Loan Broker Mean

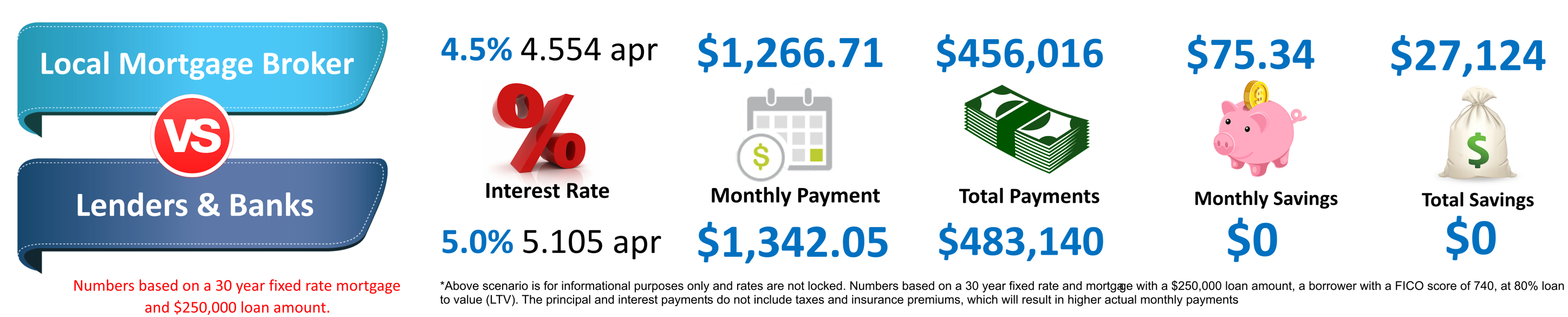

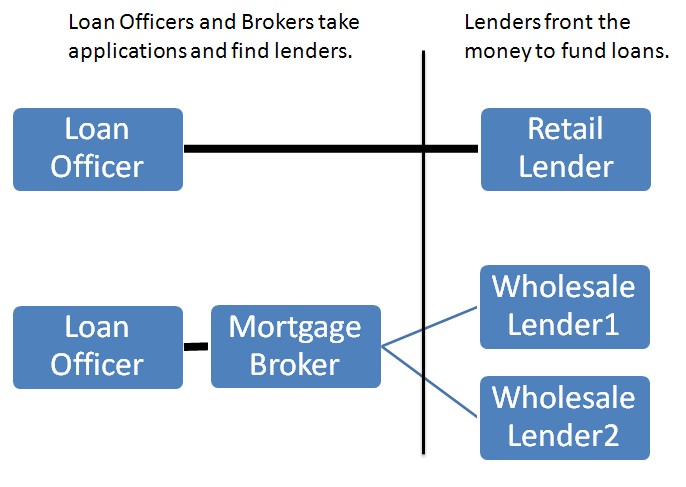

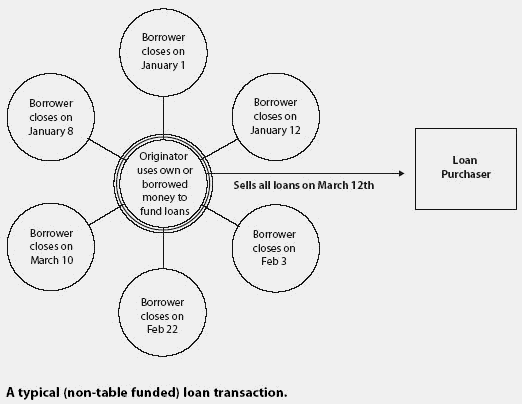

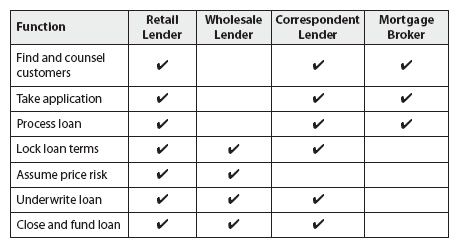

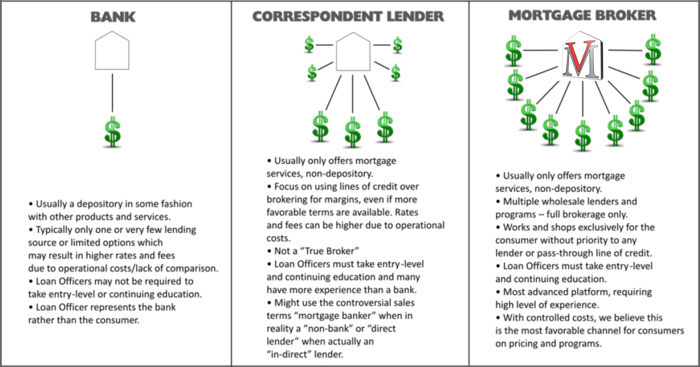

Some lenders including both traditional and non traditional lenders use brokers to provide the necessary applications documents and processes to help borrowers through the loan process.

