Home Loans Explained

Home loan plays an important role in helping one with easy availability of your dream home.

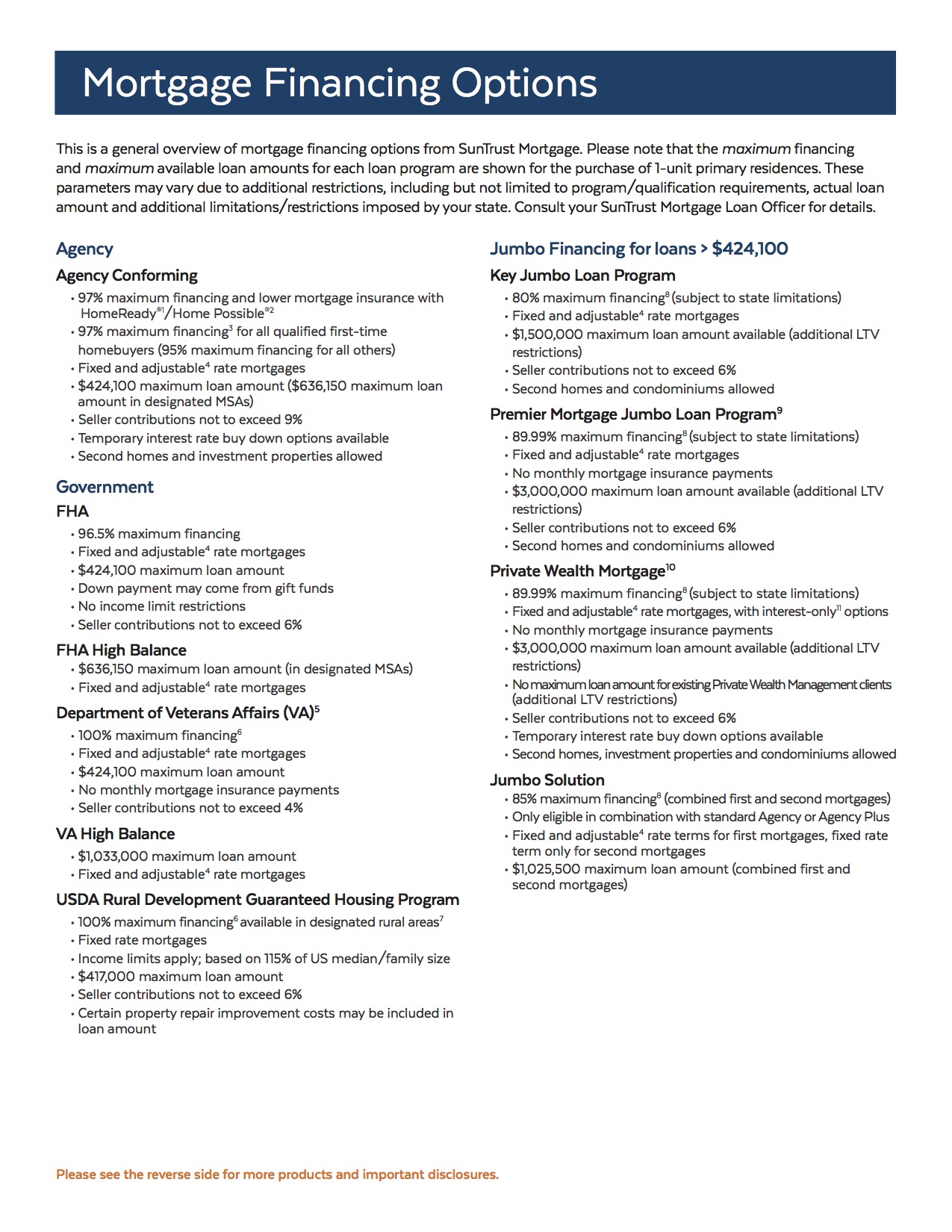

Home loans explained. Fha loans are backed by the government and designed to help borrowers of more modest means buy a home. Lenders have more leeway to accept a higher debt to income ratio if the new home mortgage is a conforming loan. Government insured home loans include the following. There are a number of banks that offer home loans at low interest rate.

They can run the mortgage loan through an automated underwriting program. In fact according to a survey by arguably one of the best mortgage providers me. If you fail to pay back the loan the lender can take your home through a legal process known as foreclosure. Find the right home loan for you view rates.

