Loan Payable In Balance Sheet

The account mortgage loan payable contains the principal amount owed on a mortgage loan.

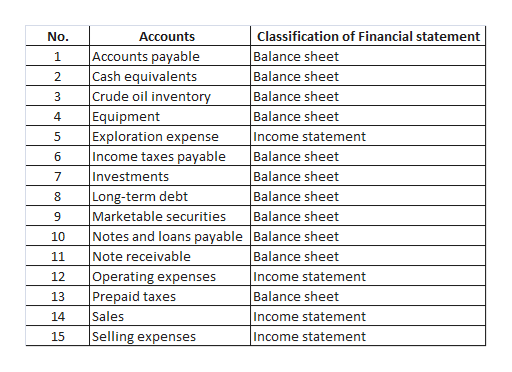

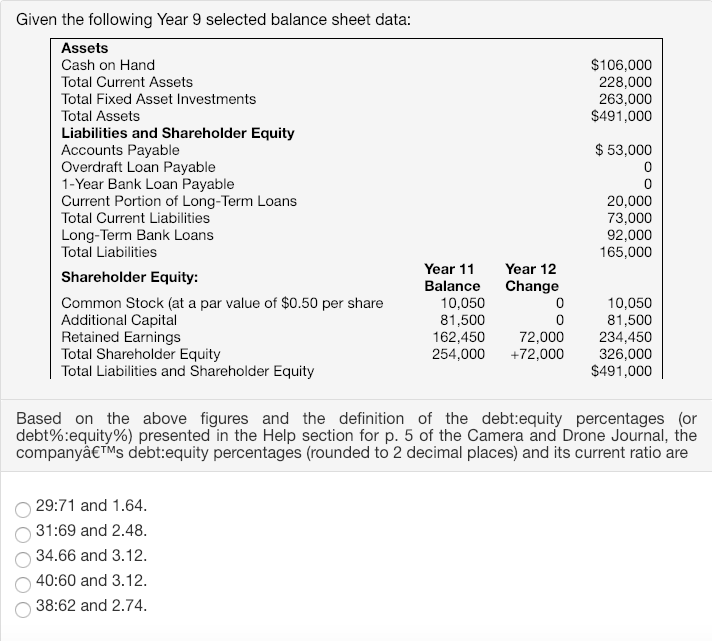

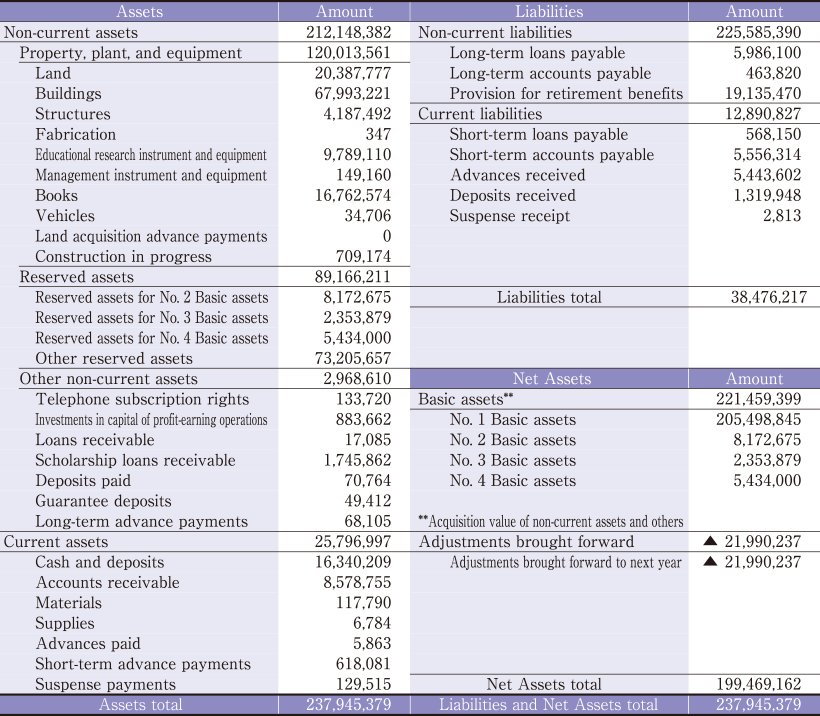

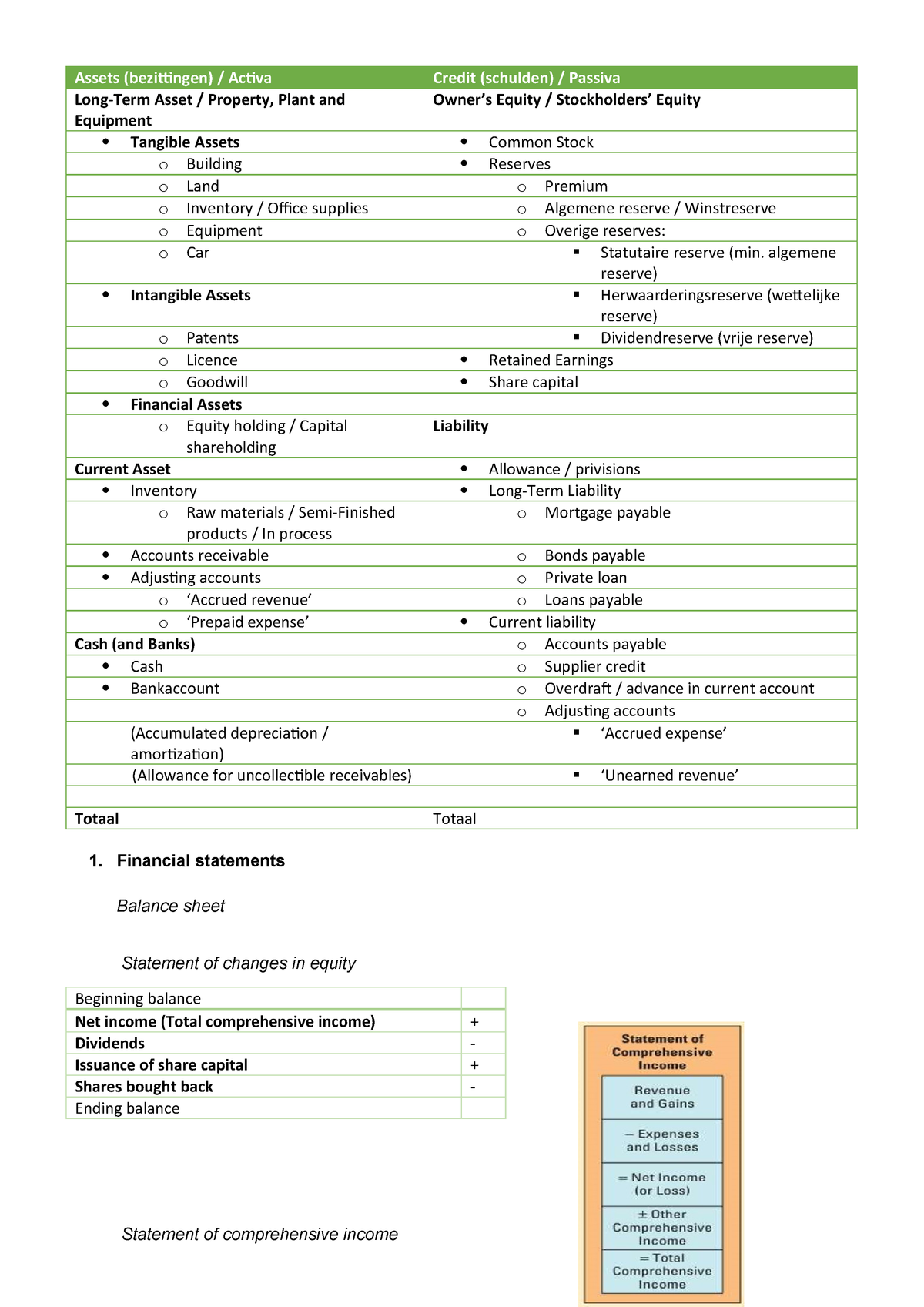

