Loan Application Verification Process

Manual validation was error prone and time consuming and.

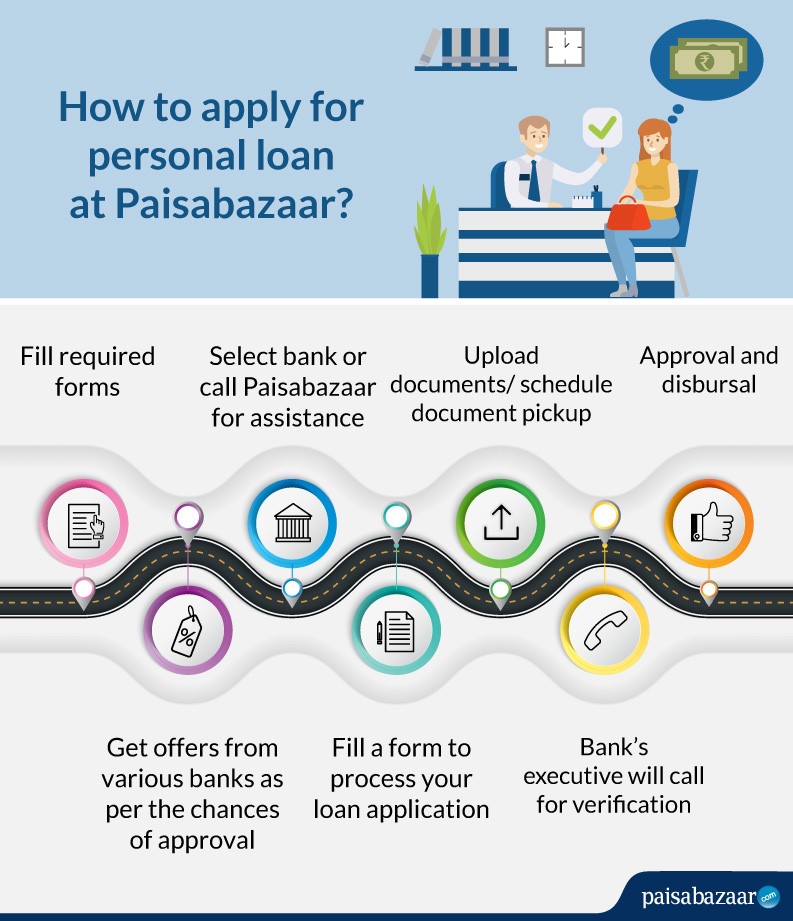

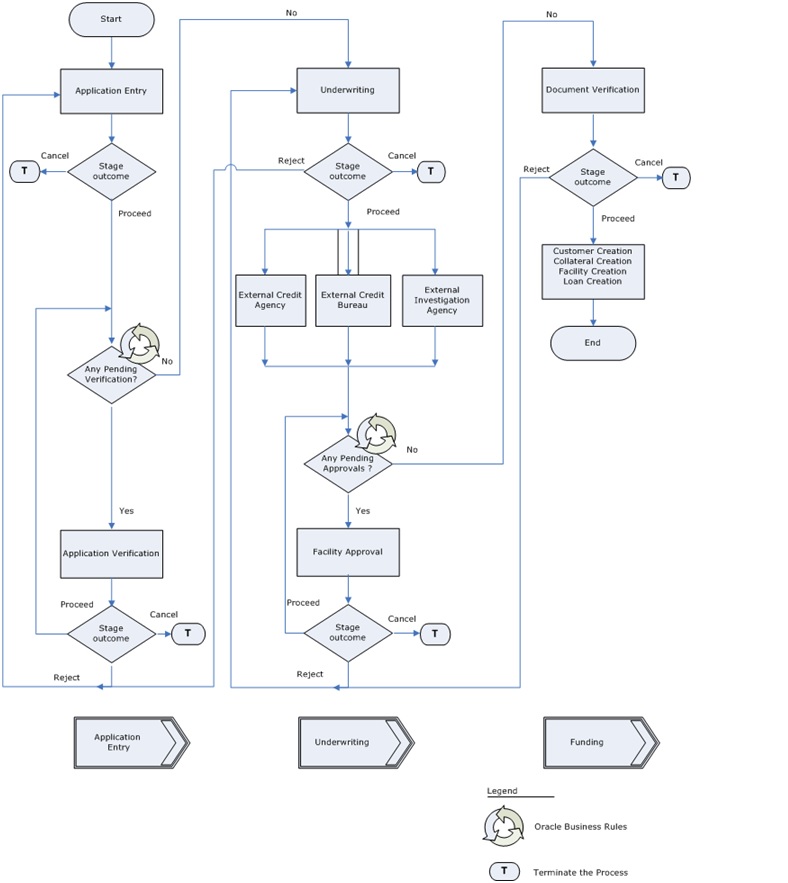

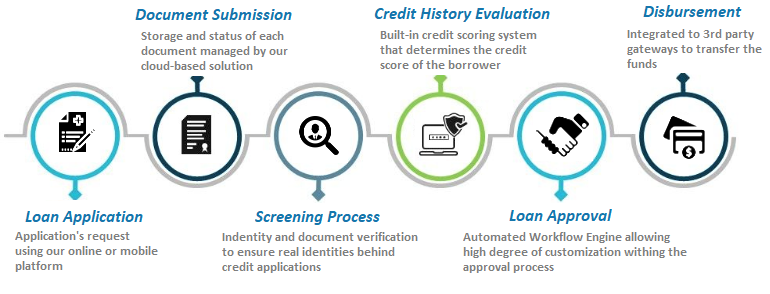

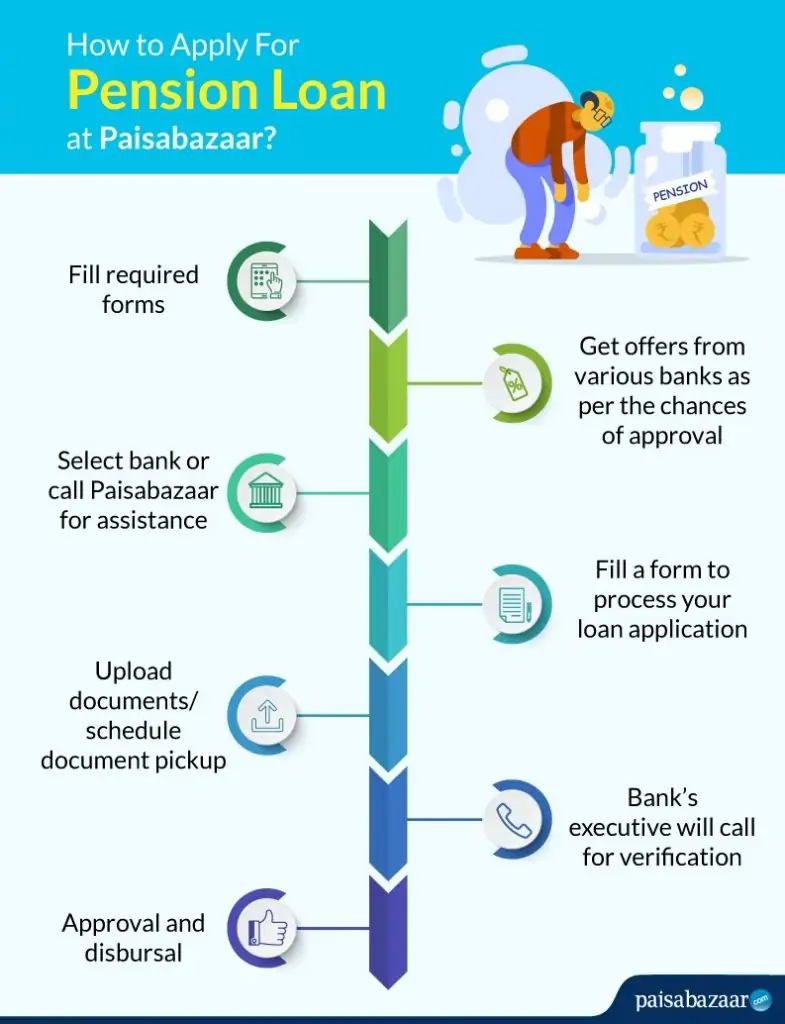

