Loans And Advances In Bank Balance Sheet

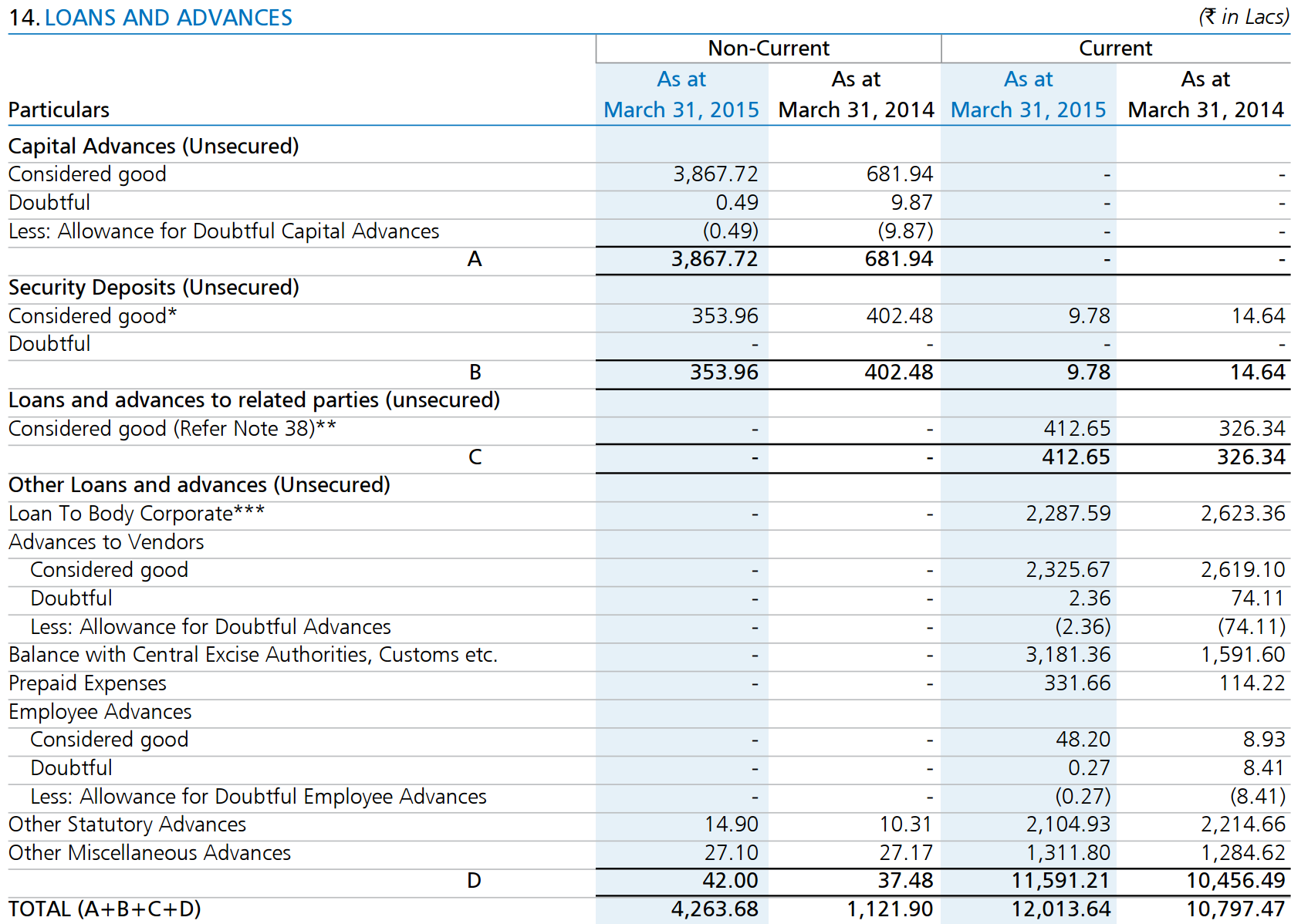

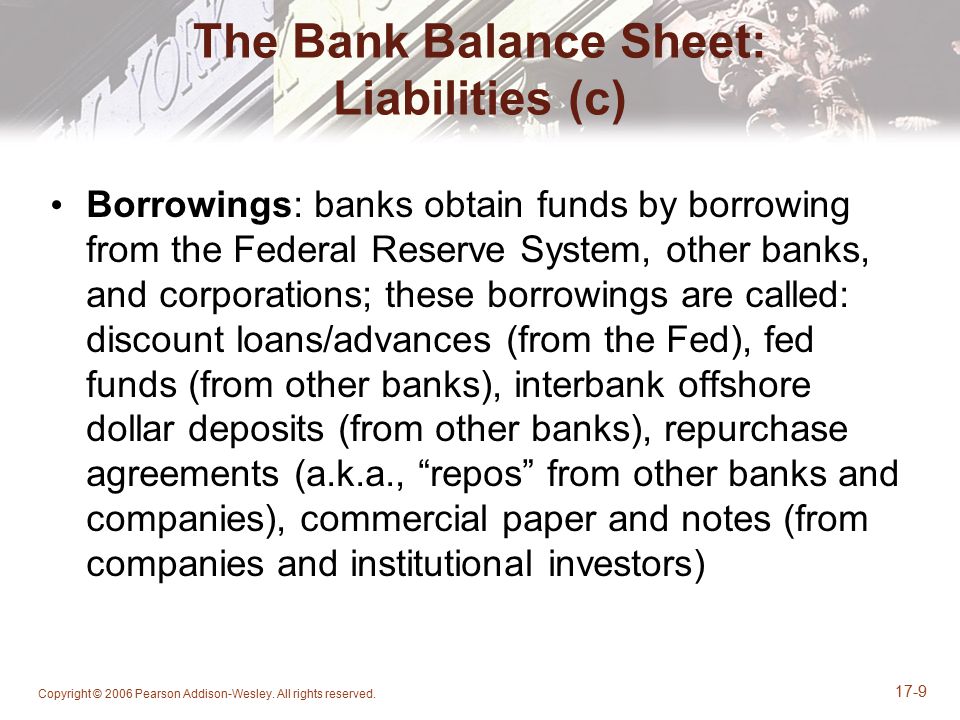

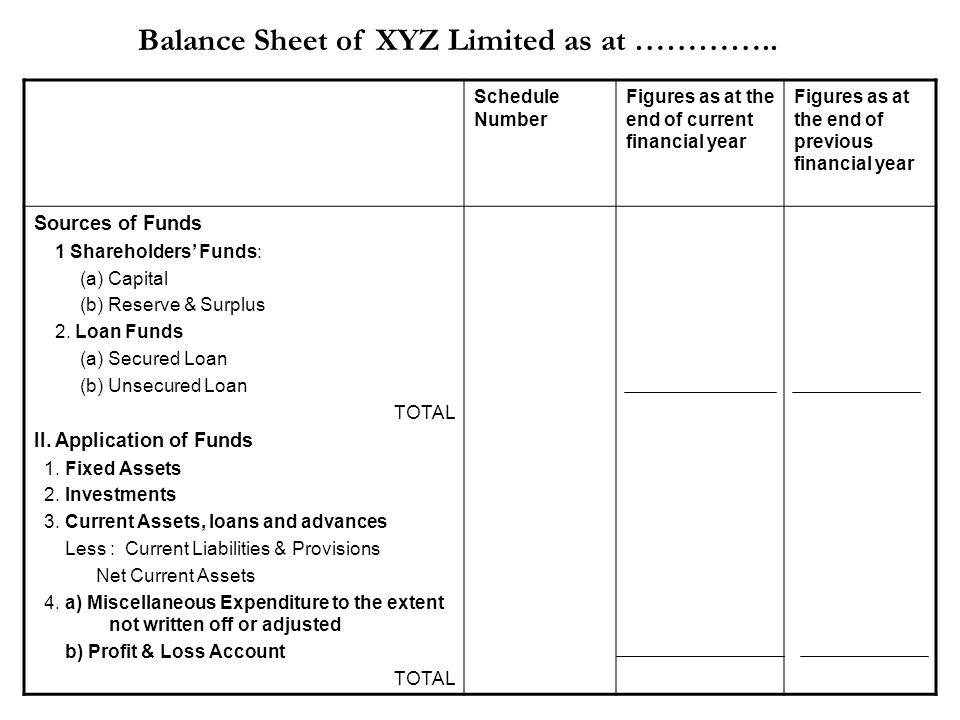

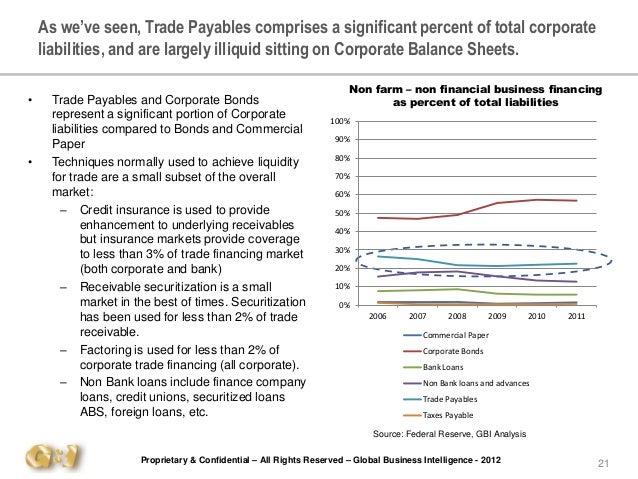

Formal contracted loans are typically designed as notes payable on a balance sheet whereas advances or purchases on credit are recorded as accounts payable.

