Installment Loans Vs Credit Cards

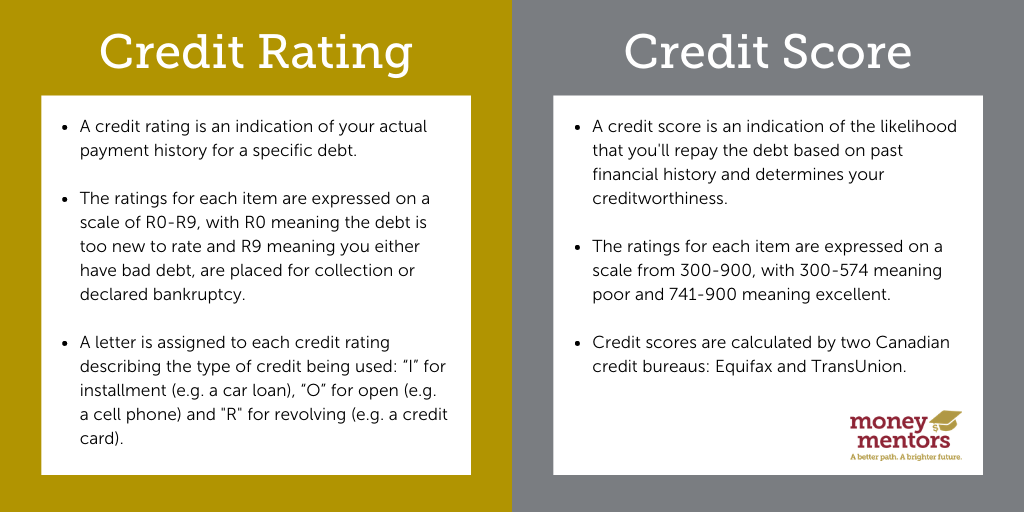

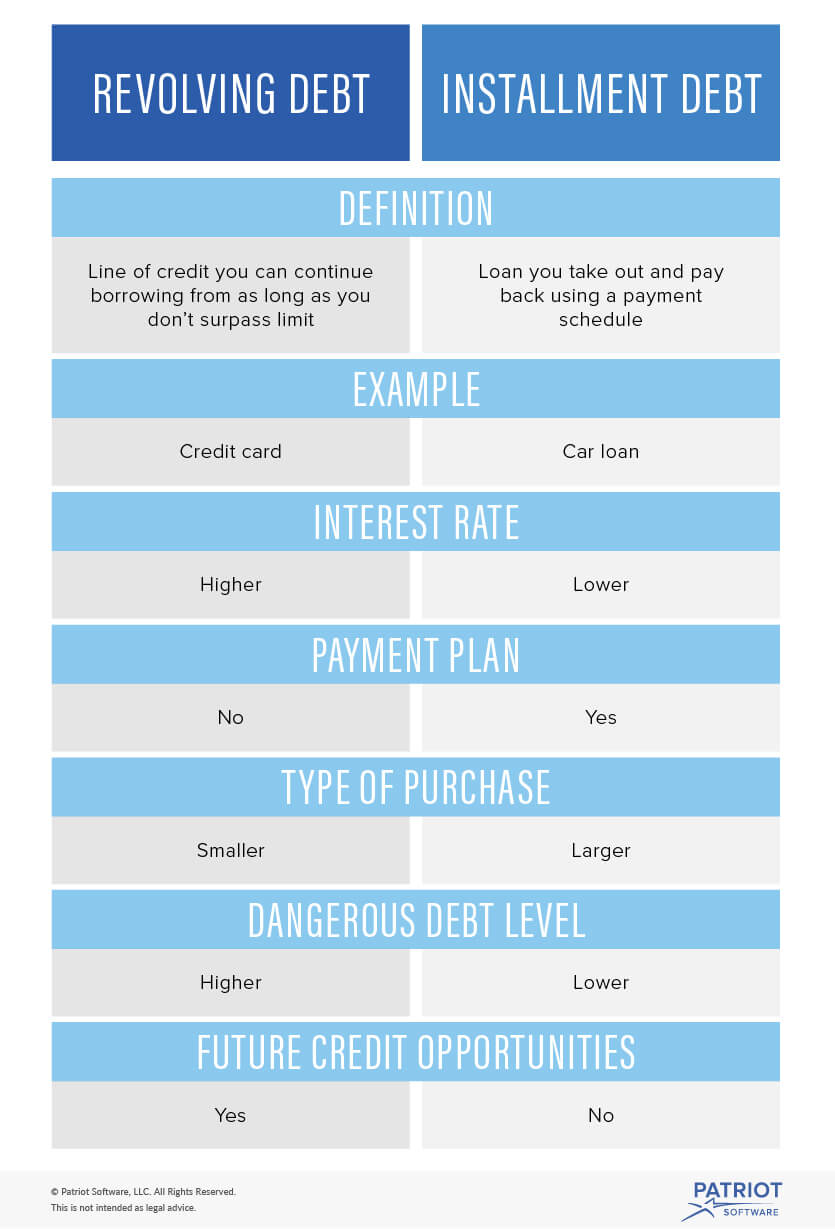

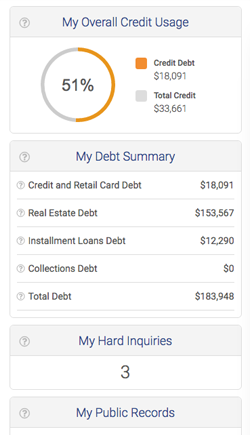

Each type of debt involved can have a different impact on your credit score and perhaps on the credit repair process.