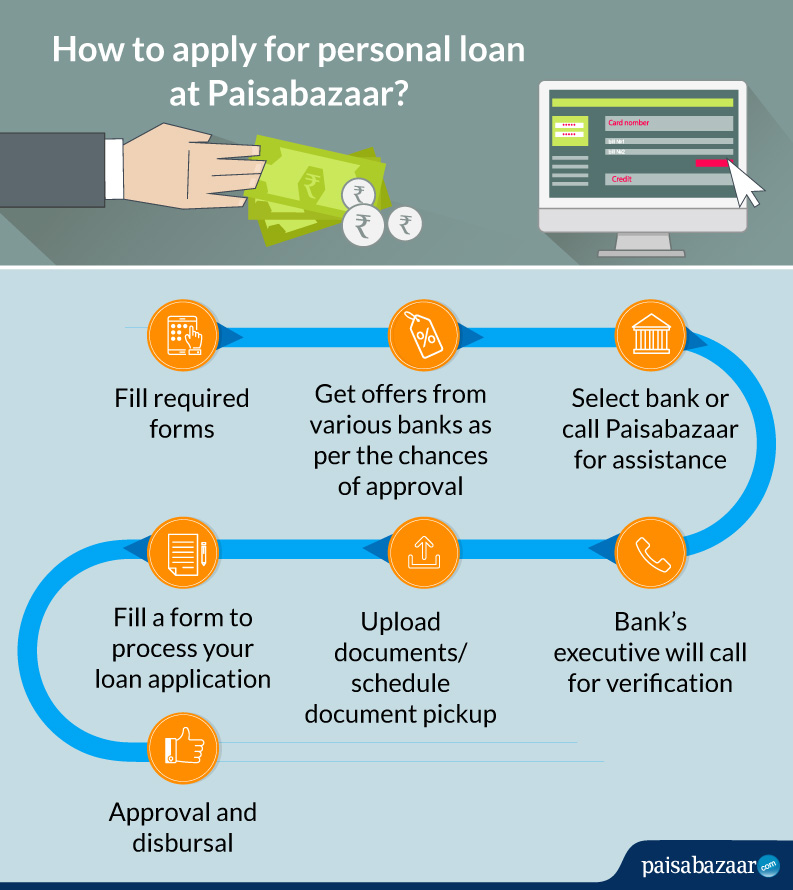

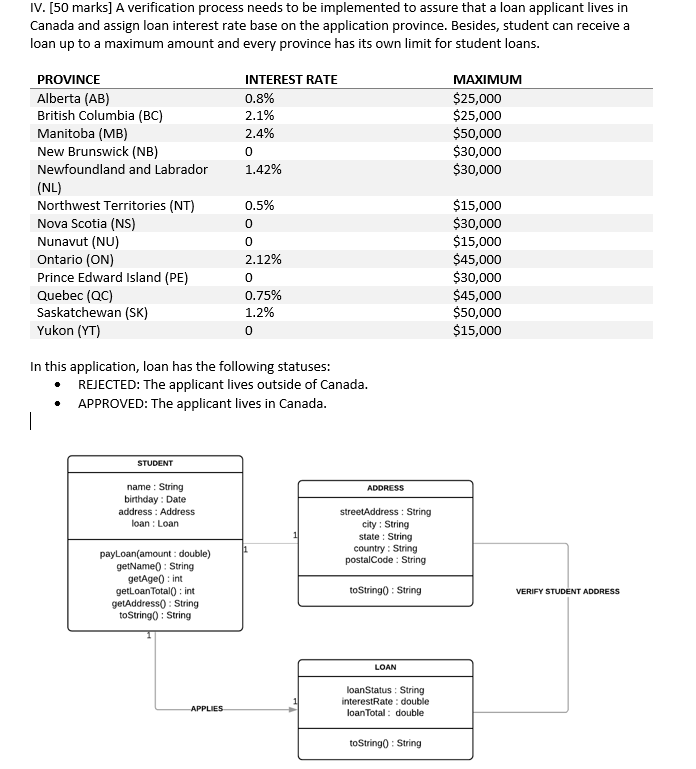

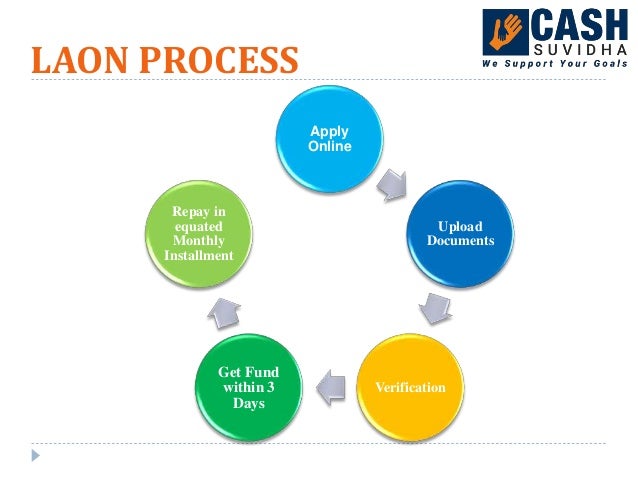

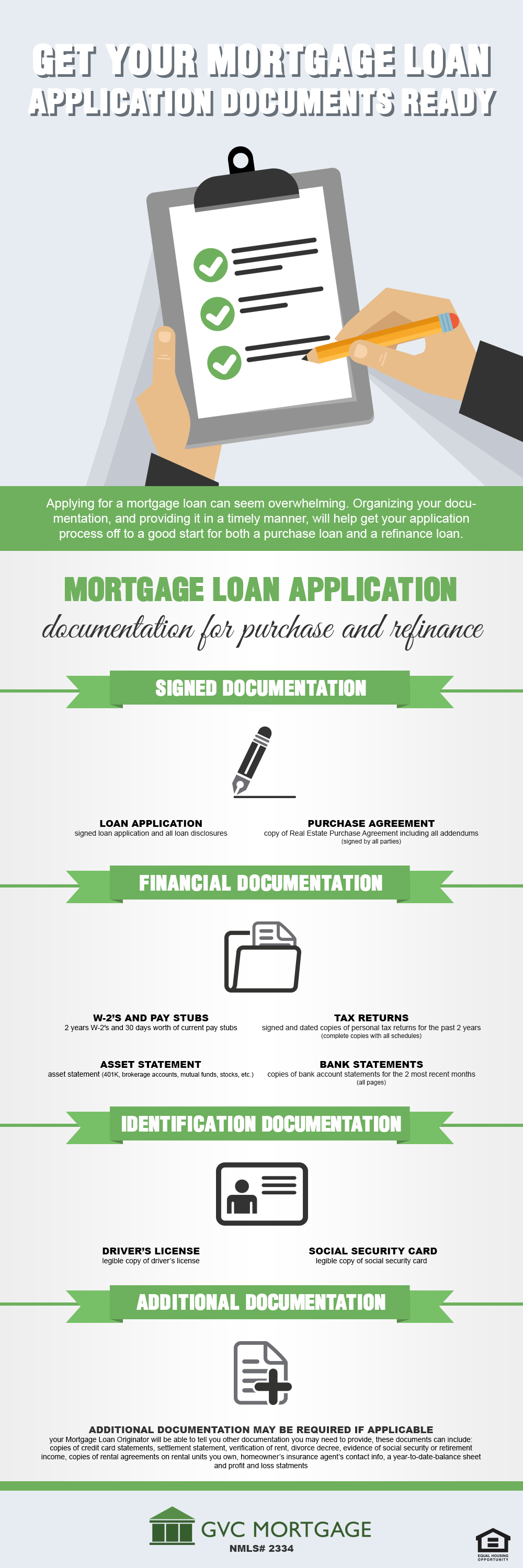

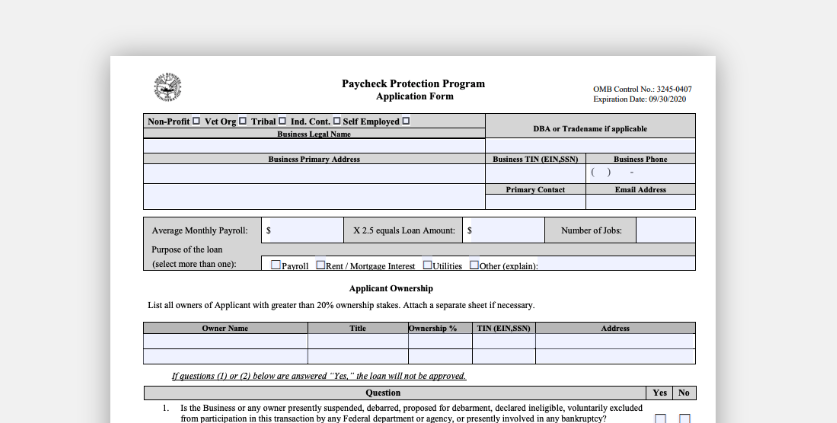

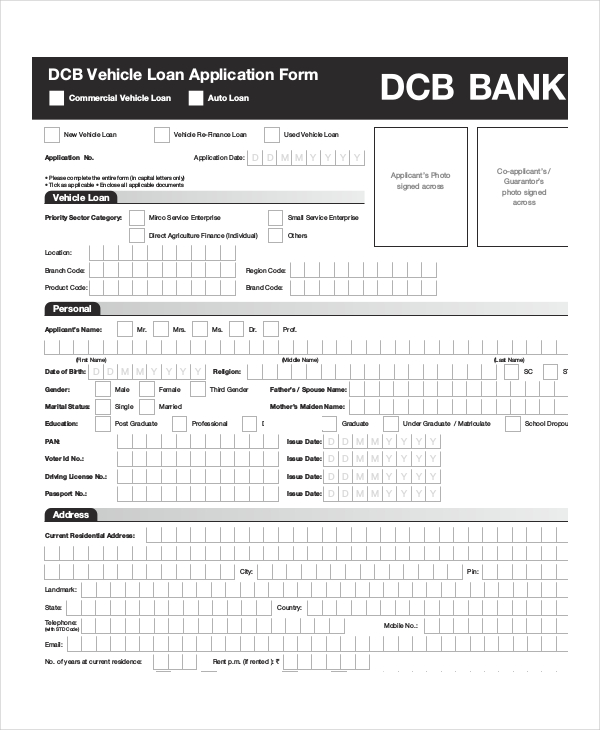

