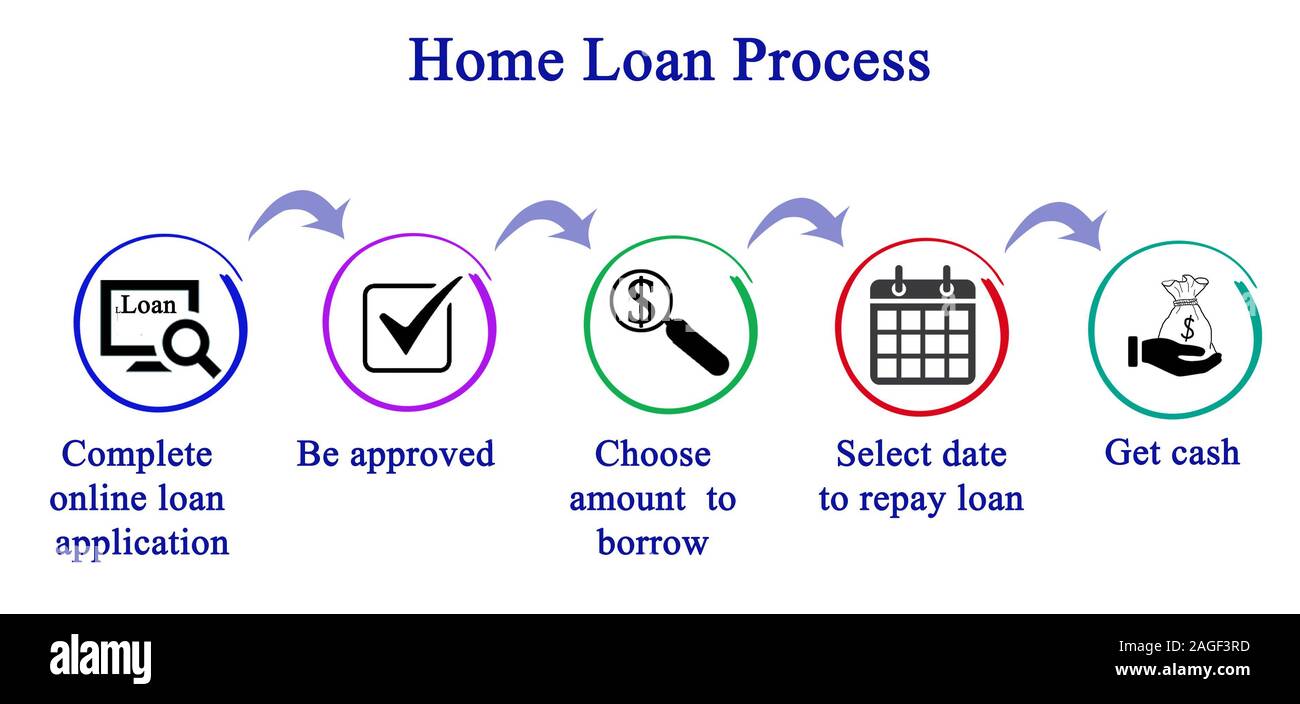

Home Loan Process

The process of taking a home loan can be daunting especially if you have never applied for any loan earlier.

