Loan Capacity Definition

Capacity relates to soundness of mind and to an intelligent understanding and perception of ones actions.

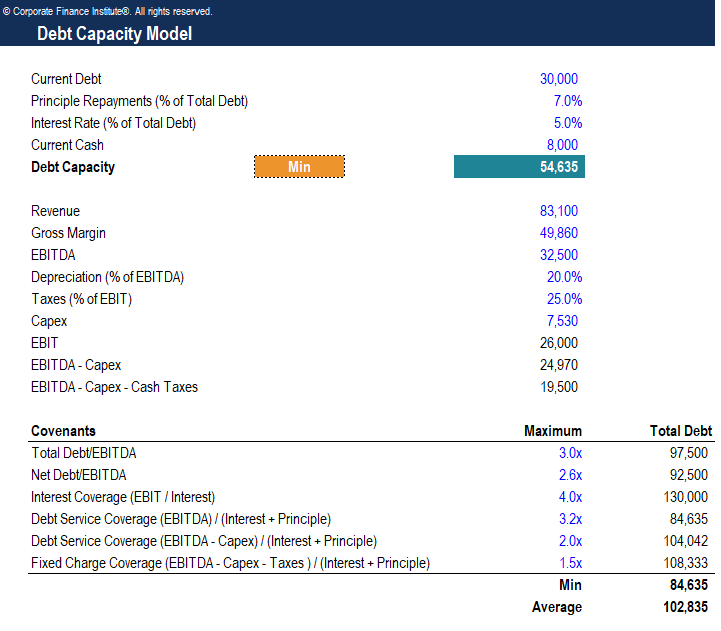

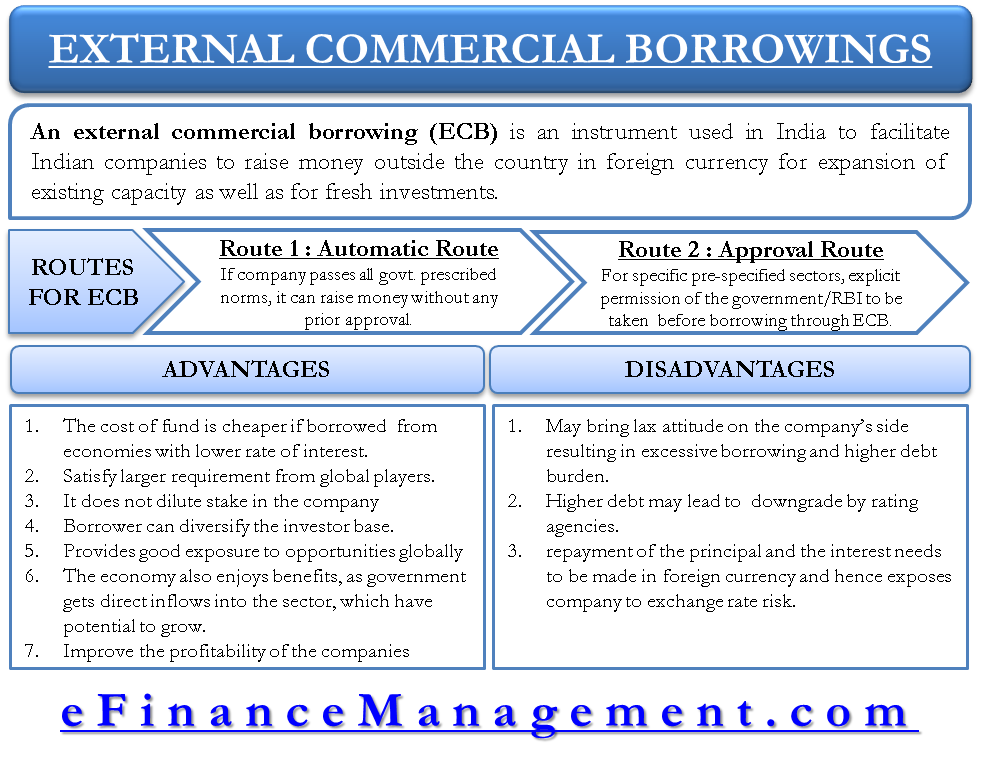

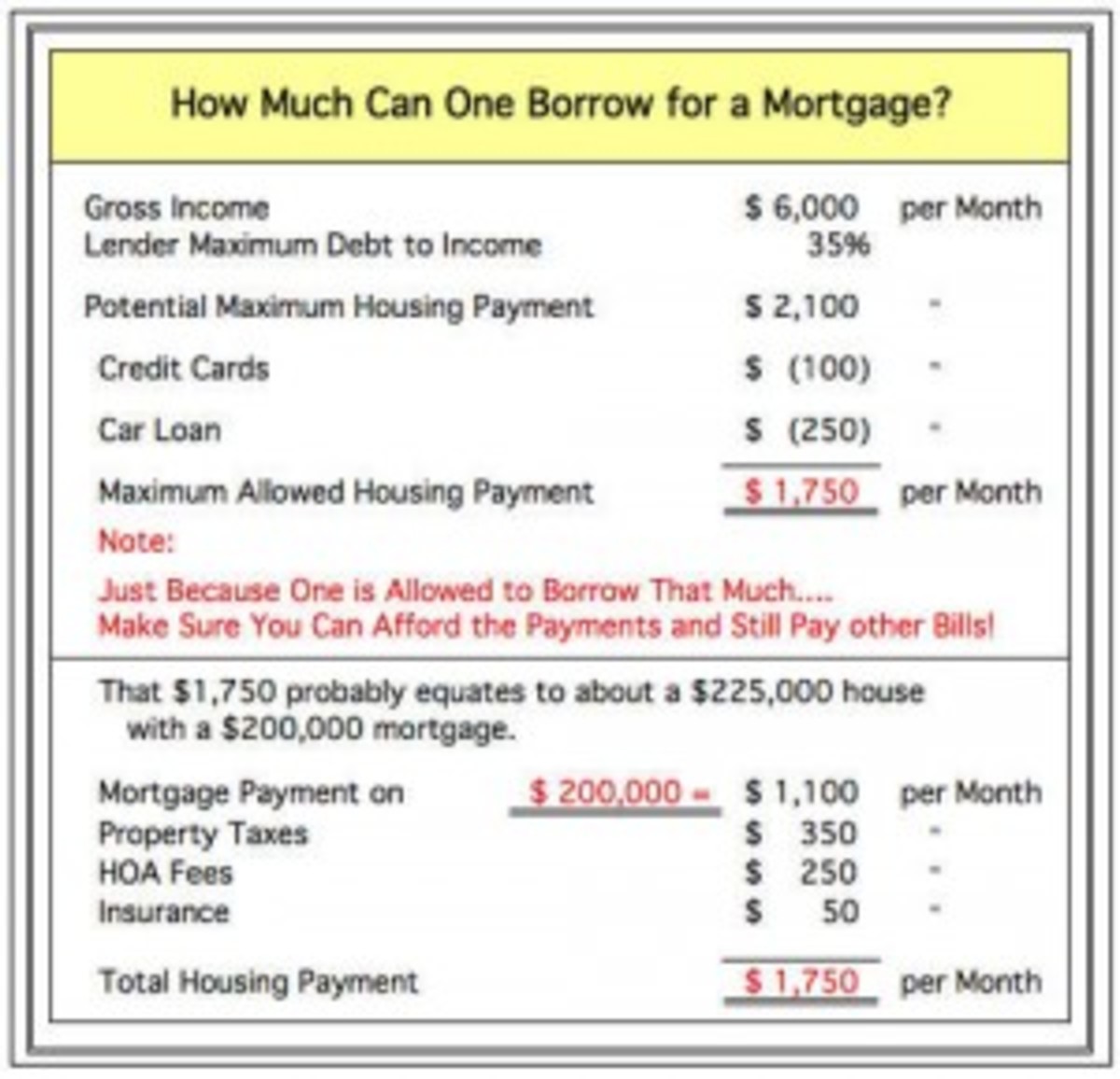

Loan capacity definition. In deciding whether you qualify for a particular loan your income is considered along with any other expenses and. The amount of money available for a company to borrow based on the companys current financial state. By definition credit capacity refers to how much credit you are able to handle. Planning for capacity requires management to accept limitations on the production process.

