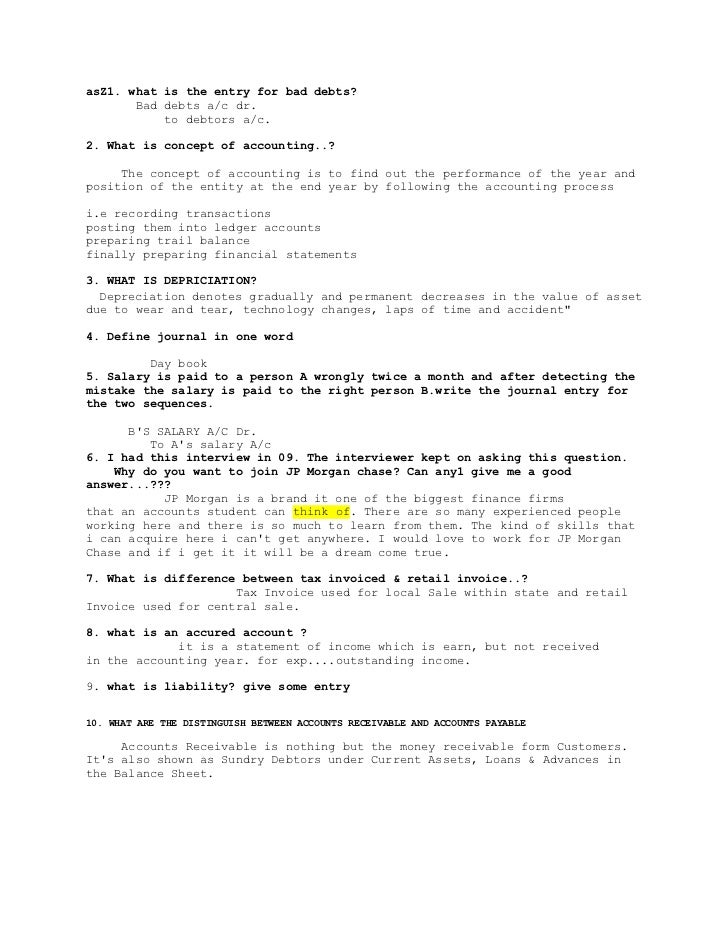

Journal Entry For Loans And Advances

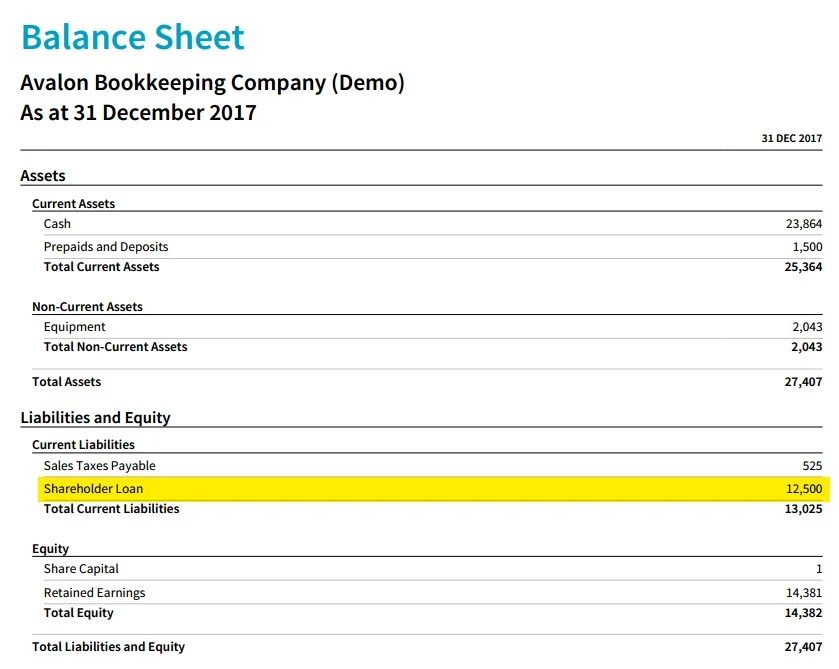

Net debt is a financial liquidity metric that measures a companys ability to pay all its debts if they were due today.

