Loan Calculator Quarterly Payments

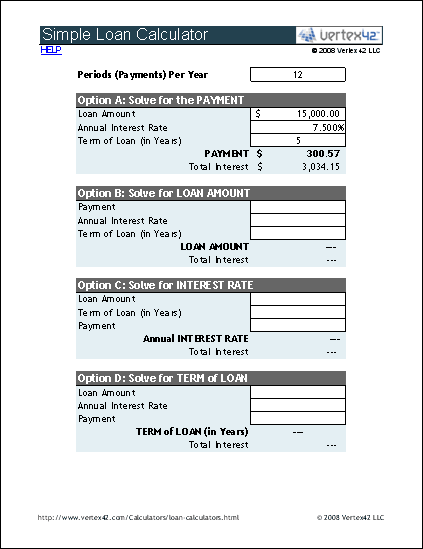

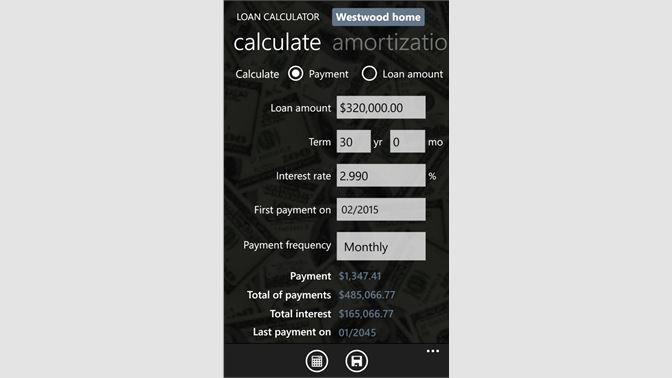

Calculate loan payments loan amount interest rate or number of payments.

