Loans And Receivables Frs 109

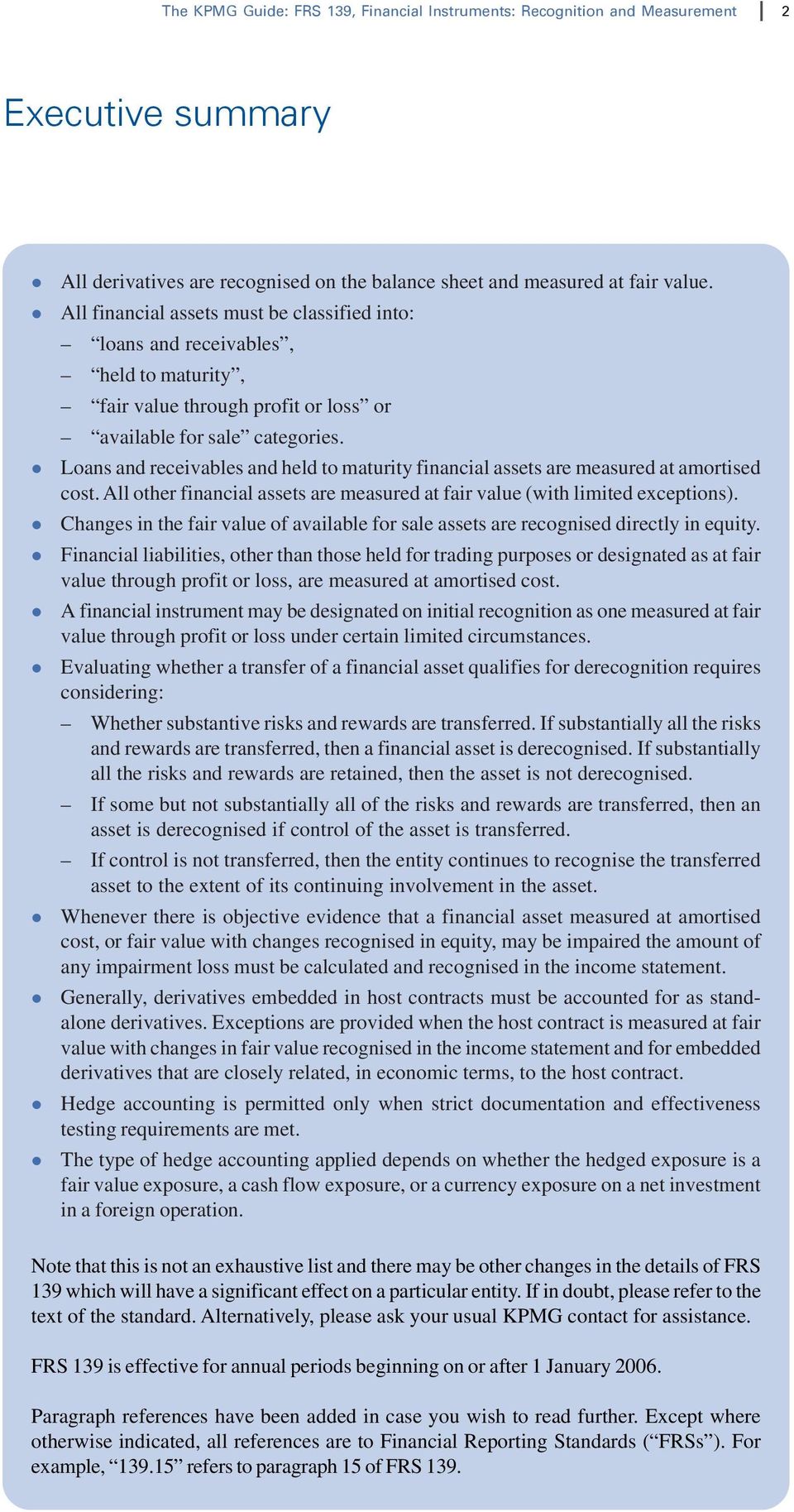

