Loan Broker Explained

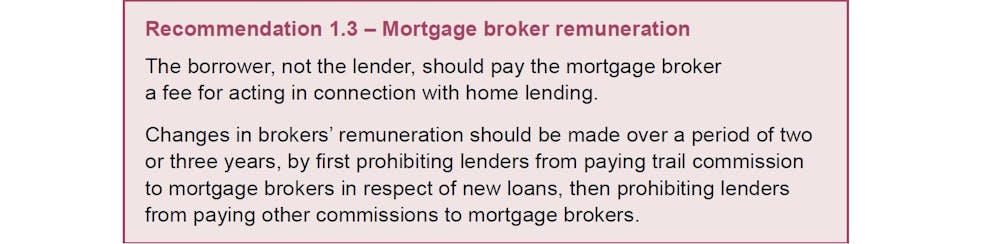

If you opt for one that does ensure that all fees are clearly explained before you commit to your broker and your loan.

Loan broker explained. This can be as high as 7 to 17 with an online lender or as low as 1 to 3 with banks or credit unions. Most run for 25 years but the term can be shorter or longer. Reputable personal loan brokers dont charge a fee for you to apply. As explained in funderas article on commercial loan brokers the broker locates lenders who will approve these businesses for their needed capital injection.

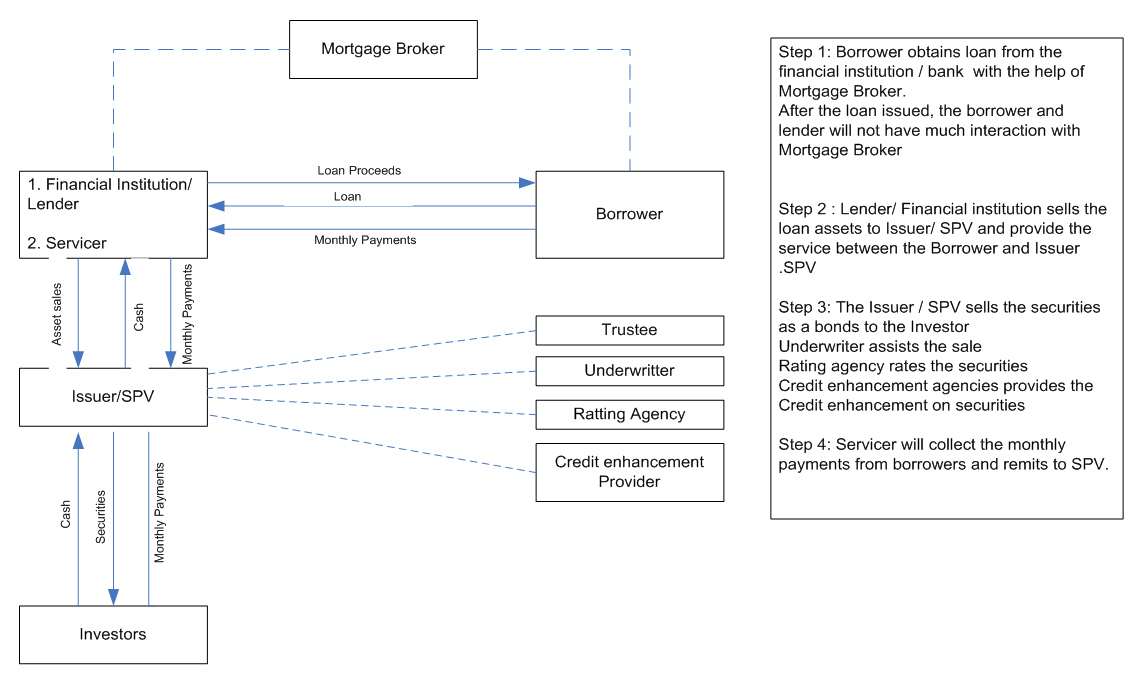

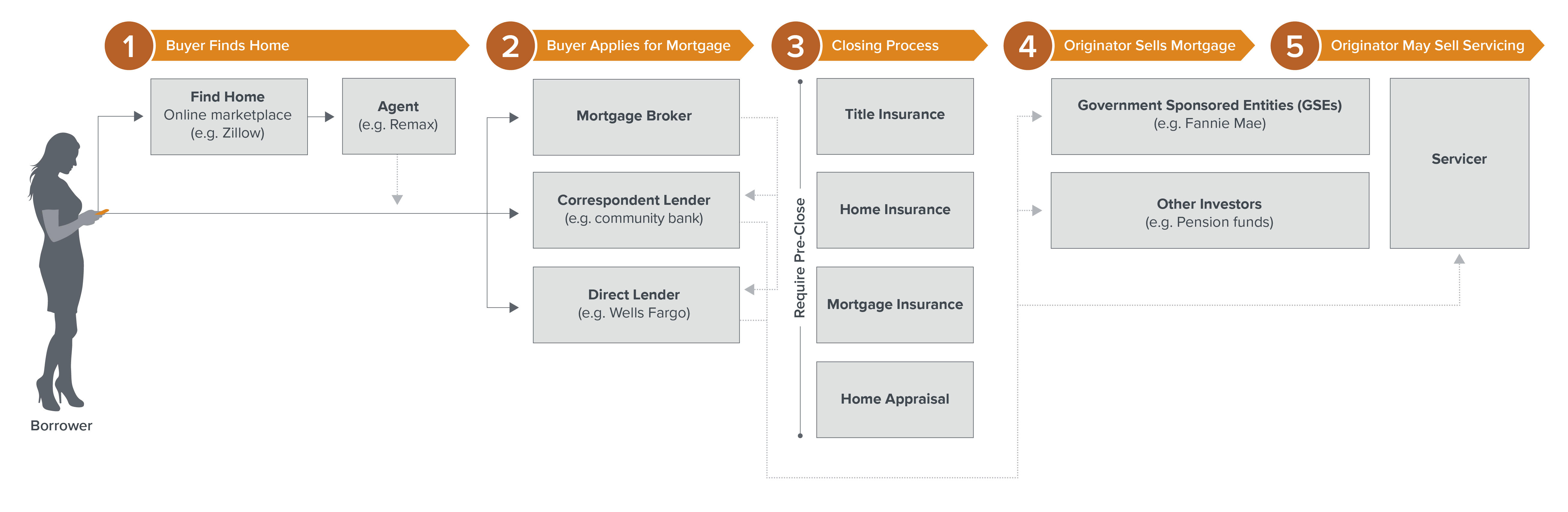

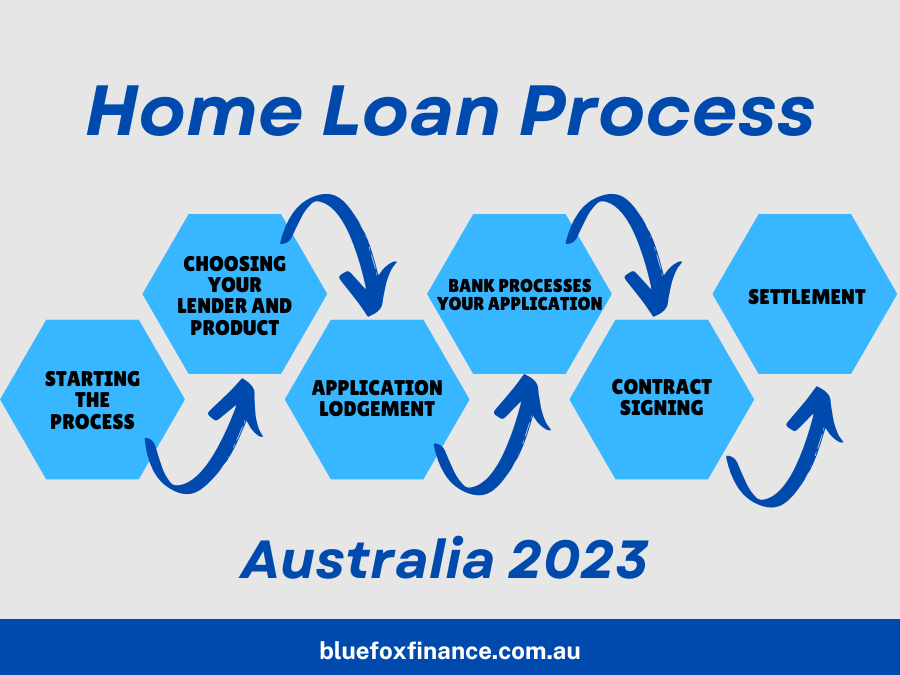

A mortgage is a loan taken out to buy property or land. Some brokers charge this fee in the form of a higher interest rate. For this service the broker will typically receive compensation in the form of a small percentage of the amount financed. The loan is secured against the value of your home until its paid off.