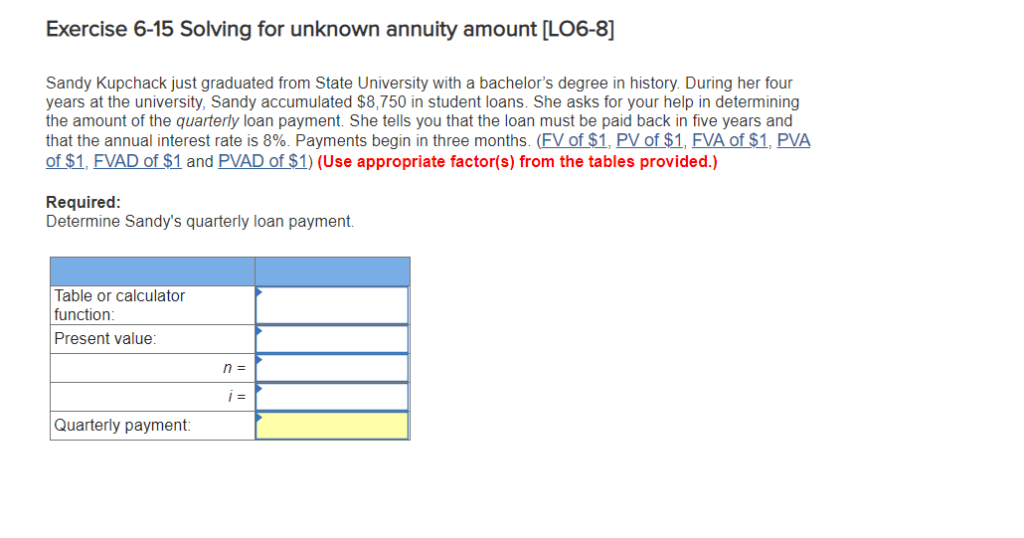

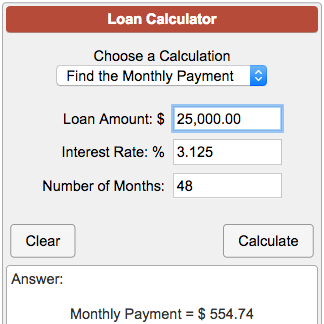

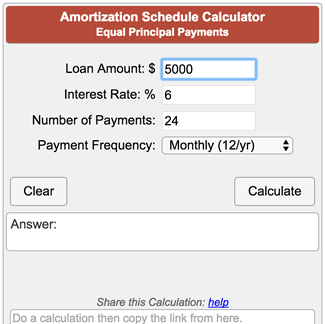

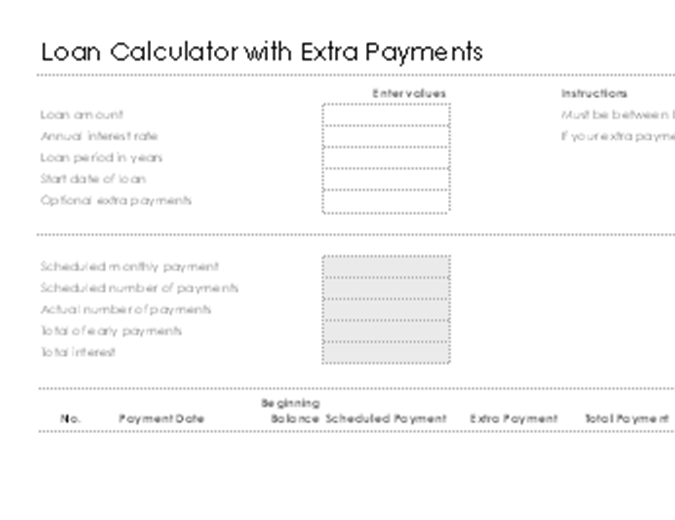

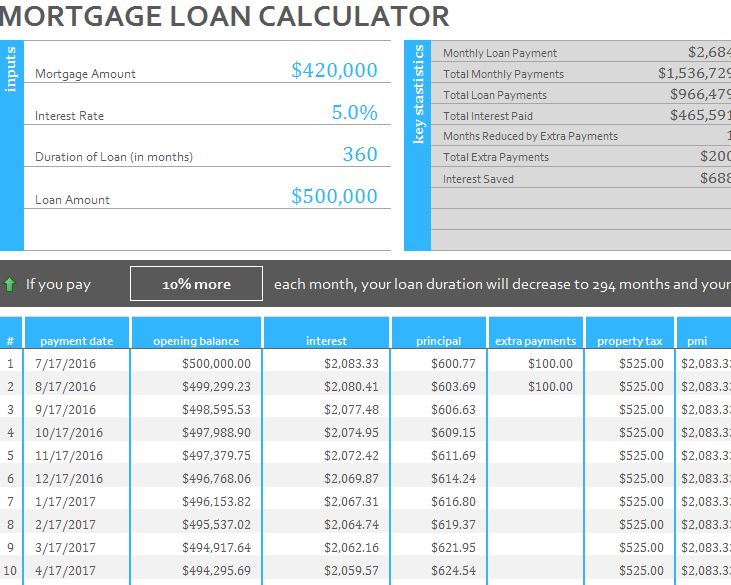

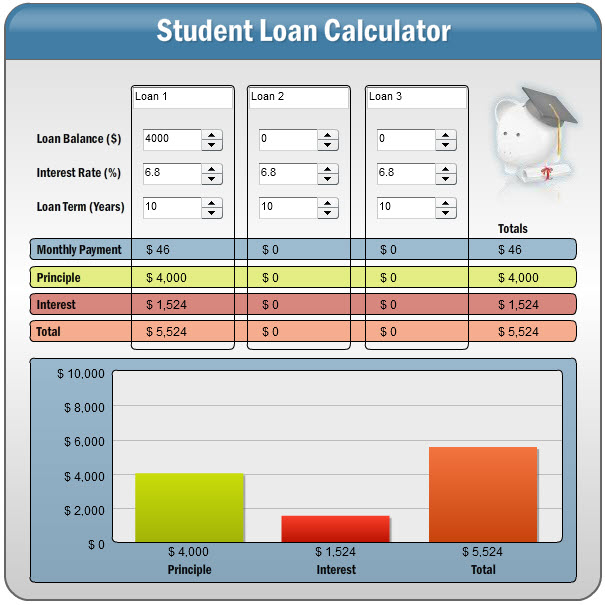

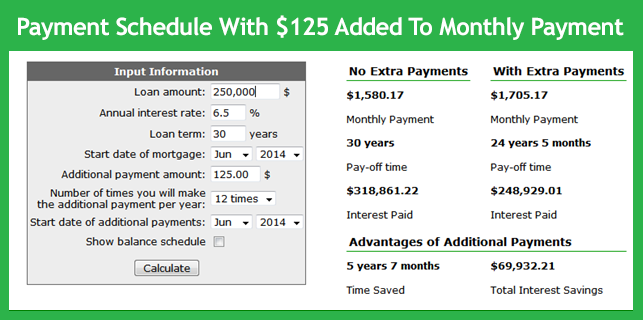

Loan calculator quarterly payments. Loan calculator showing lump sum payment made. Loan amount of quarters. For this example we want to find the payment for a 5000 loan with a 45 interest rate and a term of 60 months. Then add any other additional payments you would like to make be it one time weekly monthly quarterly or yearly.

