Intercompany Loans Ifrs 9 Classification

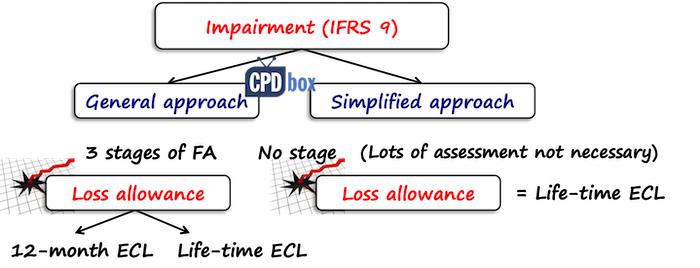

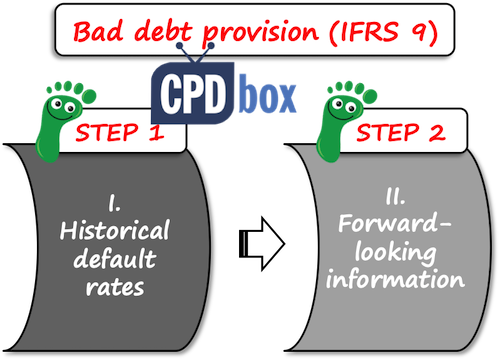

Ifrs 9 impairment practical guide.

