Home Loans By Sbi

Sbi frequently asked questions faq has listed questions and answers all supposed to be commonly asked in context of home loans.

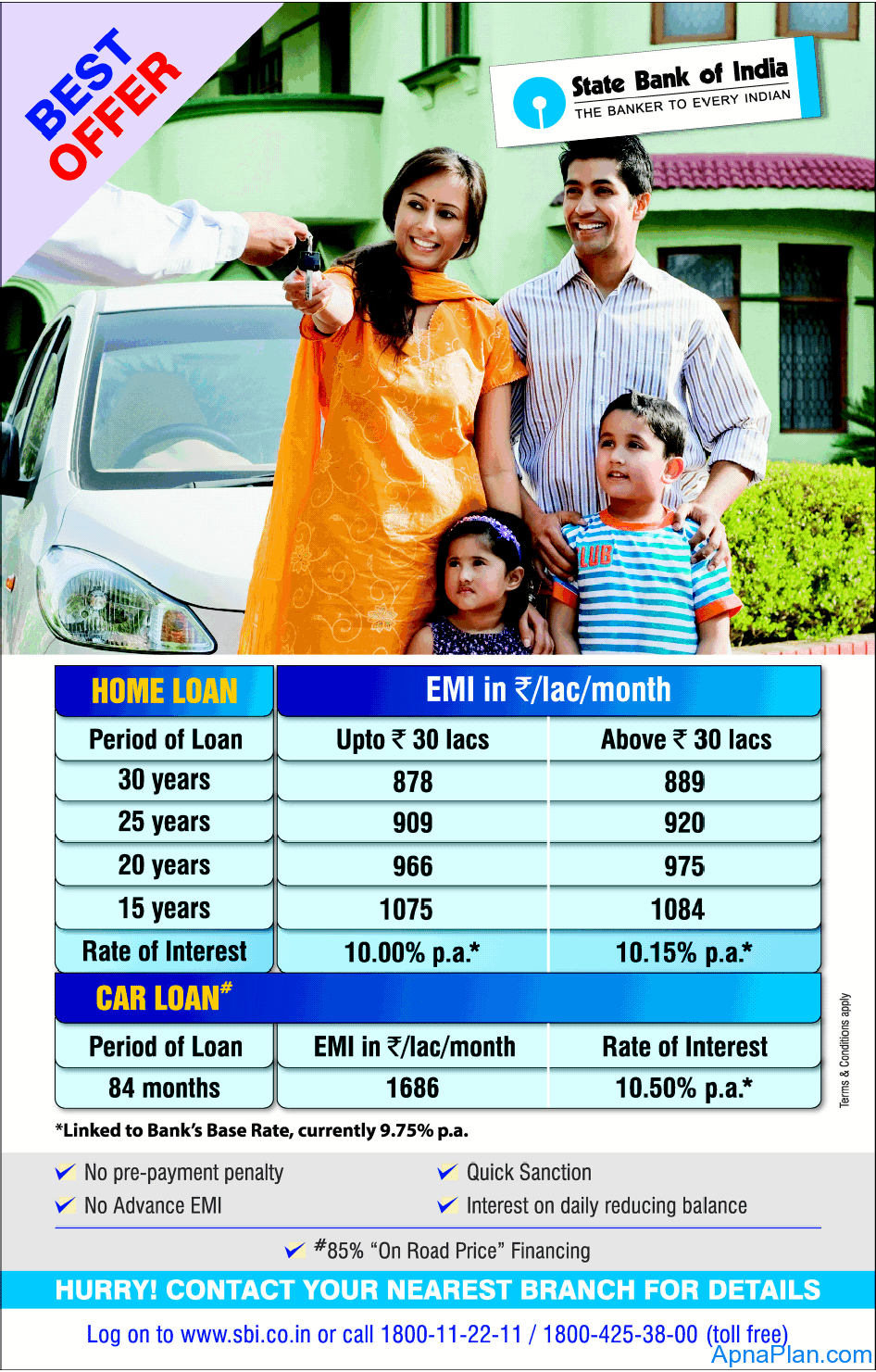

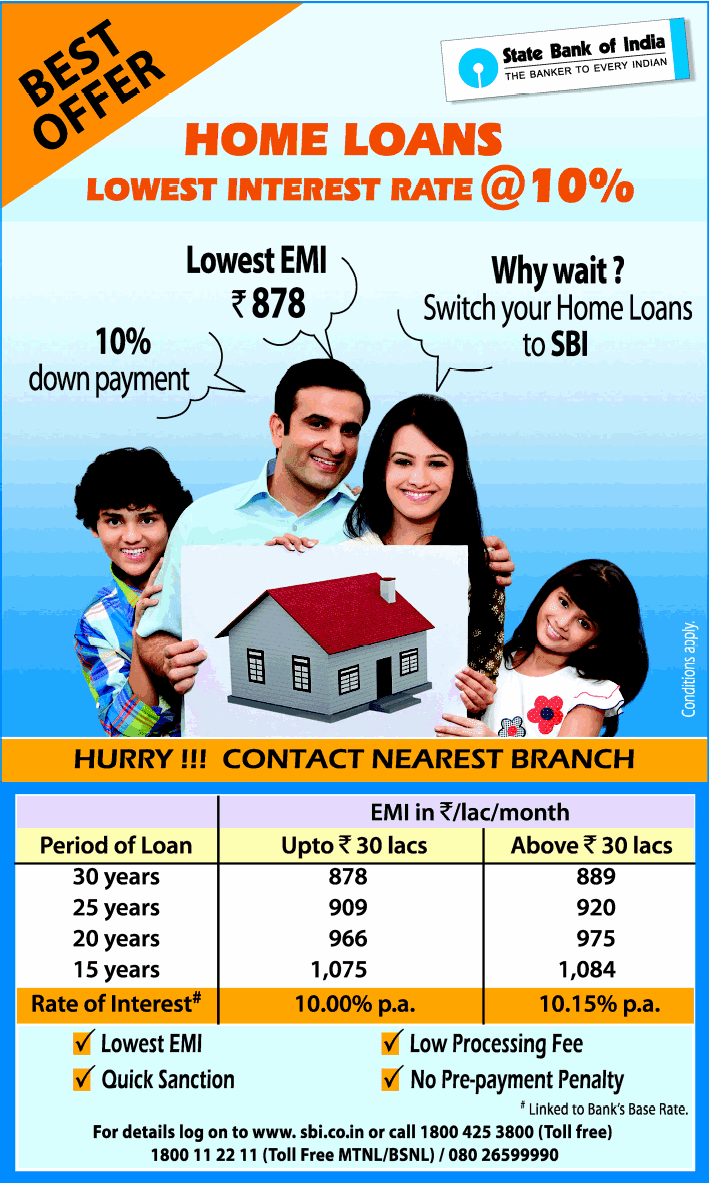

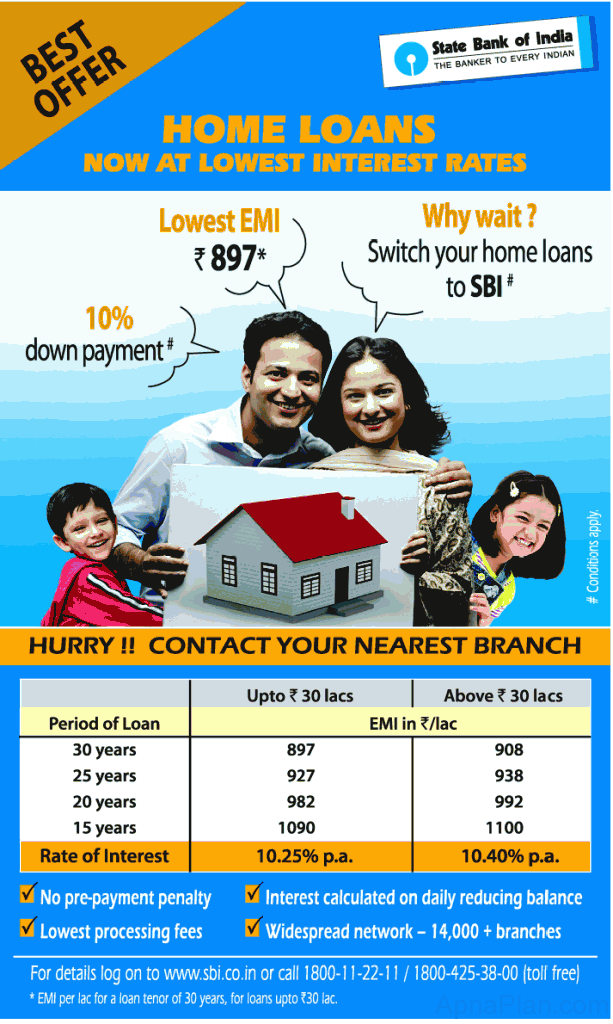

Home loans by sbi. Sbi home top up loan term loan the customers who already have a home loan from sbi and want more money can take sbi top. State bank of india is the largest mortgage lender in india which has helped over 30 lakh families achieve their dreams of owning a home. Application refers to an applicants home loan andor auto loan andor education loan andor personal loan application to the bank through sbi apply online. Please get answers to your common queries regarding the home loan security emis etc.

