Bad Loans And Receivables

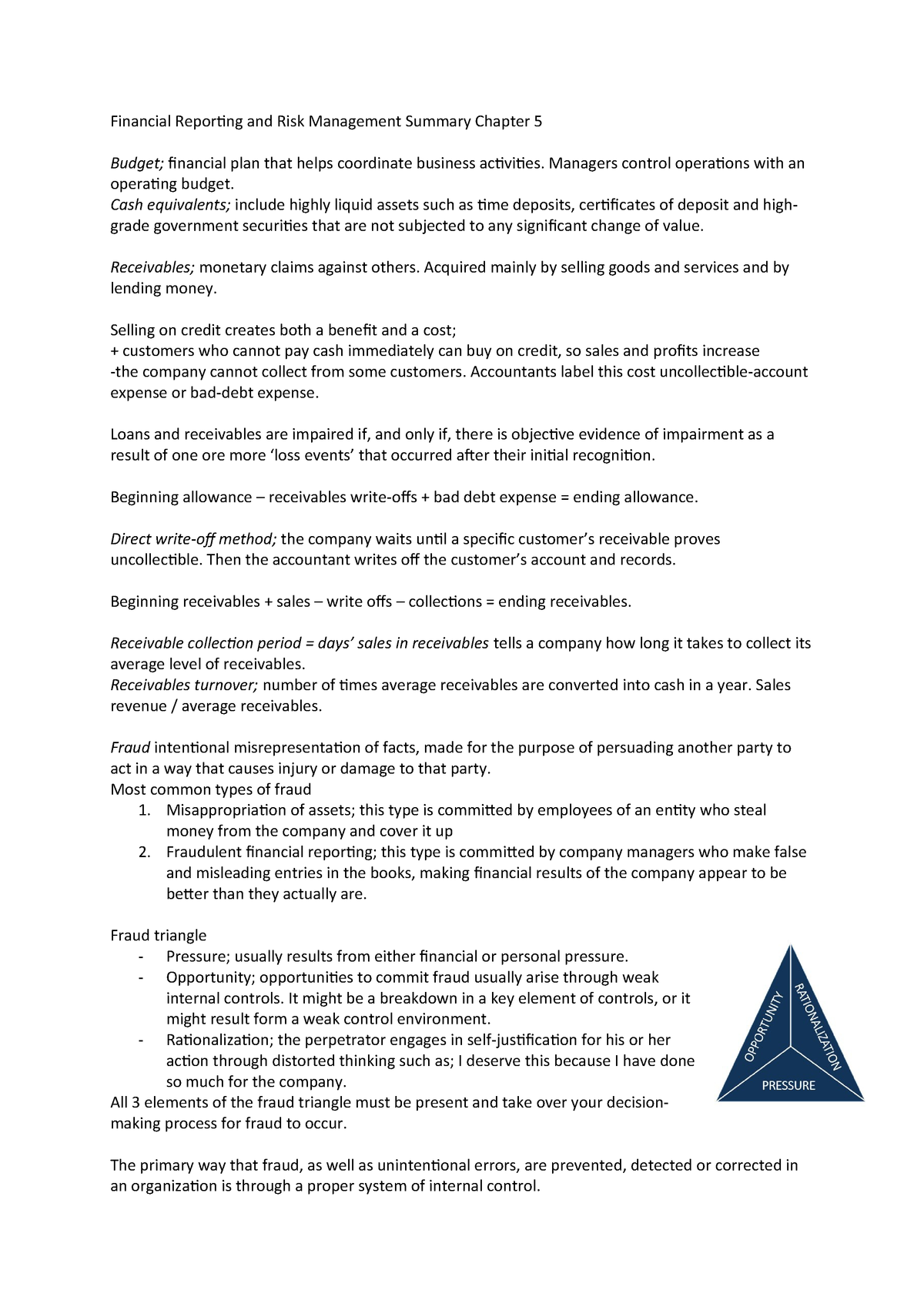

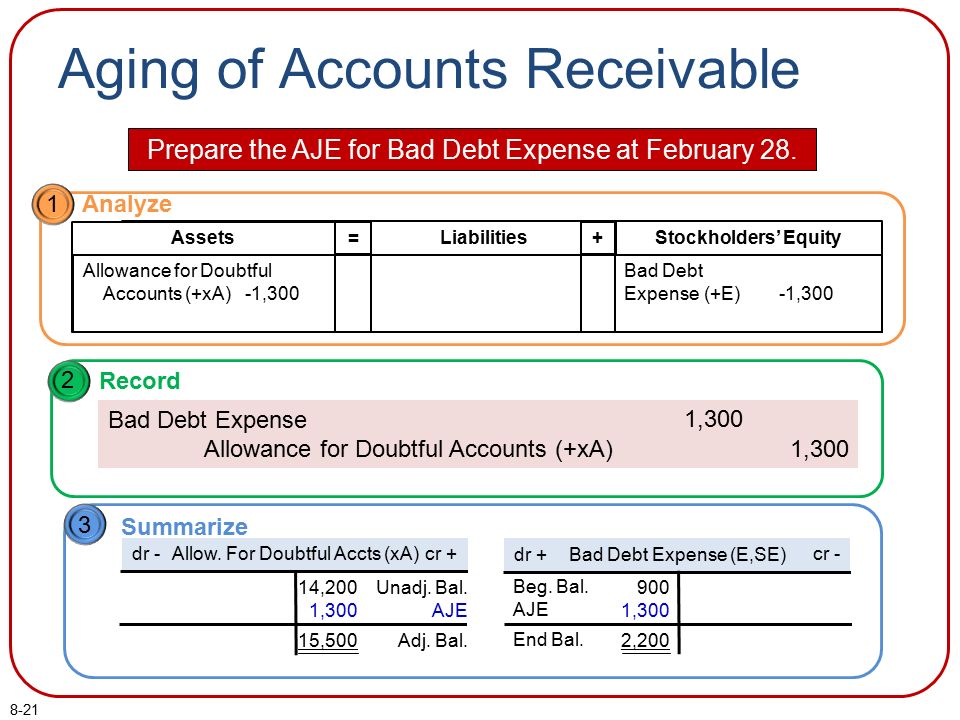

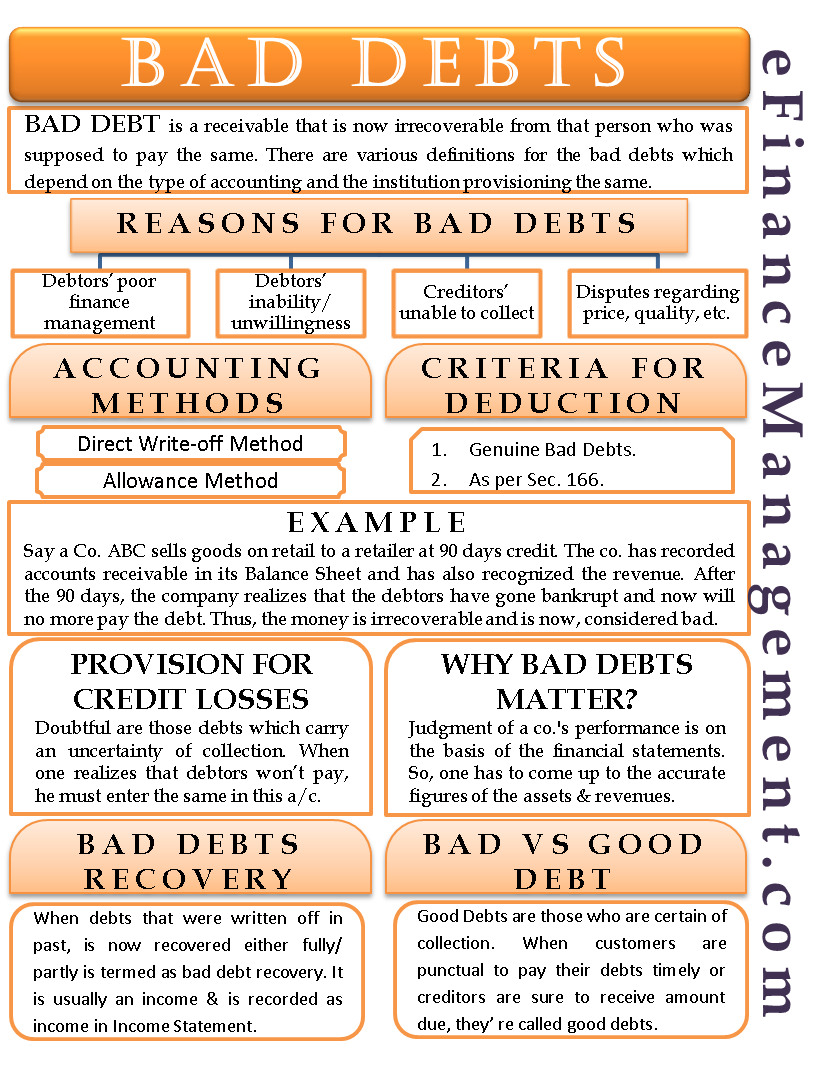

