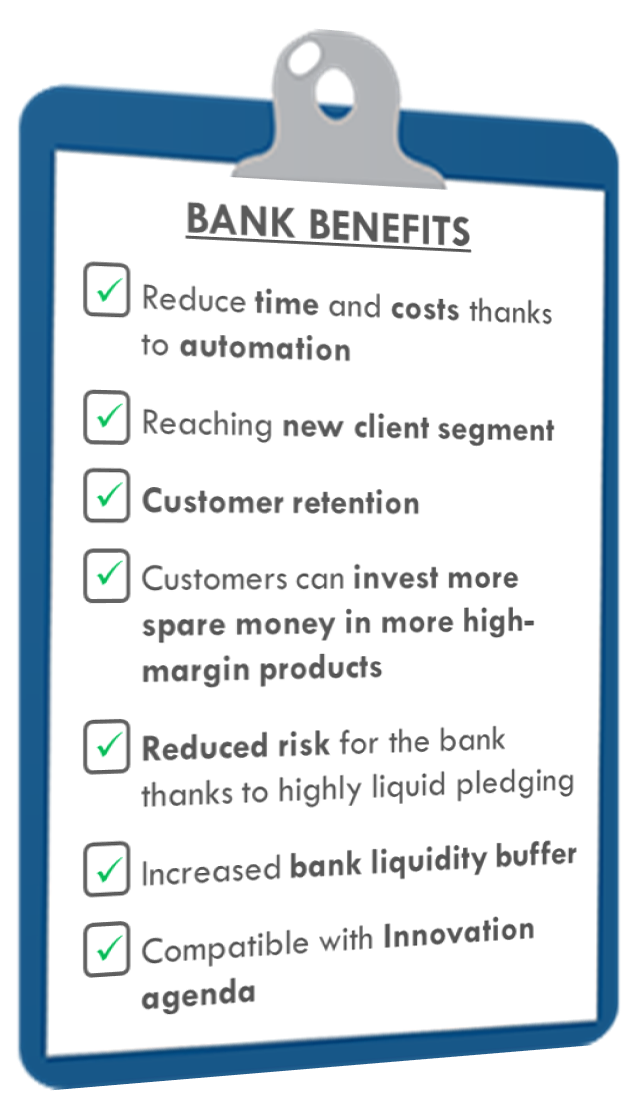

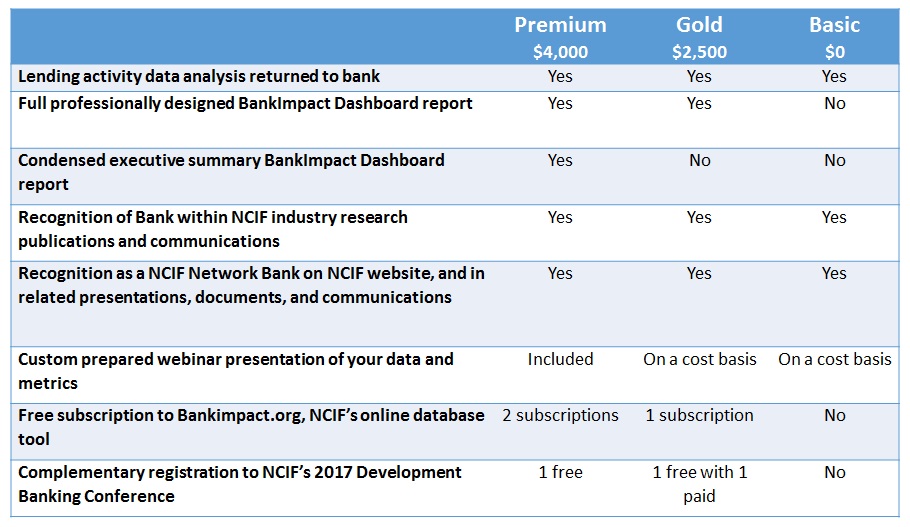

Loans Bank Benefits

Benefits of personal loan.

Loans bank benefits. The terms and price of loans will vary between providers and will reflect the risk and cost to the bank in providing the finance. The first and the most important benefit of personal loan is that unlike home loan it can be used for any. For example if you are paying a 5 percent interest rate on a 30000 loan then your yearly interest is deductible on your 1040 schedule c tax form. No limitation on end use.