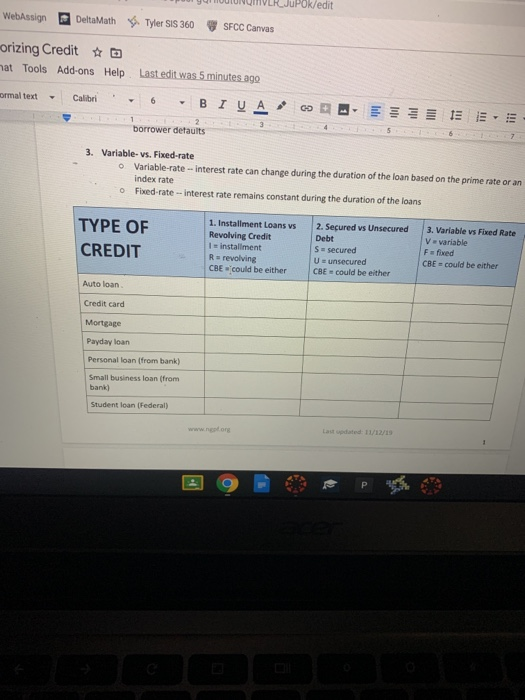

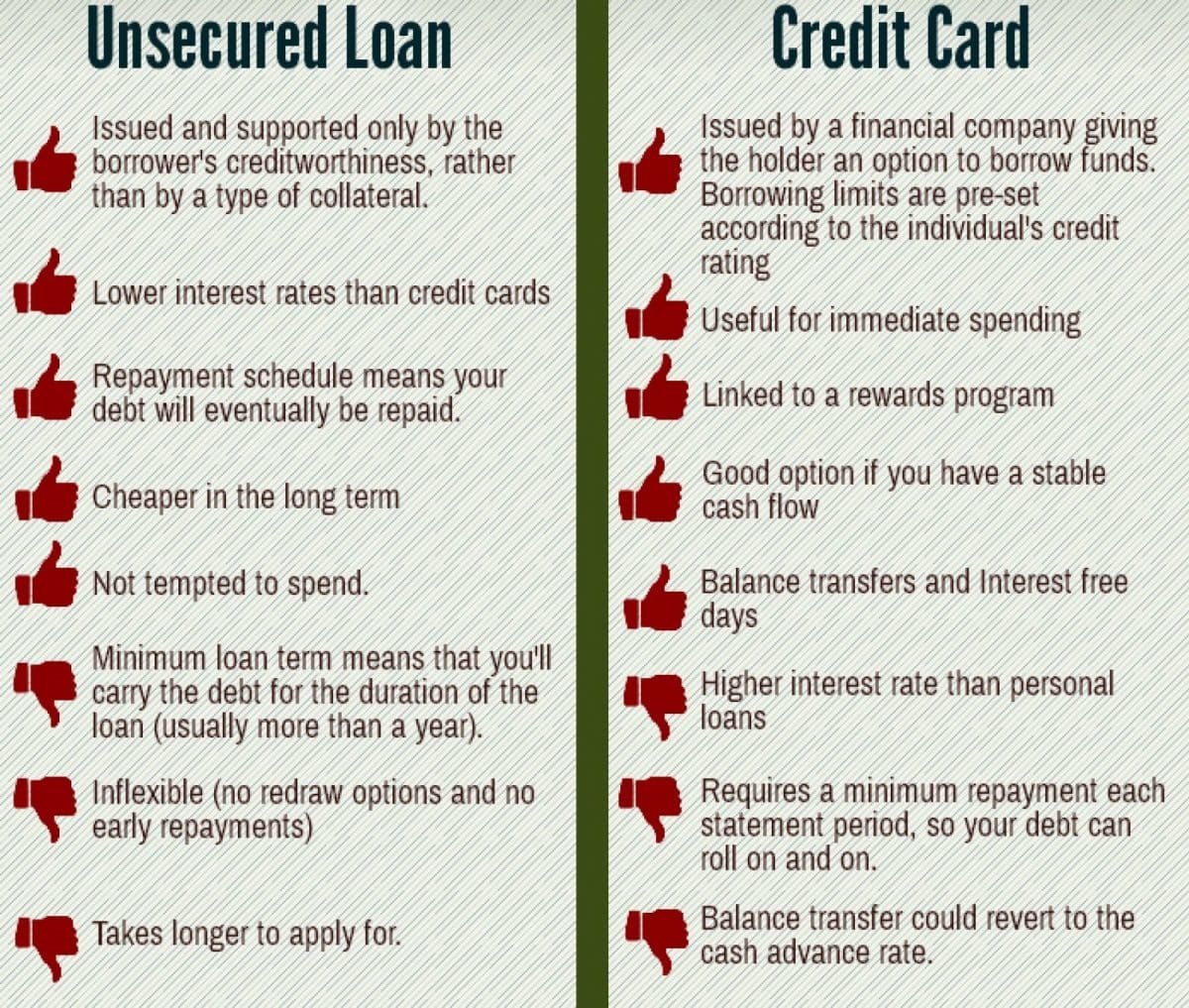

Installment loans vs credit cards. Introduction today it often is proclaimed that all loans are bad and need to be avoided at all costs but the reality is that personal loans can actually be powerful and helpful financial tools when utilized in a smart and responsible manner. You have small debts and expenses that require financing. Approval for both loans and lines of credit. The higher you go from there the worse your score will be.

The short answer is that credit card debt is worse than installment loan debt. You qualify for a credit card with a 0 promotional offer. Anisha sekar june 10 2020. When youre paying down installment debt and credit card debt focus on your credit card debt first.