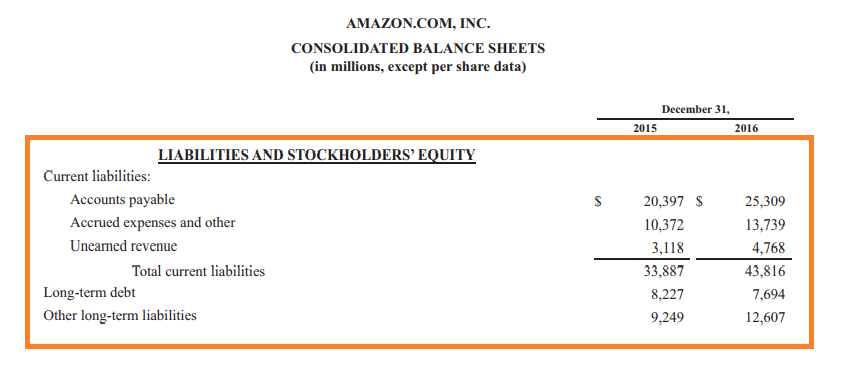

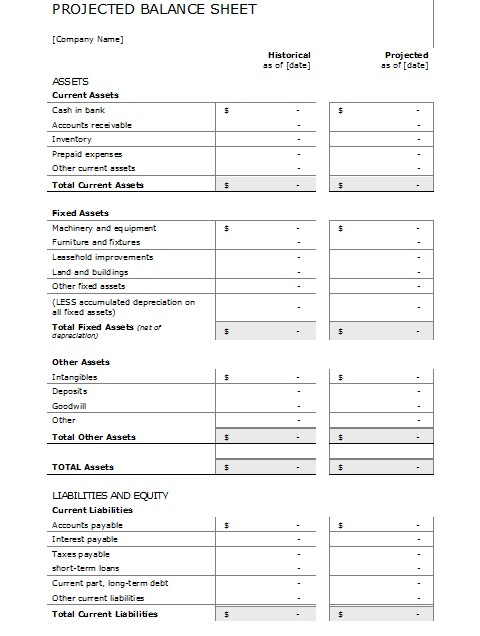

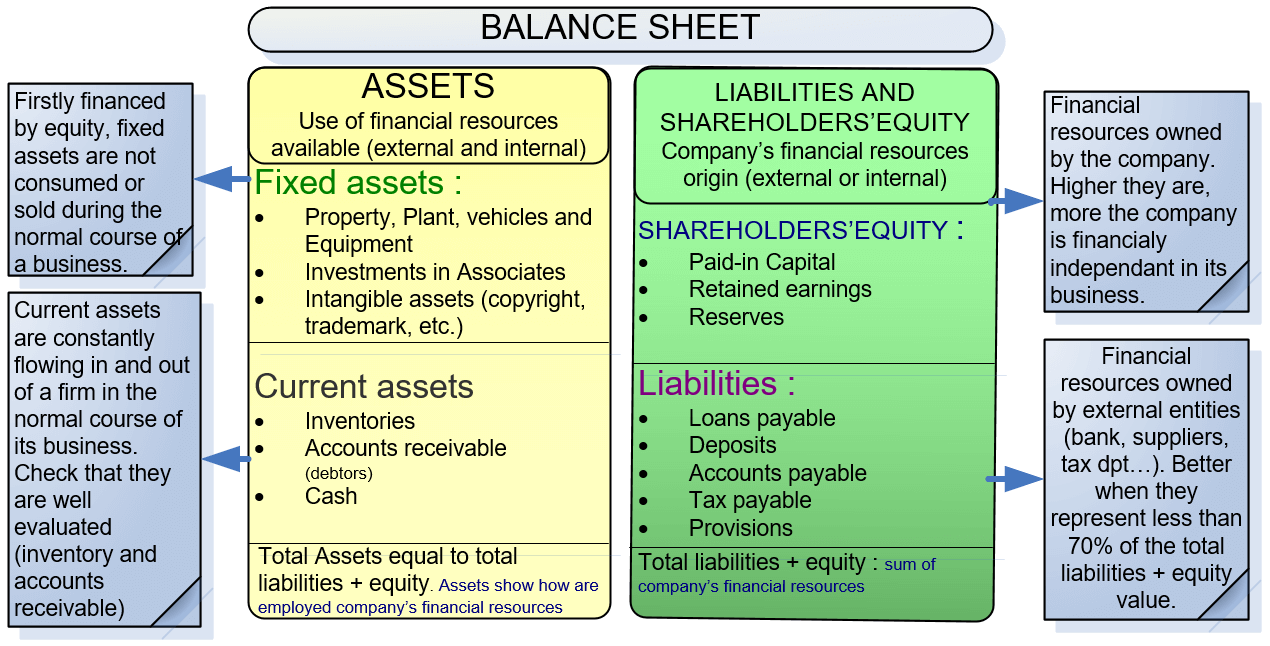

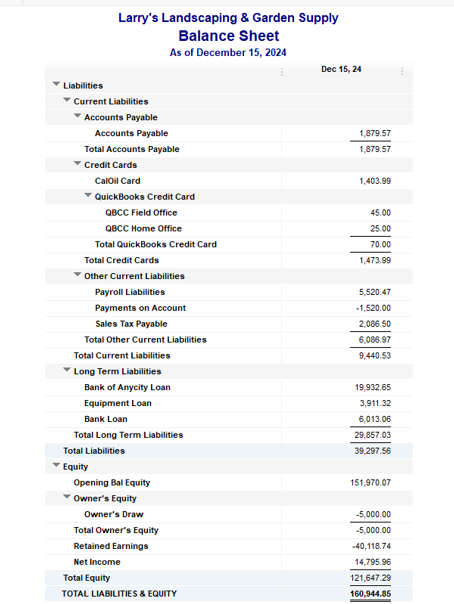

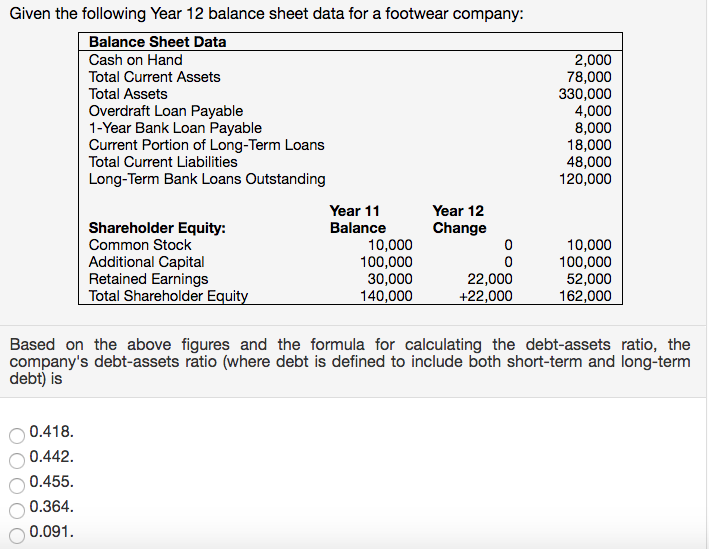

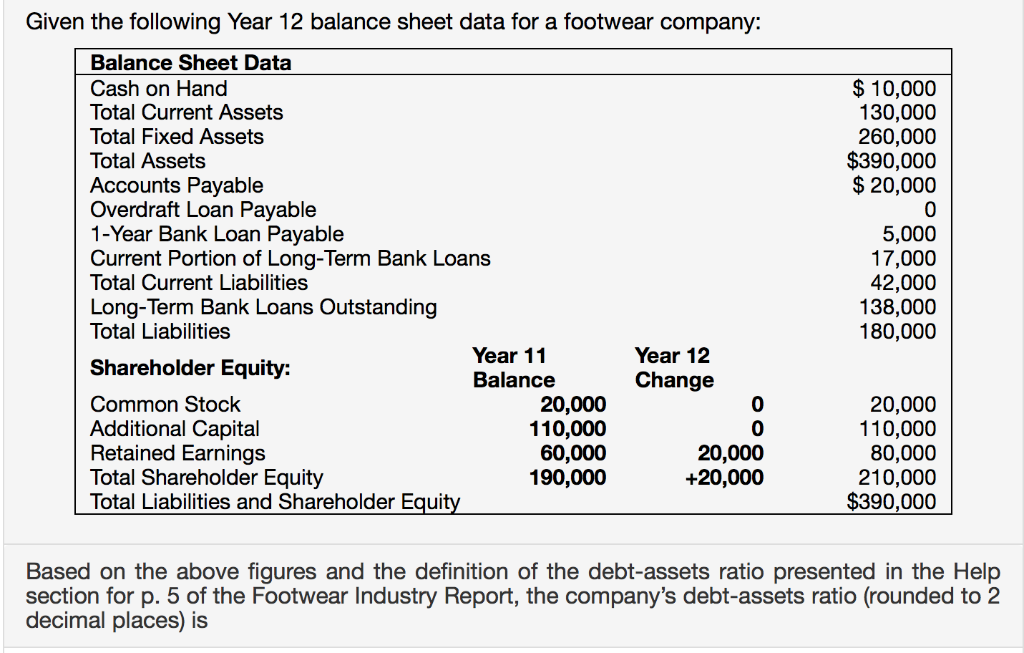

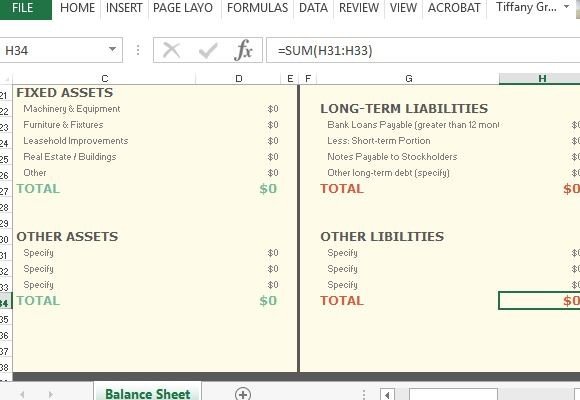

