Loans And Receivables Ifrs 9

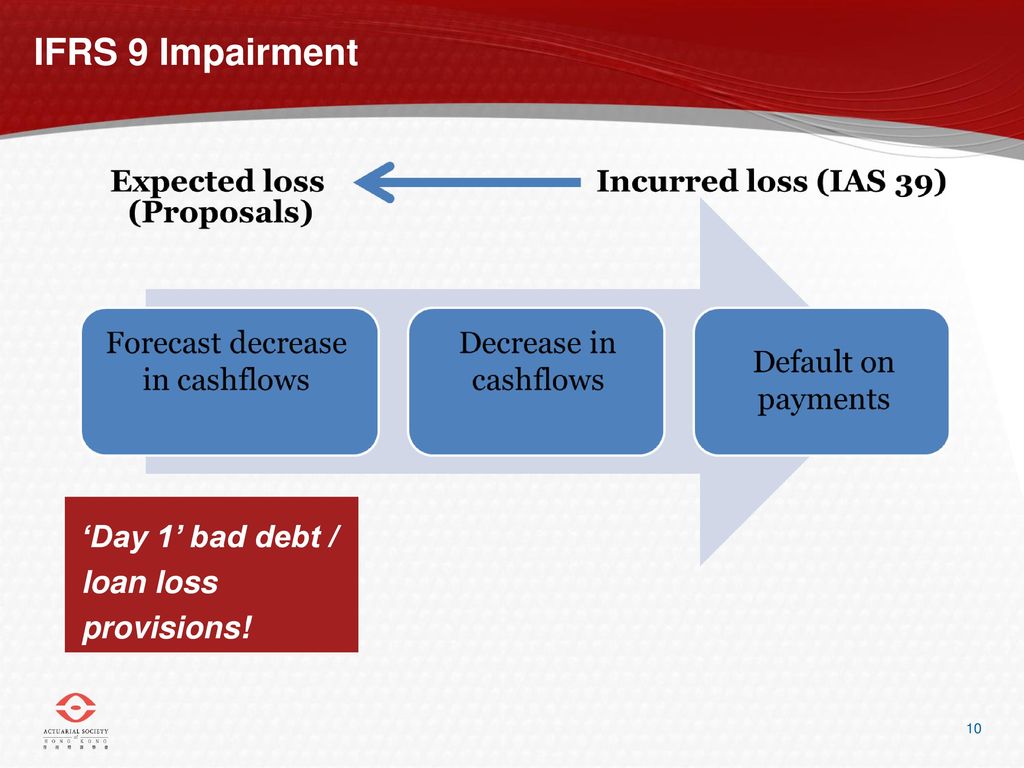

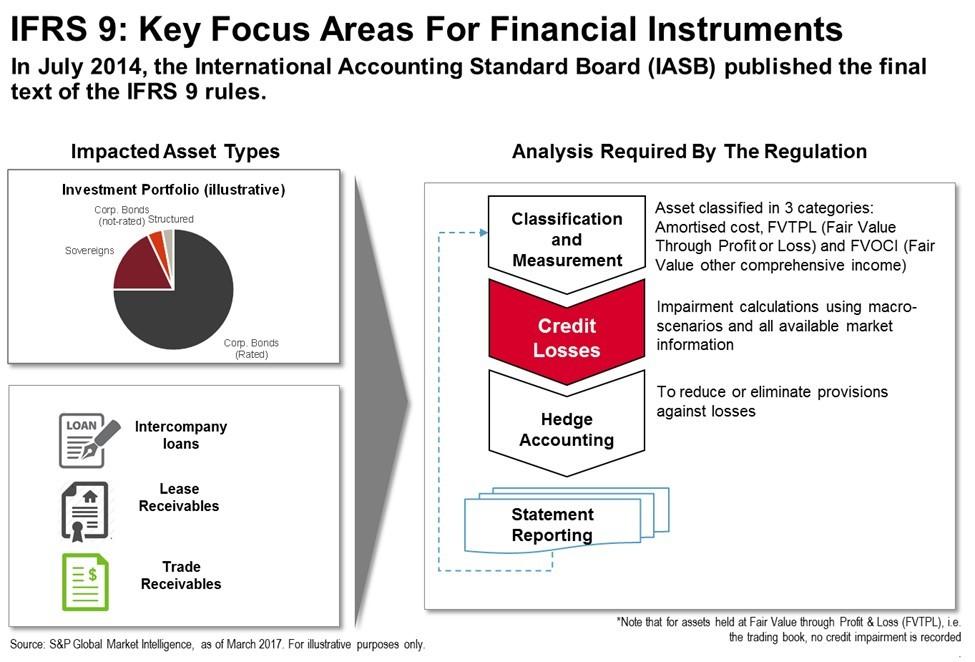

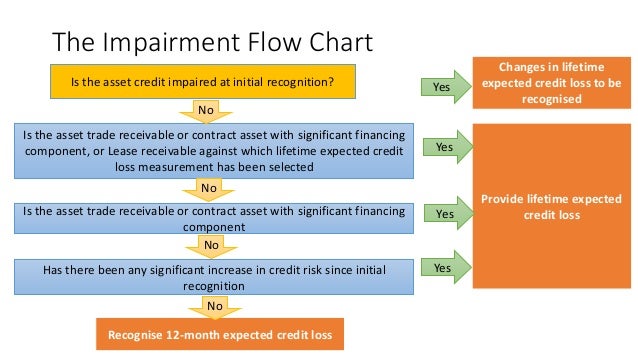

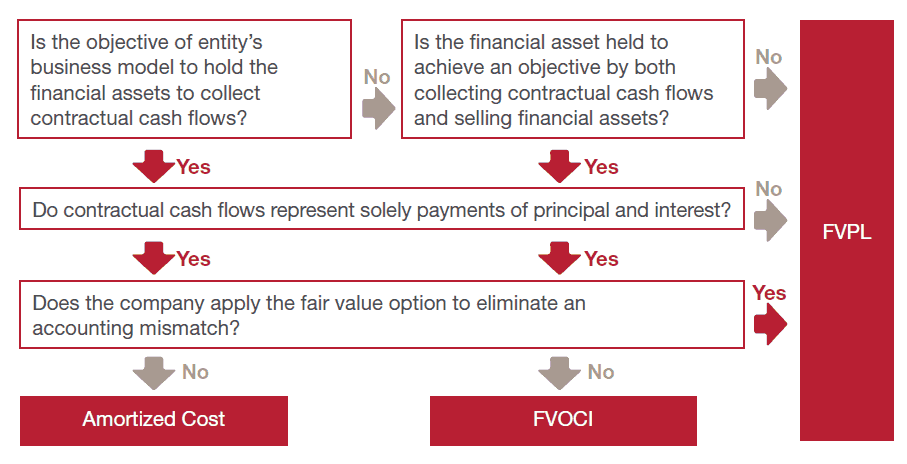

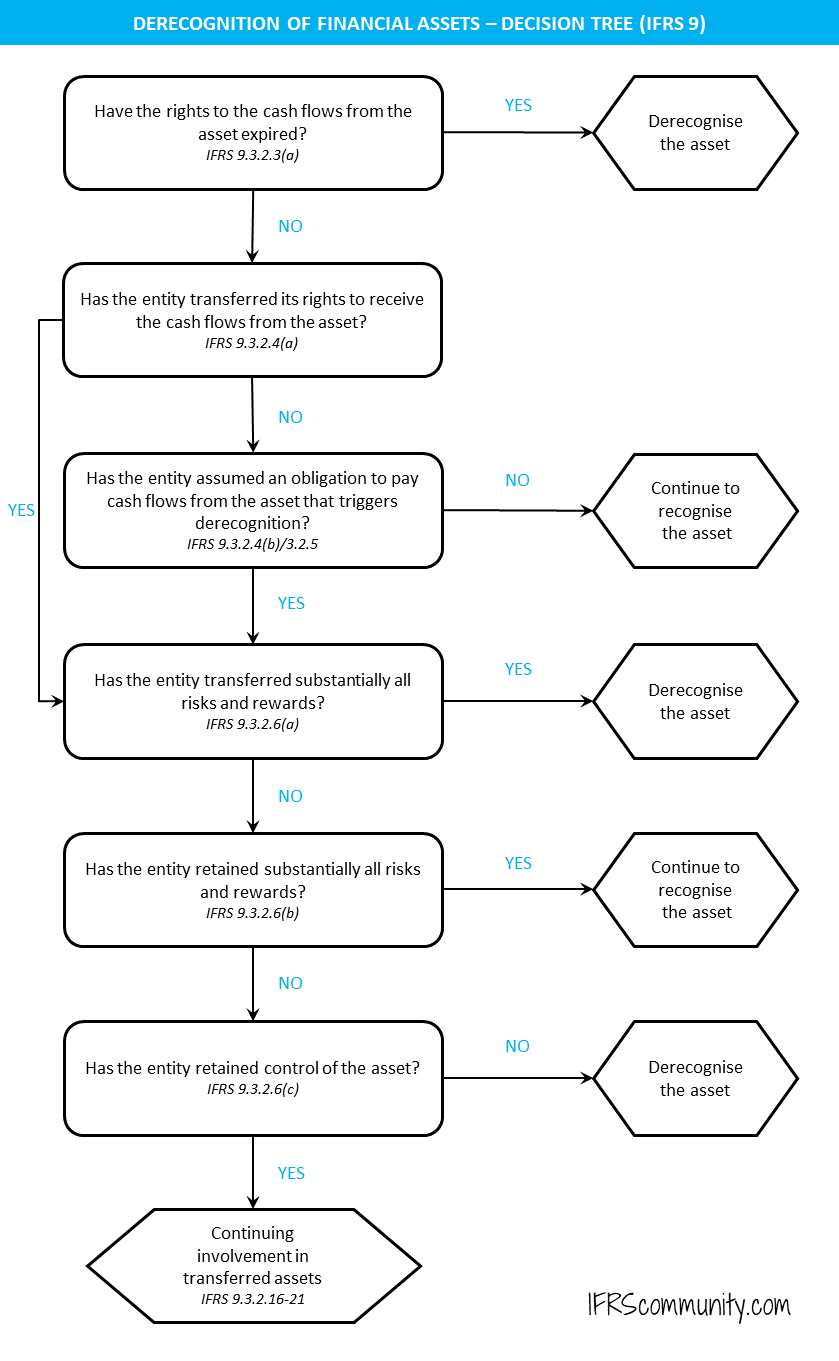

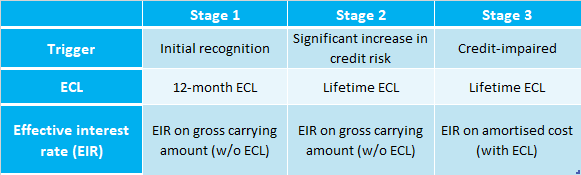