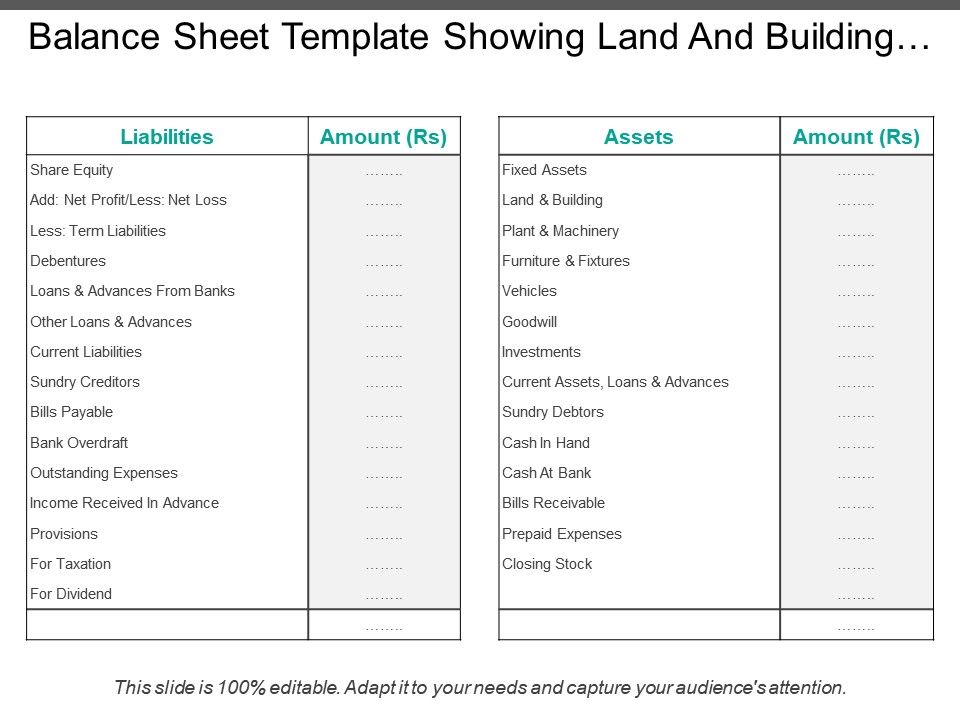

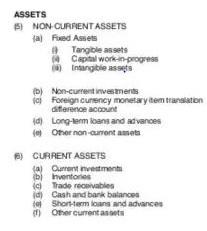

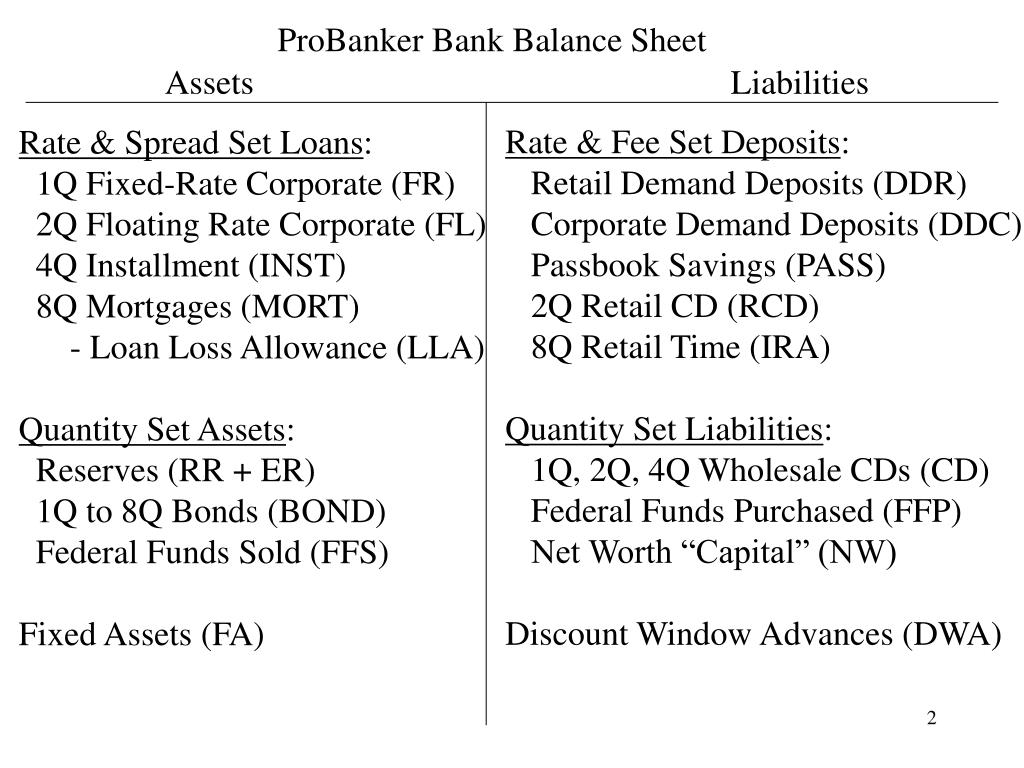

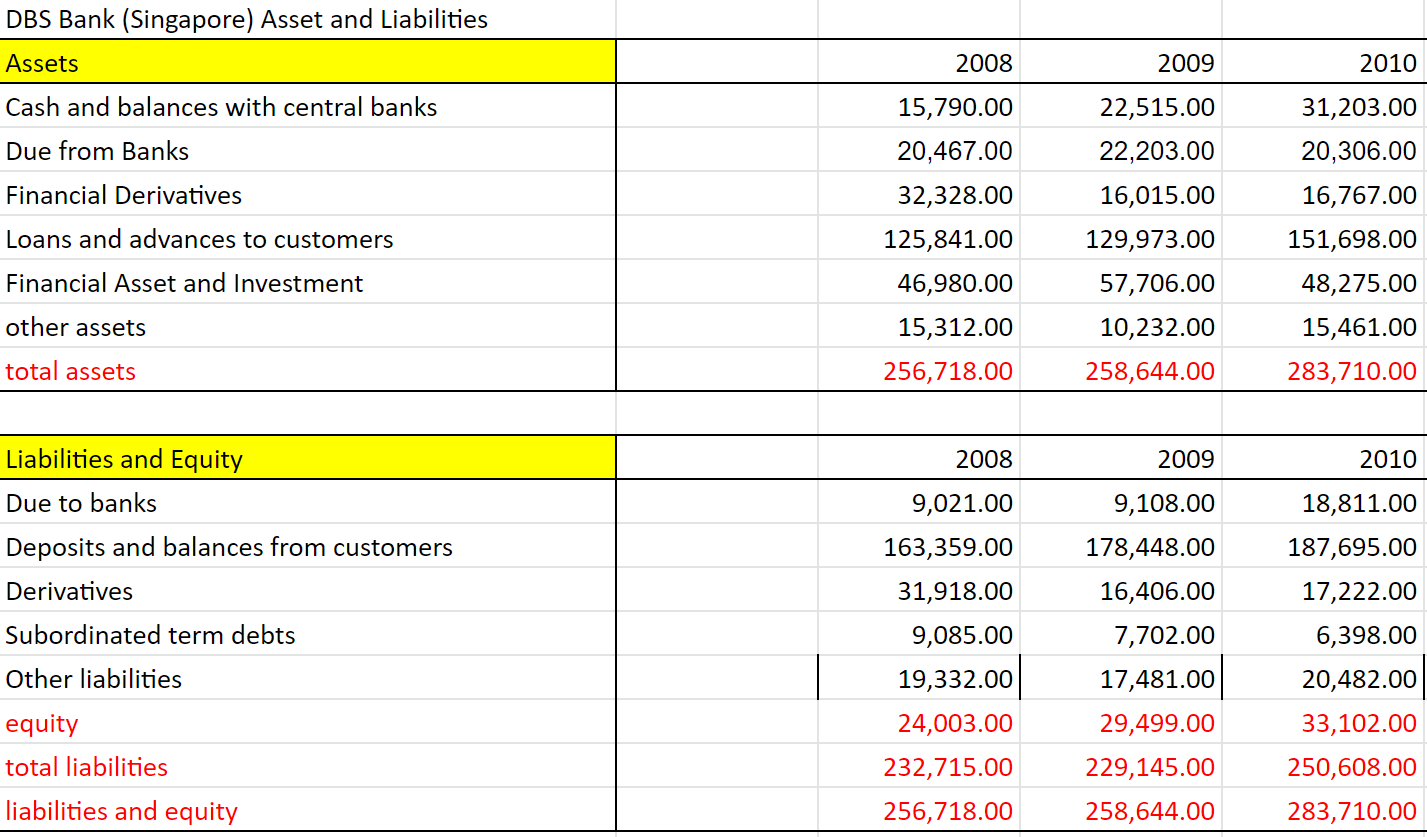

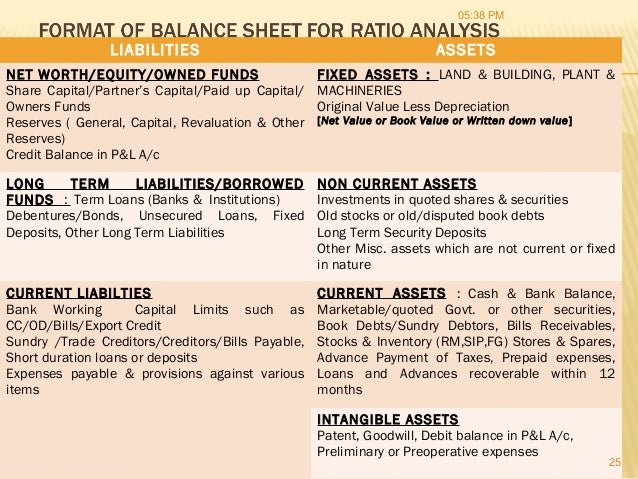

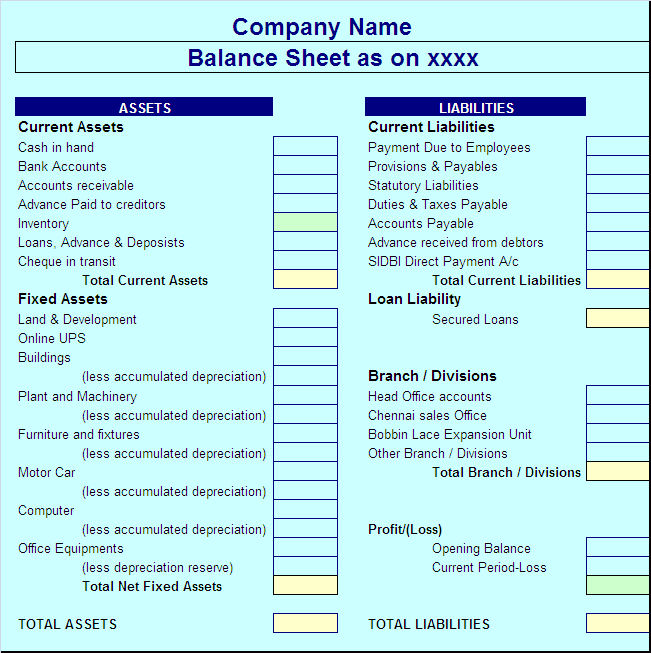

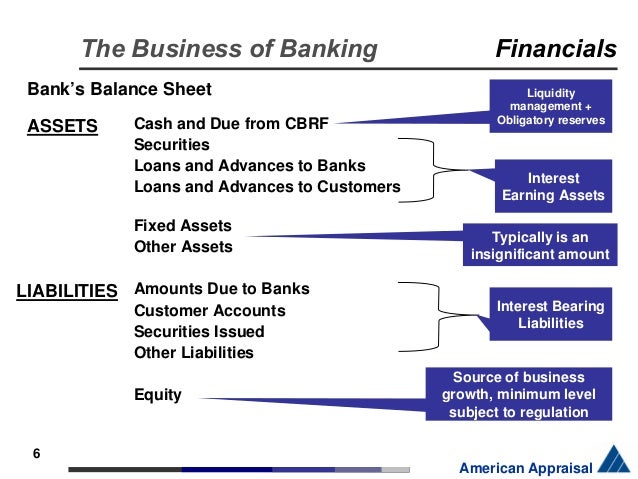

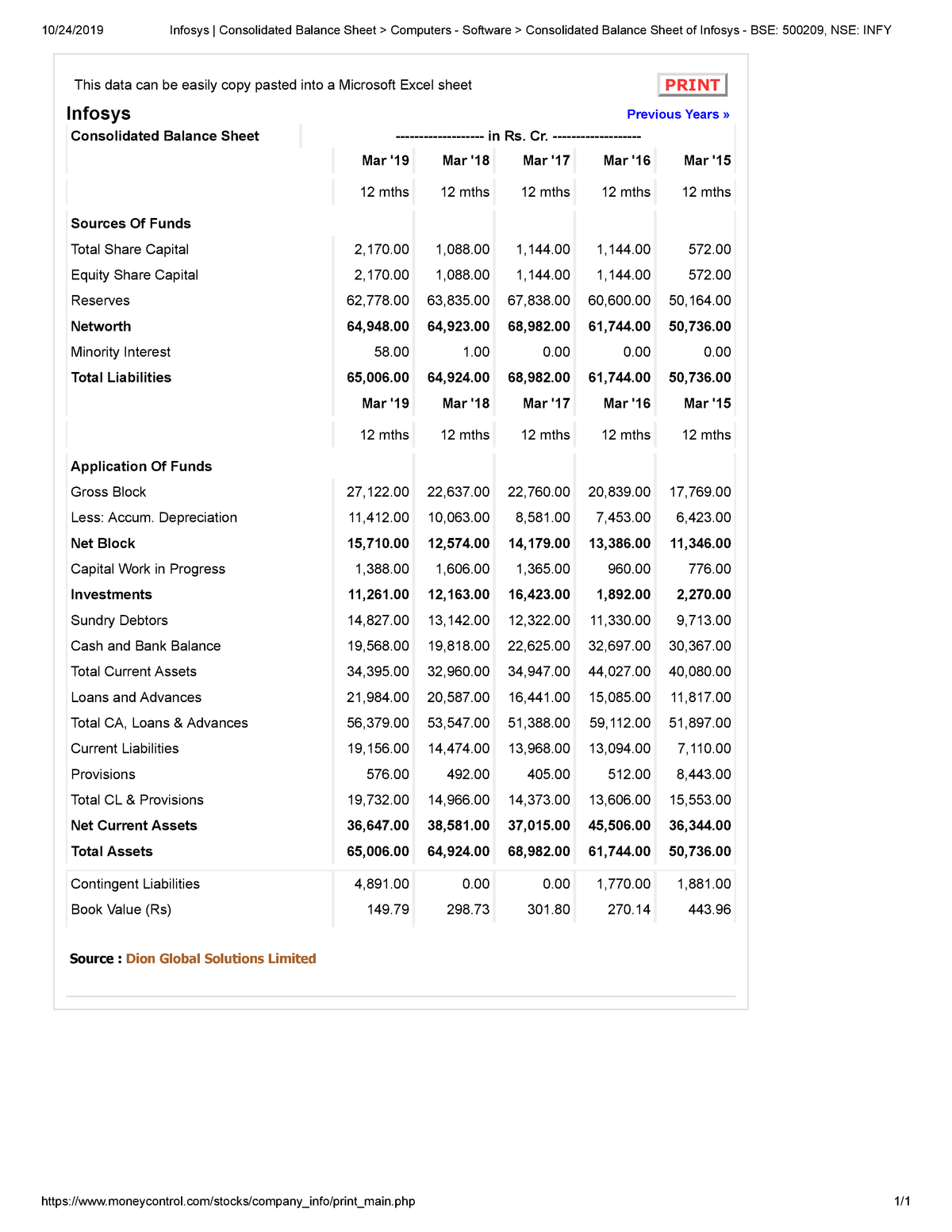

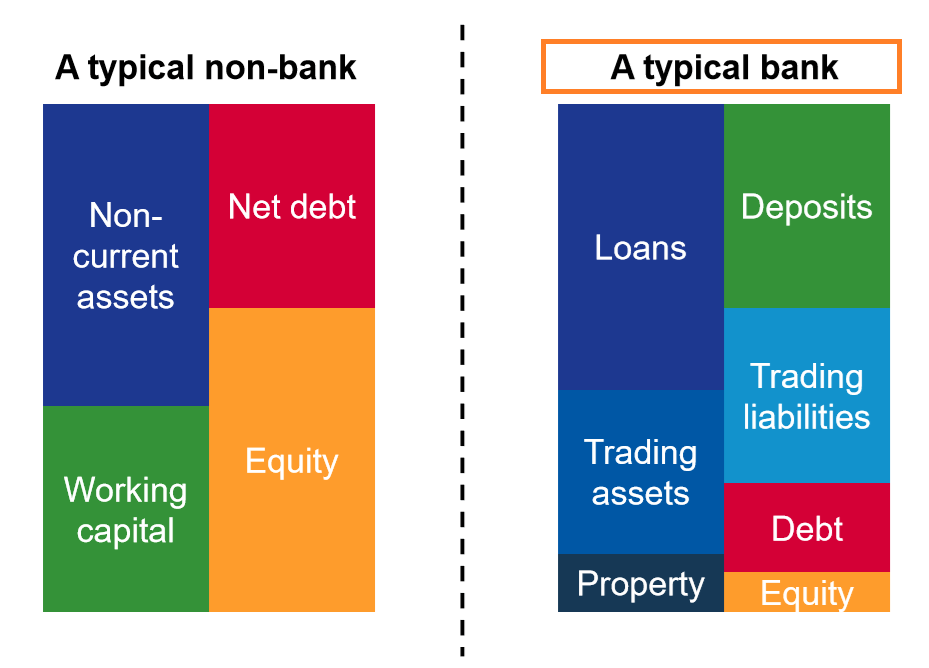

