Loan Restructure Meaning

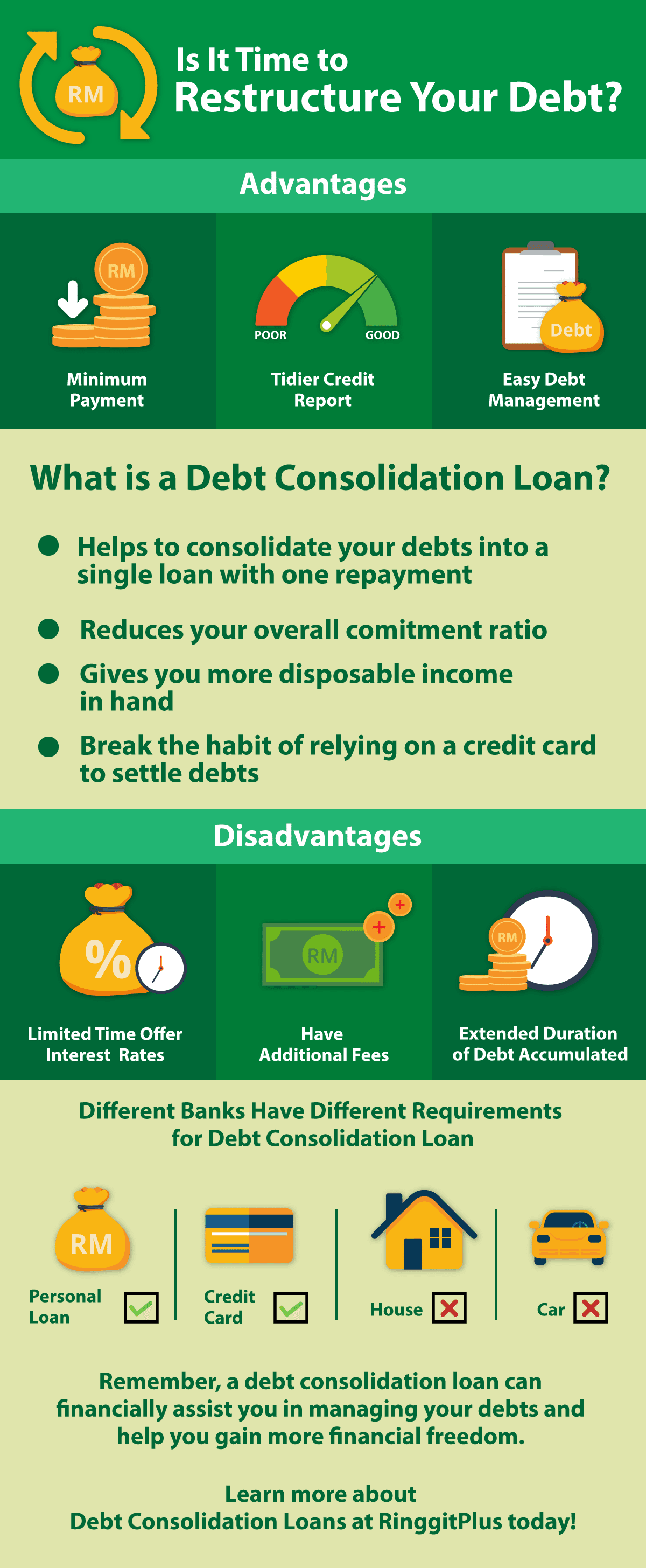

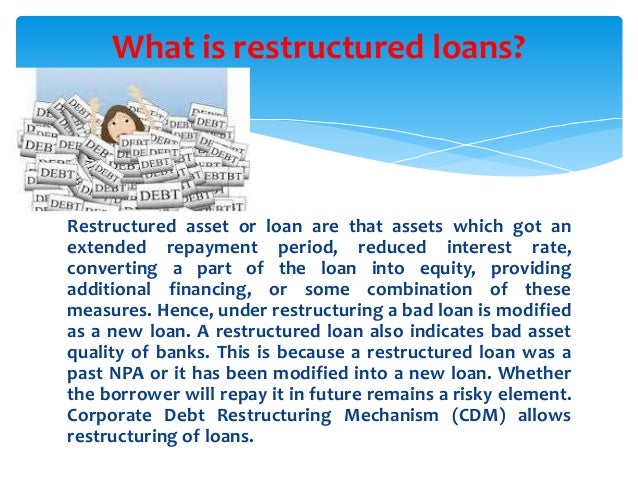

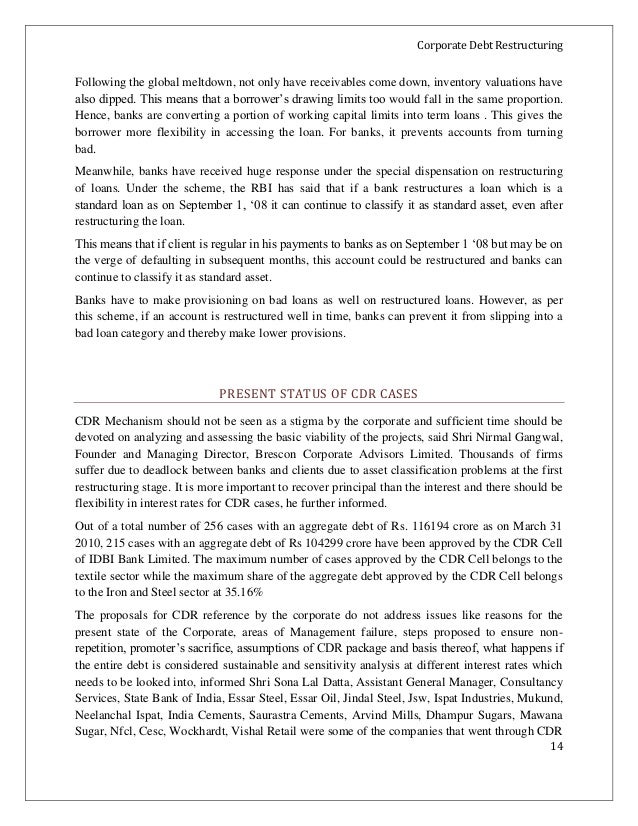

The purpose of restructuring of a loan is to accommodate the borrower who is in financial difficulty and unable to repay the loan as per repayment schedule.