On the other hand ifrs 9 establishes a new approach for loans and receivables including trade receivablesan expected loss model that focuses on the risk that a loan will default rather than whether a loss has been incurred.

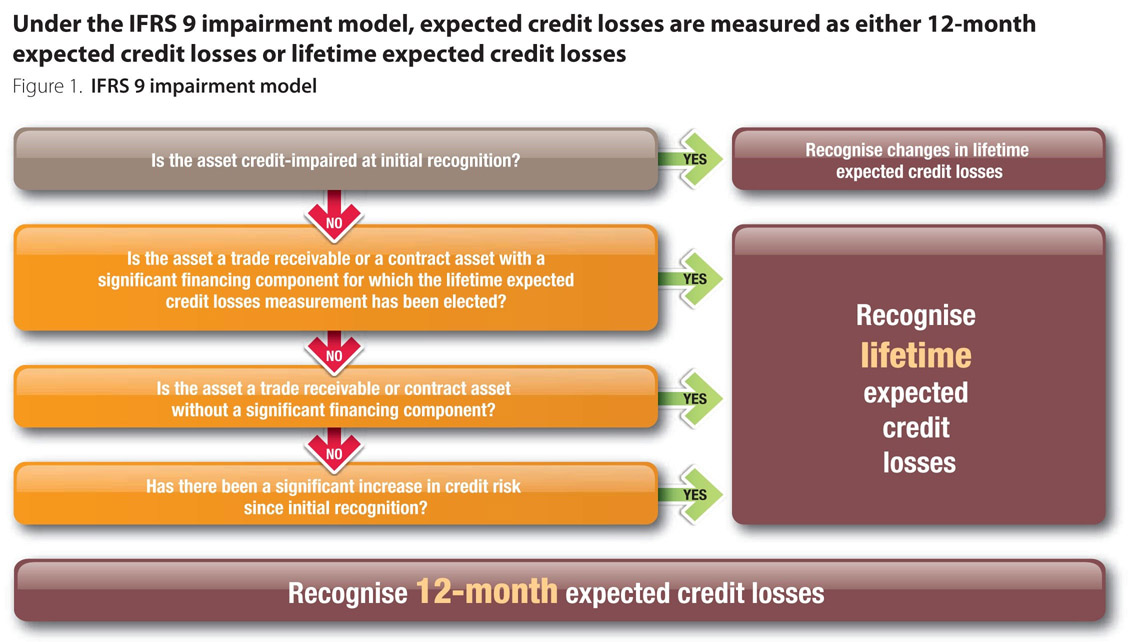

Loans and receivables ifrs 9. The new model can produce the same measurements as. And any others that are subject to ifrs 9s impairment account ing a group that includes lease receivables loan commitments and financial guarantee contracts. But occasionally banks can have other financial assets too. For the sake of simplicity the remainder of this summary will focus on the ecl framework as it applies to loans.