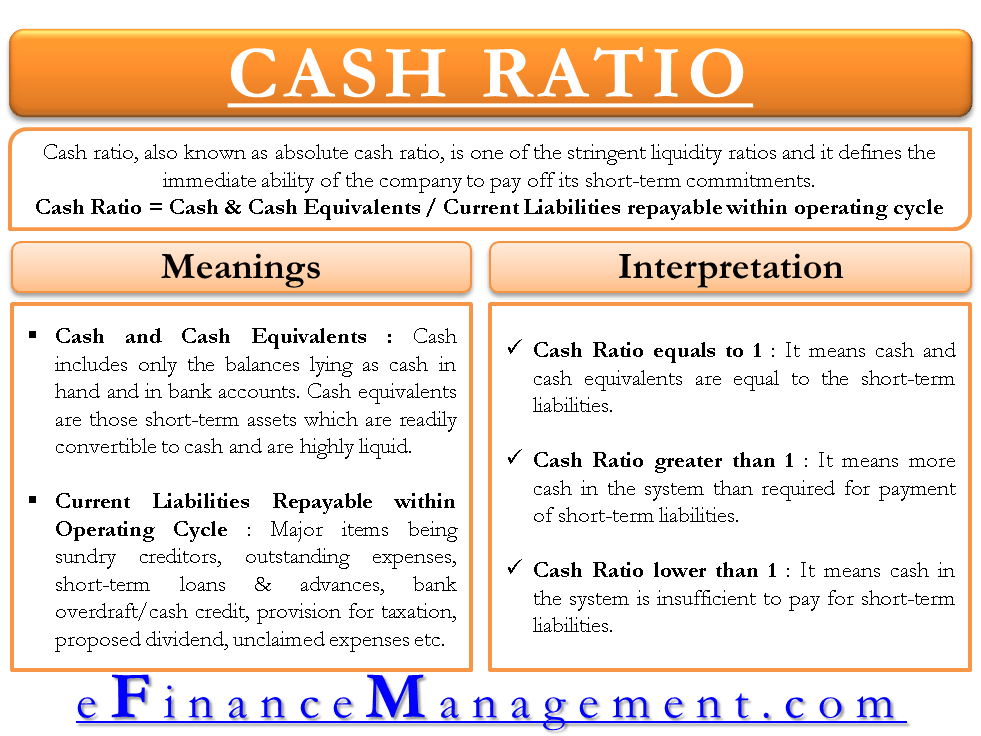

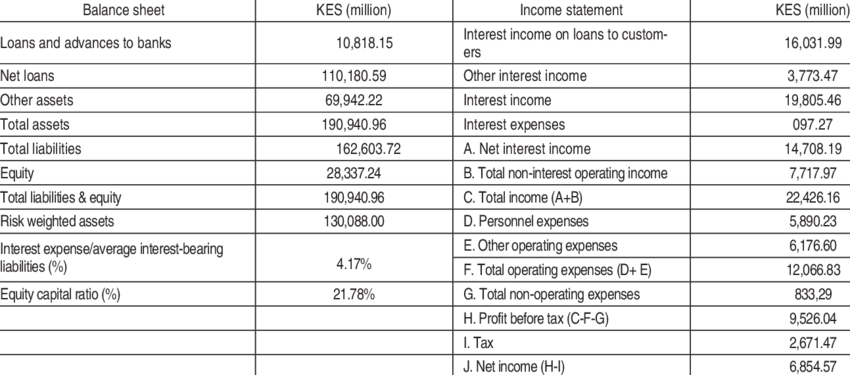

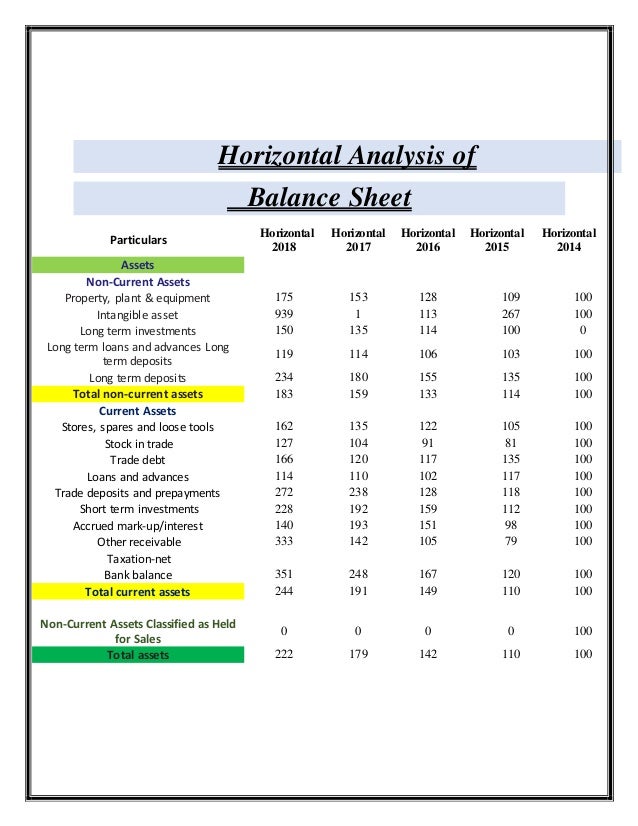

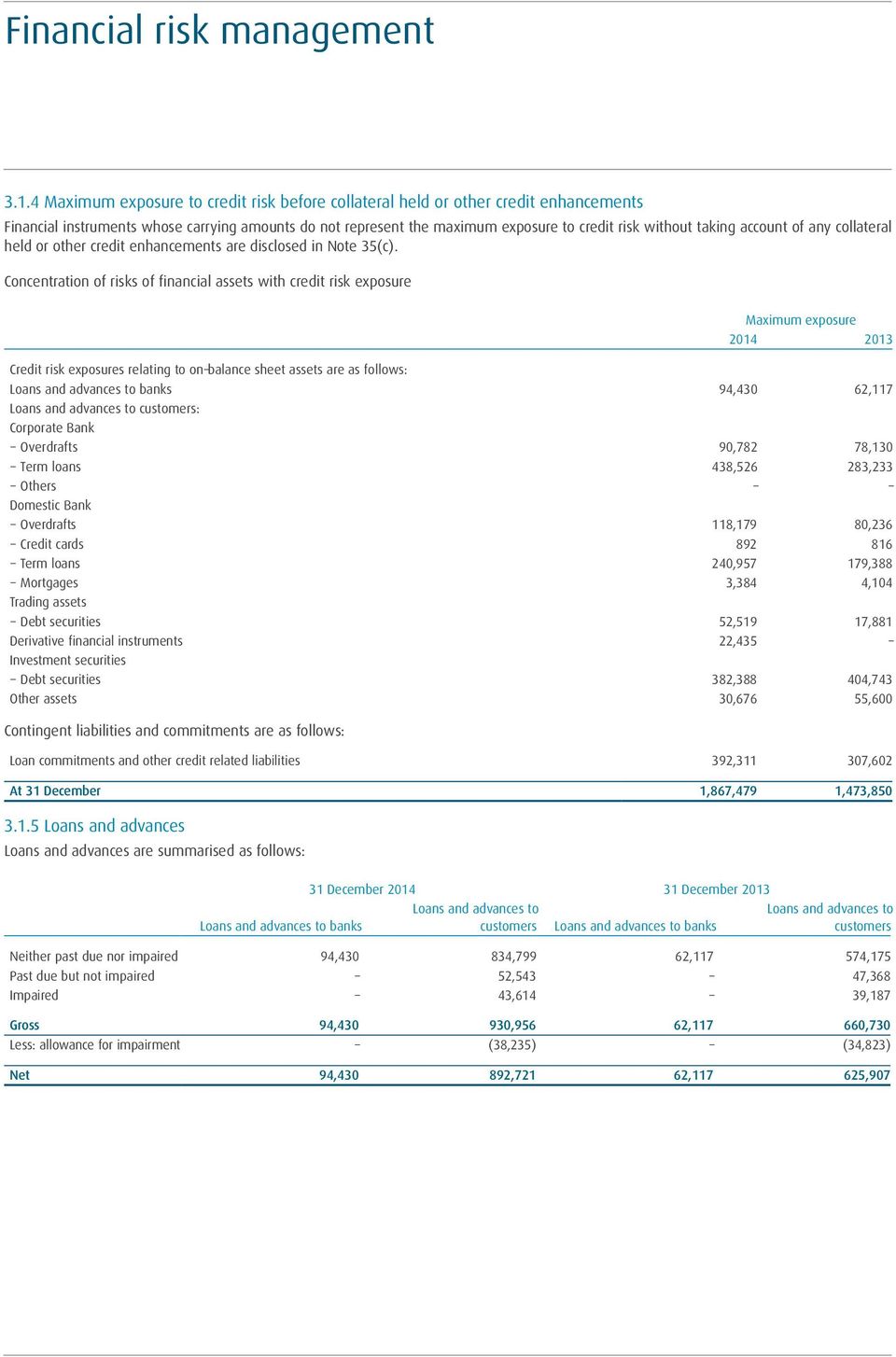

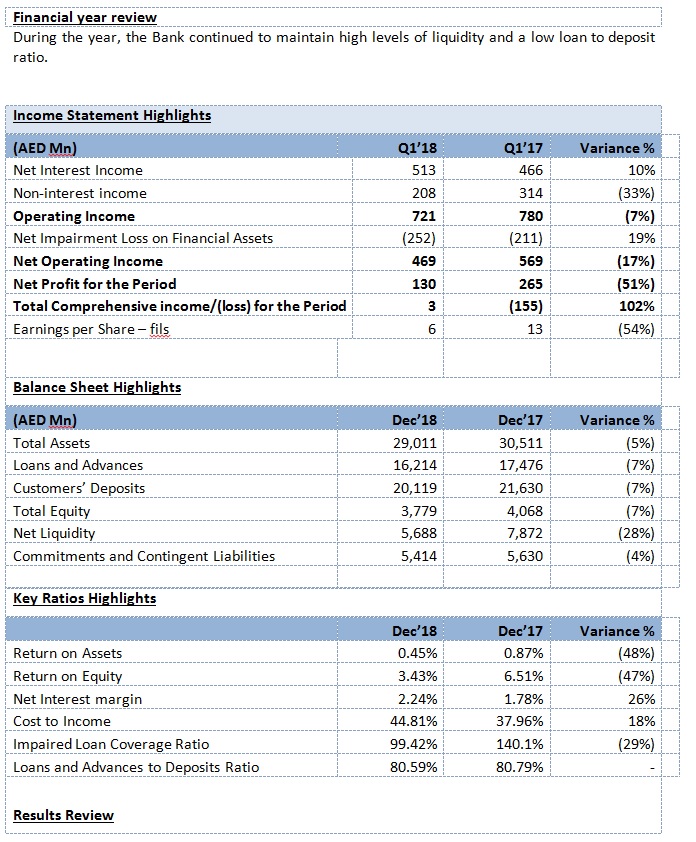

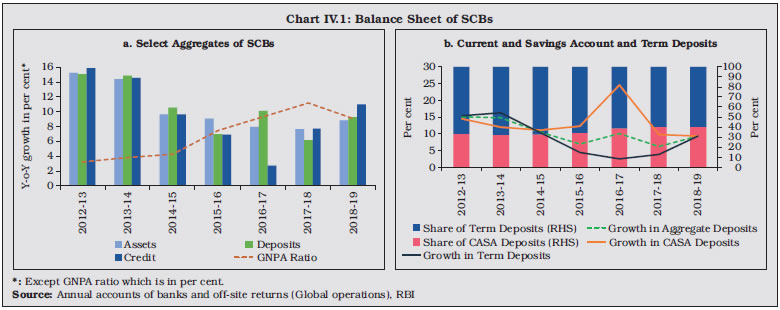

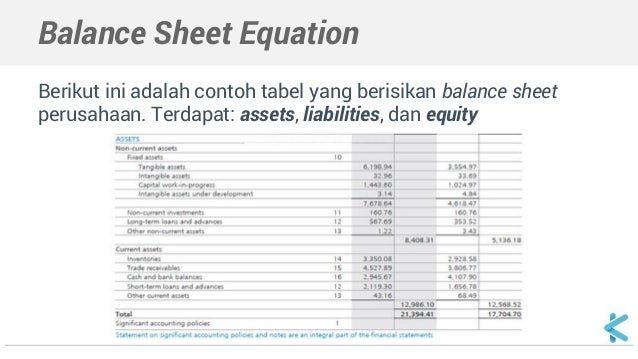

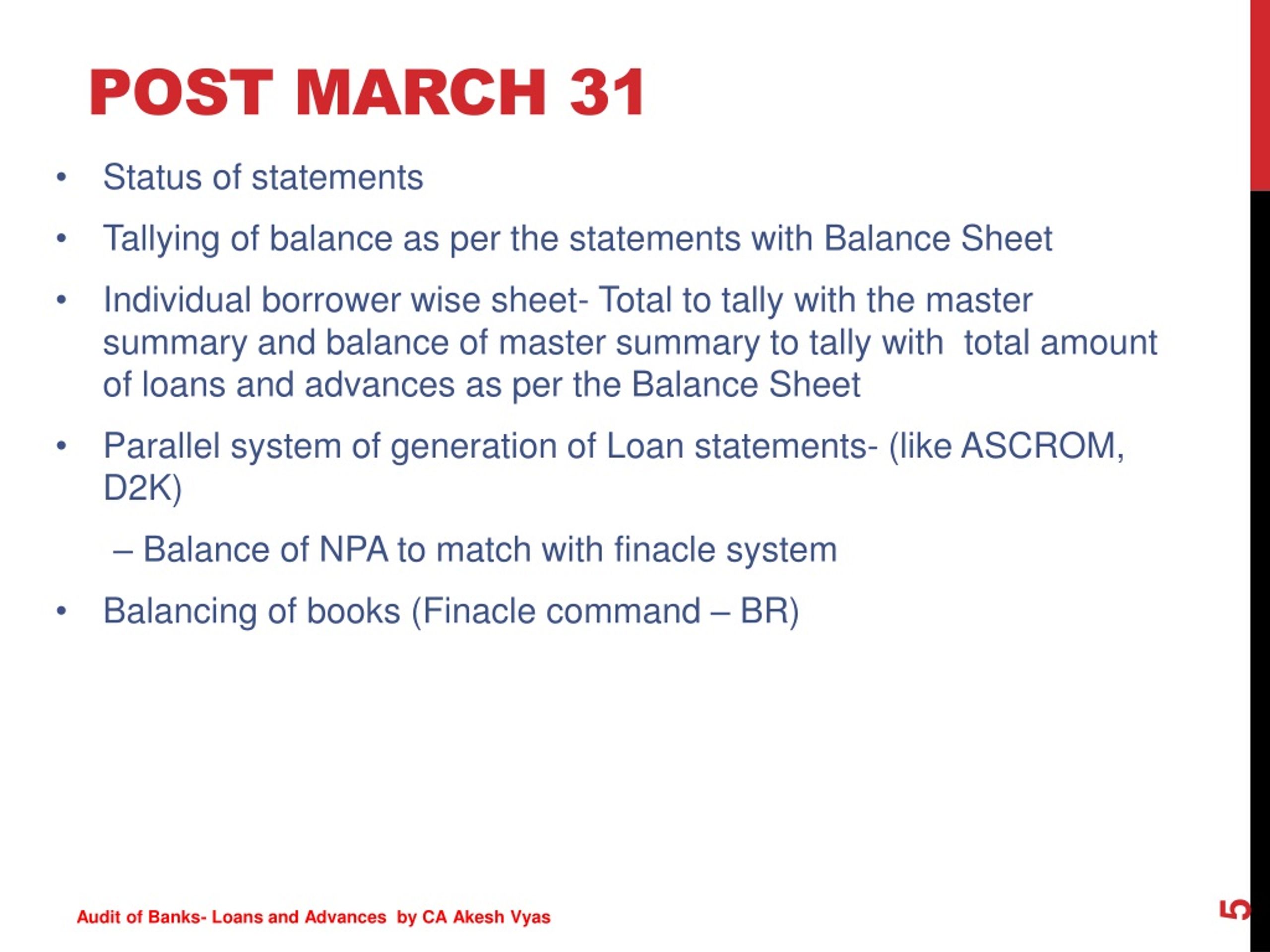

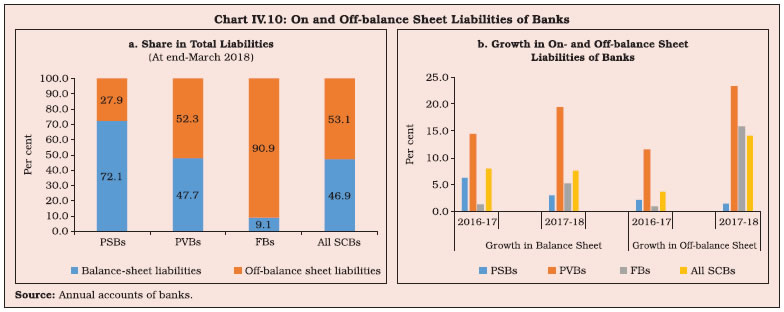