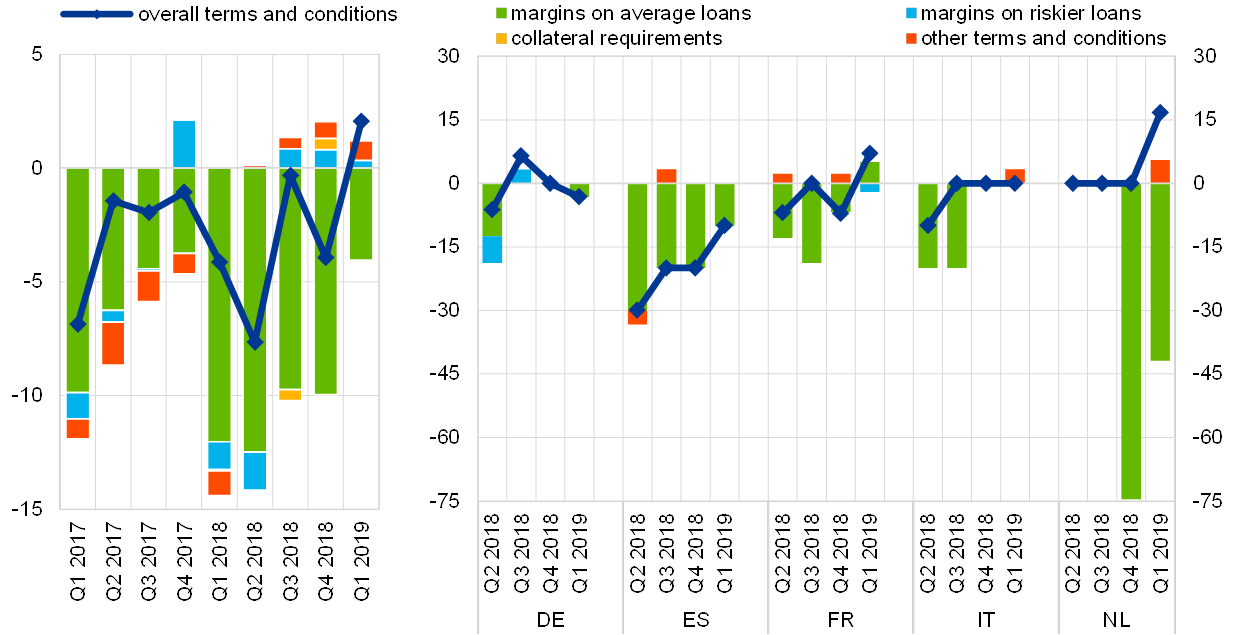

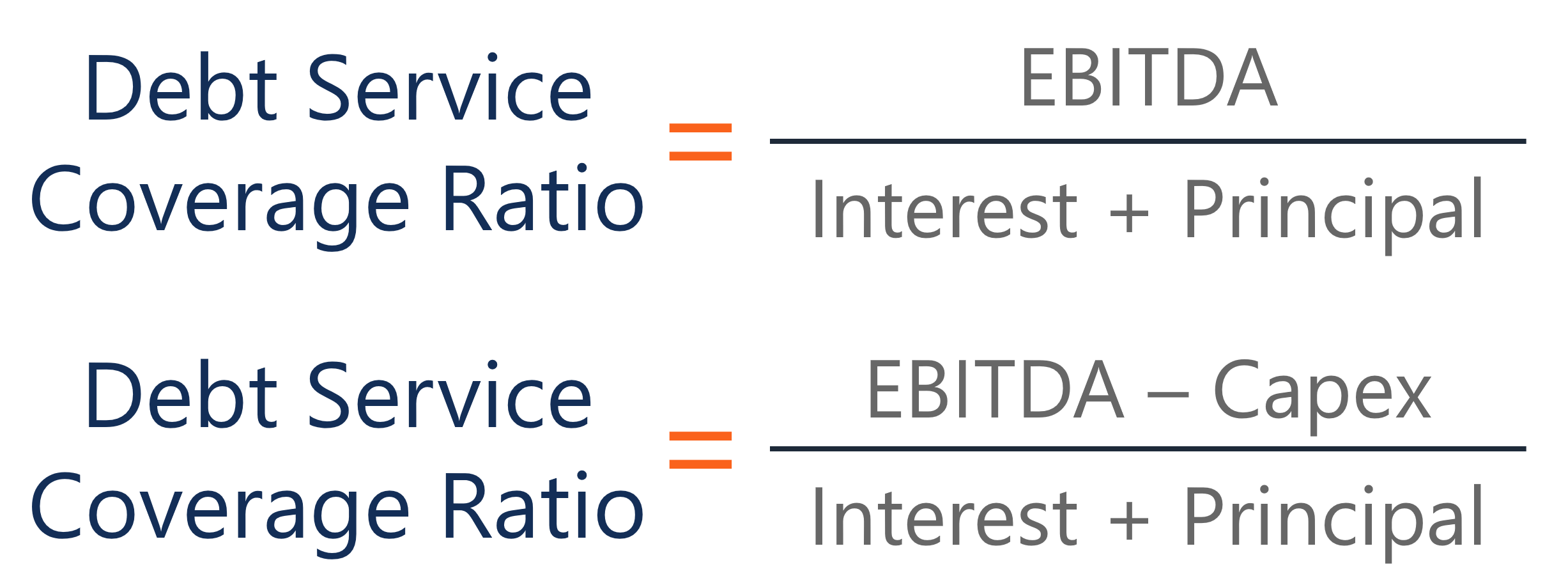

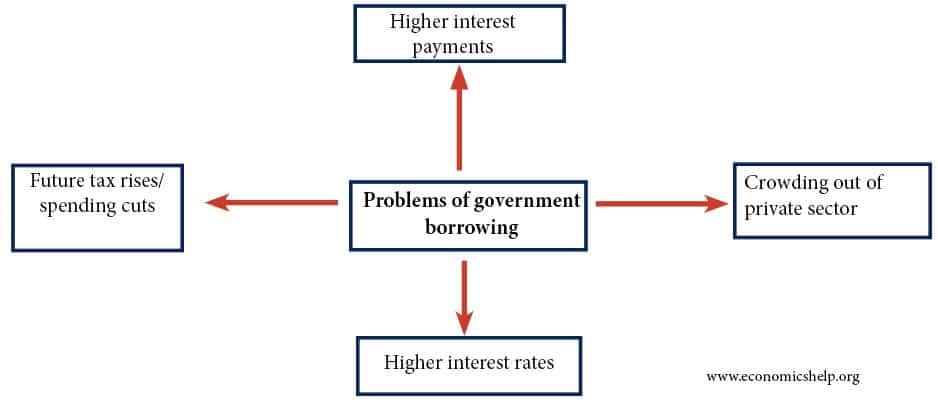

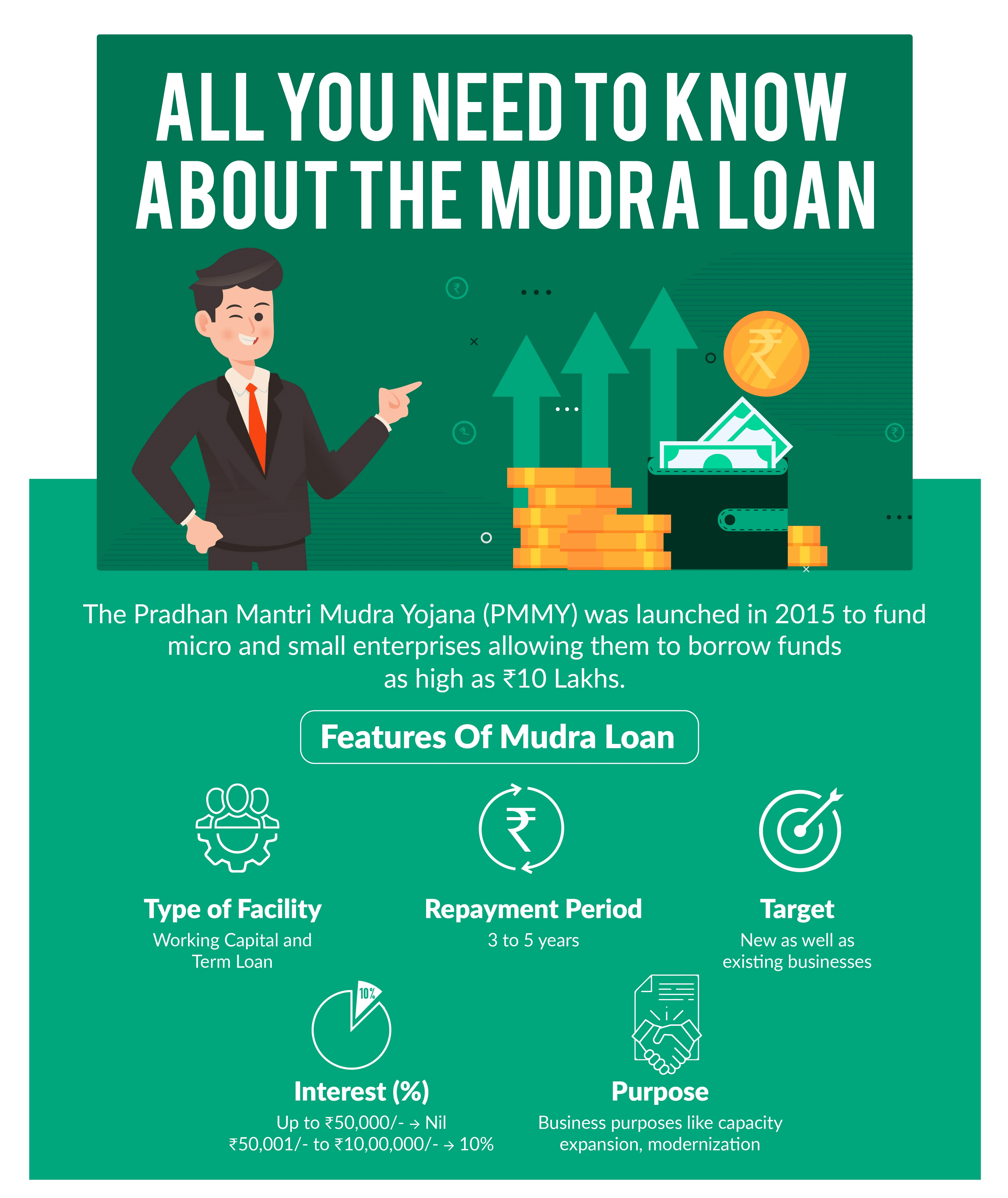

In particular it is important to note that the replacement margin is positive and that the replacement margin coverage ratio is greater than one. Borrowing capacity is a term used to describe the total monetary amount of loans or credit that a lender is willing to extend to a client. Capacity is the maximum level of output that a company can sustain to make a product or provide a service. The repayment capacity measures suggest that the case farm has sufficient funds to cover debt obligations and asset purchases.