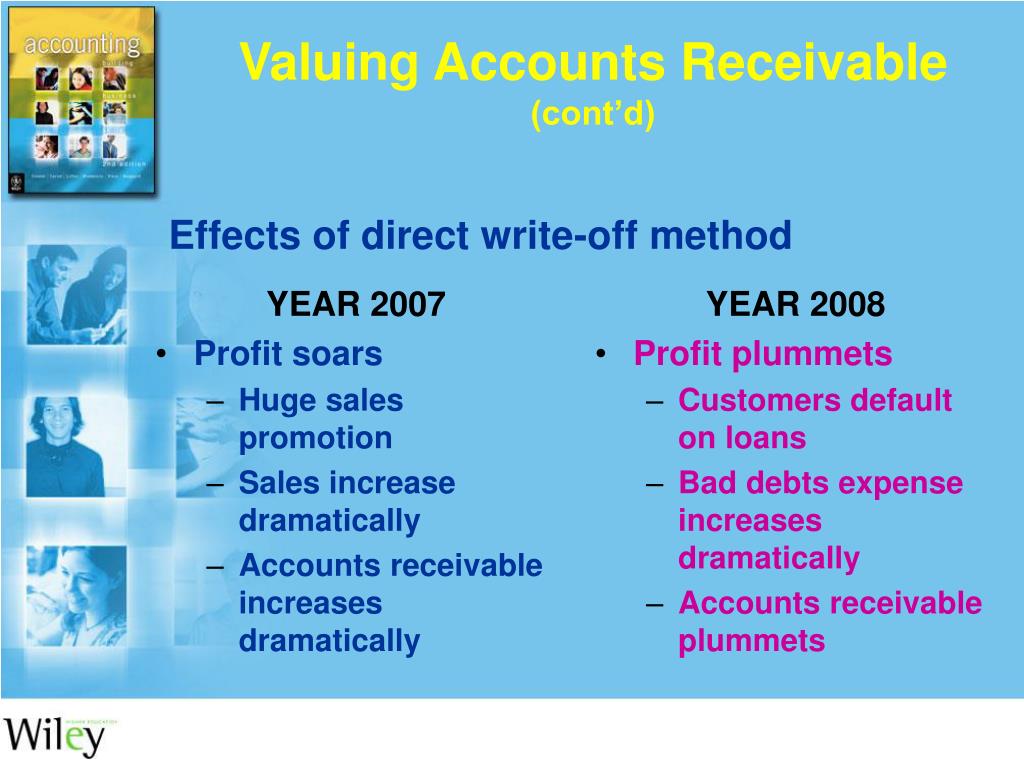

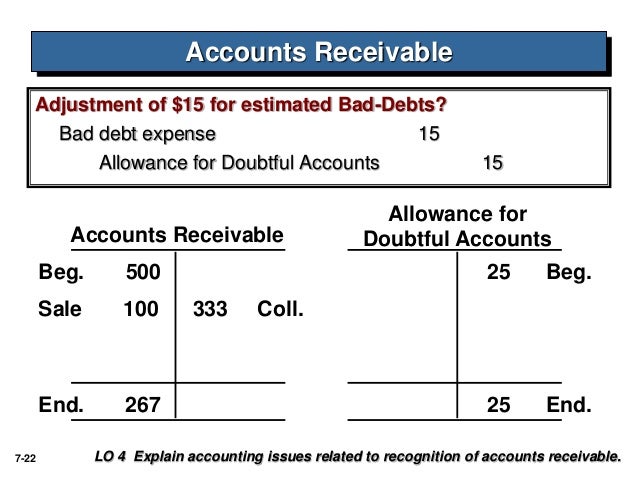

Bad debt is debt that is not collectible and therefore worthless to the creditor.