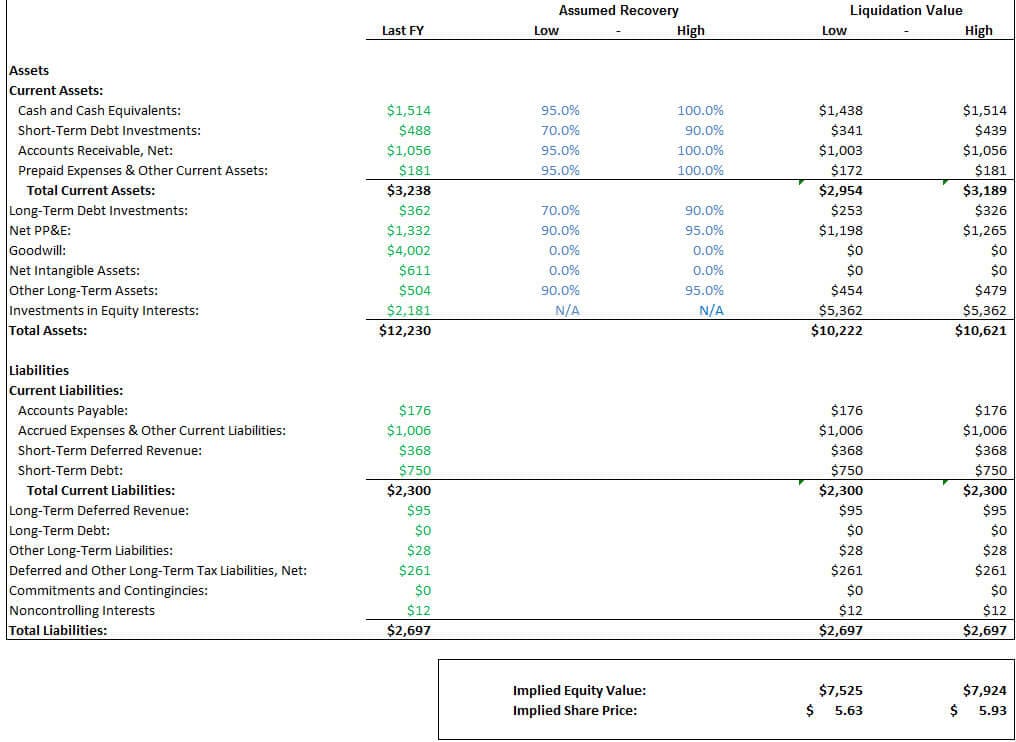

Loan restructure meaning. New loan that replaces the outstanding balance on an older loan and is paid over a longer period usually with a lower installment amount. During this covid 19 period ncba is walking the journey with you by restructuring your loan at no cost to you. Debt restructuring is a process that allows a private or public company or a sovereign entity facing cash flow problems and financial distress to reduce and renegotiate its delinquent debts to improve or restore liquidity so that it can continue its operations. Fill in the below loan restructure form.

