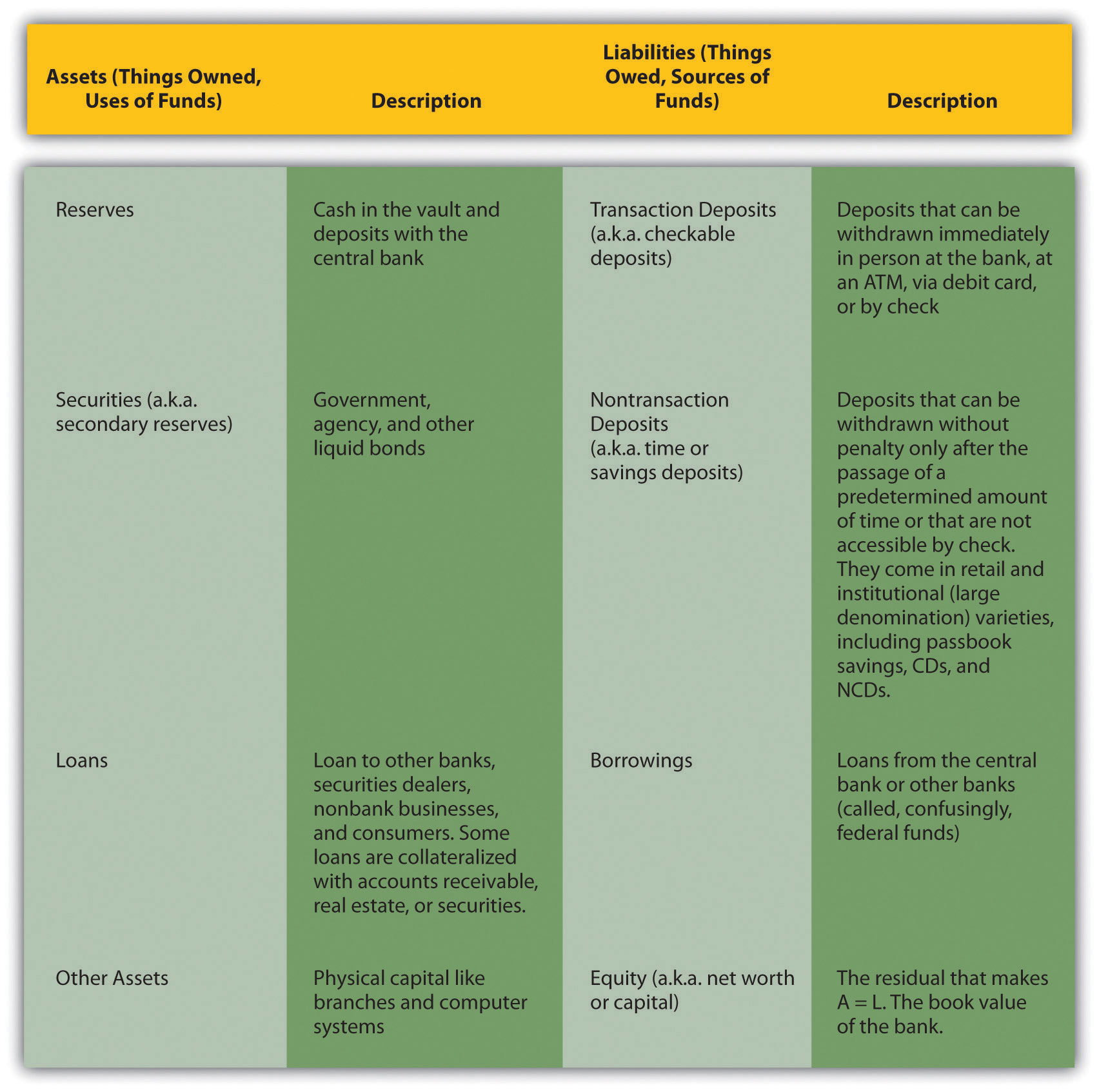

Loans Are Asset

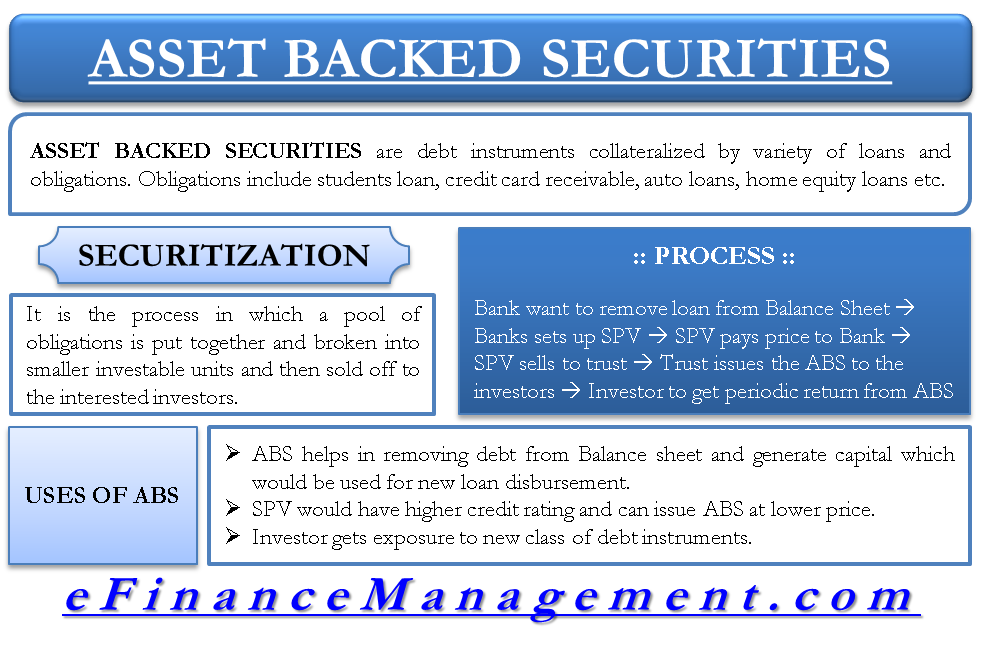

Lehman brothers asset backed securities index.