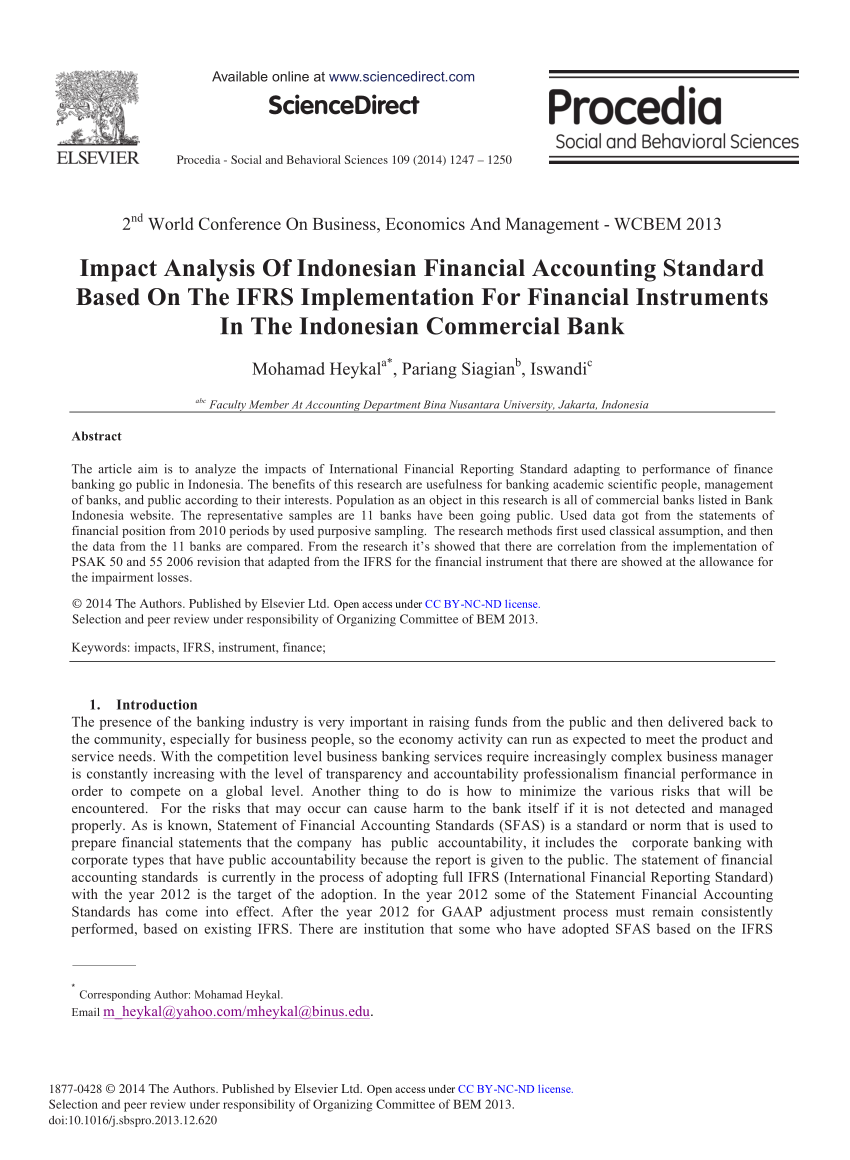

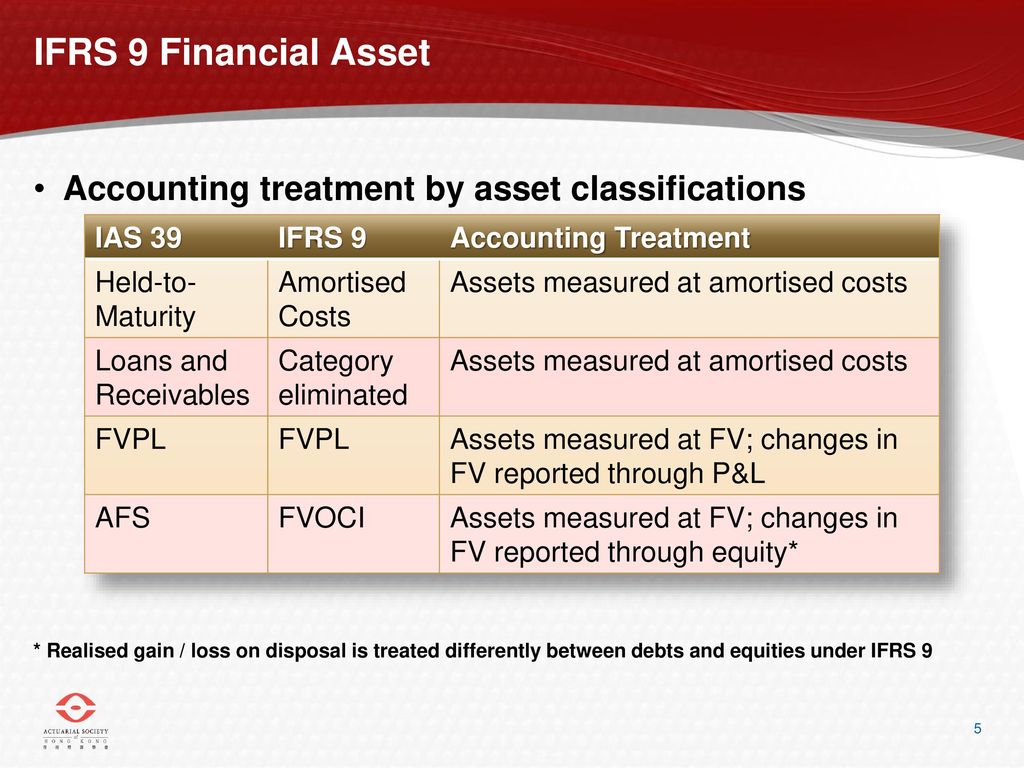

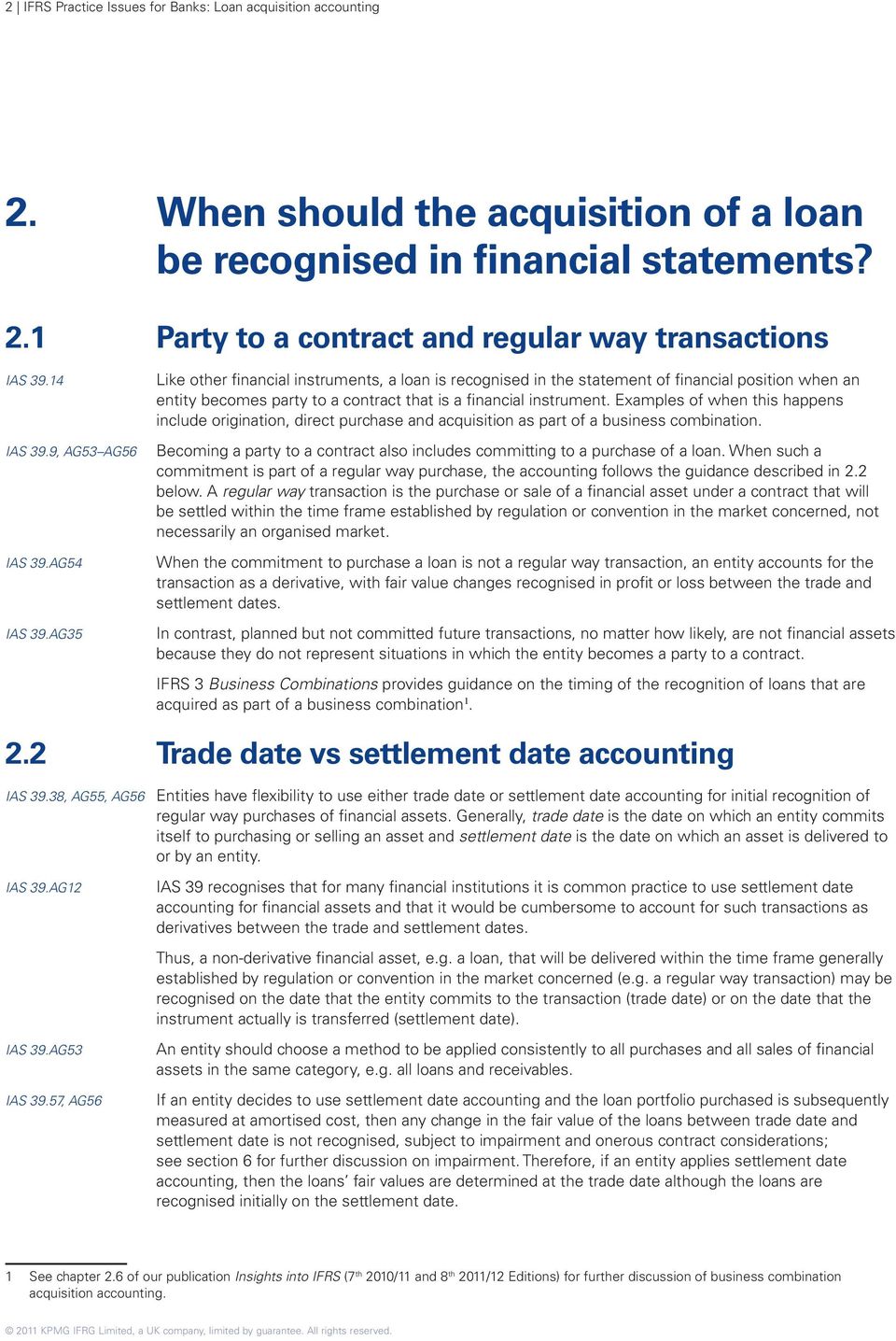

Recognition and measurement as accounting standards for financial instruments.

