Ifrs 9 Loans And Advances

This means that a loan could be subject to both.

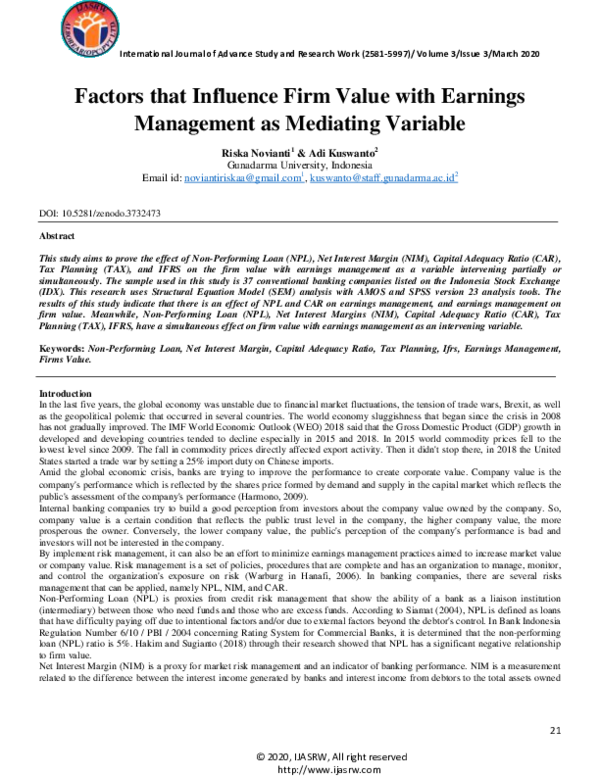

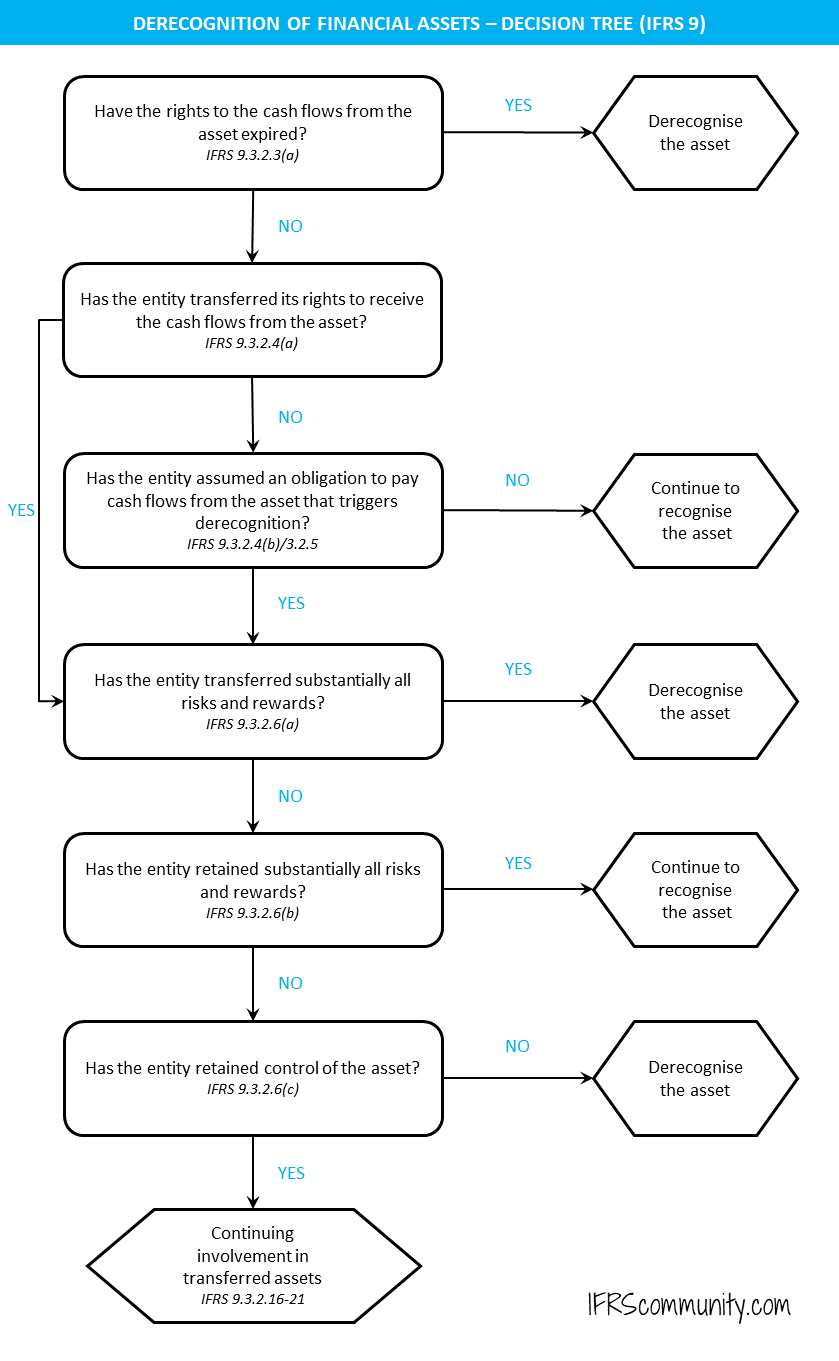

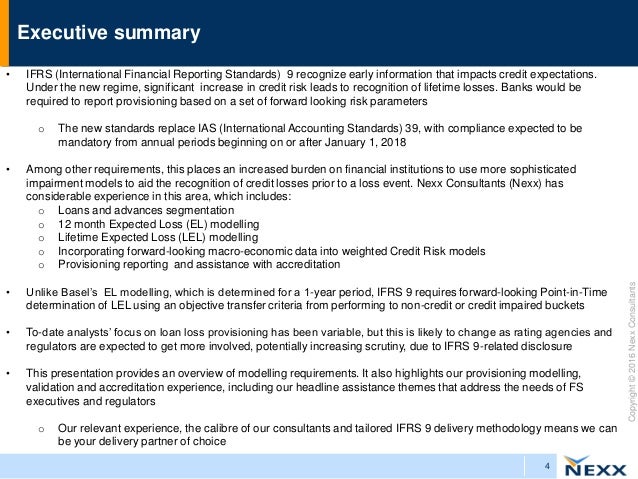

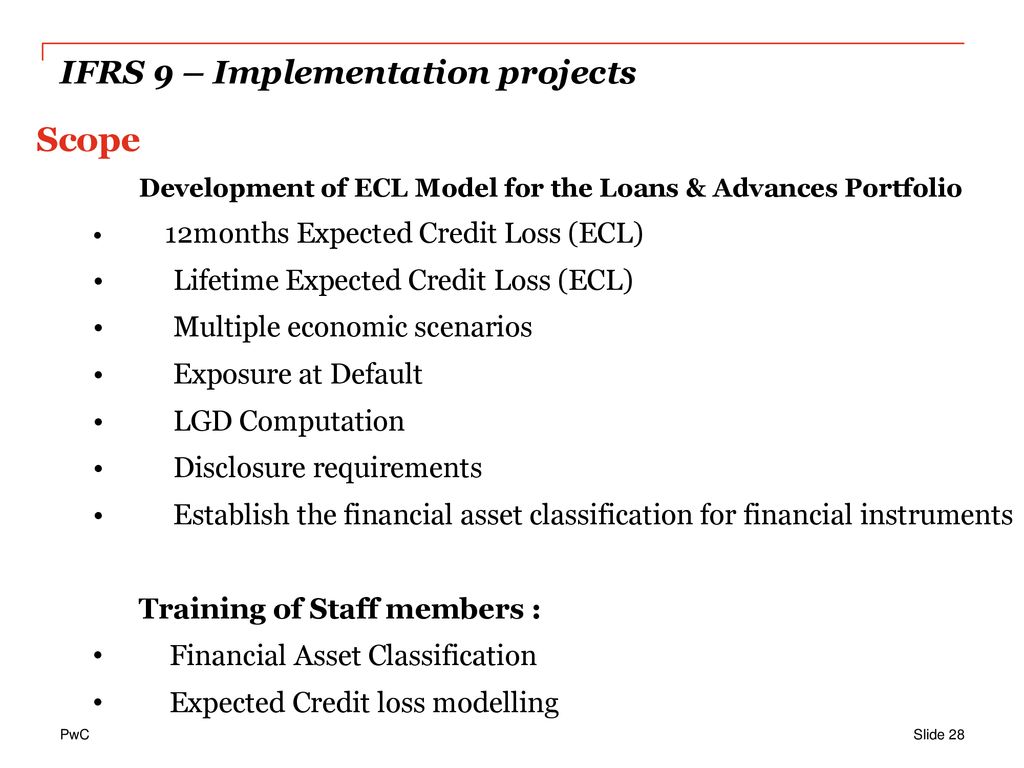

Ifrs 9 loans and advances. Loans and advances to customers 472498 10474 14 1022 461016 debt. Sicr is identified for loans and advances. Ifrs 9 allows a variety of approaches in measuring expected credit losses ecl and industry thinking. Financial assets designated at fvtpl.