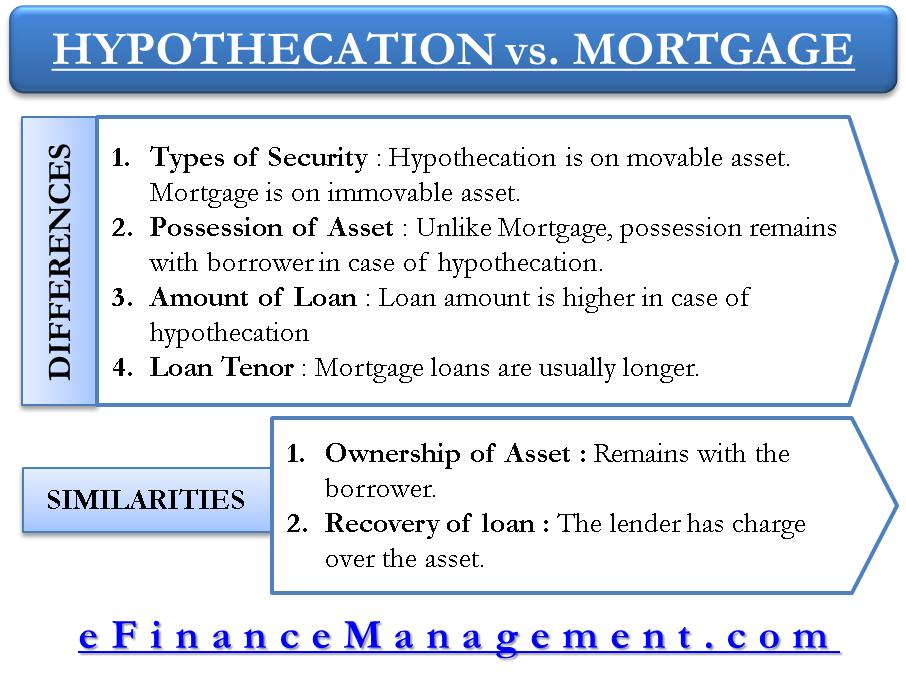

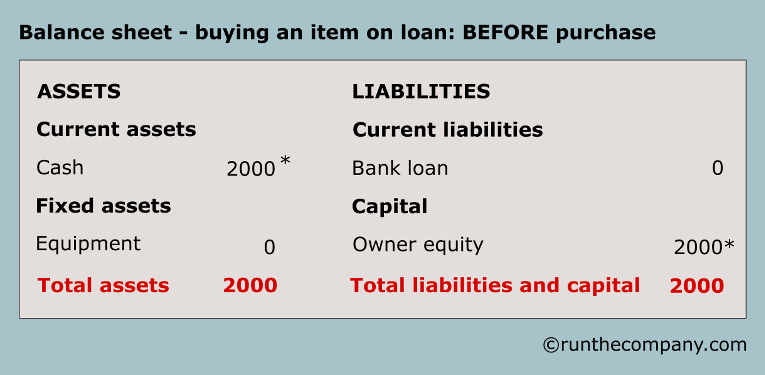

Loans are asset. This structuring allows a company to borrow from assets on an ongoing basis to cover expenses or investments as needed. Most asset based loans are structured to work as revolving lines of credit. You may get lower rates or better terms if you have funds to. In this sense a mortgage is an example of an asset based loan.