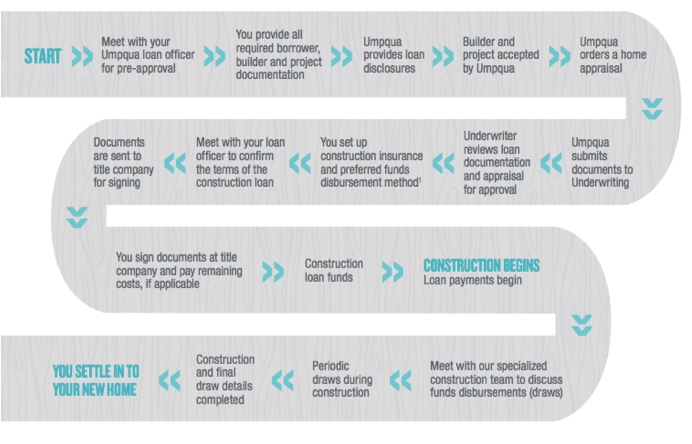

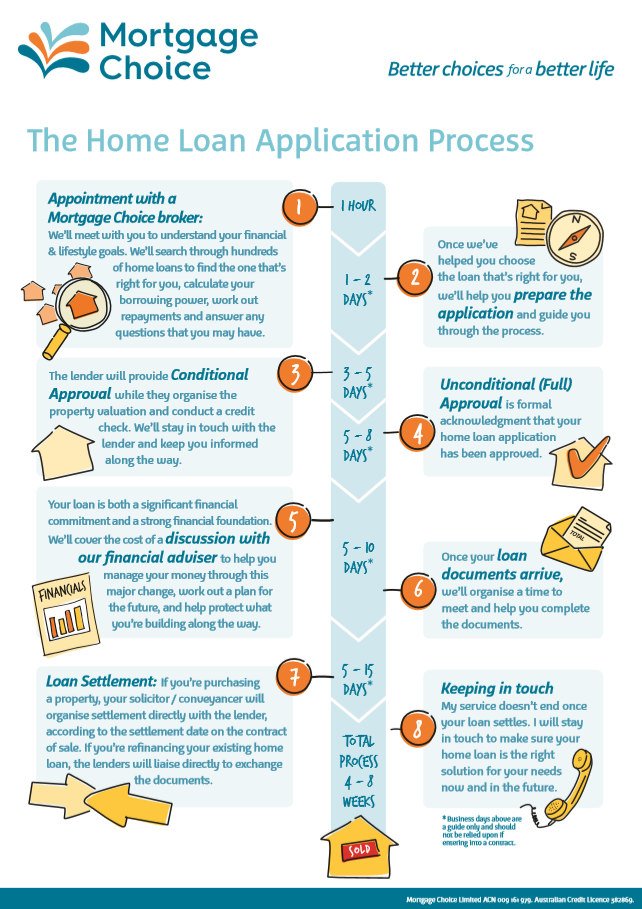

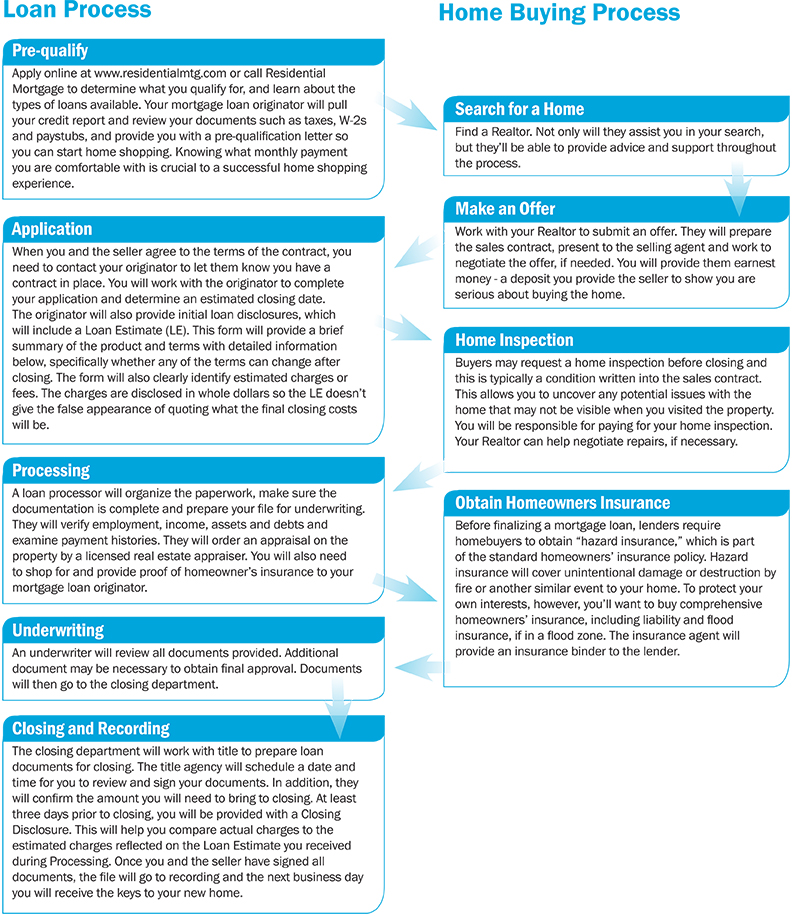

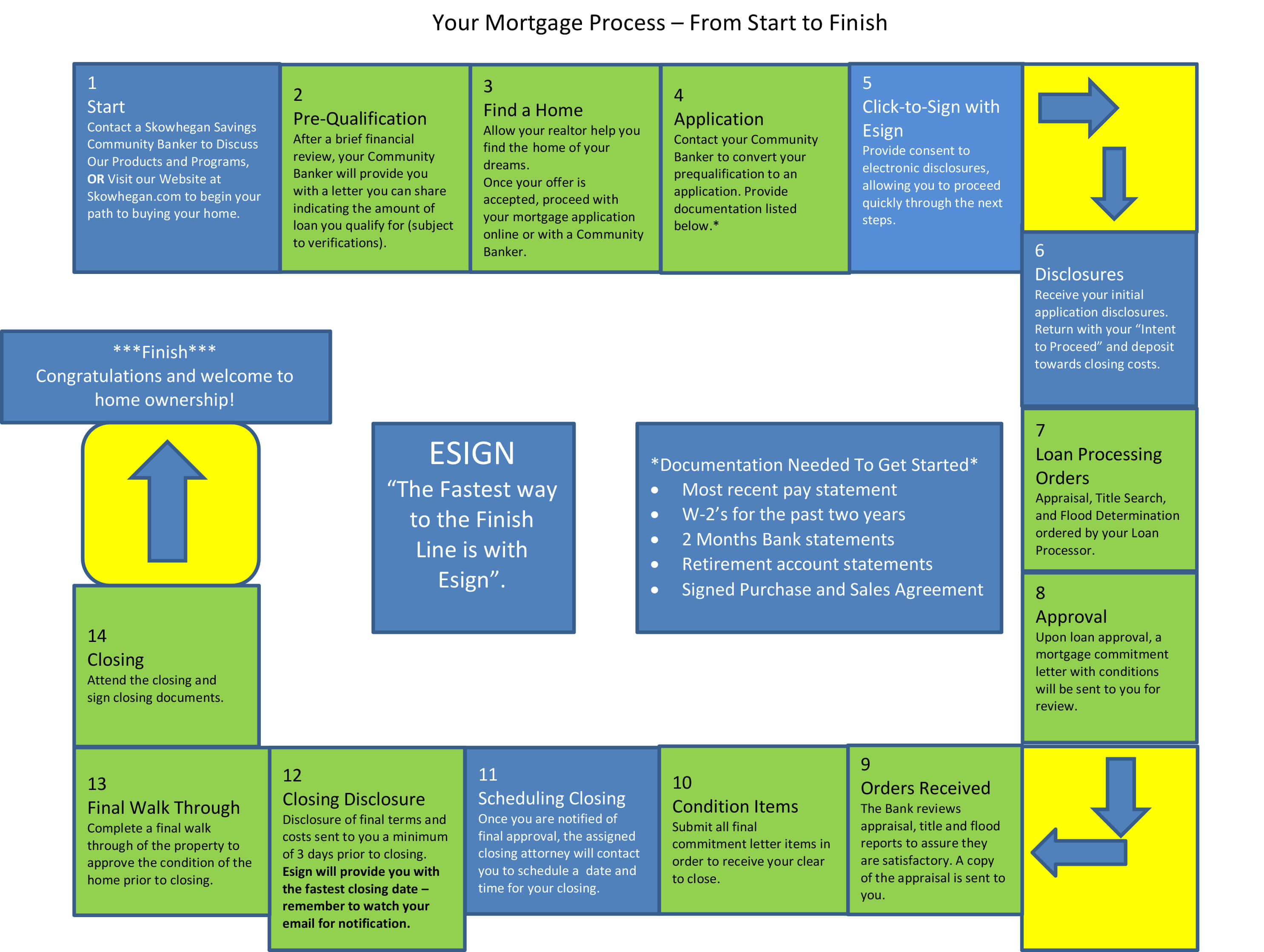

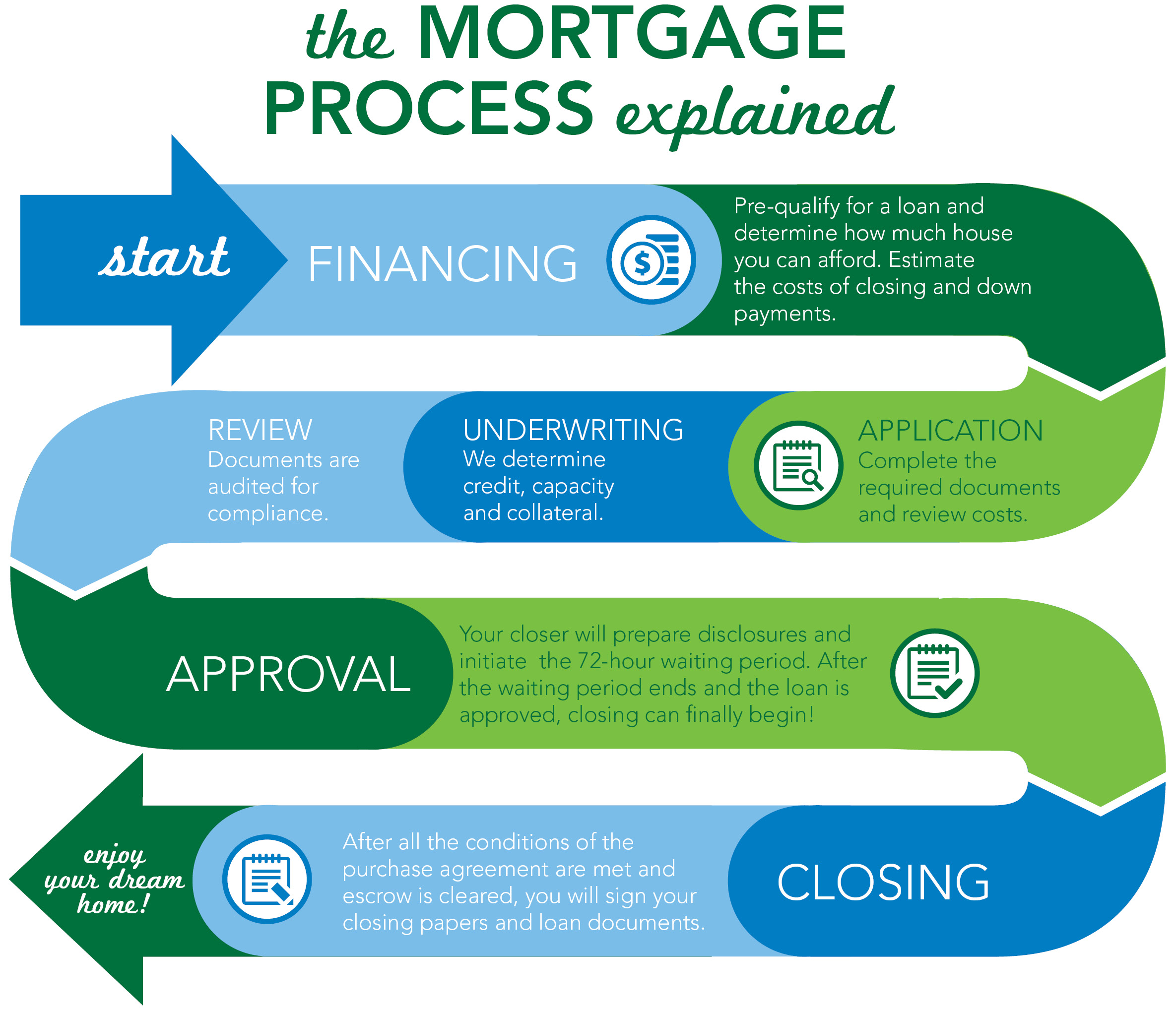

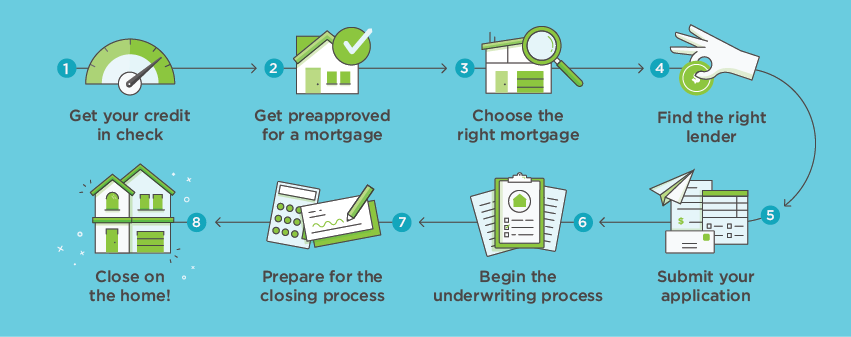

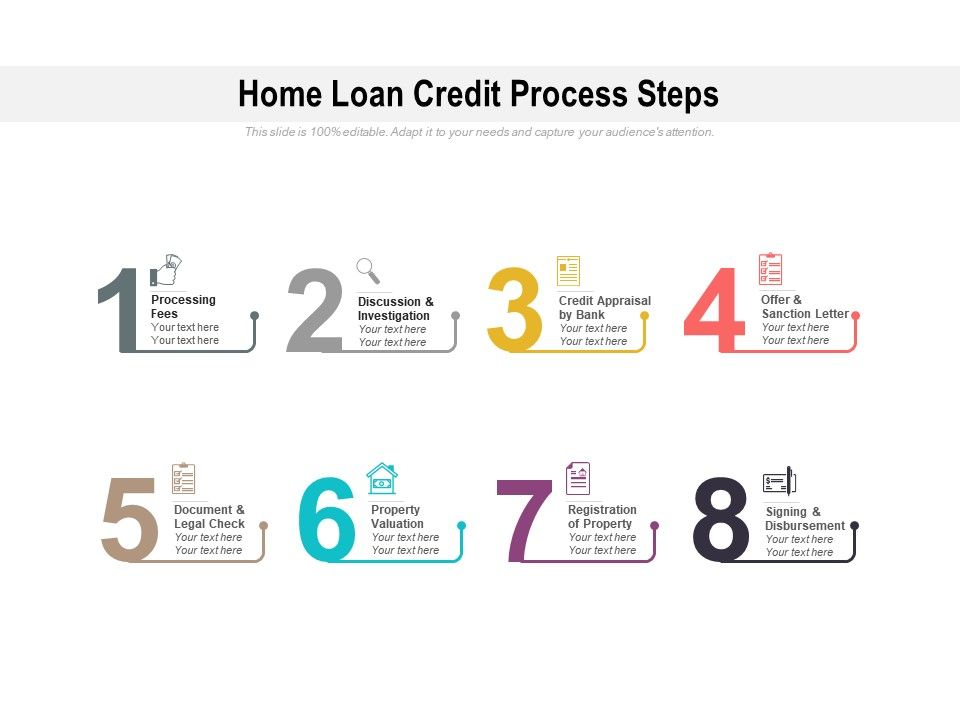

Home loan process. Following are the essential steps for complete home loan process at pnb housing finance. Many borrowers also fail to realise that the home loan process starts well before you apply for a loan and extends well after it settles. Home loan process is not that difficult as it is perceived. The home loan process can seem complicated and frustrating.

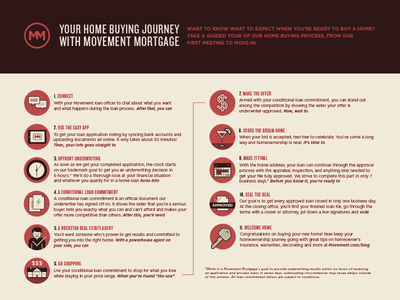

Applying for a home loan. To being with you can place an enquiry on the company website which is the easiest way and the company rep will get in touch with you. You can apply for home loan with or without finalizing the property. Mortgage pre approval mortgage pre approval.