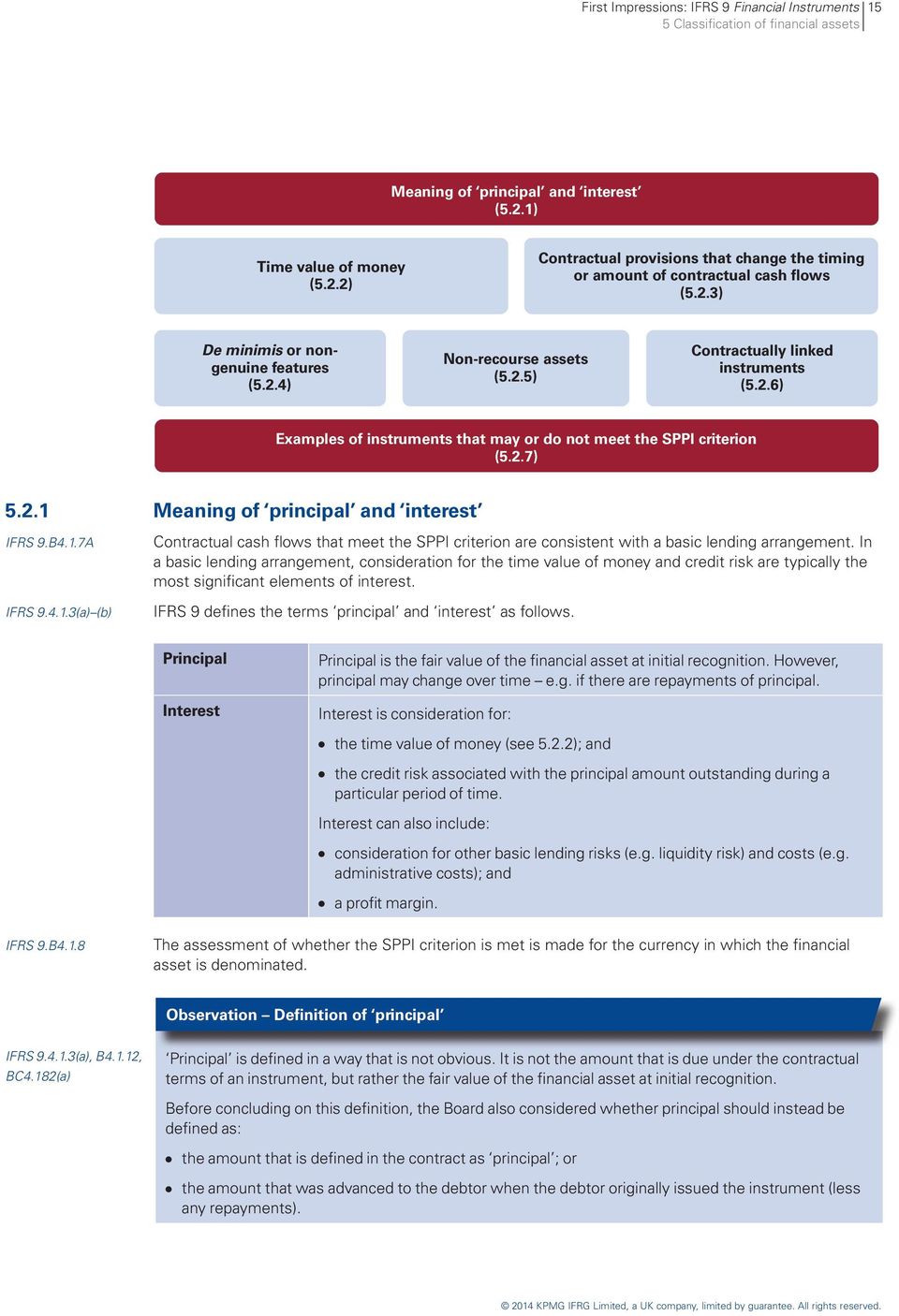

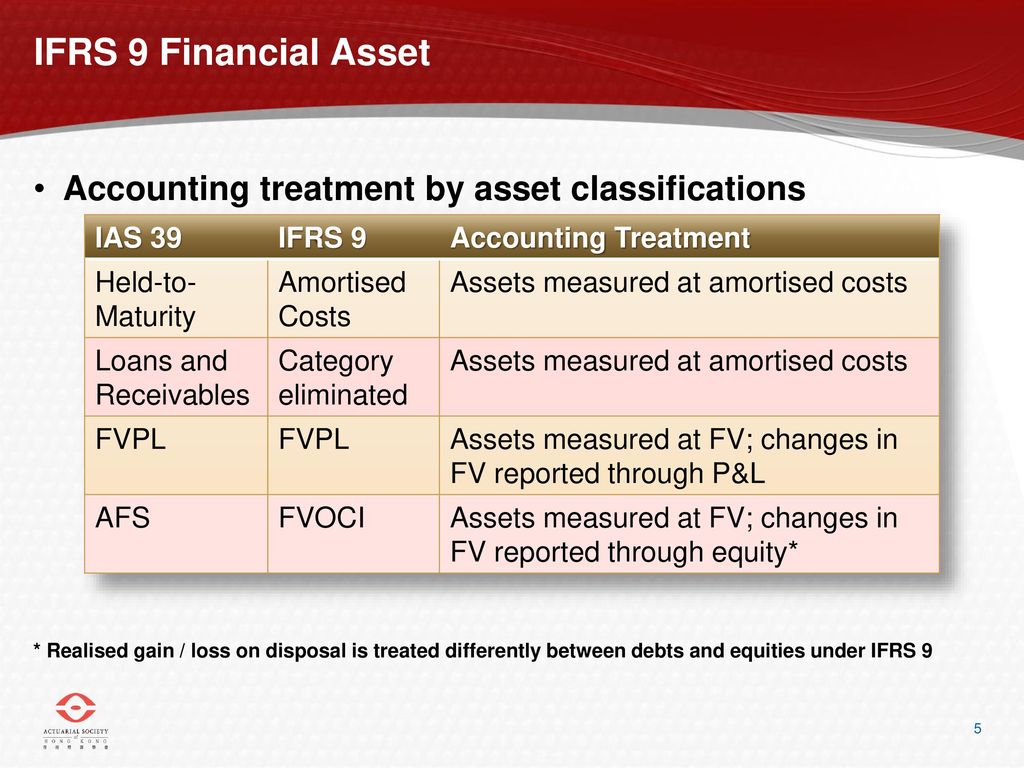

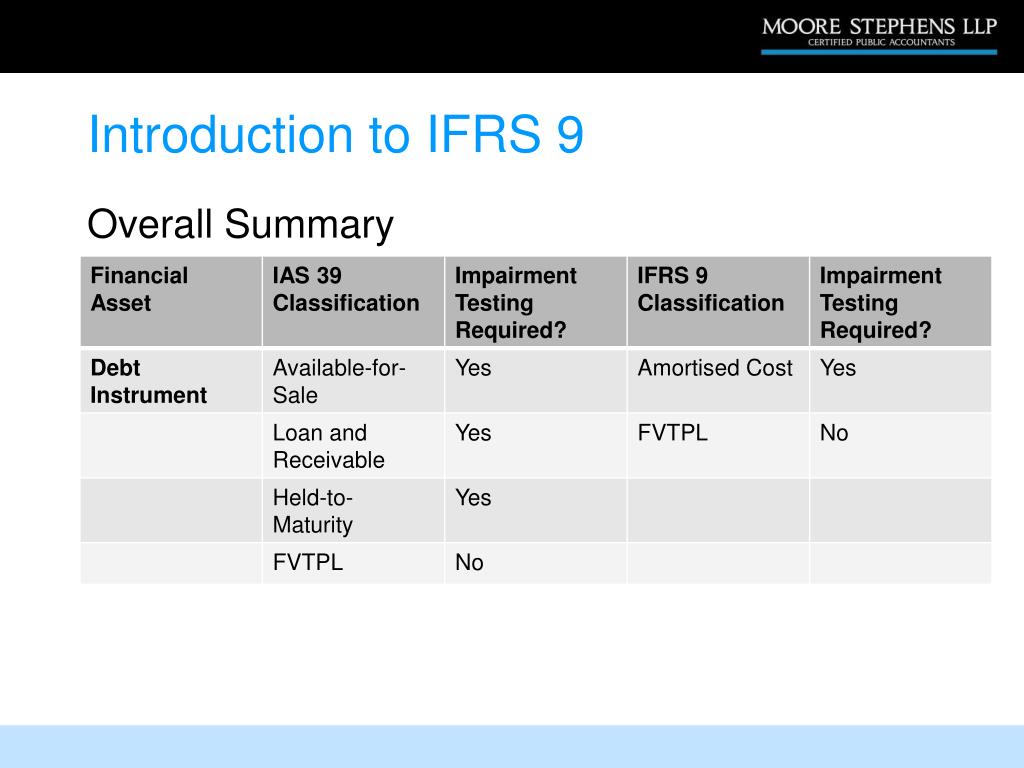

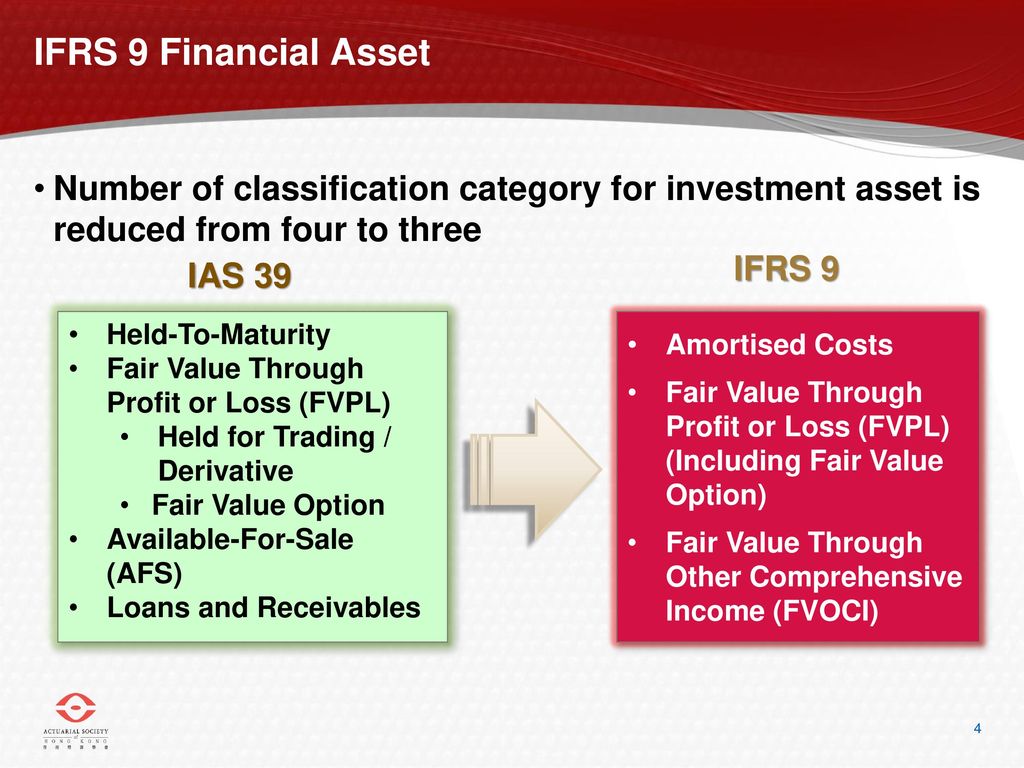

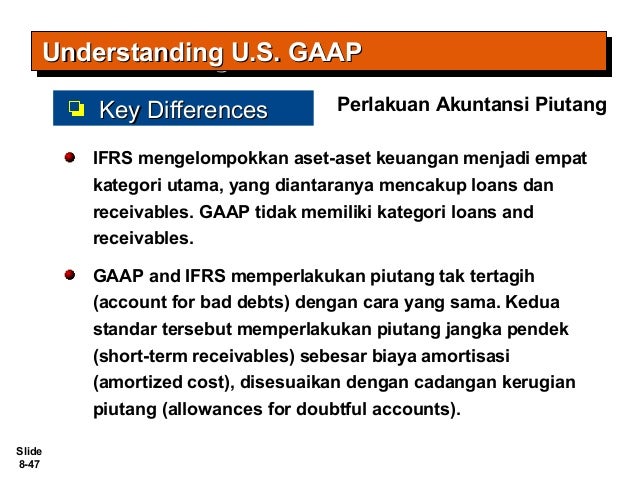

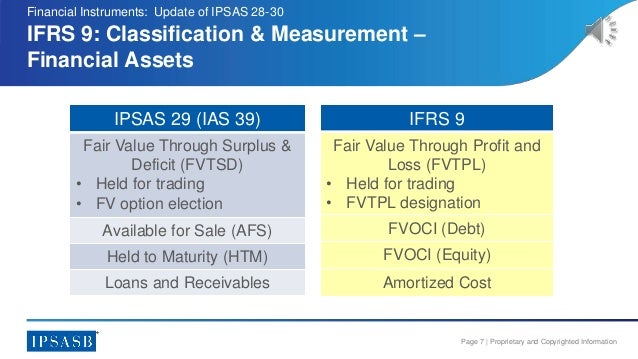

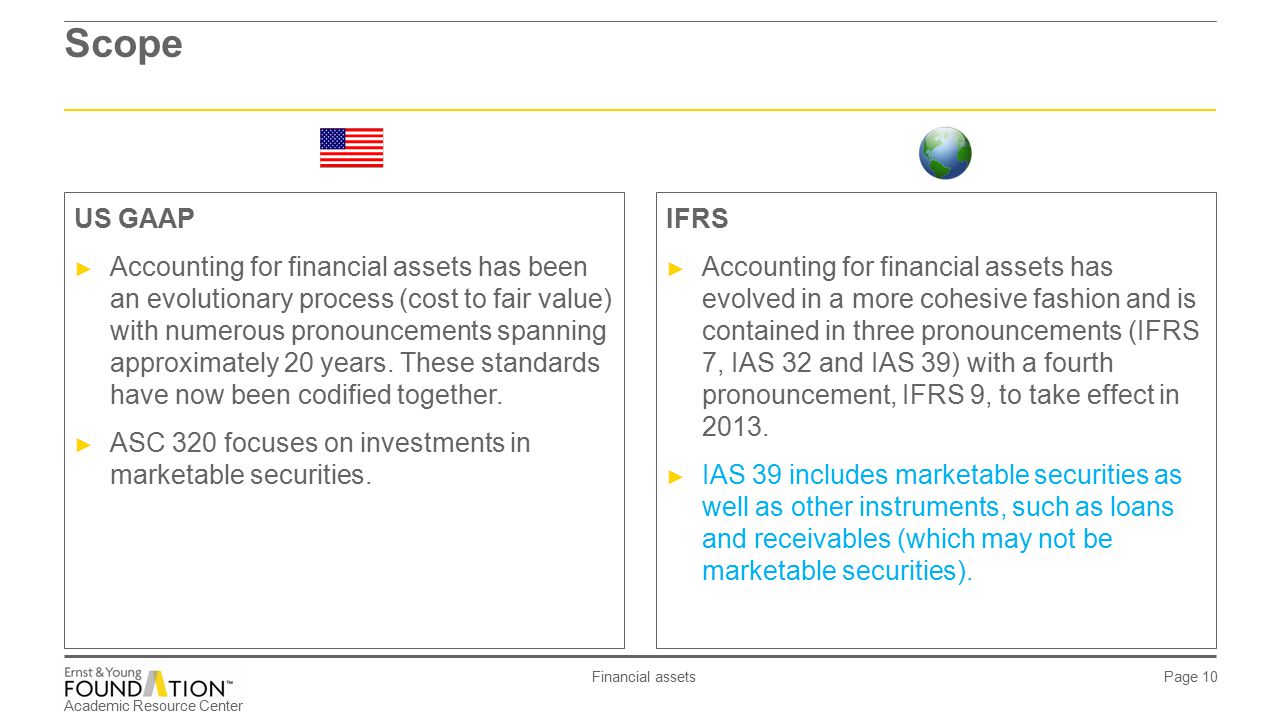

For example they may rent redundant offices and have lease receivables. In terms of ias 39 such financial assets are measured at amortised cost as they fall in the category loans and receivables. Financial assets that are debt instruments measured at fair value through other comprehensive income loan commitments that are not measured at fair value through profit or loss under ifrs 9 financial guarantee contracts that are not measured at fair. As discussed in section 11 assigning a financial asset to a business model is a new requirement under the new standard that did not exist under ias 39.

