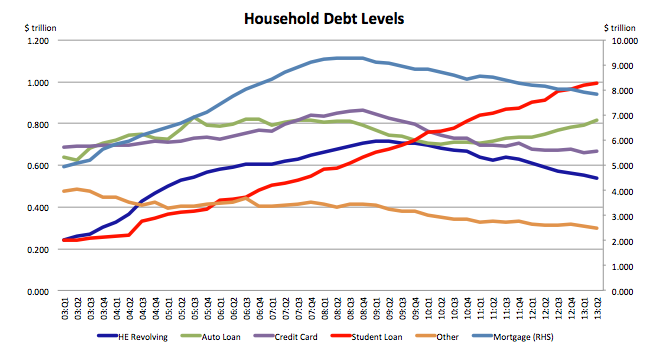

Home equity loans. While you may be approved for a 500000 mortgage based on strong credit and a solid income for example paying 3000 for a mortgage each month may not be realistic if you have substantial student loans or other debts youre paying off. Mortgages and home equity loans are two different types of loans you can take out on your home. A home equity loan might be a good choice for you to fund a one time major expense such as buying a second home or paying down credit cards.

The creditor has loaned out money while the borrower has taken out a loan. Our latest video could save you a lot of money. The lender is also called a creditor and the borrower is called a debtor. A home equity loan is a fixed rate lump sum loan with a term ranging from five to 30 years.

Youll also find that the. The homeowner pays back the loan in fixed payments each month until the loan is paid off. Mortgages are types of loans that are secured with real estate or personal property. If you dont make your payments your lender can take your house.