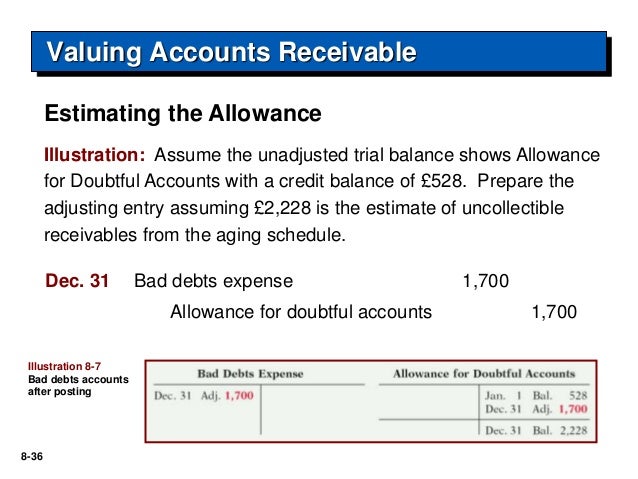

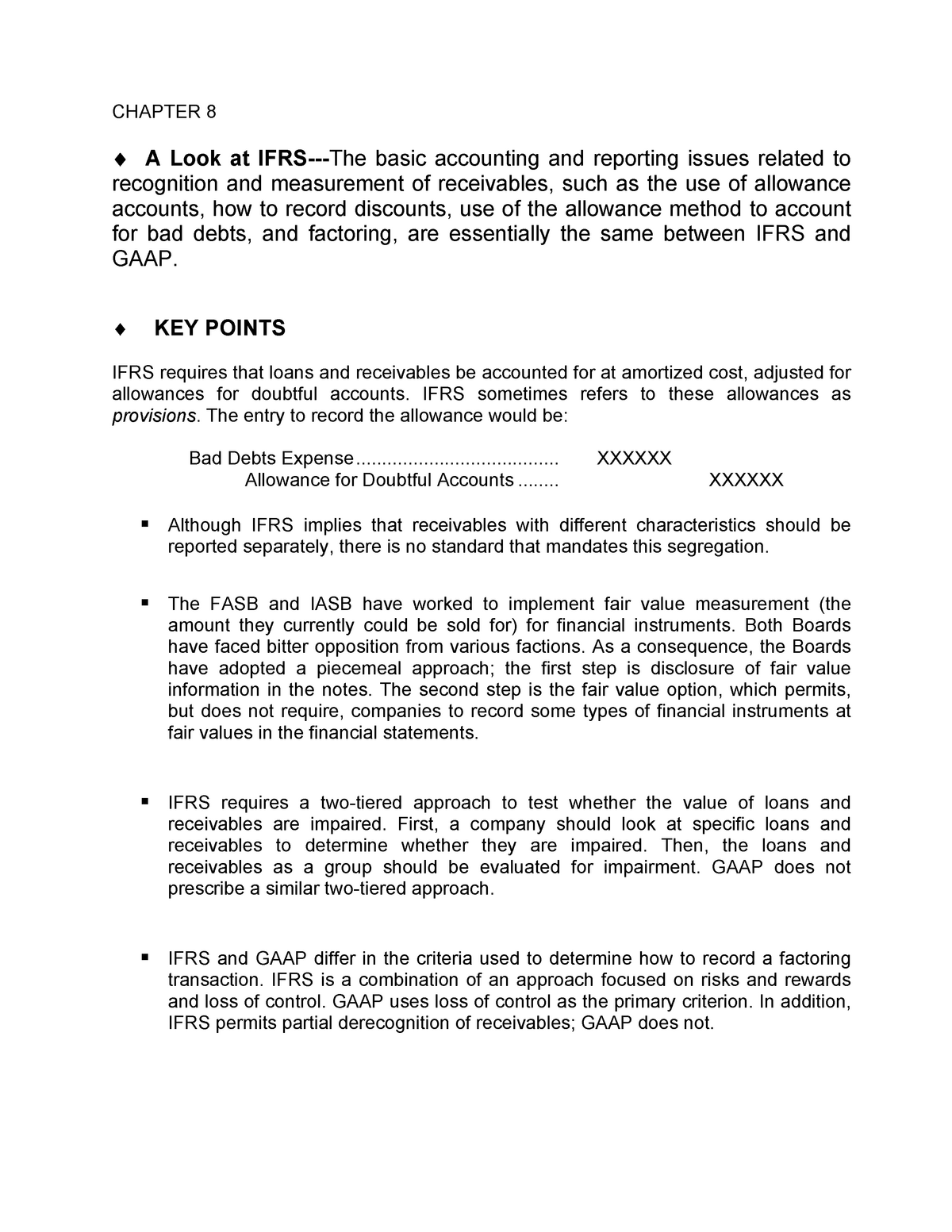

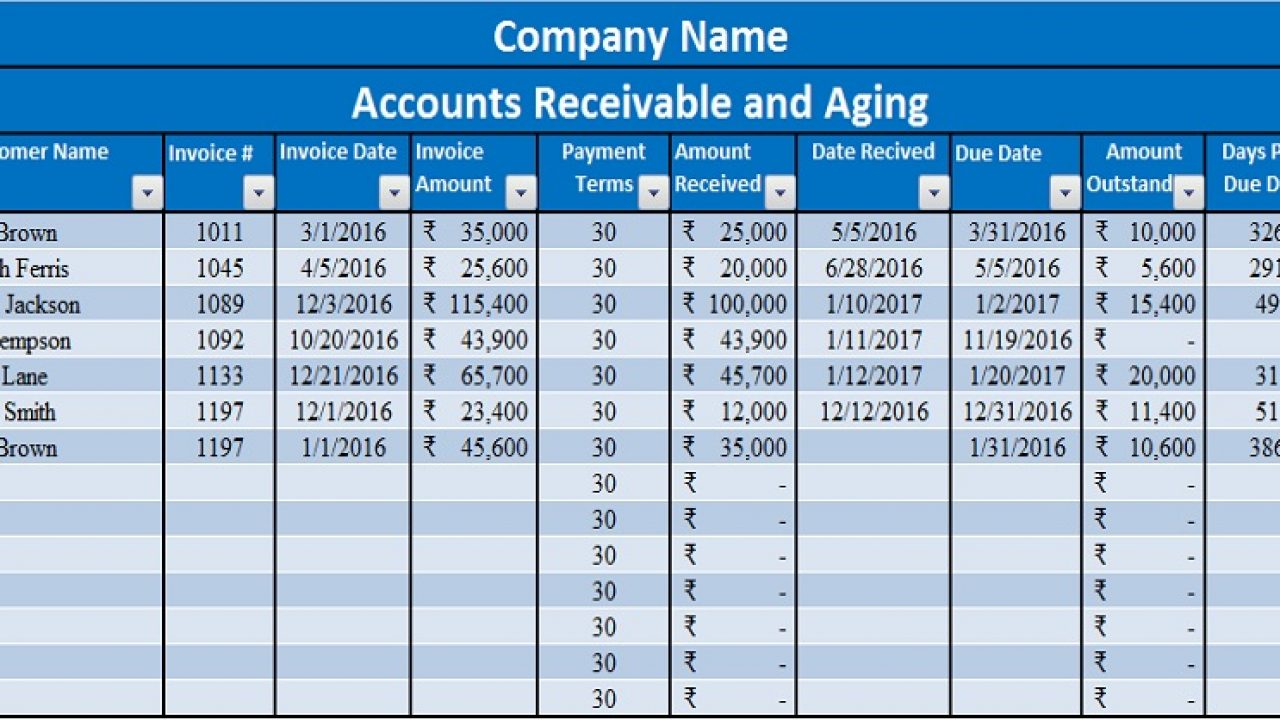

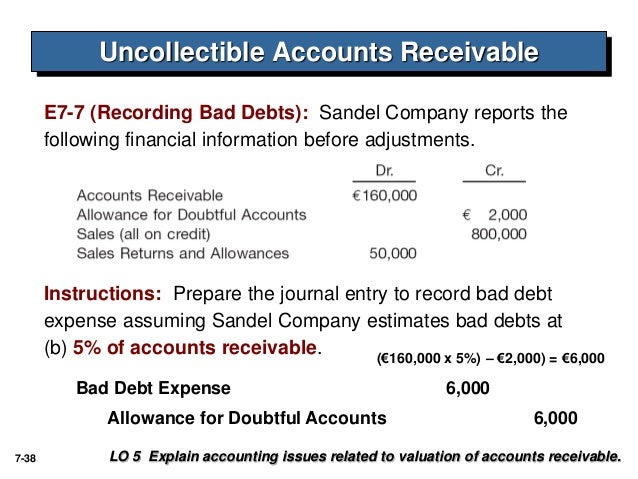