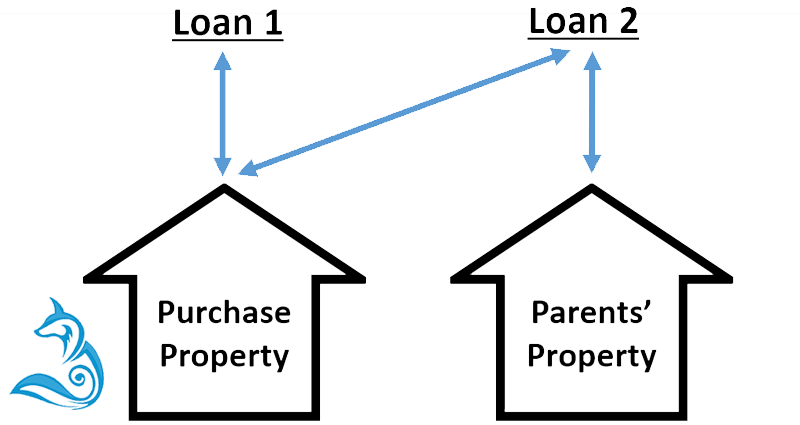

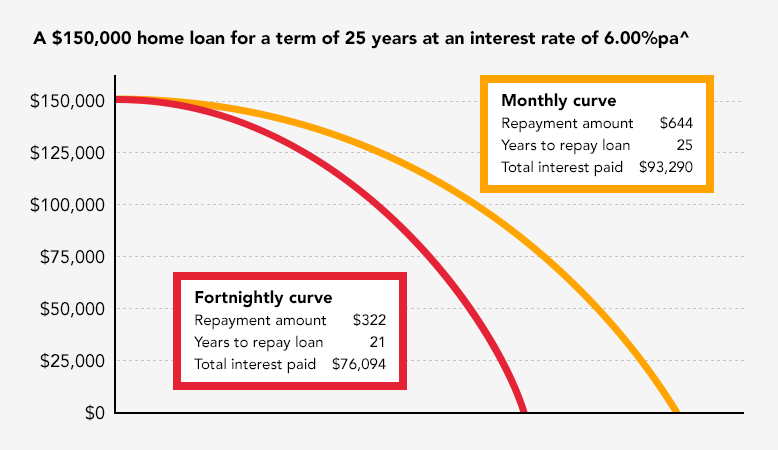

The bank or mortgage lender loans you a large chunk of money typically 80 percent of the price of the home which you must pay back with interest over a set period of time. When you start your home loan search the interest rate isnt the only thing you should consider. Taking out a home loan for a property is exciting but what can often dampen all of this excitement is the complicated home loan jargon that gets thrown around. A home mortgage is a loan given by a bank mortgage company or other financial institution for the purchase of a residence.

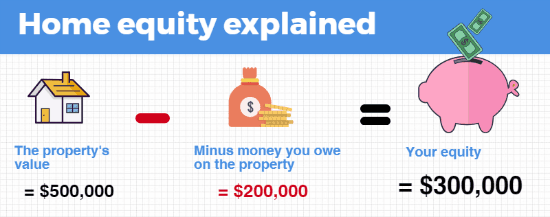

Loan to valuation ratio lvr refers to the percentage of the home loan against the value of the proposed security. This distinguishes it from the three government backed mortgage types explained below fha va and usda. Lenders may provide up to 100 of the value of the security for a loan if you agree to take out mortgage insurance lmi. See how fha.

You may want to either want to buy a new home or construct one. However most lenders will restrict the home buyer to a 50 debt to income ratio if the new home mortgage is a jumbo loan. An fha mortgage is a home loan insured by the federal housing administration. This figure is a one off payment usually made at the time of settlement.

A conventional home loan is one that is not insured or guaranteed by the federal government in any way. While typical home loans require a down payment of 20 of the purchase price of your home with a federal housing administration or fha loan you can put down as little as 35. The interest rate isnt the only thing you should consider when looking for a home loan. Here are some home loan features you should know about.

Home loan features explained.

:max_bytes(150000):strip_icc()/home-equity-loans-315556_final3-23fa1237c577475f811fe9fc06eedec2.png)