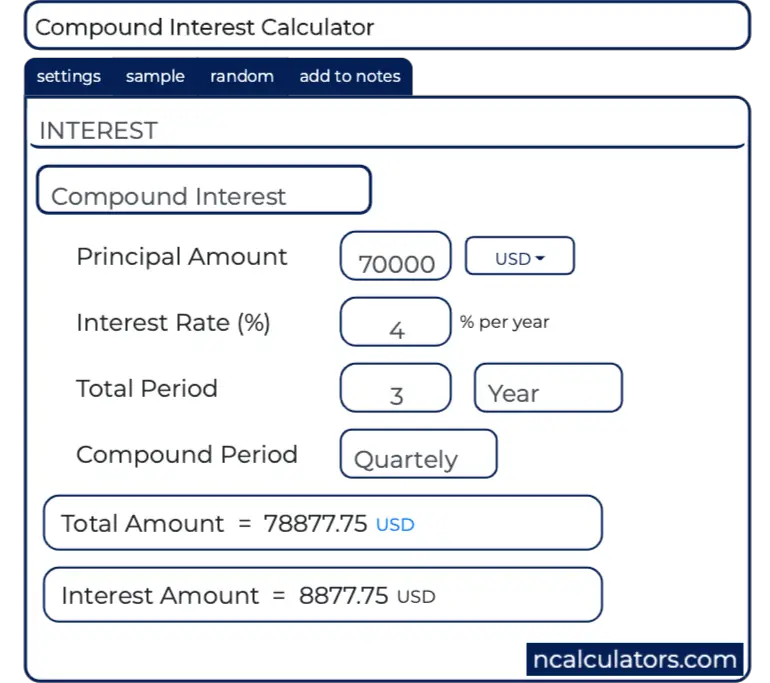

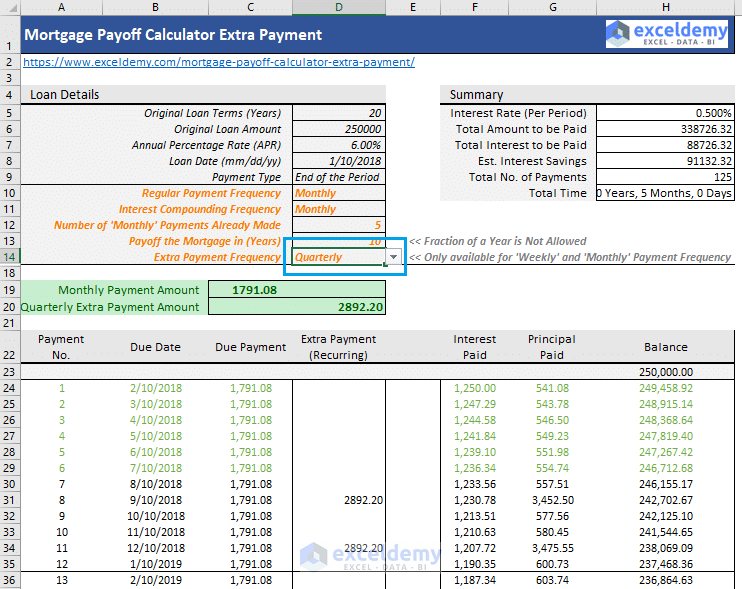

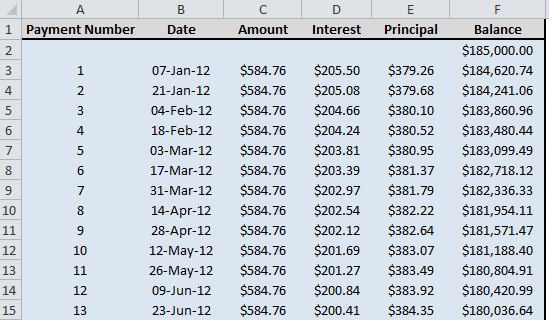

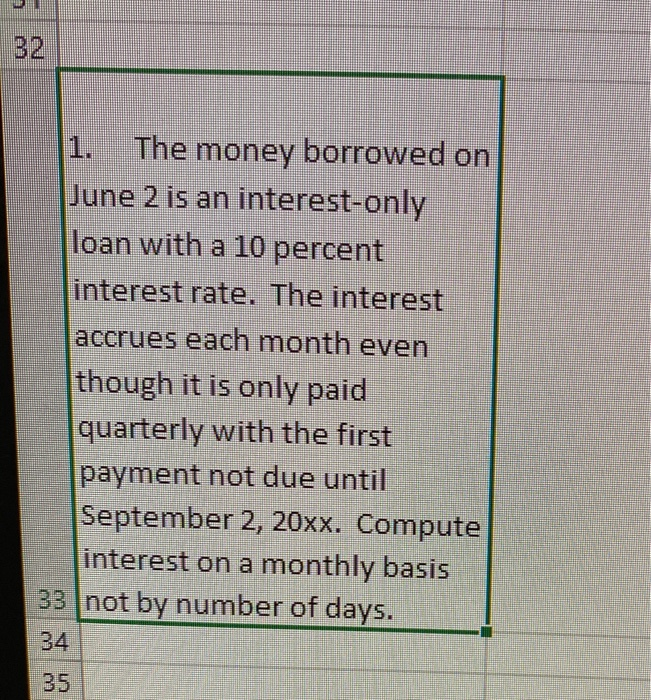

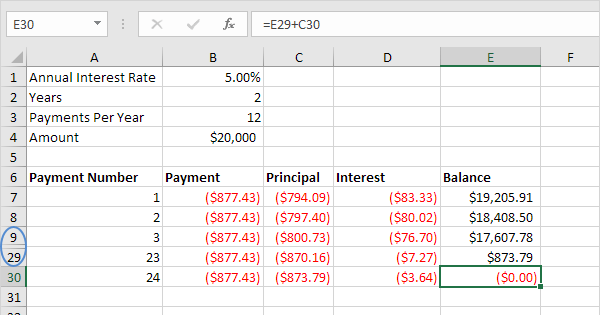

Then once you have computed the payment click on the create amortization schedule button to create a chart you can print out. Also learn more about different types of loans experiment with other loan calculators or explore other calculators addressing finance math fitness health and many more. Interest only loan is a payment plan that covers only the interest amount of the principal. Amortized due date is amortized and interest is collected through the due date.