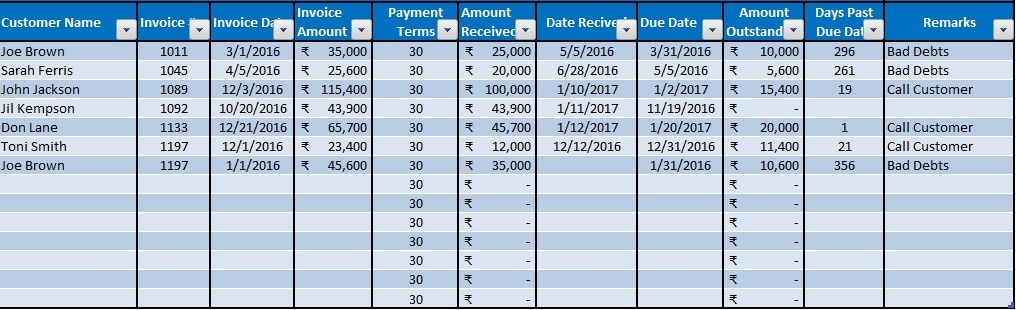

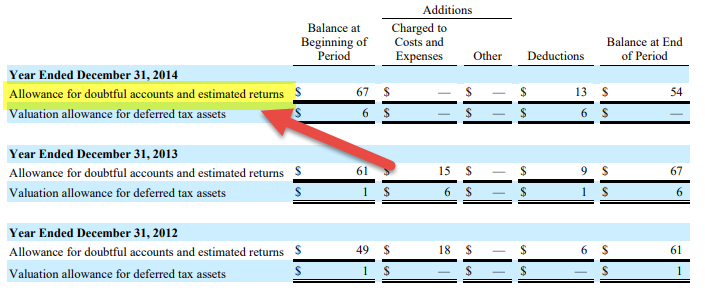

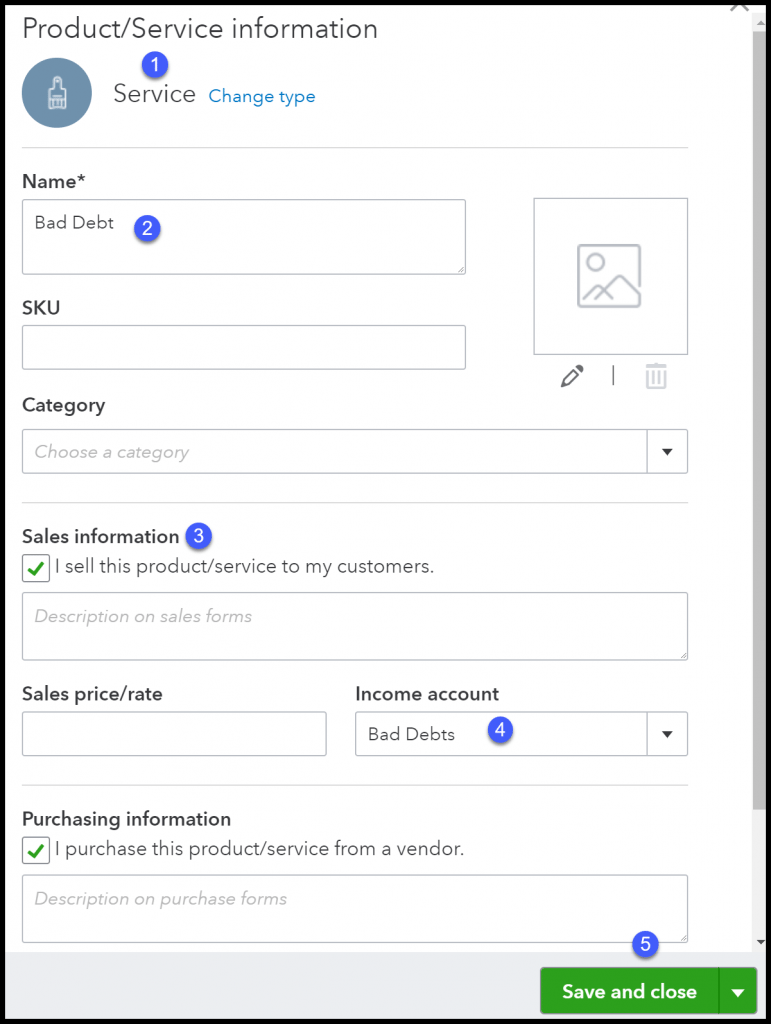

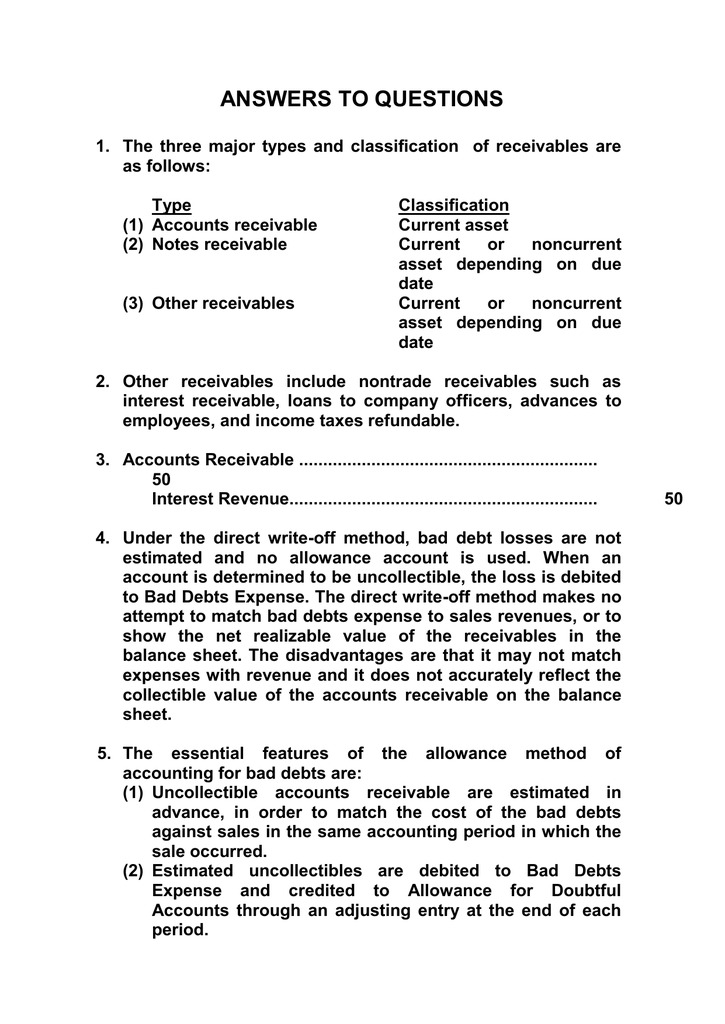

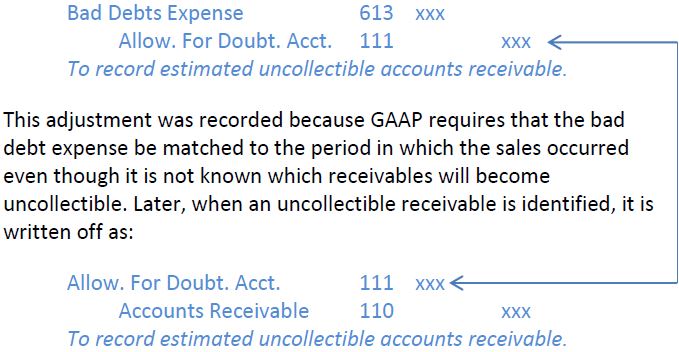