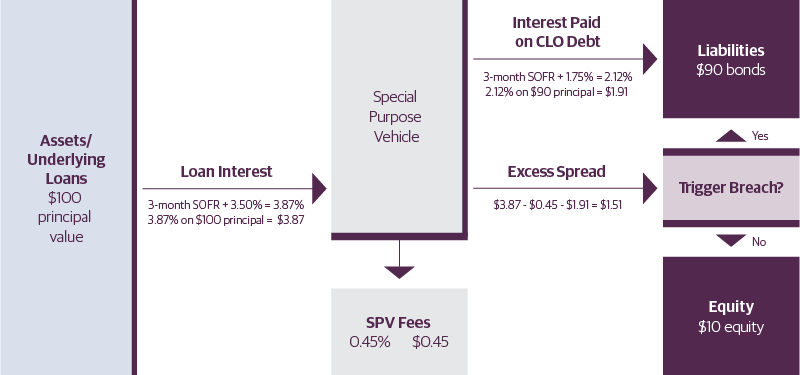

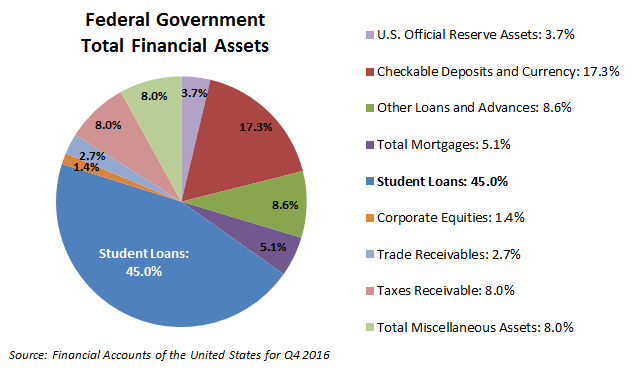

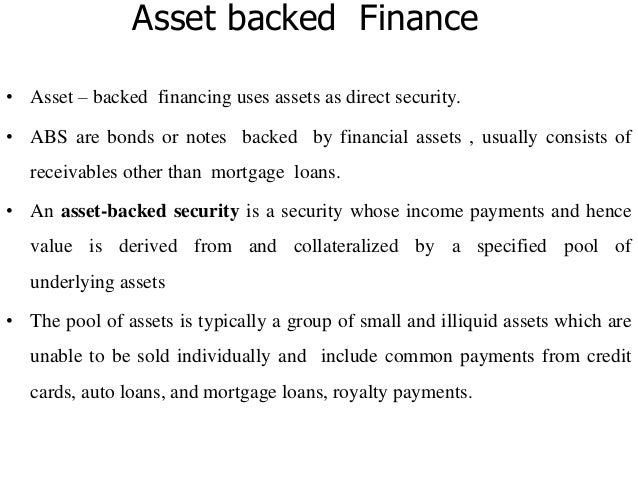

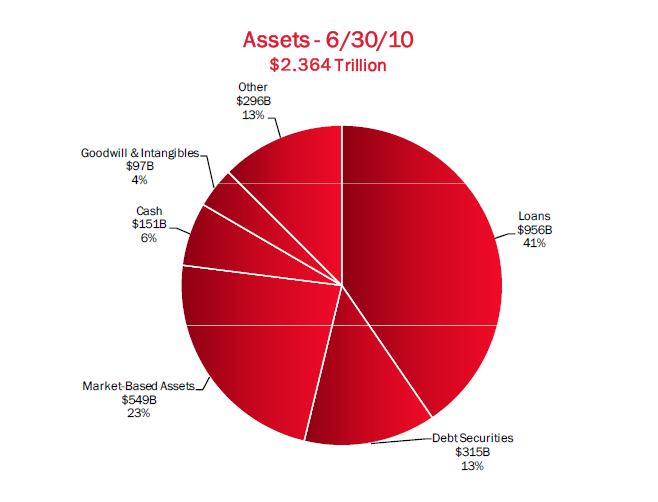

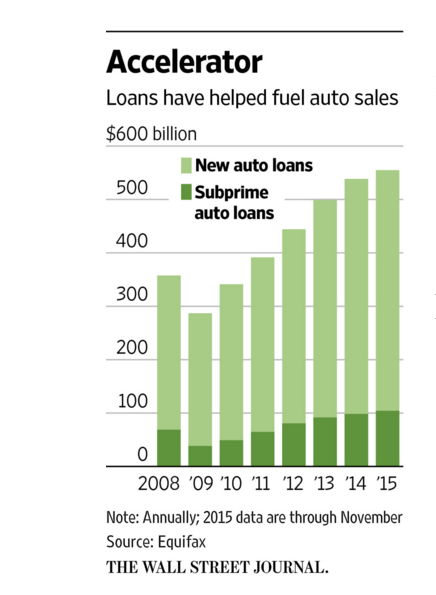

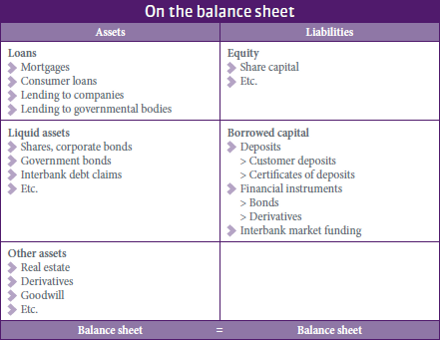

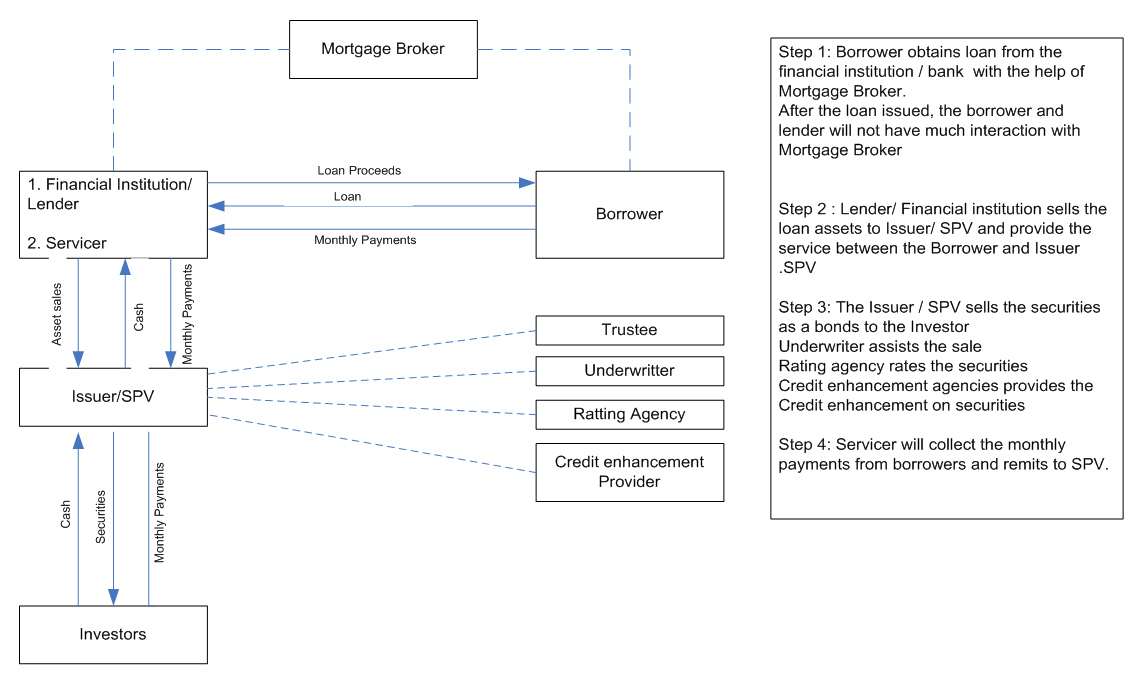

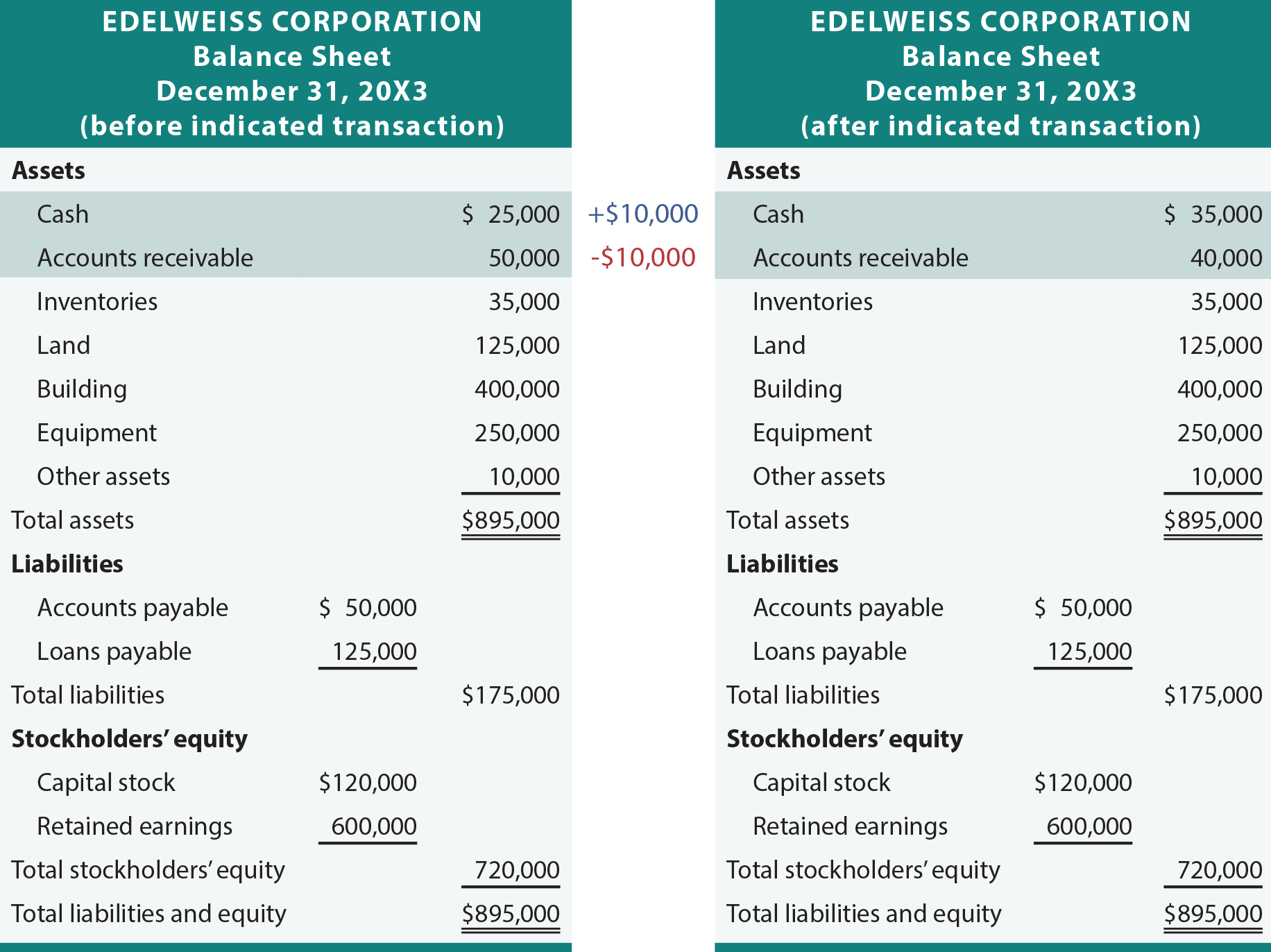

