Jumbo Loans Explained

By ted lyons brighton branch manager.

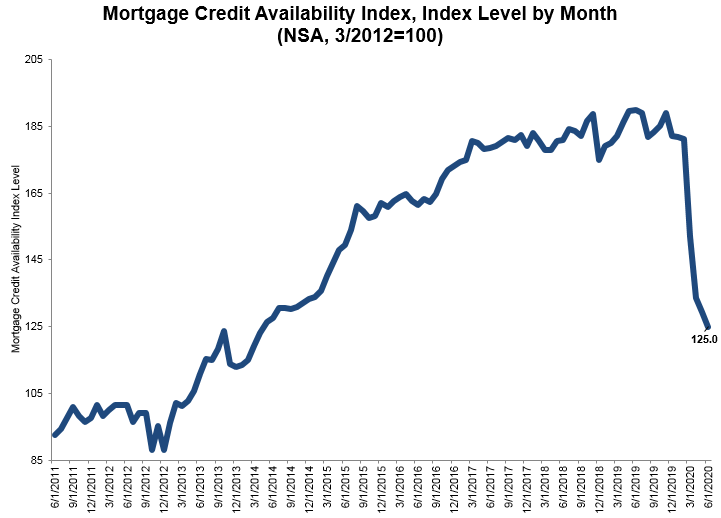

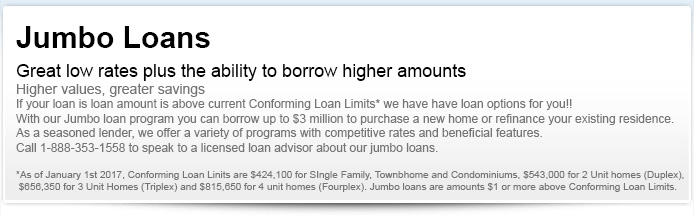

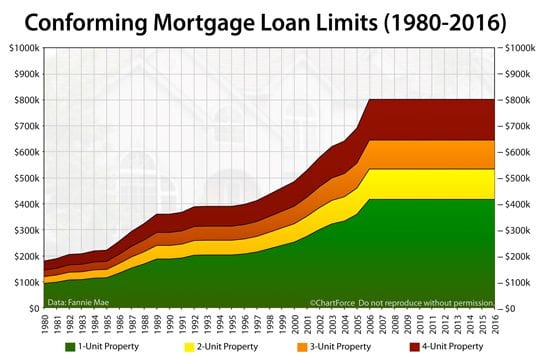

Jumbo loans explained. A jumbo loan also known as a jumbo mortgage is a form of home financing for whose amount exceeds the conforming loan limits set by the federal housing finance agency fhfa. Down payments on jumbo loans can be as little as 10 percent for loan amounts of 1 million and sometimes higher translating into a 11 million purchase price or higher. However depending on the area where youre buying a home you may find that you need a jumbo mortgage for even a. The name conveys the concept that something is really big and when it comes to mortgages.

Written by aaron crowe 10 years ago read time. Jumbo loans and conforming loans have many similarities but there are some key differences you need to be aware of. Jumbo mortgage loans explained. This is one reason interest rates for jumbo loans are usually higher than conforming loans.

Jumbo mortgages explained as the name implies a jumbo mortgage is one that is larger than your usual home loan. However some mainstream jumbo lenders will work with down payments around 10 percent and others advertise programs with. What are jumbo loans. Difference between jumbo loans and conventional loans most counties in florida 2019.

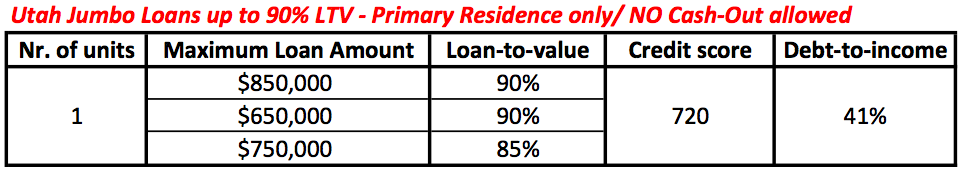

Jumbo mortgages typically require down payments of 20 percent or more. However depending on the area where youre buying a home you may find that you need a jumbo mortgage for even a modest house. A jumbo loan might only require one year of filed returns if you could document that the business was stable or growing. The approval process for a jumbo loan is generally more rigorous.