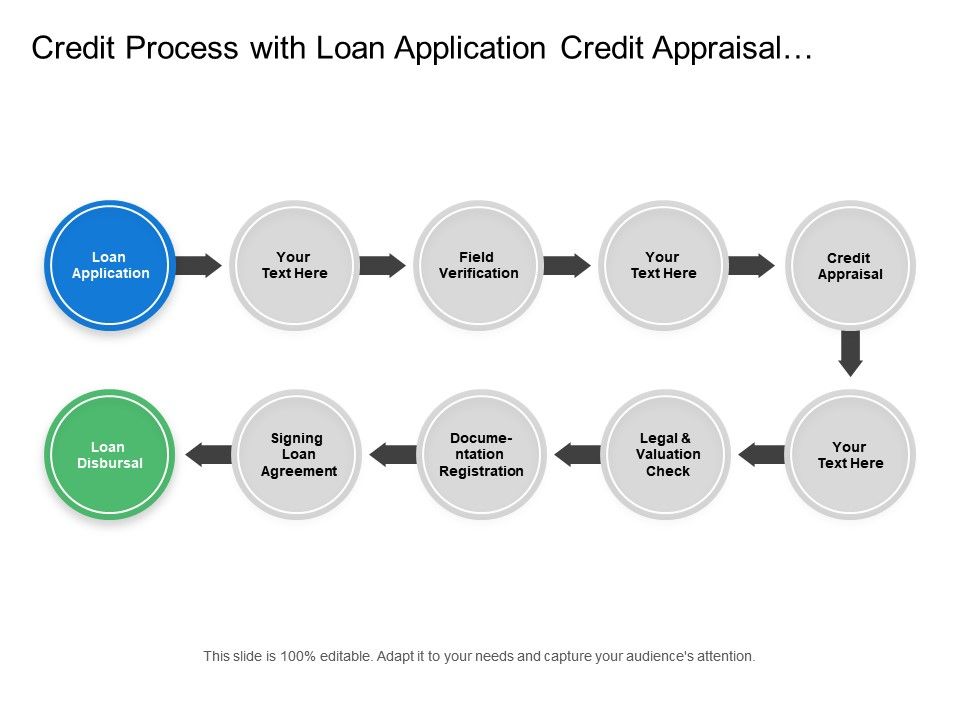

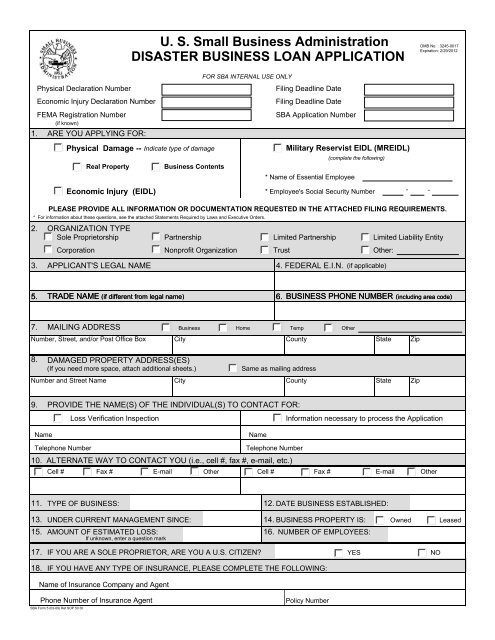

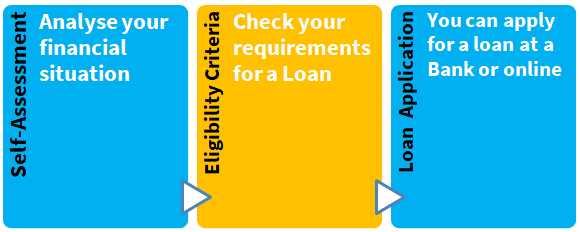

Loan application verification process. Identity document verification eg. Loan origination is the process by which a borrower applies for a new loan and a lender processes that application. Here is a brief overview of the 4 stage verification process for a personal loan that is followed by most lenders. The bank needs a loan application to initiate the document collection and verification process.