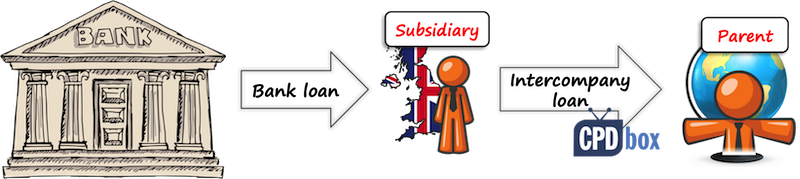

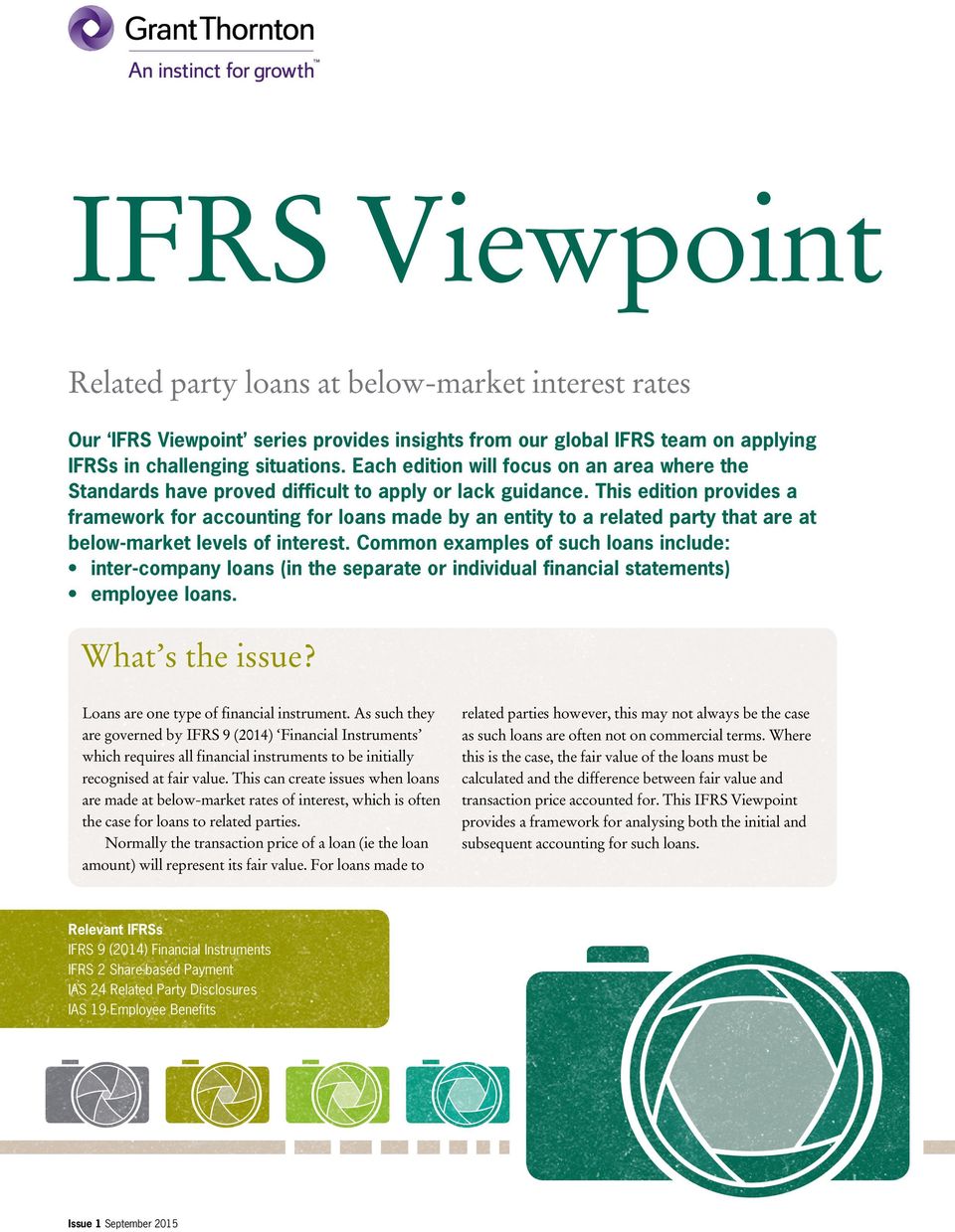

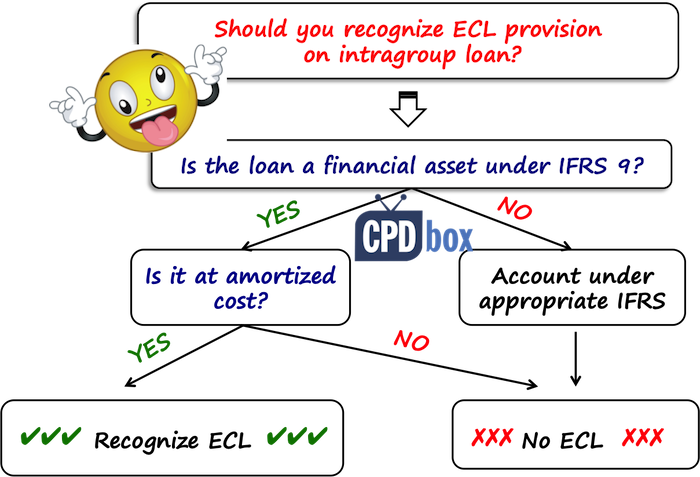

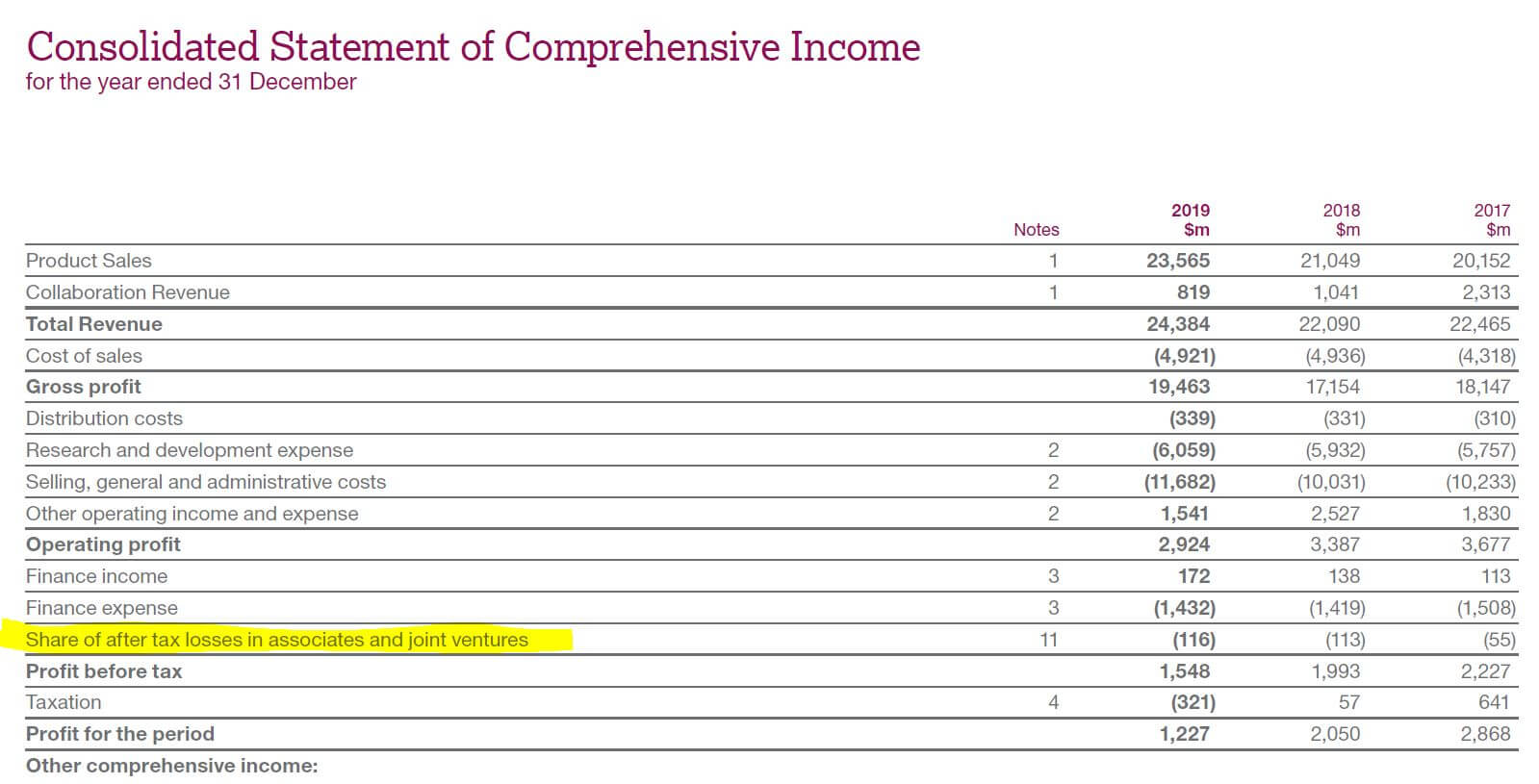

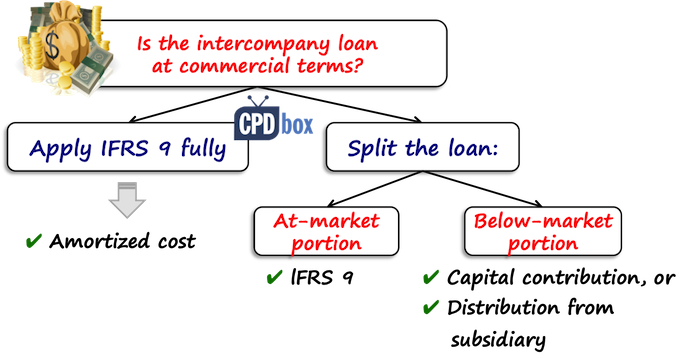

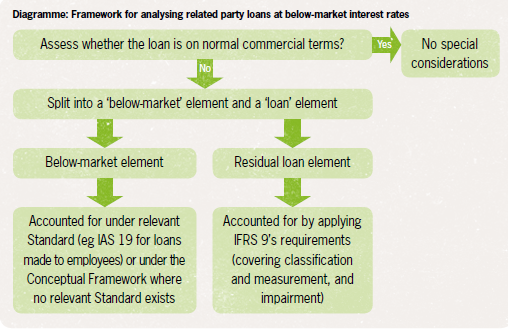

Intercompany loans ifrs 9 classification. Please read about different forms of intercompany financing and the classification challenges here. Therefore your first task is to determine whether the intercompany loan is a financial asset under ifrs 9 or some sort of a capital contribution. I have tried to help a bit in this article but i know very well that every single loan is different provided at different circumstances and indeed you should carefully assess every single aspect of it. This means that a loan could be subject to both.

