Loan Government Guarantee

We would like to show you a description here but the site wont allow us.

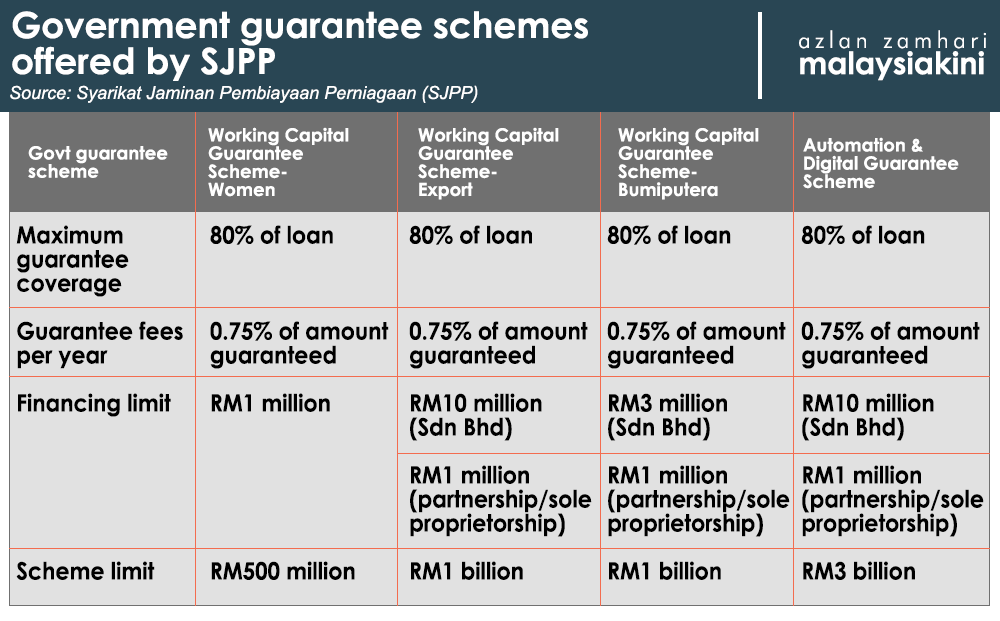

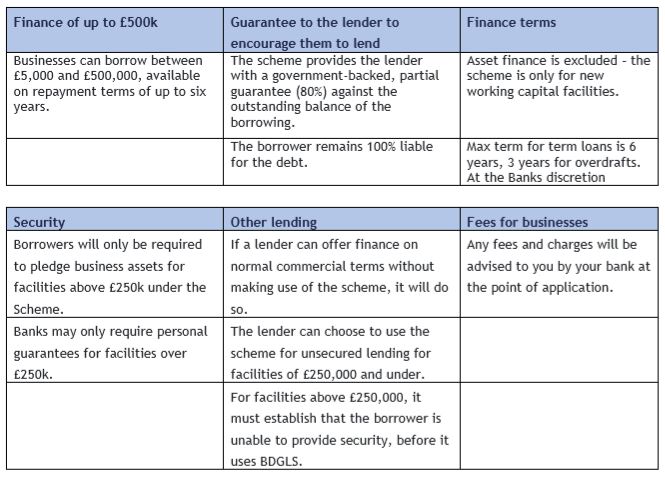

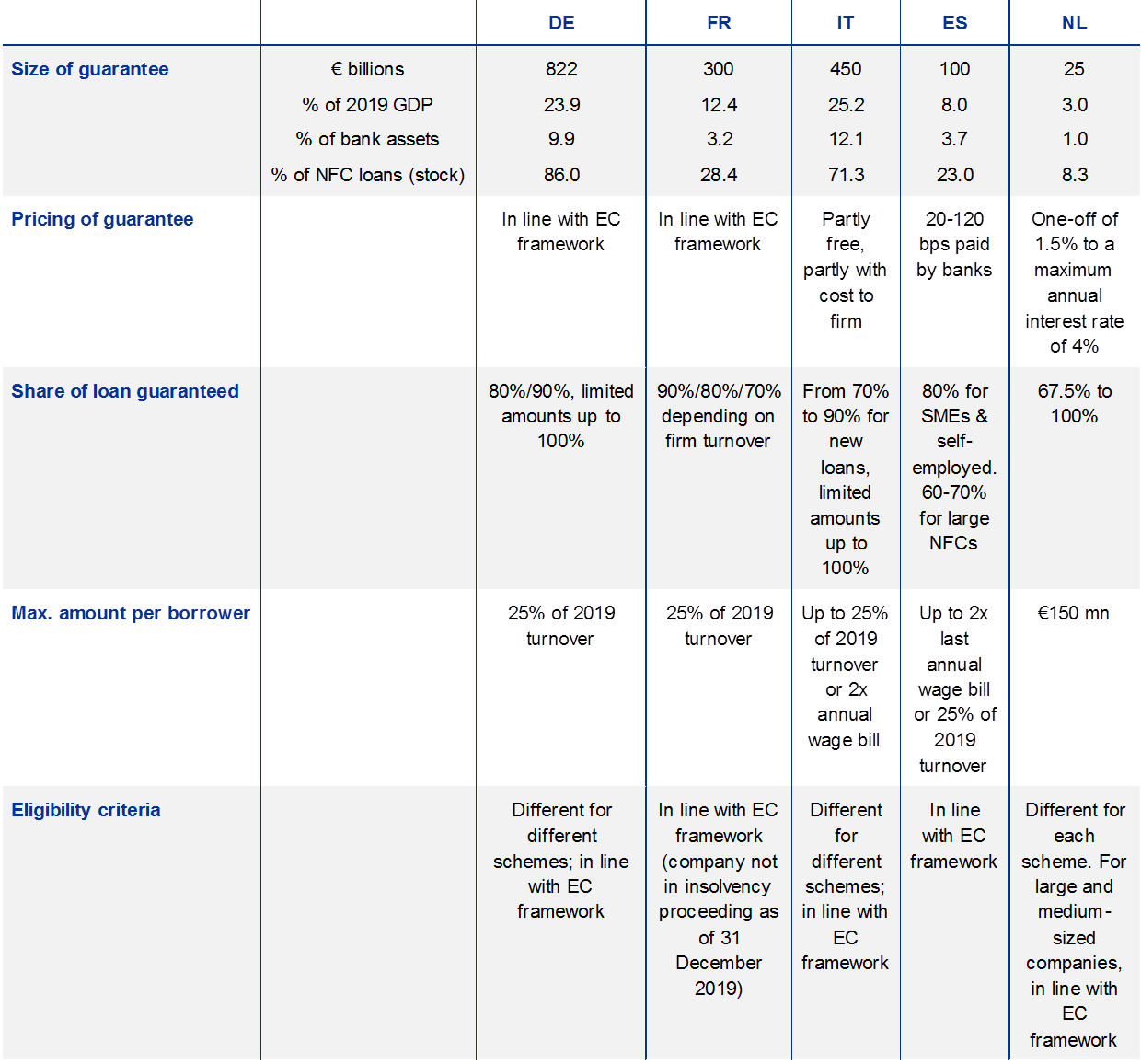

Loan government guarantee. The coronavirus small and medium enterprises sme guarantee scheme will support up to 40 billion of lending to smes including sole traders and not for profits. The scheme will enhance lenders willingness and ability to provide credit supporting many otherwise viable smes to. The loan guarantee is applicable to smes in all sectors including those mostly affected by the coronavirus outbreak such as retail outlets travel agents restaurants cinemas karaoke establishments and transport operators etc. The loans will be guaranteed by the government with a total loan amount of hk20 billion.