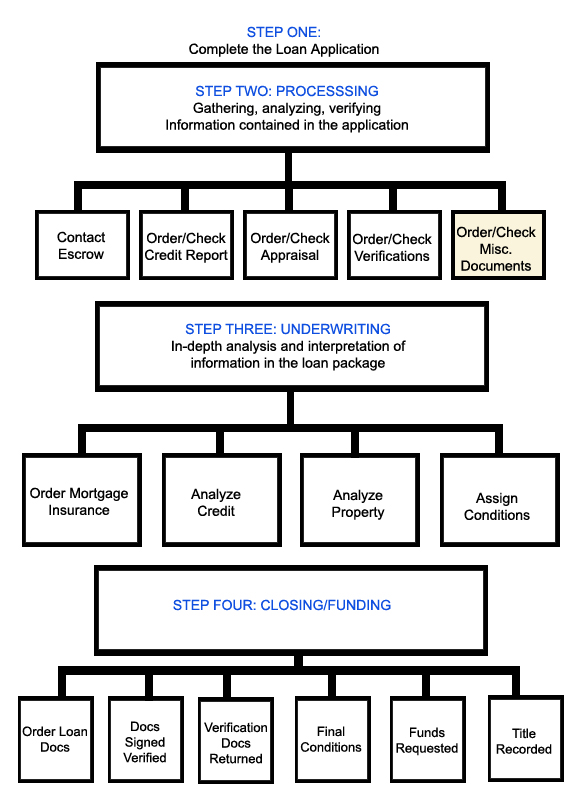

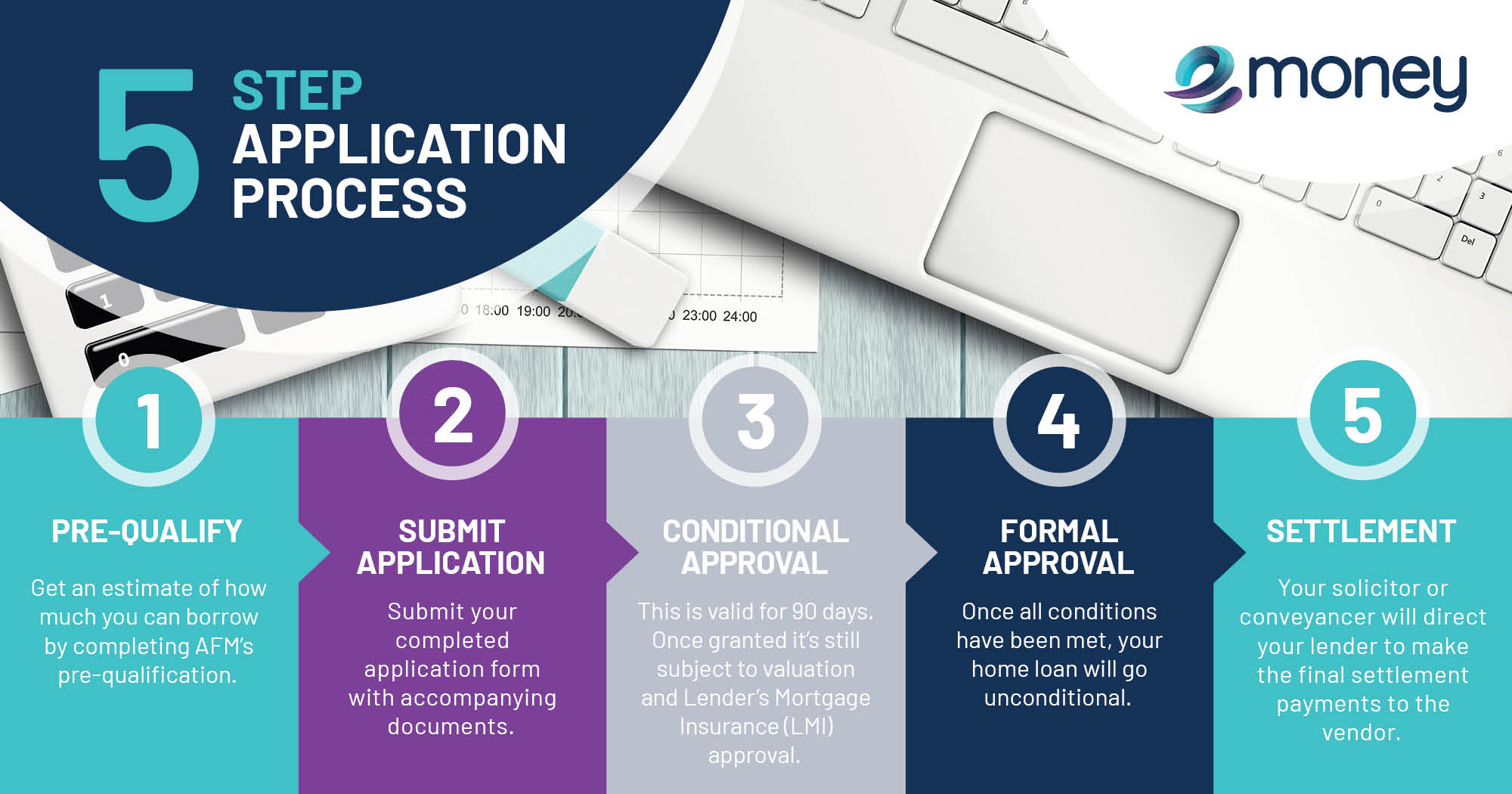

At this stage your lender will have you fill out a full application and ask you to supply documentation relating to your income debts and assets. There is a famous proverb that well begun is half done. A loan pre approval sets you up for a smooth home buying experience. Youre confused about the whole mortgage process.

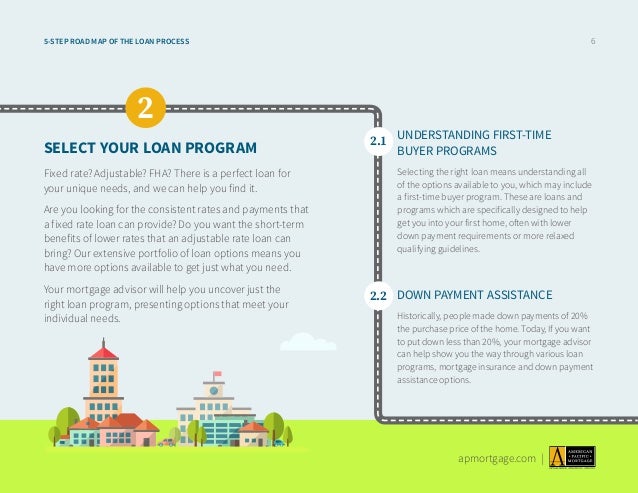

Many first home buyers and even seasoned borrowers feel intimidated because of the many steps involved. Yet with some. How to blitz the scary mortgage process. The home loan process roadmap.