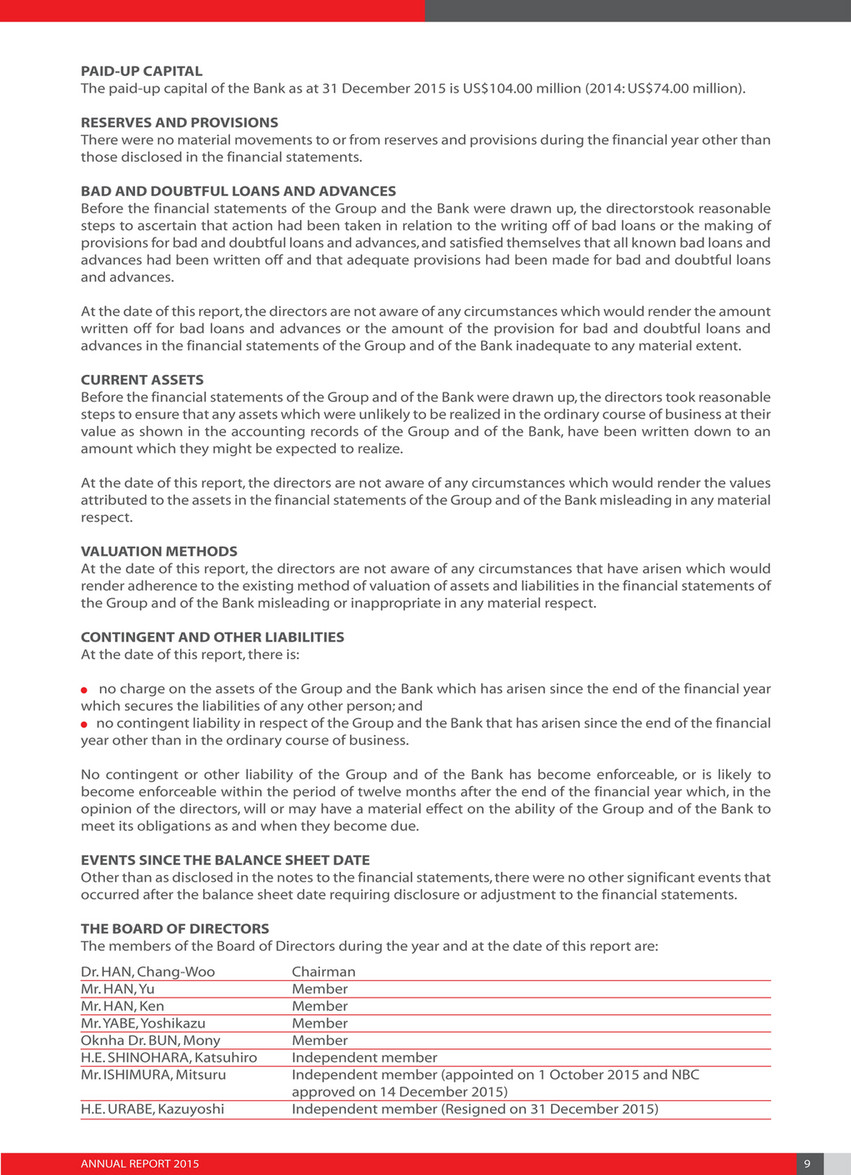

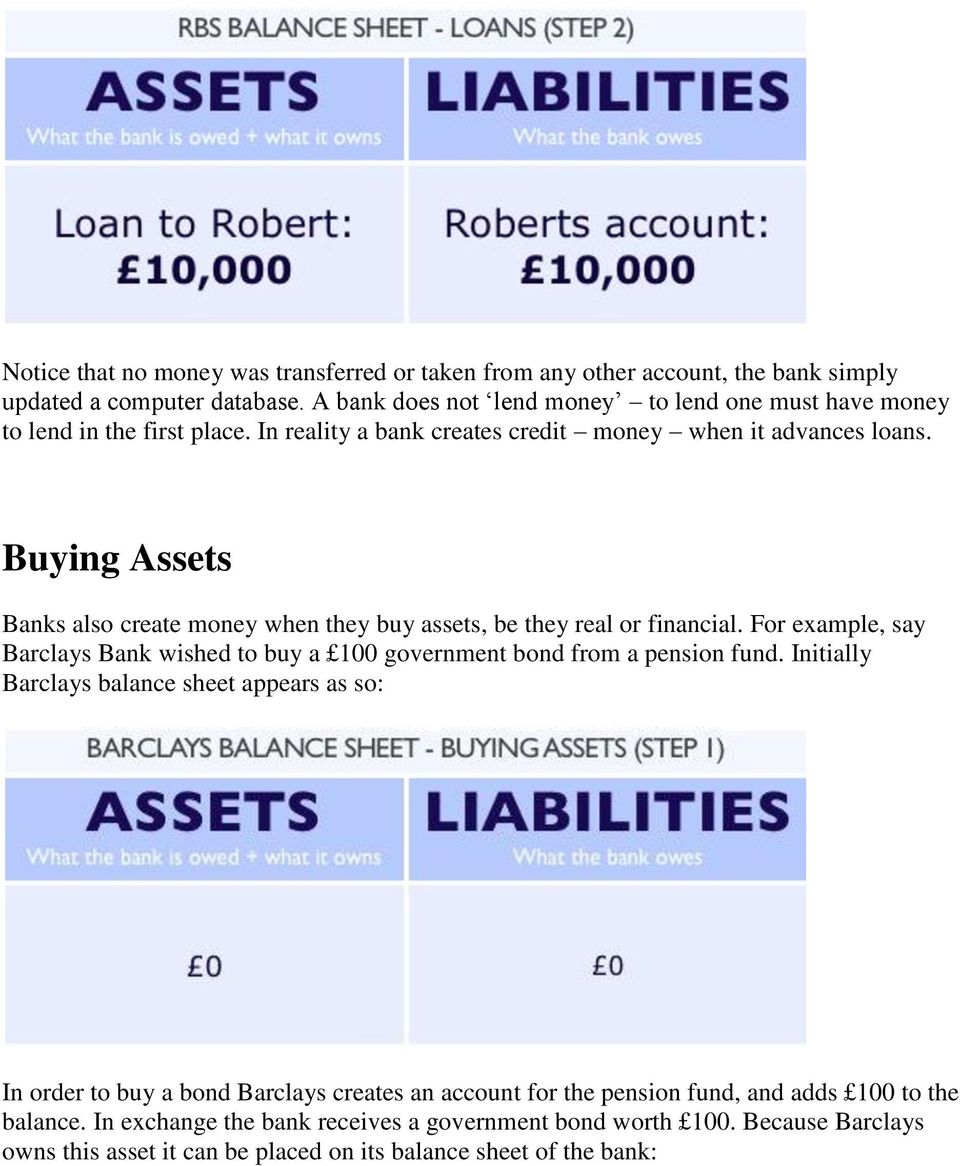

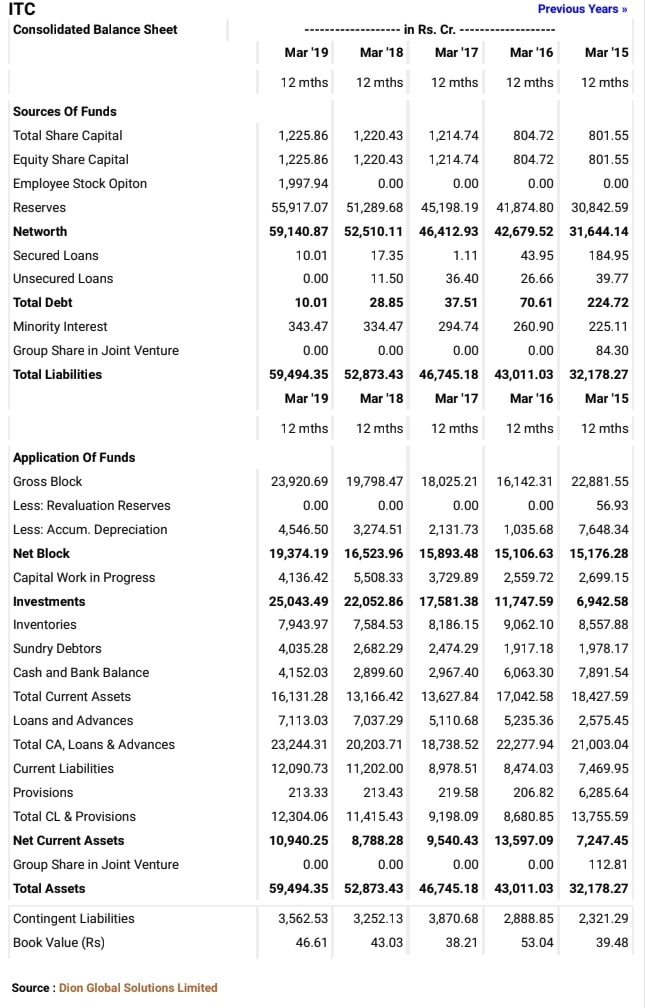

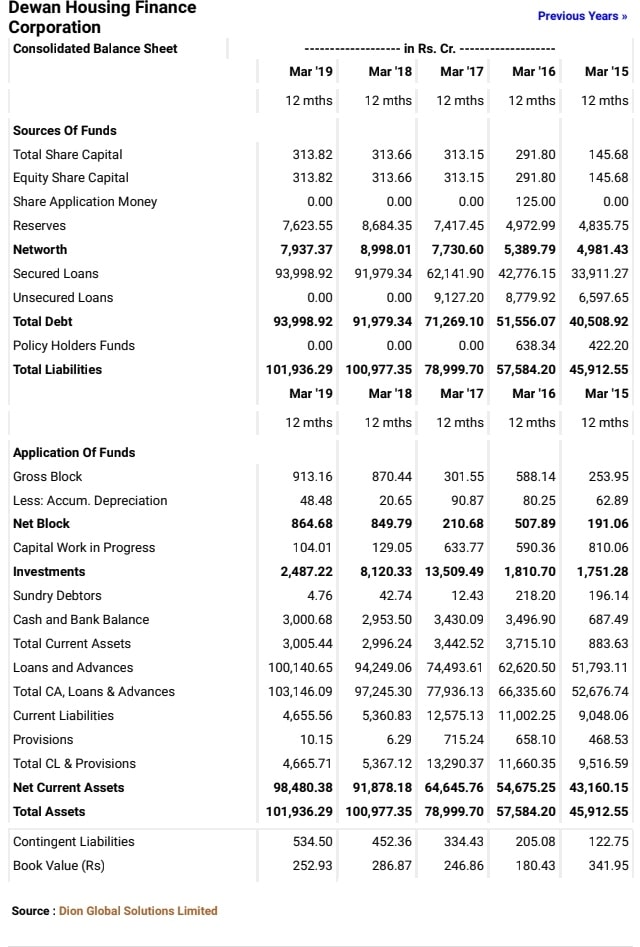

Loans and advances in bank balance sheet. The preparation of a bank balance sheet is really complicated since the banking institutions will need to calculate their net loans and it is