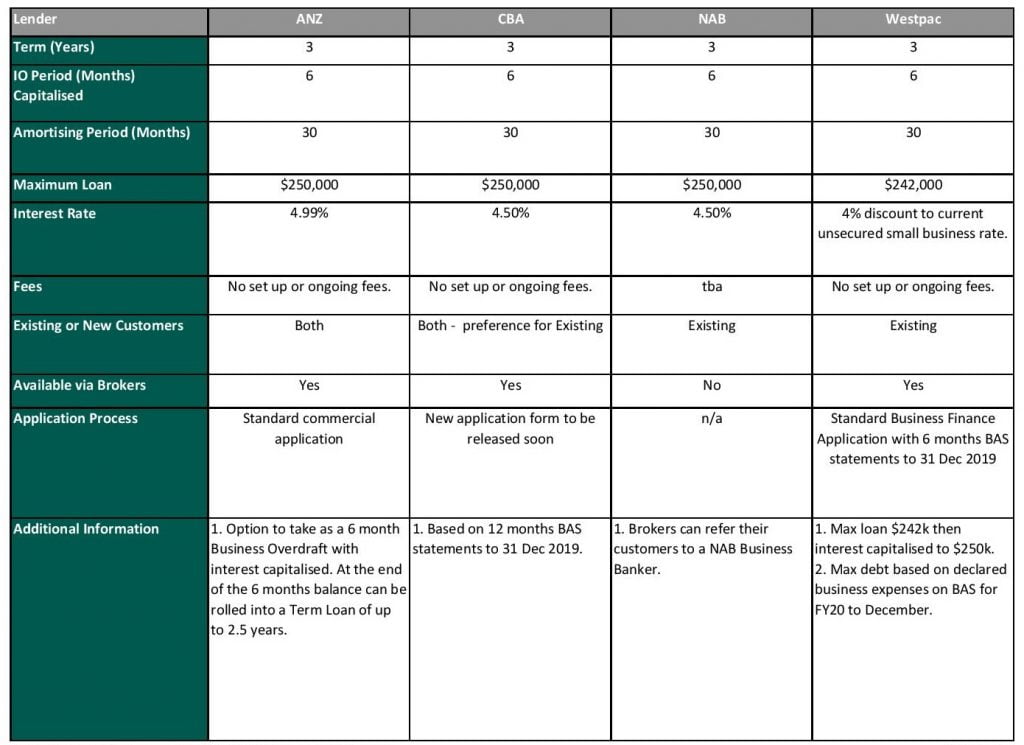

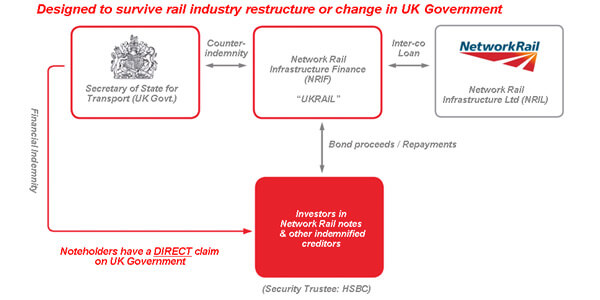

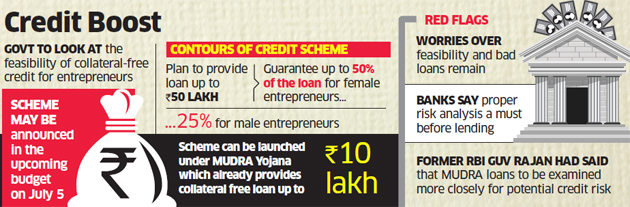

The government will provide up to 20 billion in loan guarantees for banks. Government and commercial banks are sharing the risks of these loans. A guaranteed loan is a loan that a third party guaranteesor assumes the debt obligation forin the event that the borrower defaults. A government backed business loan is a loan that the government provides a guarantee to the lender on.

After 12 months the interest rate will be 25 a year. Sometimes a guaranteed loan is guaranteed by a government. The covid 19 loan guarantee scheme is an initiative to provide loans guaranteed by government to businesses with an annual turnover of less than r300 million to meet some of their operational expenses. For covid 19 government backed business loans this guarantee is 50 of the funding amount.

Ryan stuart the policy which came out of talks between bankers and government officials will see the federal. The government guarantees 100 of the loan and there wont be any fees or interest to pay for the first 12 months. Most loan guarantee programs are established to correct perceived market failures by which small borrowers regardless of creditworthiness lack access to the credit resources available to large borrowers.

/cloudfront-us-east-1.images.arcpublishing.com/expressandstar.mna/BMA4UV2ZPFFENKY45NLOCIIBJY.jpg)

/arc-anglerfish-syd-prod-nzme.s3.amazonaws.com/public/D5OF2VNIFZEFPMTJ24B7CWONFY.jpg)