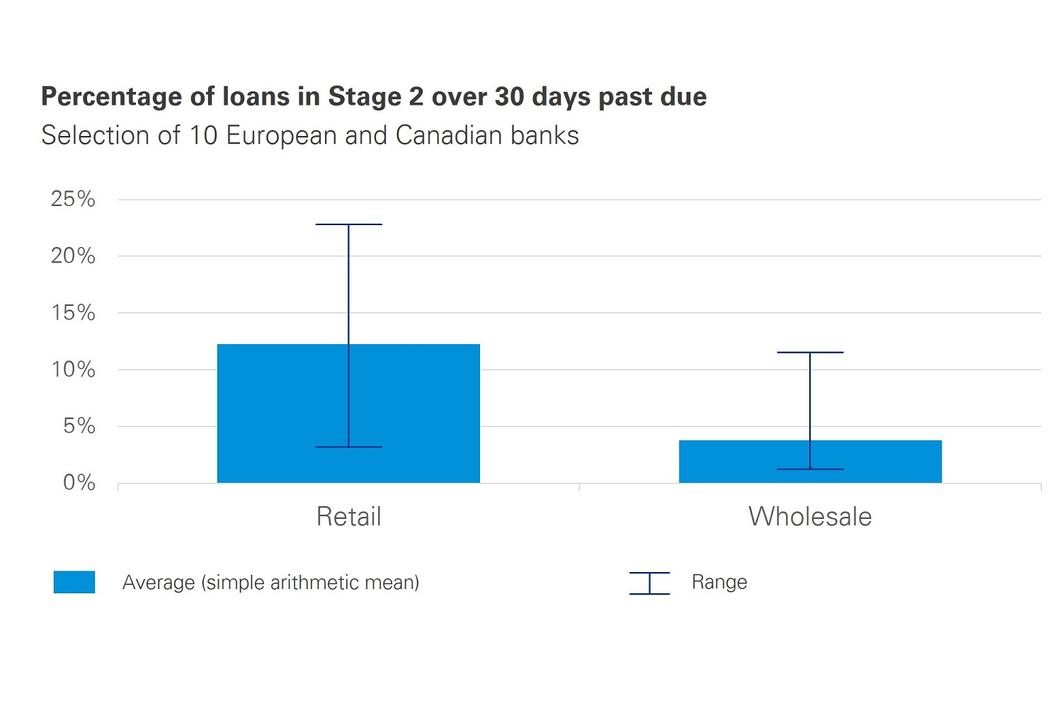

Three stages of impairment. Loans and receivables for which the holder may not recover substantially all of its initial investment other than because of credit deterioration should be classified as available for saleias 399 loans and receivables are measured at amortised cost. Loans and receivables including short term trade receivables. Under ias 39 many loans and trade receivables are classified as loans and receivables and measured at amortised cost.