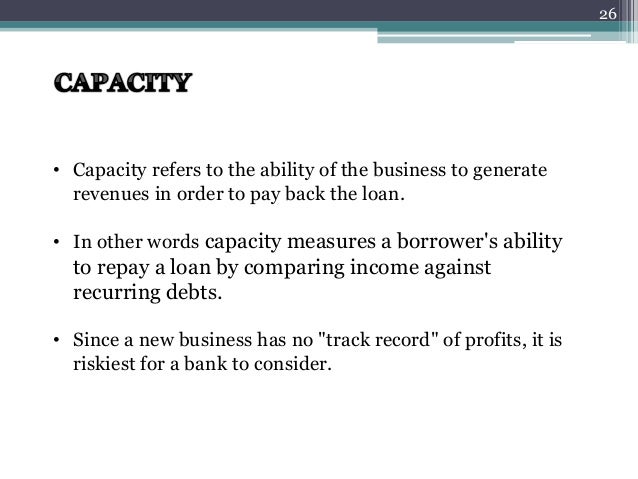

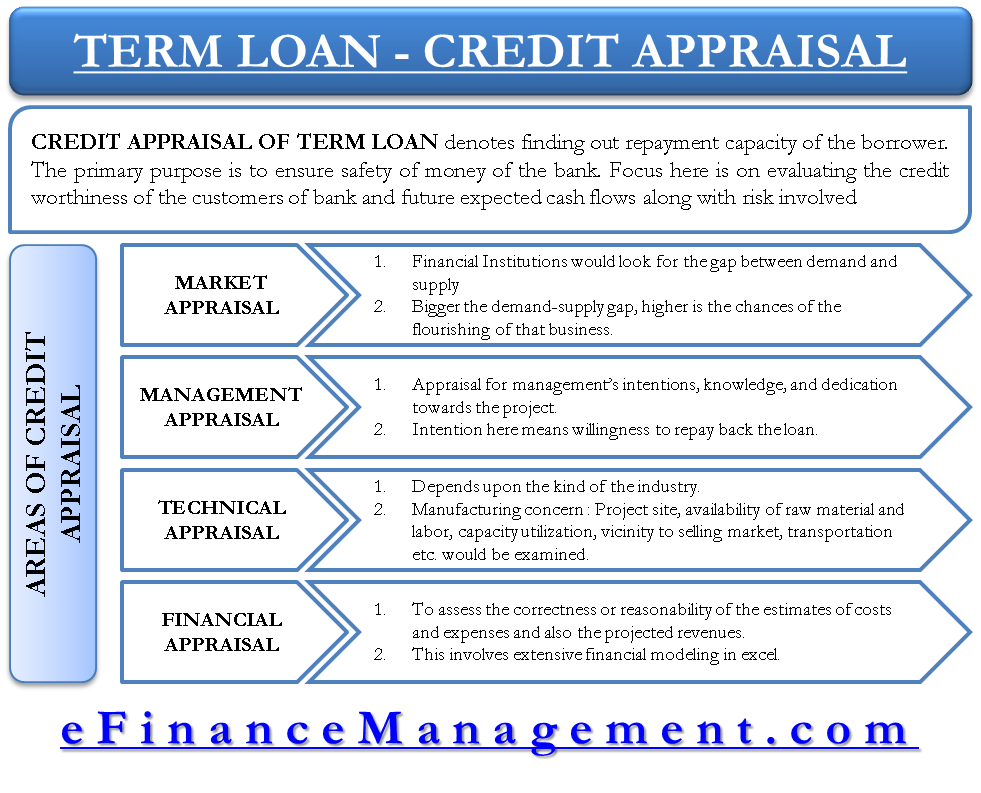

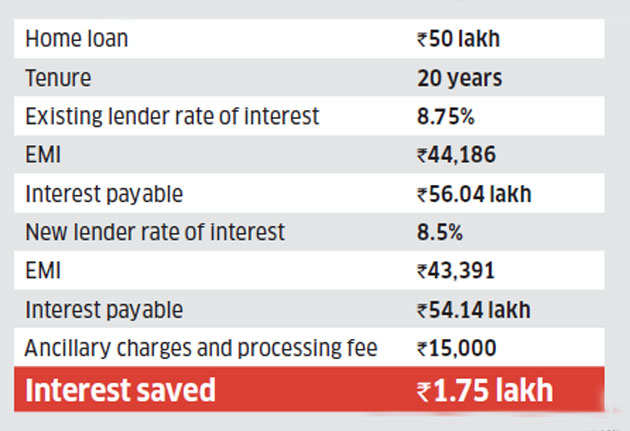

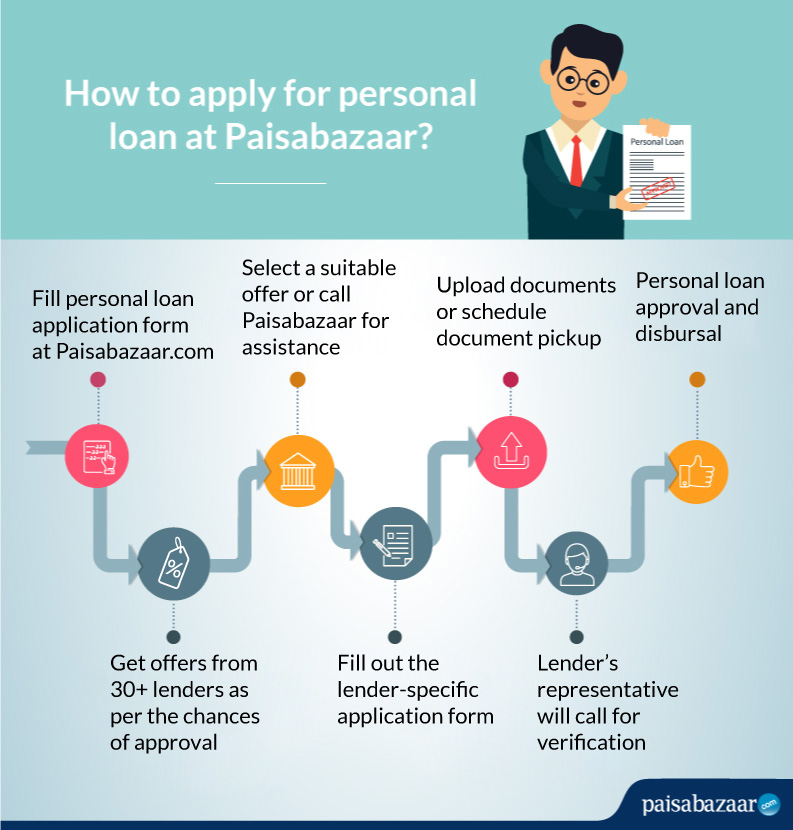

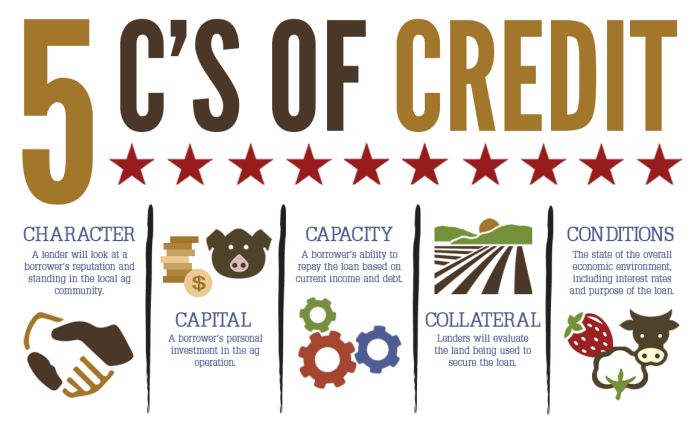

View your borrowing capacity and estimated home loan repayments. Capacity refers to the ability of the business to generate revenues to pay back the loan. A lender may also consider available collateral in determining borrowing capacity. If you are buying a business capacity is easier to determine and a business that can show a positive cash flow where income exceeds expenses for a sustained.

Companies rarely operate at full capacity both to allow themselves leeway in. It is the power either to create or to enter into a legal relation under the same conditions or circumstances as a person of sound mind or normal intelligence would have the power to create or to enter. Since a new business has no track record of profits it is riskiest for a bank to consider. Repayment is the act of paying back money previously borrowed from a lender.

For example an oil pump may have a capacity of x barrels per day meaning that it cannot produce more than x. Capacity the theoretical maximum number of products a company can produce at a given time. Repayment usually takes the form of periodic payments that normally include part principal plus interest in each. Estimate how much you can borrow for your home loan using our borrowing power calculator.

/having-good-credit-score-960528-finalv2-0a826f3392cc48dfb28f29123a805129.png)

:max_bytes(150000):strip_icc()/sofi_inv_new-e240ebec28eb47379e7a0734543fb463.png)

:max_bytes(150000):strip_icc()/mortgage_contract-5c4254734cedfd0001ce1a99.jpg)

/investopedia5cscredit-5c8ffbb846e0fb00016ee129.jpg)

:max_bytes(150000):strip_icc()/GettyImages-1185461736-c9a1ebe02ea14cbea0bffd973f38d7cb.jpg)

:max_bytes(150000):strip_icc()/prosper-inv-462fe620ddc1495aa4fb452ab913926c.png)