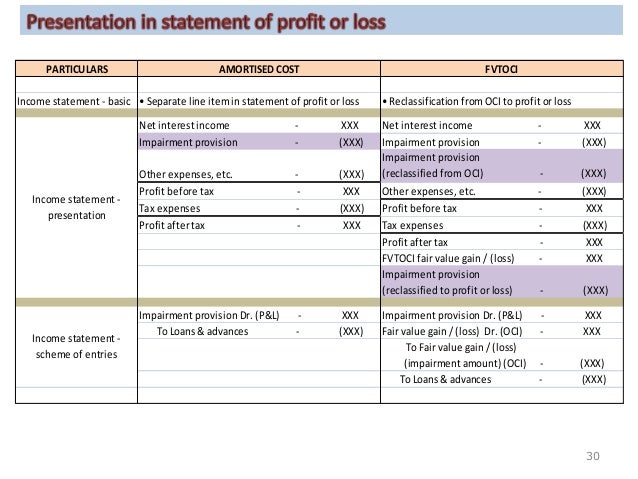

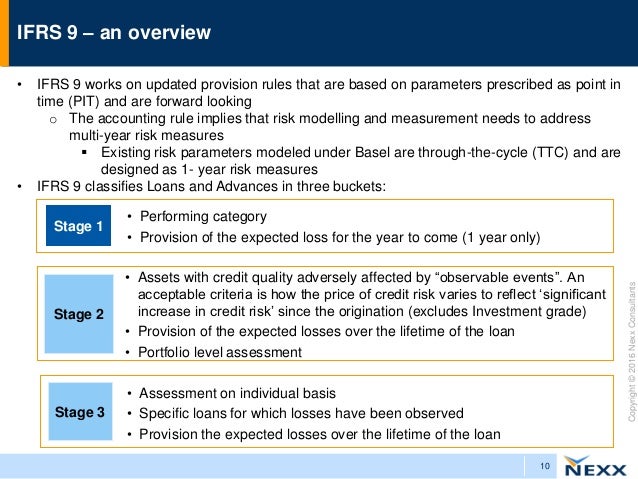

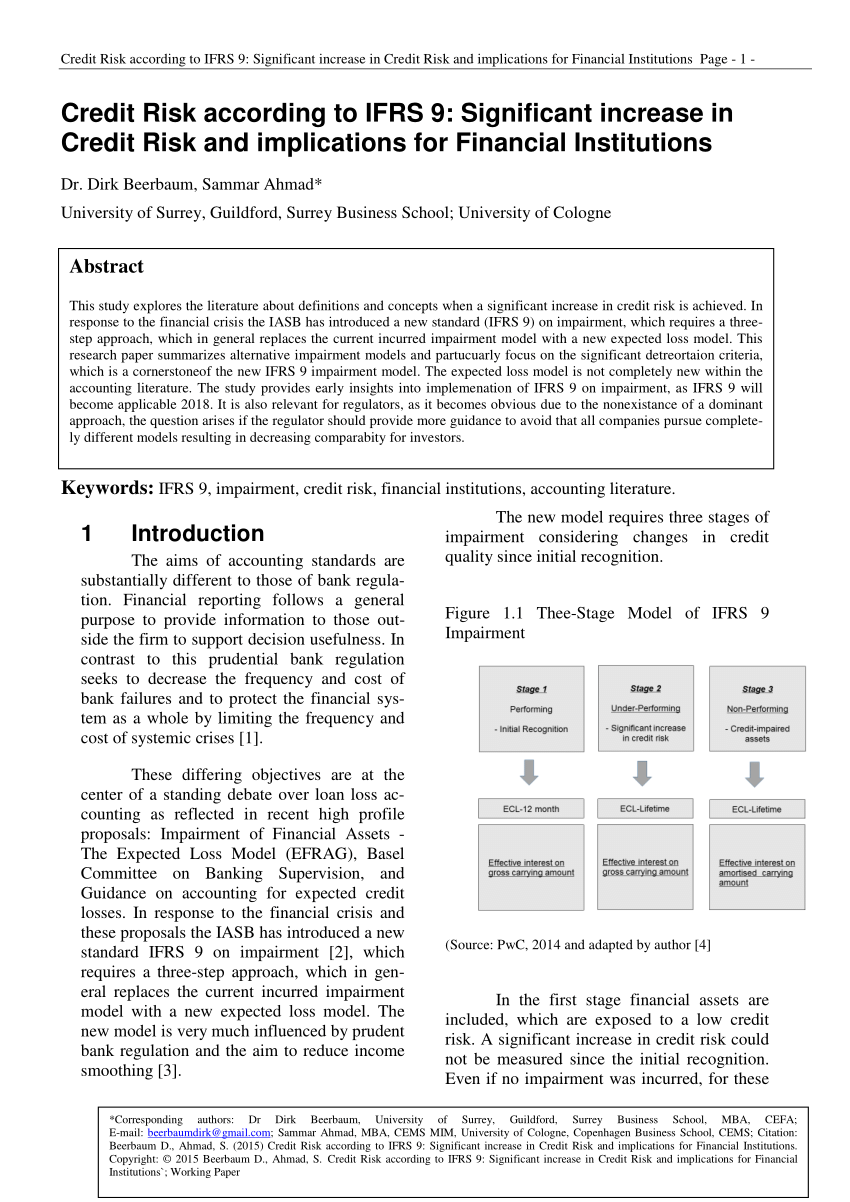

The reason is that under ifrs 15 you have to recognize them as revenue when you meet the performance obligation in this case when you service the loan over the life of the loan. Stage 1 when a loan is originated or purchased ecls resulting from default events that are possible within the next 12 months are recognised 12 month ecl and a loss allowance is established. Thus the right accounting treatment would be to recognize the loan servicing fees received up front as a contract liability under ifrs 15 and subsequently. Ifrs78f loans and advances to banks 12009 8050 ifrs78f loans and advances to customers 86514 76520 ifrs78aii trading assets 8487 10880.