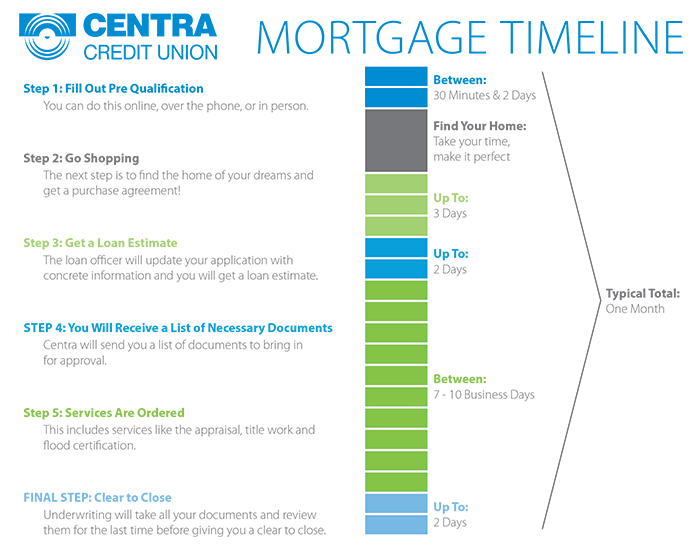

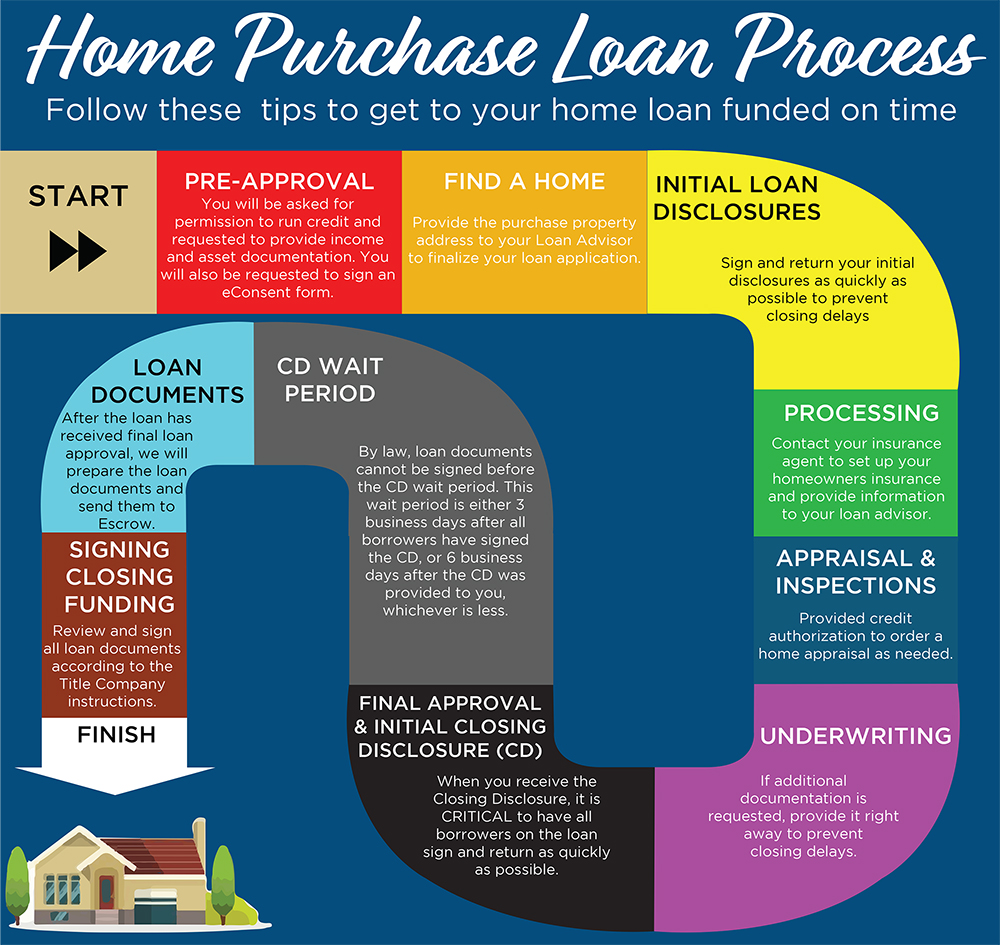

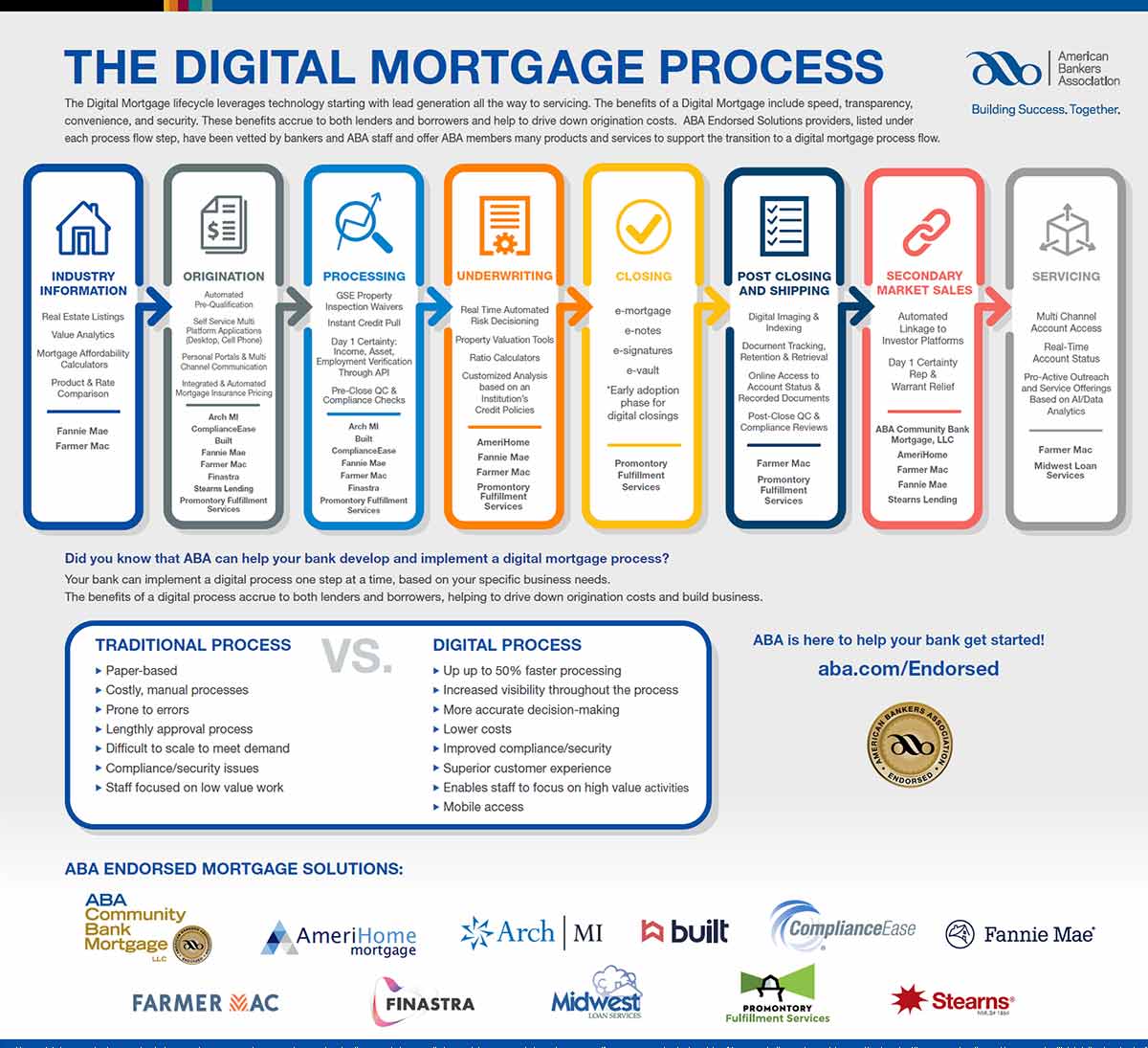

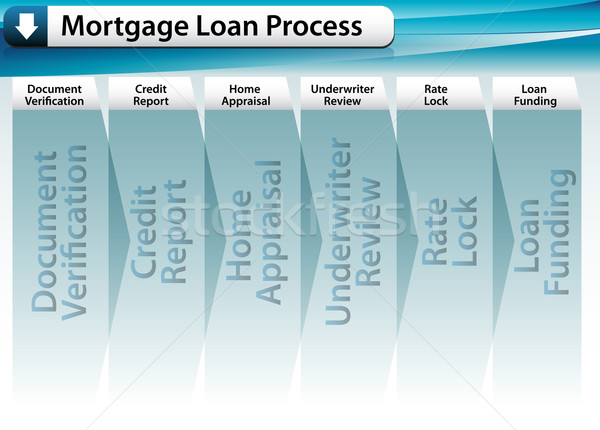

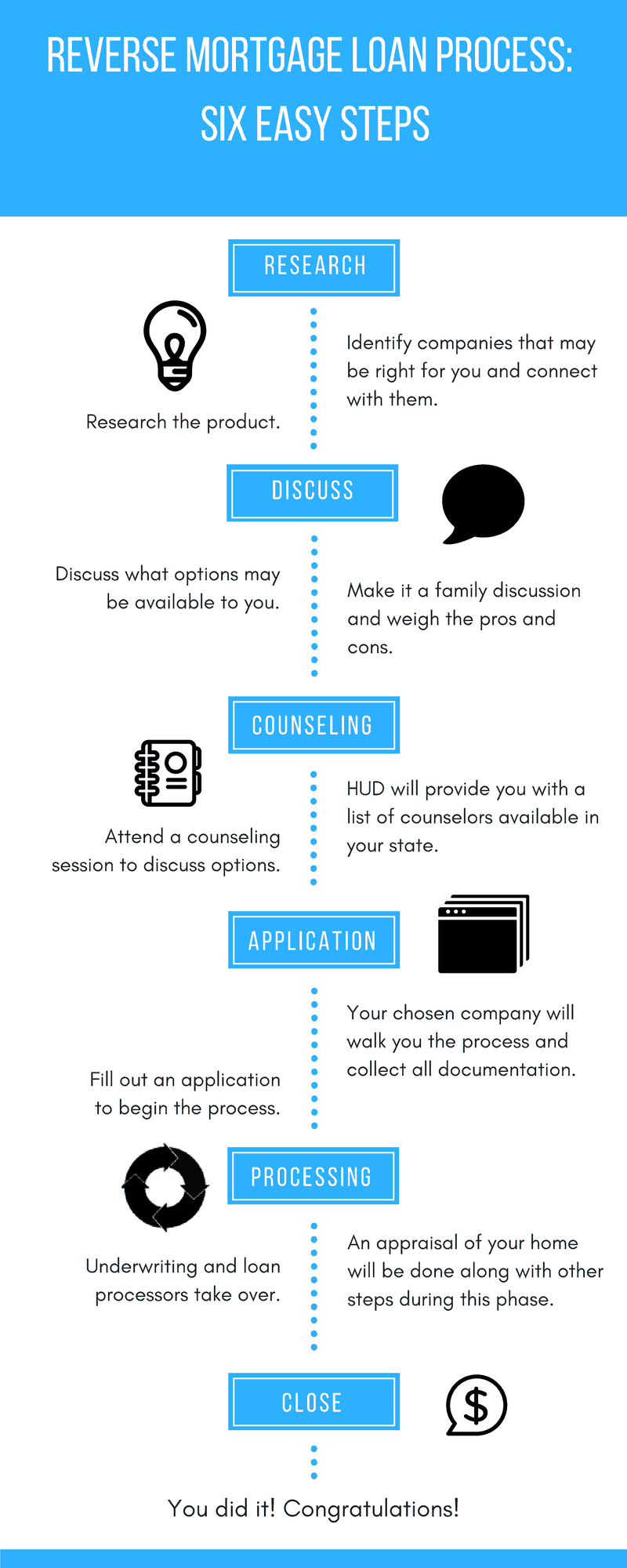

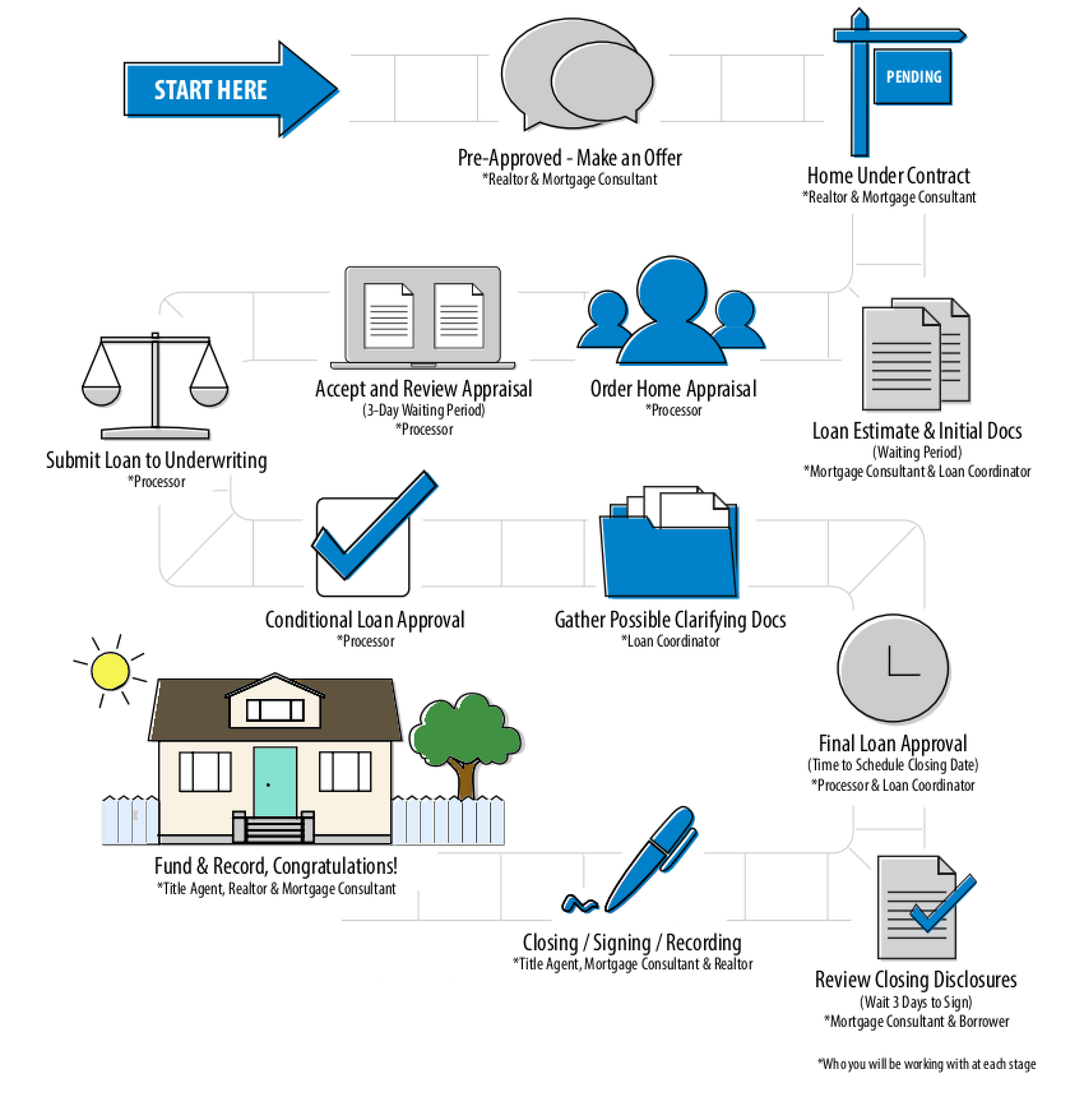

You can also call on the toll free number1800 120 8800 or if a. Heres what you need to know about each step. There are six distinct phases of the mortgage loan process. To do this youll need to contact a lender this could be a bank or a credit union and work with one of their loan officers to complete the mortgage application.

The various fees and closing cost estimates will have been discussed while examining the many mortgage programs and these. With the aid of a mortgage professional the borrower completes the application and provides all required documentation. Here is a step by step guide to equip you with the right info so you know what to expect. There is a lot of paperwork involved and sometimes it feels as if everyone but you has control over what is going on.

Click here to read more. The application is the true start of the loan process and usually occurs between days one and five of the start of the loan process. And ignorance on your part can not only make it an unpleasant experience but also prove to be costly. The same goes for home loan process.

Now that youve found the home you want to buy and a lender to work with the mortgage process begins.