Loan Definition Business Tutor2u

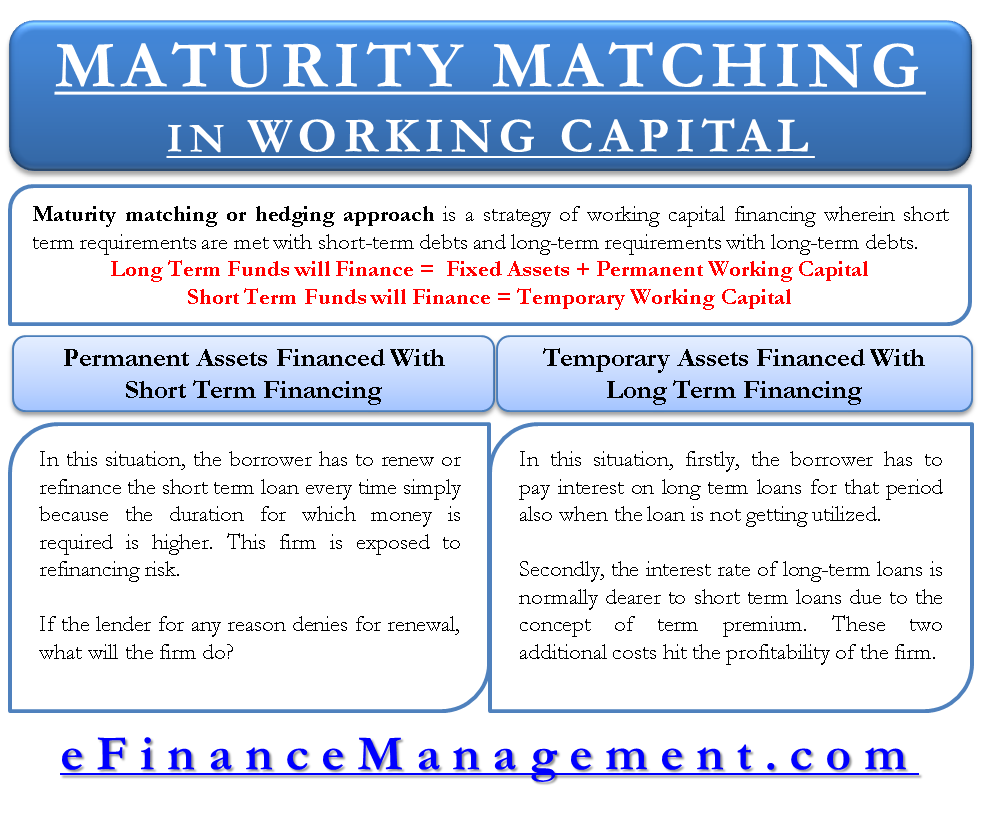

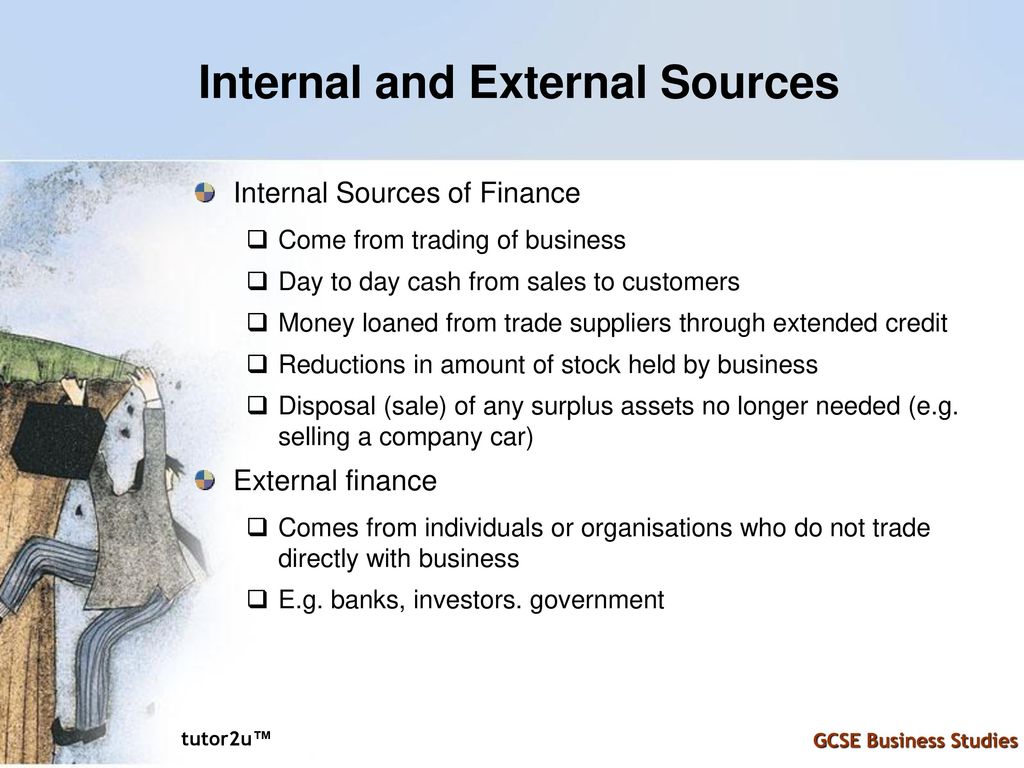

In the finance and business world the word capital used alone refers to funds invested in starting a business or expanding one plus machinery vehicles buildings etc.