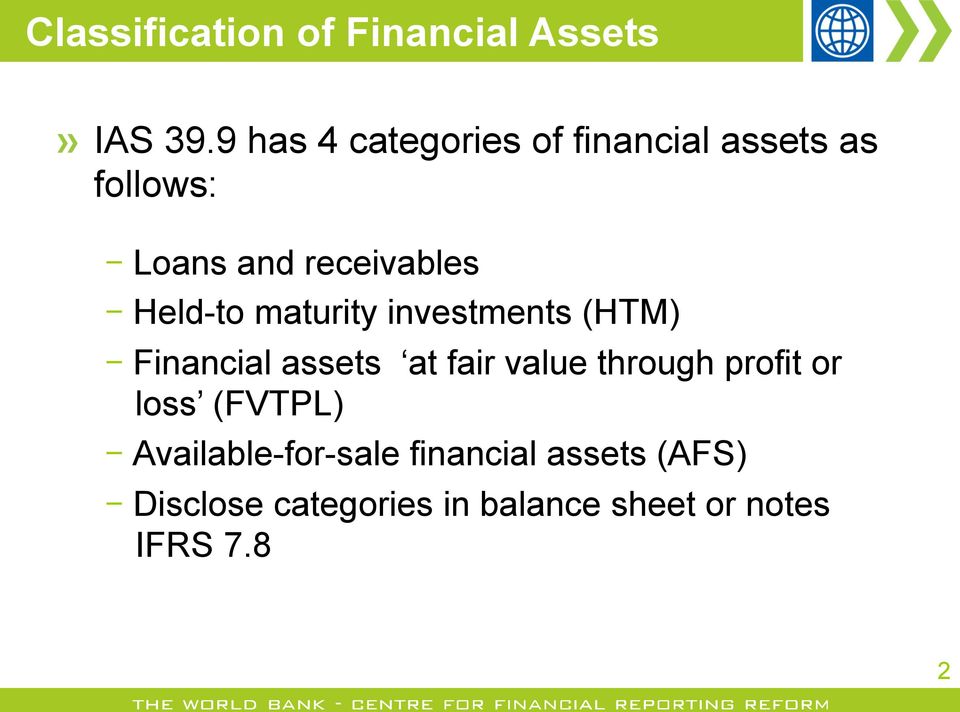

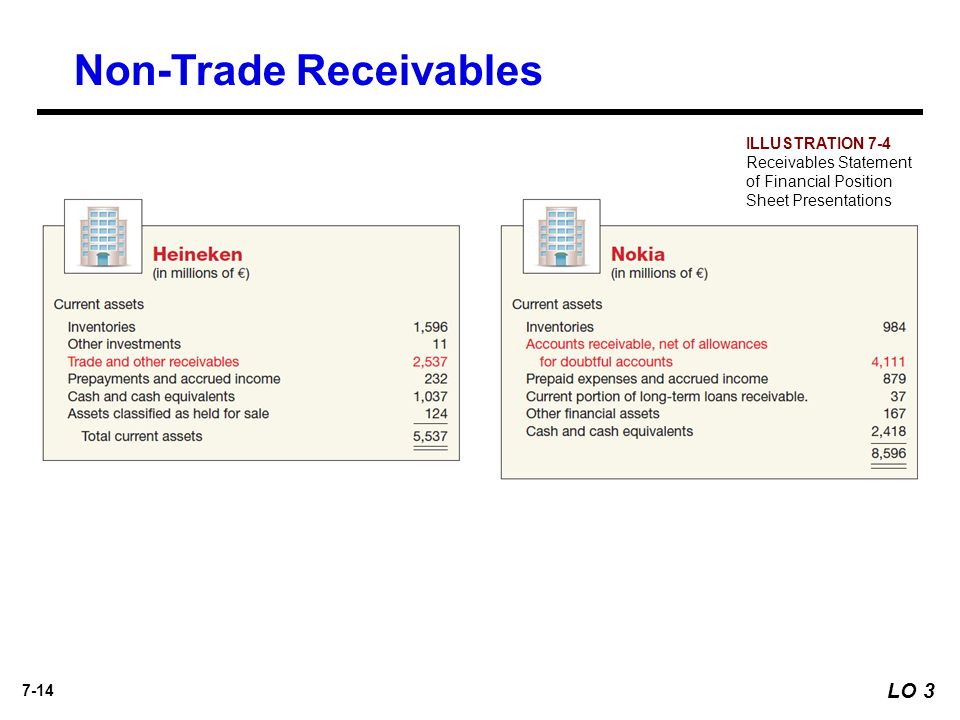

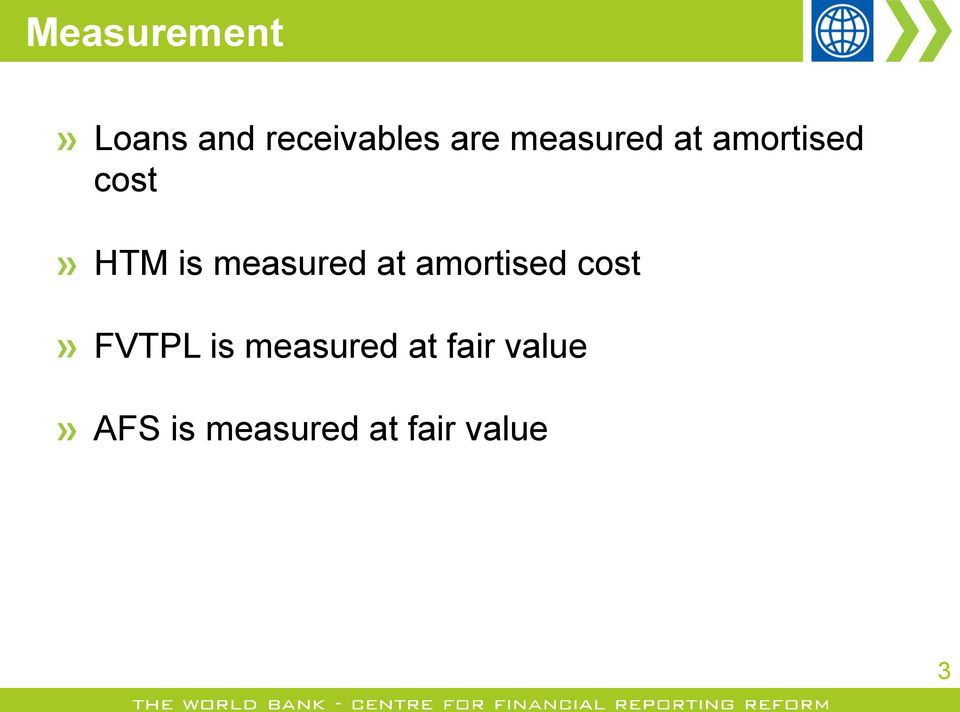

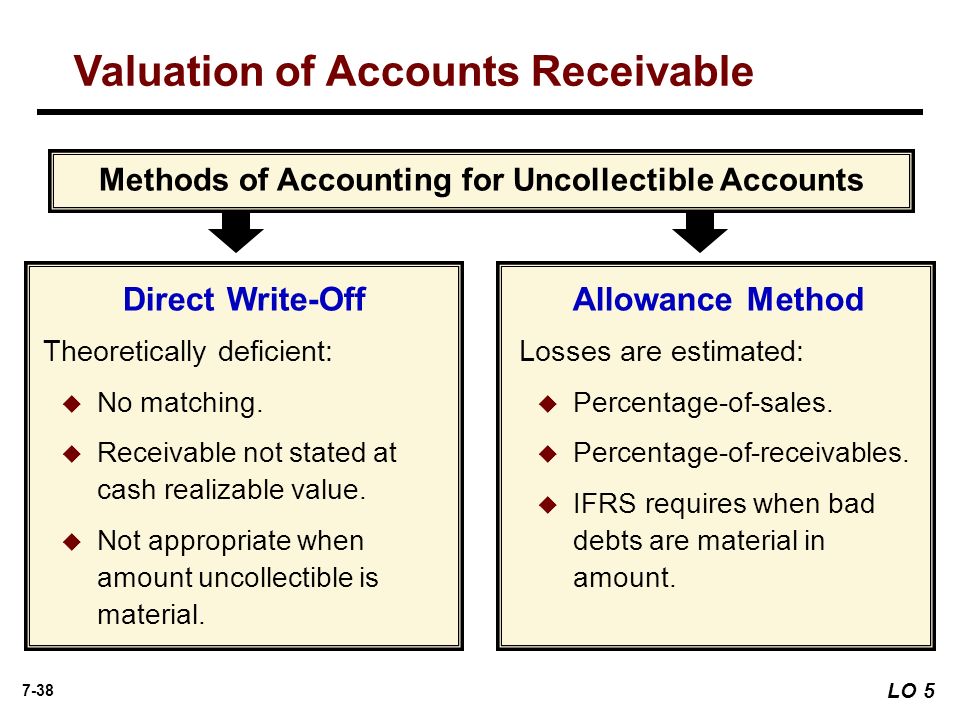

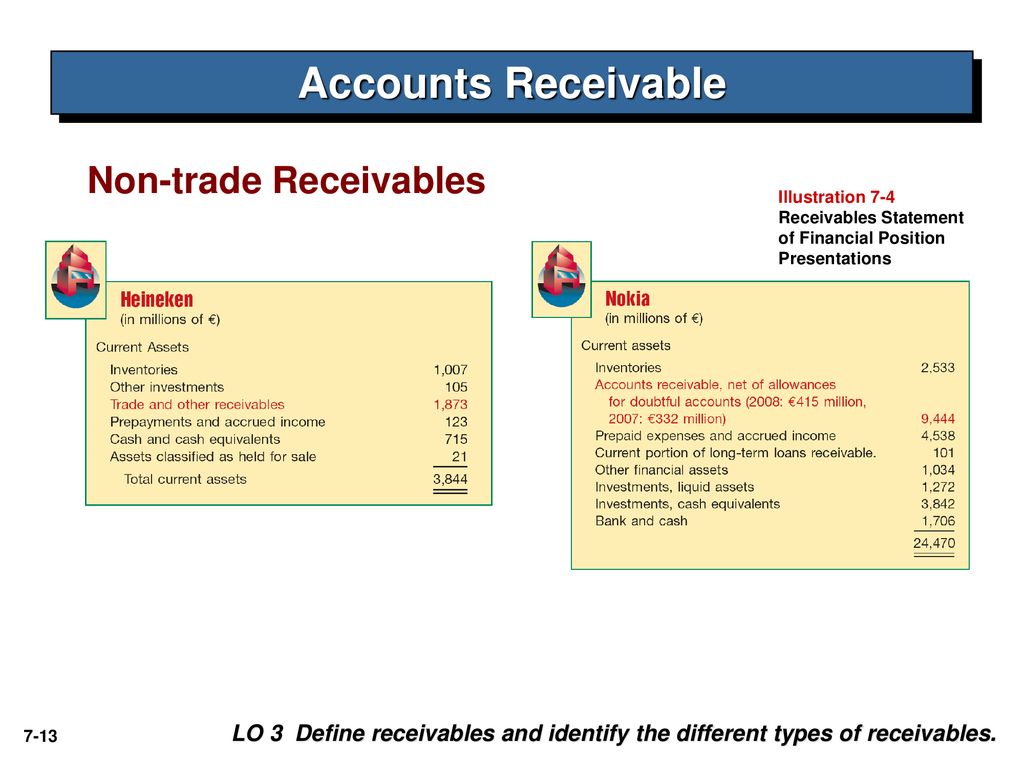

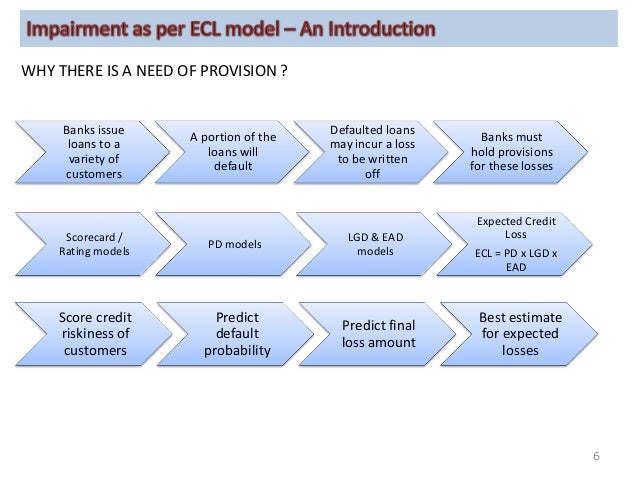

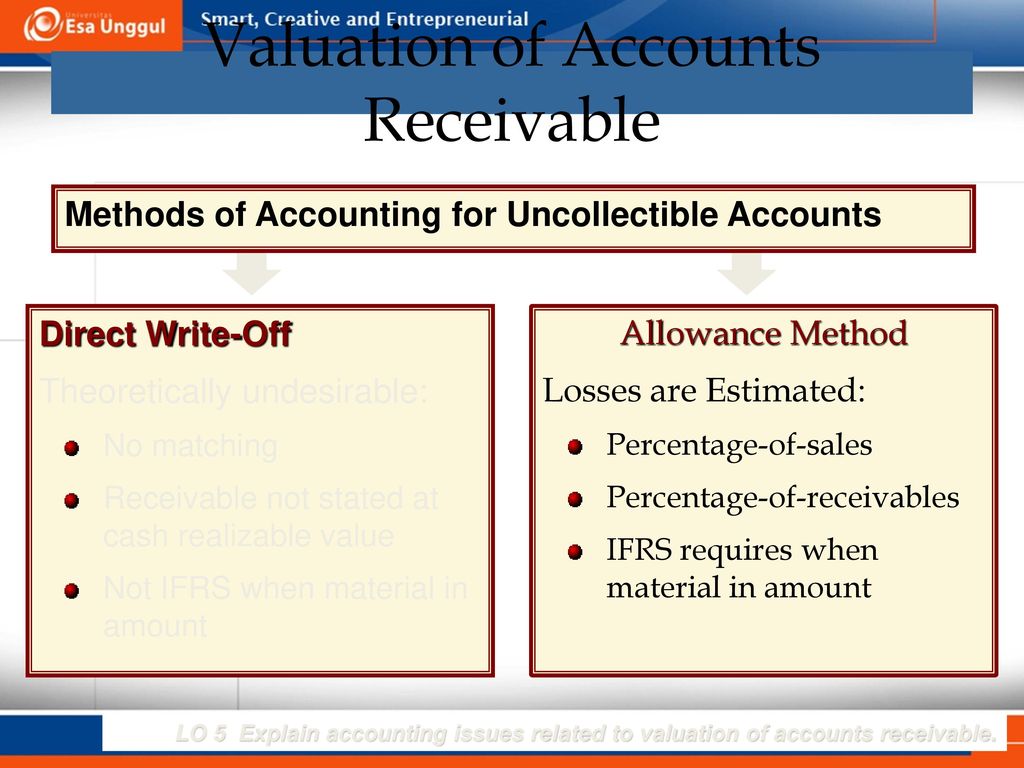

Loans and receivables frs 109. An entity may choose to apply frs 109 early. On the other hand ifrs 9 establishes a new approach for loans and receivables including trade receivablesan expected loss model that focuses on the risk that a loan will default rather than whether a loss has been incurred. Loans and receivables including short term trade receivables. Financial instruments under frs 39 financial assets within the scope of frs 39 include.

In frs 109 or sfrsi 9 for recognising classifying and measuring financial assets financial liabilities and some contracts to buy or sell non financial items. This tax treatment is termed as frs 109 tax treatment. Frs 109 tax treatment to minimise tax adjustments the tax treatment of financial assets and liabilities on revenue account that are recognised and measured under frs 109 and sfrsi 9 1 will generally follow the accounting treatment. However frs 139 applies in cases where under frs 127 128 or 131 such interests are to be accounted for under frs 139 for example derivatives on an interest in a subsidiary associate or joint venture.

