Loan Guarantor Criteria

Honesty is the best policy.

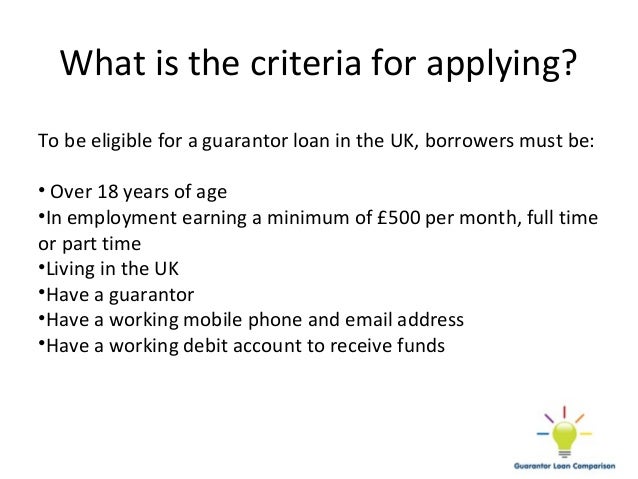

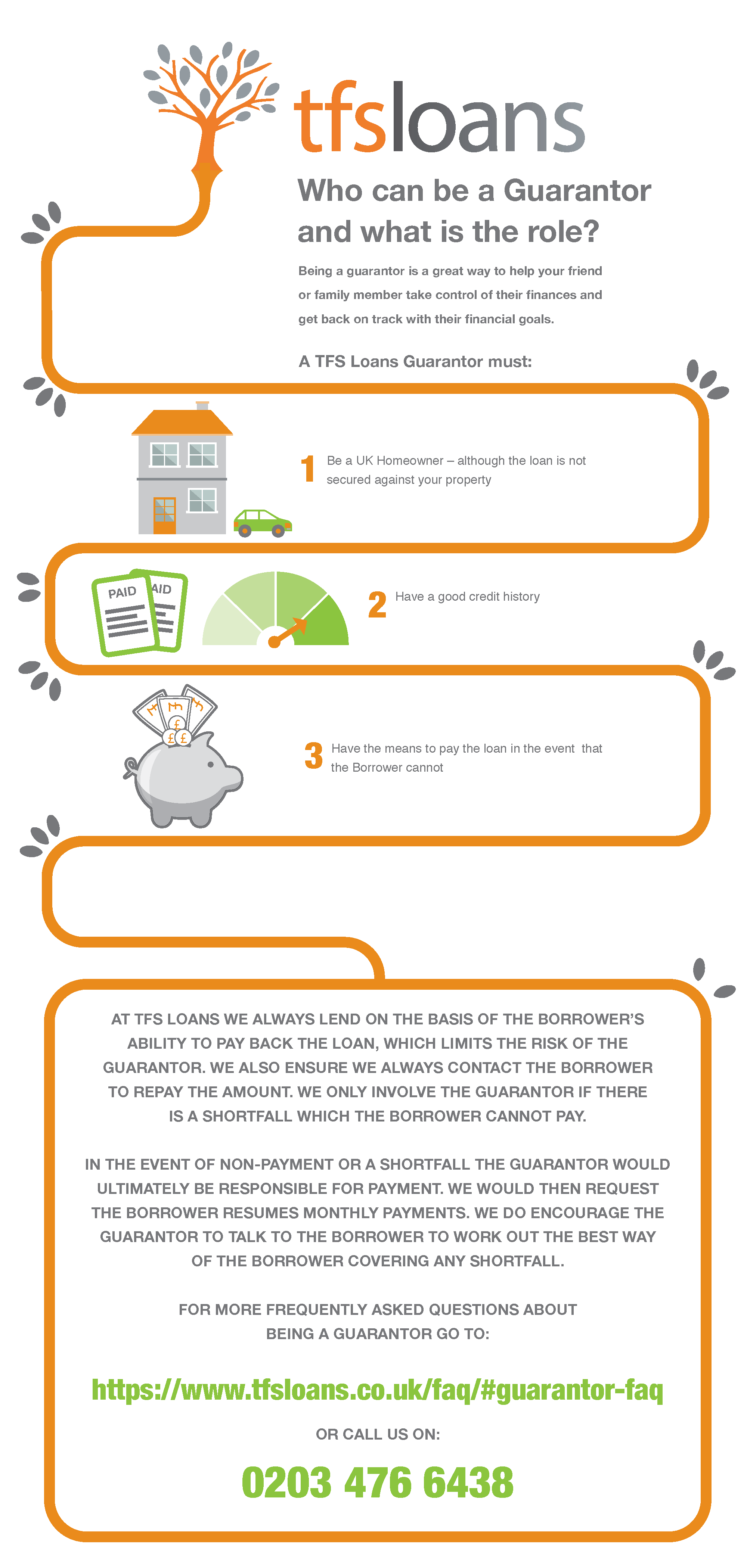

Loan guarantor criteria. If the guarantor is a uk homeowner does this mean my loan is secured against the guarantors property no this loan is completely unsecured. At tfs loans we have created a helpful infographic to guide you through our criteria for guarantors. Pulling together a big enough deposit remains a struggle for many would be property buyers especially when they have to pay for their living costs including. Guarantor loans and mortgages are one way to help someone borrow money if theyre struggling to get approved by lenders for example this might be a young person with a limited credit history or someone with a bad credit history.

10 comments on a guide to guarantor home loan requirements the main issue for many first time homeowners and investors in the current property market is the ability to save a deposit. The guarantor is often a family member or trusted friend who has a better credit history than the person taking out the loan and the arrangement is therefore viewed as less. Your right of appeal. Apply for postgrad loan.

Sometimes your guarantor needs to be a uk homeowner too but there are non homeowner loans available. A guarantor is a person who agrees to repay the borrowers debt should the borrower default on agreed repayments. Apply for slb pays loan. List of approved schools.