Welcome to the largest and most trusted home loan provider in india. As an nri you can get an in principle approval on your home loan through our online portal. Maxrs10000 plus applicable taxeswomen borrowers are also offered an interest concession of 005 on sbi home loans. Flexipay home loan calculator.

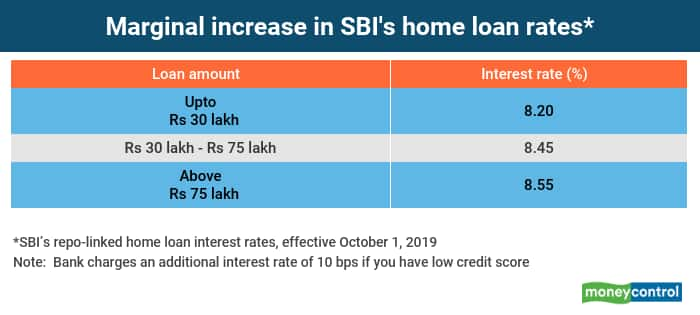

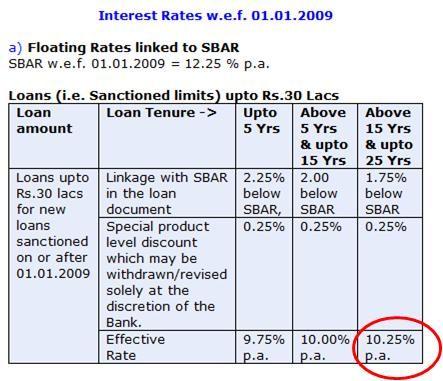

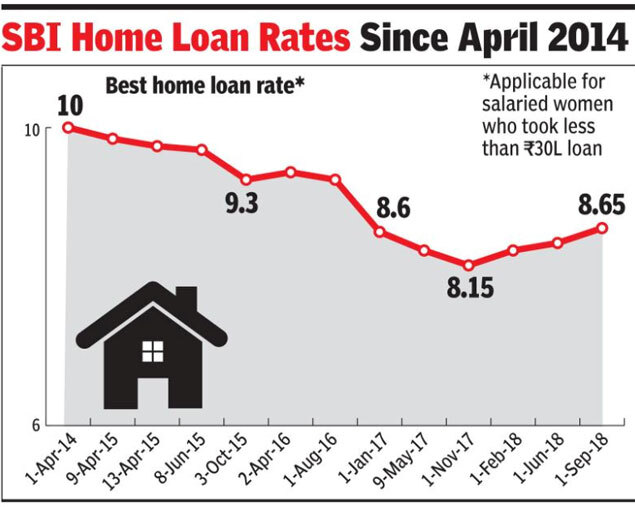

This is regular sbi home loan scheme which is the most demanding home loans in india. We also have a large number of sbi pre approved projects that you can check out. The interest rate applicable on sbi home loan interest rate is among the lowest home loan interest rates in the existing market scenario. You can browse through our range of home loan products check your eligibility and apply online.

Sbi flexipay home loan provides an eligibility for a greater loan. Information refers to any information obtained by an applicant from the bank for availing various services through sbi apply online. The loan tenure can be extended up to 30 years ensuring a comfortable repayment periodthe processing fee on these loans is 035 of the loan amount min. This variant of sbi home loan is very useful for young salaried between 21 45 years.

Sbi home loans offers a one stop solution to a home buyer.