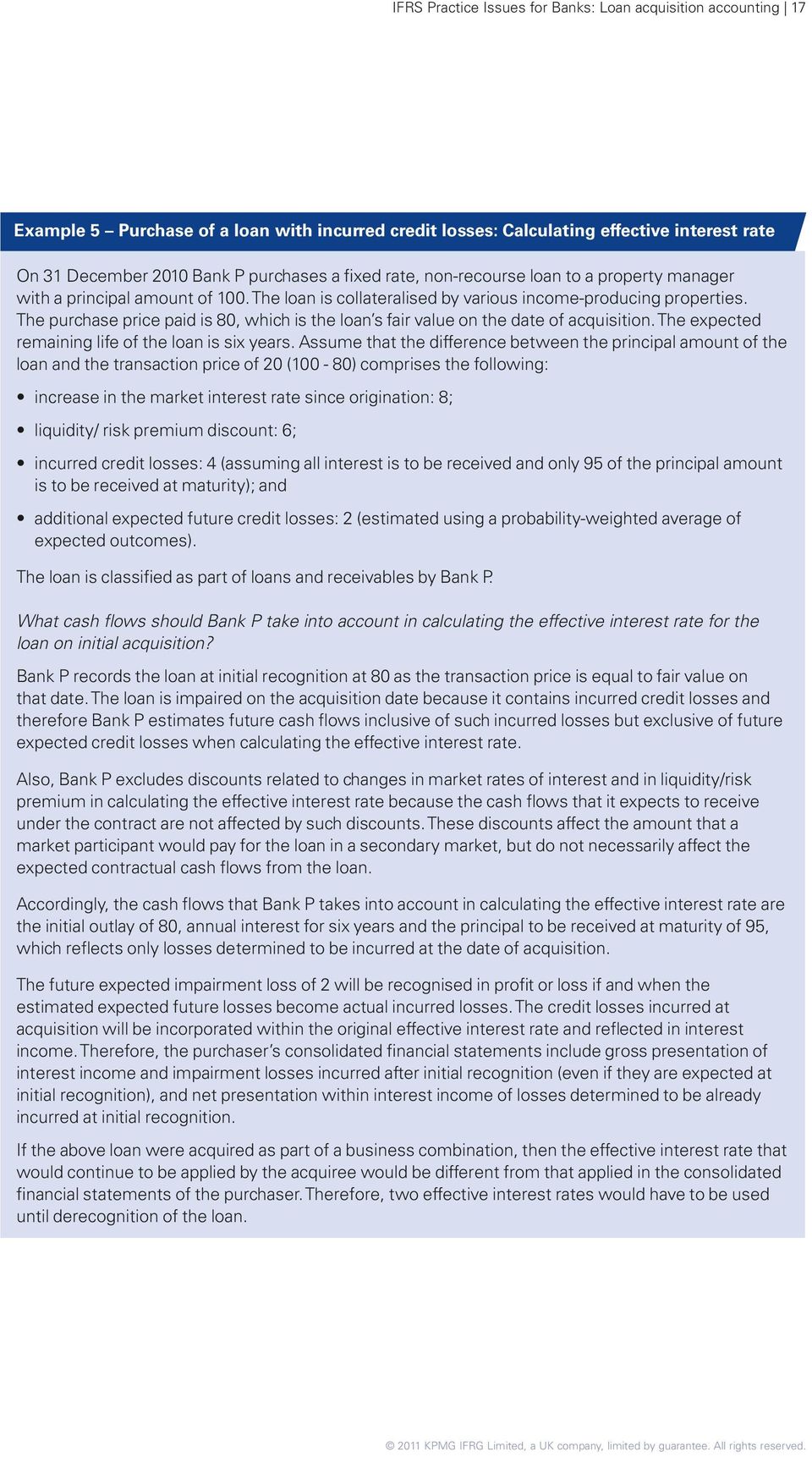

Take that bank loan for the bicycle business. Frs 109 includes the following simplifications which means the entity is not required to determine whether credit risk has increased significantly since initial recognition. At a glance 21 the asc issued frs 109 and sfrsi 9 in dec 2014 and dec 20171 respectively. Pwcs in depth ifrs 9 impairment practical guide.