really time consuming and the items recorded in this balance sheet are loans allowances short term loans etc whereas the preparation of a companys balance sheet is not that. This guide will teach you to perform financial statement analysis of the income statement balance sheet and cash flow statement including margins ratios growth liquiditiy leverage rates of return and profitability. Components of banks balance sheet. For other sectors holding a large amount of cash is considered a loss in opportunity cost.

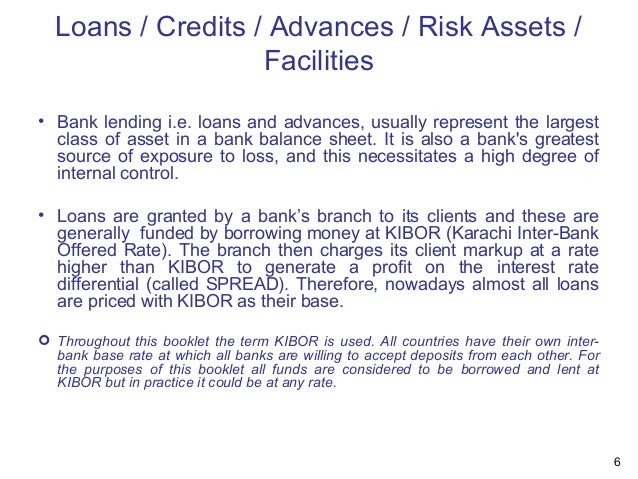

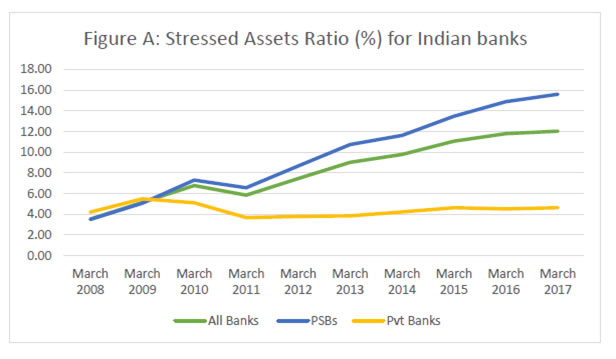

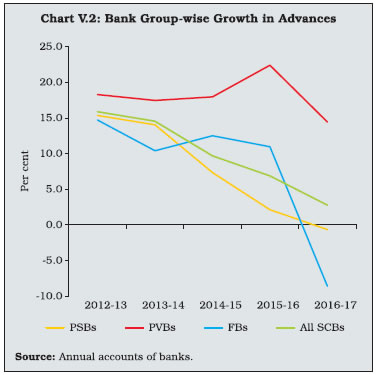

Investors monitor loan growth to determine whether a bank is. Advances are not loans. The main