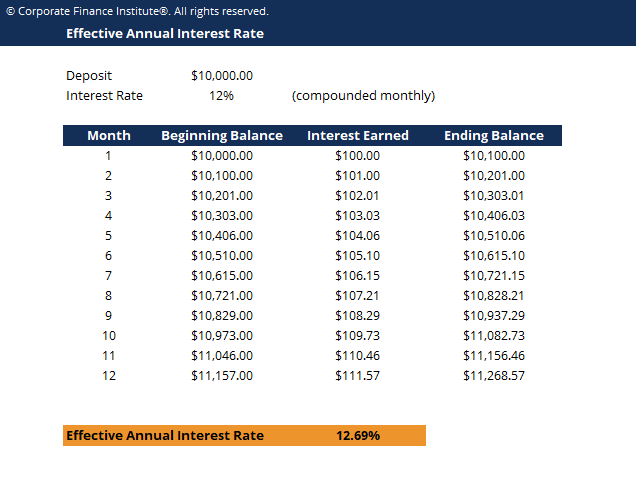

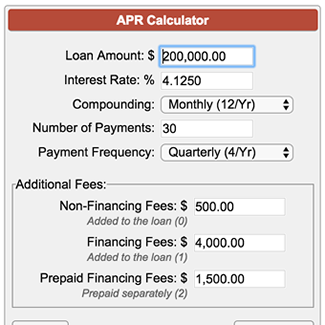

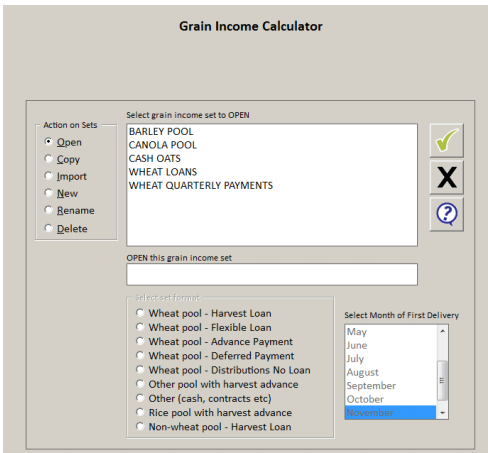

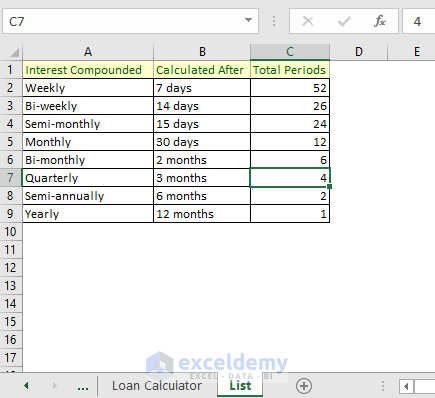

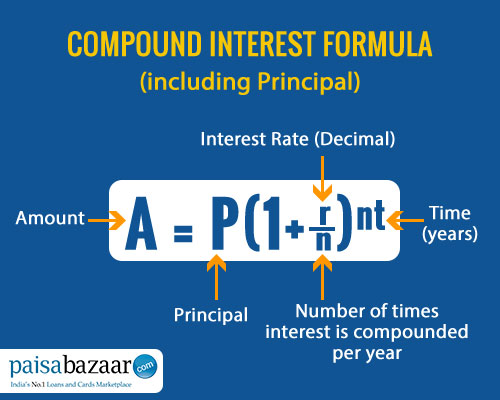

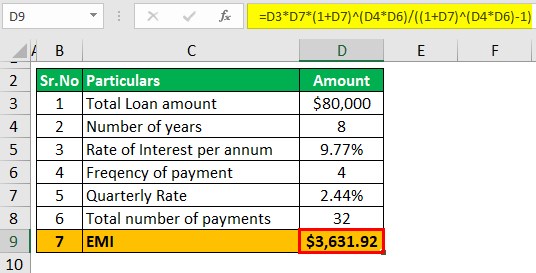

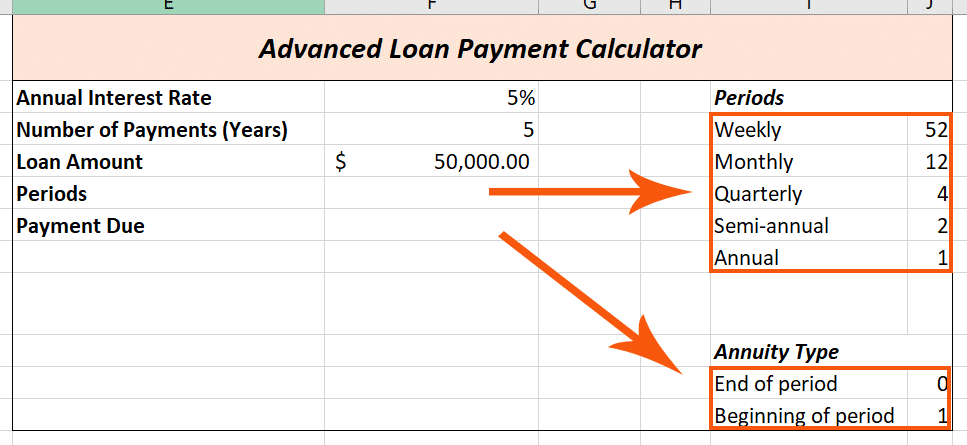

In other instances such as tax payments quarterly payments are usually made on commercial loans such as a loan from a bank. Using multiple payment ranges. Amortized paid date is a repayment plan that consists of both principal and interest. Interest rate decimal compounded.