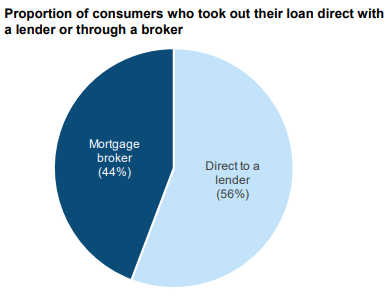

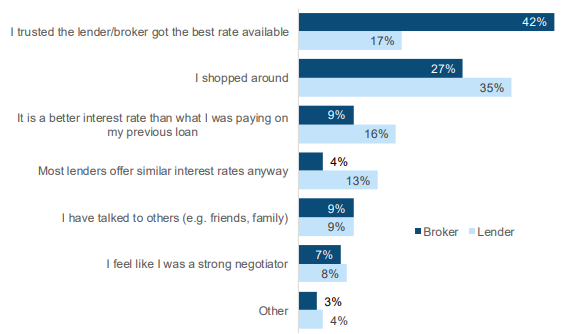

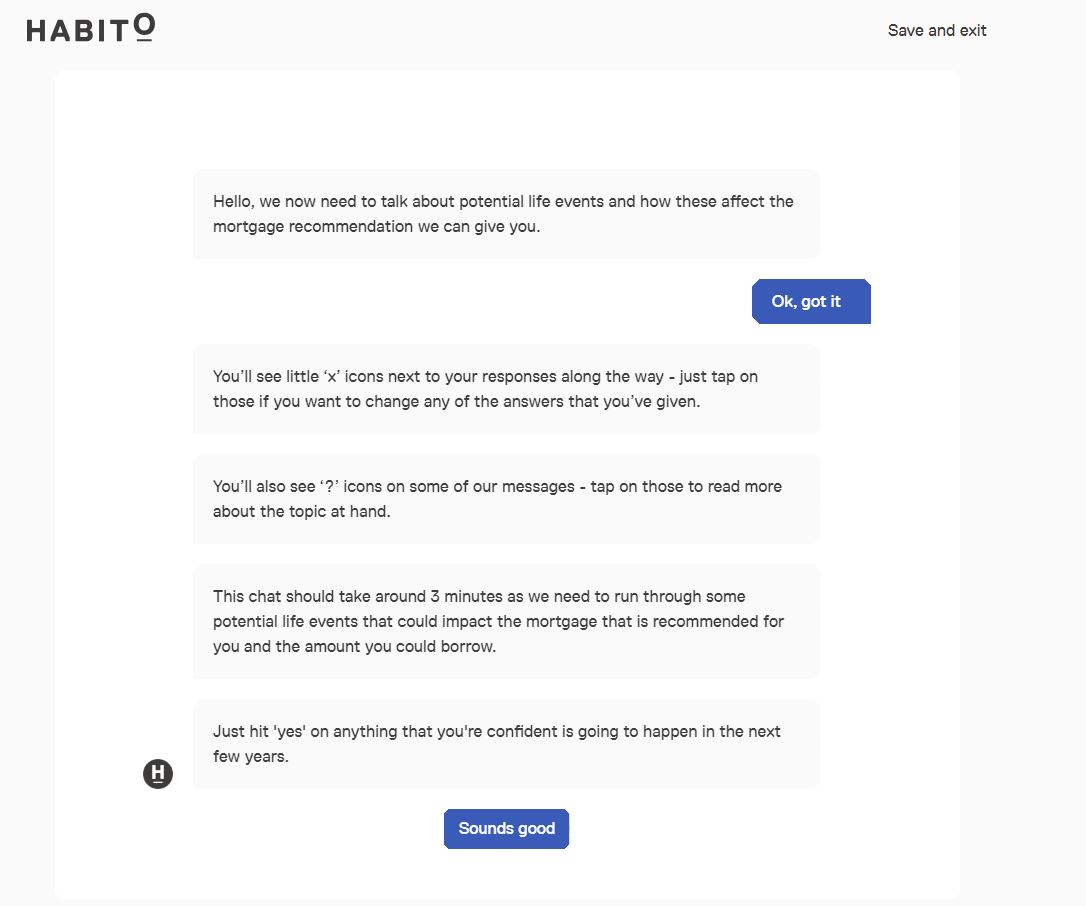

A mortgage broker is a person or company that can arrange a mortgage between you the borrower and a mortgage lender. Using these videos and manuals you can become a near expert at commercial mortgage brokerage in just one day. If you cant keep up your repayments the lender can repossess take back your home and sell it so. There are multiple personal loan brokers that dont charge a fee for a connection service.

Often broker fees for finding an sba loan are lower. Everything is explained in my marvelous step by step commercial mortgage marketing manual.

/mortgage-broker1-4eb1e0febc8548dc8e1b26a407116fff.jpg)

/mortgage-broker1-4eb1e0febc8548dc8e1b26a407116fff.jpg)