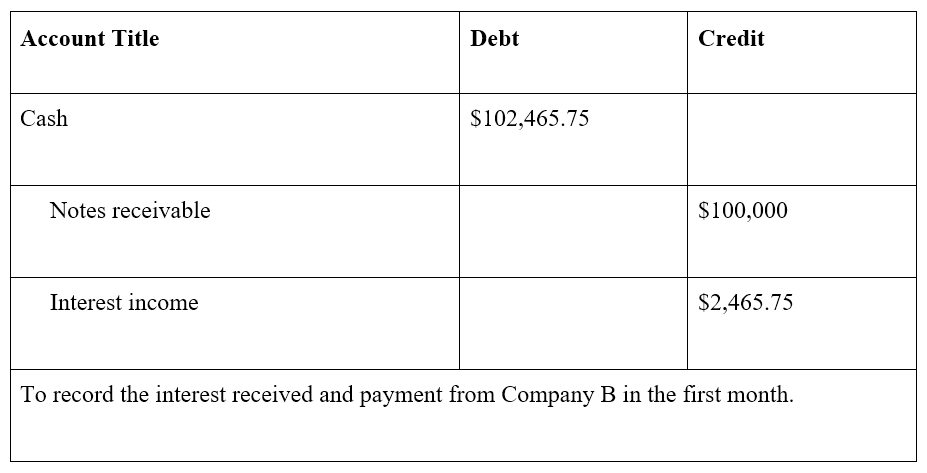

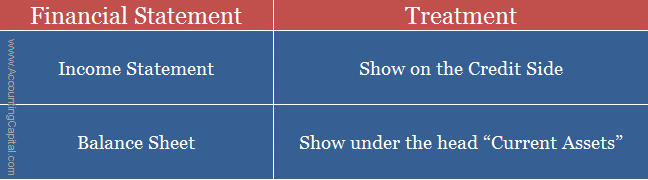

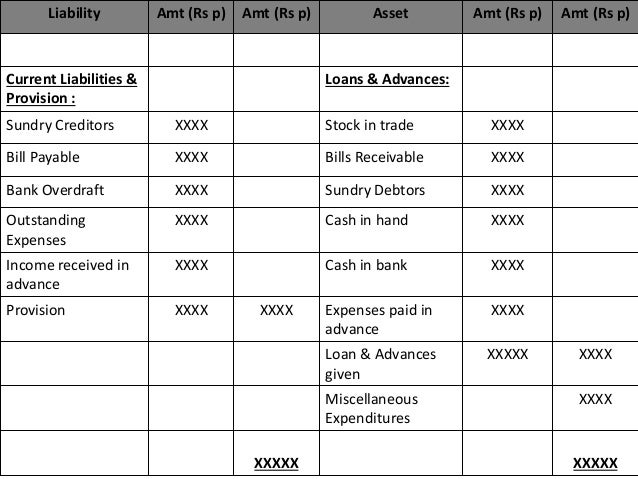

Journal entry for loans and advances. In case of advance payment from debtors bank ac to debtors in case of advance receipt to creditors creditors to bank ac. Whatis the journal entry for advance payments and advance receipts. Debit cash has been received by the business and deposited into its bank account. The cash advance needs to be reported as a reduction in the companys cash account and an increase in an asset account such as advance to employees or other receivables.

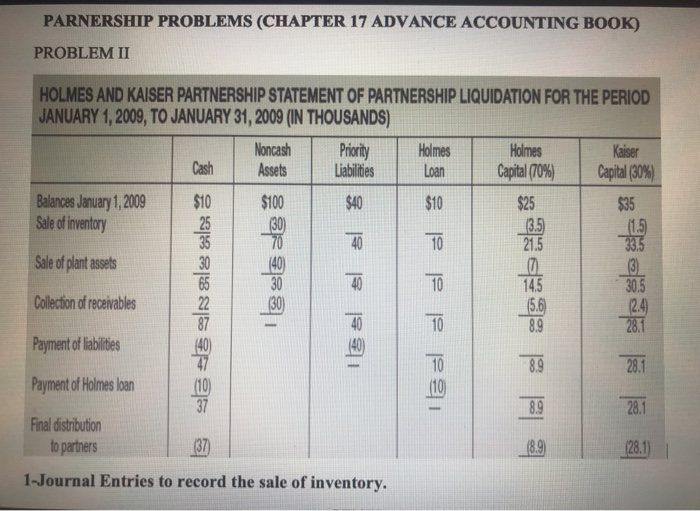

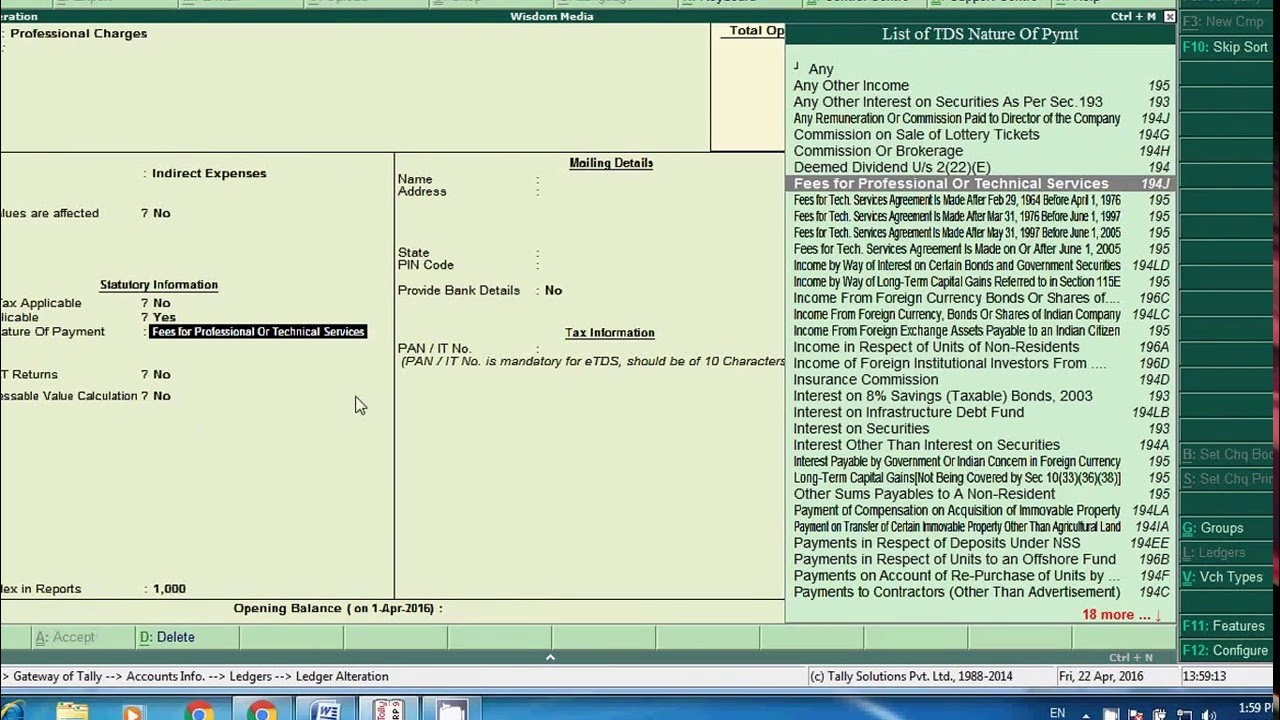

Cost of the loan is cheaper because it gives more tax benefits than any other finance ie interest on loan is an allowable expenditure but dividends are subject to tax. Possible asset accounts in which to store this information are. Following is the journal. An advance paid to an employee is essentially a short term loan from the employeras such it is recorded as a current asset in the companys balance sheetthere may not be a separate account in which to store advances especially if employee advances are infrequent.