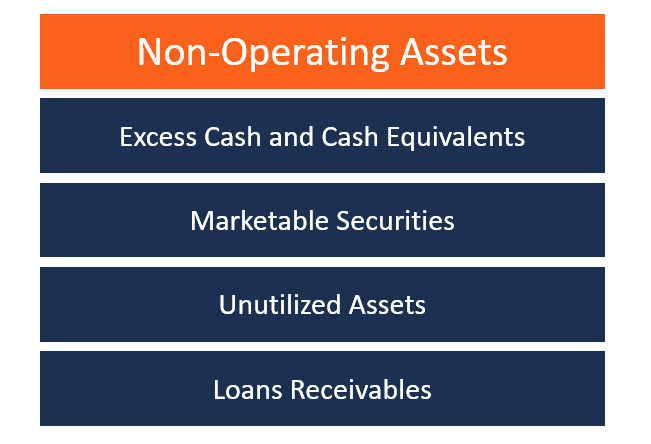

The lehman brothers asset backed securities index serves as the performance benchmark. The asset based loan or line of credit is secured by inventory accounts receivable equipment andor other balance sheet. Asset based financing also called asset based lending abl is a type of business financing backed by anything your business owns that has cash value or in other words its assets. After the housing market decline of 2008 various lenders developed a unique and innovative mortgage program called the asset depletion loan which is designed help borrowers to use assets to qualify for a mortgage.