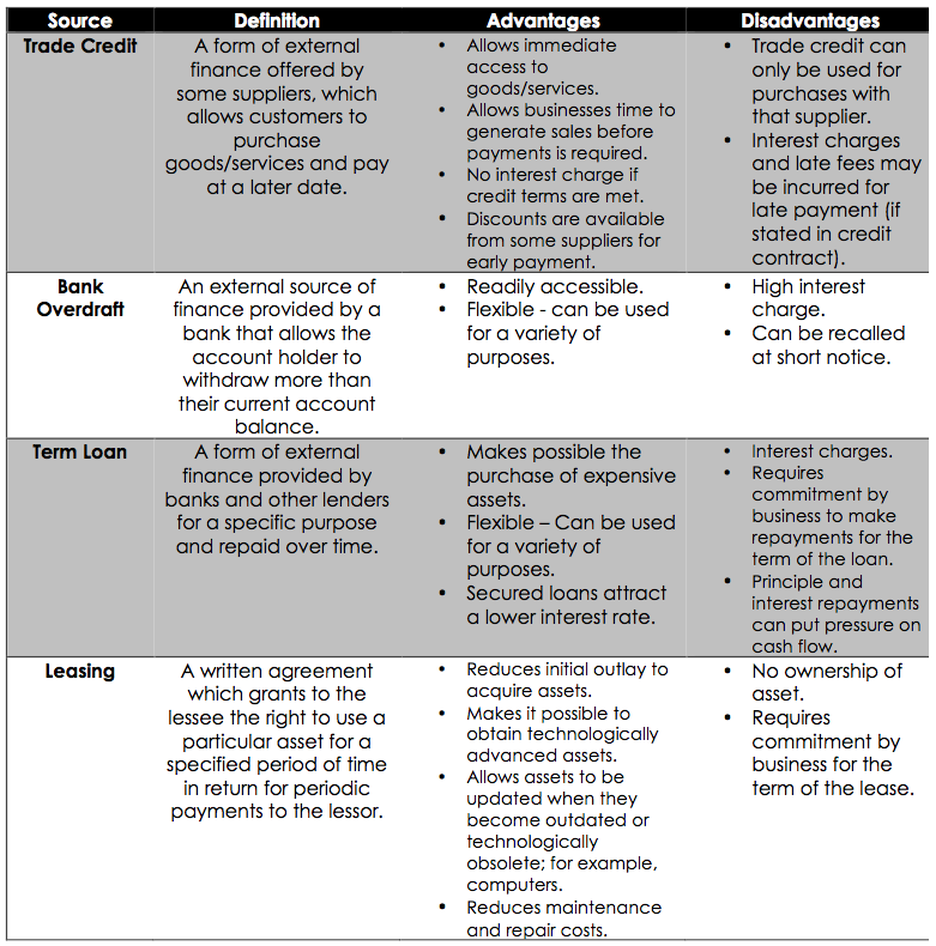

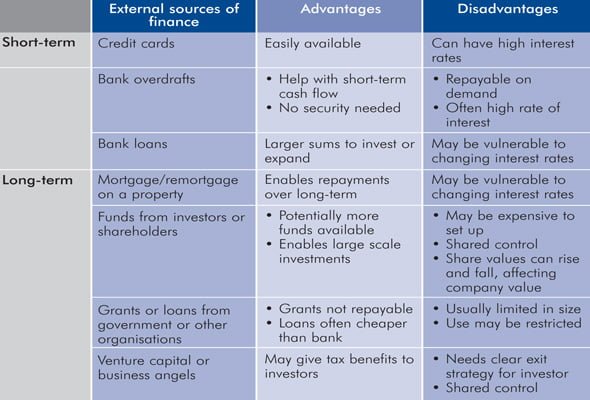

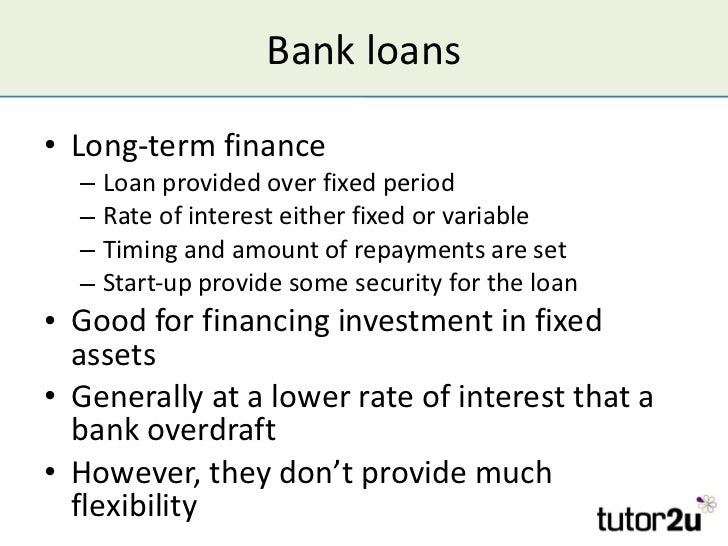

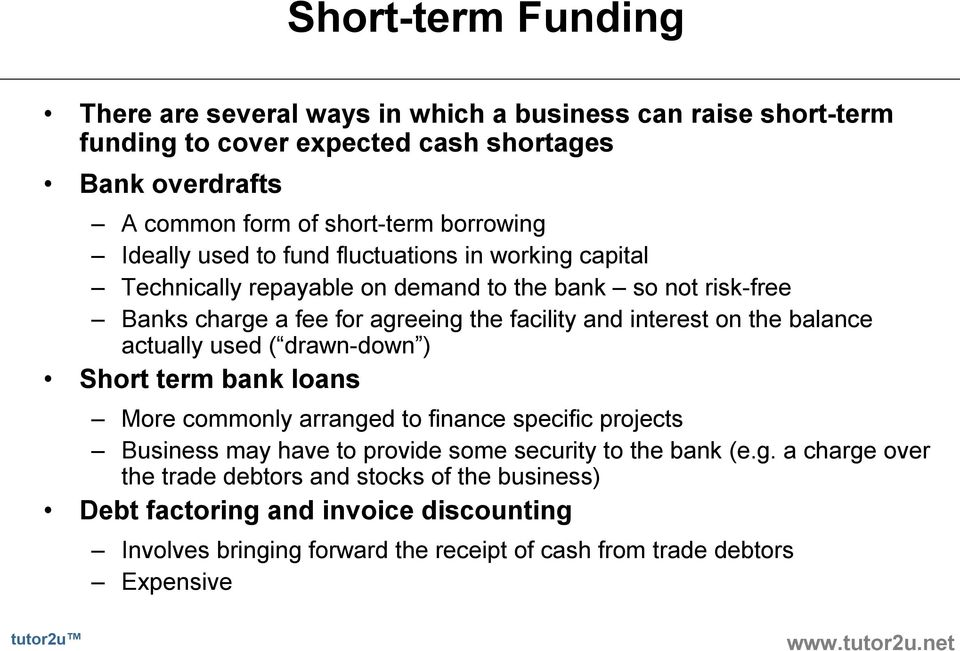

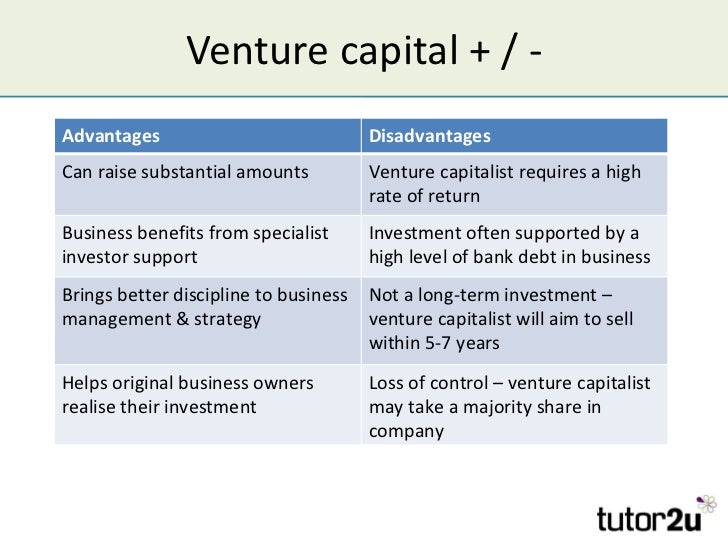

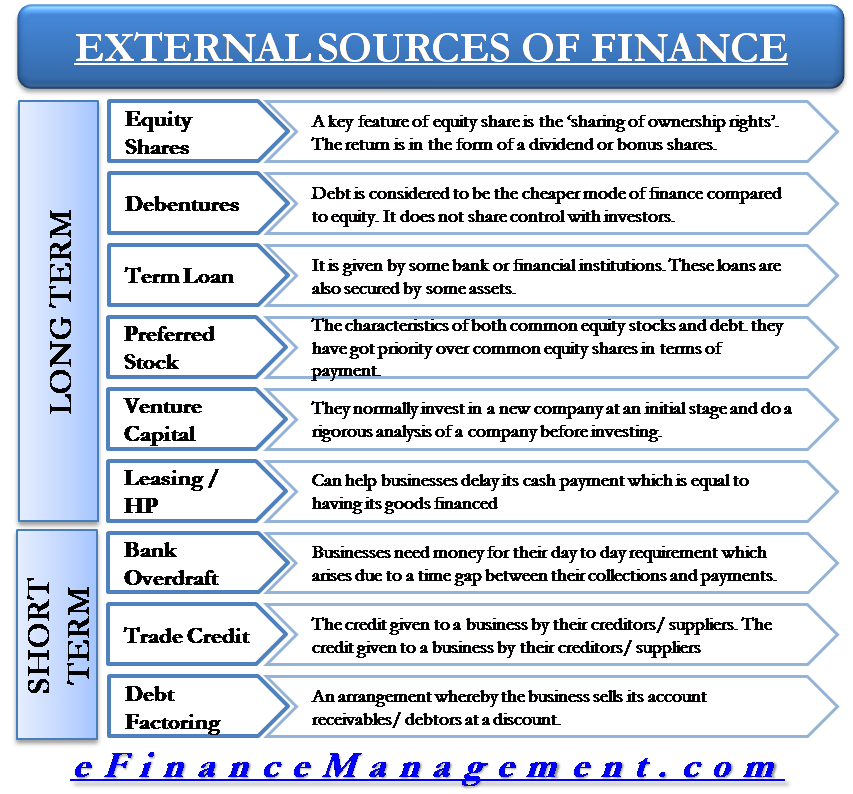

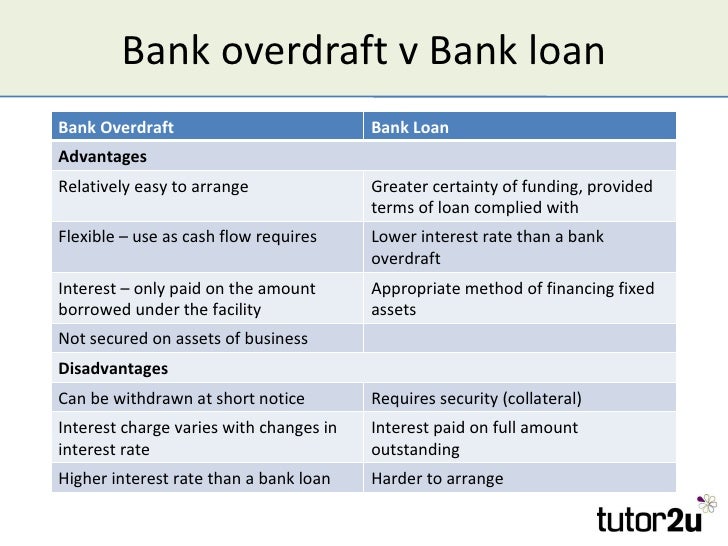