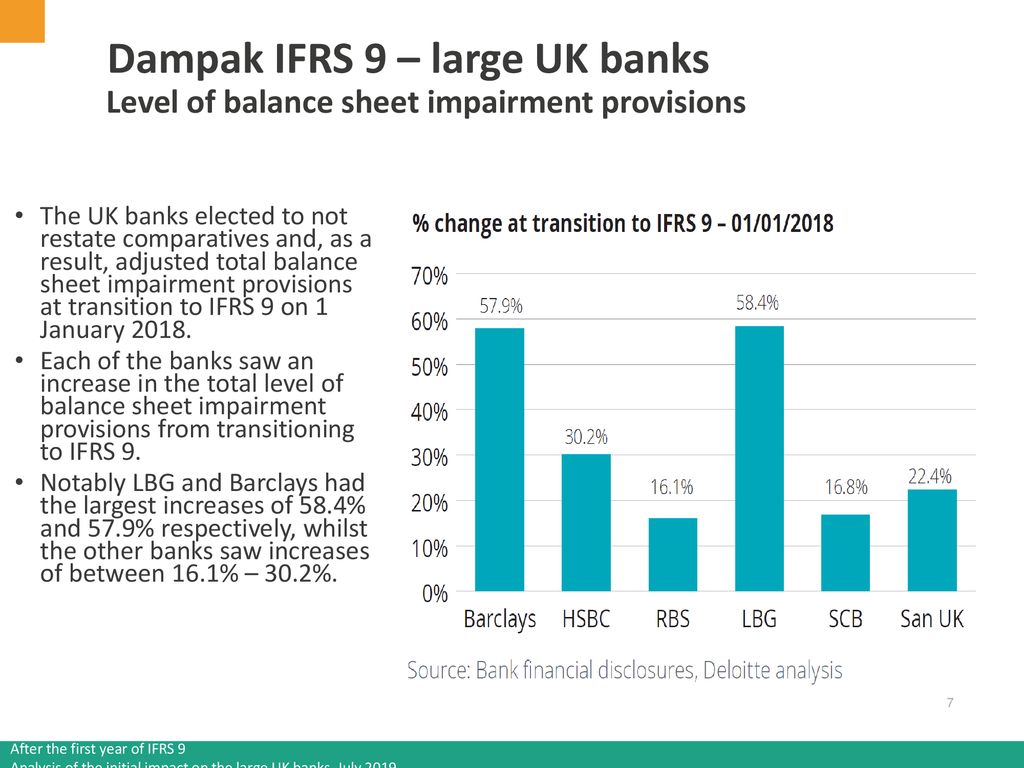

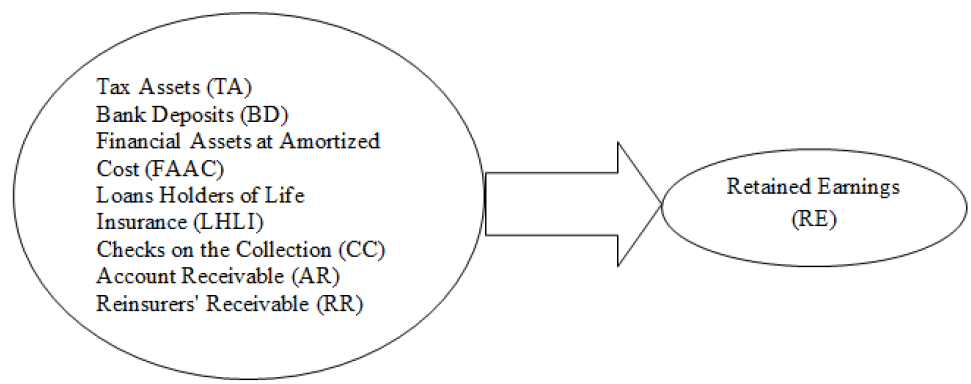

Accounts receivable loans debt securities bank balances and deposits etc. Ifrs 9 paragraph 411 states that a financial asset shall be measured at fair value unless it is measured at amortised cost in accordance with paragraph 412 which reads as follows. For financial instruments that are subject to the impairment requirements of ifrs 9 disclose for each class of financial instrument. Banks usually provide lots of loans and under ifrs 9 they have to apply general models to calculate impairment loss for loans.

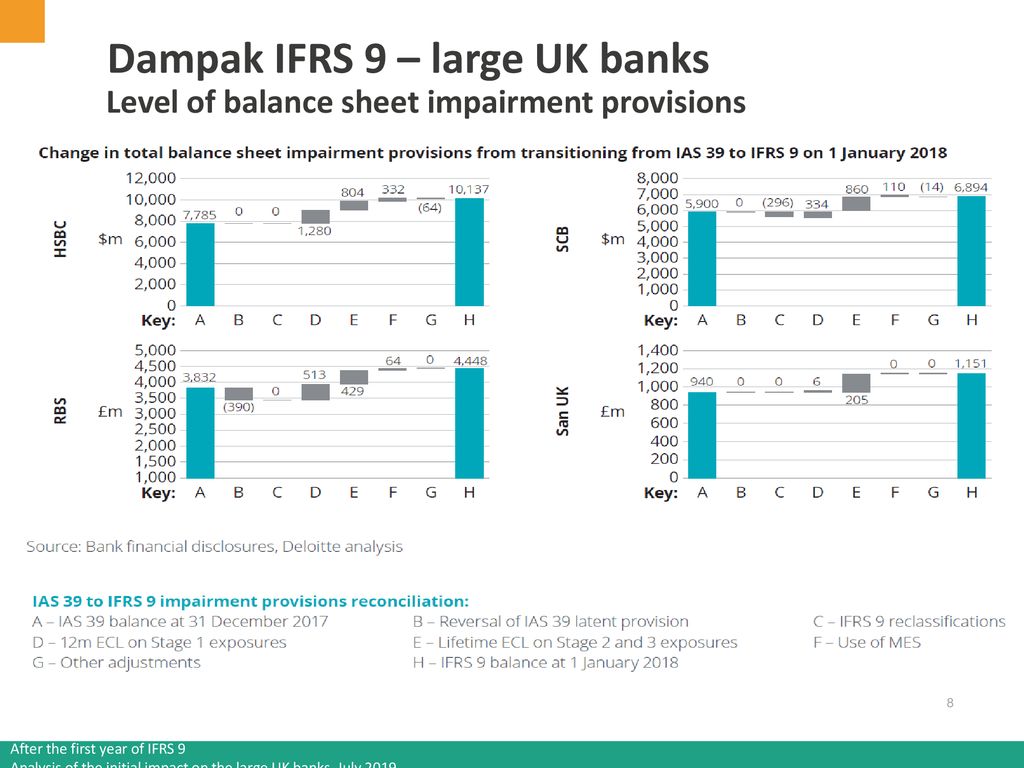

The amount that best represents the entitys maximum exposure to credit. International financial reporting standard 9 ifrs 9 responds to criticisms that international accounting standard 39 ias 39 is too complex is inconsistent with the way entities manage their businesses and risks and defers the recognition of credit losses on loans and receivables until too late in the credit cycle.

.jpg)