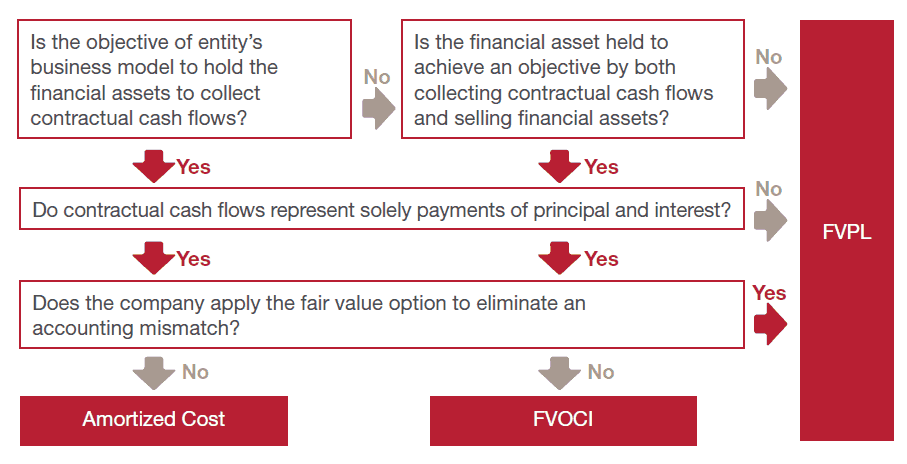

Ifrs 9 contains an option to designate at initial recognition a financial asset as measured at fvtpl if doing so eliminates or significantly reduces an accounting mismatch that would otherwise arise from measuring assets or liabilities or recognising the gains and losses on them on different bases. Under ifrs 9 up to date loans and advances rehabilitated rescheduled loans the group applied an incurred but not yet reported ibnr emergence period of three months for all up to date loans. Can you classify variable interest loan with collaterals at amortized cost. 2the impairment requirements of ias 28.