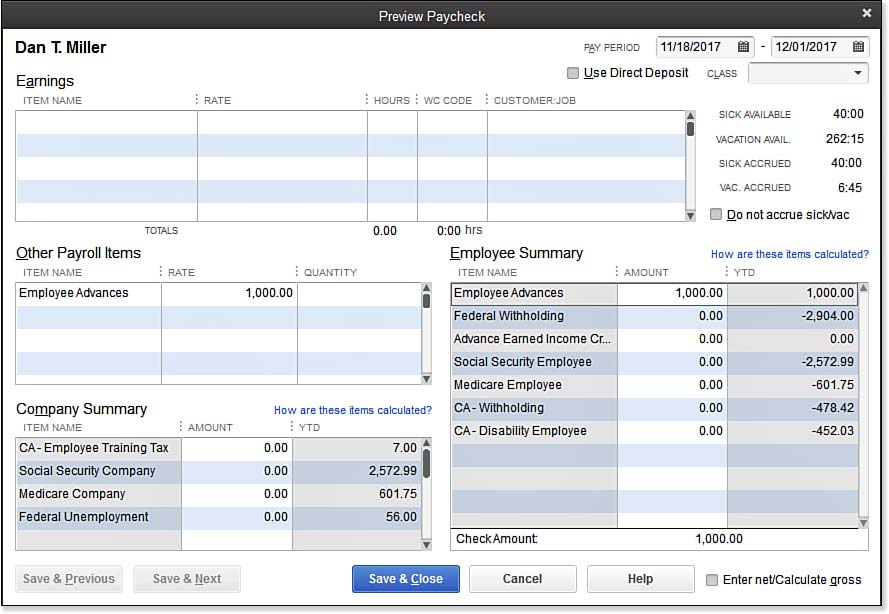

Whatis the journal entry for advance payments and advance receipts from debtors and creditors. Such a loan is shown as a liability in the books of the company. Compares a companys total debt with its liquid assets. A payroll advance journal entry is used when a business wants to give an employee a cash advance of their wages.

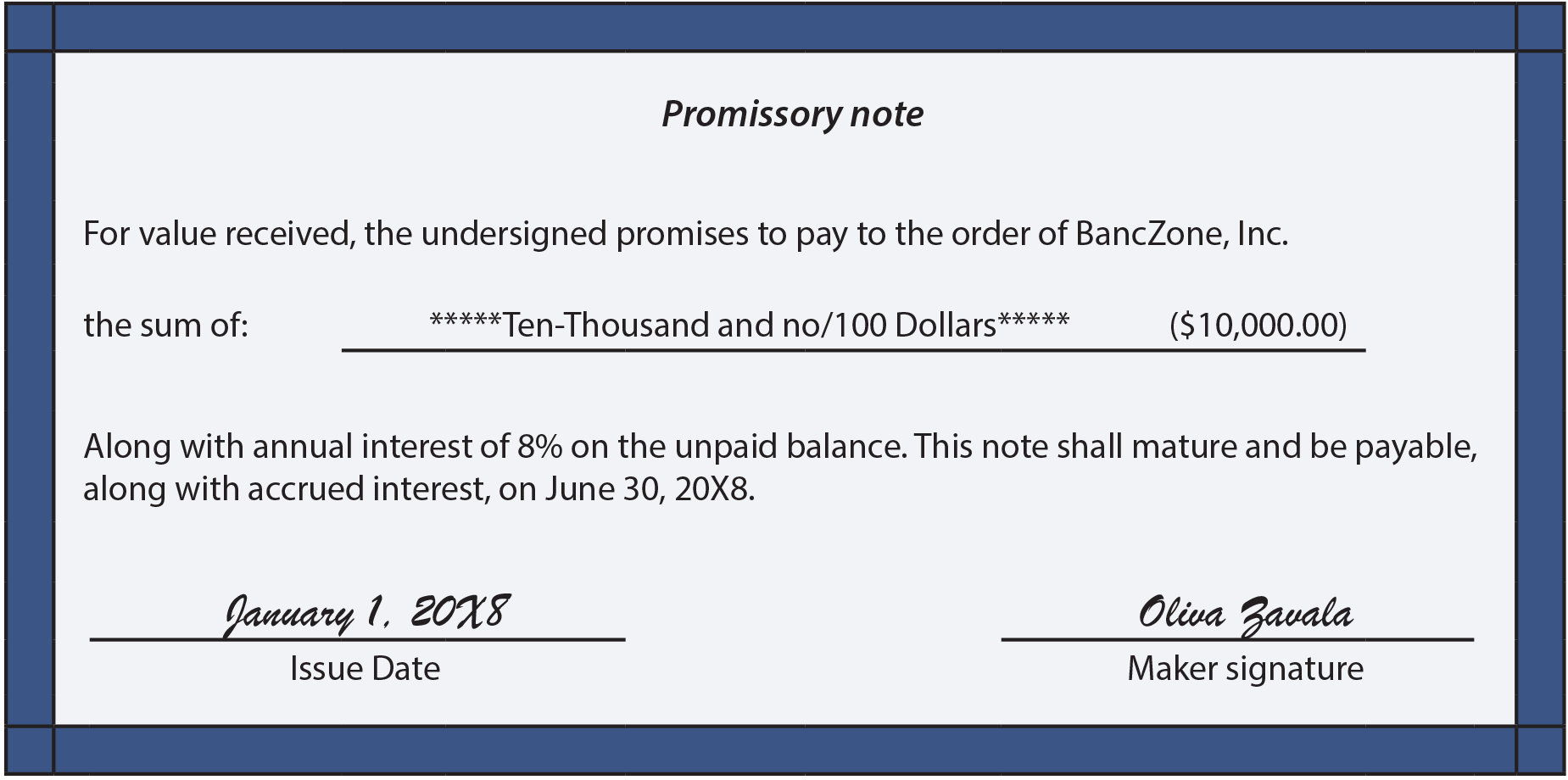

They can be obtained from banks nbfcs private lenders etca loan received becomes due to be paid as per the repayment schedule it may be paid in instalments or all at once. A cash advance to an employee is usually a temporary loan by a company to an employee. Is this answer correct. Net debt net debt net debt total debt cash.