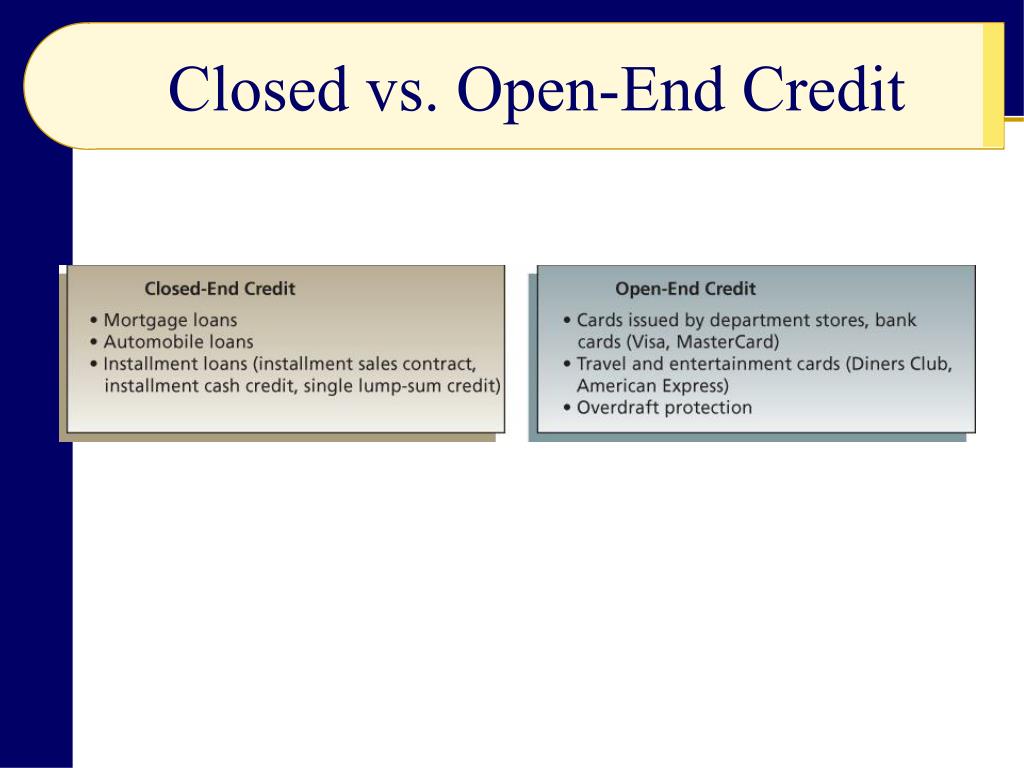

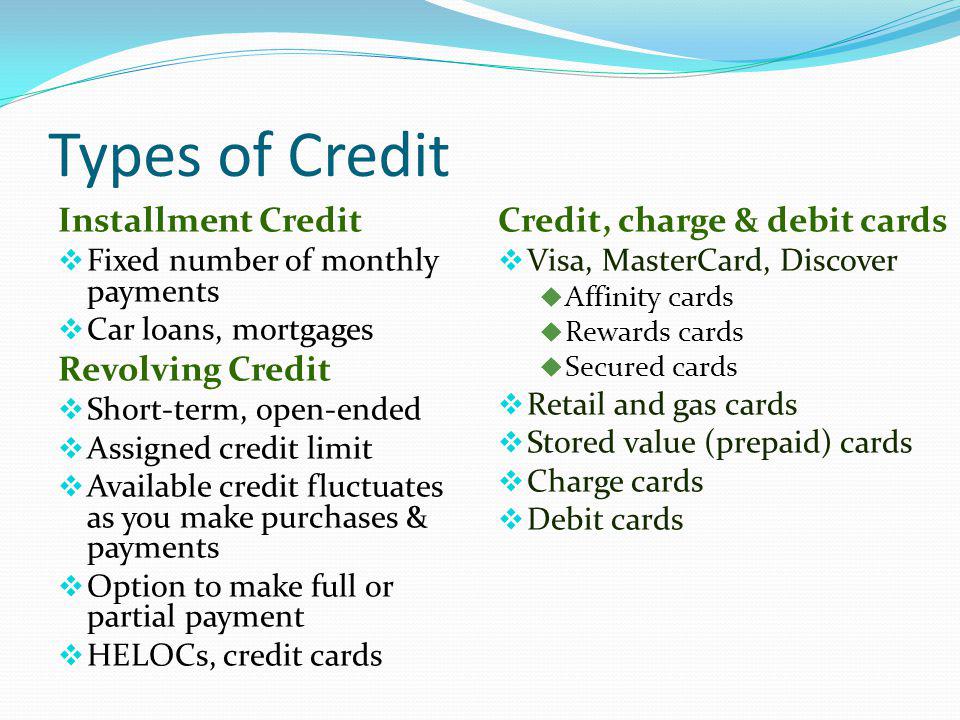

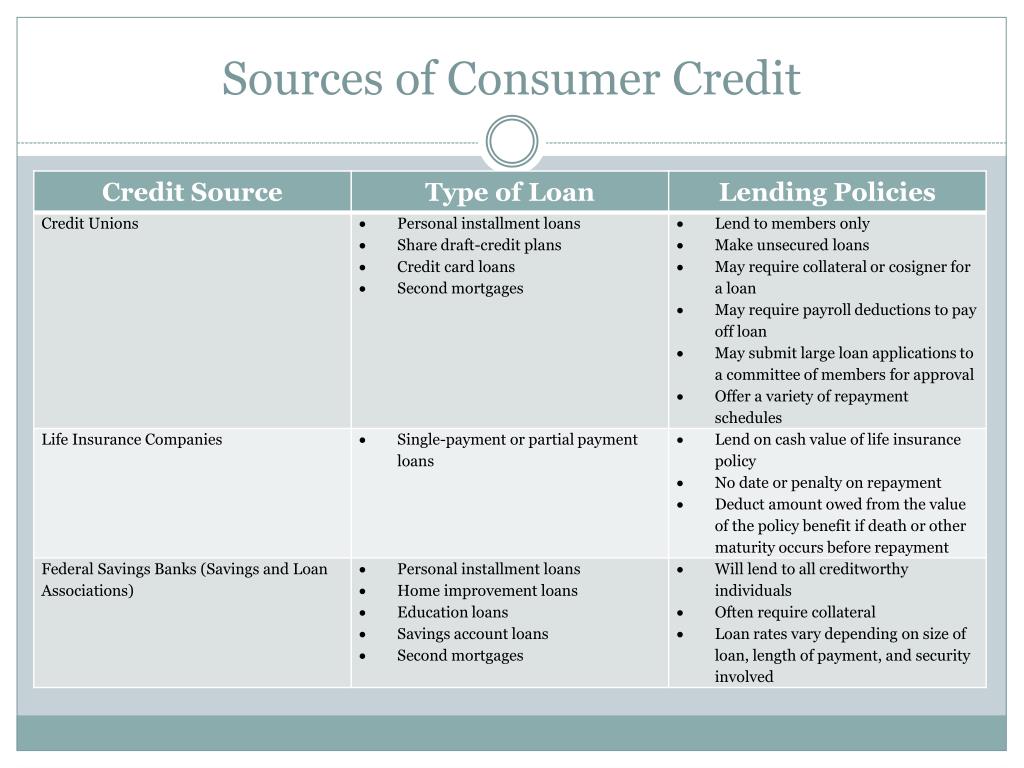

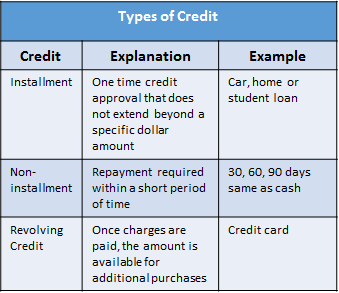

Additionally installment loanseven big ones like mortgagesare considered relatively stable and therefore have less influence on your credit score than credit card debt. Installment credit is an extension of credit by which fixed scheduled payments are made until the loan is paid in full. This is true for several different reasons. Types of revolving debt include home equity lines of credits helocs and credit cards.

When deciding between personal loan vs credit card debt keep in mind that you can use both to get out of debt much faster. When comparing installment loans vs. Loans and lines of credit are two different kinds of debt issued by lenders to both businesses and individuals. Many borrowers are easily able to achieve vantagescores above 700 while managing larger balances of installment debt.

Which debt is worse to have. Which debt is worse. With these credit types you have a limited pool of money from which you can draw out as little or as much cash as you need until you reach the maximum limit. One indirect way an installment loan can lower your revolving credit utilization ratio is to provide cash to pay off your credit card or other revolving debt.

Of course paying off any debt on time is a good thingbut there are several factors in both kinds of debt that youll want to keep. Revolving credit is credit that is renewed as the debt is paid allowing. Use a credit card when. You can pay off your credit card balance in total every month.

Which debt to pay off first.

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/beautiful-young-woman-working-from-home-583969412-5b341a6b46e0fb0037941187.jpg)

:max_bytes(150000):strip_icc()/GettyImages-1139932365-8f9a8413a3f34b2799375e57efeee64c.jpg)

/close-up-of-credit-cards-580502979-3998b1e8a9d242c98648cc04ce236e8b.jpg)