Jersey Business Loans

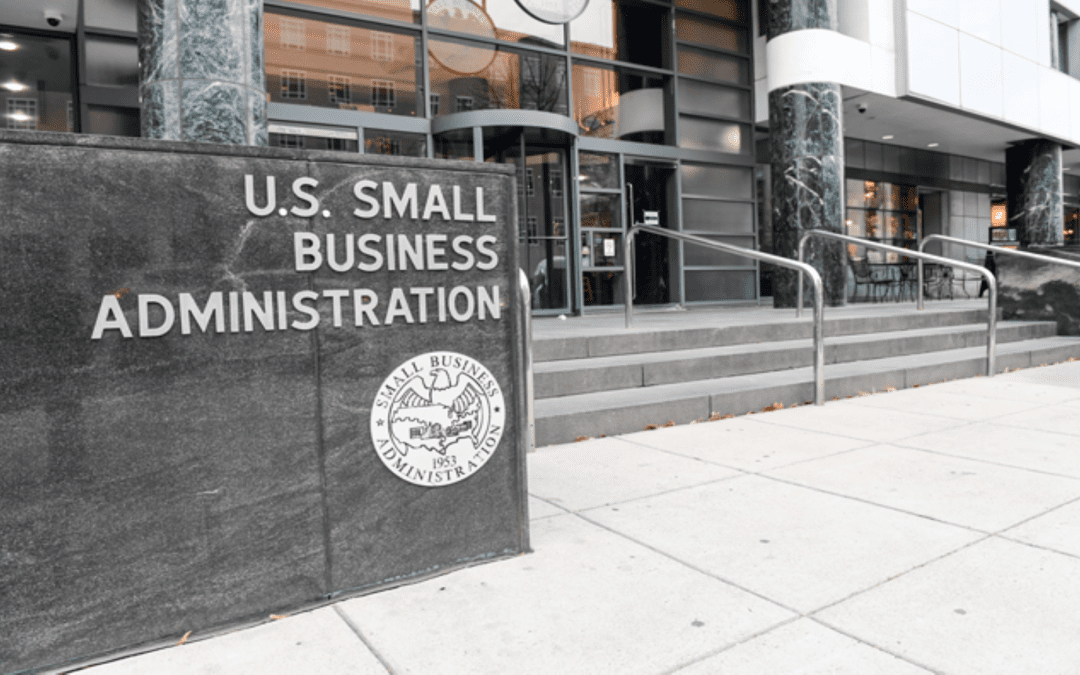

The sba 7a program is one of the most versatile business loans available.

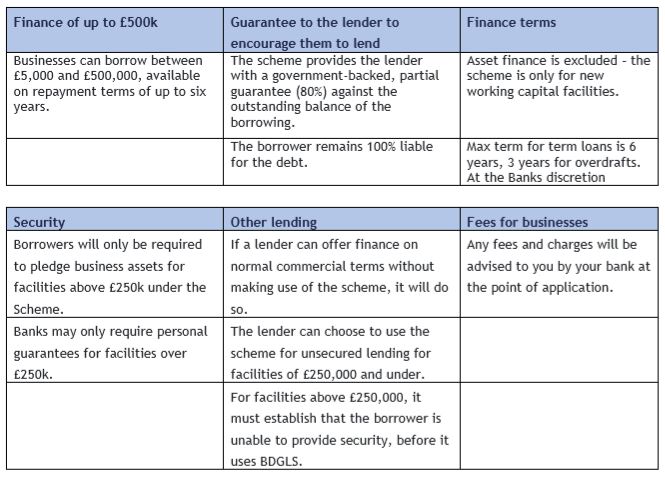

Jersey business loans. Jersey business does not administer this scheme nor does it lend or invest directly. New jersey economic development authority on thursday announced a set of programs including zero interest loans grants and other aid that could help an estimated 3000 to 5000 small and mid sized businesses affected by the covid 19 pandemic. The banks working together and with the government of jersey have structured a disruption loan guarantee scheme which will give you access to government backed loans. The new jersey business action center njbac is a business first business advocacy team within the nj department of state dedicated to solving problems and maximizing growth opportunities.