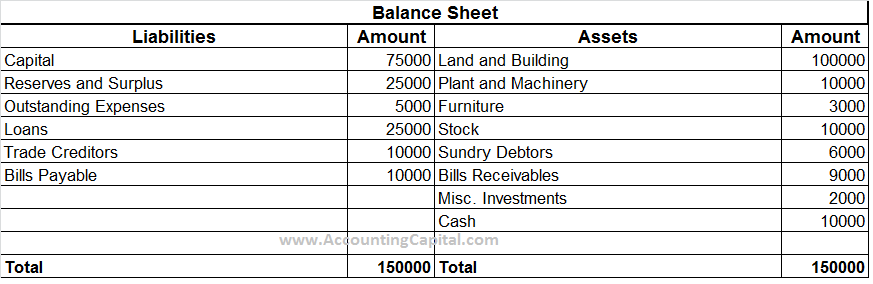

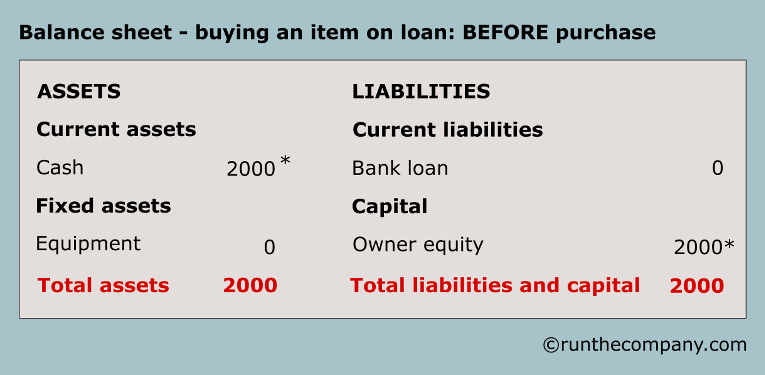

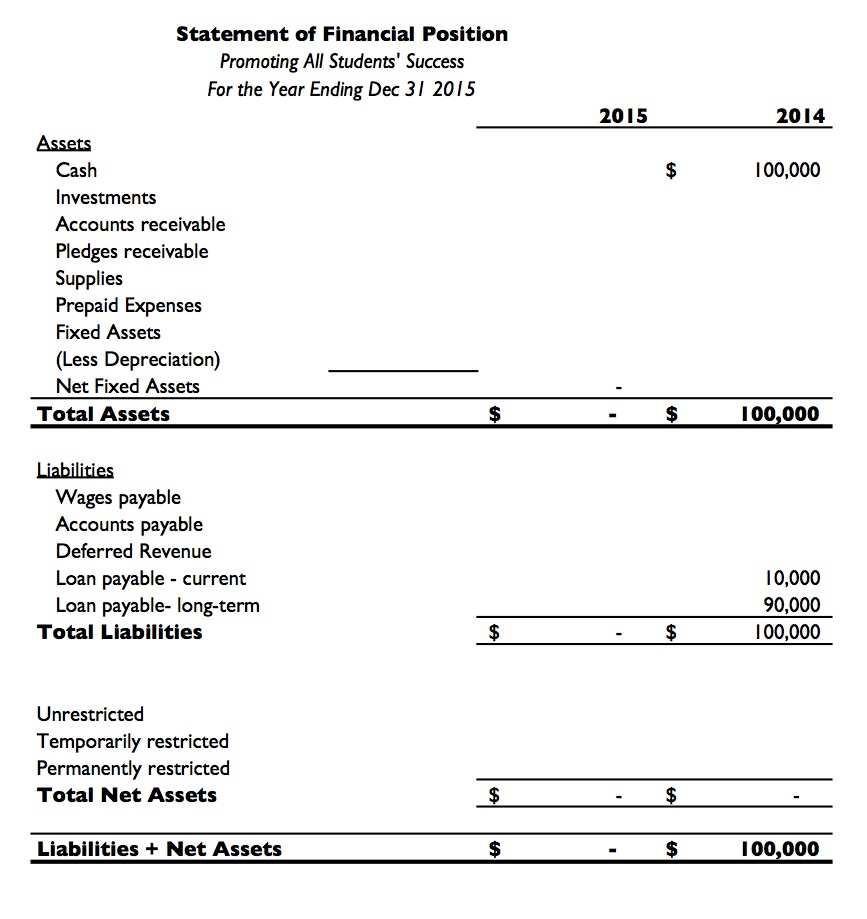

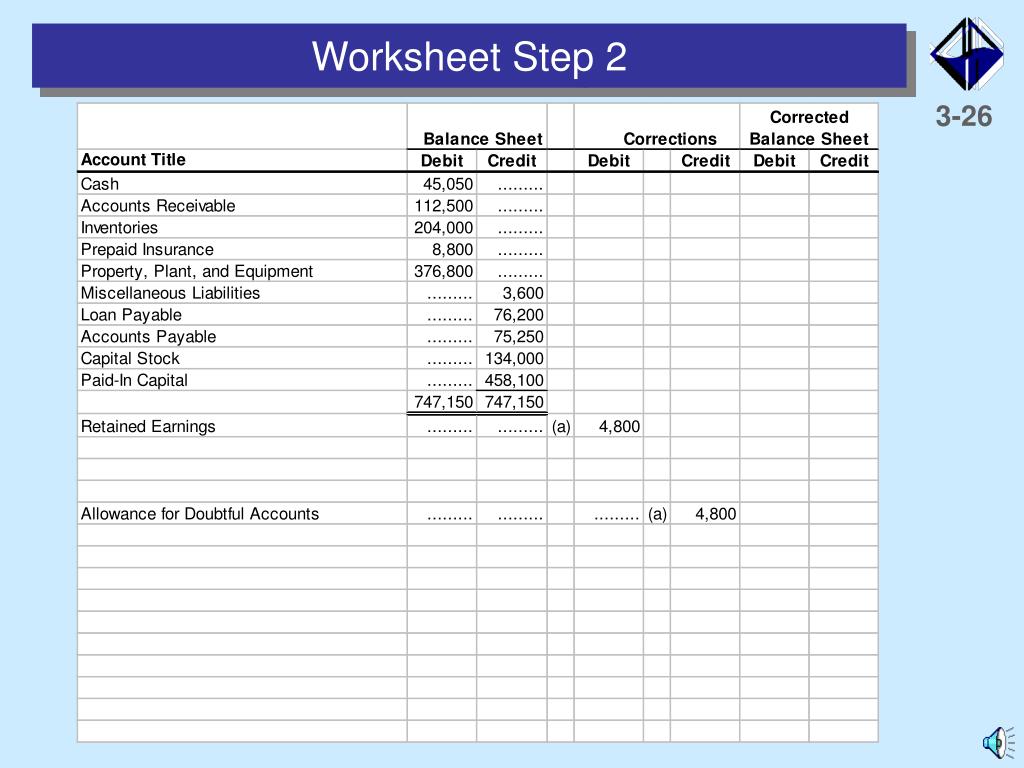

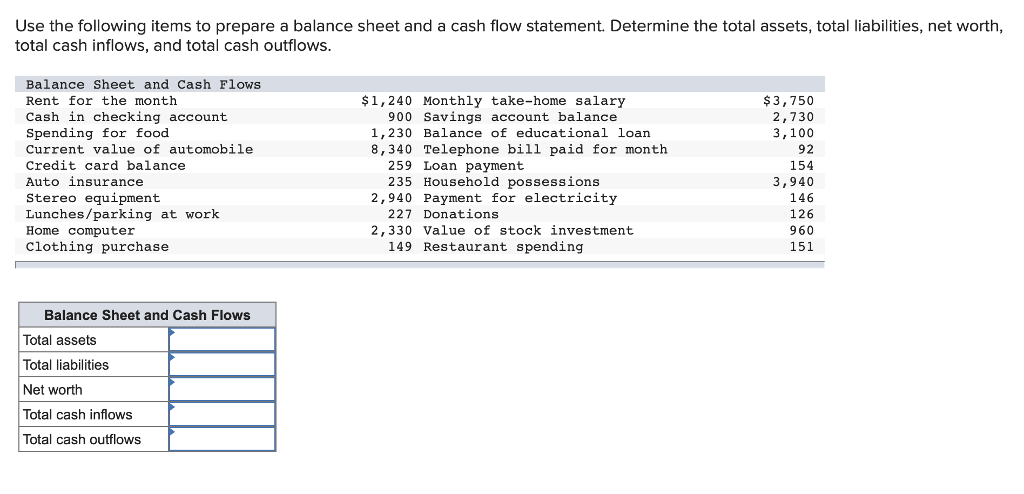

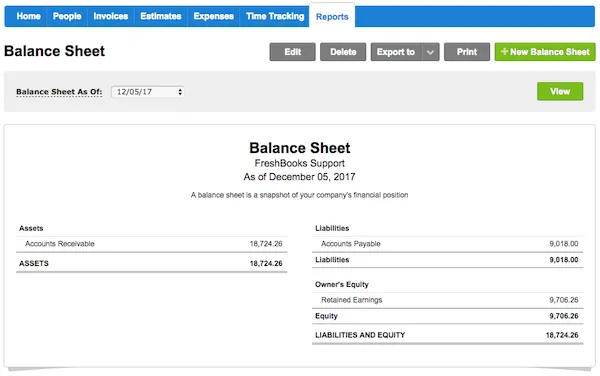

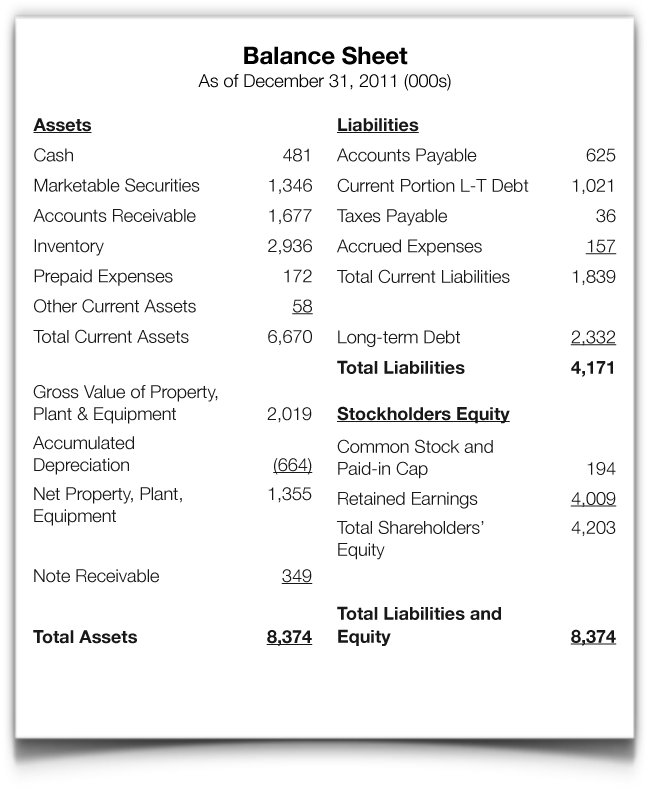