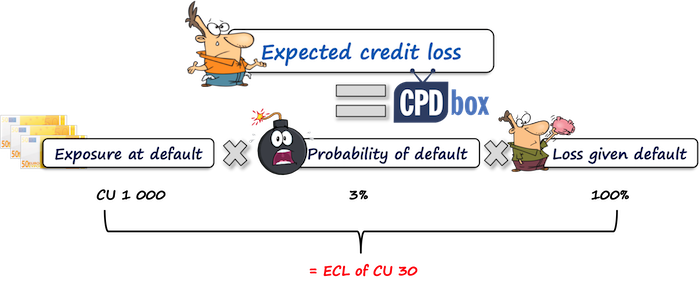

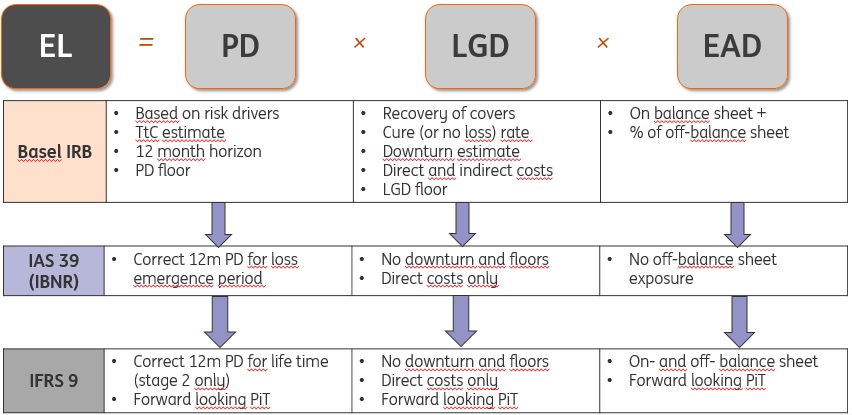

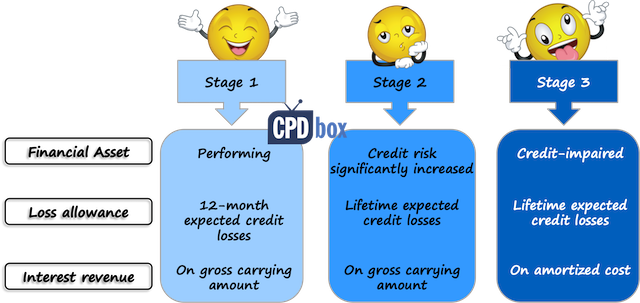

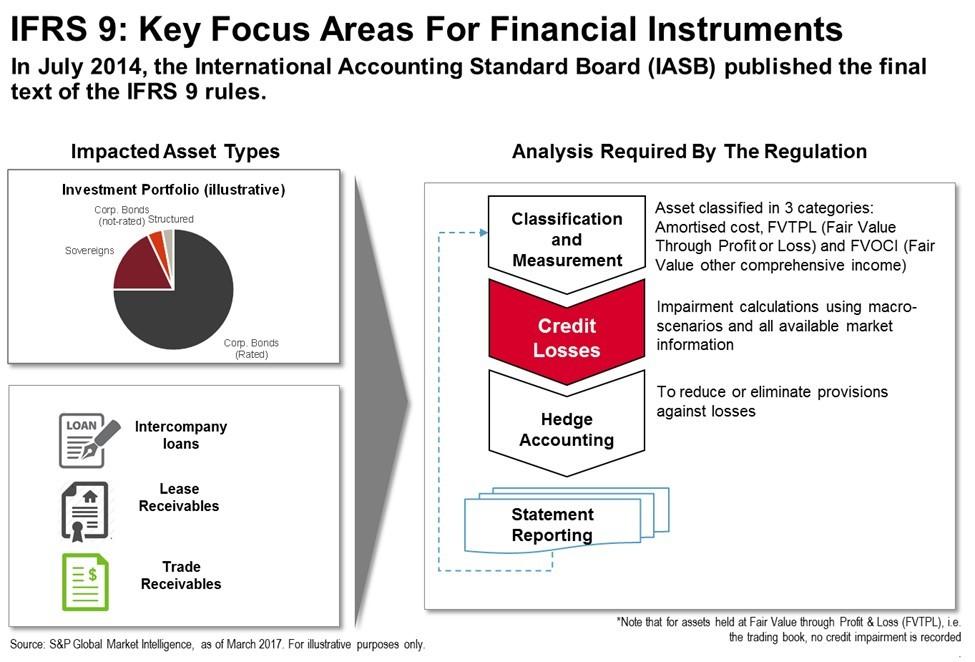

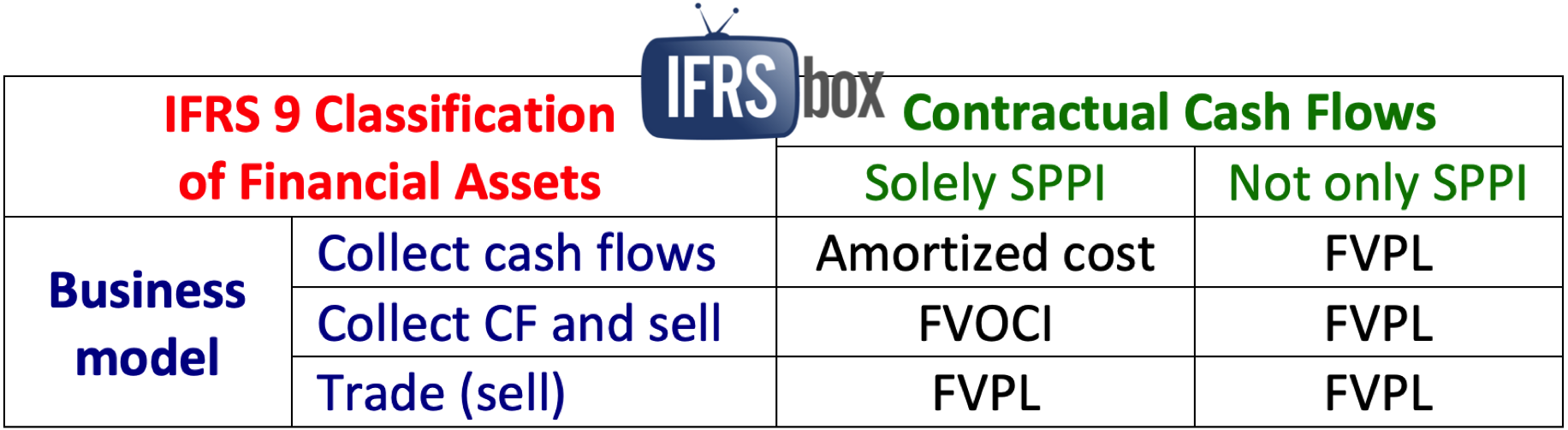

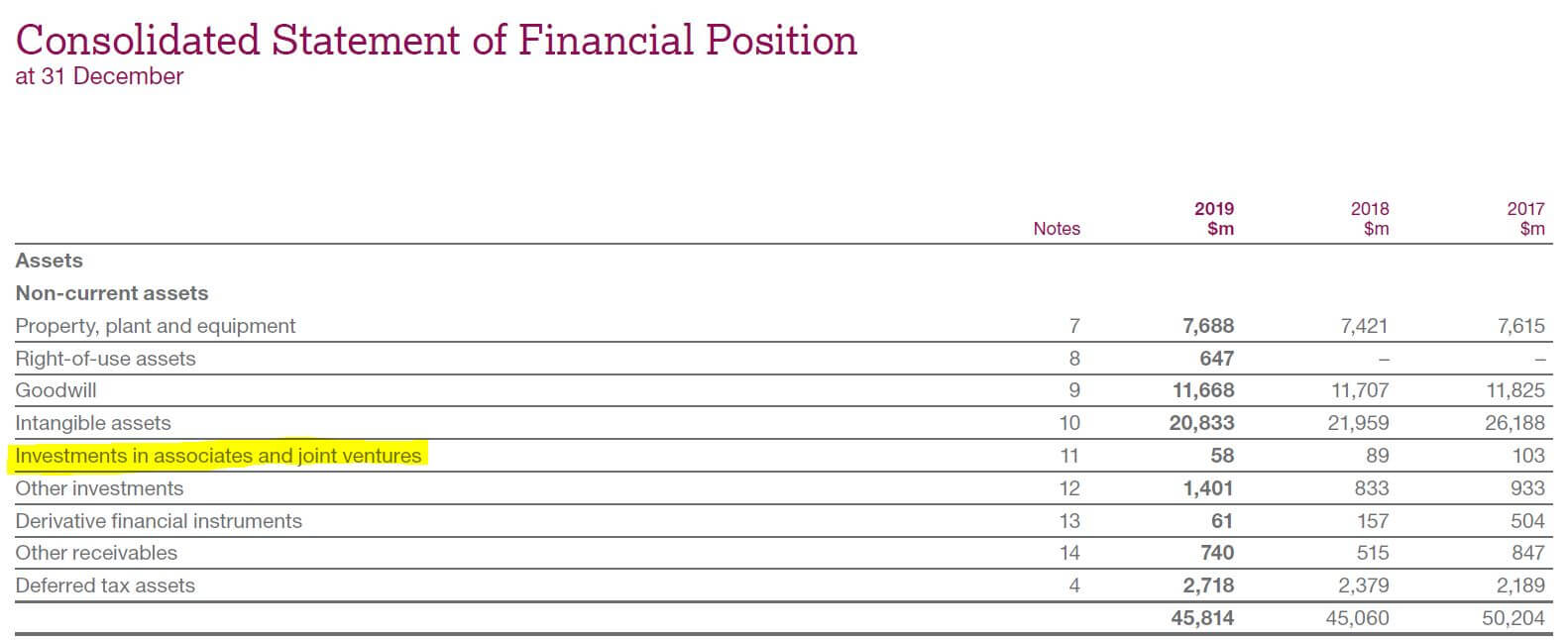

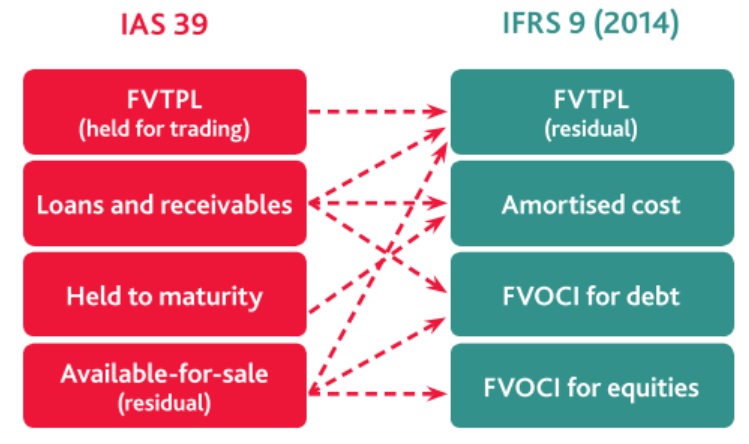

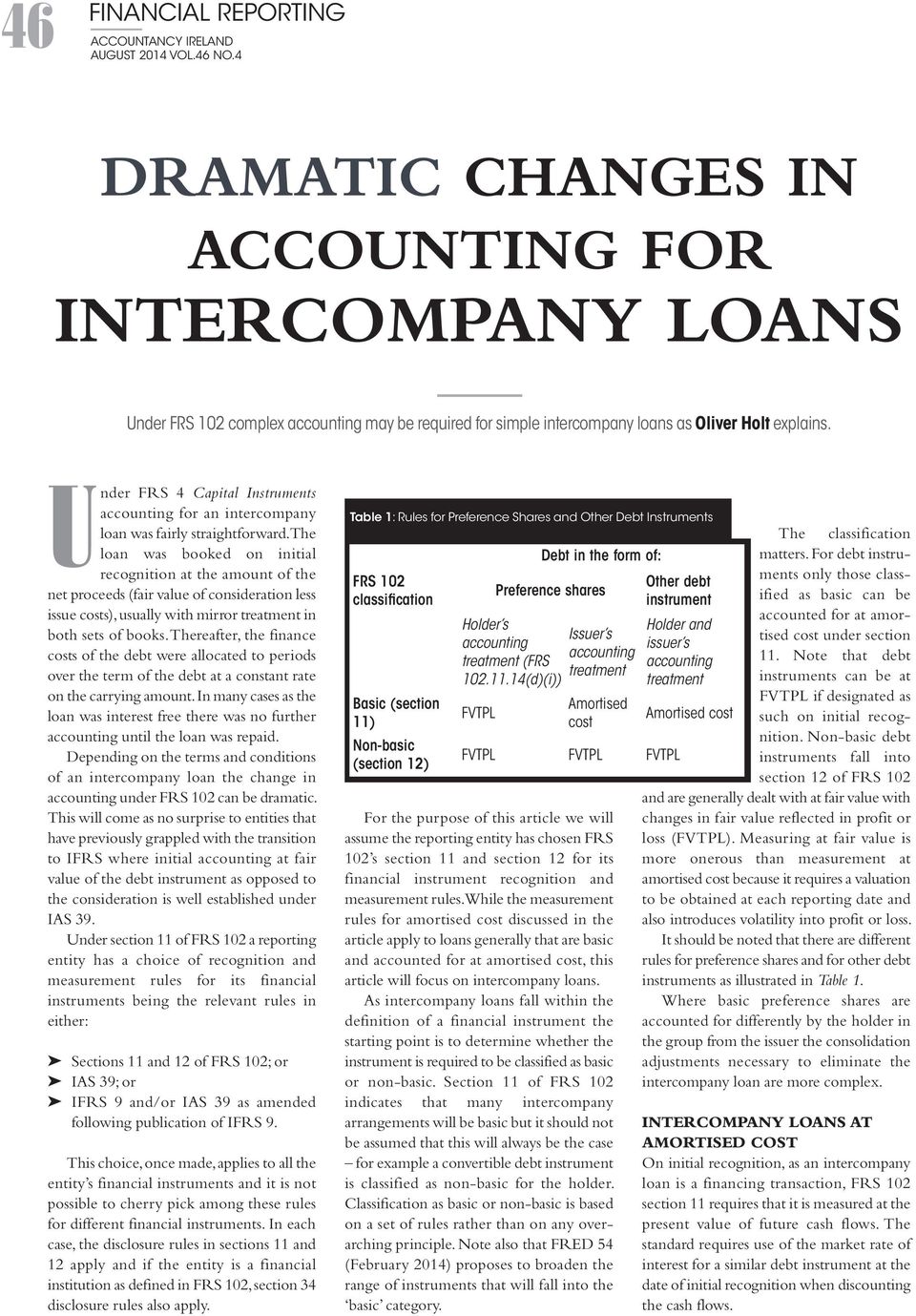

For intercompany loans receivable with no stated terms the lender also needs to consider the classification and measurement criteria in aasb 9 to determine if the criteria for amortised cost are met. 6 in july 2014 the iasb published the new and complete version of ifrs 9 hereafter ifrs 9 or the new standard which includes the new hedge accounting impairment and