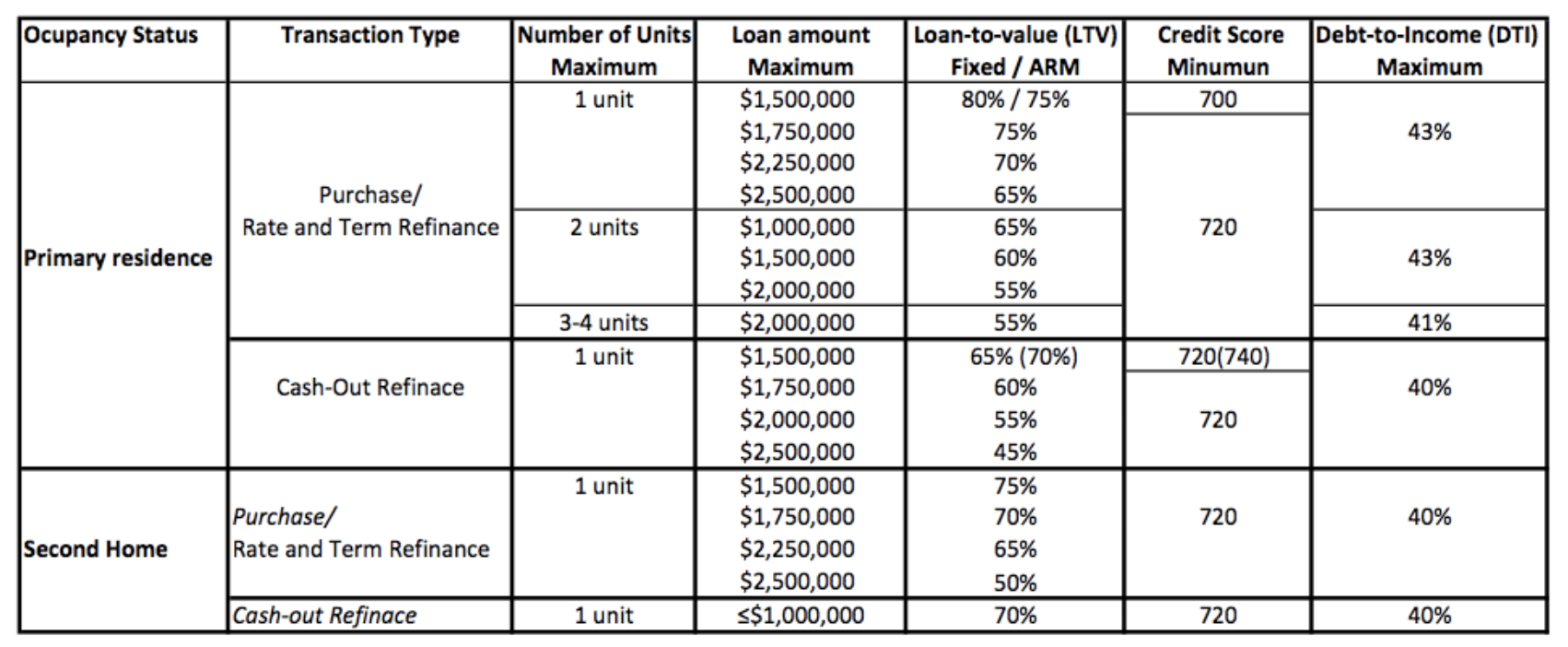

Jumbo loans are considered higher risk to a lender than are traditional mortgage loans because the loan is a larger than average sum. The conventional loan limit in most counties in eastern massachusetts for a single family home is 688850 so if a borrower wants to purchase a home. A fico score above 700 is a minimum for most buyers but other factors could warrant a slightly lower score. Debt to income ratio dti while conforming loans are more lenient on dti jumbo loans are not as flexible and have a hard cap of 43 dti.

Less than 20 percent down with no mortgage insurance. Mortgage loans above the conforming loan limits set by fannie mae and freddie mac are called jumbo loans. Youll need good credit to get approved for a jumbo loan. Jumbo loans allow you to borrow a larger sum of money than a conforming loan.

:max_bytes(150000):strip_icc()/iStock-505472872.house.key.gift-5c3cf47dc9e77c0001125229.jpg)

/what-you-need-to-know-about-jumbo-loans-4155160_final2-e8b7d0e5ae39414e9a306c0eadcca732.jpg)

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/beautiful-modern-house-in-the-forest--outdoor-480288634-5c47bd3646e0fb0001f0d5ea.jpg)

/beautiful-modern-house-in-the-forest--outdoor-480288634-5c47bd3646e0fb0001f0d5ea.jpg)