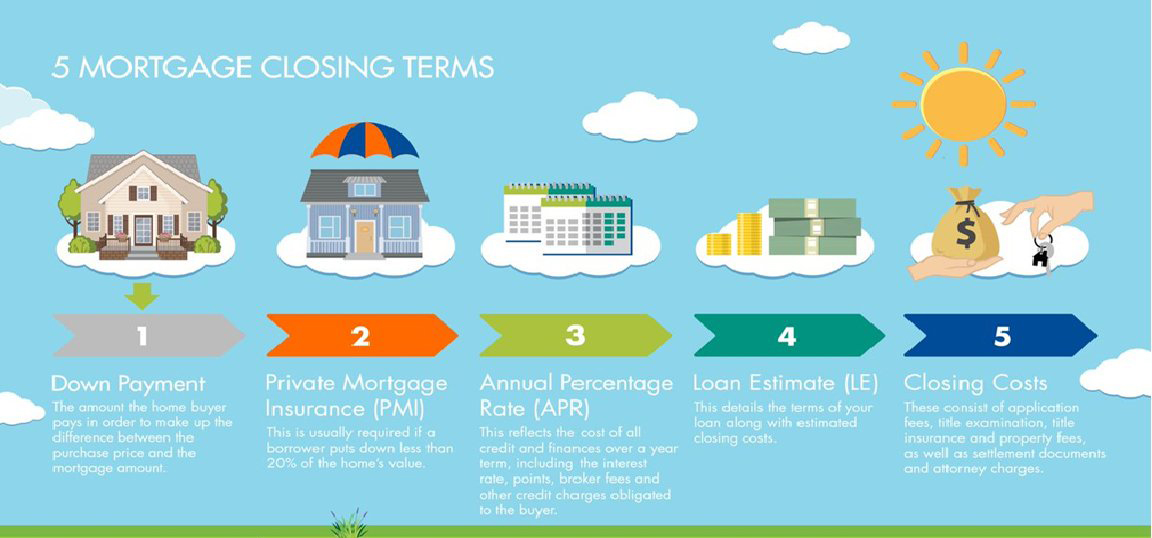

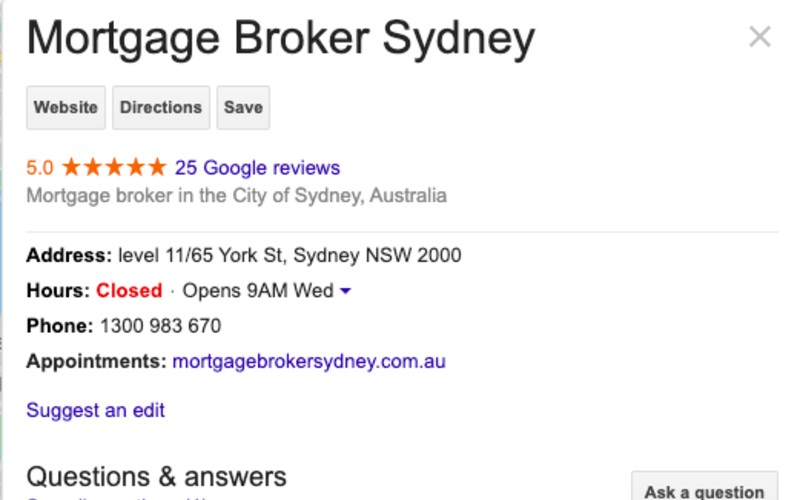

Loan broker mean. An individual or company which brings borrowers and lenders together for the purpose of loan origination but which does not originate or service the mortgages. A mortgage broker is an intermediary who can help you choose the best direct lender for you and get your loan application through the process. The broker determines an appropriate loan amount loan to value ratio and the borrowers ideal loan type then submits the loan to a lender for approval. Someone who locates banks that are willing to issue a mortgage that will meet the borrowers criteria.

As markets for mortgages have become more competitive however the role of the mortgage broker has become more popular. Mortgage brokers may have less control over your loan file because its not underwritten in house like with a mortgage banker. Mortgage broker one who facilitates transactions between mortgage borrowers and lenders. The mortgage broker does not issue the mortgage but instead receives a fee for matching the home buyer with the financial i.

Failing to do your research on mortgage brokers could mean ending up with a broker who improperly structures your loan delays your closing date or makes the homebuying process tedious and difficult. How does a broker loan work. The broker communicates with the. Sba loans are essentially conventional loans provided by banks community lenders credit unions and non profit lenders provided to small business and are backed by the small business administration.

Mortgage brokers are responsible for providing paper work between the parties and generally streamlining the process of. A mortgage broker acts as an intermediary who brokers mortgage loans on behalf of individuals or businesses. A sba commercial loan broker specializes in and should know the entire sba funding process like the bank of their hand. Traditionally banks and other lending institutions have sold their own products.

The broker might also negotiate with the lender to try and find the best possible financing deal possible for the borrower. Also known as a call loan or demand loan a broker loan is granted to a brokerage house in need of short term capital for financing clients margin portfolios.

/mortgage-149882_12801-12d1da3d4e15403c876034fa38194288.png)

/what-is-a-brokerage-account-356076_FINAL-5e0c3872c0684007b1d5595593c0c9d0.png)

/mortgage-broker1-4eb1e0febc8548dc8e1b26a407116fff.jpg)

/mortgage-broker1-4eb1e0febc8548dc8e1b26a407116fff.jpg)

:max_bytes(150000):strip_icc()/where-to-get-a-mortgage-1798459_colors_V_4_final-ebe027655b324a2cb9579b220f2b6247.png)

/mortgage-broker-3b0953175a7e4d90b99e937b79e0cd14.jpg)