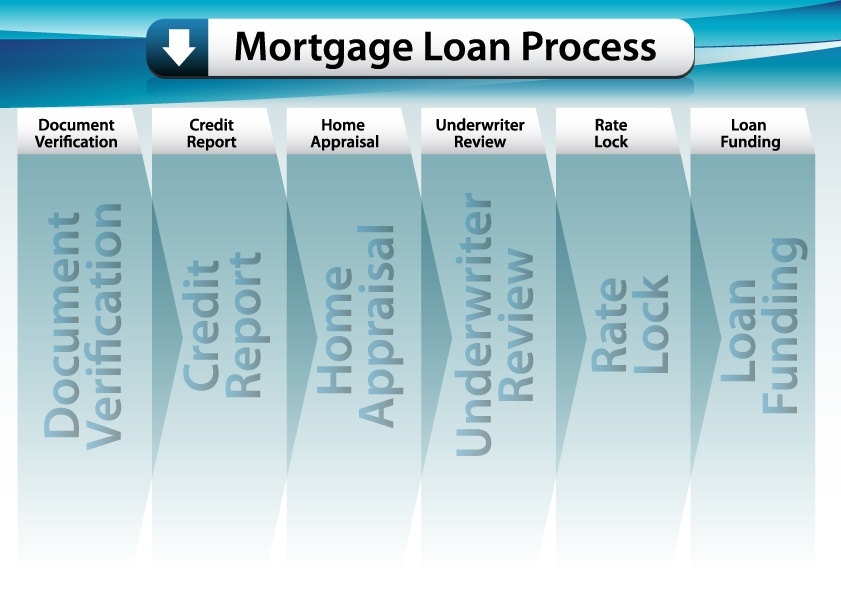

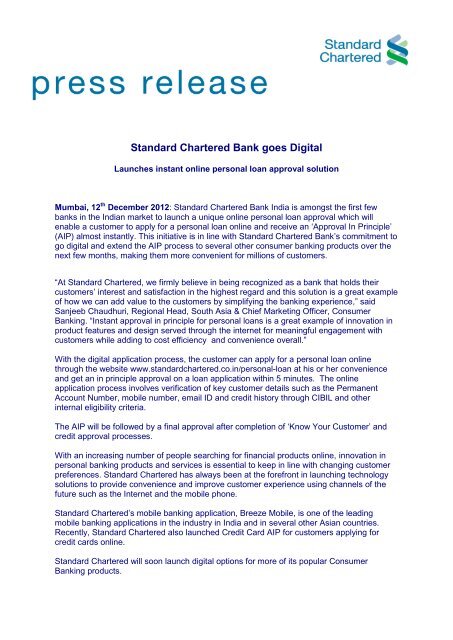

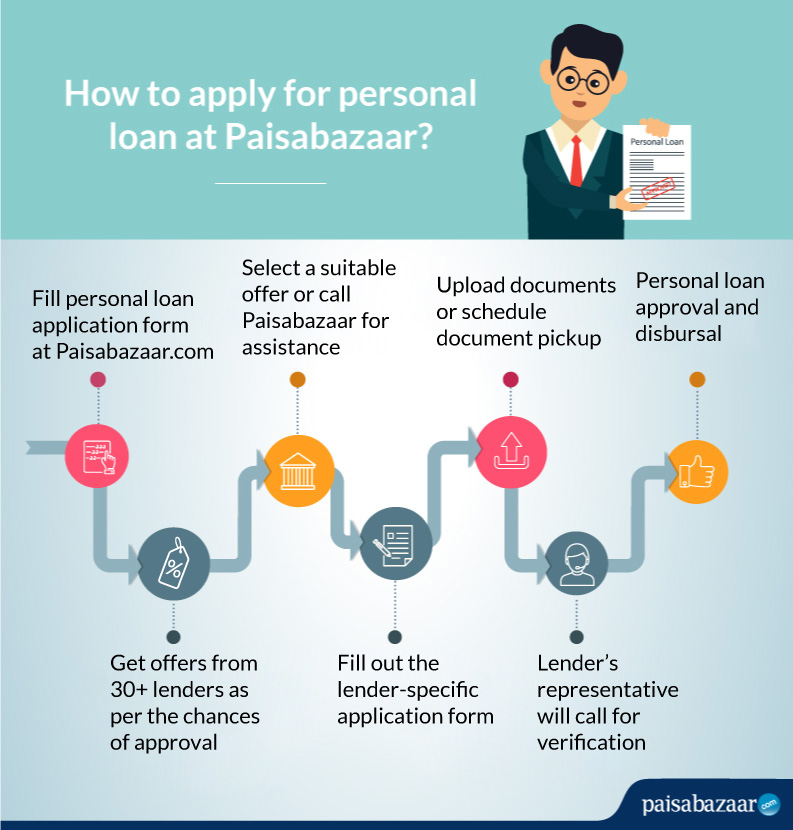

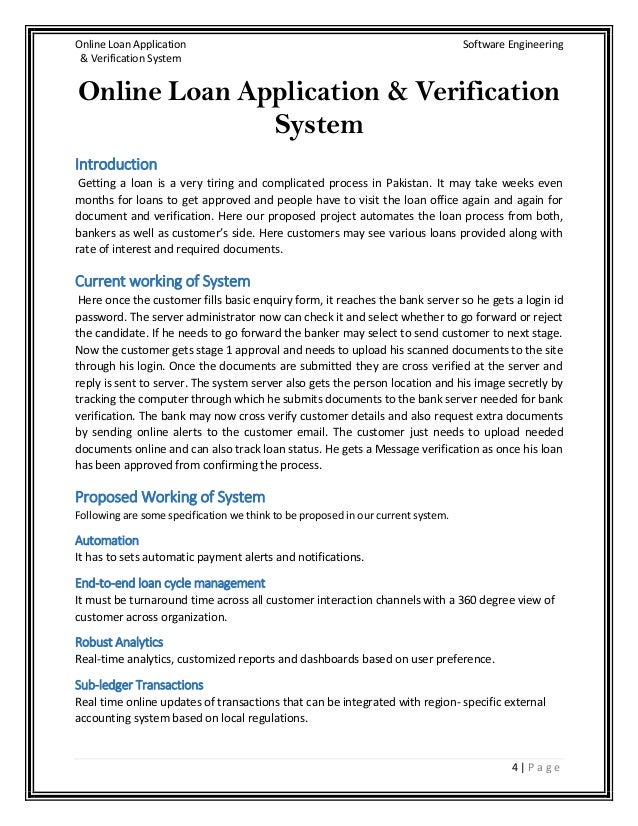

Heres what you need to know about each step. It may take weeks even months for loans to get approved and people have to visit the loan office again and again for document and verification. Mortgage pre approval mortgage pre approval. June 15 2020.