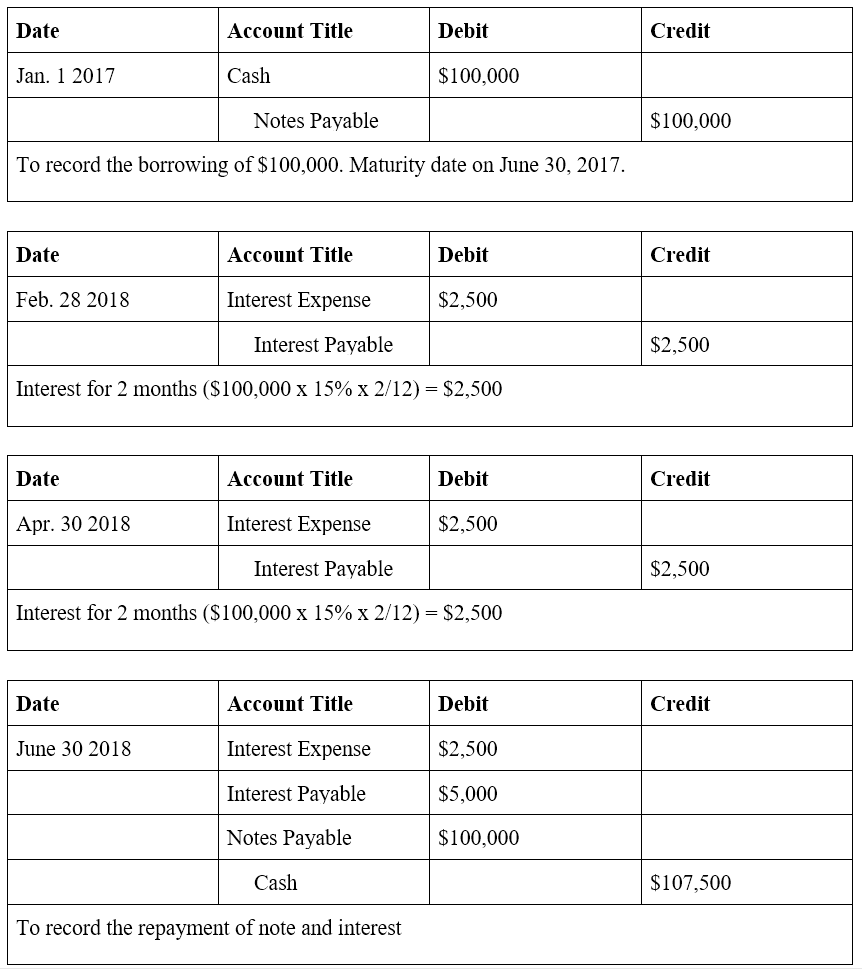

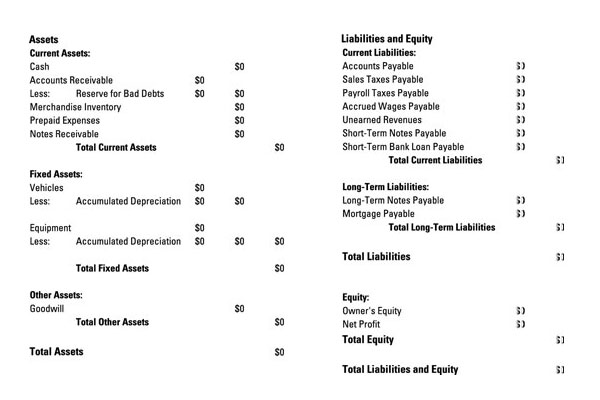

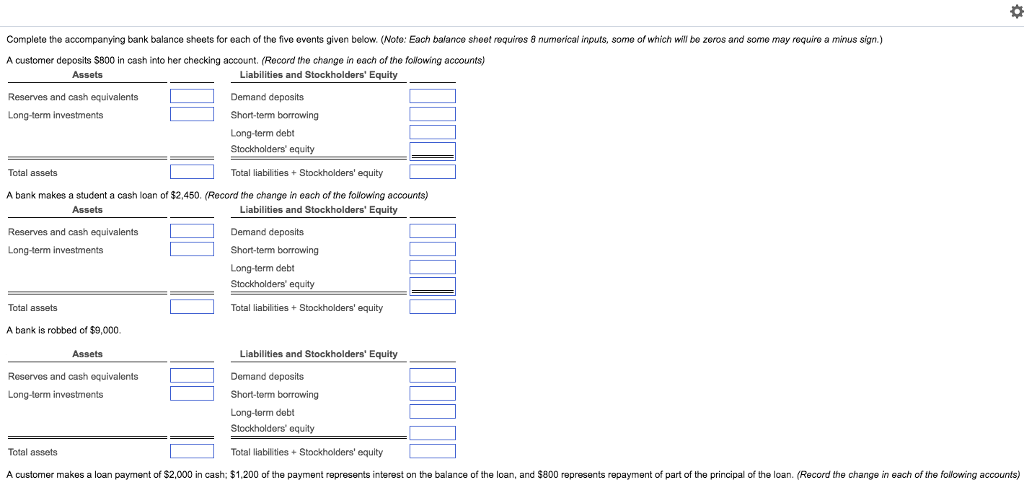

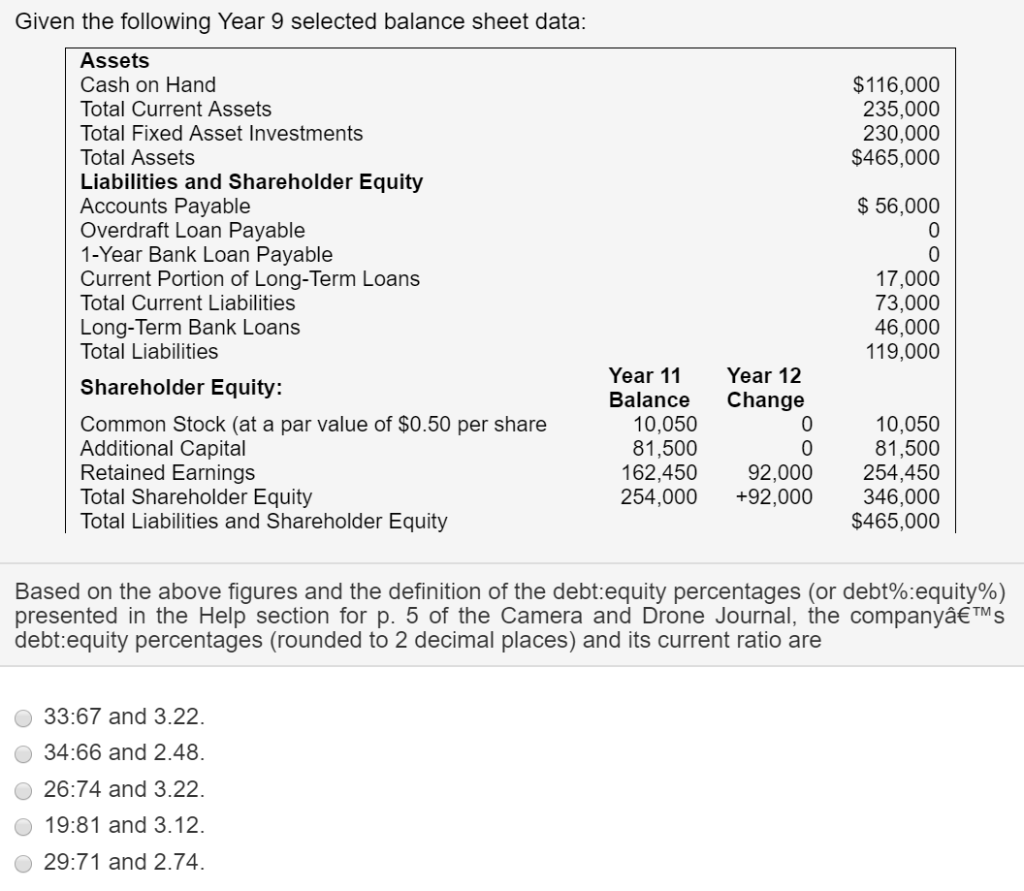

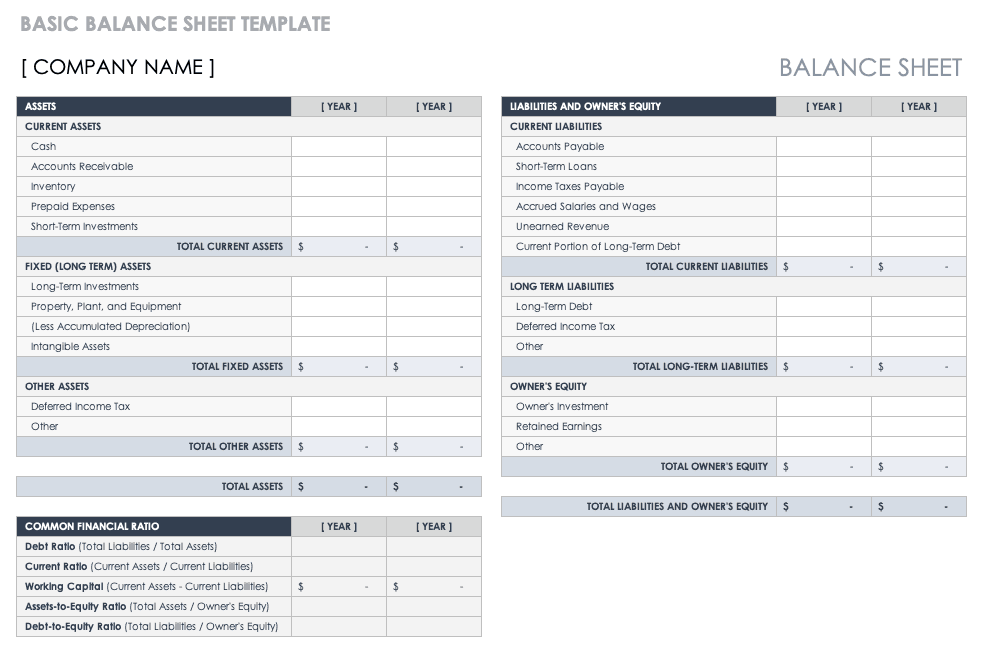

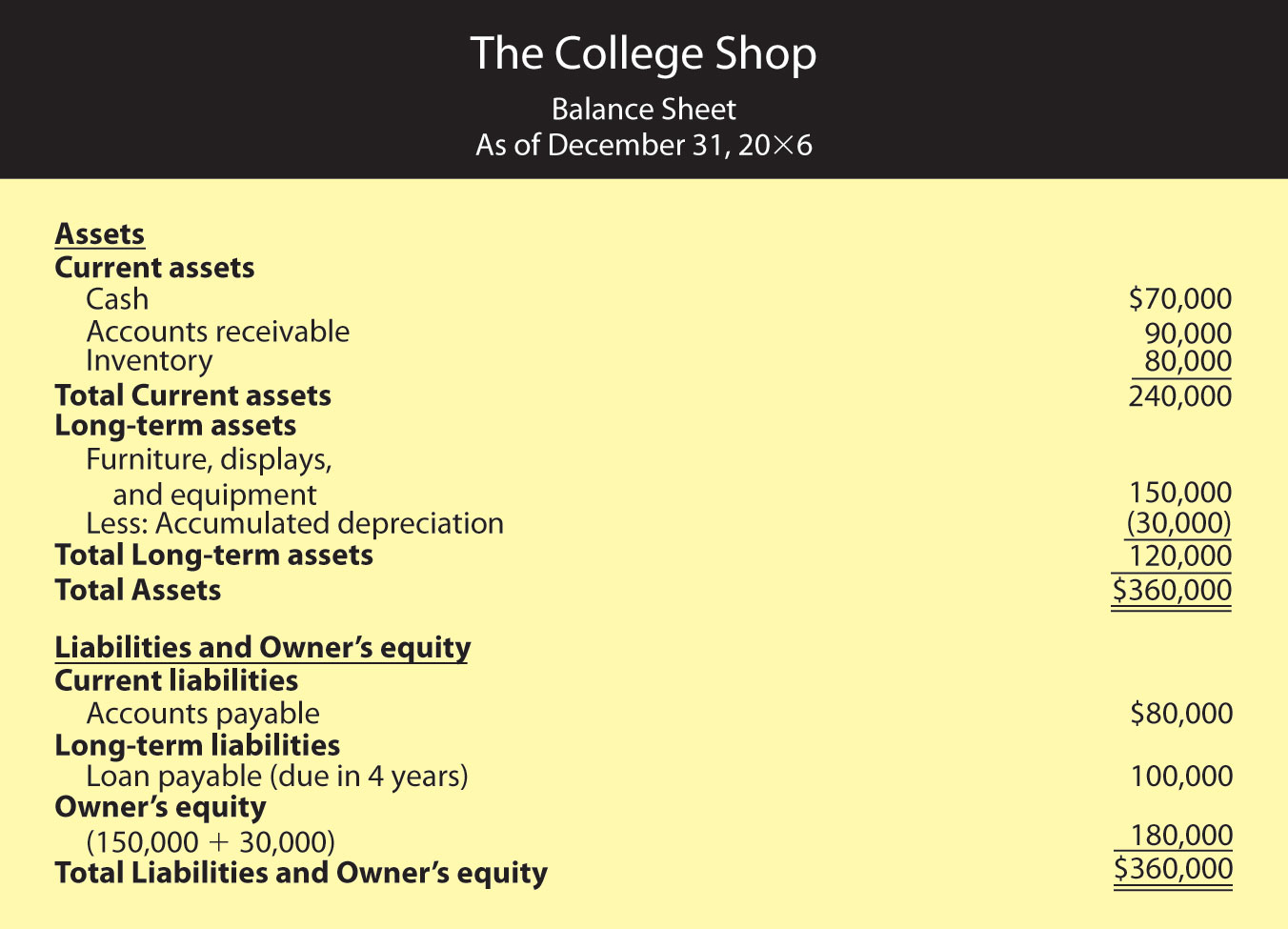

Loan payable in balance sheet. Accounts payable is a liability since its money owed to creditors and is listed under current liabilities on the balance sheet. The interest on the loan that pertains to the future is not. How should a mortgage loan payable be reported on a classified balance sheet. A balance sheet shows assets liability and owners equity.