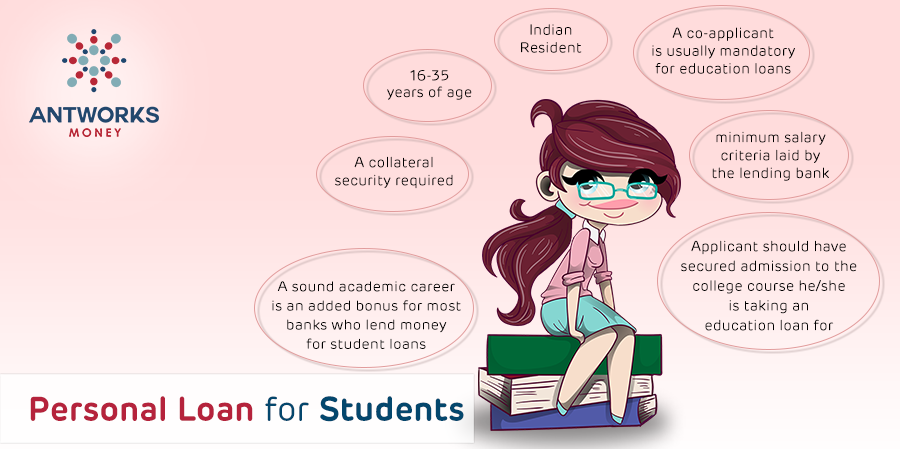

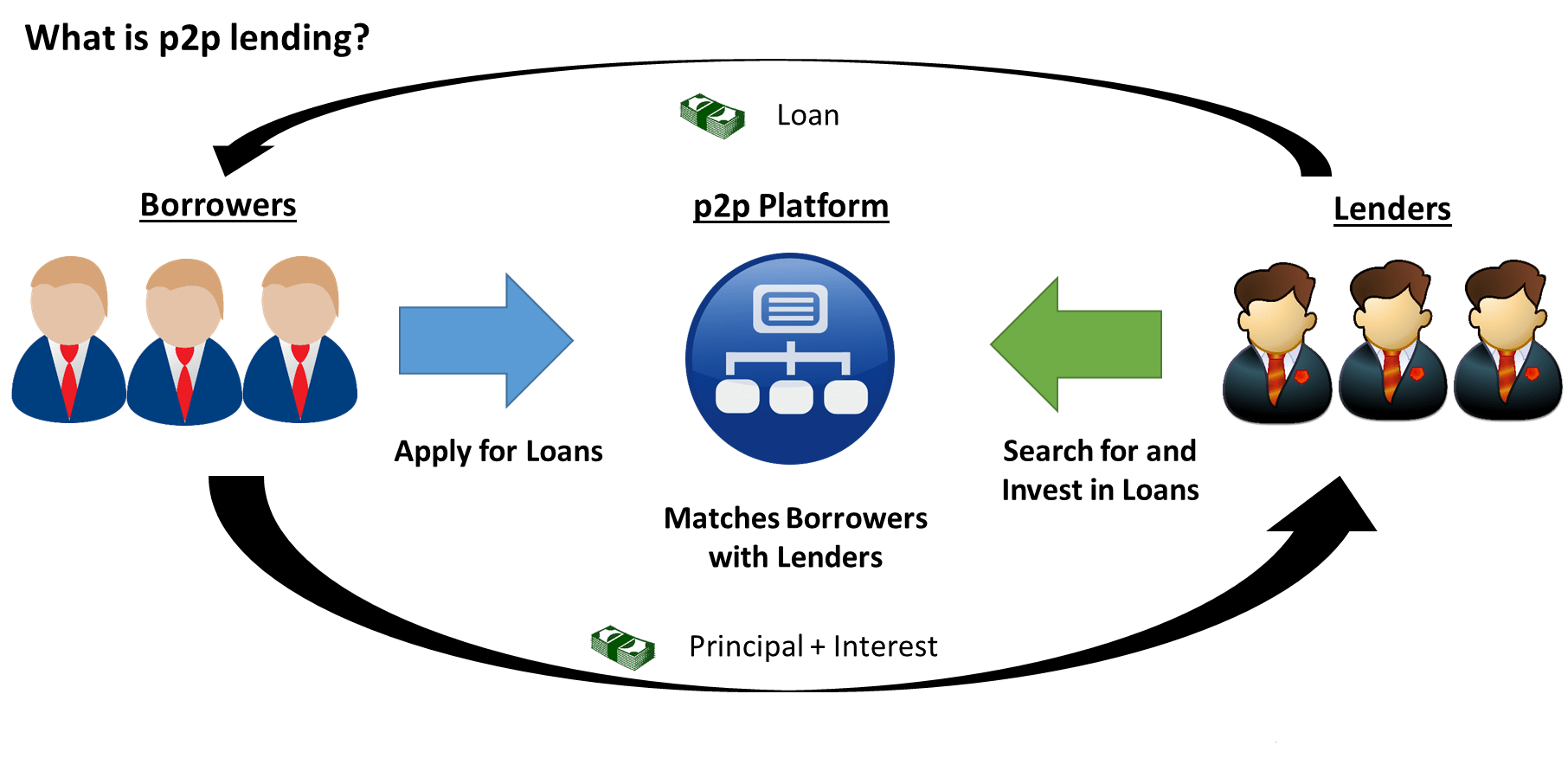

Suppose an individual wants to buy a smartphone of usd 80000 he decides to use his own usd 30000 and borrow the rest usd 50000 by bank loan at 10 interest per annum. Banks will loan money to businesses on the basis of an adequate return for their investment to reflect the risks of defaulting and to cover administrative costs. This money is of people who deposit money in their accounts in the bank can be savings current fd. Personal loan is an unsecured consumer loan which can be used by you for any purpose such as holiday trip buying furniture renovating house and medical emergencyyou are free to.

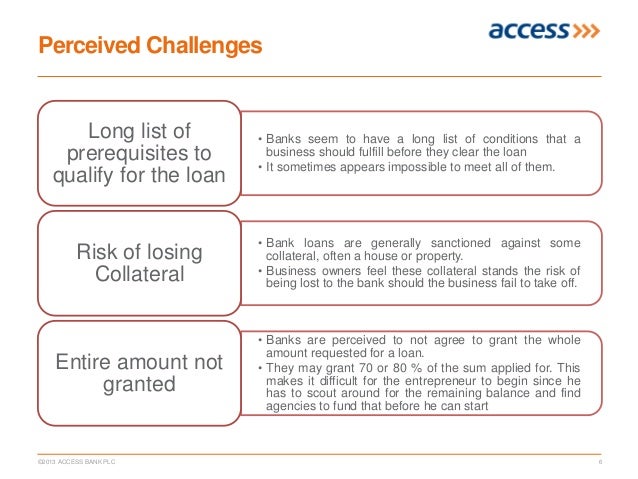

For larger sums the pricing and terms may be negotiable. Generally bank loans have the. Advantages of bank loans. One of the biggest disadvantages of bank loans is that the borrower pays way more than the purchase price of the product when he uses a loan to buy a product.

When you use a bank loan for business reasons the interest you pay on the loan is a tax deductible expense.

.jpg)