components of the above banks balance sheet are 1 cash. Bofa has 926 billion in loans.

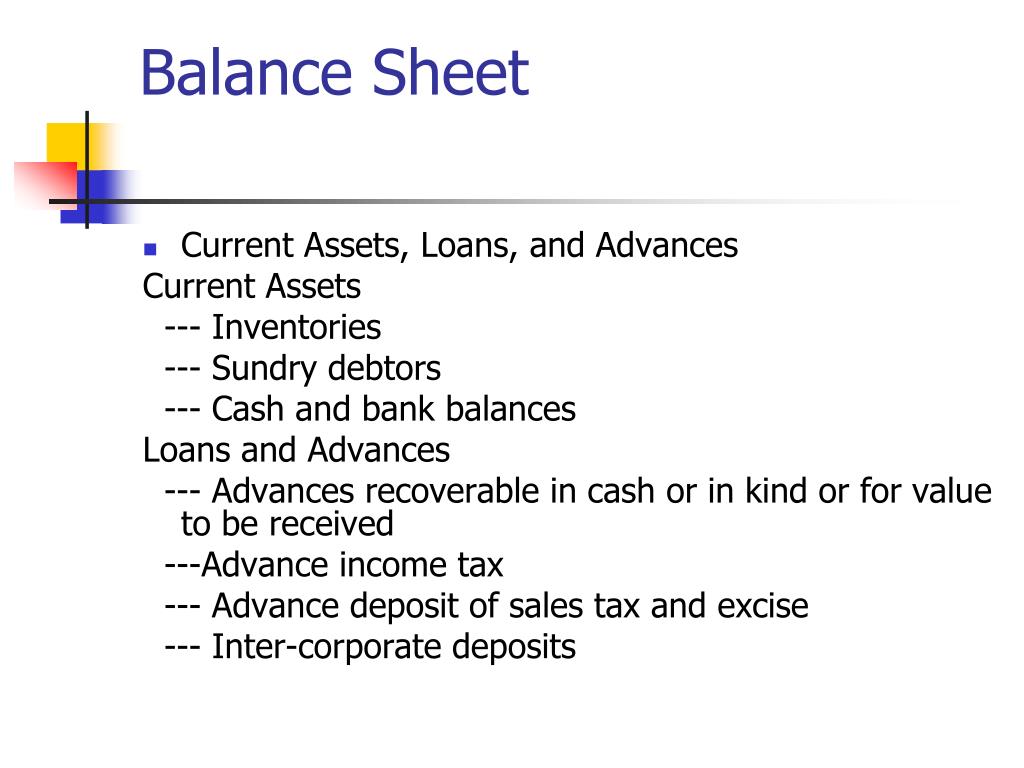

Loans and advances are general descriptions of debt obligations companies owe and must show on their balance sheet as part of total liabilities. But in the case of banks balance sheet cash is a source of income and is held on deposit. Loans are the bread and butter for most banks and are usually the largest asset on the balance sheet. For example advance may be given to the supplier of goods or services.

Difference between bank balance sheet and company balance sheet. While the general structure of financial statements analysis of financial statements how to perform analysis of financial statements.