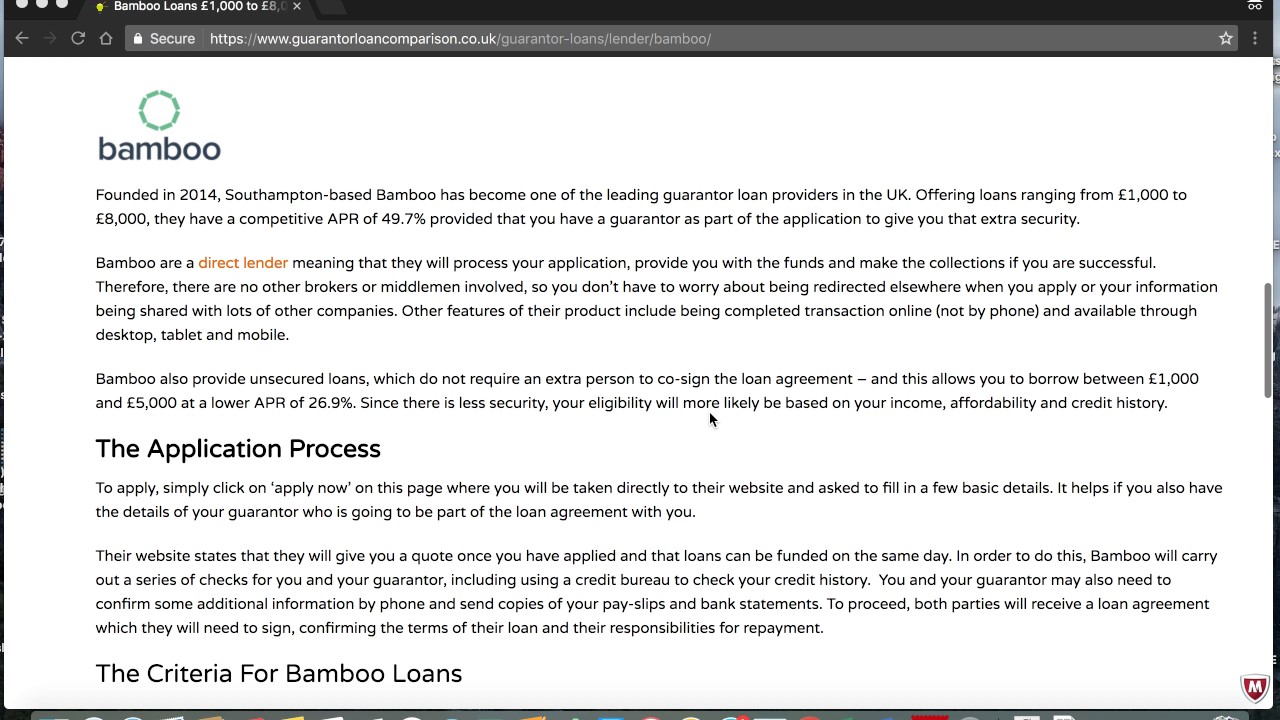

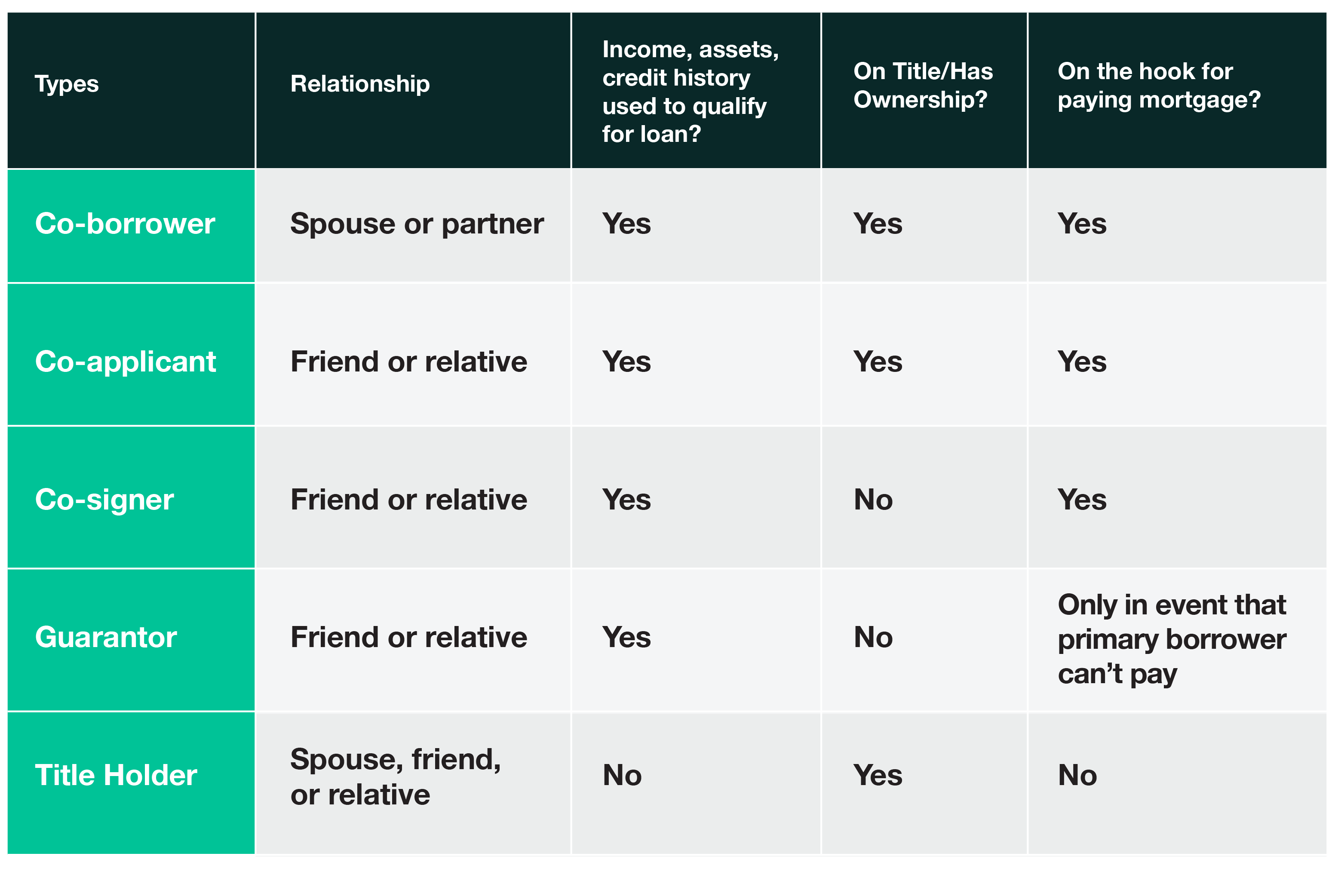

A guarantor differs slightly from a cosigner especially when it comes to a secured loan which involves collateral such as a mortgage or auto loanusing a mortgage as an example a guarantors name isnt actually on the home title and does not have the same property rights as a co signer would. The guarantor must be a uk homeowner by homeowner we dont mean you have to own your home outright it can be. Is the loan in my name or in the guarantors no the loan is in your name not the guarantors. The main criteria to be met when applying for a guarantor loan is having a trusted friend or family member with a good credit standing who is prepared to co sign the credit application and agreement.

We explain the criteria for applying for a guarantor loan including age guarantor information employment status contact details debit card and more. Dont try to beat the. There are risks involved for both borrower and guarantor so you should enter a guarantor agreement armed with all the facts. A guarantor loan is a type of unsecured loan that requires a guarantor to co sign the credit agreement.

Https Www Singaporetech Edu Sg Sites Default Files Student 20user 20guide 20 20tuition 20fee 20loan 20application 202017 Pdf