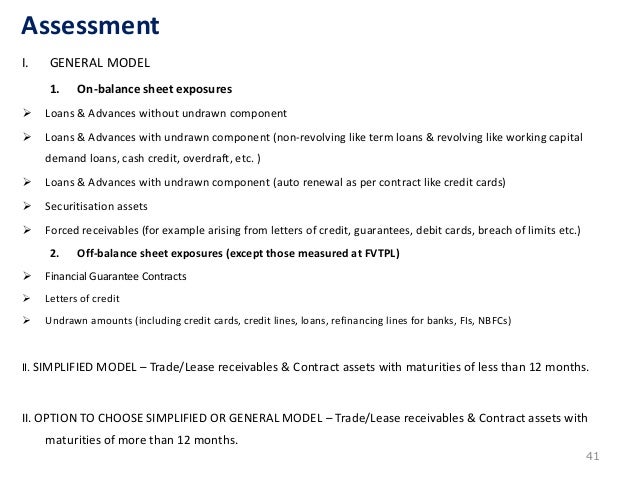

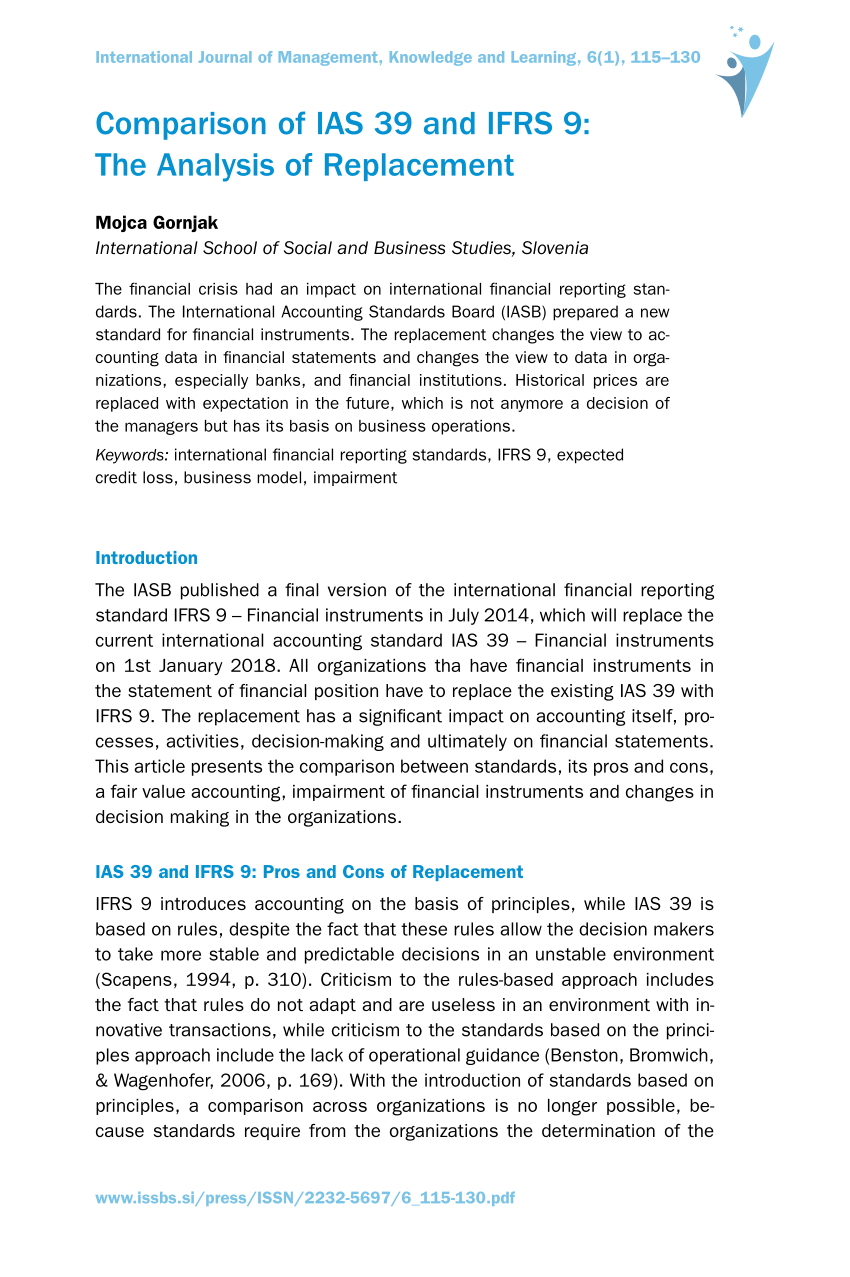

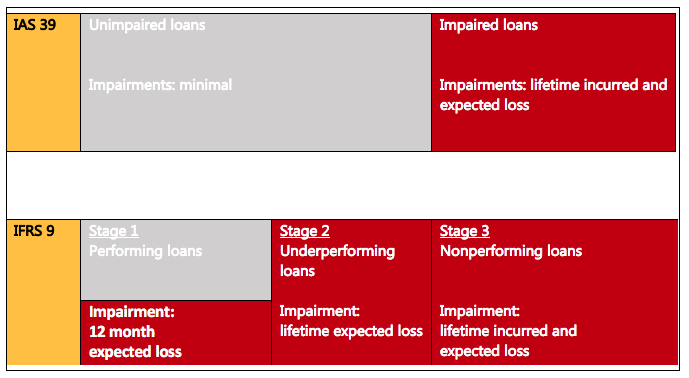

Similarly a loan to an associate or joint venture that is not equity accounted but in substance forms part of the net investment ie a long term interest is also within the scope of ifrs 9. Financial instruments within the scope of the impairment requirements of ifrs 9 which are principally loans and advances to customers and undrawn lending commitments are classified into one of three stages. Ifrs 9 requires a minimum 12 month ecl for loans and advances for which there has not been a sicr. The new model can produce the same measurements as ias 39 but one cant.