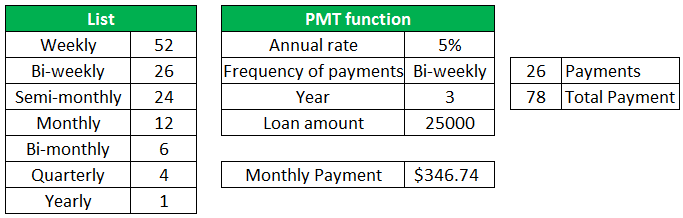

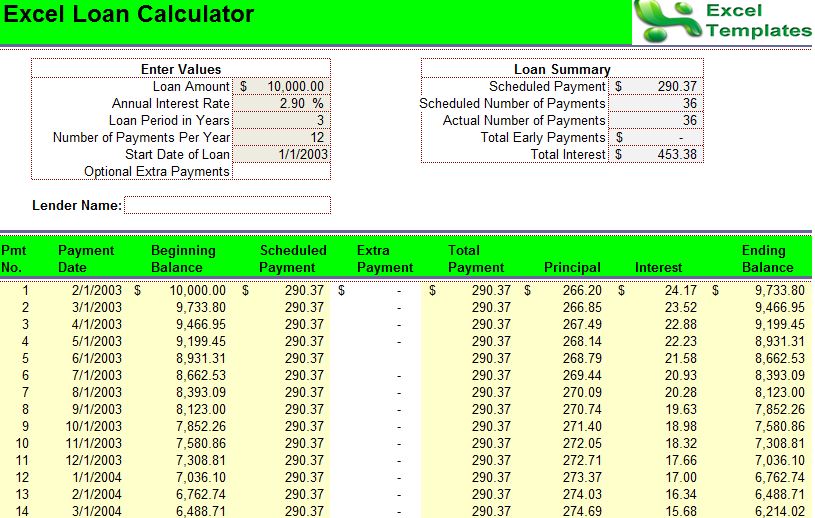

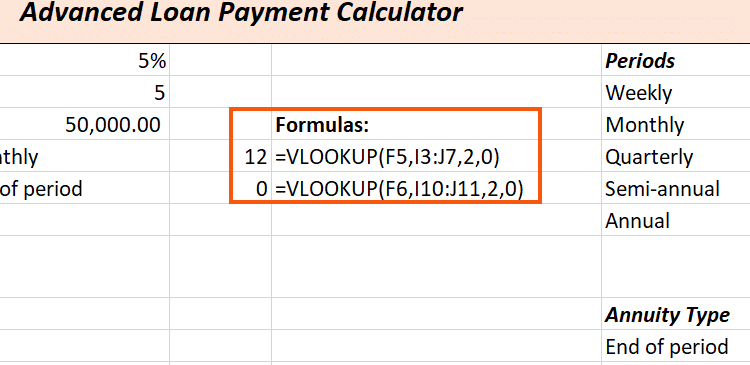

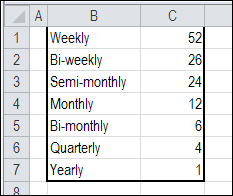

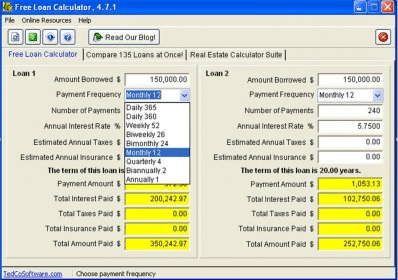

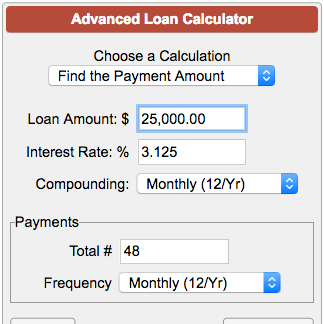

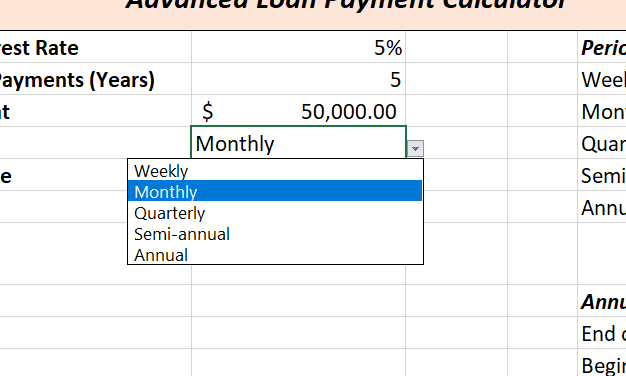

Free loan calculator to determine repayment plan interest cost and amortization schedule of conventional amortized loans deferred payment loans and bonds. Quarterly payment loan calculator enter the interest rate and two more fields then press the button next to the field to calculate. Whether you are making payments on your home car or business depending on the lender loans are repaid in biweekly monthly bimonthly or quarterly payments. This calculator will compute a loans payment amount at various payment intervals based on the principal amount borrowed the length of the loan and the annual interest rate.