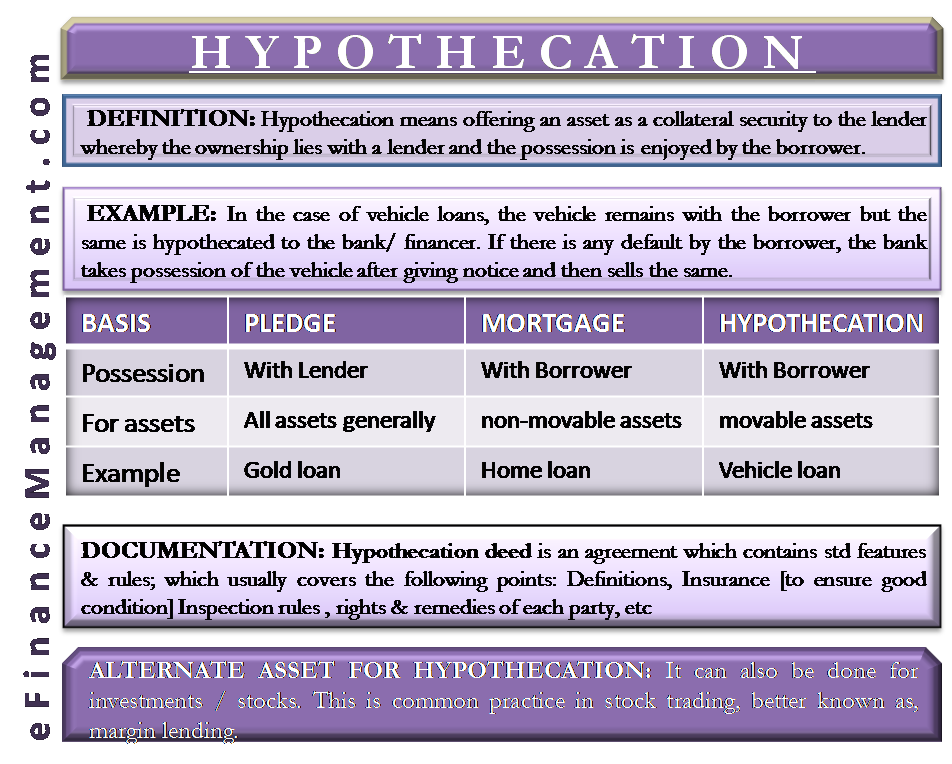

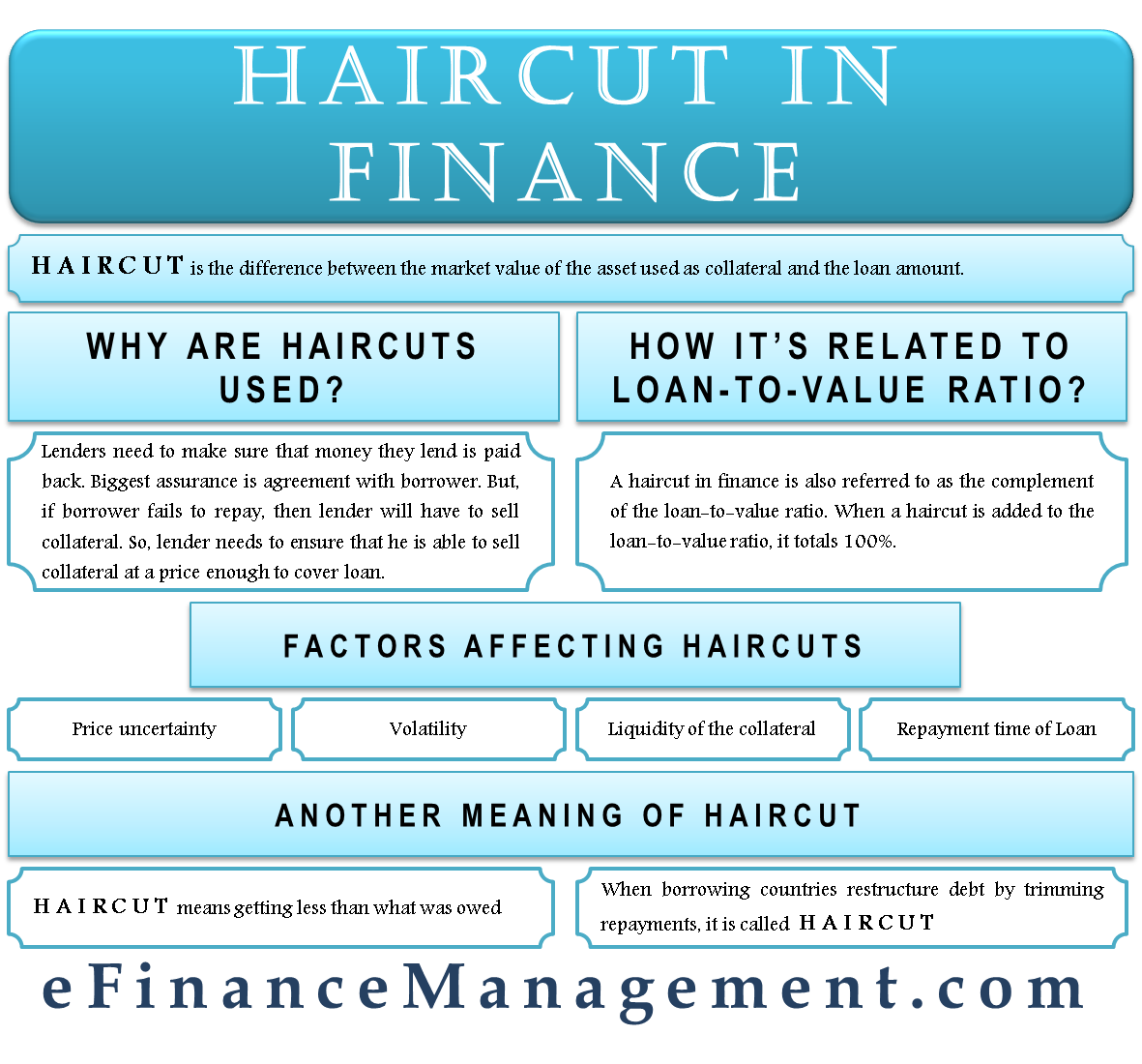

To make a basic change in an organization or a system for example. There might be situations when the business goes through long operating cycles and the cash flows may be skewed to some specific months instead of being spread evenly over the year. Replacement of old debt by new debt when not under financial distress is called refinancing. To alter the structure of something.