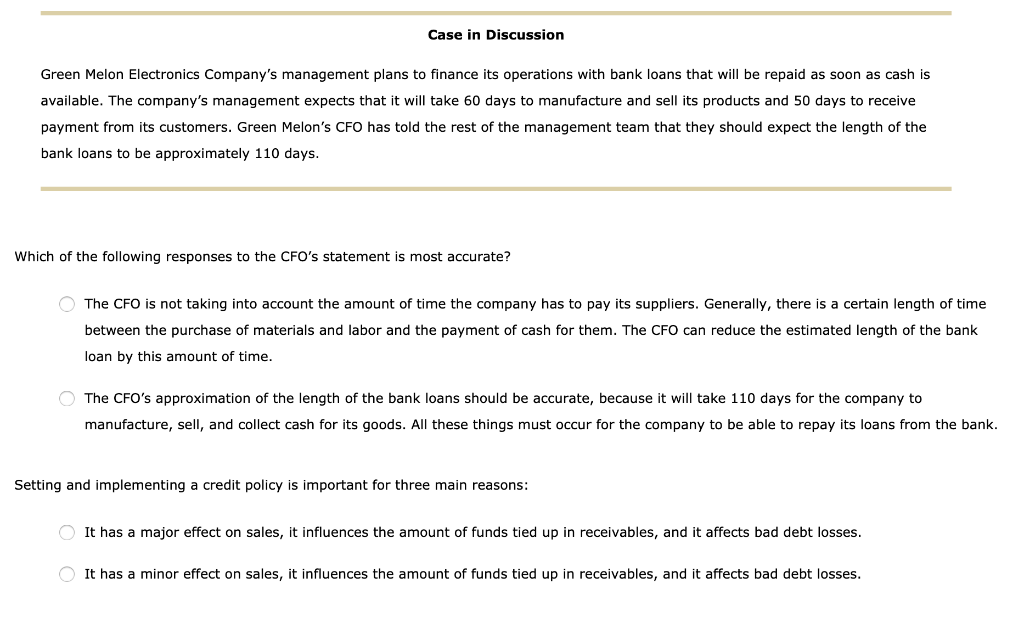

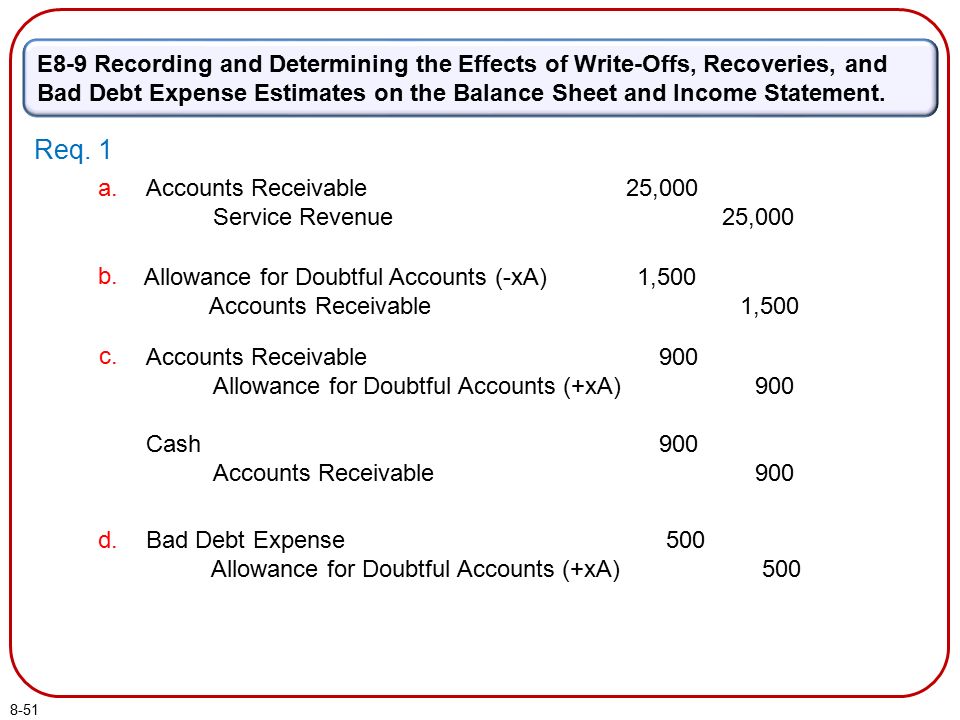

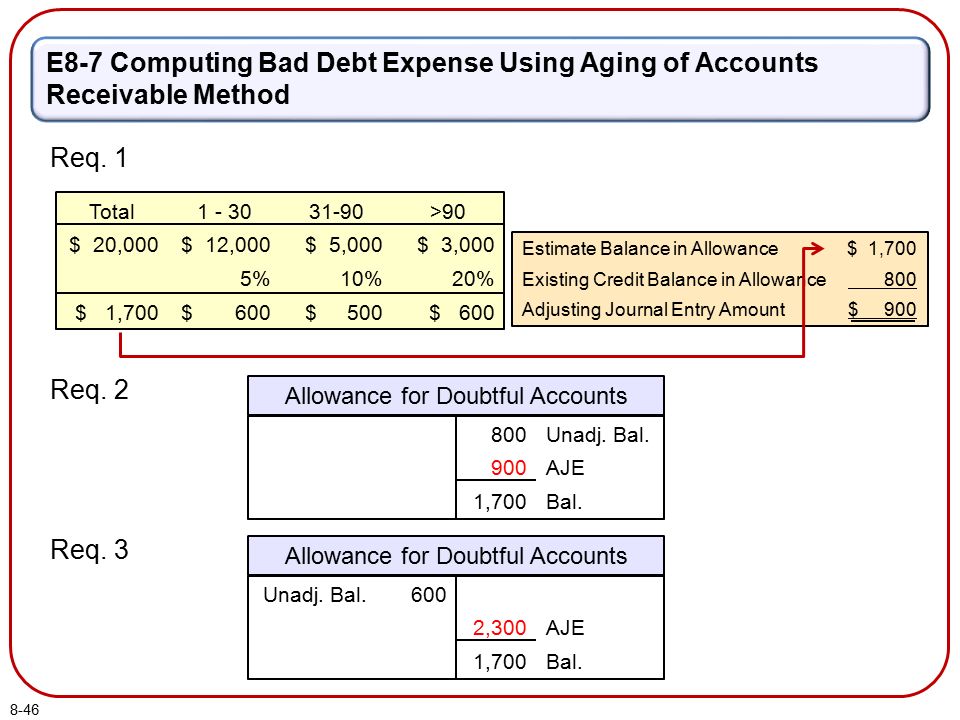

Bad loans and receivables. Yes accounts receivable factoring is available for borrowers with bad credit. Receivables are recorded by a. A loan is considered to be impaired when it is probable that not all of the related principal and interest payments will be collected. If the financial circumstances of these borrowers declines the following issues may arise that require accounting treatment.