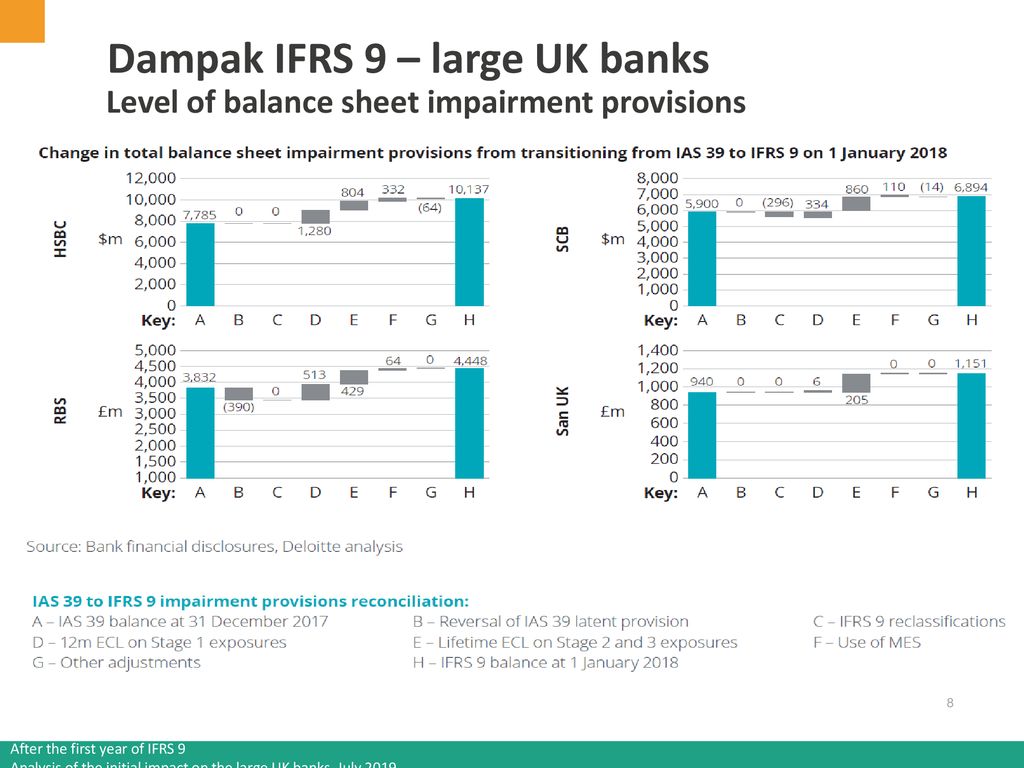

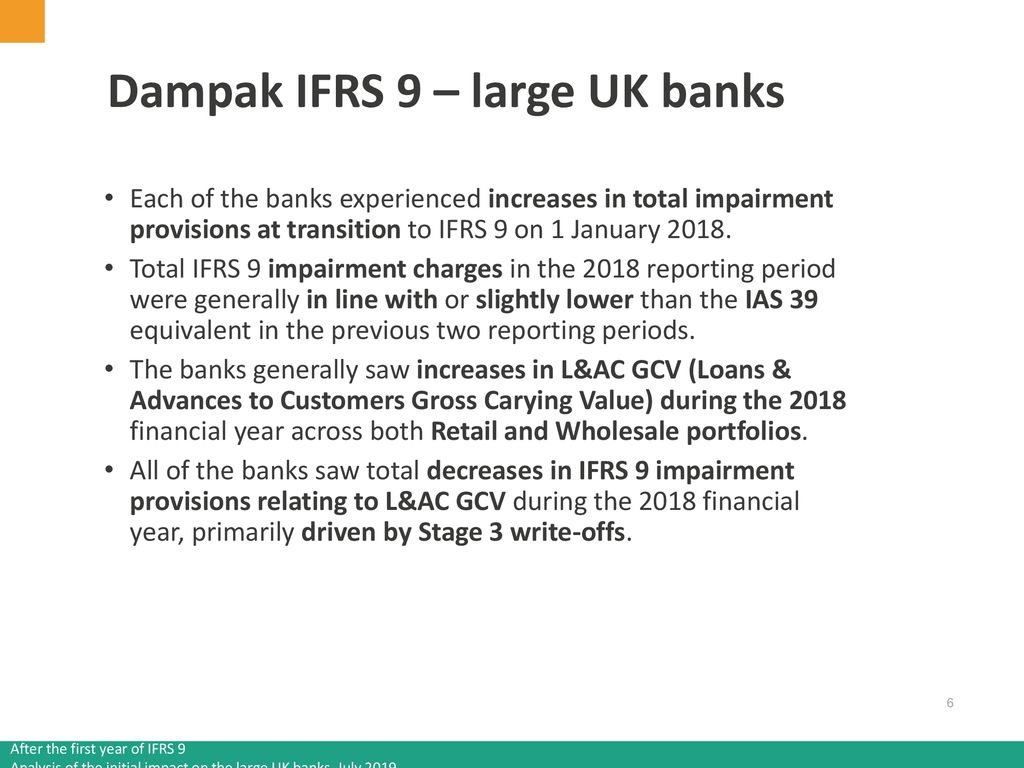

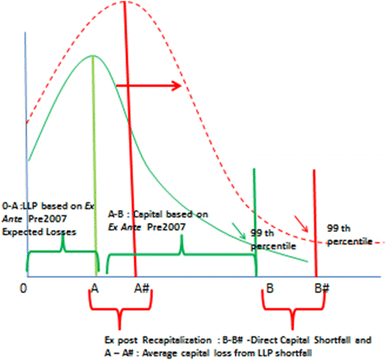

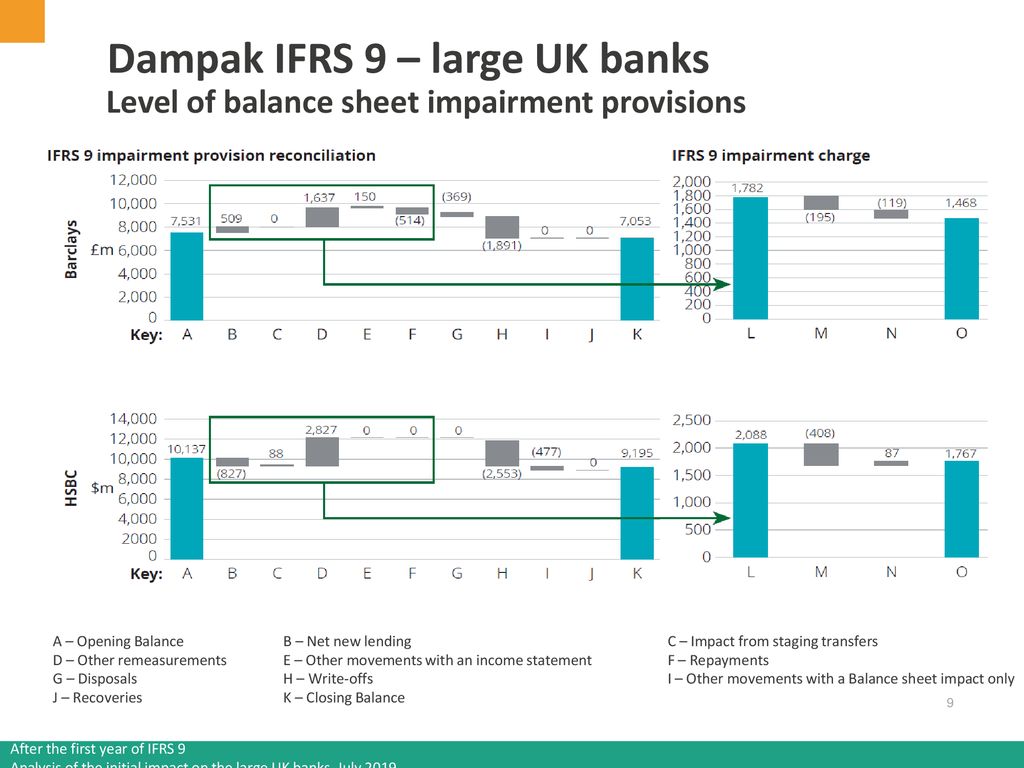

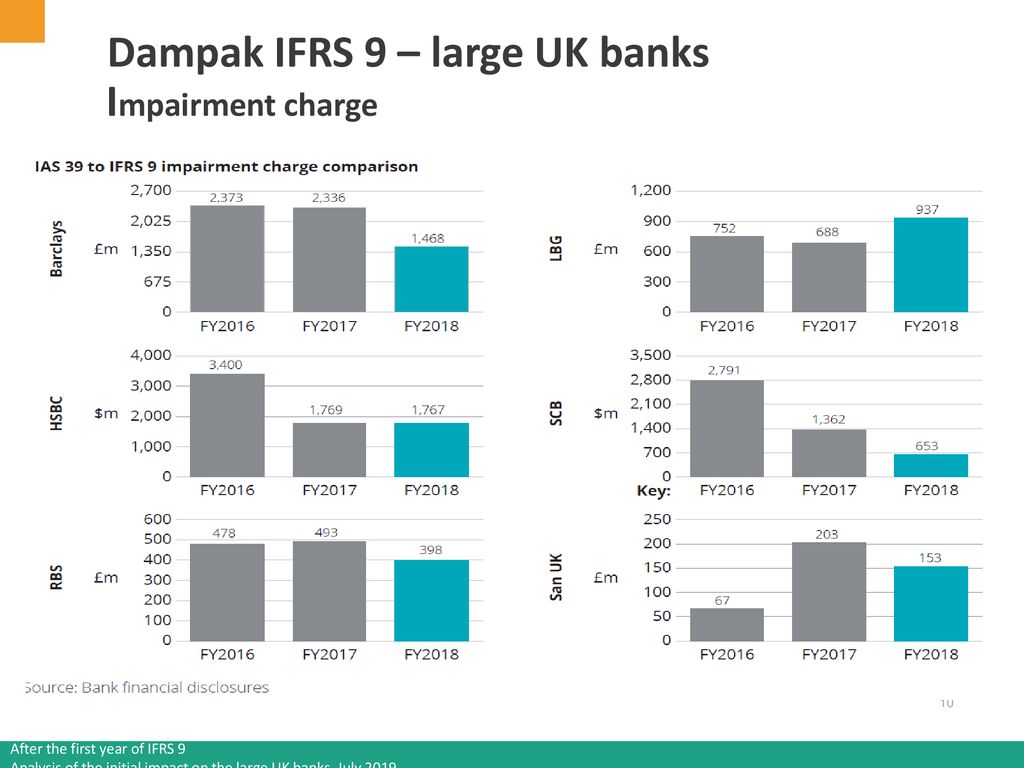

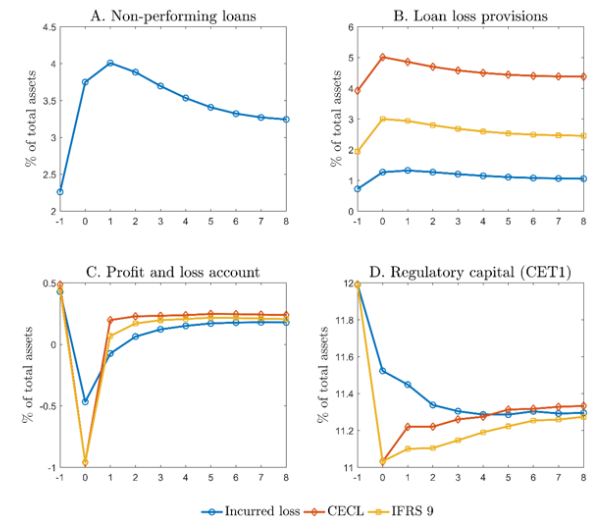

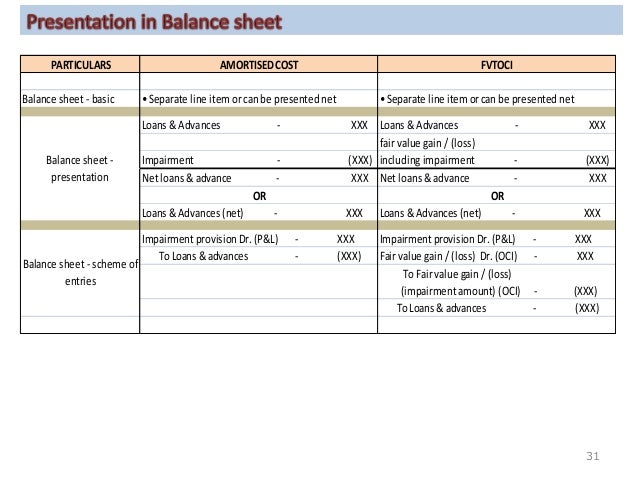

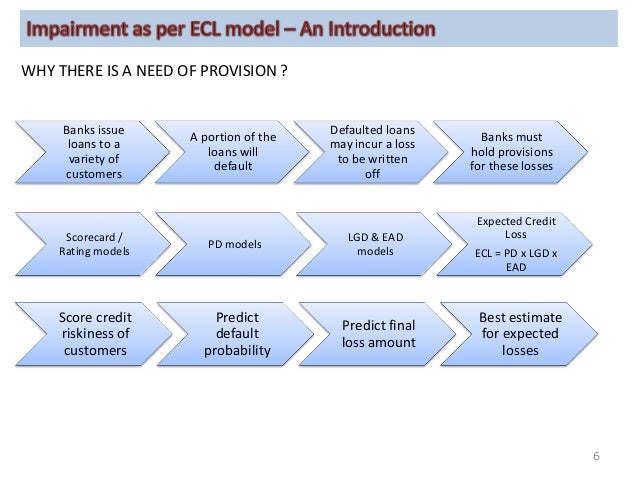