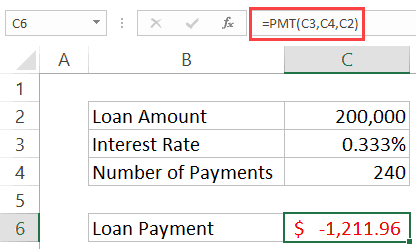

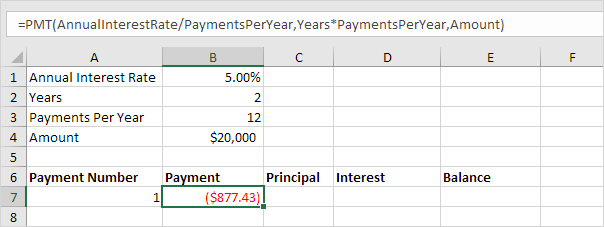

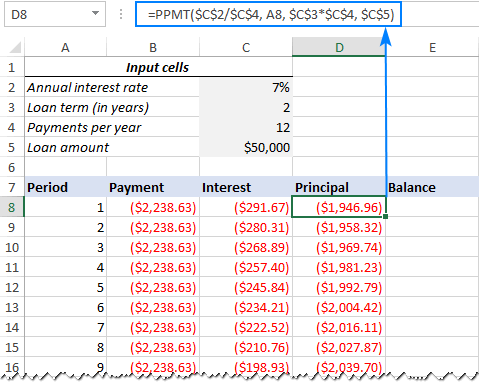

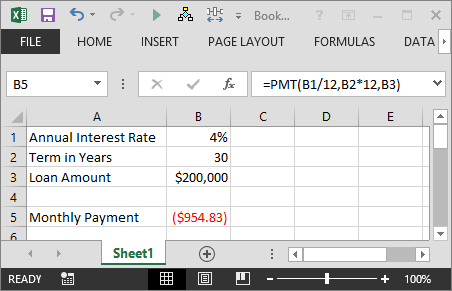

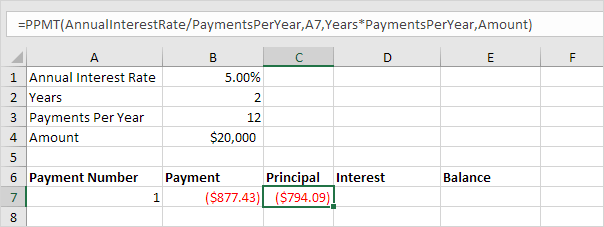

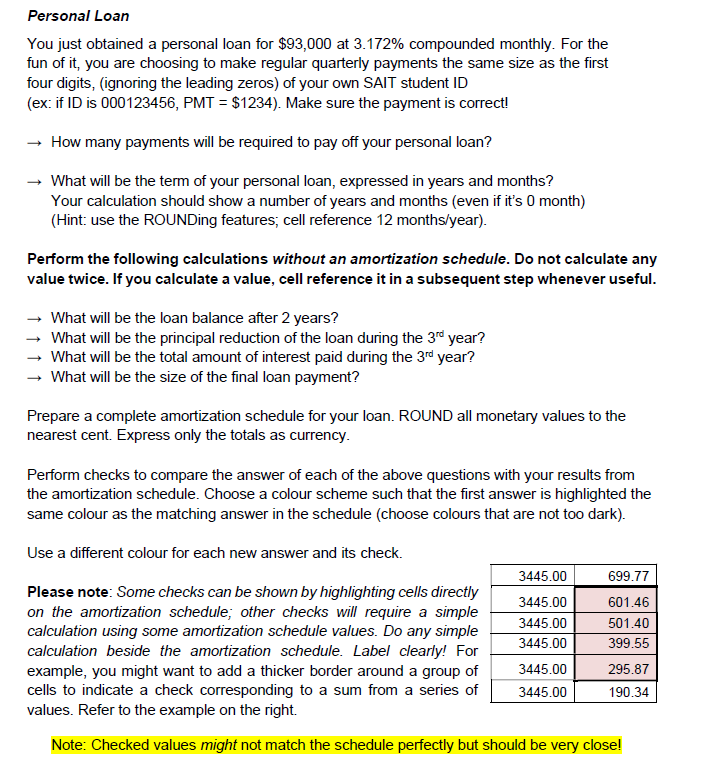

Upon agreeing to lend you the. The amortization method should be set to normal level payments unless you have a specific reason to set it to another method. Sample calculation for a loan of 10000 with 6 quarterly payments at 11 per year. You can use the pmt function to get the payment when you have the other 3 components.

Loans have four primary components. The amount the interest rate the number of periodic payments the loan term and a payment amount per period. Use this calculator to try different loan scenarios for affordability by varying loan amount interest rate and payment frequency. If the payments are made quarterly and the term is ten years then enter 40 for the total scheduled periods.

With interest only loans the monthly payments do not reduce. See the payment schedule for total interest saved. Enter your normal mortgage information at the top of this calculator.

/calculate-monthly-interest-92709ed0edc6470380a4444e2aecc37a.png)