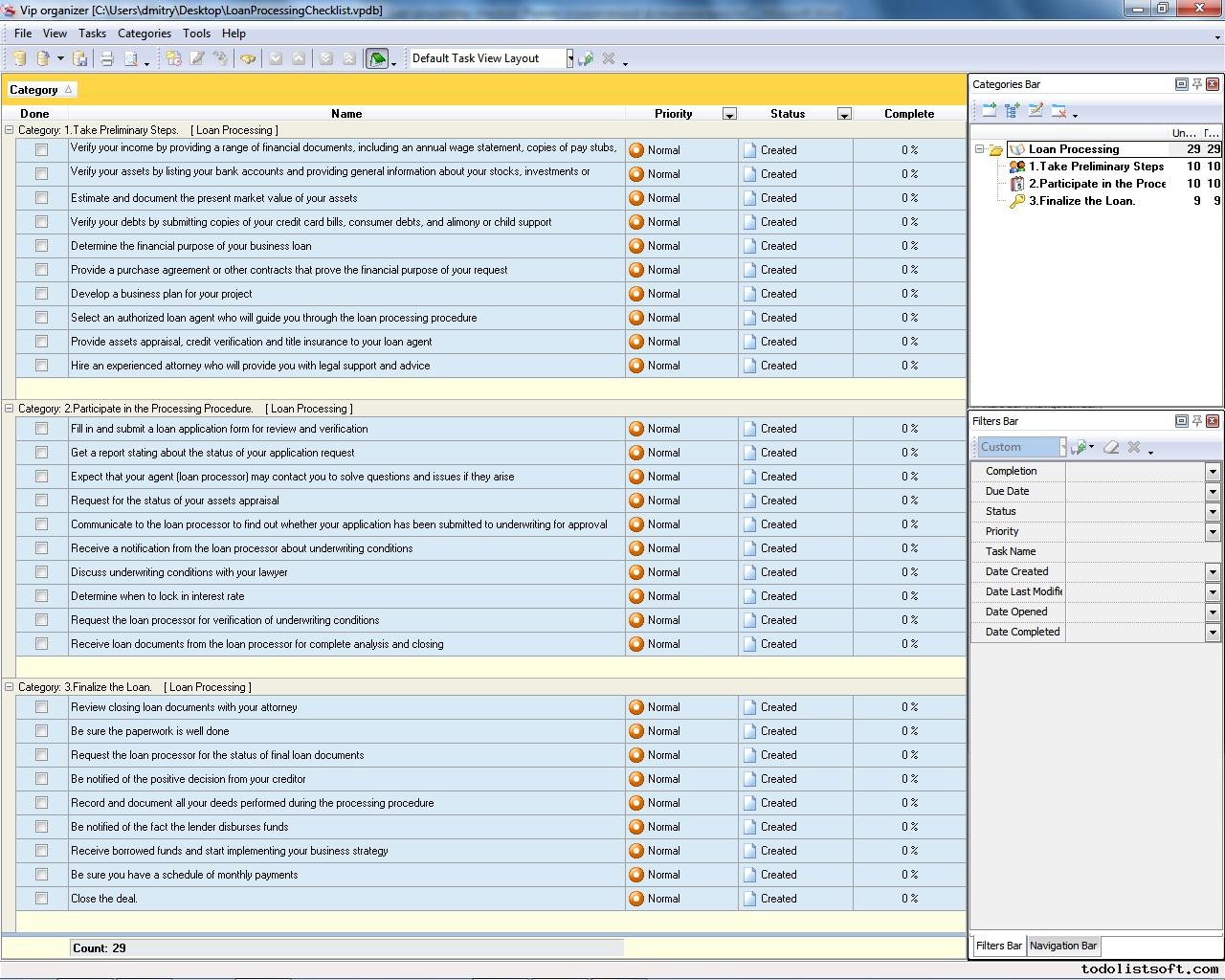

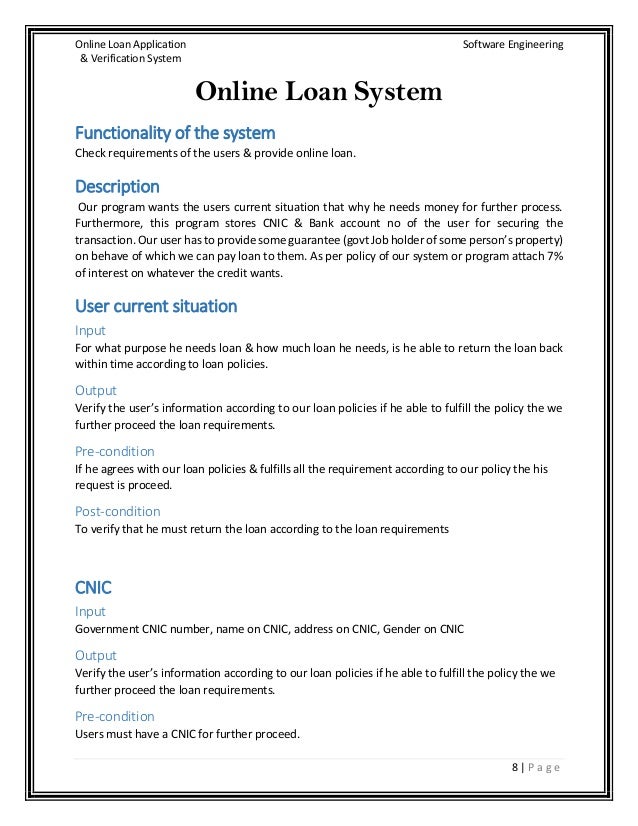

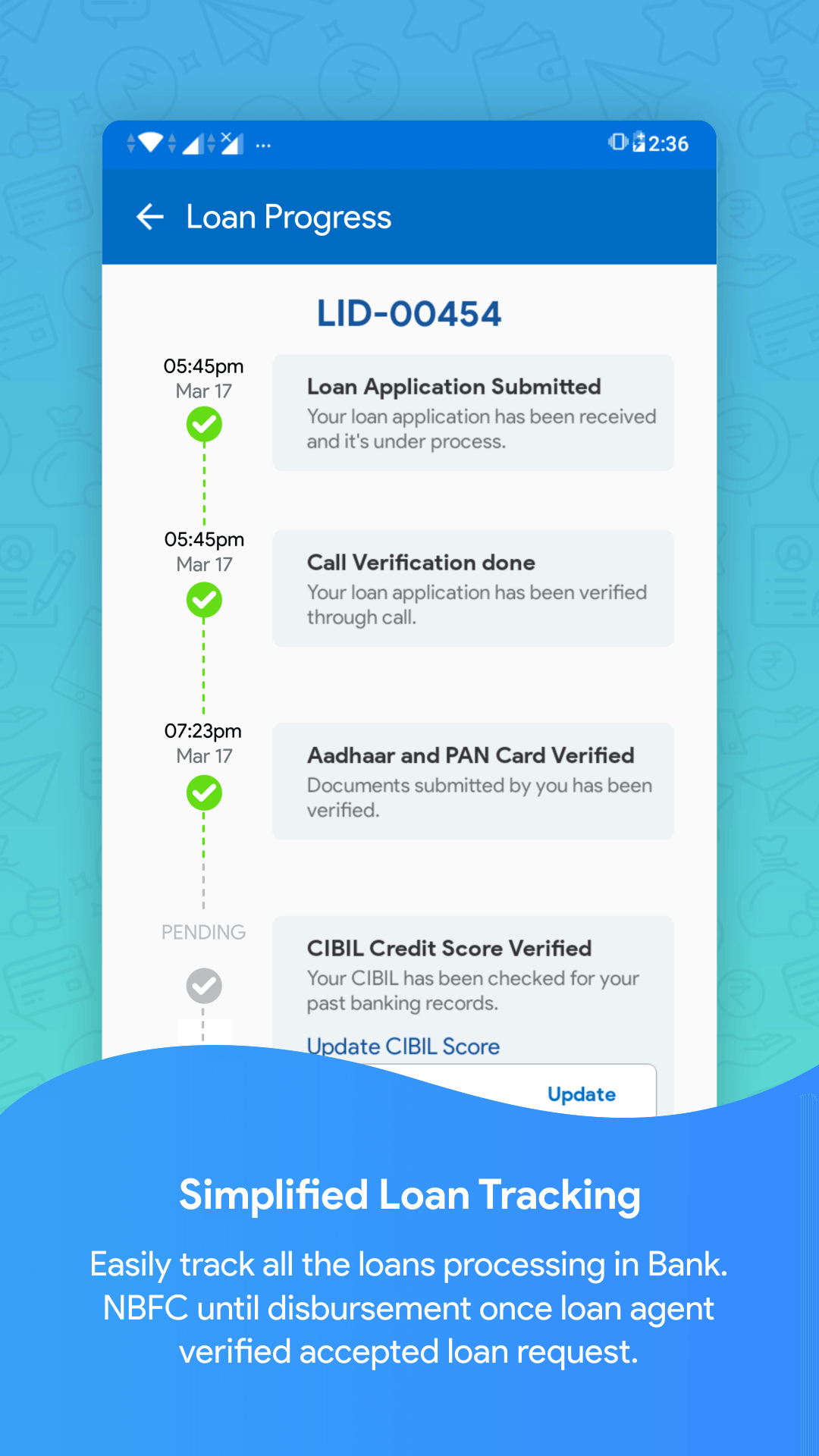

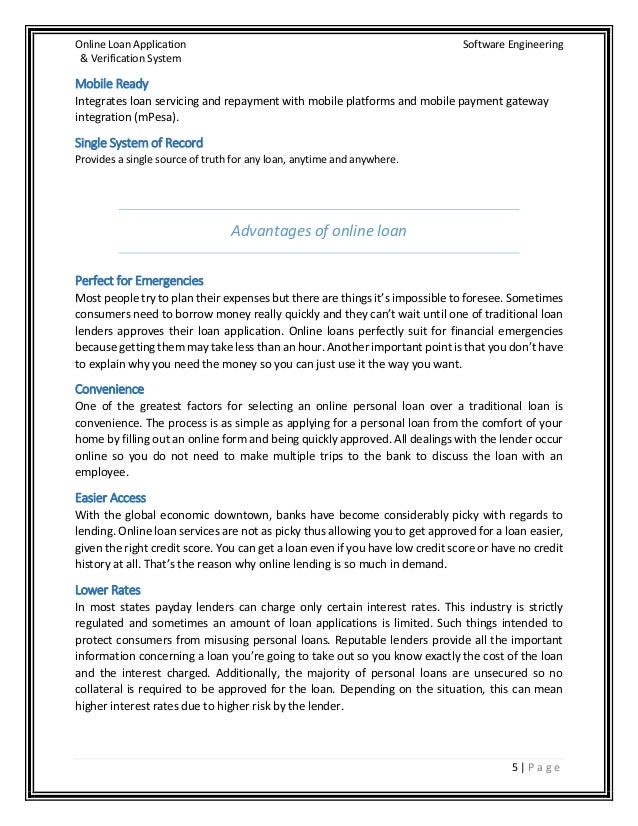

What does the verification process entail. The following faq does not apply to the secured personal loan product through avant. 10xds implemented an automated solution to verify the documents submitted by customers to avail loans and to process the loan application for a well known small finance bank in india. Online loan application software engineering verification system 4 p a g e online loan application verification system introduction getting a loan is a very tiring and complicated process in pakistan.

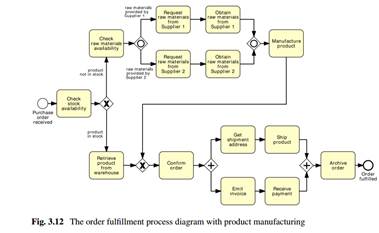