classification and measurement requirements. Intercompany loans in separate financial statements at a glance ifrs 9 requires entities to recognise expected credit losses for all financial assets held at amortised cost including most intercompany loans from the perspective of the lender. With careful planning the changes that ifrs 9 introduces might provide a great opportunity for balance sheet optimization or enhanced efficiency of the reporting process and cost savings.

Ifrs 9 also includes significant new hedging requirements which we address in a separate publication practical guide general hedge accounting. Ias 39 the previous guidance for assessing impairment of intercompany loans had an incurred loss model where provisions were recognised when there was objective evidence of impairment. 2the impairment requirements of ias 28. Loan in the scope of aasb 9 financial instruments.

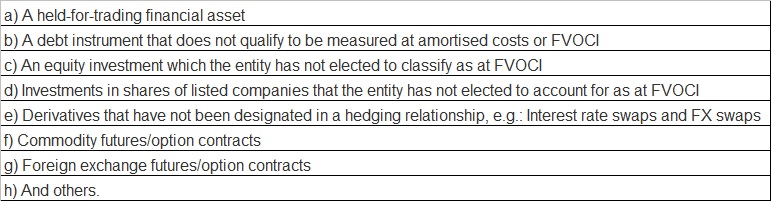

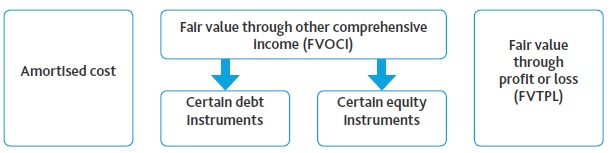

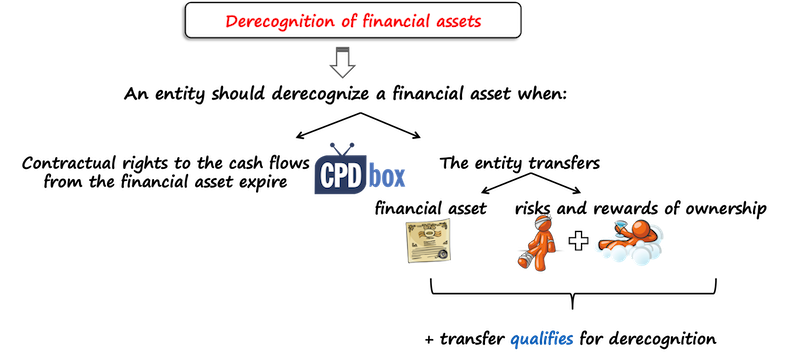

However when entities prepare their separate financial statements these intercompany positions do not eliminate and the reporting entity that is a lender needs to assess any intercompany loan assets for classification and potentially measurement of expected credit losses under ifrs 9. Ifrs 9 requires entities to recognise expected credit losses for all financial assets held at amortised cost including most intercompany loans from the perspective of the lender. I will be discussing each of the aforementioned scenarios in detail but before we go ahead we need to take a quick recap of what ifrs 9 says about the classification measurement and recognition of financial liabilities. Overview of the model 7 classification under ifrs 9 for investments in debt instruments2 is driven by the.

Intercompany loans with no loan agreementdocumentation. In particular the contractual cash flow characteristics and the business model test. Sometimes there is no formal contract and the financing provided from a parent to a subsidiary can represent a capital contribution in fact.

.jpg)