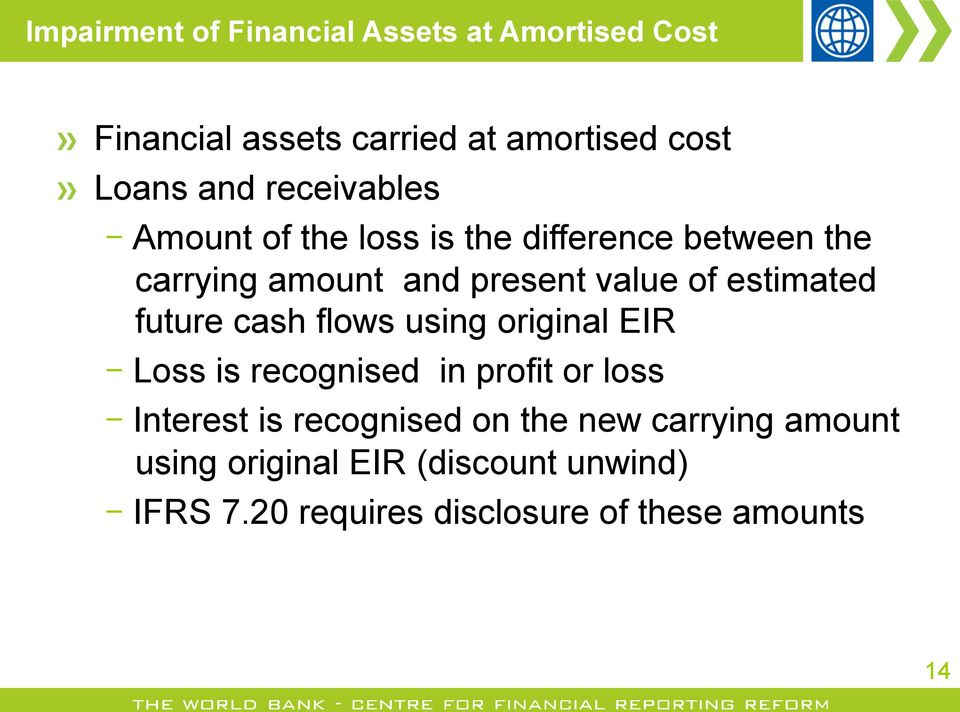

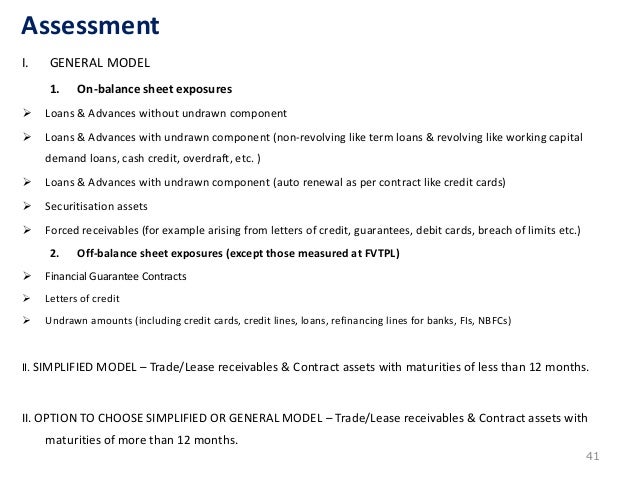

The new model can produce the same measurements as. The adoption of frs 109 will result in changes to the way companies account for financial instruments in the areas of classification and measurement impairment and hedge accounting. Zleases accounted for under frs 117 leases although certain of frs 139s requirements. Under frs 109 corporates apply one of the following approaches in recognising and measuring ecl.

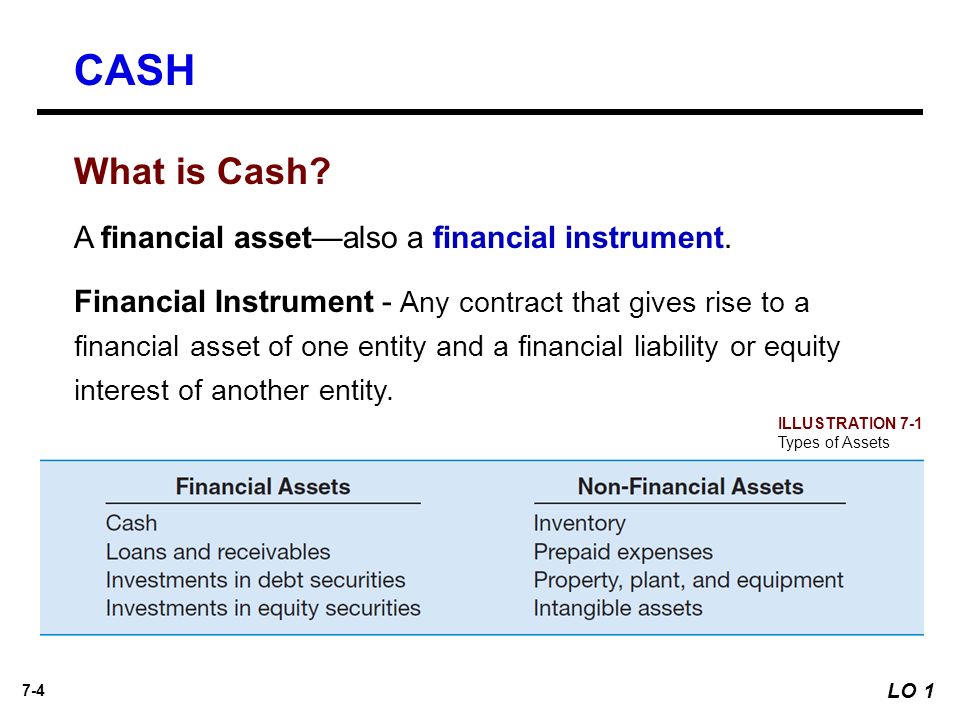

The general approach mainly for debt securities intercompany loans and financial guarantee contracts. Simplified approach for trade receivables contract assets and lease receivables. Cash deposits in other entities receivables eg trade receivables loans to other entities investments in bonds and other debt instruments issued by other entities investments in shares and other equity instruments issued by other. Frs 109 financial instruments became effective on 1 jan 2018 replacing frs 39 financial instruments.

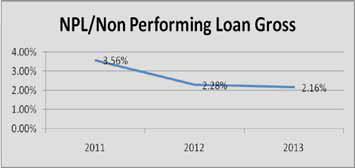

Provision matrix provides guidance for calculating expected credit. A loan is an asset but consider that for reporting purposes that loan is also going to be listed separately as a liability. The company borrowed 15000 and now owes 15000 plus a possible bank fee and interest. Ifrs 9s general 3 stage impairment model are available for trade receivables including intercompany trade receivables contract assets or lease receivables but these do not apply to intercompany loans.