Passports drivers license national ids. There are six distinct phases of the mortgage loan process. As the personal loan is an unsecured form of lending it warrants a rigorous document verification process which might vary across lenders. Verification process widely differs from bank to bank.

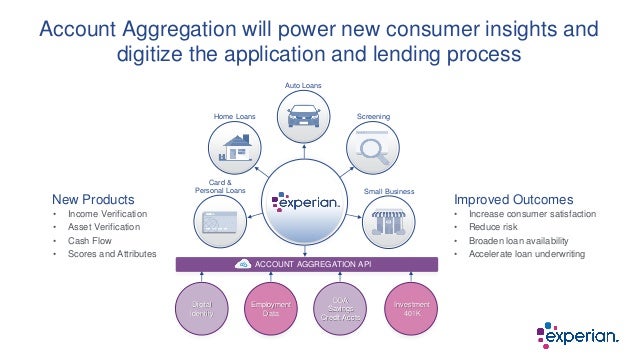

For mortgages there is a specific mortgage origination process. Receipt of personal loan application. After clarifying about the loan terms personal loan interest rates and the principal amount you need to choose a lender and apply for a personal loan for yourself. Next order the borrowers credit report evaluate their assets obtain proof of insurance and research their income sources and employment history.

Loan application data verification process for small finance bank. By 10xds team. After receiving your application the lender will process it to initiate the document collection and approve the loan disbursement. Origination generally includes all the steps from taking a loan application up to disbursal of funds or declining the application.

The process of personal loan verification from the banks perspective is as follows. This is the first stage of the verification process. 8 identity verification tests to prevent loan account fraud. The following know your customer kyc security checks are the most commonly applied tests used on the identitymind platform to better verify a potential borrowers identity during the onboarding process.

Please click here to contact us for inquiries related to the secured personal loan product.

Telkomsel Msight Id Verification Facilitate Fintech Player Customer Data Verification Process Telkomsel Digiads

/PREAPPROVEDMORTGAGEJPEG-e4fb5ba8d0164c7699b4b376a1492293.jpg)