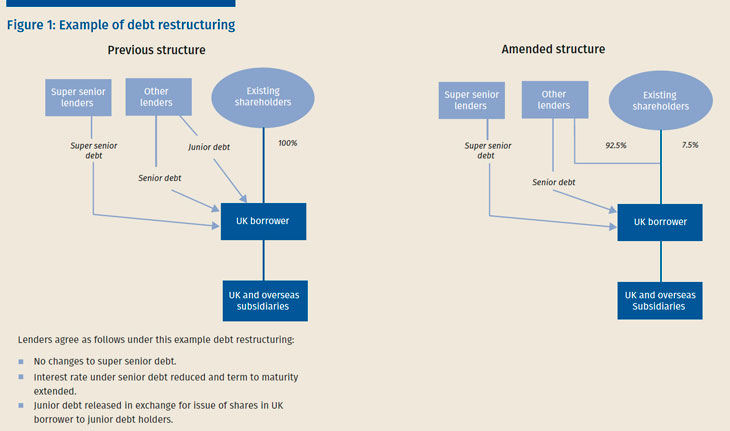

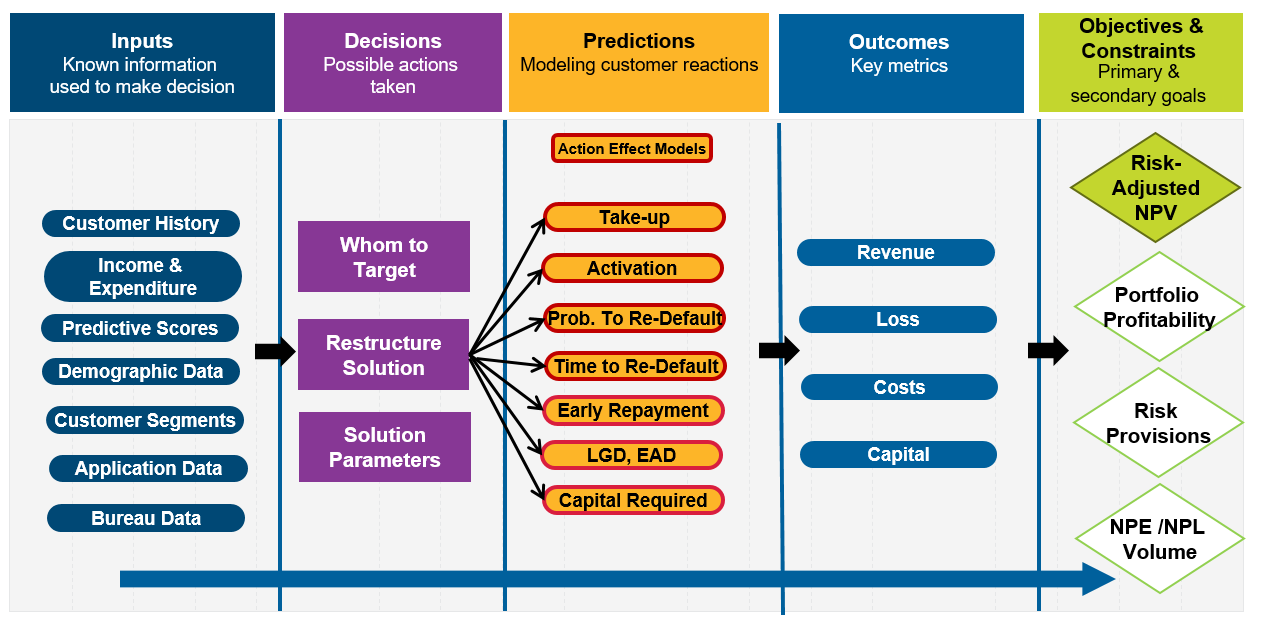

Rescheduling the loan repayment the borrower can offer to just restructure the loan repayment schedule to match the operational cash flows. Restructuring is a type of corporate action taken when significantly modifying the debt operations or structure of a company as a means of potentially eliminating financial harm and improving the. Debt restructuring is a method used by companies to alter the terms of debt agreements in order to achieve some advantage with outstanding debt obligations. To alter the makeup or pattern of.

Restructured loans are most common if the borrower states that heshe can no longer afford payments under the old terms. Fill in the below loan restructure form. Restructured restructuring restructures vtr. Loans are commonly rescheduled to accommodate a borrower in financial difficulty and thus to avoid a default.

Also called rescheduled loan. A loan for which the parties have agreed to alter the terms usually to make them more favorable to the borrowerfor example the borrower may restructure a loan to receive a lower interest rate or monthly payment. So while theres a chance to settle your sss loan through a restructuring program take advantage of it to ensure youll receive your final sss benefits in full. Similarly the cash.

Serious efforts to restructure third world debt felix rohatyn.

:max_bytes(150000):strip_icc()/balance_sheet-5bfc2f4046e0fb00265c9655.jpg)

/GettyImages-1127525589-89e58ce8185742e7acfc1bb53a627cd0.jpg)

/bank_176952073-5c65e665c9e77c0001e75c36.jpg)

:max_bytes(150000):strip_icc()/bankruptcy-3596095b06bf4a4a82d27ebb4a314f0e.jpg)