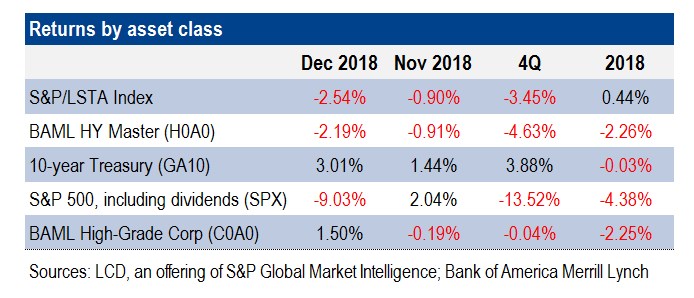

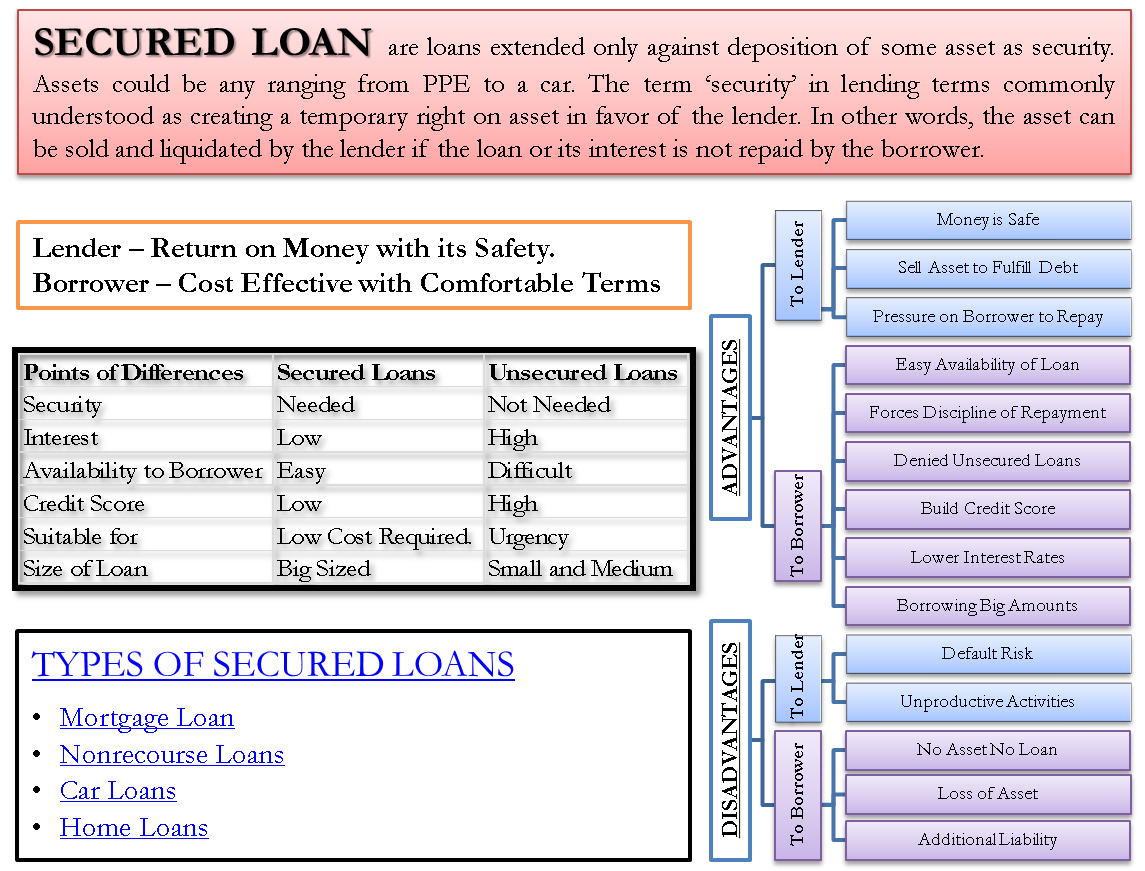

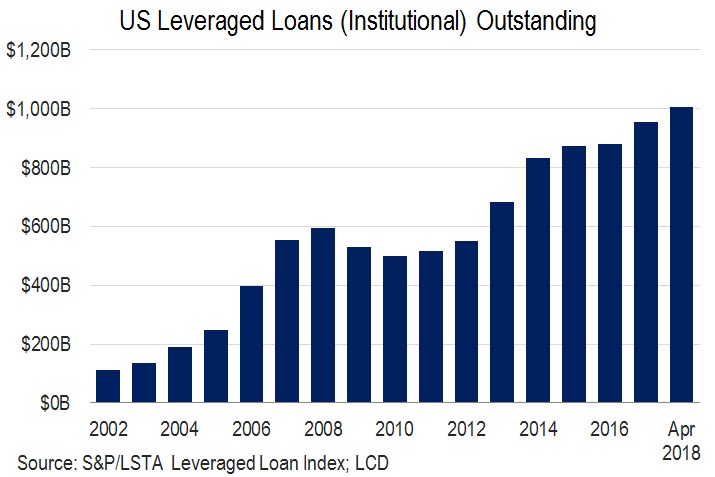

Asset based lending is any kind of lending secured by an assetthis means if the loan is not repaid the asset is taken. Senior loansalso referred to as leveraged loans or syndicated bank loansare loans that banks make to corporations and then package and sell to investors. Asset based loans are structured based on the collateral available for a lender to lend against. Asset based lending is a business loan secured by collateral assets.

Entrepreneurs can use inventory equipment accounts receivable and other assets to acquire an asset based loan that will improve working capital. Asset based mortgages asset depletion loans home buyers with a high level of liquid assets but very little documented income used to have a difficult time qualifying for a mortgage. Every business needs financing and an asset based loan can be the ideal solution. More commonly however the phrase is used to describe lending to business and large corporations using assets not normally used in other loans.

This means that if your business cant pay back the loan your lender can take and sell these assets to make up for the loss. A fixed income index that focuses on asset backed securities. Typically the different types of asset based loans include. This asset class exploded in popularity in 2013 when its outperformance in a weak market caused senior loan funds to attract billions in new assets even as the broader bond fund category experienced massive outflows.

/ExxonBS09-30-2018copy2-5c7ecb5c46e0fb00019b8e8a.jpeg)

/joint-loans-overview-315512_final-19175f1cf9844ee0a7a2646f500e72b3.png)

/balancesheet.asp-V1-5c897eae46e0fb0001336607.jpg)

:max_bytes(150000):strip_icc()/collateral-loans-315195-v3-5bc4cbf746e0fb002693d842.png)