Loan definition business tutor2u. A bank loan provides medium or long term finance. Venture capital is a form of risk capital. Business tutor2u a bank loan is the most common form of loan capital for a business. The providers of loans are paid out before ordinary shareholders in the event that the business fails assuming there is some cash left.

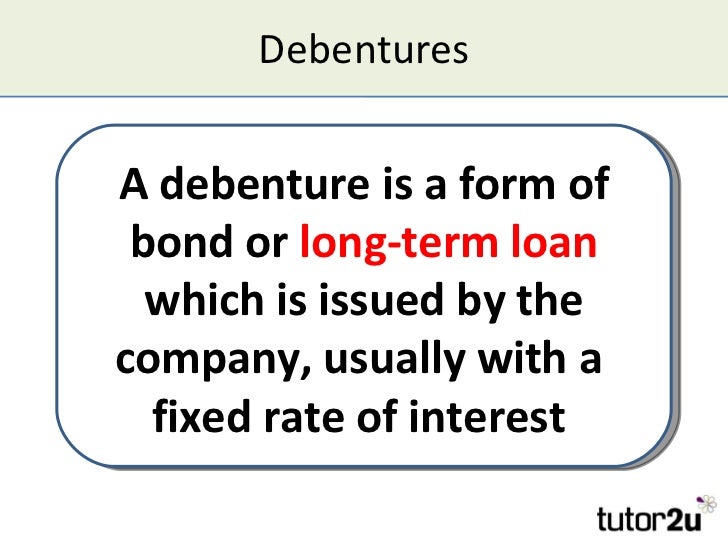

Qa what is a bank loan. The loan is committed the business does not have to worry about the loan being withdrawn whilst it complies with the terms of the loan subscribe to email updates from tutor2u business join 1000s of fellow business teachers and students all getting the tutor2u business teams latest resources and support delivered fresh in their inbox every. Debentures exist as an alternative form of investing in a company that is more secure than investing in shares because interest payments must be made by the company. The interest rates attached to most business loans are very good.