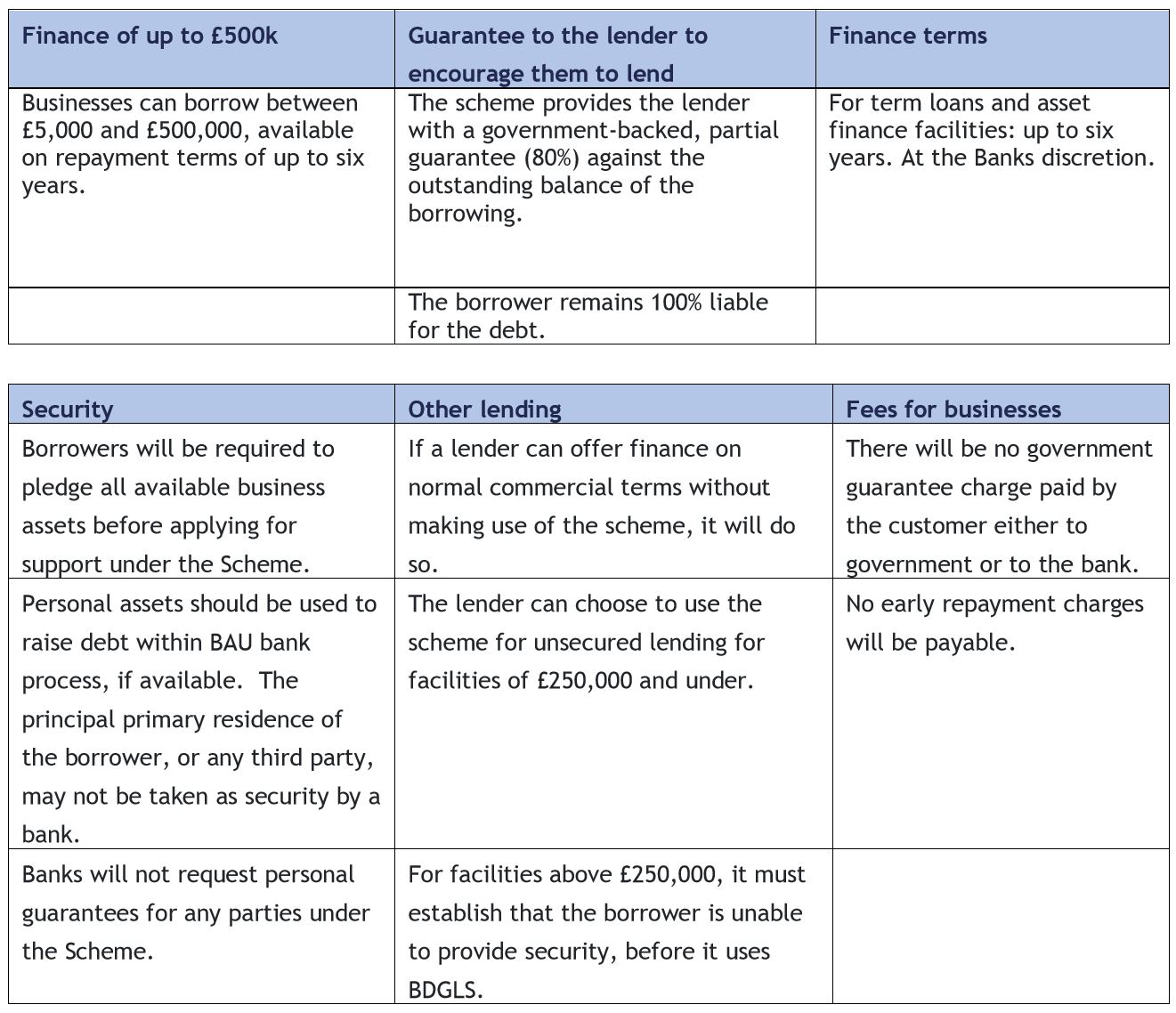

The state offers access to abundant and comprehensive resources encompassing small business financing programs general and specialized business assistance training services. You will access this scheme directly through the banks and the availability and structure of the loan will depend on your businesss individual circumstances. A flexible business loan in jersey allows you to decide how the money is used to enhance your business. Business disruption loan guarantee scheme checklist.

If you are interested in borrowing through business disruption loan guarantee scheme to support your business you should talk to your existing relationship manager at your bank. Fintech business lenders are able to provide loans ranging from 2 5 years with rates that begin in the high single digits and can fund within a week. Trihawk capital offers small business administration sba loans in jersey city new jersey through out 7a and 504 programs. Alternative business loans are a way for new jersey small businesses to get very affordable financing without the hassles they would have to experience with going through a bank or credit union.

Whether you are an entrepreneur own a business on main street are located on a corporate campus or interested in expanding your products and services. Small businesses in new jersey were approved for more than 95 billion in loans from the paycheck protection program or ppp as of april 16 the small business administration sba said in a report. We are proud of our reputation for helping local companies by providing bespoke financial solutions. Small business administration loans in jersey city nj.

/https://specials-images.forbesimg.com/imageserve/5ea7852ef2e611000641cadd/0x0.jpg)

/arc-anglerfish-arc2-prod-jerseyeveningpost-mna.s3.amazonaws.com/public/UQ4EWECDNZEJ7BGFPTLBLIVNTQ.jpg)

/arc-anglerfish-arc2-prod-jerseyeveningpost-mna.s3.amazonaws.com/public/7OEIUDWJTZBUFBJCDUWVPEUFLM.jpg)