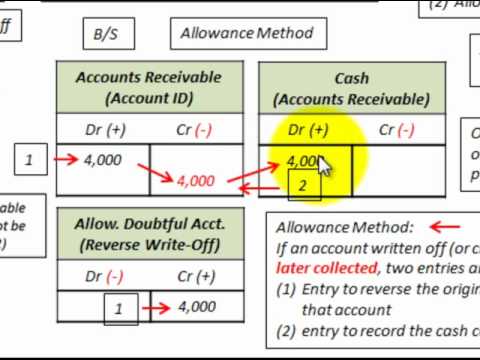

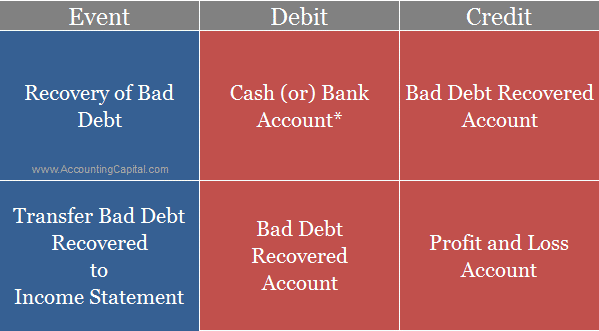

For loan written off during the year dr provision account if there was an initial provision or bad debt and cr loan receivable account. Receivables is an asset designation applicable to all debts unsettled transactions or other monetary obligations owed to a company by its debtors or customers. Can i get accounts receivable factoring with bad credit. If on the other hand you received a loan from a bank the amount payable is treated as a liability which could be short or a long term.

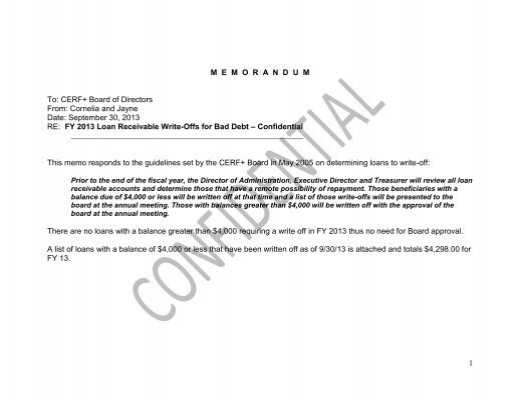

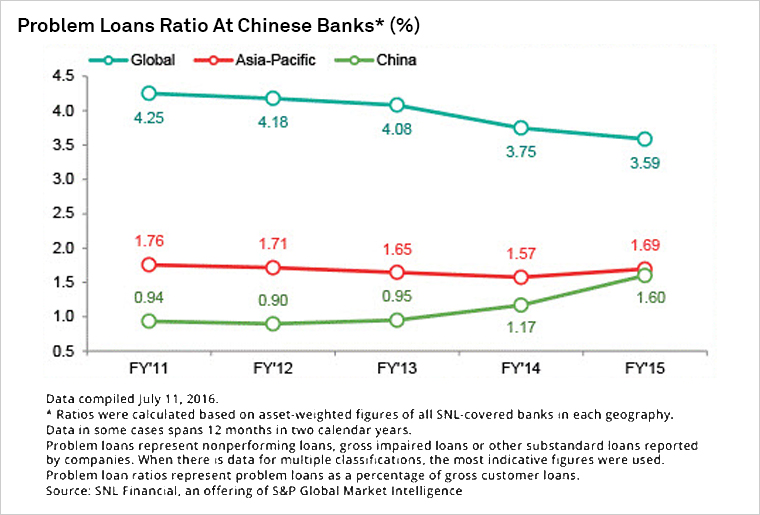

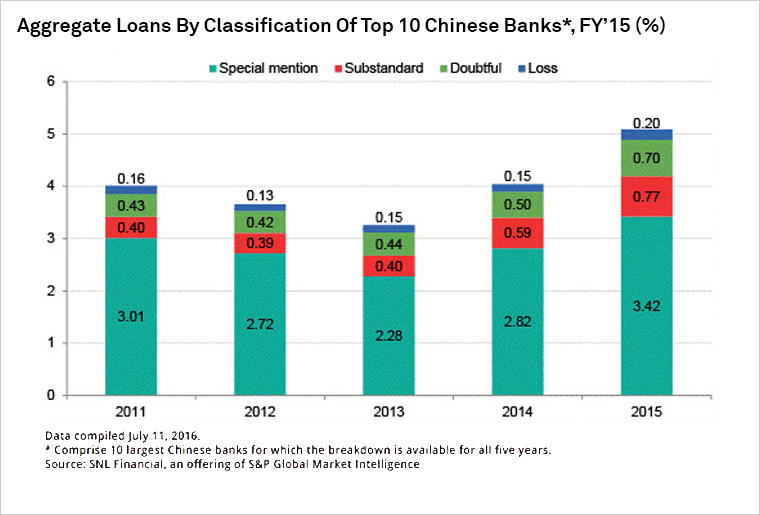

A business may own one or more loans that are payable by third parties. Accounting treatment for loan payable. Synchrony financial has been impacted by covid 19 with lower loan receivables lower net interest margins and higher provision for credit loss. Loans and receivables for which the holder may not recover substantially.

And you are still responsible for collecting the payment from your customer. Instead the receivables merely act as collateral for a loan.

/accounts-receivables-on-the-balance-sheet-357263-FINAL3-49402f58e70a42ab9468144f84f366d6.png)