The bank becomes a secured creditor with collateral over the business assets. Boston house 214 high street boston spa west yorkshire ls23 6ad tel. A growing business might take a loan out for 50000 but finds it only needed 250000. However debenture holders have no share in the company itself.

3 5 or 10 years the rate of interest and the timing and amount of repayments. Banks are competing for customers so they are obligated to offer a deal which is at least in line with what their competitors are offering. 3 5 or 10 years the rate of interest and the timing and amount of repayments. Subscribe to email updates from tutor2u business join 1000s of fellow business teachers and students all getting the tutor2u business teams latest resources and support delivered fresh in their inbox every.

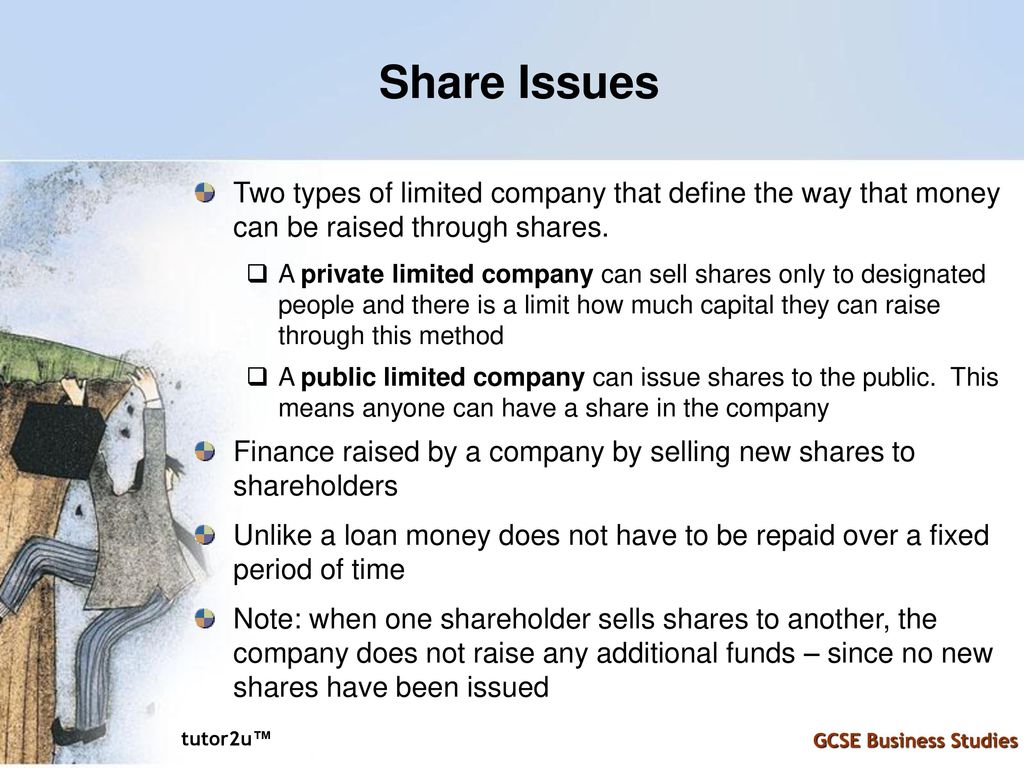

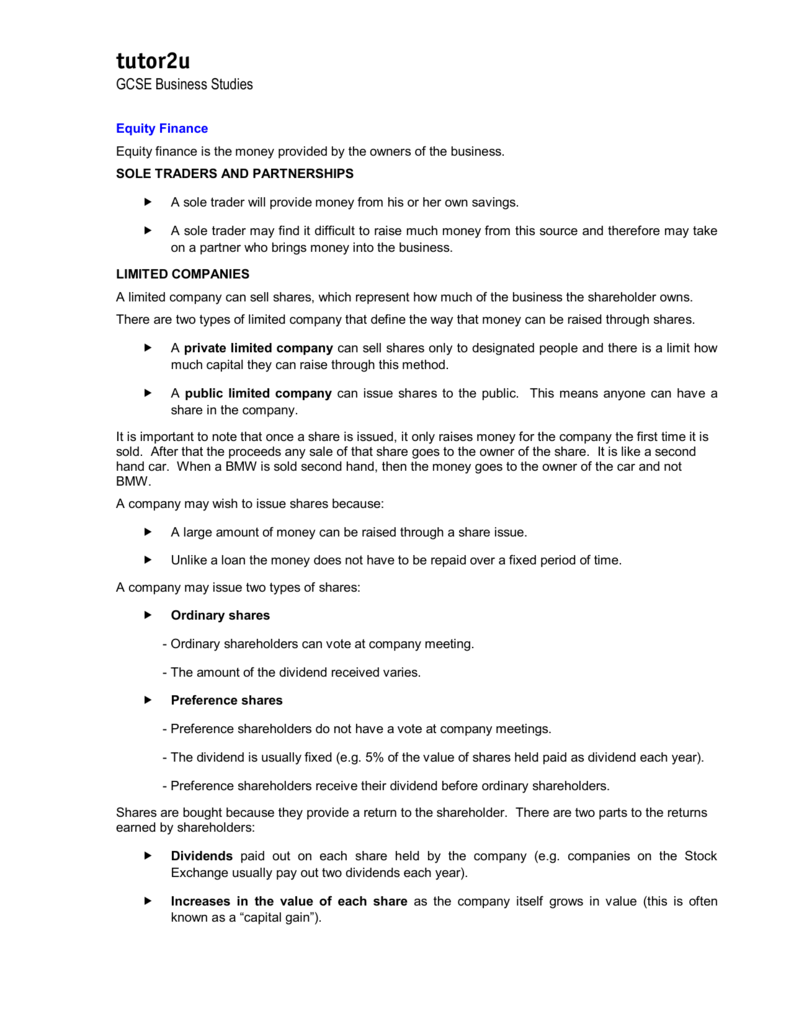