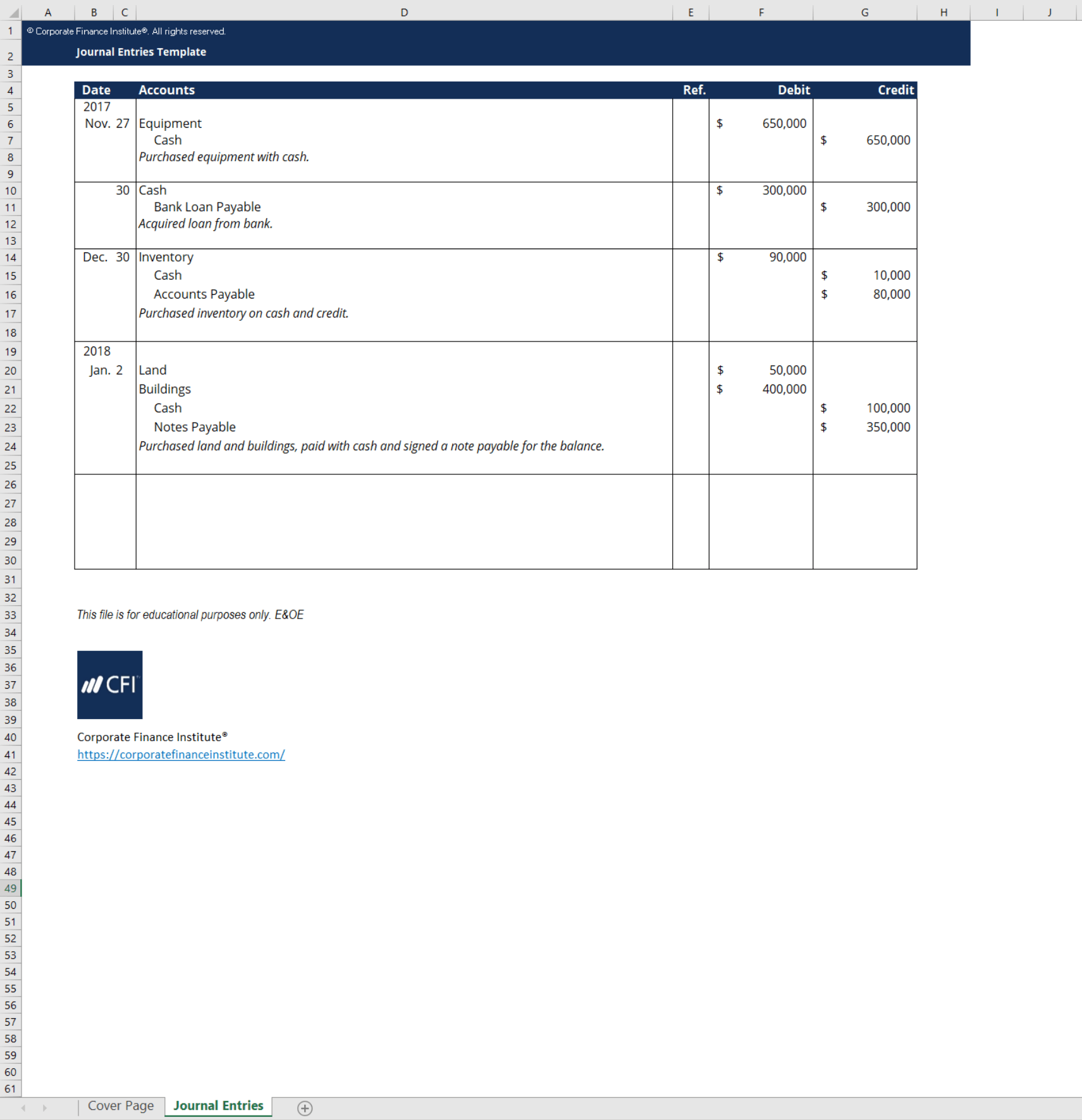

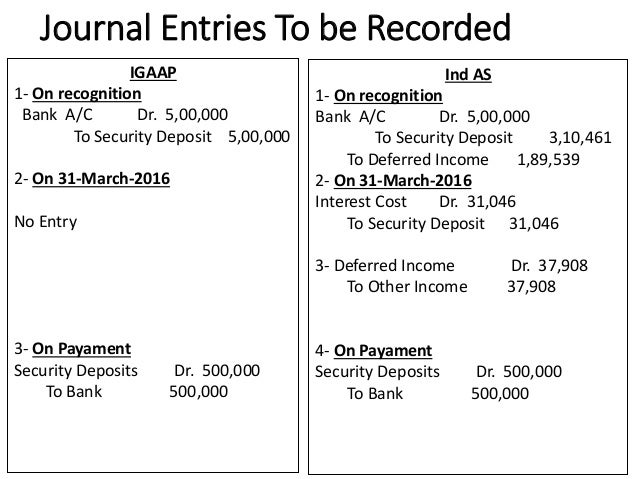

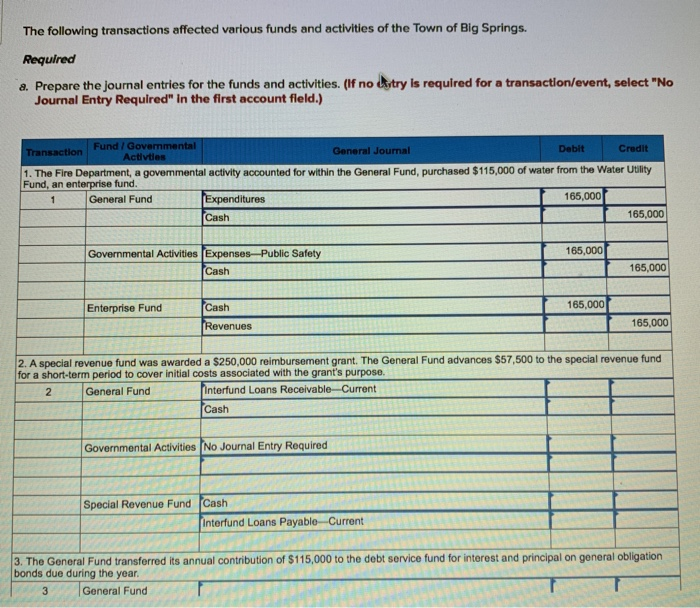

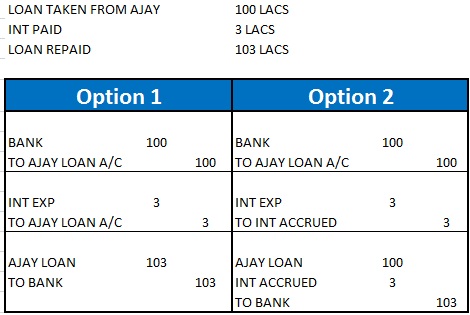

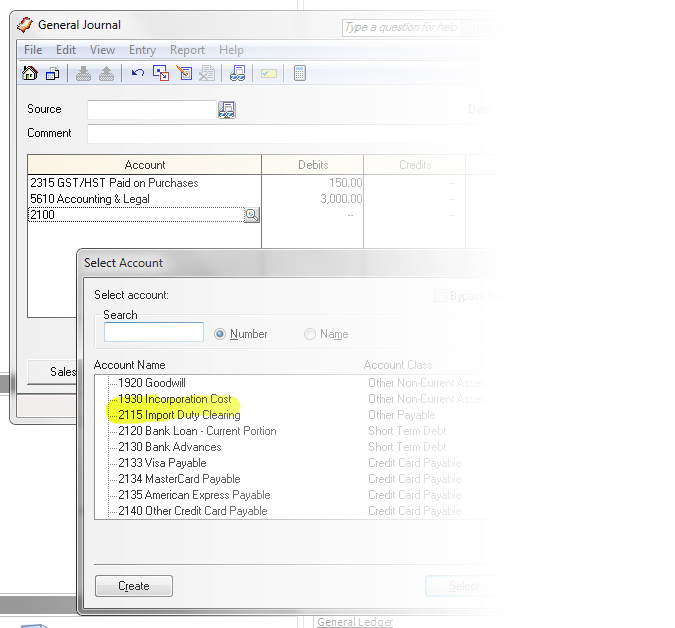

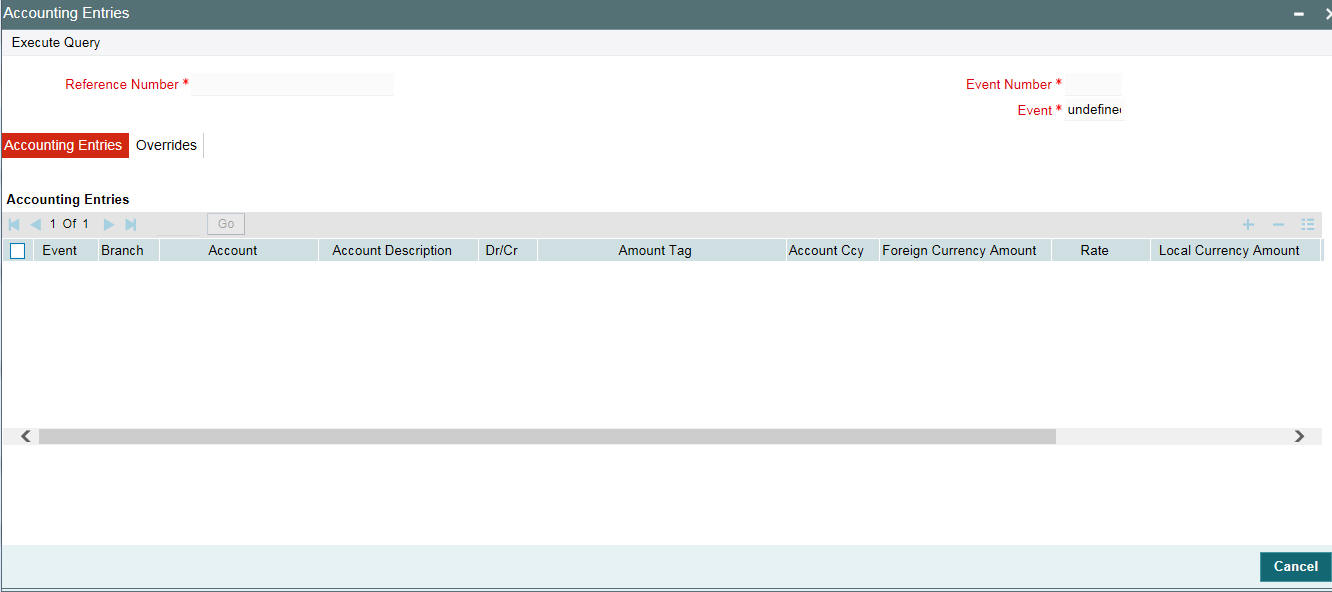

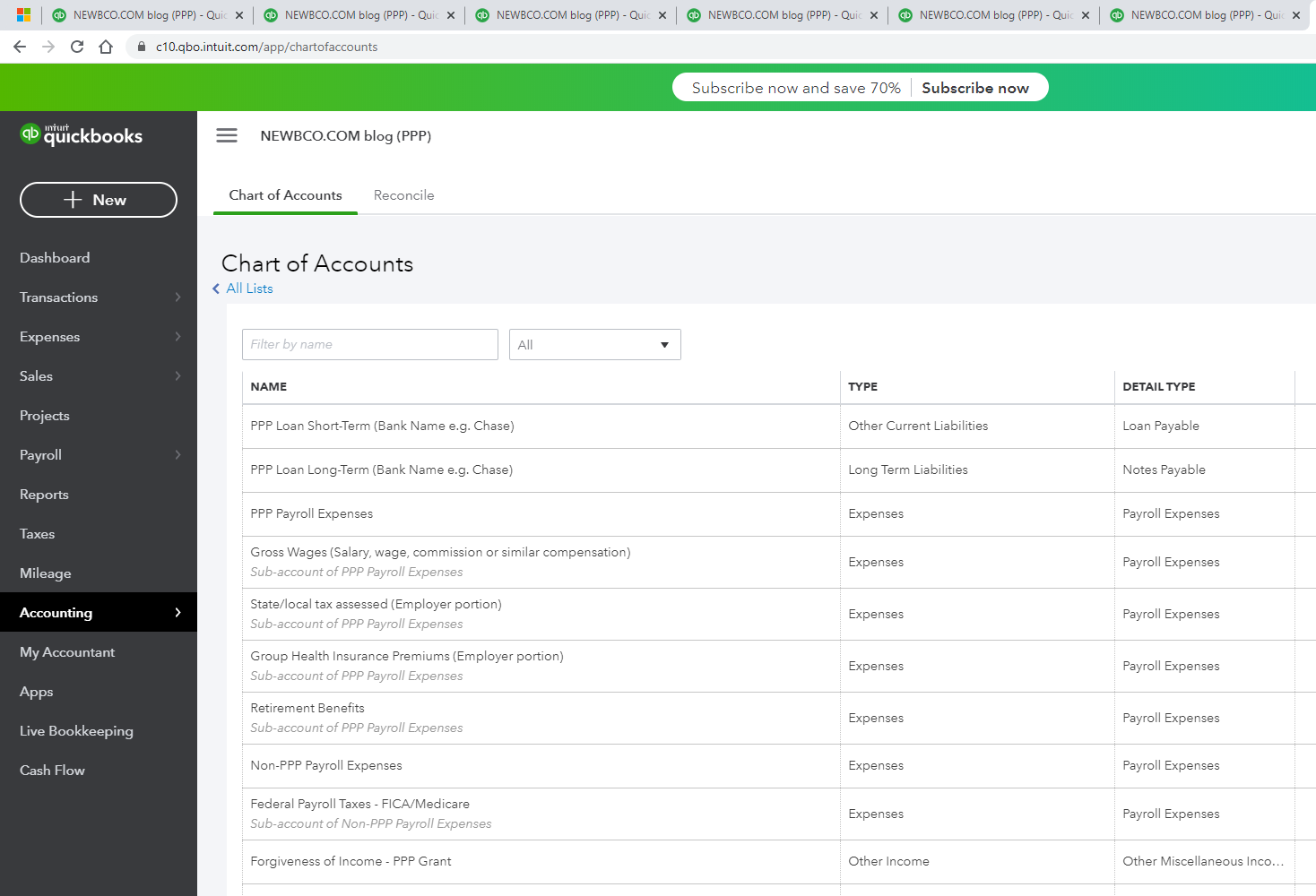