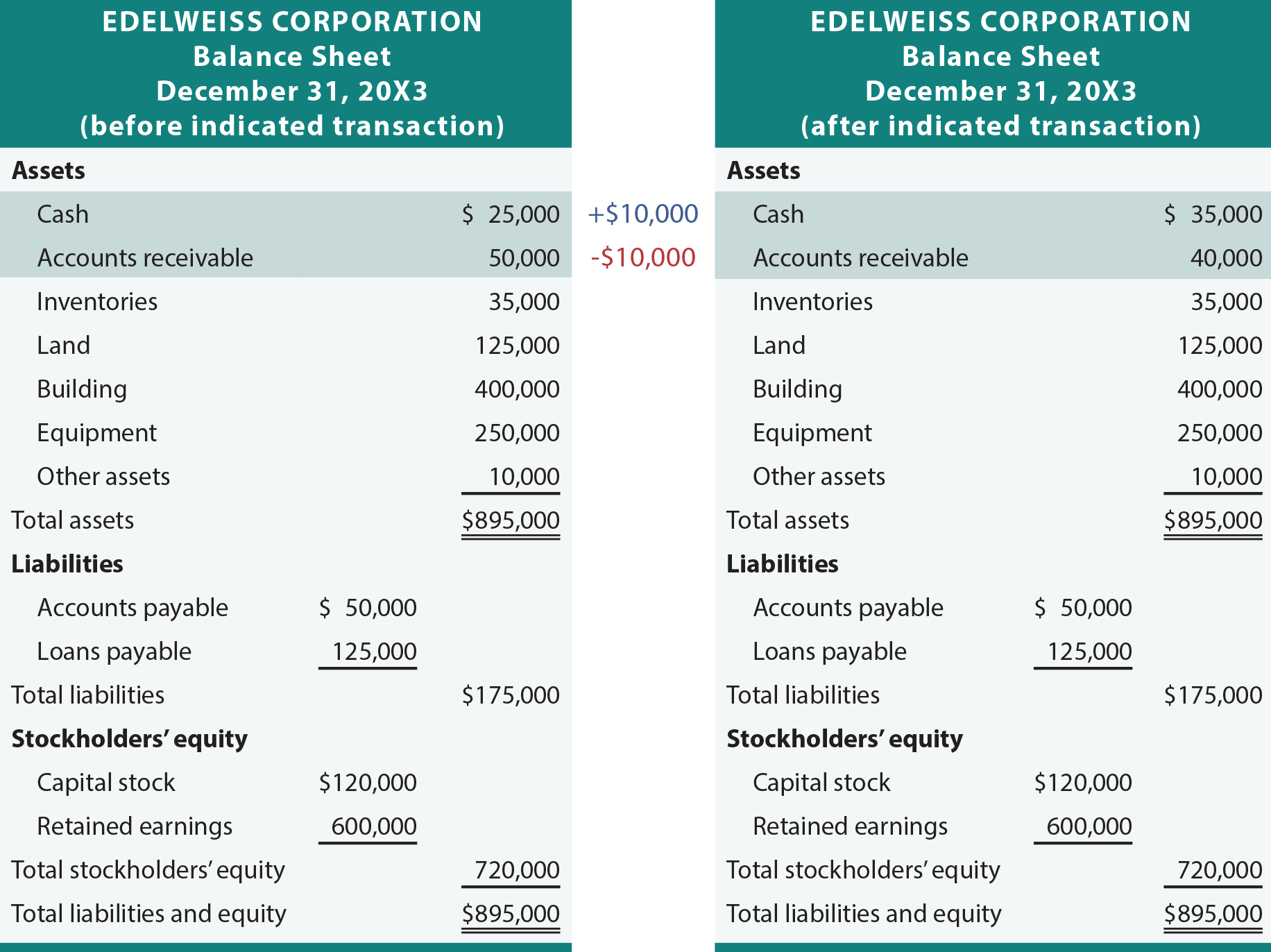

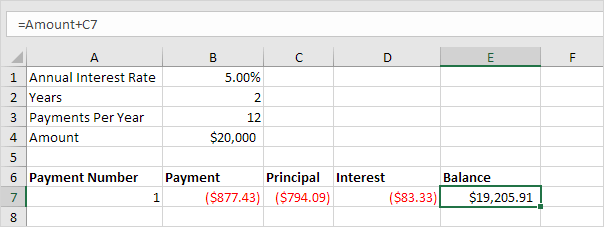

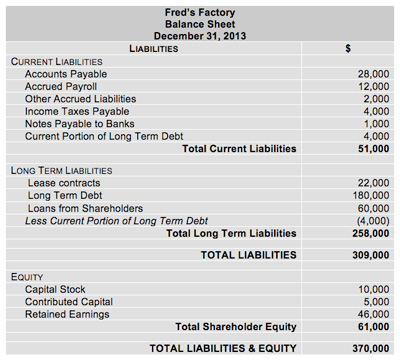

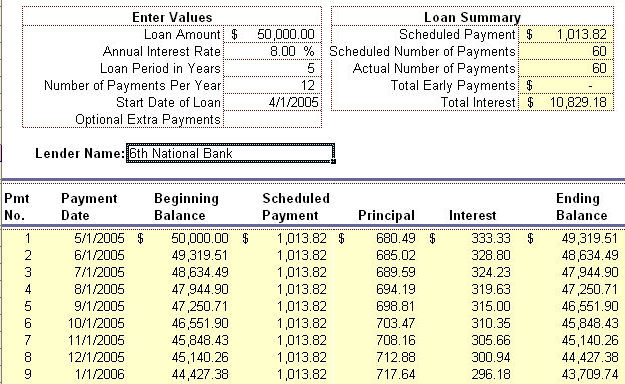

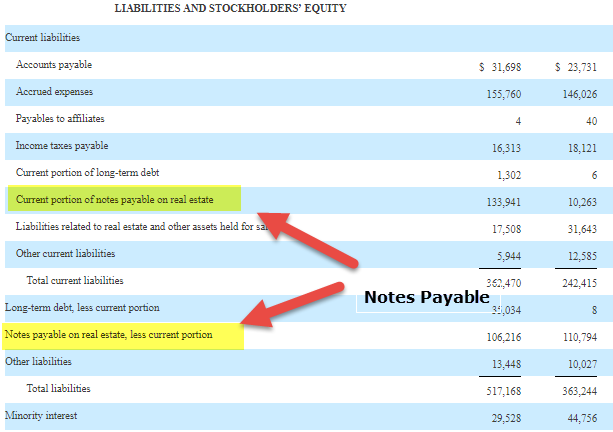

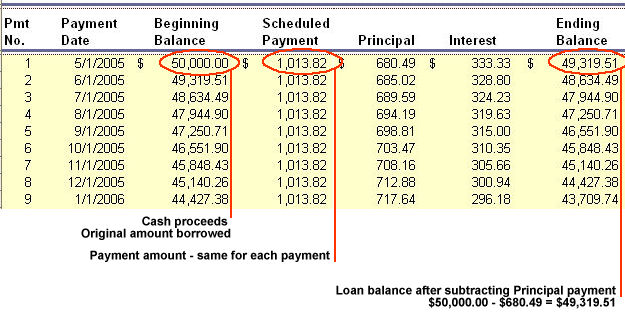

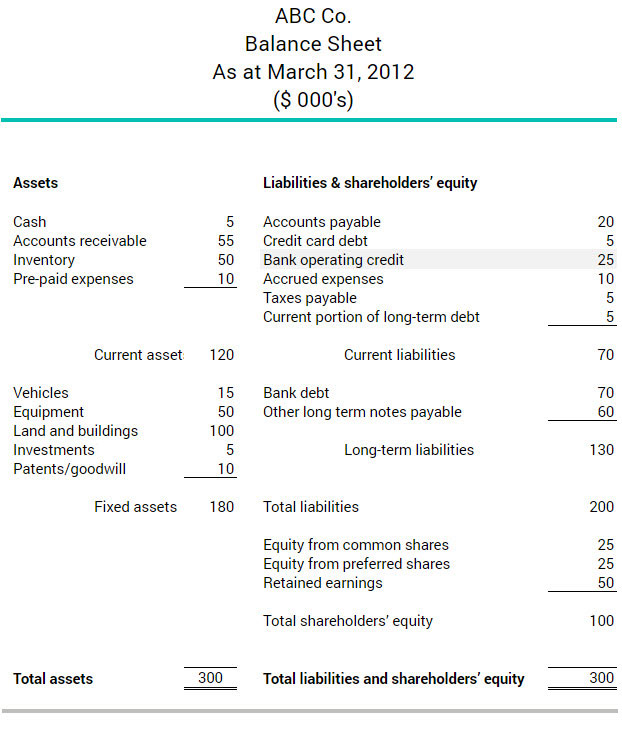

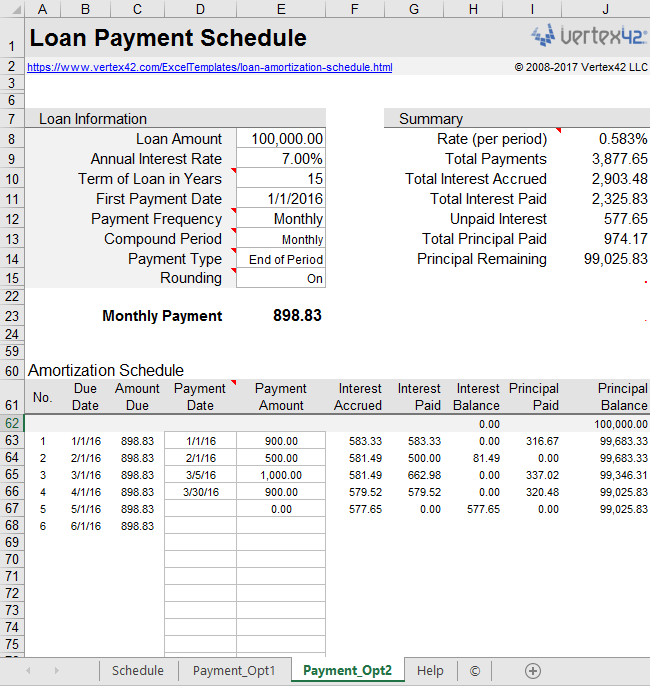

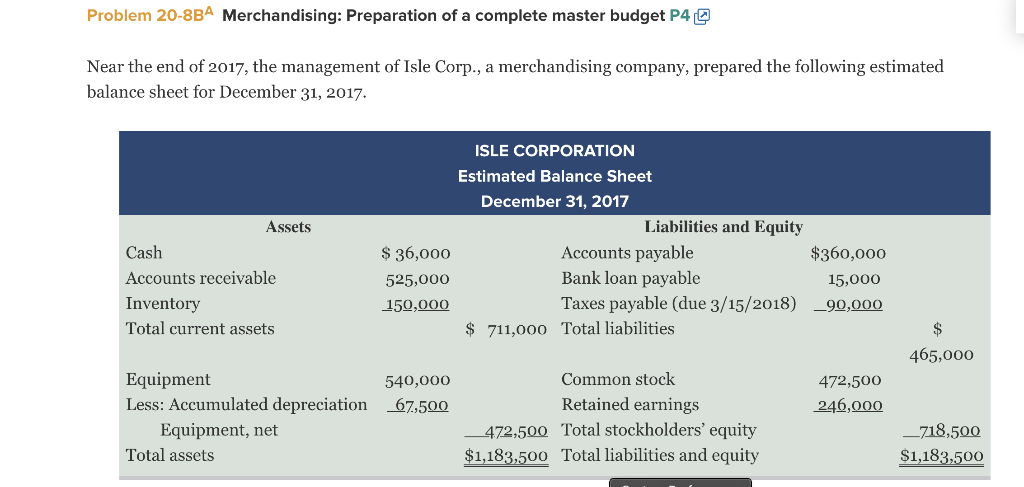

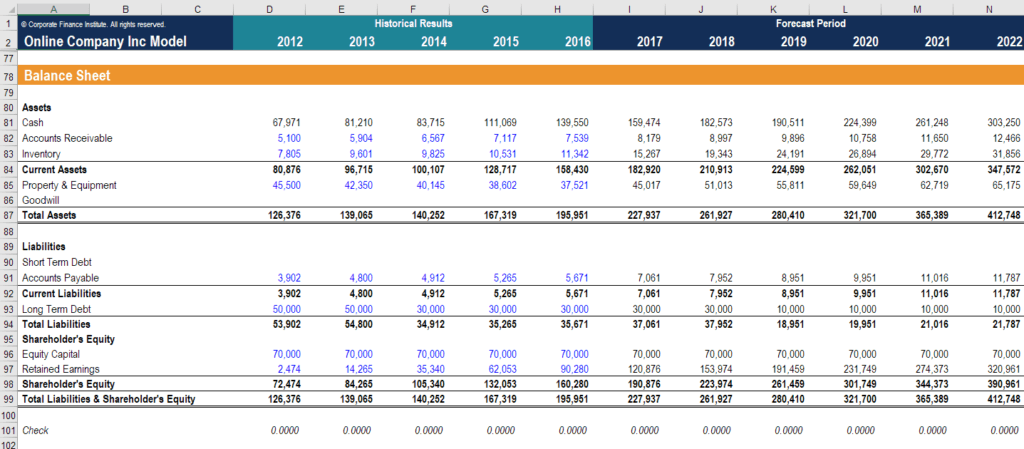

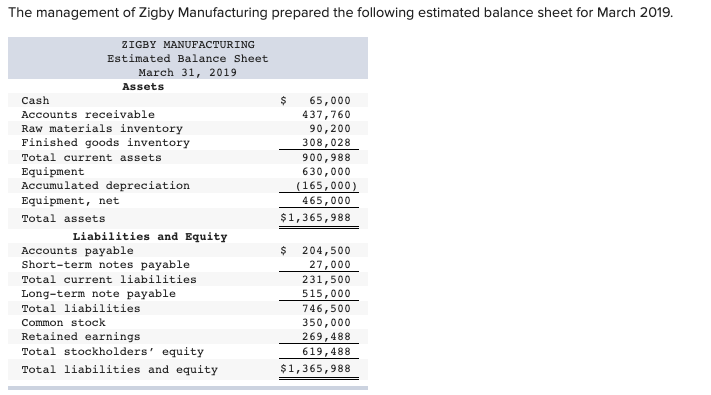

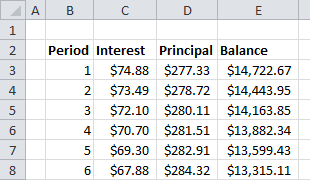

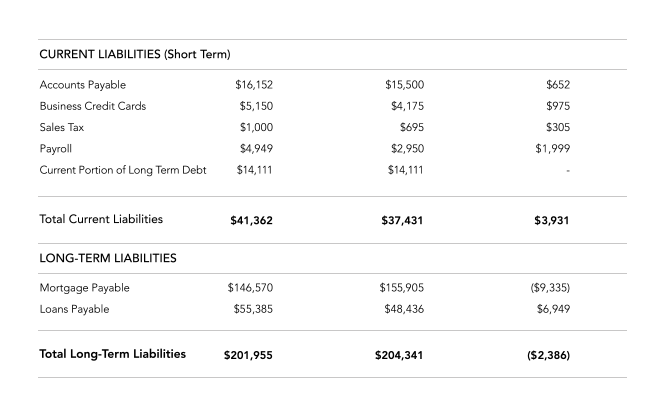

The remaining 339800 350000 principal balance minus the 10200 in payments will be presented as loan payable noncurrent portion. The remaining principal amount should be reported as a long term liability. On the december 2011 balance sheet the 10200 that is principal due in the next 12 months will be the loan payable current portion. Formal contracted loans are typically designed as notes payable on a balance sheet whereas advances or purchases on credit are recorded as accounts payable.