A bank loan provides medium or long term finance. They can also include a security that will guarantee the investment even if it defaults and there are two different ways for the debenture to be secured. If the business fails then the bank has first call on what is left before the shareholders. Risk capital is invested as shares equity rather than as a loan and the investor requires a higherrate of return to compensate him for his risk.

Of course the interest rates are still going to allow enough room for the banks to see a healthy return on their profits. 44 0844 800 0085 fax. The bank sets the fixed period over which the loan is provided eg. The bank sets the fixed period over which the loan is provided eg.

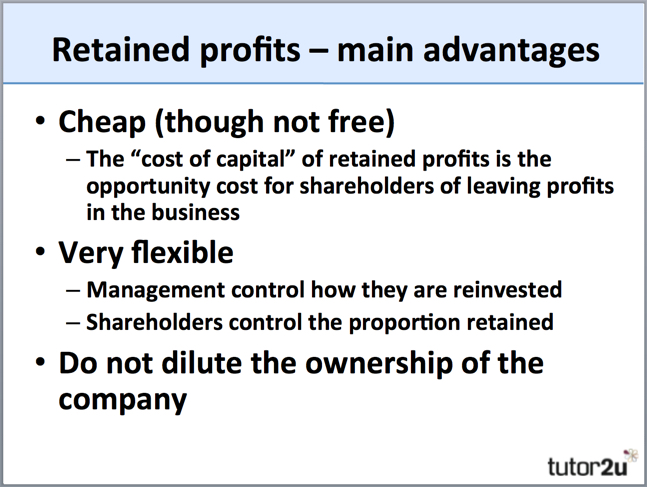

In other words capital that is invested in a project in this case a business where there is a substantial element of risk relating to the future creation of profits and cash flows.