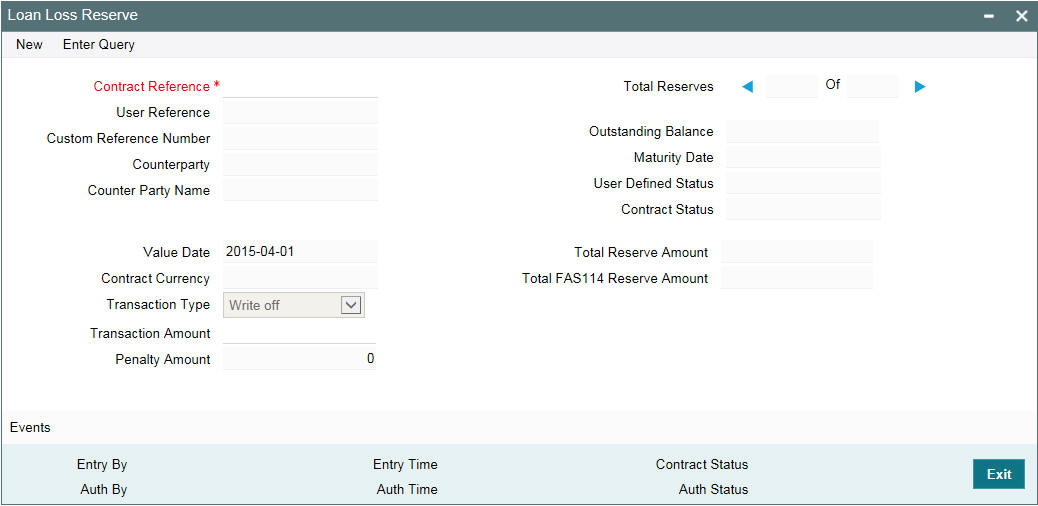

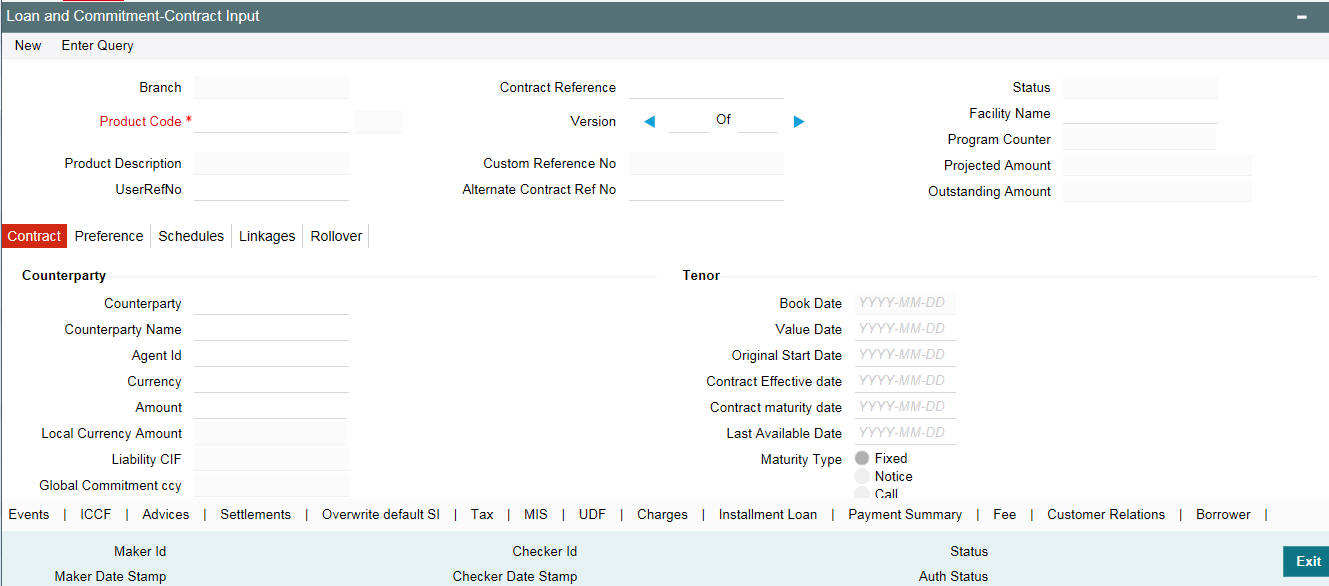

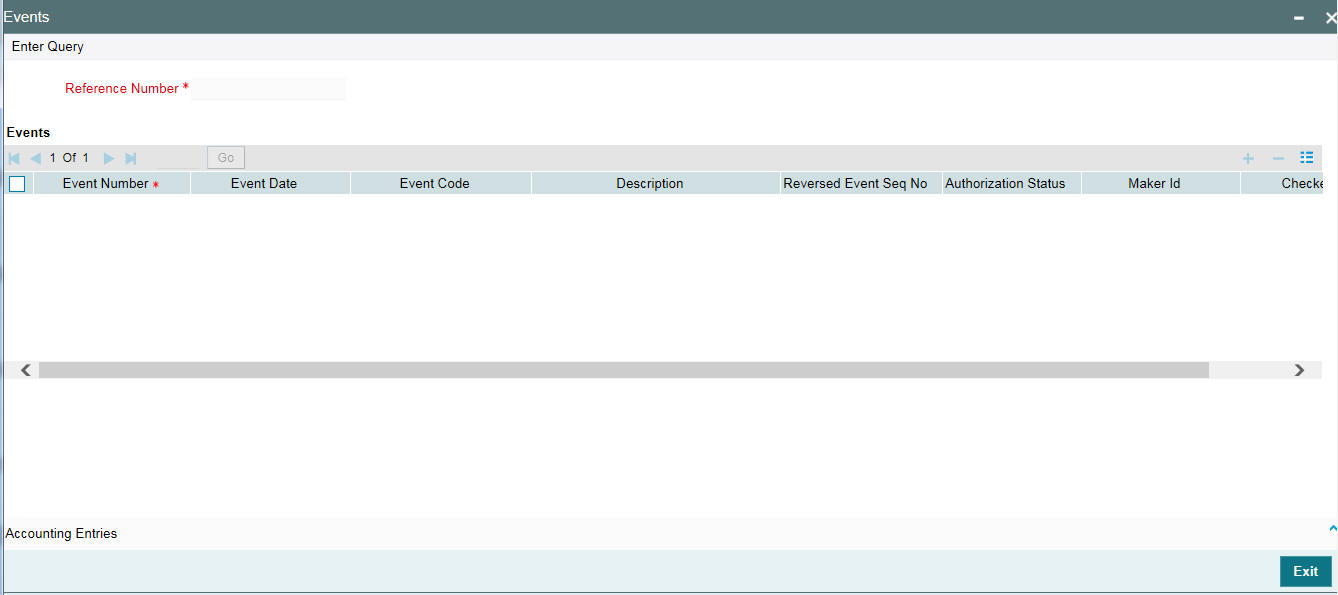

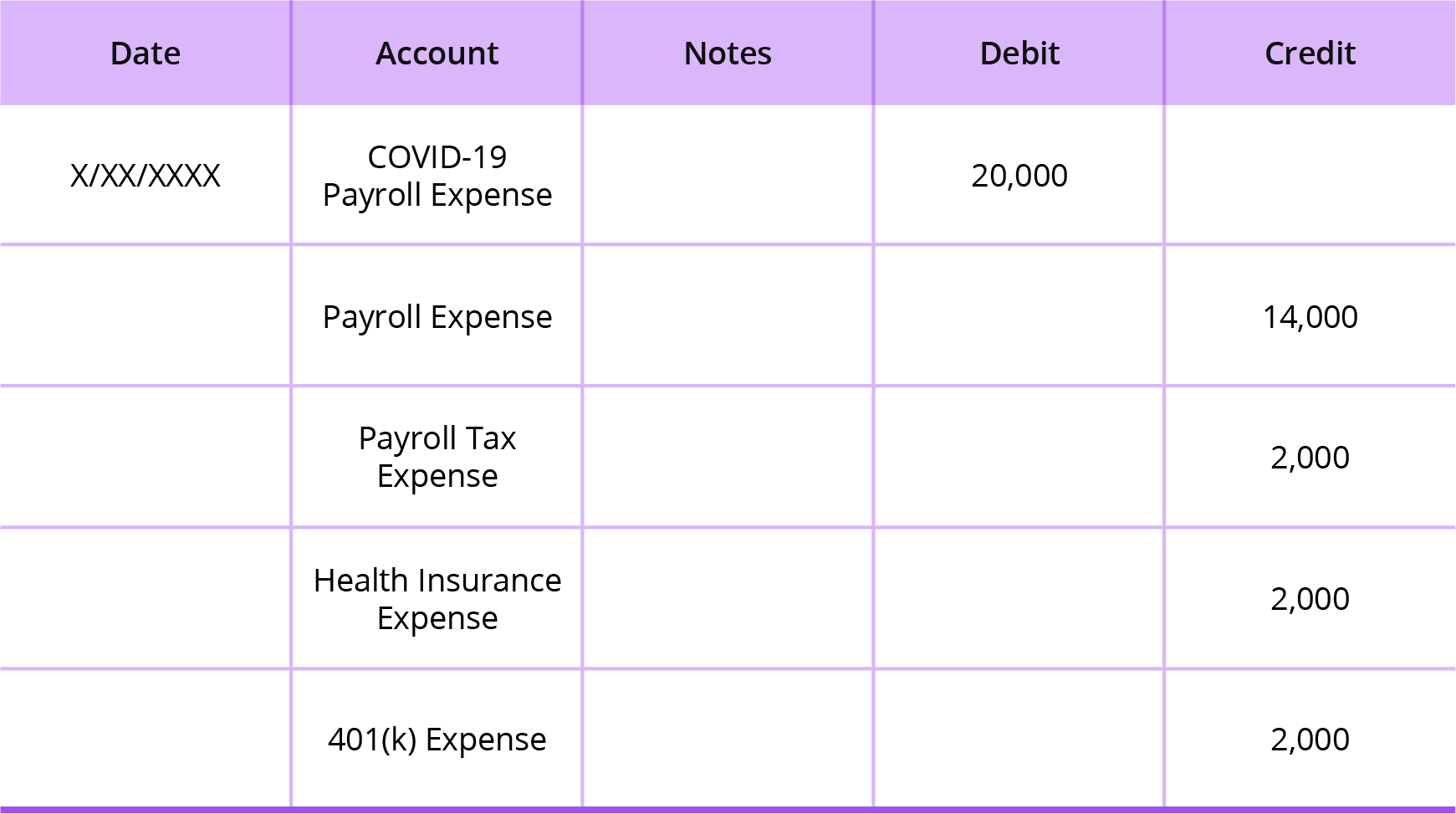

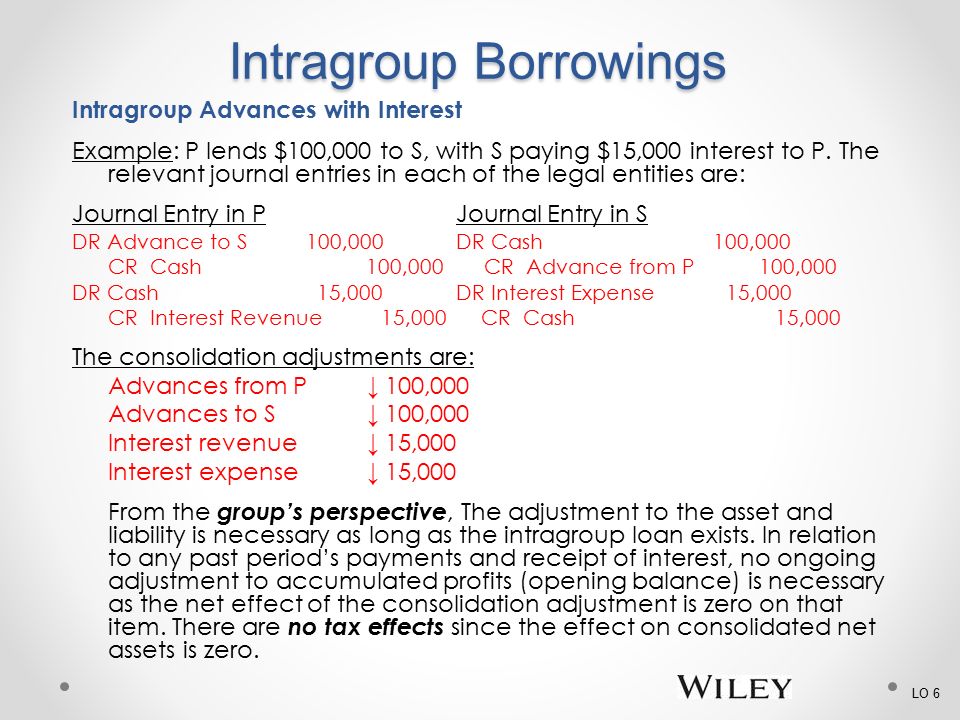

Without proper journal entries companies financial statements would be inaccurate and a complete mess. However now we will discuss the accounting treatment of loan. Below are some discussion and suggested entries for gaap basis financial statements. The journal entries of this loan are as follows.

Here are our recommended steps and journal entries to ensure the proper reporting treatment for these loans based on the issuance of the loan forgiveness of the loan and recording of expenses related to the loan. The payroll advance is in effect a short term interest free loan to the employee to be repaid when they next receive their wage payment. Hence loan is preferable financing tools for the business owner. In other words the company is the lender and the employee is the borrower.

Receive a loan journal entry explained. Employee advances for high volume situations.