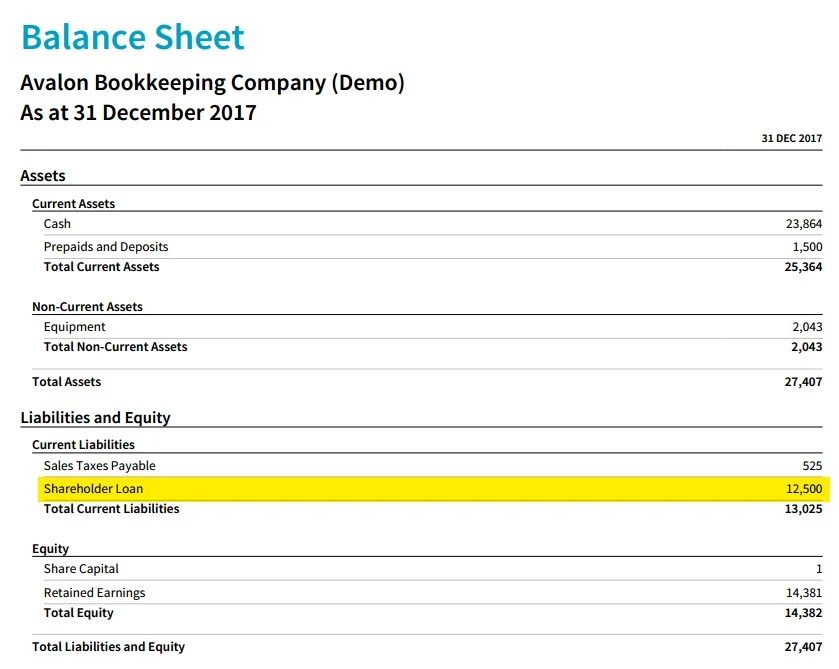

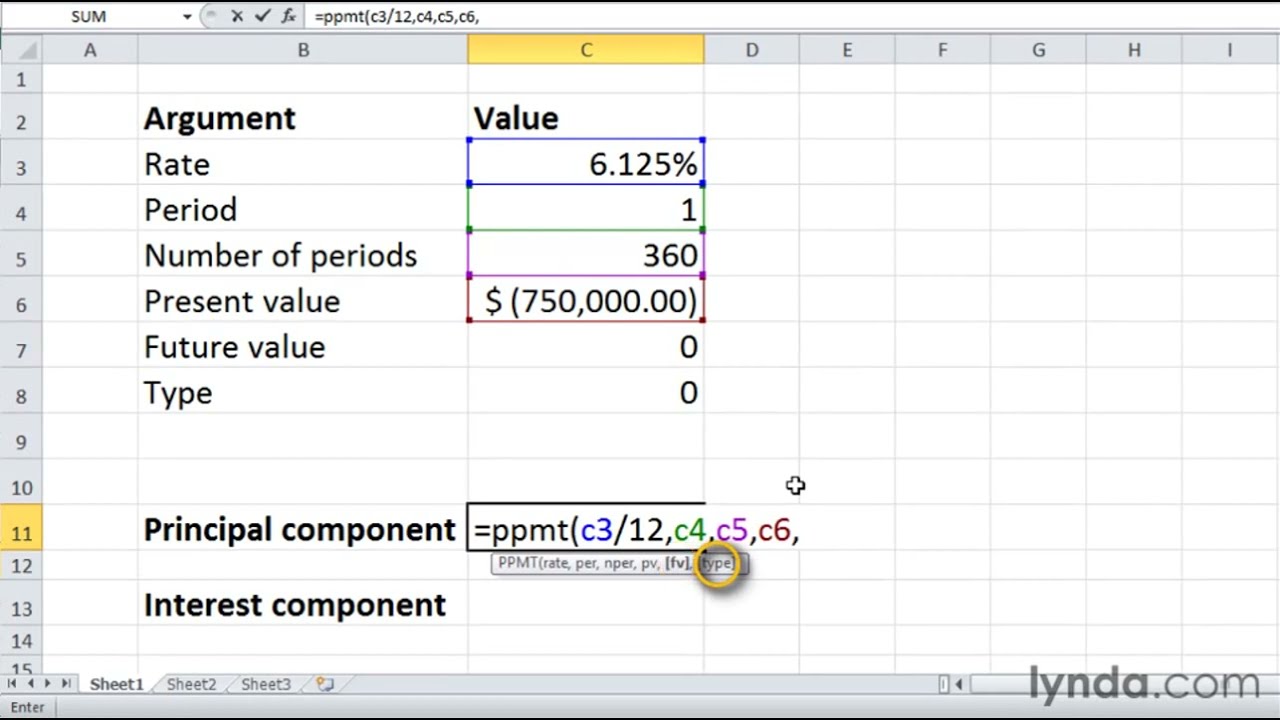

If a company has a loan payable that requires it to make monthly payments for several years only the principal due in the next twelve months should be reported on the balance sheet as a current liability. When you factor in interest though things get more complicated. Its essential that this loan be either positive or zero by the end of the year or the shareholder may be liable for tax on income equal to that amount. The principal payment of your loan will not be included in your business income statement.

This payment is a reduction of your liability such as loans payable or notes payable which is reported on your business balance sheet. Many notes payable require formal approval by a companys board of directors before a lender will issue funds. Shareholder loans should appear in the liability section of the balance sheet. The loan is documented in a promissory noteif any portion of the loan is still payable as of the date of a companys balance sheet the remaining balance on the loan is called a.

An example of a notes payable is a loan issued to a company by a bank. Definition of a mortgage loan payable. Only the interest portion of a loan payment will appear on your income statement as an interest expense. Current liabilities are short term liabilities of a company.

That reduces your cash asset account by 5000 and your loan payable balance by 55000. Loans and advances are general descriptions of debt obligations companies owe and must show on their balance sheet as part of total liabilities. Suppose you have 60000 in loans payable and you pay back 5000 this month.

/ExxonBS09-30-2018-5c637e7946e0fb000110665e.jpg)

/AppleBalanceSheetInvestopedia-45d2b2c13eb548ac8a4db8f6732b95a0.jpg)

:max_bytes(150000):strip_icc()/AppleBalanceSheetInvestopedia-45d2b2c13eb548ac8a4db8f6732b95a0.jpg)

/accounts-receivables-on-the-balance-sheet-357263-FINAL3-49402f58e70a42ab9468144f84f366d6.png)

.png)