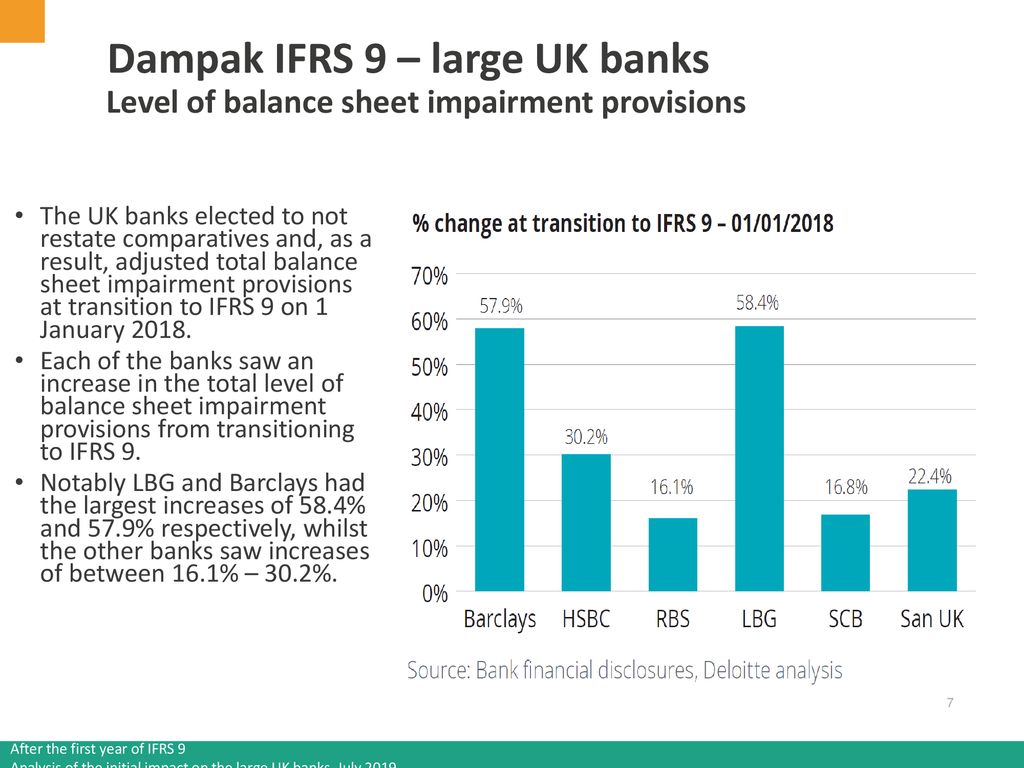

Other hand ifrs 9 establishes a new approach for loans and receivables including trade receivablesan expected loss model that focuses on the risk that a loan will default rather than whether a loss has been incurred. The following table summarises the impact of the initial adoption of ifrs 9 expected credit losses on loans and advances to customers which are carried at amortised cost on the balance sheet. The tables show the stage allocation of loans at 5 april 2018 the ifrs 9 impairment provisions and the resulting provision coverage ratios.

.jpg)

%2C445%2C291%2C400%2C400%2Carial%2C12%2C4%2C0%2C0%2C5_SCLZZZZZZZ_.jpg)